🔬 Oil is Volatile, Buffett Loves Cash, and Much More

"Investing is the intersection of economics and psychology"

- Seth Klarman"A fool with a plan can outsmart a genius with no plan"

- T. Boone Pickens

Table of Contents

A.M. Allocations:

- More Like ‘Berkshire Cashaway’

- Crude Mood Swings: The Unpredictable Value of Oil

Hot Headlines

ARTIFICIAL INTELLIGENCE - The UK hosted a summit on AI safety and future regulation, attended by representatives from 28 nations, including the US and China. At the Bletchley Park summit, UK Prime Minister Rishi Sunak aimed to establish the UK as a leader in AI safety, but faced overshadowing by the US, which announced its own AI safety institute and secured press attention through Vice President Kamala Harris. Despite this, the summit ended with a diplomatic success as the nations attending signed a joint statement on AI, with the UK rallying support for global cooperation on the issue. (Bloomberg)

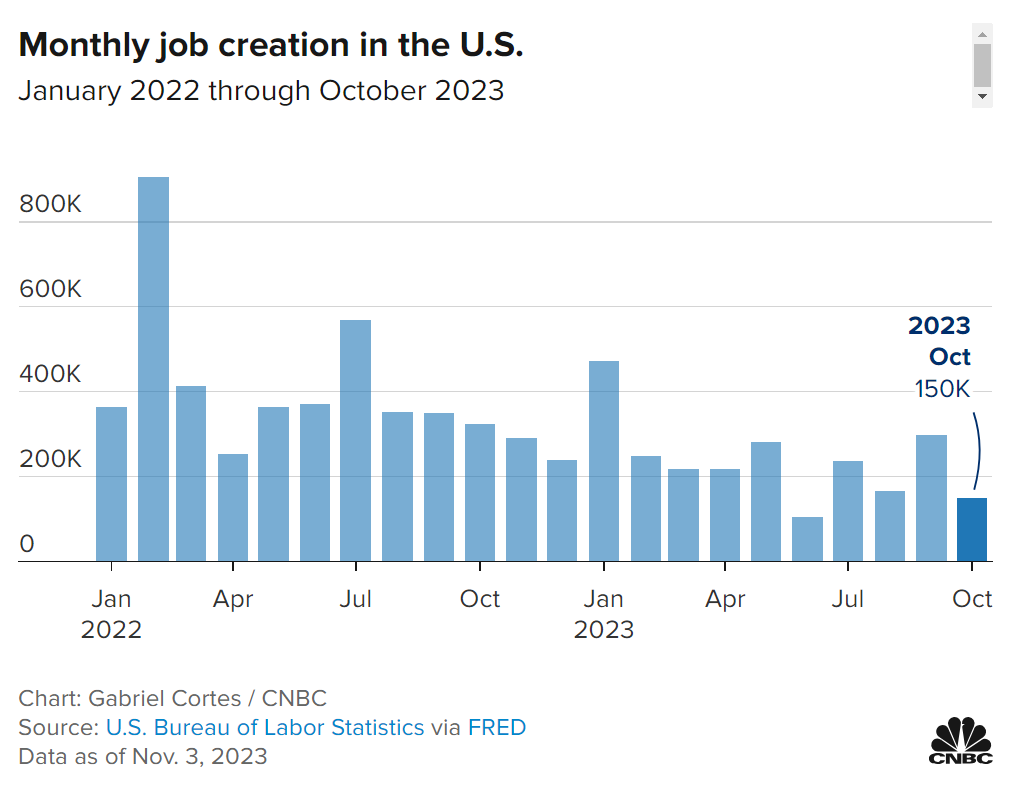

US EMPLOYMENT - U.S. job growth slowed in October with nonfarm payrolls increasing by 150,000, falling short of the expected 170,000, partly due to the United Auto Workers strikes affecting manufacturing jobs. The unemployment rate ticked up to 3.9%, marking the highest level since January 2022 and surpassing the forecasted steady rate of 3.8%. This deceleration in job creation was received positively by the market, as it could potentially ease the pressure on the Federal Reserve in its efforts to combat inflation. A CME Group tool to gauge the probabilities of future rate hikes now only sees a 5% chance of a December rate increase. (CNBC)

