🔬OpenAI is a Disaster, Oil is Going to Be Free Soon, and Much More

“Time in the market beats timing the market”

- Ken Fisher

“Why is there so much month left at the end of the money?”

- John Barrymore

Table of Contents

🔥 Hot Headlines

🤭 Joke Of The Day

📈 Market Movers

🙋♂️ Trivia

📊 Market Update

Hot Headlines

ALTMAN IN TALKS TO RETURN TO OPEN AI - A few days after the CEO of the world’s most famous artificial intelligence company was reportedly fired, he is said to be in talks with the Open AI Board about returning to the helm. Rumors circulating that Ilya Sutskever - co-founder and chief scientist - was behind the coup as a possible power struggle emerges within the company. (The Verge)

HOUSING CONSTRUCTION STRENGTHENS - In October, U.S. home construction increased unexpectedly by 1.9%, reaching a 1.37 million annualized rate. This was ahead of Wall Street’s 1.345 million estimate, driven by limited supply in the resale market and a rise in permit applications to 1.49 million (Wall Street estimate of 1.45 million). (Bloomberg)

ELON MUSK BACKLASH GROWS - Elon Musk's endorsement of anti-Semitic rhetoric has led to significant backlash, with major advertisers like Apple, Disney, and Lionsgate suspending their business on the social media platform X, formerly known as Twitter, and potentially impacting its financial stability. Tesla's share price has experienced volatility, dropping initially but slightly recovering, amidst concerns from shareholders and calls for the Tesla board to take action against Musk, including potential censure. This controversy raises concerns about lasting damage to Tesla's brand and the possibility of Musk being demoted or removed by the board, amid fears that further advertising crises and Tesla stock sales could exacerbate the situation. (Barron’s)

OIL PRICE DECLINE - Oil popped +4% on Friday but that wasn’t enough to stop its fourth straight week of declines, as excess supply continues to fill-up storage facilities in Cushing, Oklahoma. Refining margins in China are also notably reduced, implying soft demand out of the world’s largest importer. 2024 demand estimates out of the International Energy Agency and the U.S. Energy Information Administration have also been falling for months, with the EIA’s estimate now indicating a 100k-barrel-per-day surplus in the oil market next year. (Reuters)

