🔬Nvidia Puts In Work

Plus: AI frenzy leads to MASSIVE Capex spending; the S&P 500 sheds some deadweight; and much more!

"Learn how to take a punch or you should not be doing this job."

- Bill Ackman

“Napoleon, don’t be jealous that I’ve been chatting online with babes all day.”

-Kip Dynamite

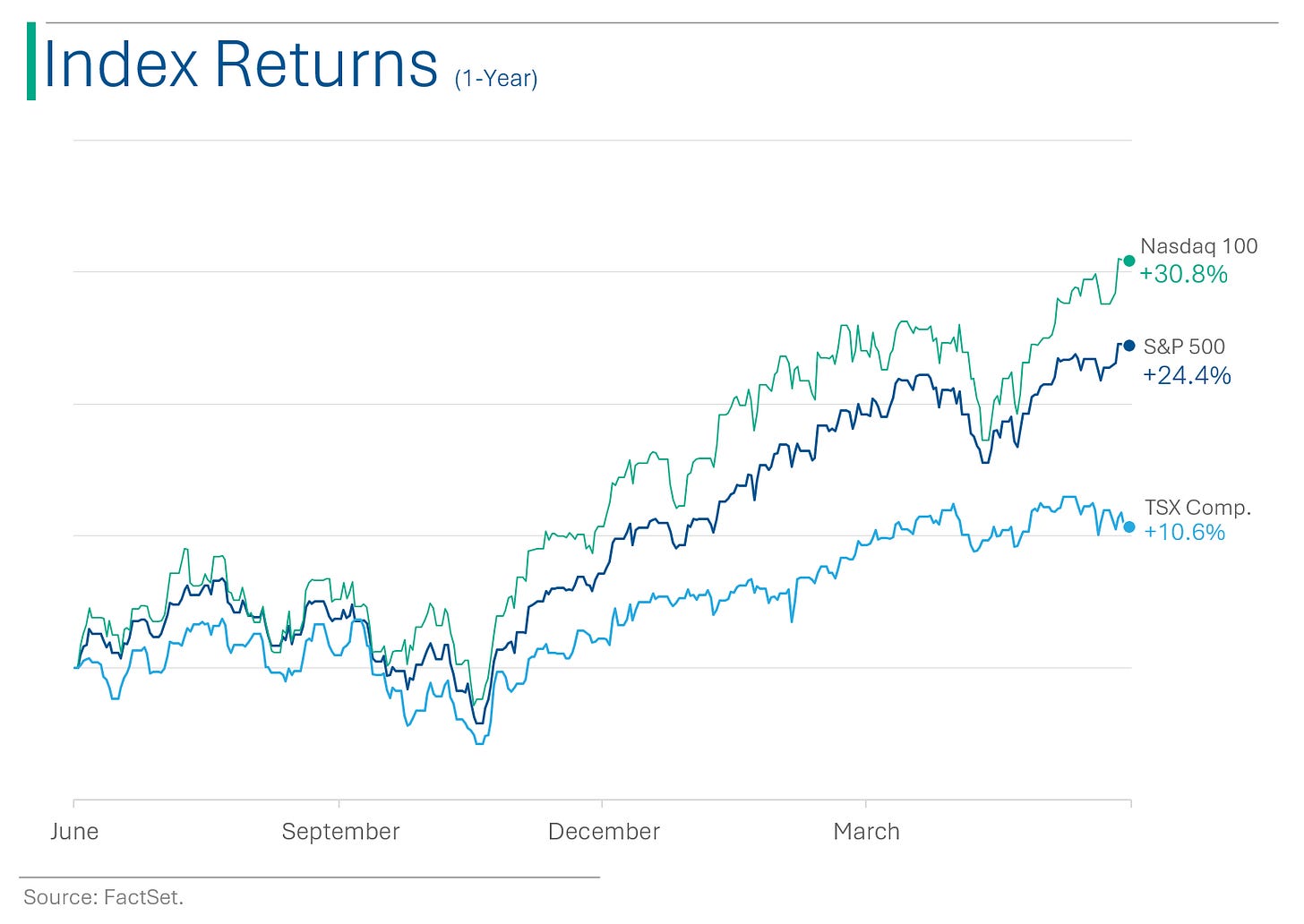

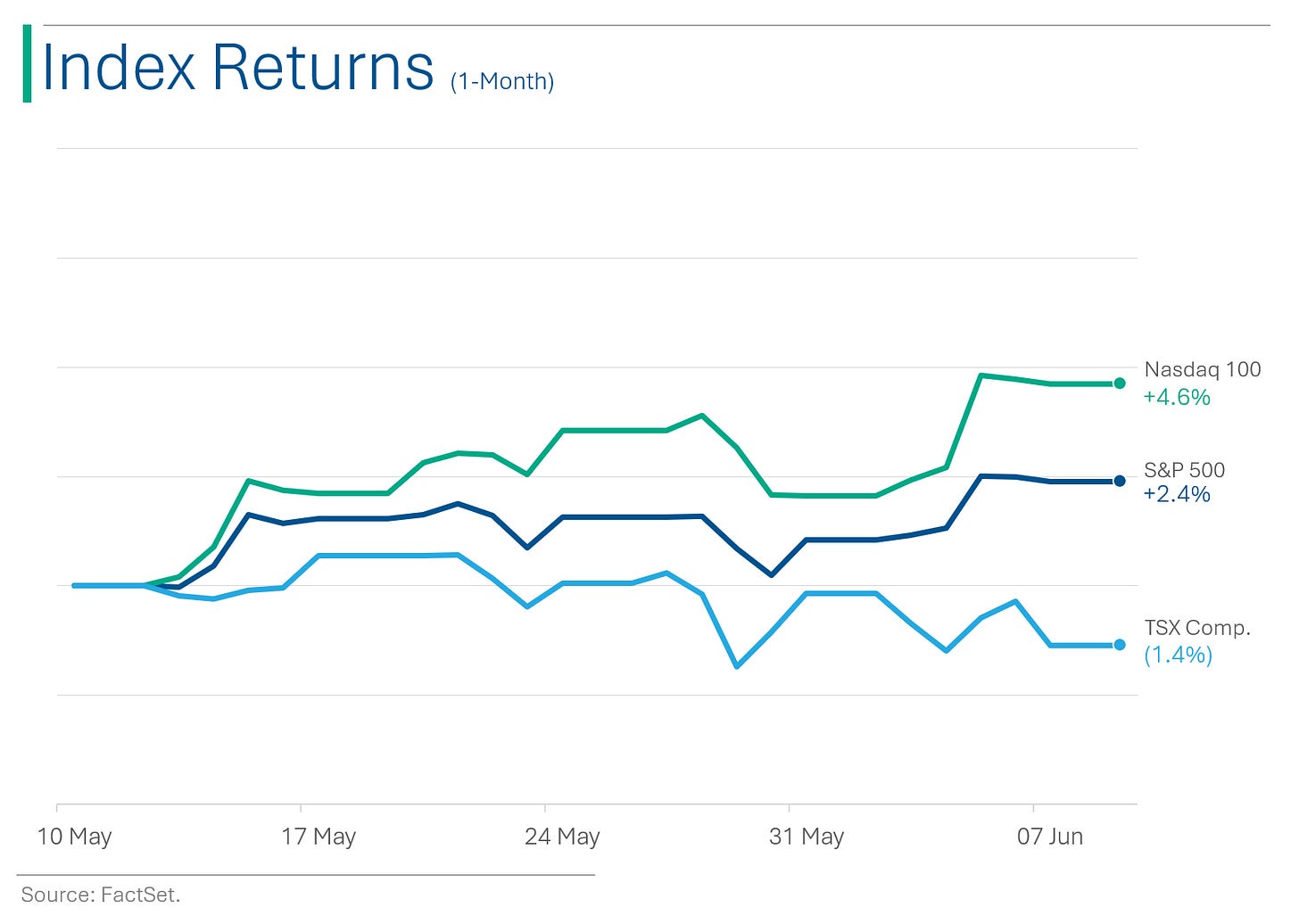

The big US markets had a soft end to the week with the S&P 500 -0.1% and the Nasdaq -0.2%, on a pretty catalyst-light day of trading. However, the week was strong with the indices up 1.3% and 2.4% respectively.