US ELECTION POLLING - Polls by the New York Times and Siena College show Democratic President Joe Biden trailing Republican Donald Trump in five key battleground states (Arizona, Michigan, Georgia, Pennsylvania and Nevada) a year before the U.S. election, amid concerns about Biden's age and economic management. Polls show Biden ahead in Wisconsin but he beat Trump in all six states on his way to winning the 2020 election. (Reuters)

CHINA MARKET ACCESS - At the China International Import Expo, Premier Li Qiang announced China's commitment to further open its economy, projecting imports of goods and services to reach $17 trillion in five years and promising to relax market access and foreign investment restrictions. The expo, however, faced criticism from the European Chamber of Commerce in China, calling it a "political showcase," amid China's intentions to actively pursue membership in the Comprehensive Progressive Trans-Pacific Partnership, currently comprised of 12 countries. (Reuters)

"No matter how the world changes, China's pace of opening up will never stall, and its determination to share development opportunities with the world will never change"

- Li Qiang

ELON MUSK’S AI CHATBOT - The new AI company that Elon Musk founded as part of X (formerly Twitter), xAI, has introduced Grok, an AI prototype with a witty and rebellious personality designed to tackle edgier queries, currently in beta and slated for inclusion in the X Premium+ service. Positioned as a competitor to firms like OpenAI, Grok has shown promise in initial tests, offering more current data integration and outperforming other models in its class, while xAI aims to diverge from creating "politically correct" systems and foster AI that caters to diverse viewpoints.

(Reuters) Lucid cuts prices of electric sedans amid EV price wars.

(Axios) Tyson recalls nearly 30,000 pounds of dino shaped chicken nuggets after customer complaints about finding metal in the food.

(Axios) Dating apps lose their luster with college students - 79% of students said they don’t use a dating app.

(CNN) Saudi Arabia’s oil production cuts have tipped its economy into reverse - Q3 GDP down 4.5% year-over-year.

(WSJ) Breaking Down the Best Earnings Quarter in a Year

Joke Of The Day

I saw on the news that the CEOs of T-mobile and Sprint got married last weekend. Great wedding, terrible reception.

I just started a business where we specialize in weighing tiny objects. It’s a small-scale operation.

A.M. Allocations

More Like ‘Berkshire Cashaway’

