🔬Nvidia vs. Microsoft... in charts!

"If stock market experts were so expert, they would be buying stock, not selling advice"

- Norman Ralph Augustine

"Everyone has a plan until they get punched in the mouth”

- Mike Tyson

Fresh all-time highs for the big US markets with the S&P 500 +0.5% and Nasdaq +0.9% on Friday. For the week, the S&P was up +2.0% and the Nasdaq +3.5%. So, pretty ok.

6 of 11 sectors closed higher for the week, led by Communication Services (+3.9%), mostly due to Meta, and Tech (+3.8%).

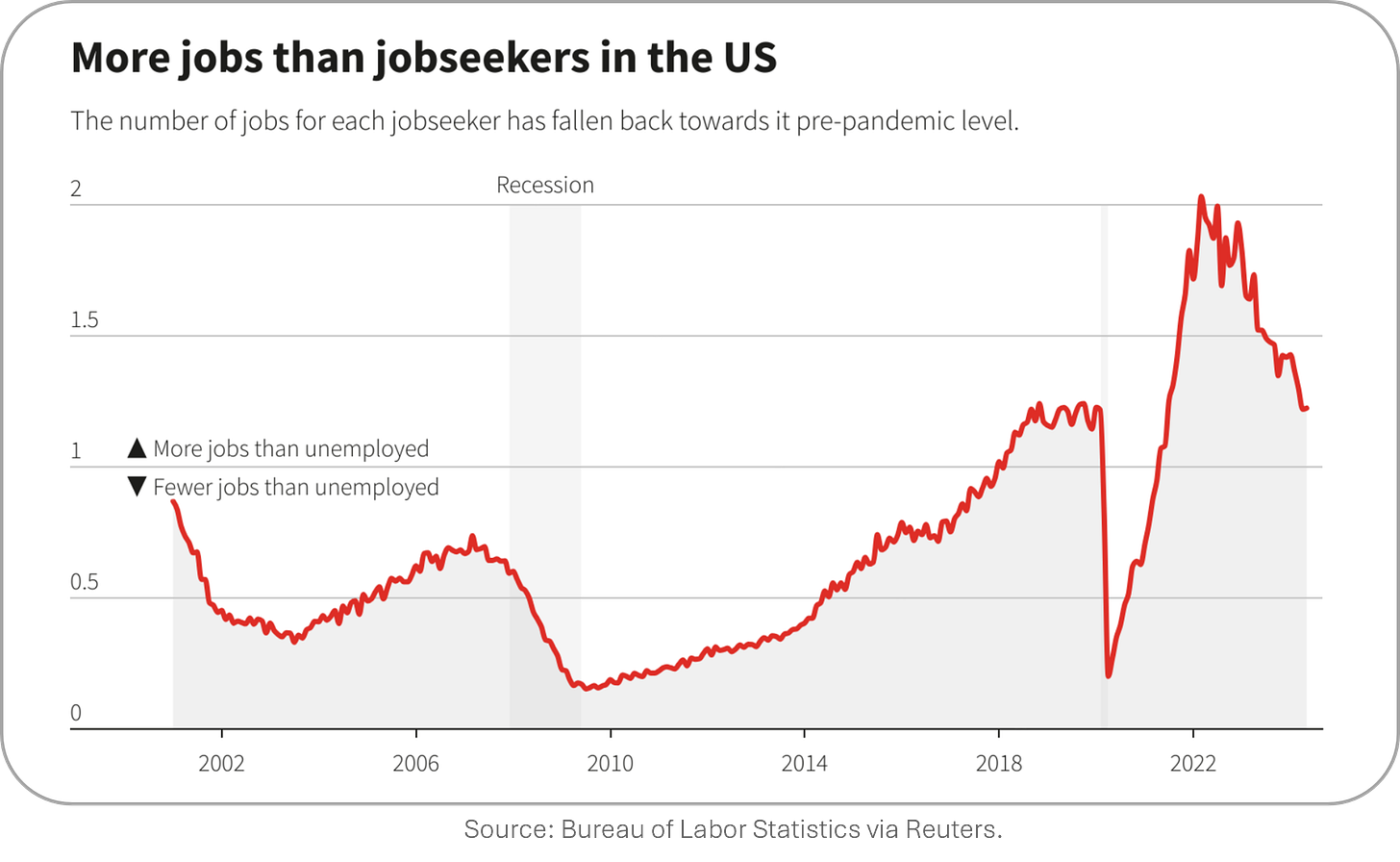

June Nonfarm Payrolls had a minor beat (206k vs. 190k consensus) but real issue was big negative revisions to May (218k from 272k) and April (108k from 165k). Yeeesh.

