🔬Nvidia's Quarter Didn't Suck (Now We Can All Go Back About Our Business).

Plus: Shake-up on the Dow with Walgreen's dropped for Amazon; China's grip over its stock market tightens; Canada's new pipeline could hurt US wallets; and much more.

"If stock market experts were so expert, they would be buying stock, not selling advice"

- Norman Ralph Augustine

"Everyone has a plan until they get punched in the mouth”

- Mike Tyson

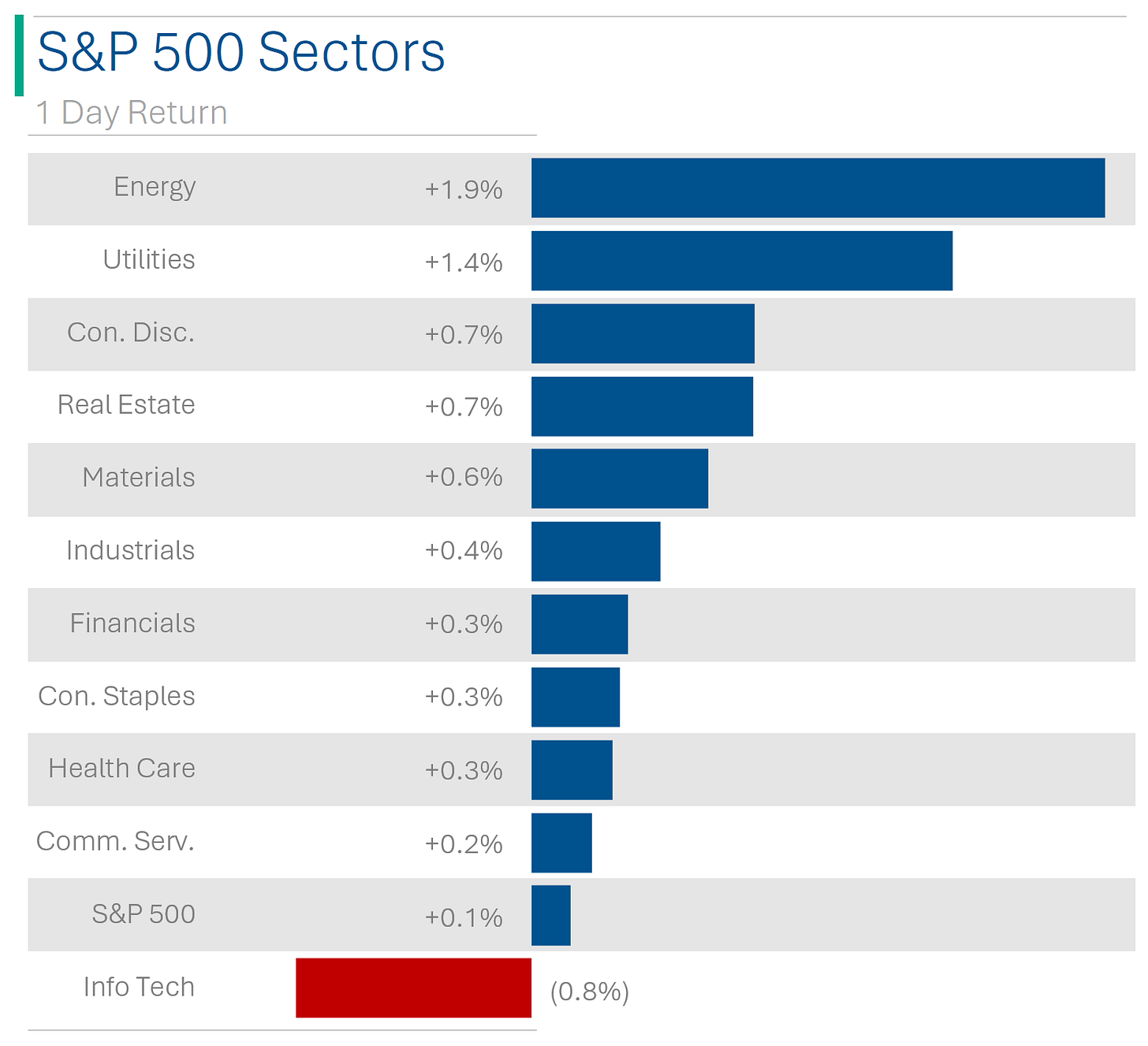

Mixed day of trading on the big US markets, with S&P 500 +0.13% and Nasdaq -0.32%.

