🔬Q1 Wrap-Up: What's Baked Into The Market?

Comm Services, Info Tech, and Energy are Q1's biggest winners; S&P P/E at highest level since dot-com bubble; and much more

Short note today as I’m just finishing up vacation. Back to full capacity tomorrow!

Street Stories

Q1 Wrap-Up

We’re kicking off the second quarter with a look back at how things evolved during the course of Q1.

To start, the market experienced another double digit return over the last three months. In fact, the trajectory of the market has basically been linear since things bottomed out in October. For the moment, it seems like you can set your watch to the level of the S&P 500, but I’m going to go out on a limb and predict that this won’t last in Q2.

And for the most part, the sectors that did well in Q1 were the same ones that have been on a roll over the last 12 months. The only exceptions being that Energy - essentially flat in 2023 - caught a bid as crude prices ticked up over the quarter. Consumer Discretionary also seemed to run out of steam after being the number 3 sector throughout 2023, as concerns around the health of the US consumer persist into the second quarter.

On the valuation front, the S&P 500 finished Q1 with a forward P/E multiple of 21.1x. Excluding the Covid blip when valuations went wonky (mostly due to miniscule denominators), this is officially the highest the index has traded at since the Dot-Com Bubble. Bears out there seem to be getting more ammunition by the day, as making the case for continued market strength grows increasingly difficult.

