Peak Apple? And The Great Rate Relapse

"In the business world, the rearview mirror is always clearer than the windshield"

- Warren Buffett

"Money isn't everything but it sure keeps you in touch with your children"

- J. Paul Getty

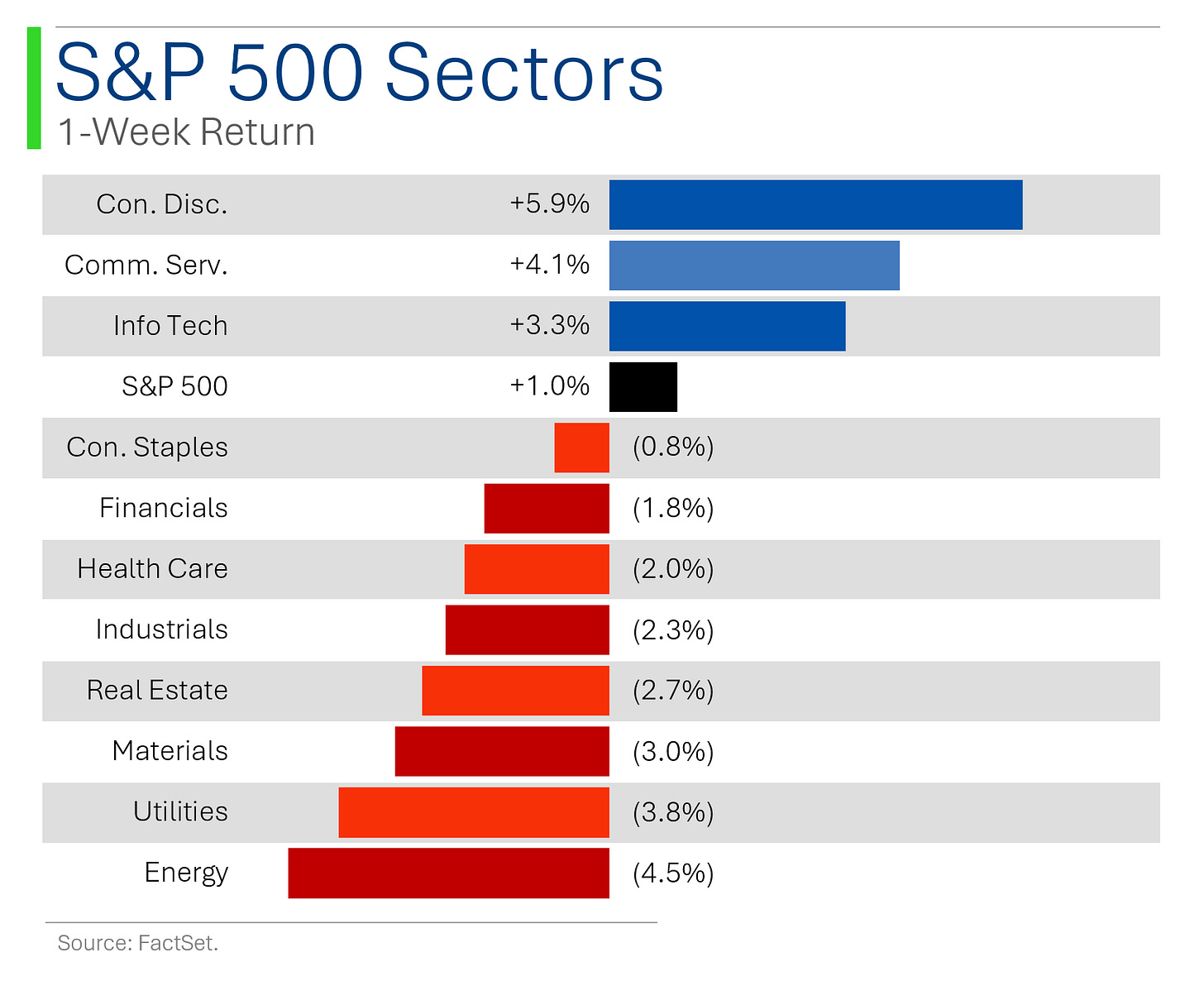

Choppy week in the market but things still ended up higher (yet again), bringing the S&P 500’s tally for the year to a blistering +27.7%.