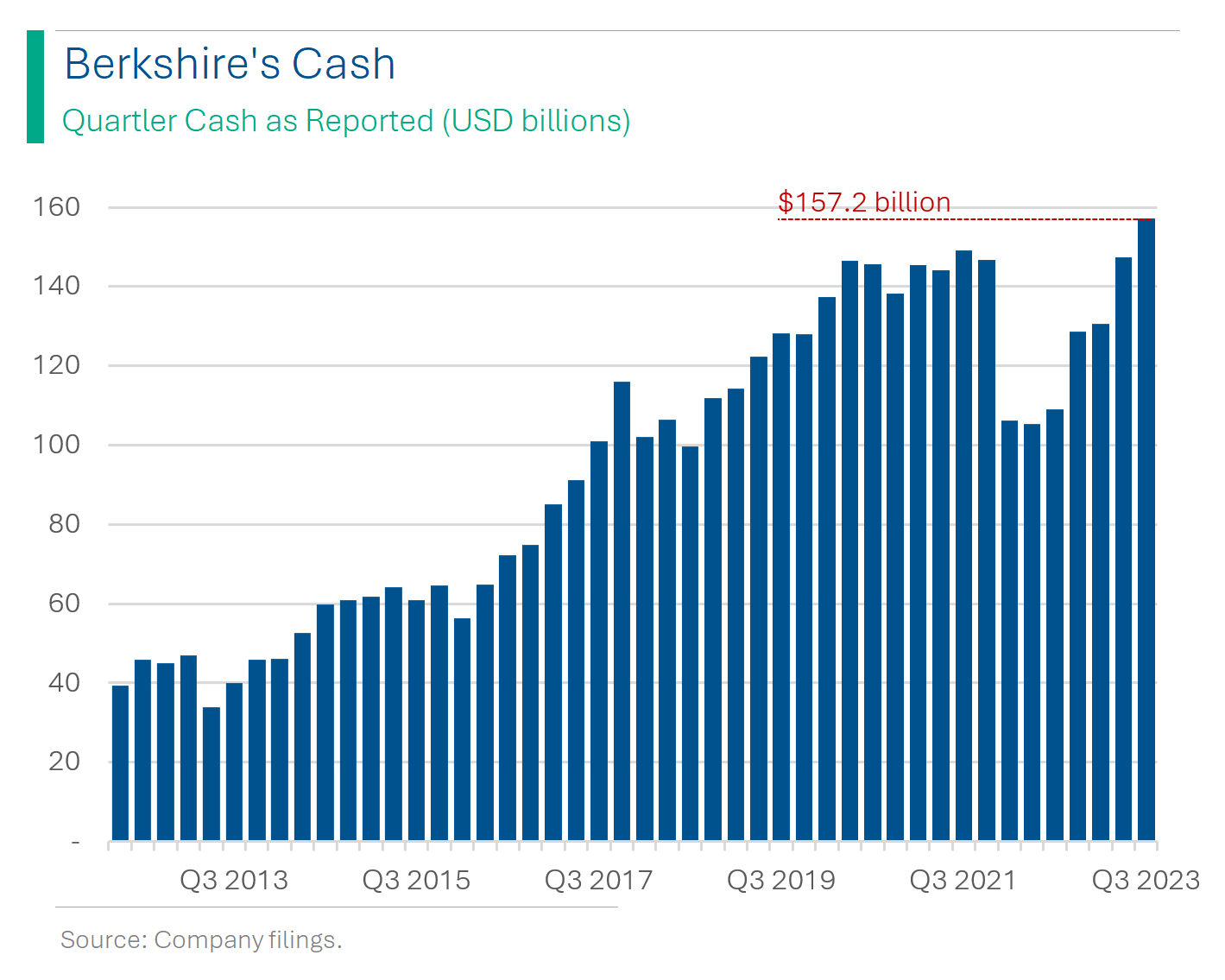

Even at 93, when Warren Buffett does something, people tend to want to know why. For example, when his company, Berkshire Hathaway, released its financials this Saturday, showing a $157.2 billion cash pile - the highest in the firm’s history - a lot of investors took note. For an idea of just how big this cash pile is - if it were a company, it would be the 42nd largest one in the US, in between Intel and Disney.

Berkshire Hathaway also reported a 40.6% increase in third-quarter operating earnings to $10.8 billion but a net loss of $12.8 billion - driven by a $30.3 billion loss on equity investments. The conglomerate's insurance underwriting business rebounded strongly with earnings of $2.4 billion, and it continued its stock repurchases, buying back $1.1 billion in the third quarter.

Explainer: This is interesting because it shows the trade-offs Messrs. Buffett and Munger are making between bonds and cash vs. equities. Typically, an investor will load up on cash if they see the risks in the market as outweighing the opportunities, or if they want to have cash available to invest in companies that get overcorrected by the market (having so-called ‘dry powder’).

In Berkshire’s case, this war chest isn’t just sitting in a bank account either. $126.4 billion of it is in short-term government securities, like T-Bills. So they are getting a decent return of perhaps around 5%. This highlights the importance of the Equity Risk Premium - that is, the spread or return that equities are priced to deliver over bonds/cash instruments. Buffett is demonstrating that the return equities are currently offering just isn’t tempting enough to forego the government-backed, safer and locked-in T-bill return. As we’ve talked about previously, higher interest rates increase the trade-off between stocks and bonds, and this can pose an often underappreciated risk as the reaction to bad or mixed news in the stock market can lead to an unexpectedly large reaction as people find better homes for their capital.