5 of 11 sectors closed in the green last week, pulled higher by another monster week for Tech (+3.8%). Utilities (-3.9%) and Energy (-3.5%) were the worst, with a weakening oil price to blame for the latter following OPEC+ announcing an upcoming end to voluntary production cuts.

Only big positive for Friday was Nonfarm Payrolls posting a strong beat for May (+272k vs. +180k for Wall Street’s consensus).

Notable companies:

GameStop (GME) [-39.3%]: Announced plans for a 75 million share sale while an early release of Q1 financials showed below-consensus EPS and revenue. Keith "RoaringKitty" Gill held a livestream to discuss the company, which was ‘meh’.

3M (MMM) [+2.7%]: Upgraded to buy from hold at Ashler Capital; cited new CEO's growth focus and fading litigation risks.

DocuSign (DOCU) [-4.7%]: Q1 report was decent with raised FY guidance ranges, although by less than the Q1 beat; analysts positive on IAM rollout but noted underwhelming print against expectations for reacceleration.

More below in ‘Market Movers’.

Street Stories

Nvidia Puts In The Work

2023 wasn’t exactly a bad year for Nvidia: shares popped +239% but coming from such a small baseline, its impact on the S&P 500 was pretty modest. The $894 billion in market cap it gained over the year contributed only around 11% of the S&P’s total return. Yawwwwn.

In 2024, however, Nvidia has been the index’s workhorse. Of the total $4.8 trillion that the five hundred companies in the S&P have added so far this year, $1.8 trillion of it comes solely on the shoulders of Nvidia.

This means that Nvidia has contributed 36% of the TOTAL gains made by the S&P 500, and even out-pacing all of its Mag7 peers by ~40%.

What’s interesting is that despite the shares being a rocket ship, the stock has actually maintained a short interest well above most of its peers. As you can see below, a lot of poor sods have been consistently short Nvidia during its monumental rise.

Some of that is banks hedging options positions. And some of that is folks that will soon be entering the job market. We call that a ‘widow maker trade’.

Monster AI Investment

Financial writer Amrita Roy aka The Pragmatic Optimist wrote an interesting piece on the lag time that will happen before AI becomes profitable (AI may take longer to monetize than most expect. How long will investor optimism last?).

What stuck out to me was when she mentioned that the Big 4 companies building up these AI compute monoliths (Amazon, Meta, Microsoft and Alphabet) will be spending more on capital expenditures (mostly AI chips and servers) this year than the other 86 companies in the S&P Tech and Communication Services sectors COMBINED.

Turns out she was correct - with $33 billion in wiggle room. Damnnnn.

S&P 500 Gets a Makeover: New Kids on the Block Cause Stock Party

CrowdStrike Holdings, GoDaddy, and KKR & Co. are joining the S&P 500 before the market opens on June 24, booting Comerica, Illumina, and Robert Half off the index in a move to better reflect the large-cap market space (because what the S&P 500 really needed was more cybersecurity, web services, and investment firms.)

Shares of all three companies skyrocketed in after-hours trading following the news, with CrowdStrike up +5.4%, GoDaddy up +3.7%, and KKR up +7.7%, taking their tallies for the year to +37%, +31%, and +18%, respectively.

Looks like the index is shedding some dead weight.

Joke Of The Day

"People tell me I'm condescending..."

*Leans in real close*

"That means I talk down to people. "

Hot Headlines

WSJ / Nations are competing to build their own AI champions in the shadows of the US and China. Countries in Asia, the Middle East, Europe and the Americas are pouring billions of dollars into new domestic computing facilities for artificial intelligence, opening up a fast-growing source of sales for companies like Nvidia.

Barron’s / Investing in sports has arrived and is only going to get bigger. Private equity now dominates the market for sports teams but the list of publicly traded options is growing.

NY Times / Roaring Kitty’s livestream failed to impress investors (nor did the weak earnings) sending shares down 39% Friday. Q1 revenue came in at $882 million, down 29% year-over-year, and Keith Gill’s livestream didn’t add anything new to the meme-stock’s investment case. Was pretty funny to watch tho.🫠

CNBC / GM leans on Costco to help sell its EVs. GM is aggressively expanding its vehicles listed on Costco’s Auto Program, primarily its EVs, including new editions like the Chevy Equinox. The Costco Auto Program has facilitated more than 500k vehicle sales per year for the last half decade.