10 of 11 sectors closed in the green, led by Energy (+1.9%) and Utilities (+1.4%). Tech (-0.8%) was the only loser on the day.

The big story of the day was Nvidia’s Q4 earnings release which came out strong (details below).

Cybersecurity company Palo Alto Networks (-28.4%) got smoked after reporting a weak quarter and lowering guidance… the world’s biggest hacking organization, LockBit, getting raided probably didn’t help them either.

Street Stories

Nvidia Delivers Big Fourth Quarter

The most anticipated quarterly report in years has finally come, and the market can rest easy that Nvidia delivered. As I discussed yesterday, market sentiment has depended on ongoing growth, and Nvidia has shouldered much of that burden. A bad miss and suddenly a lot of oxygen might have been sucked from the room. Luckily for stocks, that didn’t happen.

The estimates that Wall Street had for the quarter were huge but ultimately Revenue and EPS come in well ahead (8% and 12% beats respectively). Moreover, they were near the tippy top of even the most aggressive analysts forecasts.

Important for the continued momentum was where the company targeted its revenue guidance for next quarter (their Q1 2025). That also came out nicely ahead of where the Street was targeting, and again near the top of where even the punchiest analysts were aiming. Impressive.

To cap things off, Nvidia shares have taken flight in after hours trading since the report came out after market close. As I write this, shares have popped +14.2%, enough for the stock to open at a fresh all-time high.

Highlights:

Q4 Earnings Per Share: $5.16 vs. Wall Street est. $4.59 [+12% Beat]

Q4 Revenue: $22.10 billion vs. Street’s $20.4 billion [+8% Beat]

Segment Revenue:

Datacenter: $18.4 billion vs. Street’s $17.1 billion [+8% Beat]

Gaming: $2.9 billion vs Street’s $2.73 billion [+6% Beat]

ProViz: $463 million vs Street’s $422 million

Automotive and Robotics: $281 million vs. Street’s $274.5 million

Guidance:

Q1 2025 Revenue: $24.0 billion (+/- 2%) vs. Wall Street est. $22.2 billion

Q1 2025 Gross Margin: 77.0% (+/- 50bp) vs. Street’s 75.5%

The Dow & Walmart, I mean Walgreens

I did a bit of an explainer/rant on the Dow Jones Industrial Average a few months back (“The Dow Explained (And Why I Hate It)”) with the punchline being that it’s…just weird. Without rehashing everything, one of the oddest things about it, is that unlike a normal index, whereby the company weightings are determined by their market capitalizations (re: size), the Dow is weighted by price. I know. Dumb, eh?

Getting to the point now; on January 30th Walmart announced that it will be doing a 3-for-1 stock split effective this Friday… something about allowing more ‘Associates’ to purchase shares. Cool. Why that matters is that because the Dow is old-timey, the share split - which will presumably reduce Walmarts share price by 2/3rds (market cap left unchanged) - means that its weight in the Dow will be reduced by that much too.

Now the folks at Dow Jones are conscious of sector representation (even if basic index logic is lost to them) and were concerned about retailers being underweight in the index. Their (admittedly elegant) solution to this was to kick off weakling Walgreens and replace it with Amazon. The result is that the other index weights don’t get shaken up too much and they get to add a third member of the Magnificent 7 to the index. Pretty clever… in a weird, lazy way.

