🔬Precious Metals... in charts!

Plus: All-Time Highs just keep coming; and much more!

"Waste no more time arguing about what a good man should be. Be one"

- Marcus Aurelius

"If you think nobody cares if you're alive, try missing a couple of car payments"

- Earl Wilson

Another day, another all-time high for the big US markets, with S&P 500 +0.1% and Nasdaq +0.3%.

Only 6 of 11 sectors closed higher but when the best finisher in Tech (+0.7%) the market is usually up. Comm. Services (-1.0%) was worst - mostly just from Meta giving back some of yesterday’s Friday’s gains.

Notable companies:

Taiwan Semiconductor (TSM) [+1.4%]: Media reports new flagship launches from Qualcomm and Mediatek could boost demand for 3nm production process; positive sell-side commentary and price target increase from Morgan Stanley.

ServiceNow (NOW) [-5.0%]: Downgraded to sell from neutral at Guggenheim Securities; cited valuation, risks to consensus Subscription, and delayed uptick in GenAI business.

Morphic Holding (MORF) [+75.1%]: Agreed to be acquired by Lilly (LLY) for $57/share in a $3.2B deal; represents a ~79% premium to prior close; expected to close in Q3 2024.

More below in ‘Market Movers’.

For my fellow Ontarians dealing with the liquor store strikes, here’s an interactive map of non-LCBO locations for booze sales: LINK

Street Stories

Precious Metals Pt. I: The Metals

This is part one of a two parter on precious metals. Today covers the metals, tomorrow the companies. Pitter patter. Let’s get at ‘er!

Full disclosure: I’ve never been a gold bug, or really owned many gold stocks.

I have a baseline understanding of how they work…But most of that knowledge comes from being a junior investment banker at the end of the commodities super cycle in the early-2010s; wasting away pitching megamergers that went absolutely nowhere.

So maybe some of this bias comes from the painful memories of all-nighters for meaningless pitches. Mostly though, it’s cuz I don’t think they’re great investments.

Over the last 18 years gold has performed the best of the precious metals but still falls well short of the stock market. Silver is, in my opinion, just a spicier version of gold. Maybe some more industrial use cases, but whippy as hell.

When it comes to platinum and palladium, I literally have no clue. And I’m not convinced too many other people do.

Recently, however, the precious ones have been working surprisingly well. With the exception of basket case palladium, precious metals are clearly the best performing chunk of the global commodities market (save for Cocoa which is up +200% in the last year and a half).

Another interesting sidebar is copper’s performance in the chart above - given the proliferation of AI of late, and the fact that many data centers that power AI use copper wiring - I had expected a stronger 2-year price change than 26%.

Geopolitical risk and sticky inflation have led to one of the greatest flights to quality in history, and those on the right side of the metals market have done rather well.

And while each metal has its own use cases - gold in electronics and medicine; silver in batteries and solar - they definitely do exhibit a decent amount of correlation. Especially in times of uncertainty.

What’s interesting is that despite the growing demand for gold, we haven’t exactly been digging a hell of a lot more of it out of the ground. As a reference, from 1994 to 2023, global GDP has grown by 276% ($28 trillion to $105 trillion) but gold production by volume has only increased by 30%.

By value, however, this figure is +880% as gold has went from ~$390 an ounce to ~$2,400.

Silver, on the other hand, has seen much higher production growth. Driven by significant increases in industrial demand, silver has actually been in a structural market deficit for nearly four years.

This deficit has started to narrow but in 2023 industrial demand grew ~11% - and it’s probably a safe bet that this level of high growth will persist for many years as use cases - from electronics to solar cells to EVs - continue to grow rapidly.

Ryan’s Thoughts: When considering the physical metals, I’ve never been a buyer. I can definitely see their value as a inflation hedges but I think investing in stocks has more of an edge. And more upside.

I also think it takes a lot of brain power to do it right when it comes to investing in precious metals. And for that time and effort you get fewer shots on goal. There’s only a handful of metals out there to trade but a gazillion stocks.

Lastly, it’s also pretty darn boring…

All-Time Highs

The S&P 500 closed at a fresh all-time high for the 34th time this year. That marks an impressive 27% of trading days ending in a new record. Truly these are the good times.

The Nasdaq has been a bit of a slouch with only 24 ATHs - roughly 19% of the time.

