🔬Nvidia Becomes Fifth Biggest Company (Very Briefly)

Plus: JetBlue finds itself in bed with activist Icahn; Bitcoin breaks $50k; automation sales have biggest decline in 2023 in more than a decade; and much more

"In the short run, the market is a voting machine, but in the long run, it is a weighing machine"

- Benjamin Graham

“A fool and his money are lucky enough to get together in the first place”

- Gordon Gekko (Wall Street)

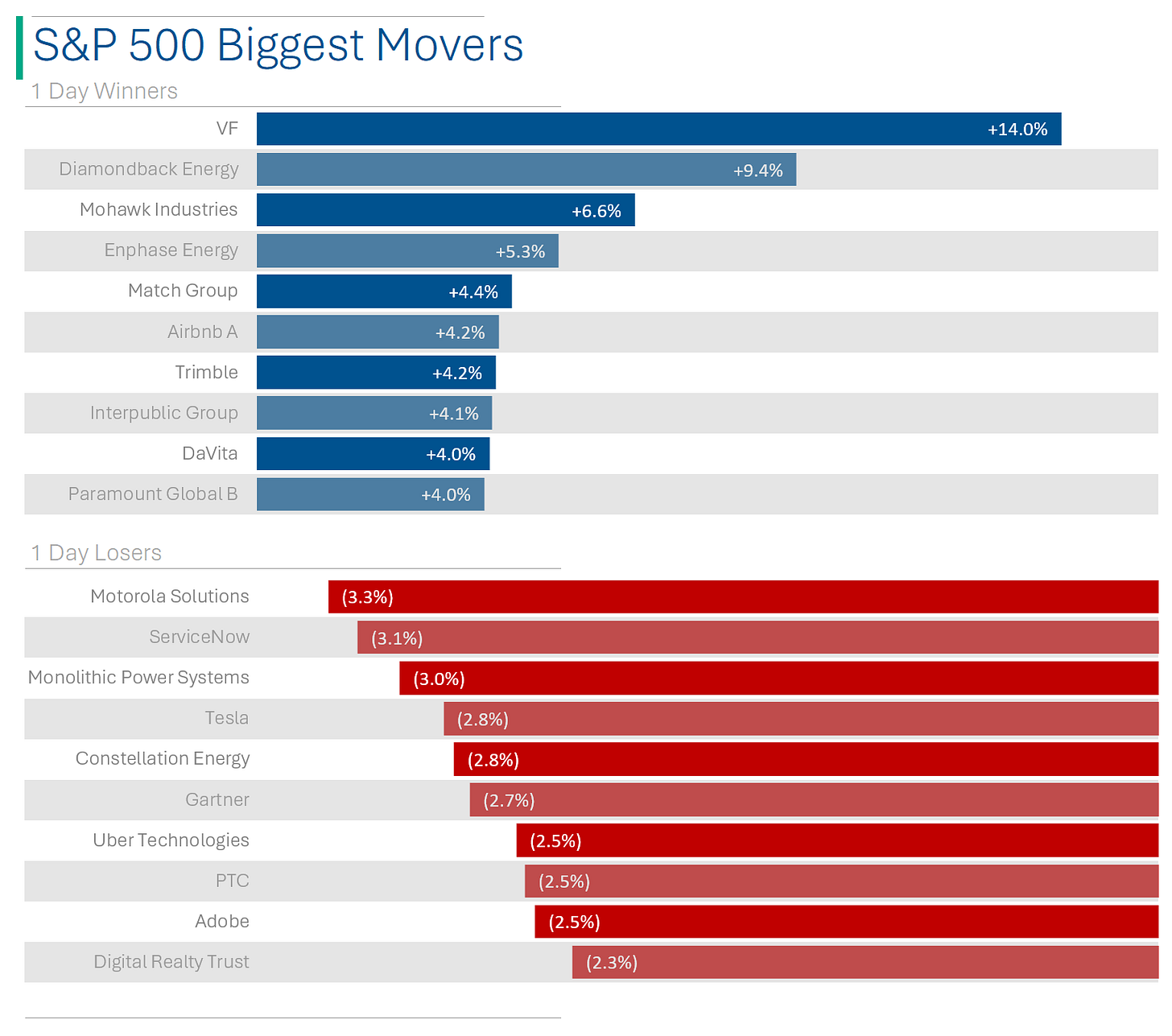

The big US markets closed down Monday with the S&P 500 -0.09% as it struggled to push clear of the 5k mark the hit on Friday. The Nasdaq -0.30%,

7 of 11 sectors closed up with Utilities and Energy (both +1.1%) in the lead. Info Tech - which powered the S&P 500’s move to 5k last week - fared the worst at -0.8%.

