🔬Palantir [Part II]: It Trades At What Multiple?!

Plus: Price hikes from the streamers is getting ridiculous; and much more!

"It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong."

- George Soros

"Life is really simple, but we insist on making it complicated."

- Confucius

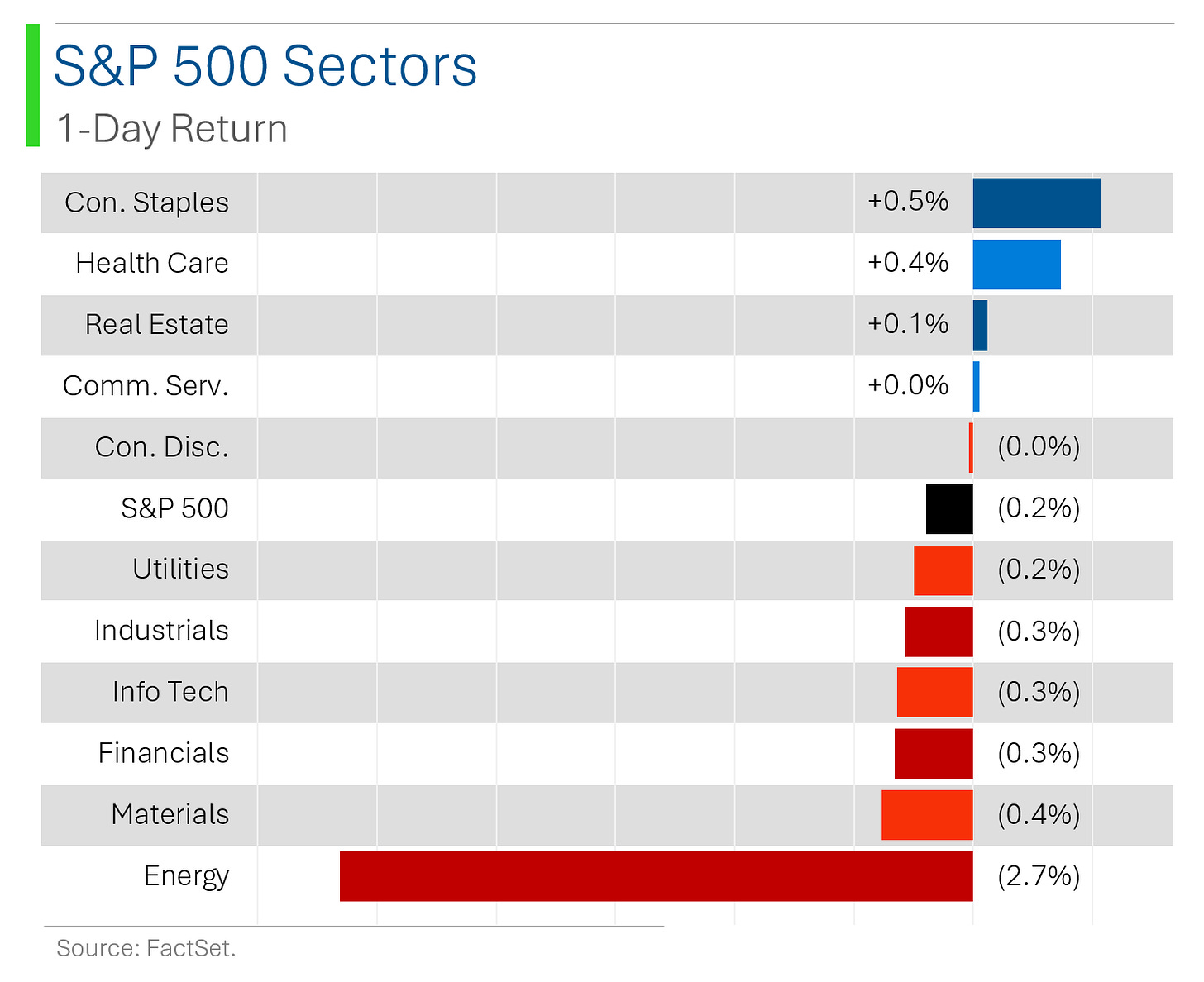

Soft day for the big US markets, reversing Monday’s big gains with the S&P 500 -0.2% and Nasdaq -0.3%. Muted traded day with investors sitting on their hands for more macro data later in the week.