Notable companies:

Meta (META) [+5.9%]: Data release shows that Meta’s investments in AI are showing potential.

Macy's (M) [+9.5%]: Arkhouse and Brigade reportedly raised their offer to acquire the company to $24.80/share, up from $24.00/share.

Micron Technology (MU) [-3.8%]: DigiTimes reported comments from a senior executive on potential overcapacity issues due to global investments.

More below in ‘Market Movers’.

Street Stories

Nvidia vs. Microsoft

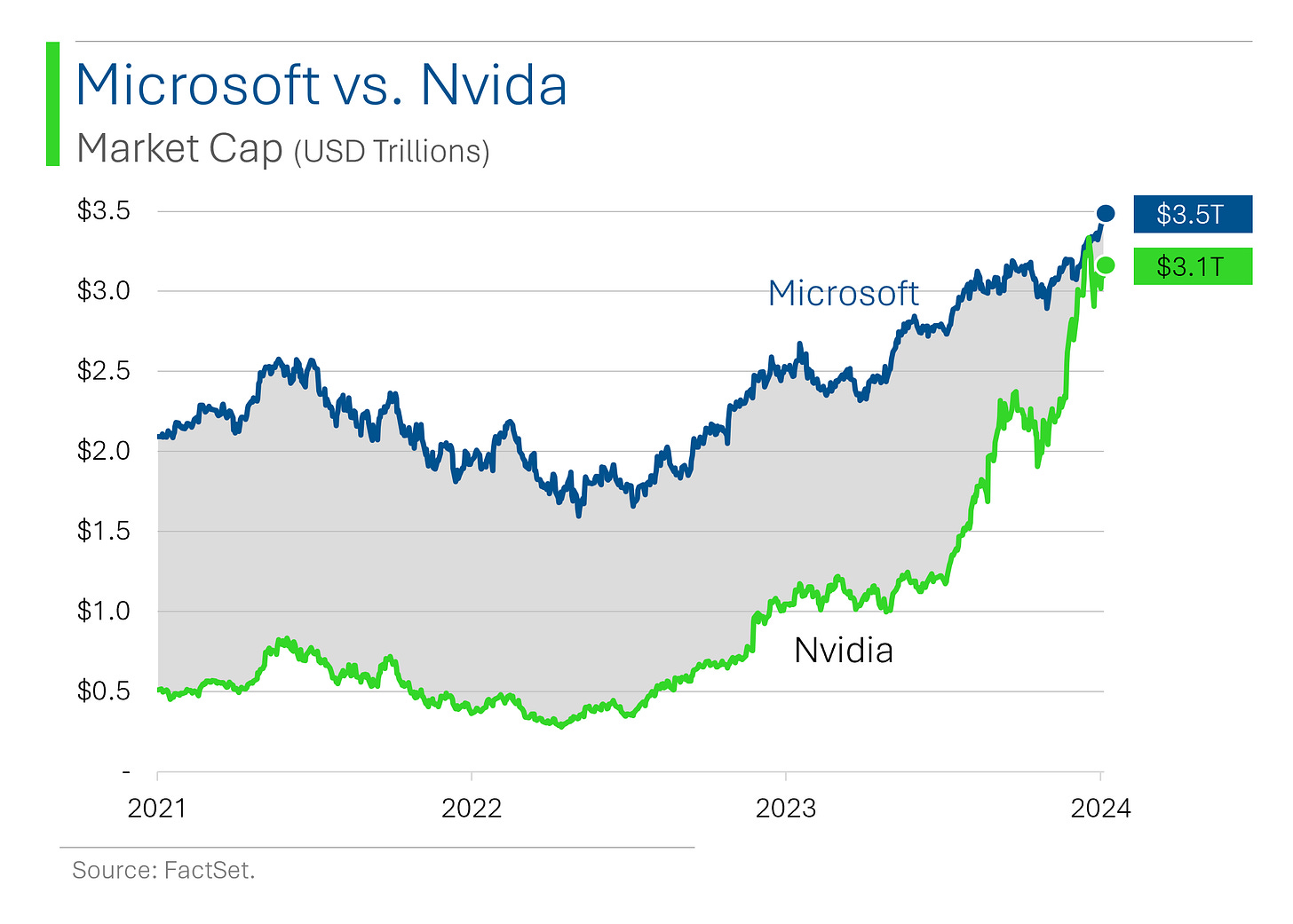

Ok, fine. Microsoft and Nvidia aren’t exactly sworn rivals (Microsoft is allegedly their biggest customer in fact) but given they are currently in a battle to be the largest company in the world I thought it would be a cool comparison.

To start, some of the air got let out of Nvidia’s tires after it briefly (literally one trading day) became the biggest company in the world. Since then, a teeny gap has opened up between the two ($379.6 billion to be exact). Peanuts really.

The only way you get to the +$3 trillion valuation needed to take a shot at the king is by a stupid amount of share price performance. Just how stupid?

Over the last nine years (2024 included) Nvidia has had average share price gains of +105%.

Microsoft’s amazing +30% deserves some respect here too. If my PA could do that I wouldn’t need to write a newsletter. I mean, I would, I just wouldn’t need to.