Macro news was also a bit mixed but Friday’s Non-Farm beat expectations nicely (227k vs. Street bogey of 200-210k) after a soft October (more below in ‘Macro Update’).

Thanks for reading and hope everyone has a great weekend!

- Ryan

Street Stories

Peak Apple?

After a few weeks with Nvidia as the world’s largest publicly traded corporation, Apple has resumed the top spot which it has occupied for the better part of the last decade.

And, like, good for them and all. But it’s hard to say that Apple is the growth monster it was in times past.

And it’s not exactly like investor confidence has been growing. In fact, 2026 revenue estimates are off 17% from where they were just a few years ago.

Within the company, iPhone sales still make up the bulk of revenue. And they’re flat.

In fact, only Services (App Store, Cloud, Apple News, Apple TV, etc.) has shown any growth over the last few years. And if you’ve been keeping up with all the App Store lawsuits over the past two years, even that growth engine has some question marks attached to it.

Wall Street still holds a generally positive rating on the shares, with 63% of Analysts pushing a Buy rating.

However, the average price target of $244 is just a freckle above the market price so how much value they see left in the shares is up for grabs.

And with their prospects chilled, you’d think you would be able to pick up the shares at a discount to the premium they traded at in the past.

But you’d be wrong!

Apple is as expensive as it’s been in the last five years on a P/E basis - trading at a 44% premium to the S&P 500.

To wrap, it’s hard to be bearish on Apple since it has consistently proved doubters wrong. No company has consistently launched +$10 billion product after product and their expectations for Apple Intelligence - their foray into the AI frenzy - are pretty lofty.

And while they may be late to the AI party, Apple has rarely been the first (MP3 player, smartphone, digital store, etc.) but they usually come out as best.

That said, Warren Buffett may be proved right in cutting his Apple stake recently - formerly his largest position - by more than half. Clearly Apple isn’t the no-brainer it was in years past.

Inflation Expectations Trump Rate Cuts

The biggest financial theme of the year has been AI - to the point where I’m sick of writing about it.

The second biggest theme of the year has probably been sticky inflation and the long awaited slashing of interest rates.