3 of 11 sectors finished higher, mostly the defensives led by Staples (+0.5%) and Health Care (+0.4%).

Notable companies:

Boeing (BA) [-4.2%] Grounded 777X test fleet due to engine mounting structure failure, with analysts noting this could delay deliveries into 2026.

Bank of America (BAC) [-2.5%] Berkshire Hathaway disclosed sale of 14M shares, totaling ~100M shares sold since late July.

Eli Lilly (LLY) [+3.1%] Late-stage trial for weight-loss drug tirzepatide showed a 94% reduced risk of Type 2 diabetes in overweight patients.

More below in ‘Market Movers’.

Street Stories

Palantir Part II

Today is a follow up from yesterday’s Should You Buy Palantir (or just be scared of it)? where I dug into the growth and operations of the business. Today I tackle the profitability and valuation. On guard! 🤺

Yesterday I talked about how Palantir has generally crushed earnings season, missing on revenue estimates only once since its been a public company. The company has also consistently blown past their published revenue guidance; only falling short of the top end of their target range once (Q4 2022).

Generally this can earn a company a reputation of being sandbaggers but, given that they have historically pegged guidance at a massive average of +5.1% quarter-over-quarter growth, they get a pass here. Truly a machine firing on all cylinders.

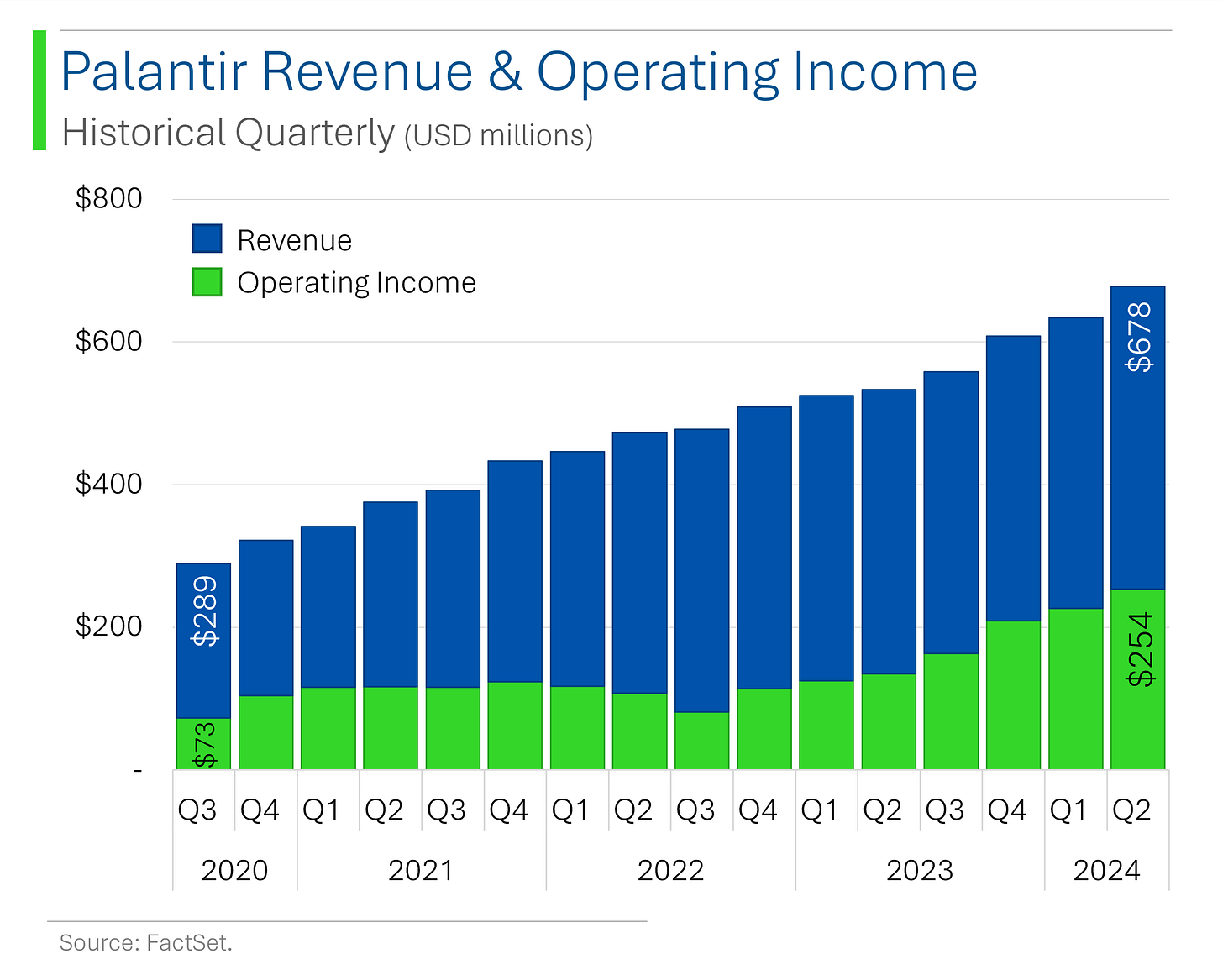

Operating income (EBIT) has been a bit more muddled (we talked yesterday about the expectations reset in 2022) but for the past two years they have been able to effectively convert this strong revenue growth into profitability.

Since hitting a trough in Q3 2022, the company has been able to realize incredible economies of scale. For example, since then revenue is up an impressive +42% while operating income is up +212%. God I love software…

This is best seen in the growth of their operating margin - which doesn’t really look like it’s slowing down…

But while Palantir appears to be in the pocket as far as growth and profitability, Wall Street isn’t exactly banging the drum on the shares. The average target price from the Street sits at just $25.52 per share - well shy of the company’s $32.50 share price - and only 39% of analysts have the company as listed as a buy.

What gives?