A Barrel of Surprises: Canada's Pipeline to Hurt U.S. Wallets

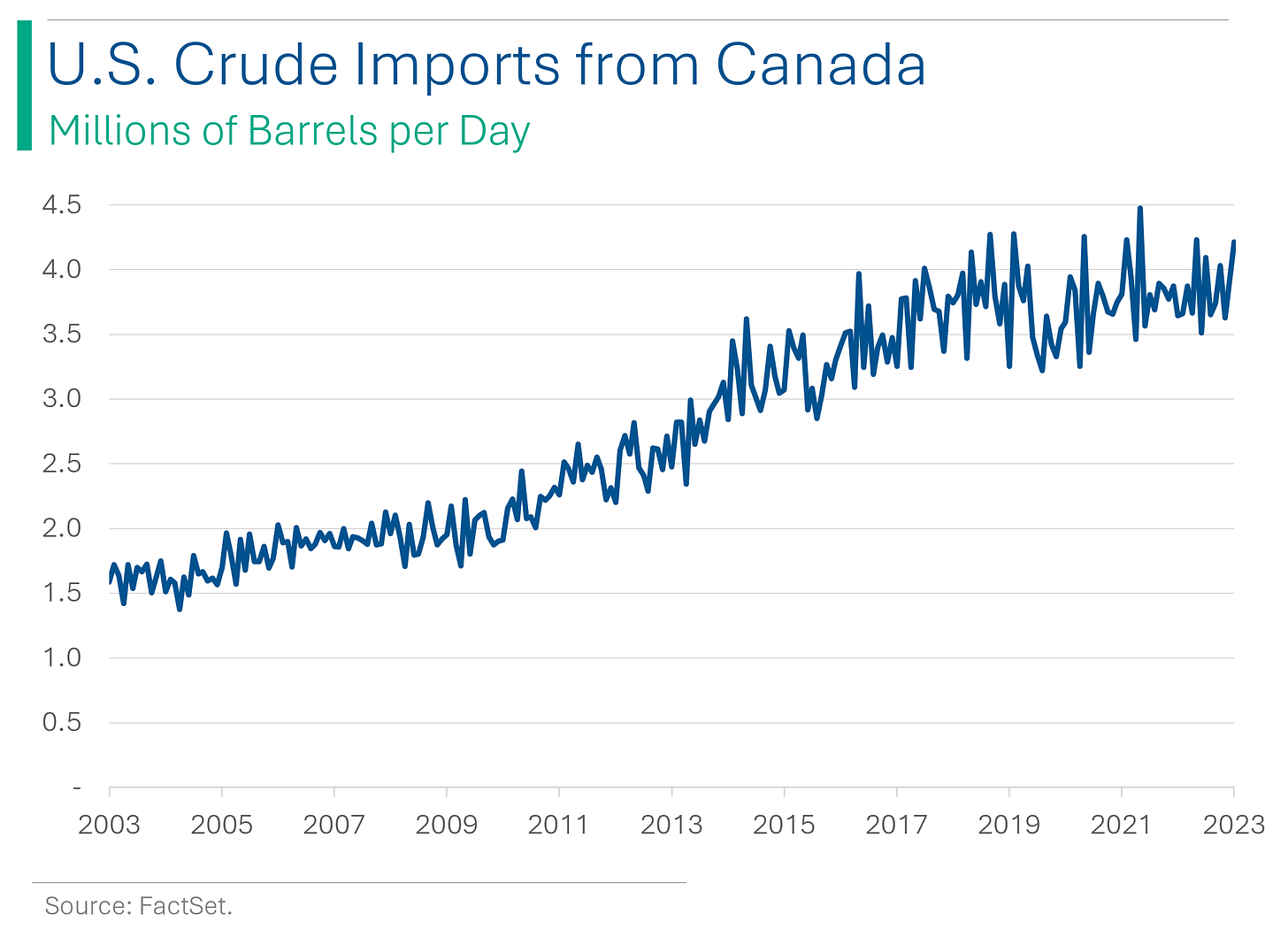

The U.S. has benefited from artificially cheap Canadian crude oil due to limited pipeline capacity (you’re welcome), with U.S. refiners importing about 4 million barrels a day at a discount. The expansion of Canada's Trans Mountain pipeline, expected to start in the second quarter, will allow Canadian oil more access to global markets, potentially reducing the discount and impacting U.S. refiners differently based on their location. West Coast refiners might see benefits due to cheaper shipping costs, while inland refineries, particularly in the Midwest, could face negative impacts due to their reliance on Canadian crude and limited access to alternative heavy crude sources. (The WSJ has more on this)