Bitcoin was up +5.5% to break the 50k barrier, while Oil was +0.1% following last week’s ~6% gain.

VF Corp - owner of brands like Vans, North Face and Supreme - was up 14% after news broke that the founding Barbey family (15% owners) was backing activist investor Engaged Capital to hammer through changes.

Beleaguered regional bank NYCB saw its shares pop 7% on executives buying shares…but that quickly melted as the share closed down +0.2%. Sorry fellas.

Street Stories

Nvidia Becomes 5th Largest Company (for 2hrs)

In Monday trading, Nvidia briefly surpassed Amazon to become the world’s 5th largest company. And while it didn’t hold to the close, this emphasizes the incredible run that Nvidia - a company most people hadn’t heard of until 2023 - is having now that it is roughly the same size as one of the global household names.

Up +630% since its bottom in 2022, Nvidia has chalked up one of the most incredible accumulations of wealth in history. Sure, baby tech companies or pre-revenue biotechs make moves like that all the time, but never at this scale. For context, in the last two years the $1.2 trillion in market cap gain Nvidia has made is larger than the combined gains of Meta, Amazon, Alphabet, Apple and Aramco - the largest 2nd through 6th largest companies in the world. Microsoft, the newly minted world’s largest company, is the only one that comes close by gaining $874 billion - only about 74% of what Nvidia’s done.