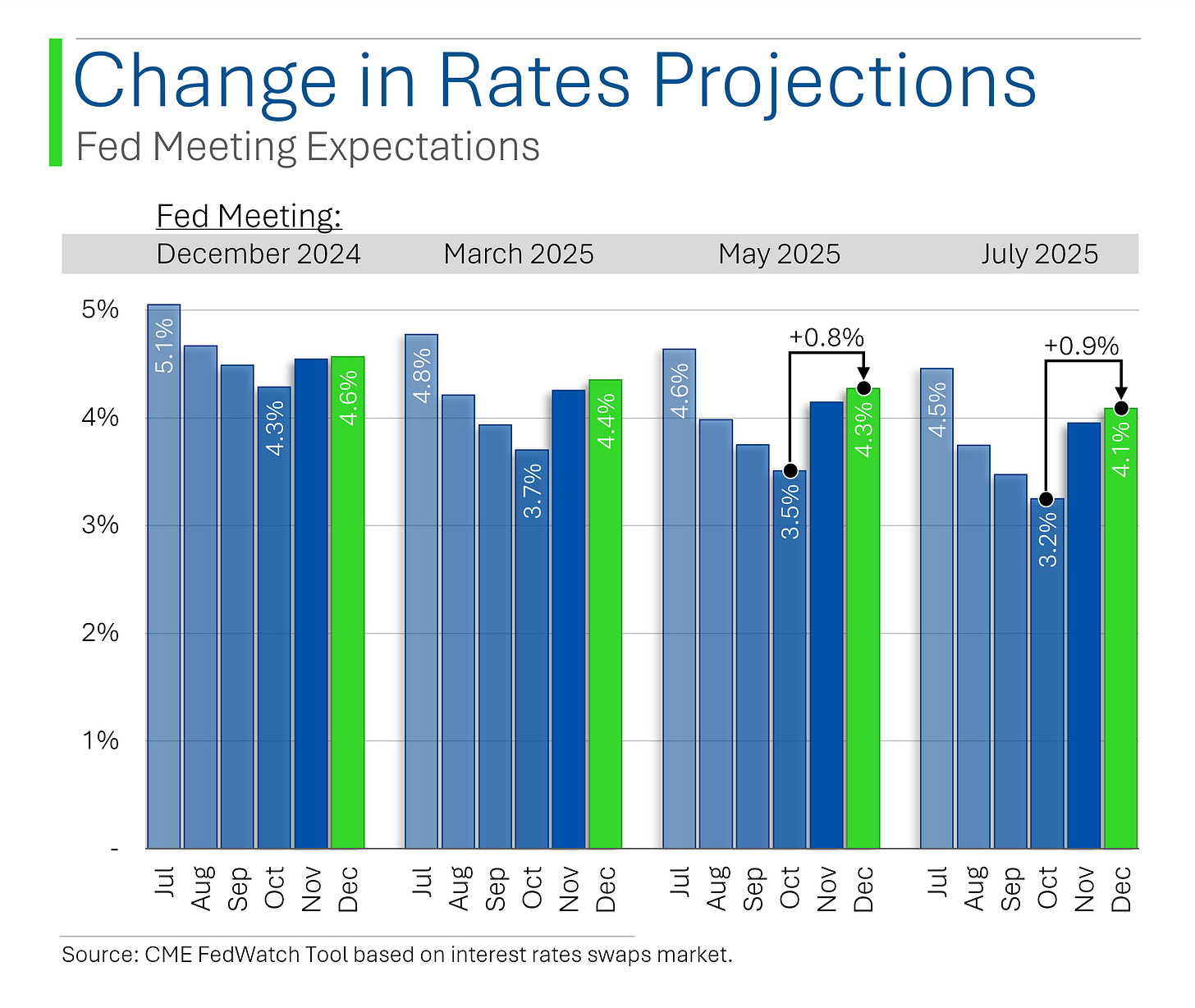

After 14 months of interest rates sitting at the 5.25-5.50% target range, we finally got our first chop in September (50bps) followed by another in November (25bps).

At the time of that first cut, the market’s expectations (as implied through the interest rate swaps market) was for the upper-bound of the Fed Funds Rate to be 3.1% by October 2025.

Just a few short months later and that number is now 4.0%.

As you can see below, expectations for some of the upcoming Fed announcements has done something of a 180. But why?

Well, there’s a lot of reasons but the easiest to point to is that inflation - which had been steadily ticking down since April - has started to increase again. Signs of a robust US economy have also meant that many see inflation continuing to be elevated well into 2025.

Another big whammy to inflation expectations has been the massive tariffs that President-elect Trump has proposed. Making imports more expensive may prove a bolus for domestic producers but it’s the US consumer that will be footing the bill for most of it.

The result is that the market is really only pricing in another four-ish 25bp cuts over the next twelve months.

And the results can be seen in the shape of the U.S. yield curve. Short-term rates have come down significantly since the cuts began but the back-end of the curve has increased significantly.

The biggest area where this is felt is the mortgage market, where the average interest rate for a new mortgage is back to 6.8%. Hopefully, things turn out better than expected on the inflation front and we see an end to these stifling rates soon.

Not least because I’m tired of writing about inflation too. 🫠

Joke Of The Day

What’s the difference between the stock market and a casino? In a casino, at least the drinks are free.

Macro Update

Non-Farm Payrolls [Friday]

Nonfarm Payrolls for November grew by 227K, beating expectations, with unemployment ticking up to 4.2% and hourly earnings slightly above consensus at 0.4%.

Analysts noted a messy report, highlighting disparities between surveys, and market expectations for a December Fed rate cut rose to 89%.

uMichigan Consumer Sentiment [Friday]

Preliminary December consumer sentiment hit 74.0, its highest since April, with notable improvement in current conditions but mixed inflation expectations.

Political bifurcation in sentiment remained evident, with Republicans optimistic and Democrats cautious about future economic impacts.

ISM Services [Wednesday]

The November ISM Services index dropped to 52.1, missing consensus and marking its lowest level since August, as business activity, new orders, and employment all declined.

Economists highlighted tariff uncertainties and mixed industry growth, while factory orders rose modestly by 0.4%.

Job Openings & Labor Turnover Survey [Tuesday]

October JOLTS job openings came in strong at 7.74M, while hires dipped and the quits rate rose slightly to 2.1%.