Crude Mood Swings: the Unpredictable Value of Oil

The fact that one of the most economically important commodities in the world is more volatile than a penny-stock should be concerning to us all. Whether we like it or not, we’re still decades away from the culling of fossil fuels from our everyday lives and, as minimal saving rates help illustrate, most people don’t have much room to absorb sudden price shocks. As the price of oil finds it way to nearly everything, we are very exposed to Oil’s volatile nature.

Explainer: Below is a bit of a refresher on some of the reasons why oil has been on a rollercoaster ride since summer:

September 5th - Russia and Saudi Arabia announce they will continue production cuts until year end (Reuters). Oil price starts multi-week rally.

October 4th - U.S. Energy Information Administration (EIA) releases data highlighting reduced demand for oil, particularly gasoline, based on a weak global economic outlook. Oil price drops 5.6% and begins broader pull-back.

October 6th - Hamas attacks Israel. Initial market reaction was relatively muted but as broader tensions - notably between the US and Iran - developed, the price began a 6.4% rally over the following two weeks.

Late October - As the expectations for a broader regional conflict in the middle-east have began to diminish, the oil price has retreated back to lows not seen since August.

Trivia

Warren Buffett trivia today...

Warren Buffett is renowned for his frugality. He still lives in the Omaha home he purchased in 1958. How much did he pay for it, an amount that wouldn't buy you a modern-day tool shed?

A) $25,000

B) $31,500

C) $50,000

D) $60,000The investment maestro’s legendary lunch auctions have raised millions for charity. What’s the highest bid ever placed to dine with him, not including tip?

A) $1 million

B) $2.6 million

C) $3.5 million

D) $4.6 millionThe Oracle of Omaha, Mr. Buffett, bought a struggling textile mill named Berkshire Hathaway in which year, inadvertently creating a monster of a different industry?

A) 1962

B) 1965

C) 1970

D) 1985

(answers at bottom)