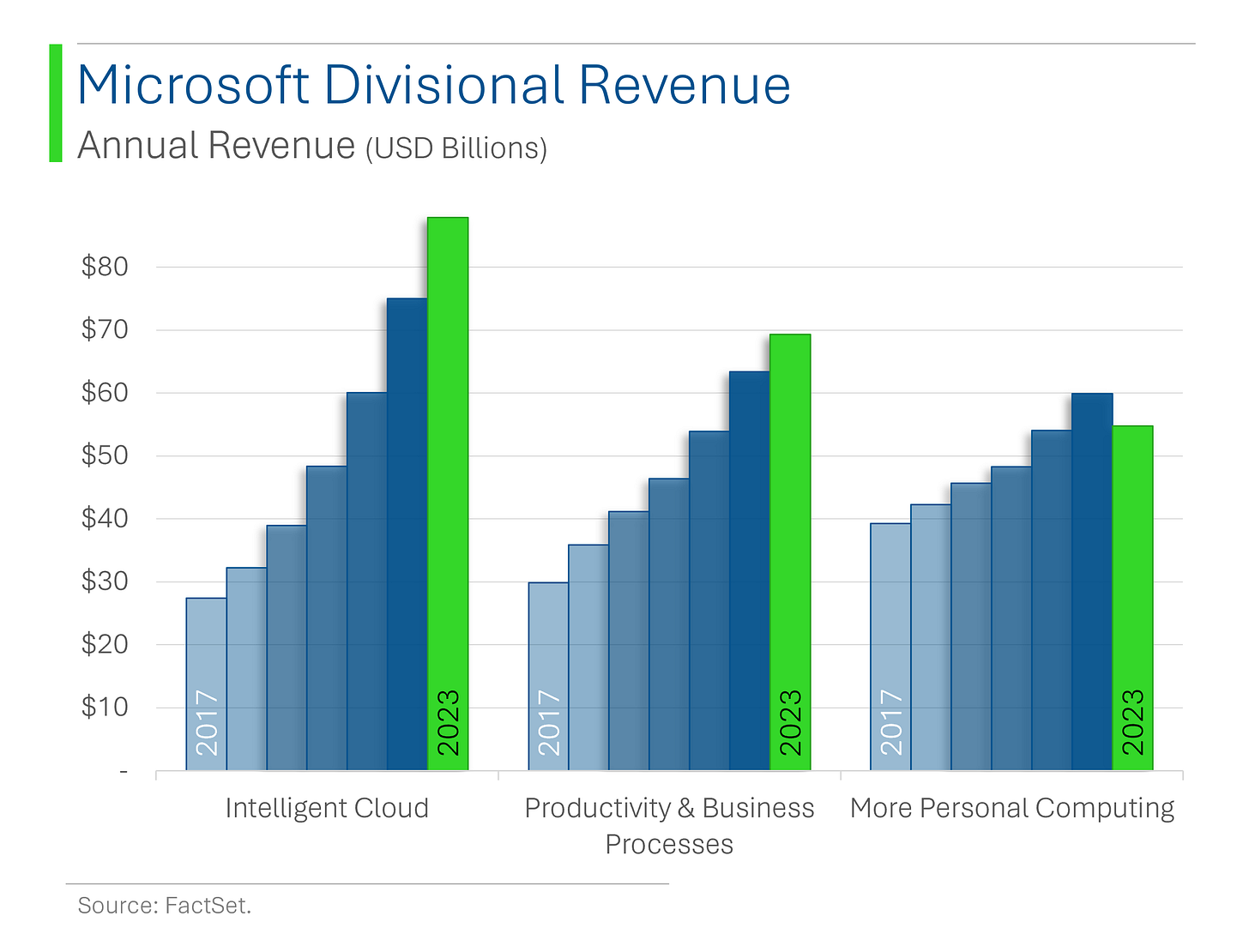

Looking at revenue growth, the scope and diversification of the Microsoft business really stands out. Rain or shine, the company bangs out double digit growth like clockwork.

Nvidia, however, has had a bit more of a rocky path but, now that data centers are the have found their way into being the most valuable things on the planet, it’s been a rocket ship.

For context, over the last five years, Nvidia has grown revenue by +42%… annually. Microsoft has banged out +14% which is pretty darn impressive too.

What might stand out here, however, is: Microsoft’s growth, albeit slower, has been remarkably consistent, while Nvidia’s… not so much. Looking at Wall Street’s estimates, they see Nvidia banging out another incredible year (their fiscal 2025) but growth estimates begin to cool thereafter. More on this later.

Another interesting way to look at Nvidia’s incredible success is the consistent upgrades to estimates as Wall Street grows increasingly positive on their prospects.

For example, in July 2021 Wall Street’s revenue target for Nvidia’s fiscal 2025 was a measly $36 billion. This has been progressively jacked up to $120 billion - a 232% increase!

Focusing on Microsoft, I think one of the ways that best captures how incredible of a company this is comes from the consistent growth we see generated from all of its business units.

Basically, they are either a monopolist or oligopolist in several of the world’s largest and most profitable businesses. Even the soft 2023 performance of Personal Computing is set to be offset by the record year in 2024.

Contrast this with Nvidia, which is really only a brand name due to their data center business. A business that was their third largest segment as recent as 2017.