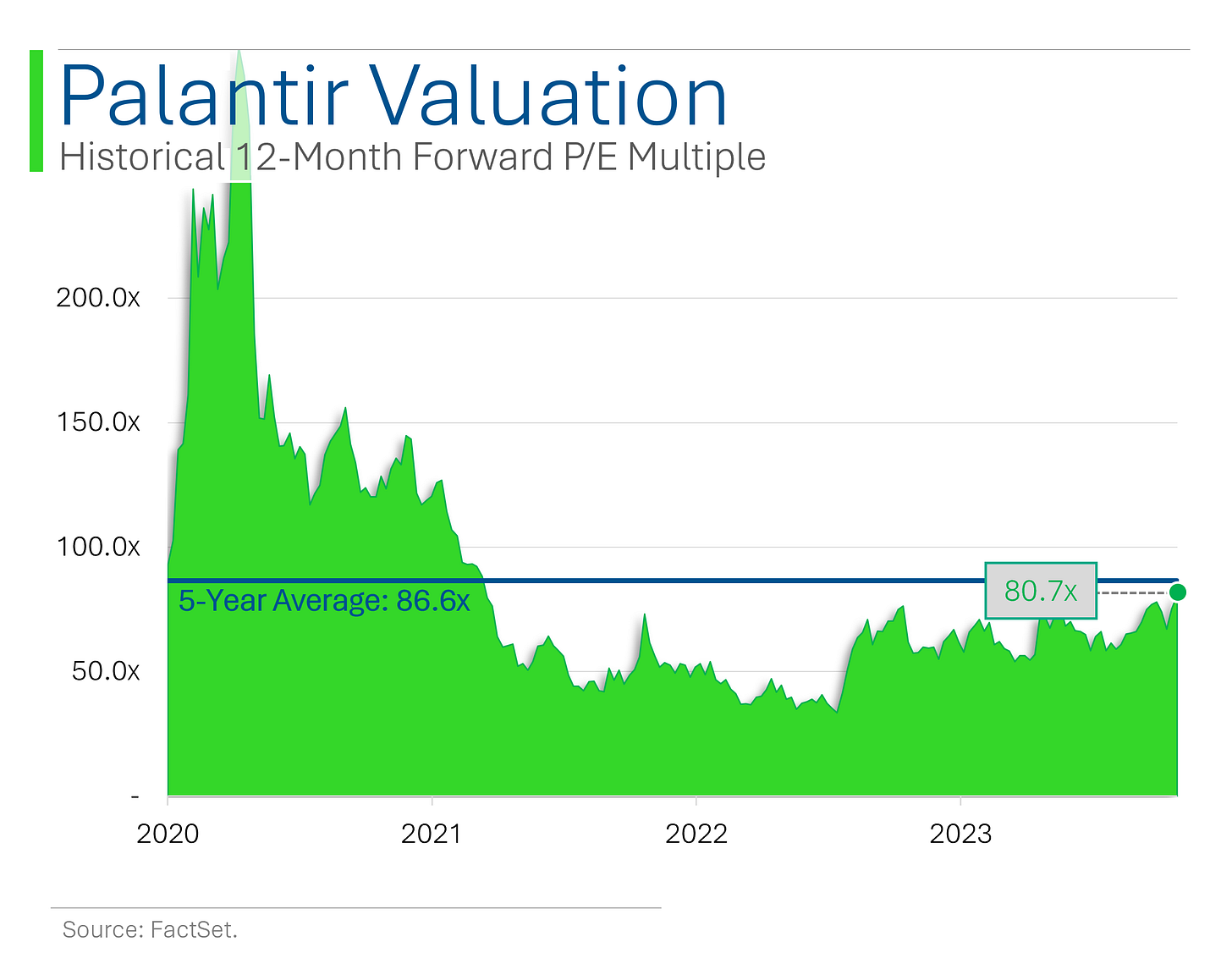

Much of that has less to do with the company’s operations - which are great - but the fact that the company trades at a hefty valuation. As you can see below, the company trades at an 81x forward P/E - which is pretty huge at roughly 4x what the S&P 500 trades at. This is fine for small-cap companies with lots of blue sky ahead of them but Palantir currently has a fully diluted market cap of $81 billion.

For example, you could buy AMD or Broadcom at less than half the valuation but with similar growth rates. Hell, even Nvidia trades at half the multiple!

Looking at just the big Software peers, it’s very clear that Palantir is in a league of its own as far as the premium paid. However, that’s not to say Palantir is a bad investment: but if you own it, you need to have confidence that it’s going to outgrow those peers - and do so long into the future.

Ryan’s Thoughts: I’ve got a few investment mantras and one of them is ‘Most people want to buy stocks at low P/E multiples and sell them at high P/E multiples. Me, I want to buy them at high P/E’s and sell them at low P/E’s. I just want the ‘E’ to grow a few thousand percent first.’

Palantir is definitely not cheap but if you you’ve got thick skin and a long-term outlook, you could end up doing just fine. ✌️🤞

Did streaming really kill the cable star?