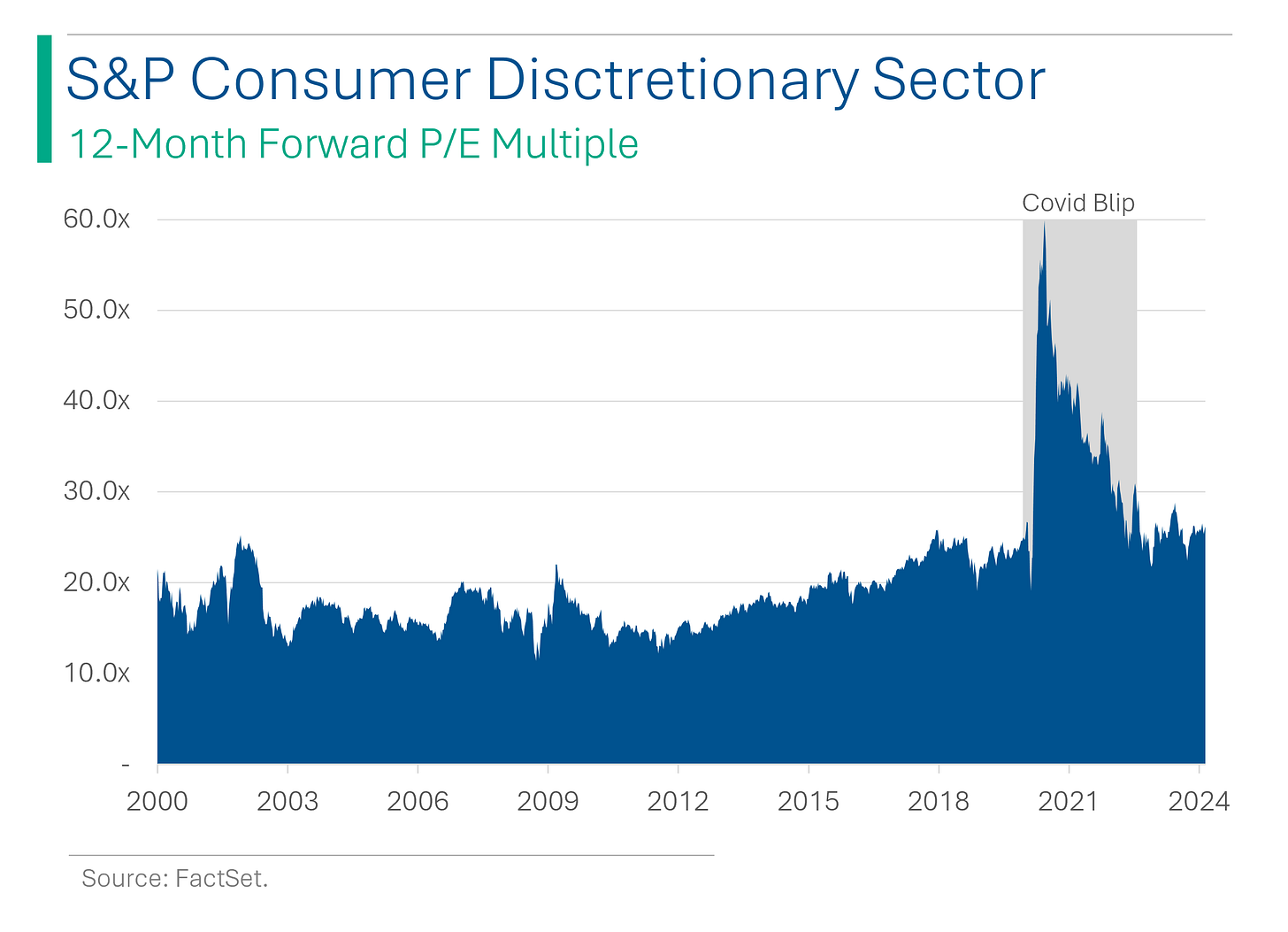

Looking at the sectors individually, Info Tech and Consumer Discretionary are trading at significant premiums to the rest of the market. While Real Estate is the only sector to trade at a lower P/E multiple now versus the end of 2023, due to selling pressures tied to ‘higher for longer’ mortgage rates.

And while Tech is trading well above it’s historical average multiple, it is still well below the insanity that marked the Tech Bubble.

Consumer Discretionary stocks continues to trade near record levels, despite underperforming the majority of the S&P over the course of Q1.