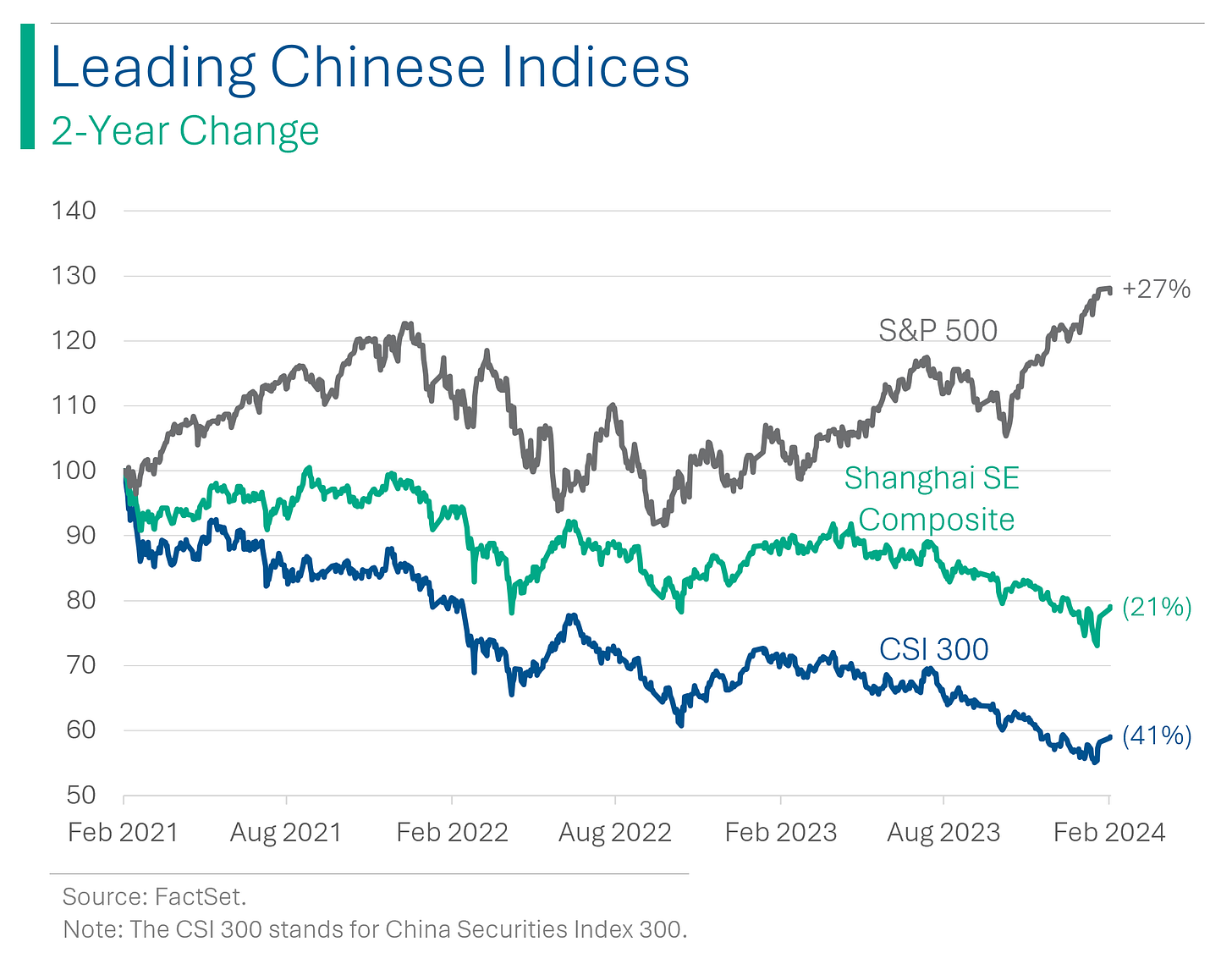

Beijing’s Stock Market ‘Guidance’ Increases

The list of actions taken by China to support its ailing stock market grows, with its markets now having shed ~$7 trillion in value. China's Shanghai and Shenzhen stock exchanges have pledged to enhance supervision of quantitative (‘quant’, if you’re cool) trading and extend reporting requirements to offshore investors. Actions are a response to trading bans imposed on Ningbo Lingjun Investment Management for abnormal trading behavior (dumping $360 million in shares one minuting into Monday trading was the last straw).