For those with longer memories, the company was a rocket ship in 2017 and 2018 on the back of their GPUs being used as the backbone for crypto mining. A business which has since evaporated as GPUs got replaced by ASIC chips.

For those with concerns about history rhyming, this might be a worthwhile consideration for the datacenter business.

In the event that Nvidia does see demand for their chips start to pull back, one of the most likely reasons would have to do with its customer concentration.

Bloomberg estimates that currently their top 4 customers represent a staggering 40% of total revenue.

Investing 101: Extremely high customer concentration is bad. Extremely high concentration in customers that are all currently spending tens of billions of dollars to make their own chips to replace you. Well, that’s a potential disaster.

Now, I’m not going to suggest that Microsoft & Friends will find themselves directly competing in the GPU market with Nvidia. But Nvidia’s biggest advantage isn’t so much its chips but its Cuda platform for running AI. With +4 million developers on their ecosystem, they’ve formed something of a monopoly in this regard.

But Microsoft (Azure), Amazon (AWS) and Alphabet (Google Cloud) are also the biggest cloud computing companies in the world, with their AI offerings becoming increasingly powerful. And increasingly turn-key.

This makes for more of a tempting proposition for companies that would normally be forced to go it alone and build their own data center with Nvidia chips.

And we aren’t talking pennies here. As I wrote about a few weeks ago (Monster AI Investment), those guys plus Meta are spending more on capital expenditures this year ($193 billion) than the other 86 companies in the S&P 500 Tech and Communication Services sectors COMBINED - with a good chunk of that going towards AI offerings to indirectly compete with Nvidia’s based datacenters.