Coin Telegraph / Crypto crimes are growing due to AI and don’t expect them to slow down. Research firm Elliptic’s 2024 report exposes how AI is increasingly used for sophisticated crypto crimes, from deepfake promotion scams to state-sponsored cyberattacks, signaling that these threats are just beginning.

WSJ / College sensation Caitlin Clark left off U.S. Women’s Olympic Basketball Team.

Trivia

Today’s trivia is on financial crises.

The term "Too Big to Fail" became widely used during which crisis?

a) Panic of 1837

b) Great Depression

c) 2008 financial crisis

d) Panic of 1907The Panic of 1907 led to the creation of which major U.S. financial institution?

a) FDIC

b) SEC

c) Federal Reserve

d) IMFThe United States’ abandoning of the the gold standard played a role in the extended period of inflation in it’s aftermath. What year did the US drop the gold standard?

a) 1951

b) 1933

c) 1968

d) 1971

(answers at bottom)

Market Movers

Winners!

Oddity Tech (ODD) [+20.5%]: Announced $150M share buyback plan; guides Q2 revenue to ~$189M vs prior guidance $185-189M.

Geron (GERN) [+18.0%]: FDA approved Rytelo (imetelstat) for certain myelodysplastic syndromes; approval came earlier than expected; no box warning.

Quanex Building Products (NX) [+4.1%]: Fiscal Q2 EBITDA ahead on in-line sales; reiterated FY guidance; seeing seasonal uptick in NA demand; Europe remains challenging.

3M (MMM) [+2.7%]: Upgraded to buy from hold at Ashler Capital; cited new CEO's growth focus and fading litigation risks.

Skechers USA (SKX) [+2.5%]: Upgraded to buy from neutral at BofA Securities; cited valuation, solid footwear trends, improving wholesale environment, and possibly conservative H2 guidance.

Losers!

GameStop (GME) [-39.3%]: Announced plans for a 75M-share sale; early release of Q1 financials showed below-consensus EPS and revenue; Keith "RoaringKitty" Gill held livestream to discuss company.

Semtech (SMTC) [-17.9%]: Announced departure of President and CEO Paul Pickle; appoints director Hong Hou as President and CEO; reaffirms FQ2 guidance.

Concrete Pumping Holdings (BBCP) [-12.9%]: Fiscal Q2 revenues, margins, and EBITDA missed; lowered FY guidance; flagged project delays due to higher rates and weather; infrastructure remains strong on IIJA; downgraded at William Blair.

Samsara (IOT) [-12.4%]: Q1 beat on key metrics, including ARR (+37% growth), and raised FY25 guidance; Street positive on fundamentals but flagged likely disappointment with magnitude of upside.

Vail Resorts (MTN) [-10.3%]: Q3 earnings and revenue missed; FY24 revenue guidance lowered due to softer demand for Australian resorts; ticket sales declined this past season due to weather.

DocuSign (DOCU) [-4.7%]: Q1 earnings and revenue better; billings and FCF ahead of consensus; raised FY guidance ranges, but by less than the Q1 beat; analysts positive on IAM rollout but noted underwhelming print against expectations for reacceleration.

Market Update

Trivia Answers

c) ‘Too Big to Fail’ got popular during the 2008 financial crisis.

c) The Federal Reserve was created in the aftermath of the Panic of 1907.

d) The US dropped the gold standard in 1971.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

I wonder about two things related to NVIDIA:

- The amazing GPU's they sell are used to run software to learn things and solve problems

- The data centers that are being build will keep running for years using better and better software to learn more and more things about the world, technology, etc.

1. When the purchases have been made and the data centers are running, who will NVIDIA sell to next?

2. When the first mover advantage has passed and many companies offer chips with similar capabilities for lower prices or a new technology like RISE 2.0 or whatever unknown approach will come out, what will happen to NVIDIA?

Wow, great report! Jam packed with info and hilarious memes.

The Big Short meme with “listening to college grads explain what they’ve been up to in networking events” had me cracking up.

I just wrote a blog post relating to Millennials giving Gen Z advice for the future too.

Good stuff!