The exchanges aim to address concerns that quant trading, particularly high-frequency trading, can amplify market volatility and disadvantage smaller investors. This move reflects regulators' broader efforts to stabilize the stock market and ensure fair trading practices amidst rapid expansion of quant hedge funds and market volatility.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

The FTSE 100 has been looking thinner lately. It's lost several Pounds.

Hot Headlines

Bloomberg | Private Equity payouts at major firms plummet 49% in two years. #bailout

CNN | Chinese companies are raising internal militias. Move allows them to support Beijing’s military…and also help kibosh those pesky worker protests.

The New Yorker | Facebook Marketplace Through the Ages…

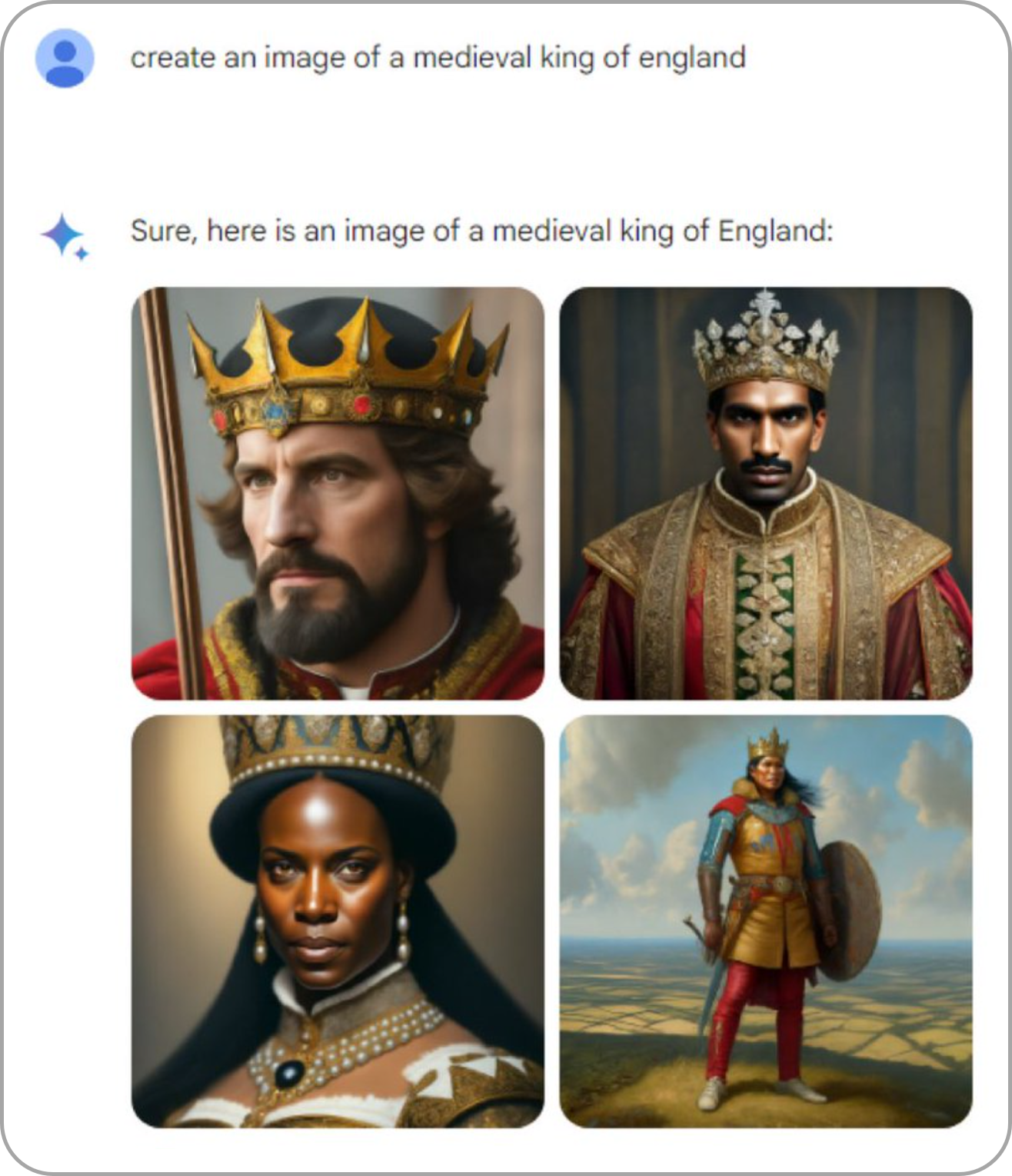

NY Post | ‘Absurdly woke’: Google’s AI chatbot spits out ‘diverse’ images of Founding Fathers, popes, Vikings. Some of these are gold.