But at +22.3% for the year and +43.4% in 2023 I think they get a pass…

Joke Of The Day

My resumé is just a list of things I hope no one ever asks me to do.

Hot Headlines

Bloomberg / Microsoft orders China staff to use iPhones for work and drop Android. Move comes as Microsoft tightens cybersecurity in the country and, due to the banning of Google Play, Apple’s App Store is the only approved way for employees to download the new cybersecurity applications.

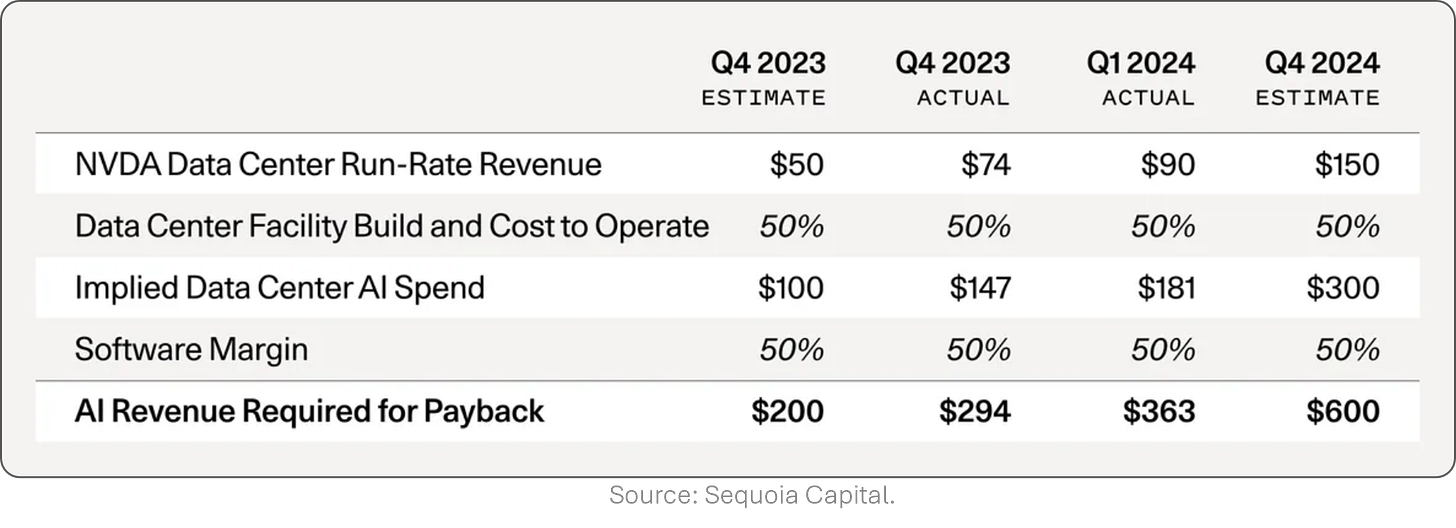

Tom’s Hardware / AI industry needs to earn $600 billion per year to pay for massive hardware spend. Worry over an AI bubble increased following a Sequoia Capital report that highlights the expensive cost of this infrastructure, notably AI datacenters.

CNBC / Activist Elliot Management threatens Southwest Airline with proxy fight for new management. Elliott told Southwest’s board that, barring a dramatic change in attitude, it would seek to give shareholders a “direct say” in effecting leadership change at the struggling airline. Them’s fightin’ words!

Reuters / U.S. 'breakeven' monthly job growth may be 230k according to SF Fed report. Monthly job growth cooled to 177k for the most recent three month period, with unemployment going from 3.8% in March to 4.1% in June. *cough* rate cuts *cough*

Yahoo Finance / Airbus confirms it delivered 323 airplanes in first half. The figure is +2% from 316 they delivered in H1 2023. Boeing’s numbers are due any day now and are going to look like a disaster. Of the the 266 they delivered in H1 2023, 211 were 737 MAX.