Next, on the margin side, Nvidia has shown massive growth here. Back when they were just a lowly player in the gaming card market they struggled to hold a gross margin close to 50%.

More recently, hundreds of billions in surplus demand has led to customers displaying far less price sensitivity. The concern here is obviously that once demand and supply get closer to together these margins will recede quite drastically.

For example, beyond a small tablet and laptop business, Microsoft pretty much a software company - arguably the best one. In a steady state, the company selling products at zero marginal cost (software) should arguably receive higher gross margins than the one selling hardware made by third party manufacturers (chips).

Lastly, I think the thing that surprises most people about Nvidia is that despite adding $2.5 trillion in market cap over the last three years, the company doesn’t really trade at an insane valuation.

For context, Nvidia trades at a forward P/E less than 2x what the S&P 500 trades at (21x) but is expected to grow earnings ~22x the S&P’s next year (108% vs. ~5%). That said, it’s not about next year but the long-term, and if Nvidia will be able to sustain that level of profitability.

Ryan’s Thoughts: Both are incredible companies. Microsoft is a well oiled, diversified, steady performer with low risk of a material blow-up. Nvidia is more of a one-trick pony. But that pony just so happens to be arguably the most highly valued equine in the history of the world.

Which stock is the most likely to hit $5 trillion first? Nvidia. Which stock is the most likely to go back to $1 trillion? Also Nvidia.

Joke Of The Day

The FTSE 100 has been looking thinner lately. It's lost several Pounds.

Hot Headlines

Wired / After a 10-year wait, Mt. Gox bitcoin is finally being returned. The $9 billion windfall comes after a 2014 hack saw the loss of $400 million in Bitcoin - now worth $45 billion.

Tech Crunch / OpenAI breach is a reminder that AI companies are treasure troves for hackers. From billions of conversations with ChatGPT or information tucked into training datasets, the pile of info floating around could pose risks to individuals, companies and governments.

Gizmodo / Weirdest AI use case? Using AI to age verify customers at vending machines selling bullets. The vending machine company behind this new trend, American Rounds, says it uses artificial intelligence and facial recognition technologies to verify that buyers are of legal age to buy bullets.

Reuters / Apple greenlights Epic Games marketplace app in Europe. Latest capitulation after the Fortnite maker escalated things over Apple’s exorbitant pricing cut on the iOS App Store leading to the EU stepping in.

Reuters / Charting the Fed's economic data flow. A helpful look at the data behind their decision making process.

Trivia

Today’s trivia is on Bill Gates.

What year did Bill Gates and friends found Microsoft?

A) 1972

B) 1975

C) 1980

D) 1985

As of 2023, approximately what was Bill Gates' net worth?

A) $50 billion

B) $120 billion

C) $200 billion

D) $90 billion

Microsoft's Windows OS holds what percentage of the desktop/laptop market share as of 2023?

A) 58%

B) 92%

C) 85%

D) 70%

Bill Gates was famously arrested in 1977 for what reason?

A) Accounting fraud

B) Traffic violation

C) Trespassing

D) Public disturbance

(answers at bottom)

Market Movers

Winners!

Macy's (M) [+9.5%]: Arkhouse and Brigade reportedly raised their offer to acquire the company to $24.80/share, up from $24.00/share.

Meta (META) [+5.9%]: Data release shows that Meta’s investments in AI are showing potential.

Baxter International (BAX) [+5.3%]: Reports suggest the company may be discussing selling its kidney-care unit to CG for over $4B, including debt; BAX previously discussed a sale of this segment instead of a proposed spinoff.

Losers!

Big Lots (BIG) [-15.2%]: Company to close 35-40 stores this year; filing states substantial doubt about its ability to continue operations, per NY Post.

Frontier Group (ULCC) [-6.8%]: Downgraded to underperform from market perform at Raymond James; noted unclear outlook amid evolving market and potentially softer demand.

Micron Technology (MU) [-3.8%]: DigiTimes reported comments from a senior executive on potential overcapacity issues due to global investments.

Market Update

Trivia Answers

B) Microsoft was founded in 1975.

B) Bill Gates’ net worth is estimated at $120 billion.

D) Microsoft holds around 70% of the operating system market for laptop/desktop.

B) The famous mugshot was for a traffic violation.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Great post & charts