Pajiba | Best movie review I’ve read in a long-time: Madame Web (the new ‘Spiderverse’ movie). Highlights: ‘a burning dumpster dropped into a volcano filled with moldy fish’ and ‘it makes Morbius look like the Godfather’.

Trivia

This week’s trivia is on great financial dynasties. Today’s is on Bill Gates.

What year did Bill Gates and friends found Microsoft?

A) 1972

B) 1975

C) 1980

D) 1985

As of 2023, approximately what was Bill Gates' net worth?

A) $50 billion

B) $120 billion

C) $200 billion

D) $90 billion

Microsoft's Windows OS holds what percentage of the desktop/laptop market share as of 2023?

A) 58%

B) 92%

C) 85%

D) 70%

Bill Gates was famously arrested in 1977 for what reason?

A) Accounting fraud

B) Traffic violation

C) Trespassing

D) Public disturbance

(answers at bottom)

Market Movers

Winners!

Bausch + Lomb (BLCO) [+13.8%] Q4 earnings and revenue beat driven by solid sales from Lumify, Eye Vitamins, and Dry Eye portfolio. Miebo marked the strongest launch in dry-eye disease in years. FY24 revenue guidance exceeds expectations, despite potential FX headwinds.

NeoGenomics (NEO) [+12.1%] FQ3 EPS and revenue surpassed forecasts, fueled by ASP and volume growth. FY24 net income and revenue outlook beat consensus, with Clinical Services growing 20% y/y and Advanced Diagnostics 17%.

Garmin (GRMN) [+8.8%] Q4 pro forma EPS and revenue exceeded expectations. The company raised its dividend and announced a new repurchase program. FY24 guidance aligns closely with expectations, with notable performance in Auto OEM, Aviation, and Marine sectors; gross margins highlighted as a key positive.

Losers!

Palo Alto Networks (PANW) [-28.4%] Lowered FY24 revenue and billings guidance again, citing cybersecurity spending fatigue, federal softness, and a strategic shift. Concerns rise over discounting and sustainability, leading to multiple downgrades.

Teladoc Health (TDOC) [-23.7%] Q4 earnings outperform but revenue falls short. BetterHelp's revenue and user growth disappoint, with lower marketing yield. Q1 and FY guidance underwhelm, sparking analyst concerns about long-term prospects.

Global-e Online (GLBE) [-16.9%] Q4 EPS misses slightly, though revenue beats expectations. Q1 guidance disappoints, FY24 outlook aligns with forecasts amid 42% GMV growth y/y. Management comments on 2023's consumer sentiment volatility and 2024's uncertain macro environment.

SolarEdge Technologies (SEDG) [-12.2%] Q4 EPS exceeds forecasts, but revenue doesn't meet expectations, with Q1 guidance also falling short. Operating and gross margins underperform, with management anticipating a recovery starting Q2 and channel normalization in 2H24 amid current demand and inventory challenges.

Keysight Technologies (KEYS) [-6.7%] FQ1 EPS and revenue beat expectations, but Q2 forecasts lag. Management sees constrained demand but potential growth in AI-driven sectors. Analysts view backlog as possibly bottoming but anticipate a slower recovery.

International Flavors & Fragrances (IFF) [-6.4%] Q4 earnings miss, revenue meets expectations. Goodwill impairment in Nourish and pharma destocking impact, with FY guidance disappointing. Analysts react to dividend cut and lack of asset sale announcements.

Market Update

Trivia Answers

B) Microsoft was founded in 1975.

B) Bill Gates’ net worth is estimated at $120 billion.

D) Microsoft holds around 70% of the operating system market for laptop/desktop.

B) The famous mugshot was for a traffic violation.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

They crushed it!