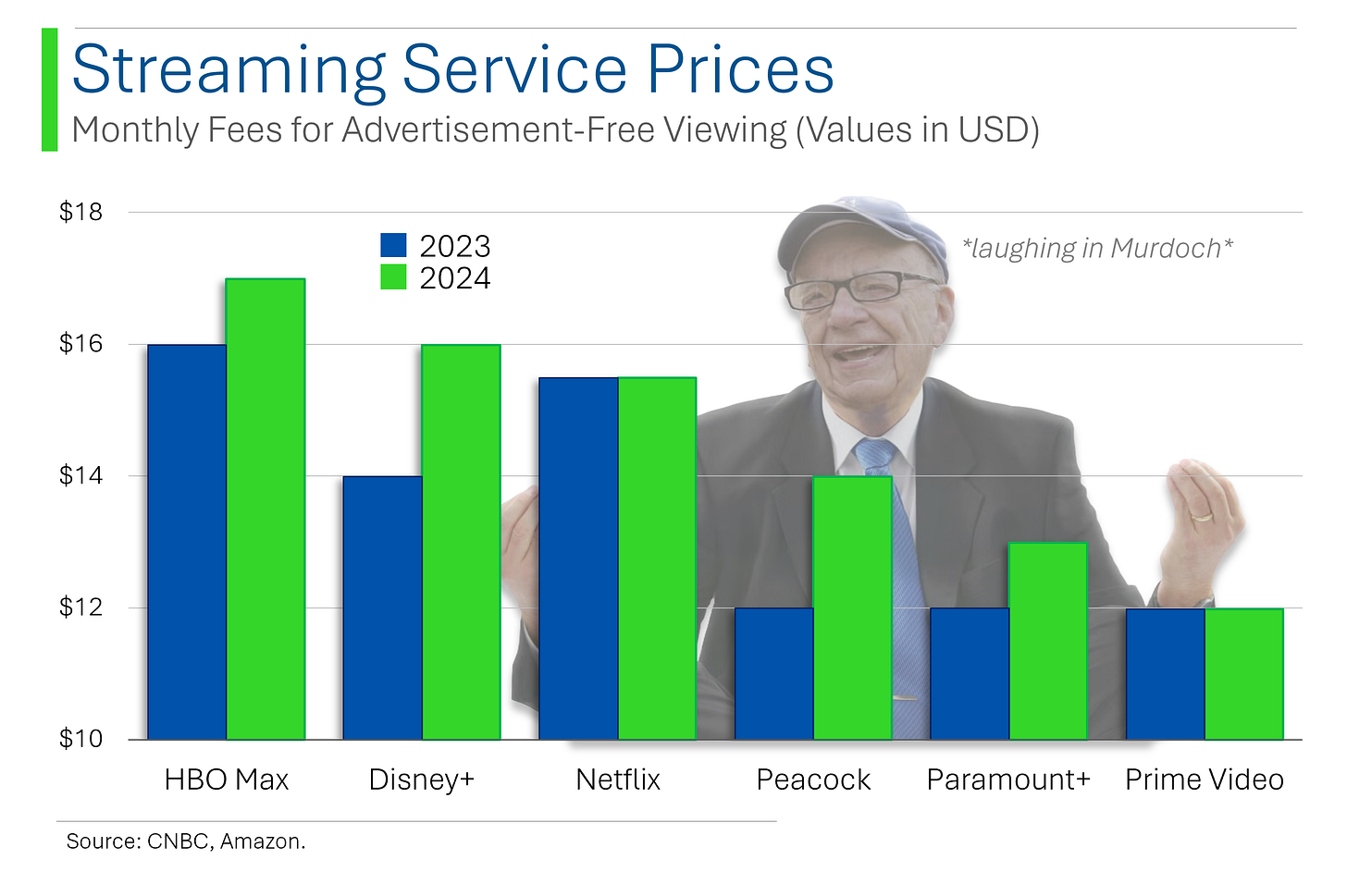

Streaming services like Disney+, Max, and Peacock have been hiking prices faster than you can say “cord-cutting,” with ad-free tiers now costing up to $16.99 a month. Disney+ alone raised prices by $1-$2 per month across its platforms, pushing its ad-free tier to $15.99.

Combined, the top streaming services have raised their prices about 8% over the last year (at least Rupert looks happy).

The problem here? Like cable, streaming users aren’t a captive audience. And the unsubscribe button is now readily available by law.

Joke Of The Day

What’s Forrest Gump’s password? 1forrest1.

