"If you owe the bank $100 that's your problem. If you owe the bank $100 million, that's the bank's problem"

- Jean Paul Getty

“If you want a guarantee, buy a toaster”

- Clint Eastwood

The big US markets were up again yesterday (S&P 500 +1.41%, Nasdaq +2.20%) following Friday’s first up-day for the year.

10 of 11 sectors closed up. Tech (+2.7%) lead the way following some positive company news (like Nvidia product launch) and the start of CES 2024 today.

The Energy sector (-1.2%) was the only loser, as the oil price cratered -4.1% following more negative demand sentiment, primarily the price cuts announced by the Saudis.

Boeing crumbled -8.1% following the door plug event, while American Airlines (+7.2%) - who doesn’t operate 737 MAX 9s - and competitor Airbus (+3.4%) their saw their shares pop.

Street Stories

Magnificent Nvidia

The Magnificent 7 were the big story of 2023 but that started to fizzle out by mid-December. Since then Meta has done a titch better than the market (+2.7% vs. +1.4% for the S&P) but everyone else has stumbled. Everyone except Nvidia.

Adding to the strength, the shares popped +6.4% on Monday, bringing the total market cap added over the past 12 months to around $750 billion and a fresh new all-time high. The pop yesterday came ahead of the biggest week in tech: CES 2024 (Consumer Electronics Show), which starts today, as they announced upgrades to their PC based graphics cards (mostly for gamers but they’re pitching it as useful for PC-based AI).

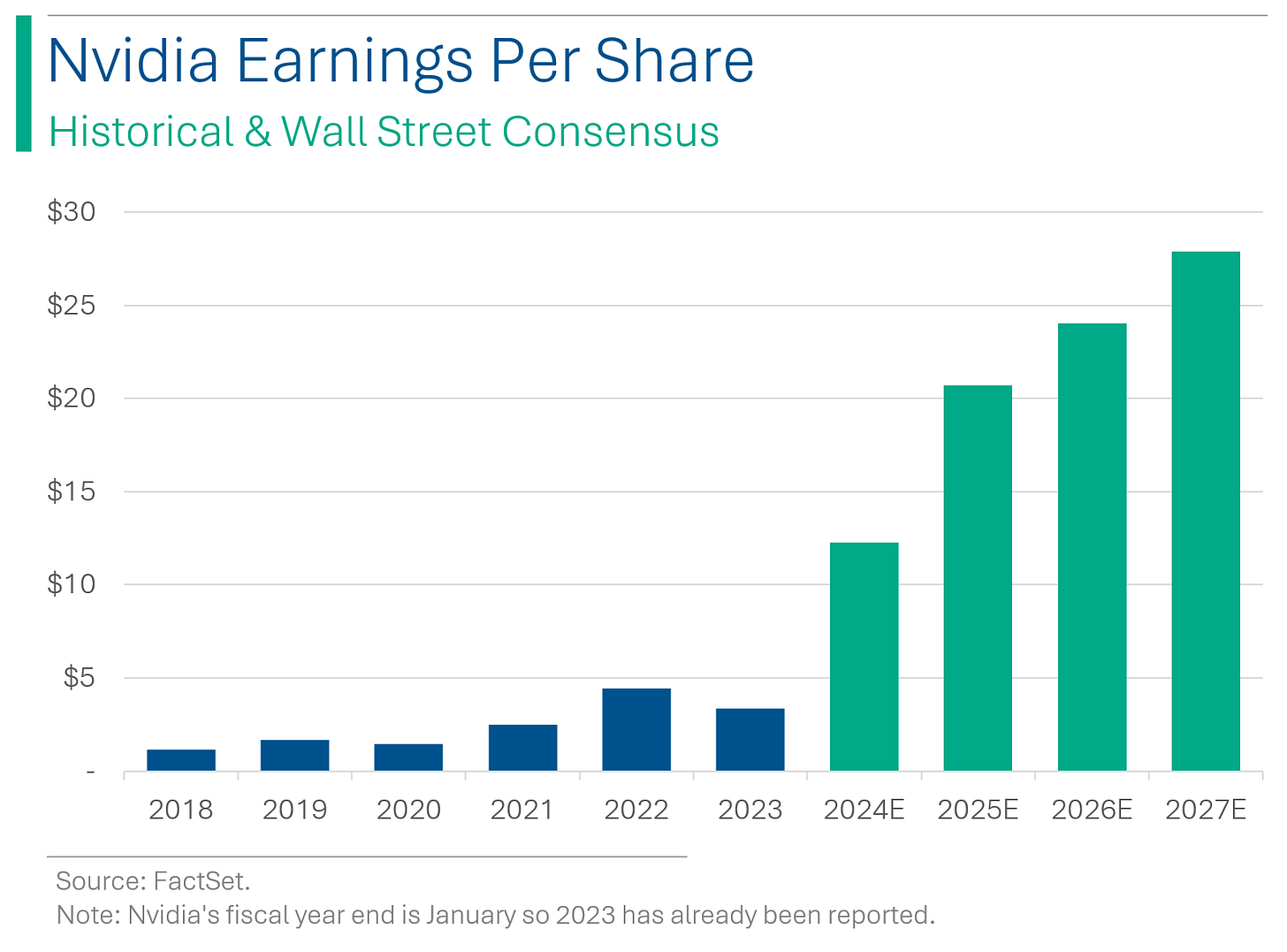

As I’ve written about before (including a short primer on the chip makers), as ridiculous as this AI hype-train may seem, Wall Street analysts have their love for Nvidia expressed in tangible estimates. Whether or not those forecasts come true is one thing, but they seemingly justify some of this exultation.