ISM Manufacturing [Monday]

The November ISM Manufacturing index improved to 48.4, its best reading since April, driven by gains in new orders, employment, and production, though it remained in contraction territory (<50).

Trivia

Today’s trivia is on Apple.

What year was Apple founded?

A) 1976

B) 1974

C) 1985

D) 1981What famous ad campaign debuted during the 1984 Super Bowl?

A) “Think Different”

B) “The Future Is Here”

C) “Here’s to the Crazy Ones”

D) “1984”What was Apple’s first portable device?

A) iPod

B) Newton PDA

C) PowerBook

D) MacBookWhen was the first iPhone released?

A) 2005

B) 2009

C) 2007

D) 2010What year did Steve Jobs get fired from Apple?

A) 1981

B) 1985

C) 1989

D) 1991What year did Steve Jobs return to Apple?

A) 1993

B) 2004

C) 2001

D) 1997

(answers at bottom)

This Week In History

December 8, 1980 – Assassination of John Lennon: Former Beatle John Lennon was shot and killed in New York City, impacting music and culture worldwide.

December 6, 1917 – Halifax Explosion: A munitions ship explosion in Halifax, Canada, killed approximately 2,000 people and caused widespread destruction, being one of the largest non-nuclear explosions.

December 8, 1991 – Dissolution of the Soviet Union: Leaders of Russia, Ukraine, and Belarus signed the Belavezha Accords, effectively dissolving the Soviet Union and ending the Cold War era.

Market Update

Market Movers

Friday:

Asana (ASAN) [+43.6%] Q3 earnings beat expectations with strong multiyear deals and AI momentum, raising guidance and impressing analysts.

Lululemon (LULU) [+15.9%] Q3 results topped estimates with solid international growth and women's sales, alongside a solid holiday start.

Smith & Wesson Brands (SWBI) [-20.3%] Missed earnings and revenue expectations, citing inflation and softer demand trends as major issues.

Thursday:

American Airlines Group (AAL) [+16.8%] Raised Q4 guidance significantly and announced a Citi co-branded card partnership, boosting investor confidence.

American Eagle Outfitters (AEO) [-14.3%] Missed on sales and lowered guidance despite Black Friday traffic gains and a decent holiday shopping start.

Wednesday:

Roku (ROKU) [+9.6%] Speculation of a potential acquisition sent shares higher after an analyst noted the company's pricing power and unique data.

Mattel (MAT) [+5.6%] CEO highlighted strong Black Friday sales and brand momentum during a Morgan Stanley conference.

Eli Lilly (LLY) [+2%] Released study results showing its weight-loss drug Zepbound outperformed Wegovy by a wide margin.

Foot Locker (FL) [-9%] Posted weak Q3 earnings and guidance as consumer demand and promotional pressures dragged down performance.

Box (BOX) [-7.7%] Beat Q3 expectations but flagged weaker billings and FX headwinds that dampened near-term outlook.

Tuesday:

AT&T (T) [+4.6%] Shared ambitious financial plans, including $40B in shareholder returns, during its analyst day preview.

United States Steel (X) [-8%] Dropped after Trump reiterated his opposition to a foreign acquisition of the company.

Microchip Technology (MCHP) [-7%] Cut guidance due to weak orders and inventory issues, despite cost-saving plans to close a factory.

Tesla (TSLA) [-1.6%] Fell as November China sales declined and Musk's bid to reinstate his massive pay package was denied.

Monday:

Super Micro Computer (SMCI) [+28.7%] Jumped after an internal review found no evidence of fraud and ruled out financial restatements.

Tesla (TSLA) [+3.5%] Upgraded by analysts citing potential for AI and CyberTaxi opportunities alongside Musk’s increased appeal to new buyers.

Upstart Holdings (UPST) [-14.5%] Downgraded on valuation concerns as future funding improvements seemed fully priced in.

Stellantis (STLA) [-6.3%] Dropped after CEO resignation due to differing views with the board, as the company searches for new leadership.

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

A) Apple was founded in 1976.

D) Apple’s “1984” stood out for it’s references to the George Orwell book of the same name [Link].

B) Apple’s first portable device was the Newton PDA. It was a bomb.

C) The first iPhone was released in 2007. It wasn’t.

B) Steve Jobs was fired in 1985.

D) Steve Jobs returned to Apple in 1997.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.