Hot Headlines

CNBC / Lowe’s cuts full-year outlook as it expects weaker home improvement sales. Economists usually look to home improvement centers such as Home Depot and Lowe’s as barometers for the overall economy. And in this case, they’d see a 4% decline in sales through the rest of the year.

CNBC / RFK Jr. campaign ‘looking at’ joining forces with Trump, running mate Shanahan says. RFK Jr.’s independent campaign is considering this partnership or staying in the race to secure over 5% of the vote, positioning themselves as a third-party alternative for 2028. Ie: zero upside and you look like a tool.

Bloomberg / Azerbaijan formally applies to join BRICS says Foreign Ministry. Another East/West wedge?

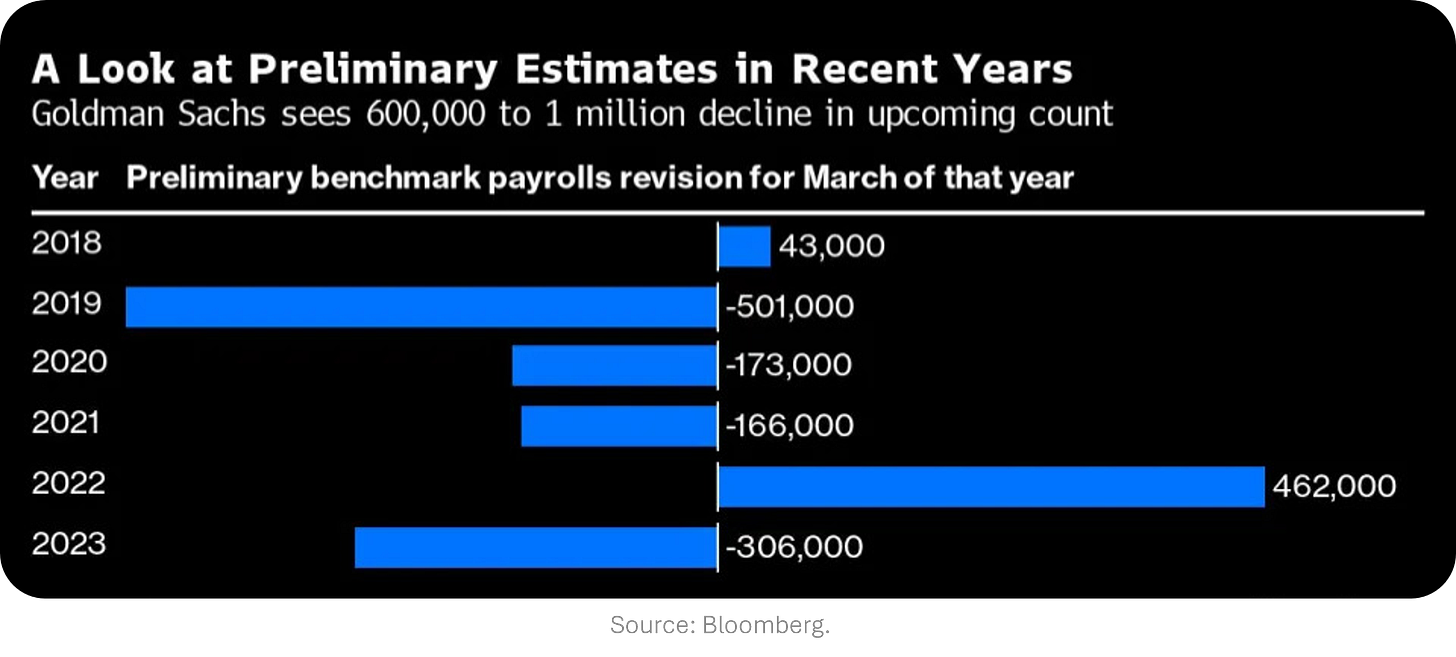

Bloomberg / Fed confronts up to a million US jobs vanishing in revision. Economists at GS and WFG estimate that the US actually added between 500k and 1m less jobs through the year until March. This would represent the largest downward revision in 15 years. Something to noodle over for that September rate cut.