For example, the Street is forecasting Revenue to go from $27 billion last year to $123 billion, which is truly impressive in just 4 short years. At 46% compound annual growth, that’s start-up growth stuff, not trillion-dollar-company stuff.

And what makes that even more wild is how fast we got to this point. Just one year ago, Nvidia was forecast to see profits stay pretty flat: Some steady growth coming in from the gaming GPU business, offsetting some of the winding down of the GPU-intensive crypto mining party.

What a difference a year can make.

Tiger Woods' Nike Era Ends: $500 Million and Not a Swoosh More

Tiger Woods, after 27 years and a casual $500 million in earnings, has parted ways with Nike. As he teases about a future endorsement deal, speculation swirls around possible suitors like On Running and TaylorMade (currently his club sponsor), but for now, Tiger's keeping his golf shoes tightly laced in mystery. It's a bittersweet end to a relationship that proved more lucrative than a hole-in-one on a par five, making Woods a bigger billboard for Nike than even LeBron James, thanks to golf's leisurely pace and his enduring presence in the sport. (CNBC has more on this)

Boeing's Latest Turbulence: Door Plugs and Stock Slumps

Following Boeing’s aluminum rain event on Saturday night, United has announced that preliminary inspections have revealed that the cause of the door plug mishap appears to relate to an installation issue, including cases where bolts needed tightening. Human error is likely the best outcome here, compared to structural design issues, but that didn’t help its shares which tanked. On the brightside, if Boeing parts fall onto your property, you are eligible for a free upgrade to premium economy. (BBC has a nice report on this)

From Cancer to Cardio: Pharma Giants Open Wallets for a Healthy Dose of M&A

Over $6.4 billion in healthcare deals were announced on just the first day of the JPMorgan Healthcare Conference, including significant acquisitions by Merck & Co., Boston Scientific Corp., and Johnson & Johnson, targeting companies like Harpoon Therapeutics and Ambrx Biopharma. These deals reflect the pharmaceutical industry's strategy to buy their way into innovative therapies (especially in cancer treatment and weight-loss drugs) as the industry faces revenue challenges like expiring patents and reduced demand for Covid related products.

Explainer: The JPMorgan Healthcare Conference is held annually over four days in San Francisco and is the biggest event in healthcare by a factor of infinite. Every year in the second week of January the healthcare world goes crazy as companies use this event to:

Update financial guidance (obv)

Announce previously agreed M&A (better to release during the conference to get more hype around your deals)

Some companies, like UnitedHealth and Moderna, pre-announce their key financials (Revenue, EPS, etc.) at the conference every year.

As a result, the conference often adds significant volatility to the healthcare space as it sets the tone for sentiment, as well as emerging M&A and R&D themes. Basically, if you’re wondering why your healthcare stocks are going nuts, this is why.

Joke Of The Day

Did you hear the one about the Stockbroker who got a job at the GAP? He’s a shorts-seller.

Hot Headlines

Bloomberg | Duolingo cuts 10% of contractors as it uses more AI to create app content.

CNBC | Mortgage rate decline pulls buyers back into the housing market. The average rate on the 30-year fixed mortgage sits at 6.76% while Redfin’s Homebuyer Demand Index was up 10% from a month ago to its highest level since August.

Yahoo Finance | China’s weight in emerging-market index drops to record low. The country’s stock market has erased almost $4 trillion in value since 2021, ranking among the world’s worst performers last year.

CNN | A terrifying 10 minute flight adds to years of Boeing’s quality control problems. Nice little history lesson. Also makes me not want to fly for a while.

WIRED | The 10 coolest things so far at CES 2024.

Trivia

This week’s trivia is on famous financial dynasties. Today’s is on the Rockefellers.

What percentage of the US oil refining business was controlled by John D. Rockefeller’s Standard Oil at its peak?

A. 50%

B. 70%

C. 90%

D. 80%What was John D. Rockefeller's estimated net worth at its peak, adjusted for inflation?

A. $100 billion

B. $340 billion

C. $200 billion

D. $500 billionWhich Rockefeller was the governor of New York for four terms and served as Vice President under Gerald Ford?

A. John D. Rockefeller Jr.

B. Nelson Rockefeller

C. David Rockefeller

D. Laurance Rockefeller

(answers at bottom)

Market Movers

Winners!

Harpoon Therapeutics (HARP) [+111.9%]: Agreed to be acquired by Merck for $23 a share in cash, a deal valued at $680M.

Axonics (AXNX) [+20.5%]: Entered a definitive agreement for acquisition by Boston Scientific for approximately $3.7B in cash.

Crocs (CROX) [+20.3%]: Guided Q4 revenue growth over 1% year-over-year, surpassing previous and FactSet estimates. 2023 marked by market share gains and a successful holiday season.

American Airlines Group (AAL) [+7.2%]: Upgraded to overweight from equal weight at Morgan Stanley and noted for having limited exposure the the Boeing 737 MAX 9 situation.

Losers!

Spirit AeroSystems (SPR) [-11.3%]: The company manufactured and initially installed the door-replacement panel involved in the Alaska Air flight incident. Boeing was responsible for the final completion.

Boeing (BA) [-8.0%]: U.S. regulators have temporarily grounded 171 Boeing 737 MAX 9 jetliners for safety inspections after a cabin panel issue mentioned above.

Market Update

Trivia Answers

C. Standard Oil controlled about 90% of US oil refining at its peak around 1890.

B. In today’s dollars, John D. Rockefeller was worth around $340 billion.

B. Nelson Rockefeller was a 4x New York Governor and VP under Ford.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Those NVDA EPS forecasts are amazing!