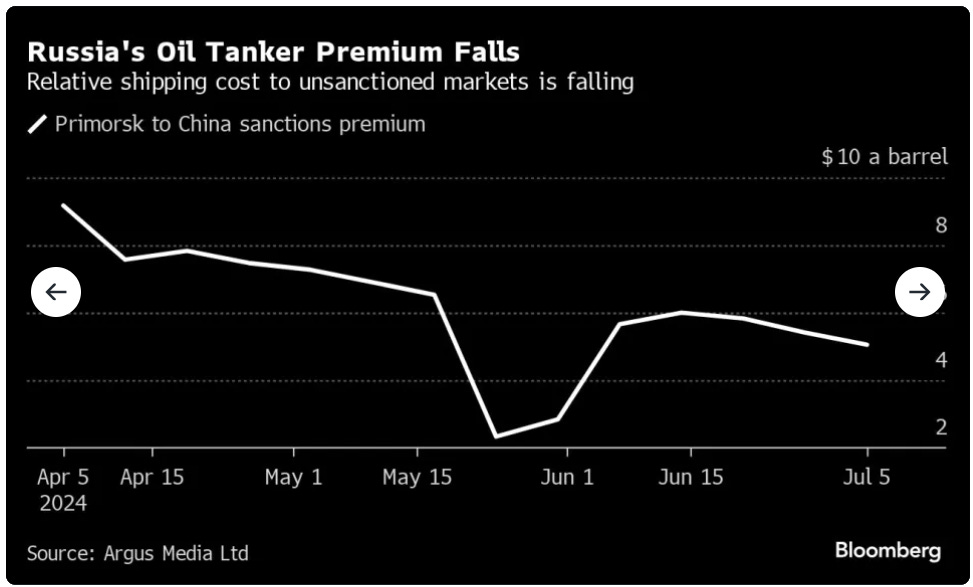

Bloomberg / Russian Oil deliveries keep getting cheaper despite sanctions. Cuz Russia and India.

Trivia

Today’s trivia is on Warren Buffett.

When Warren was just a kid in Washington, D.C., he was making more money than most of his teachers doing what?

A) Doing landscaping

B) Flipping houses

C) Day Trading

D) Delivering the Washington PostAfter graduating from the University of Nebraska in three years, Warren was rejected from Harvard. This ended up being one of the best things that ever happened to him as he then applied to this university where he learned from his future mentors Benjamin Graham and David Dodd.

A) Columbia

B) Princeton

C) Stanford

D) University of ChicagoWarren lives a famously modest life, including living in a house he bought for $31,500 in what year?

A) 1948

B) 1958

C) 1968

D) 1978

(answers at bottom)

Market Movers

Winners!

Morphic Holding (MORF) [+75.1%]: Agreed to be acquired by Lilly (LLY) for $57/share in a $3.2B deal; represents a ~79% premium to prior close; expected to close in Q3 2024.

Corning (GLW) [+12.0%]: Sees Q2 core EPS at high end or slightly above prior guidance $0.42-0.46 vs FactSet $0.45; driven by strong adoption of new optical connectivity products for GenAI.

SolarEdge Technologies (SEDG) [+9.3%]: Upgraded to neutral from underperform at BofA; cited attractive entry point despite margin and FCF recovery concerns.

Lucid Group (LCID) [+7.8%]: Q2 production at 2,110 vehicles, deliveries at 2,394 vehicles, both ahead of expectations.

Dave & Buster's Entertainment (PLAY) [+2.4%]: CFO Darin Harper disclosed purchase of 13.5k shares; total beneficial ownership now 35.7K shares.

Fortive (FTV) [+1.6%]: Upgraded to buy from hold at TD Cowen; cited more constructive capital deployment strategy, potentially rerating shares higher toward peer average.

Taiwan Semiconductor (TSM) [+1.4%]: Media reports new flagship launches from Qualcomm and Mediatek could boost demand for 3nm production process; positive sell-side commentary and price target increase from Morgan Stanley.

Domino's Pizza (DPZ) [+1.3%]: Upgraded to outperform from neutral at Baird; noted confidence in fundamental outlook and optimism around the "Hungry for MORE" strategy.

Losers!

ServiceNow (NOW) [-5.0%]: Downgraded to sell from neutral at Guggenheim Securities; cited valuation, risks to consensus Subscription, and delayed uptick in GenAI business.

Blue Owl Capital (OWL) [-4.5%]: Downgraded to hold from buy at TD Cowen; flagged tighter fee-related margins and higher.

Market Update

Trivia Answers

D) Warren delivered the Washington Post.

A) Dodd and Graham taught at Columbia.

B) Warren bought the house in 1958.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.