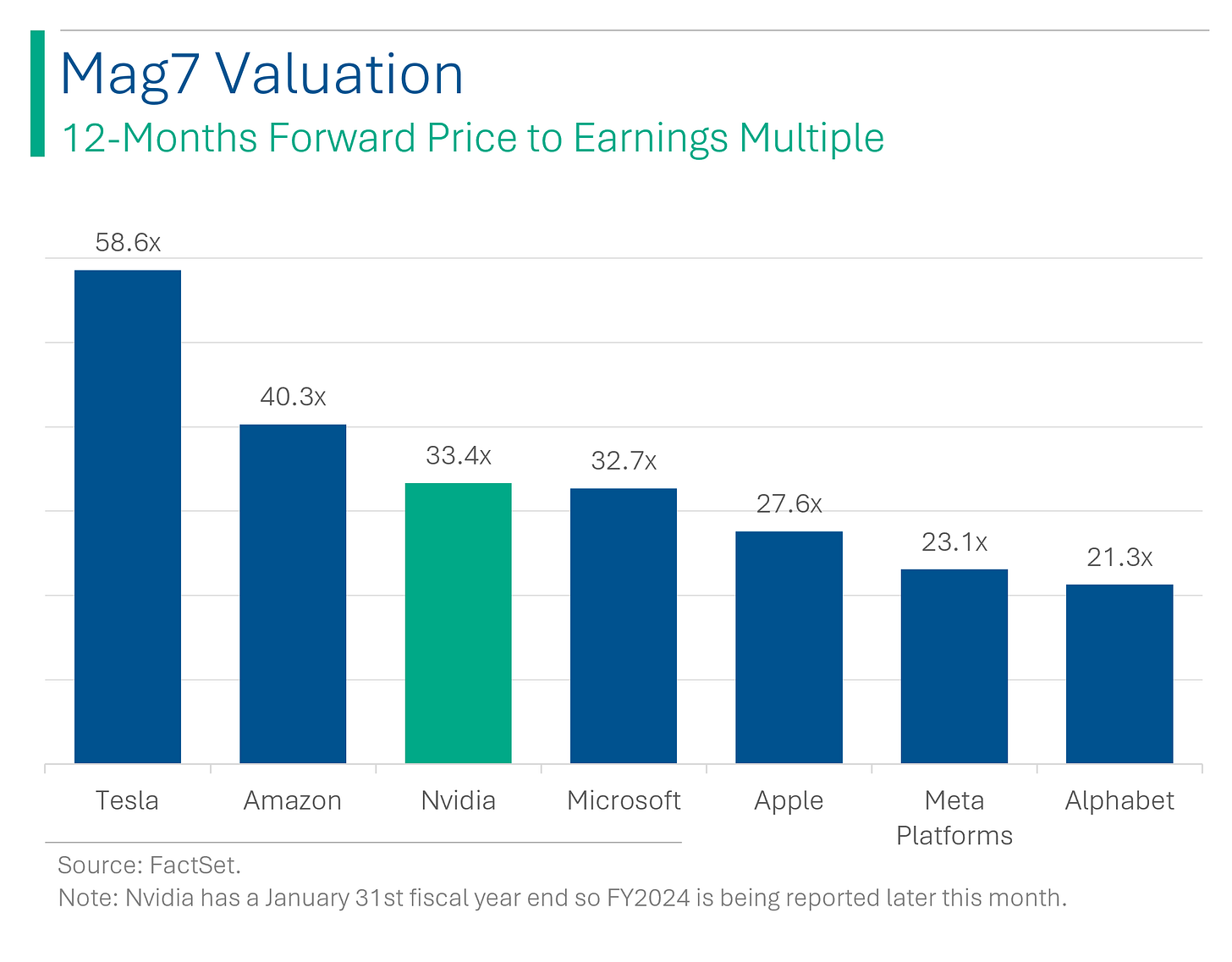

What’s even more surprising is that this has come with a relative valuation that isn’t out of whack with it’s Magnificent 7 peers. At 33.4x forward P/E, Nvidia is actually slightly less than the average of the peers at 33.9x.

The reason for this is that, as amazing as its run has been, the estimates that Wall Street has baked into the story are even more incredible. When Nvidia reports its Q4 later this month (yeah, it’s got a goofy, retailer-esque January fiscal year end), the Street is expecting Revenue to be up +119% over last year. Or 305% over the next three years.

The Earnings Per Share figures are even more staggering: Wall Street sees EPS up 610% this year and 1,312% over the next three years.

Ryan’s Thoughts: This isn’t a ‘stock pitch’ newsletter so I’m not advocating buying Nvidia (or selling - although I think only the brave or fool hearted would attempt such a thing). Rather it’s one of the most incredible stories in the history of investing and it’s good to take note that, to the extent Wall Street’s hype machine can be believed (which is a cruise ship sized ‘if’), there is a lot more substance than just AI-induced irrationality.

Icahn Announces 10% Stake In Jetblue

Activist investor and world’s least likeable human, Carl Icahn, has announced a 9.91% stake in JetBlue and is reportedly in discussions to get some Board seats. The company, whose shares have never recovered from the pandemic, continued its trend of walking into every sharp object (failed take-over by American Airlines; failed merger with Spirit) by attracting the world’s most notorious hatchetman. The roughly $204 million stake has propelled the shares ~+17% in pre-market trading as investors expect significant reforms at the regional airline.

Bitcoin Breaks $50k

The world’s most popular crypto broke $50k for the first time since December 2021. Bitcoin tanked briefly after the hype waned following its inclusion in publicly listed ETFs in January, but has regained its footing lately and broke another important psychological barrier.

The Great Robot Retreat: Economy Puts the Brakes on Automation

In 2023, North American companies reduced their robot orders by 30% compared to the previous year, marking the most significant decline in both percentage and net units since 2006 (yup, Covid was better for automation), primarily due to economic slowdown concerns and higher interest rates. The downturn affected various industries, notably automotive, which accounted for about half of the market, leading to the lowest purchase figures in five years.

Despite the pullback, advancements in robotics continued, with startups like Figure partnering with BMW to deploy humanoid robots in manufacturing, even as companies like Universal Robots faced revenue drops due to the challenging economic climate. (Reuters has more on this)

Tesla's Chargeopoly: Company Now Controls North American EV Charging

Jeep and Dodge maker Stellantis has announced it will adopt Tesla's North American Charging Standard (NACS) for select electric vehicle models starting in 2025, making it the last major Western automaker to do so. This move supports Tesla's effort to standardize its EV charging infrastructure across North America (and also have a monopoly on the IP). Stellantis will also provide adapters for current owners to access the Tesla Supercharging network, although it's unclear if these will be free like Ford's offering.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

Why did the PowerPoint Presentation cross the road? To get to the other slide.