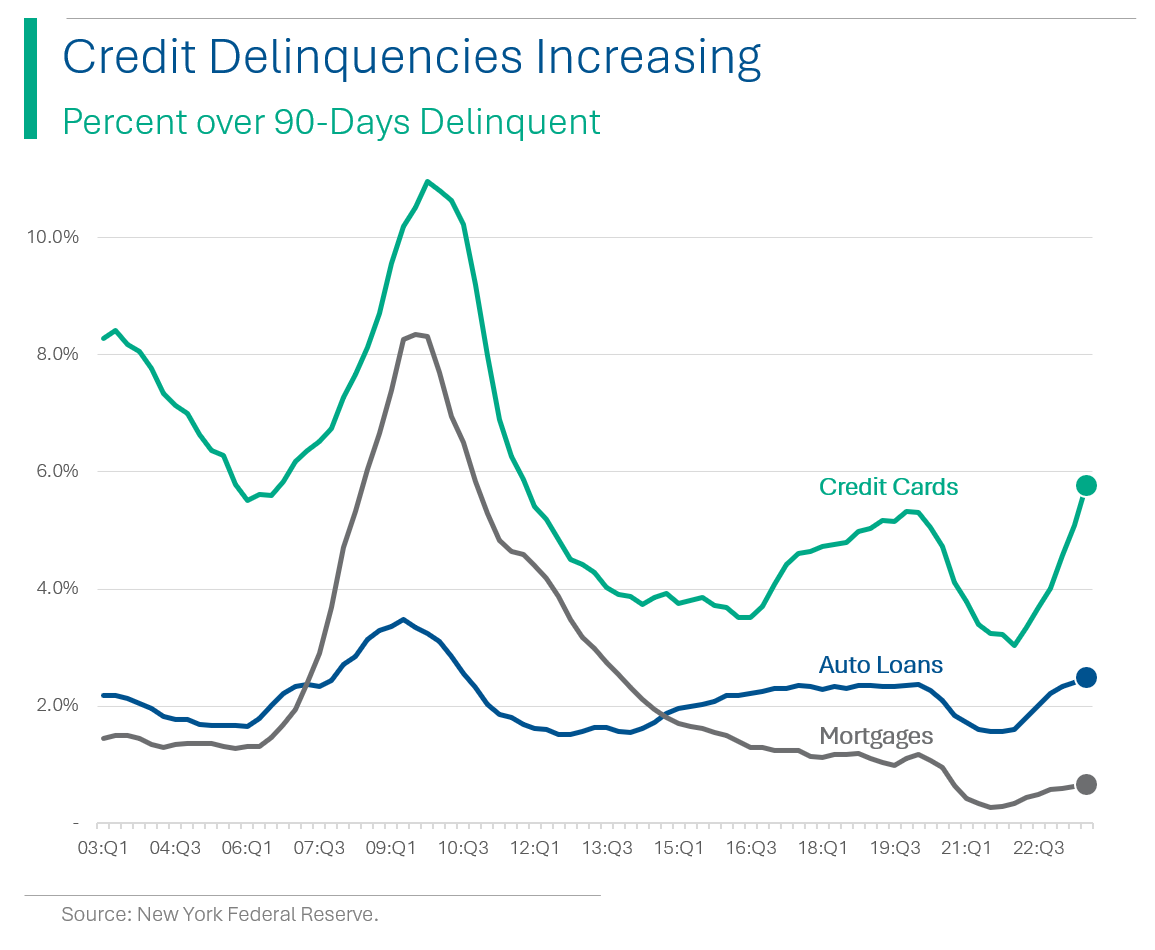

CONSUMER DELINQUENCIES - The rise in consumer credit delinquencies hasn’t reached a scary level yet, but it’s hard to argue that the trend doesn’t look concerning. (Barron’s)

HOLLYWOOD TIGHTENS ITS BELT - Despite the end of Hollywood's six-month labor stoppage sparking a flicker of hope, the industry is bracing for a bumpy ride, with studios trimming budgets and shelving projects faster than a director yells "cut!" It's a scene of contraction and consolidation, where the quest for streaming supremacy and investor appeasement turns Hollywood into a less glitzy, more penny-pinching version of its former self. Just on Wednesday alone, Netflix cancelled five more shows, including “Shadow and Bone” and “Glamorous.” (Axios)

(Yahoo) Walgreen to pay £1 billion to offload Boots pension scheme. If you have to pay £1 billion in order to get someone to take over your £4.5 billion pension, you probably suck at managing money.

(Tech Crunch) SpaceX’s second launch of largest ever rocket, Starship, was relatively successful - despite the ‘rapid unscheduled disassembly’. Made it past second stage separation this time.

(CNBC) Airlines brace for record Thanksgiving air travel. The Transportation Security Administration expects to screen 30 million passengers from Nov. 17 through Nov. 28, the most ever.

(CNN) From Sin City to Sports Central: How Las Vegas is betting big on a lucrative industry.

(CNBC) Investor JAT Capital sends scathing letter to new Bed Bath & Beyond board over CEO ouster - JAT owns 10% of the dumpster fire company.

(Yahoo) Argentina elects Javier Milei as President - You know your socialist paradise isn’t working out well when you elect an avowed Libertarian.

Joke Of The Day

Why do pediatricians not like long-term investments? They have little patients.

Market Movers

Winners!

Gap (GPS) [+30.6%]: Q3 earnings surpassed expectations with notable improvements in Old Navy's performance and margins, benefiting from strategic promotions, lower commodity costs, and reduced airfreight use. Street was also expecting a garbage quarter so that’s why the move was so extreme.

Dillard's (DDS) [+7.7%]: Announced a special dividend of $20 per share, indicating a strong financial position and shareholder-friendly moves.

Ross Stores (ROST) [+7.2%]: Q3 results exceeded forecasts, leading to an upward revision in full-year guidance.

Expedia Group (EXPE) [+5.1%]: Received an upgrade to outperform from Evercore ISI, with projections of accelerated revenue growth and EBITDA margin expansion in 2024. This outlook is supported by sustainable initiatives, technological advancements in key brands, and the OneKey brand loyalty program.

Losers!

ChargePoint Holdings (CHPT) [-35.6%]: Announced a reduction in Q3 revenue guidance and expects a $42M non-cash impairment charge, citing market challenges in North America and Europe and fleet delays. Leadership changes including a new President and CEO and the departure of the CFO also lead to downgrades by multiple brokers (because if no one wants to work at your company it’s probably terrible).

Spectrum Brands Holdings (SPB) [-11.8%]: Reported fiscal Q4 revenue in line with expectations and higher EBITDA, thanks to investment income. However, the company unexpectedly forecasted a decline in FY24 sales and EBITDA growth below consensus, indicating increased investments planned for FY24.

Trivia

In the 'Black-Scholes' model, which factor is NOT considered in option pricing?

A) Stock price

B) Strike price

C) Time to expiration

D) Dividends

The 'Efficient Market Hypothesis' implies that:

A) All stocks are undervalued

B) Stock prices reflect all available information

C) Active management always outperforms passive management

D) Markets are always in perfect equilibrium

What is the 'Sharpe Ratio'?

A) A measure of a portfolio's performance without considering risk

B) The ratio of a stock's return to its beta

C) A measure of risk-adjusted return

D) The ratio of total debt to equity of a company

(answers at bottom)

Market Update

Trivia Answers

D) Dividends aren’t included in Black-Scholes.

B) The Efficient Market Hypothesis implies that stock prices reflect all available information.

C) The Sharpe Ratio is a measure of risk-adjusted return.