Market Movers

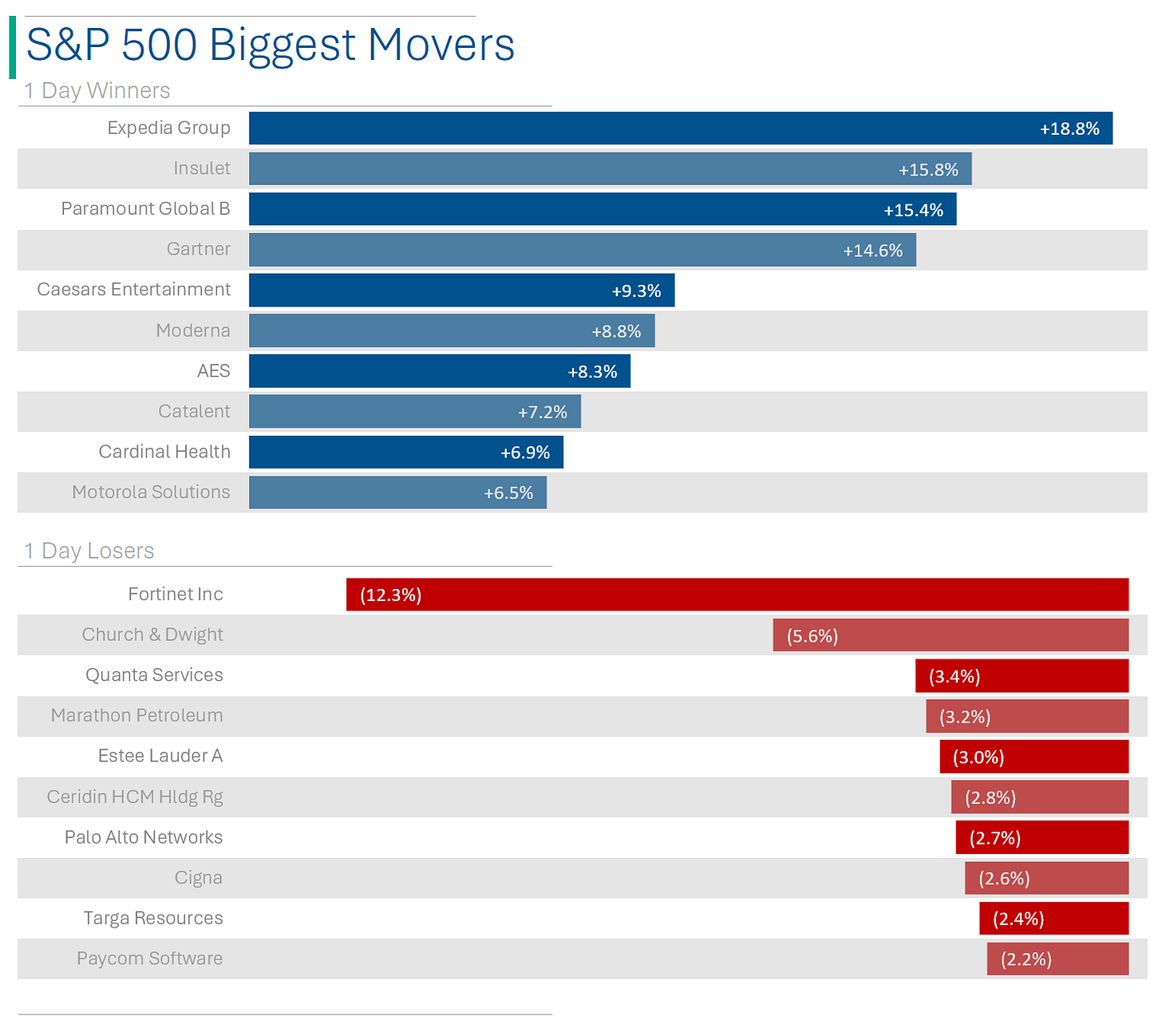

Winners

Expedia Group (EXPE): [+18.8%] Q3 results surpassed expectations with a $5B buyback plan. Despite Q4 geopolitical concerns, strong travel demand and B2C growth are seen, with prospects for 2024 acceleration.

DraftKings (DKNG): [+16.5%] Exceeded Q3 projections, with user and revenue growth spurring raised forecasts for 2023 and bullish 2024 outlooks. The market share gains and fiscal prudence were well-received.

Paramount Global (PARA): [+15.4%] Outperformed in Q3 with EPS and OIBDA beats, driven by robust Paramount+ subscriptions and expected lower DTC losses in 2023. Analysts noted significant subscriber and churn improvements.

Block, Inc. (SQ): [+10.6%] Topped Q3 estimates and uplifted FY23 guidance, targeting GAAP profitability by FY26 via cost efficiencies. Cash App's user growth and gross profit gains were key highlights.

Losers

Fox Factory Holding (FOXF): [-27.2%] Q3 earnings and sales fell short, with a downward revision in FY23 outlook due to the United Auto Workers strike and SSG market destocking, alongside the acquisition of Marucci Sports.

Restaurant Brands International, Inc. (QSR): [-1.9%] Q3 earnings surpassed predictions, but revenue didn't meet targets; comparable sales were weak, with Burger King and Popeye's seeing traffic stabilization. Analysts had higher hopes for Burger King's growth.

Apple (AAPL): [-0.5%] Fiscal Q4 sales were on target, and EPS outperformed with record gross margins; forecasted December quarter revenue aligns with the previous year, missing analyst expectations slightly due to product timing, offset by strong service sector and China market performance.

Market Update

Trivia Answers

B - $31,500.

C - $3.5 million.

B - 1965.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.