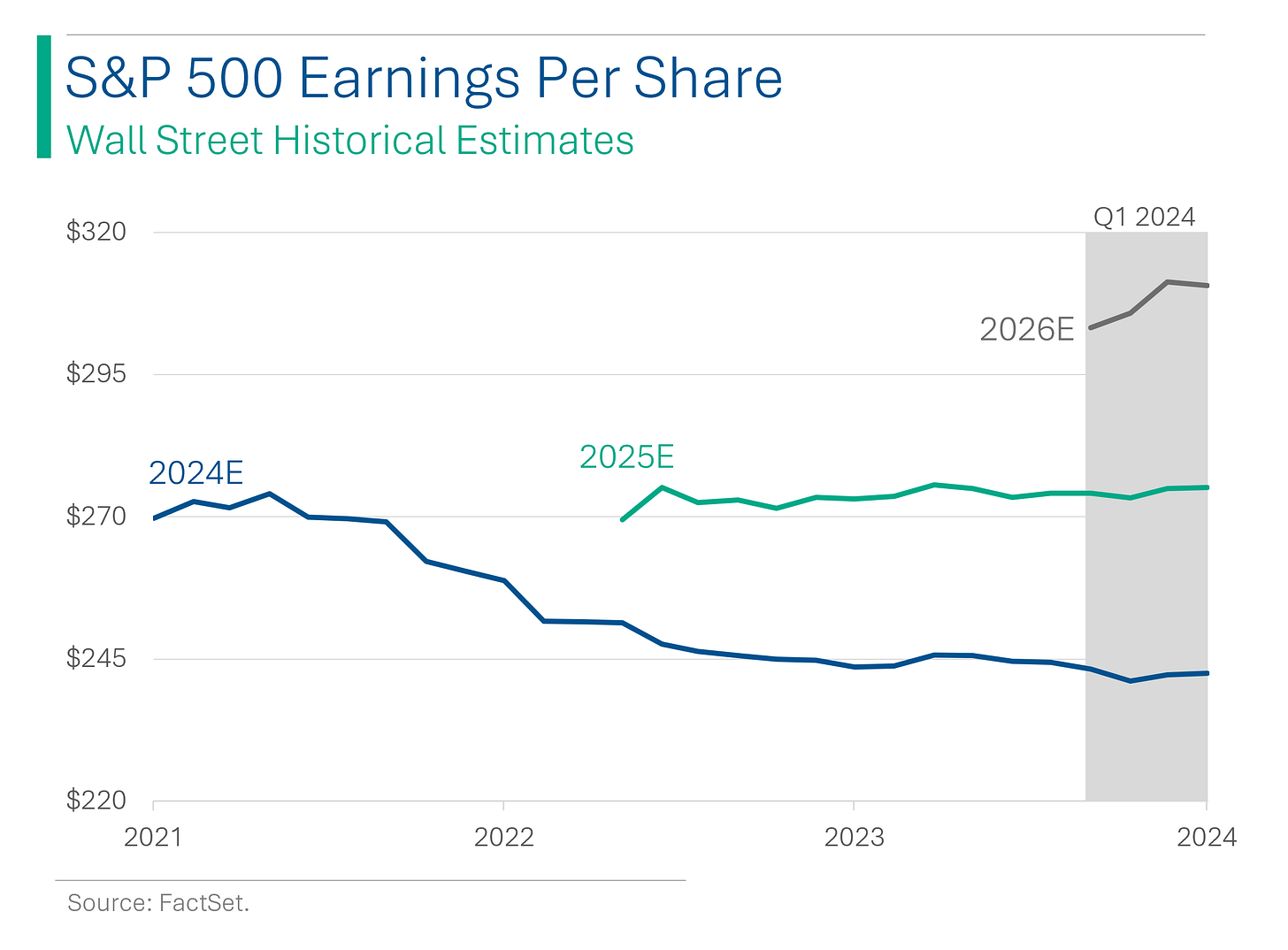

The average company in the S&P 500 saw 2024 revenue estimates remain close to flat over the course of the quarter; 2025 saw a small uptick; and 2026 has seen significant revisions upward. The 2026 boost is driven in large part by the improving ‘soft landing’ narrative that has built over the course of the quarter.

The results are similar across estimates for earnings per share, as the steady decline in 2024 estimates has officially flattened out.

As for the biggest winners in the S&P 500 in Q4 last year, it’s pretty shocking to see how roles have reversed. 7 of the top 15 performers in Q4 declined over the latest quarter, while the average company returned +0.4% compared to the S&P 500’s +10.2%.

As for the biggest winners in Q1, it’s a bit of a mixed bag with outperformance coming from everywhere: As expected there are some chip plays (Nvidia, Micron), a solid helping of Energy companies (Constellation, Marathon, Valero, etc.), as well as some fixer uppers (Disney, DaVita).

All-in-all, the set-up looks comparable to how things stood at the end of Q4, with the big difference that valuations look even more stretched. Is Q2 when we will start to see cracks emerge in the market? Or are do we need some bigger catalysts beyond just valuation? Only time will tell.

Market Movers

Winners!

Ballard Power Systems (BLDP) [+17.6%]: Signed long-term supply agreement with Solaris Bus & Coach, consolidating ~300 existing fuel-cell engine orders with a commitment for ~700 more, plus aftermarket services.

Cameco (CCJ) [+7.9%]: Goldman Sachs initiated at a Buy rating, highlighting Cameco's key role in uranium/nuclear fuel and potential for increased demand and higher prices.

Semtech (SMTC) [+6.8%]: Beat Q4 revenue, margins, and FCF; management's positive Q1 EBITDA guidance and AI, PON demand boosts received analysts' praise.

Guess? (GES) [+6.1%]: Authorized a new $200M buyback program.

Losers!

InterDigital (IDCC) [-8.6%]: Downgraded to underperform by BofA Securities due to valuation and risks from reliance on cellphone royalty growth, with uncertain timing for some short-term opportunities.

Universal Health Services (UHS) [-4.0%]: Pavilion Behavioral Health ordered to pay $60M in compensatory and $475M in punitive damages for negligence and misrepresentation claims; UHS notes potential material adverse impact.

C.H. Robinson Worldwide (CHRW) [-3.7%]: Barclays downgraded to underweight, citing underperformance in core truckload brokerage and potential margin pressures.

FedEx (FDX) [-3.3%]: Domestic transportation contract with US Postal Service to expire at September's end without a renewal, due to failure in reaching mutually beneficial terms.

Market Update

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.