WSJ / Elon Musk’s Twitter takeover is now the worst buyout for banks since the Financial Crisis. Typically banks quickly offload debt raised in big deals but due to X’s deteriorating financial position, the seven lenders have been unable to offload the debt without suffering huge losses - tying up their balance sheets and denting profitability.

Trivia

Today’s trivia is on streaming services!

Streaming services have transformed the media landscape, but profitability remains a challenge. Which streaming service first reported a quarterly profit in its financial history?

A) Netflix

B) Hulu

C) Amazon Prime Video

D) Disney+Content is king in the streaming industry. When assessing the value of a streaming service's content library, which financial metric would provide the most insight into its ability to generate long-term revenue?

A) Content amortization expense

B) Average revenue per user (ARPU)

C) Content acquisition cost

D) Subscriber acquisition cost (SAC)Subscriber churn is a critical issue for streaming services. A high churn rate can significantly impact revenue. What financial ratio best reflects a streaming service's ability to maintain its subscriber base over time?

A) Price-to-earnings (P/E) ratio

B) Lifetime value (LTV) to customer acquisition cost (CAC) ratio

C) Debt-to-equity ratio

D) Operating marginStreaming services often bundle content to increase value to subscribers. What strategy is most commonly used to improve ARPU in the streaming industry?

A) Offering multiple subscription tiers with varying levels of content access

B) Aggressive price promotions to attract new subscribers

C) Expanding into international markets with localized content

D) Reducing operating costs through technology optimization

(answers at bottom)

Market Movers

Winners!

Fabrinet (FN) [+15.7%] Fiscal Q4 results beat expectations with standout non-800G performance; telecom decline less than expected, positive sentiment on Ciena win and Q1 guidance, buyback program expanded.

Hawaiian Holdings (HA) [+11.3%] DOJ approved merger with ALK; still requires DOT exemption, with both parties working cooperatively.

Amer Sports (AS) [+10.4%] Q2 revenue and EPS exceeded forecasts; raised FY guidance, driven by strong performance in Technical Apparel (Arc'teryx) and solid Outdoor Performance.

Palo Alto Networks (PANW) [+7.2%] FQ4 earnings and revenue beat, with strong guidance; analysts positive on margins and demand, though concerned about RPO inflection and NGS ARR slowing.

Eli Lilly (LLY) [+3.1%] Late-stage trial for weight-loss drug tirzepatide showed a 94% reduced risk of Type 2 diabetes in overweight patients.

Take-Two Interactive (TTWO) [+2.9%] Announced Borderlands 4 for 2025, with reports indicating it may be the first project from Gearbox, acquired by TTWO in June.

Netflix (NFLX) [+1.5%] Closed over 150% increase in upfront ad sales for 2023; set to launch live events including NFL Christmas games and WWE Raw.

Losers!

Dentsply Sirona (XRAY) [-4.8%] CFO Coleman resigning to join PINC; analysts noted the resignation is poorly timed as XRAY is mid-transformation, which Coleman was leading.

Stride (LRN) [-4.3%] Downgraded to neutral from buy at Citi due to valuation concerns and uncertainty surrounding fiscal year guidance.

Boeing (BA) [-4.2%] Grounded 777X test fleet due to engine mounting structure failure, with analysts noting this could delay deliveries into 2026.

Bank of America (BAC) [-2.5%] Berkshire Hathaway disclosed sale of 14M shares, totaling ~100M shares sold since late July.

Market Update

Trivia Answers

A) Netflix was the first streaming service to report a quarterly profit.

A) Content amortization expense provides the most insight into the long-term revenue potential of a content library.

B) The LTV to CAC ratio best reflects a streaming service's ability to maintain its subscriber base.

A) Offering multiple subscription tiers with varying levels of content access is a common strategy to improve ARPU.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.