If a tree falls in the forest and no-one hears it…then my illegal logging business is a success.

Hot Headlines

Bloomberg | EU proposes curbs on three Chinese firms for aiding Russia. The EU has proposed new trade restrictions on about two dozen firms accused of supporting Russia’s war efforts in Ukraine. Other companies are located in India, Sri Lanka, Serbia, Kazakhstan, Thailand, Turkey. This would be the first such sanctions against Chinese companies since the start of Ukraine war.

CNN | Tiger Woods launches apparel partnership with Taylormade after 27-year Nike partnership ends. Brand is to be called ‘Sun Day Red’ after Wood’s famed tradition of wearing the color on ‘Sun Days’ (musta been a trademark issue). Reportedly it was a closely contested race to determine the new name…

Axios | US Congressional efforts to restrict Chinese companies poses risks to vital biotech supply chains. The House, Senate Homeland Security & Governmental Affairs, and House Ways and Mean committees all have ongoing reviews to limit Chinese companies.

CNN | Super Bowl LVIII sets ratings record with a staggering 123.4 million viewers, TV’s biggest audience since the moon landing. Still a wee bit shy of the 1.5 billion that watched FIFA World Cup final in 2022.

CNBC | Criminal sentencing of Binance founder CZ postponed to late April. Former Binance CEO Changpeng Zhao is charged with money laundering and is free on $175 million bond.

Trivia

This week’s trivia is on the great financial collapses. Today’s is on Enron.

What year did the Enron scandal, which led its bankruptcy, come to light?

A) 1999B) 2000

C) 2001

D) 2002

What was the primary commodity that Enron, before its collapse, was incorrectly betting would continue to rise in price?

A) Oil

B) Electricity

C) Internet bandwidth

D) Natural gas

What peculiar method did Enron use to hide its massive debt from shareholders and analysts?

A) Sale-leasebacks

B) Foreign subsidiaries

C) Special Purpose Entities (SPEs)

D) Invisible ink in financial reports

How big was Enron’s market cap at its peak?

A) $27 billion

B) $71 billion

C) $89 billion

D) $101 billion

Fun fact: Sociopath Former CEO Jeff Skilling got out of jail in 2019.

(answers at bottom)

Market Movers

Winners!

VF Corp (VFC) [+13.9%]: Reuters reports Barbey family (~15% shareholder) supports Engaged Capital's call for change, including director replacements. President Darrell bought 65K shares.

Diamondback Energy (FANG) [+9.4%]: To merge with Endeavor Energy in a ~$26B deal, expecting ~$550M yearly synergies, ~10% FCF/sh increase in 2025. Deal closing Q4'24, with a 7% dividend hike announced.

Teva Pharmaceutical Industries (TEVA) [+7.5%]: Upgraded to overweight by Piper Sandler due to valuation and positive outlook on Austedo neuroscience franchise.

Mohawk Industries (MHK) [+6.6%]: Deutsche Bank upgrades to buy, citing improved risk/reward, potential for more efficient production, and profit growth.

Joby Aviation (JOBY) [+6.4%]: Signed agreement with Dubai for air taxi services launch by early 2026, targeting 2025 for initial operations.

Losers!

Big Lots (BIG) [-29.9%]: Bloomberg reports the company is seeking cash amid ongoing losses, with limited assets left for new debt backing. Despite reaffirming Q4 comp guidance, Loop Capital Markets downgrades to sell, citing lost consumer relevance and shaky financials.

monday.com (MNDY) [-10.1%]: Beat Q4 EPS, operating income, and revenue, with GM and OM also ahead. Billings exceeded expectations, though deferred revenue fell short. FY24 revenue guidance is positive, but operating income midpoint is considered weak.

Market Update

Trivia Answers

C) Enron collapsed in 2001.

B) Enron was huge in Electricity trading.

C) Enron used Special Purpose Entities (SPEs) to hide it’s substantial debt.

D) At its peak Enron was worth $101 billion.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

$NVDA just keeps delivering!