🔬Nike: Just Do It ('it' being slash guidance)

Plus: Tesla's delivery data falls short; Payrolls was surprisingly good; and much!

“Never follow anyone else’s path. Unless you’re in the woods and you’re lost and you see a path. Then by all means follow that path.”

- Ellen DeGeneres

"How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case."

- Robert G. Allen

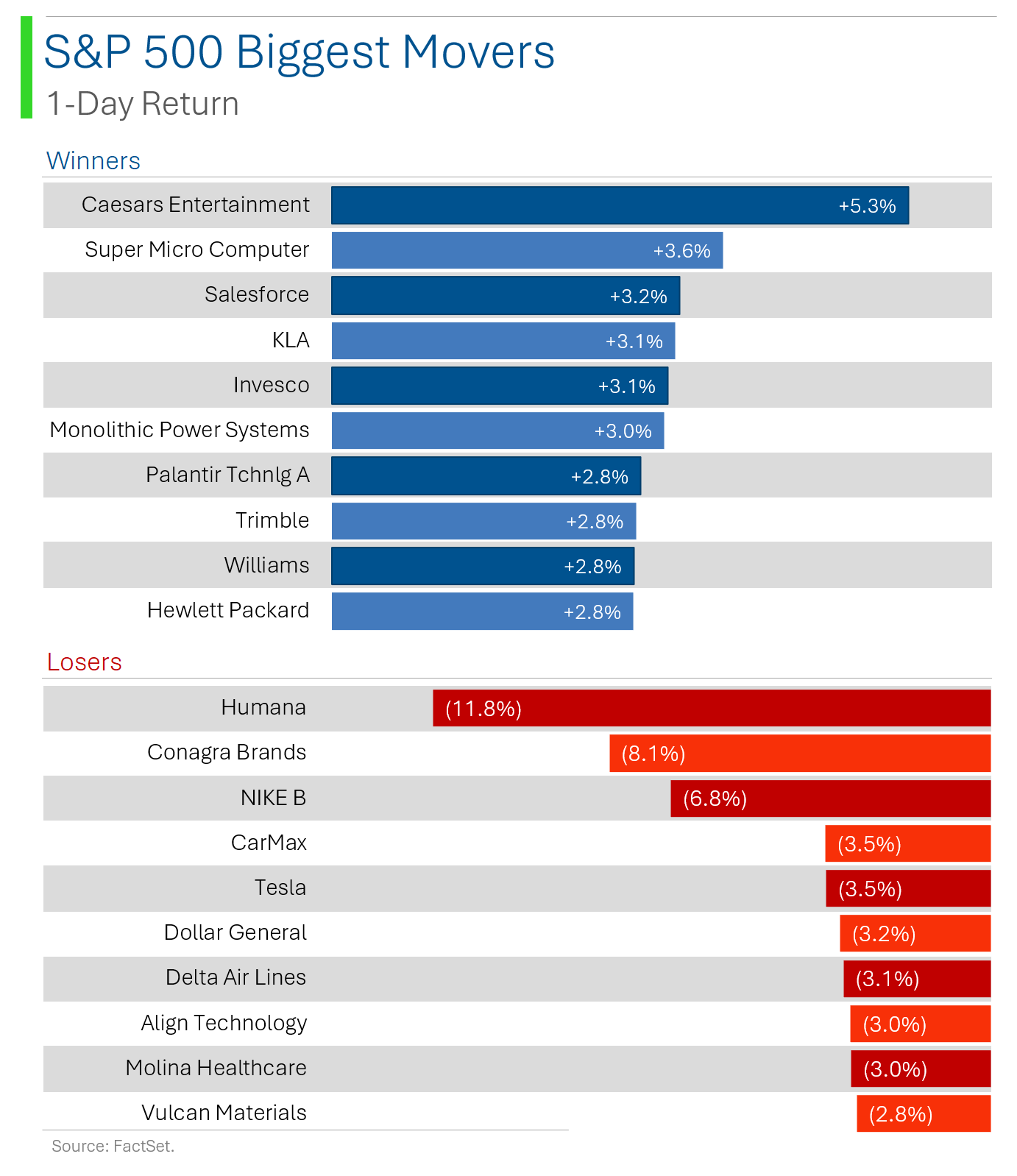

US equities were mostly flat, with mixed performance across sectors. Big tech saw uneven results, with Tesla leading decliners, while semiconductors, China tech, and casinos outperformed. Meanwhile, apparel, retail, and healthcare lagged, including weak showings from Nike and Humana.

Geopolitical concerns remain but did not weigh heavily on markets today. Markets showed resilience despite ongoing tensions in the Middle East, though risks to oil production are on the radar. US port work stoppages are also being watched as potential supply chain threats.

Corporate earnings and macro data were mixed, with focus on payrolls and guidance. ADP payrolls beat expectations, supporting the soft-landing narrative, while Humana, Nike, and Conagra all faced challenges in earnings reports. Tesla's slight delivery miss was noted, but attention is shifting to next week's Robotaxi event.

Notable companies:

Joby Aviation (JOBY) [+27.9%]: Toyota is investing another $500M to help with electric air taxi certification and production.

Caesars Entertainment (CZR) [+5.3%]: They finished their old share buyback program and launched a new $500M one, with plans to use proceeds from a sale to pay down debt.

Humana (HUM) [-11.8%]: Their preliminary Star ratings dropped significantly, with only 25% of members in top-rated plans for 2025, down from 94% in 2024.

More below in ‘Market Movers’.

Street Stories

Nike: Just Do It (it being slash guidance)

Page one of the ‘Incoming CEO Playbook’ is to rip up the company’s guidance to clear the decks. This gives the new guy/gal a clean slate and offers some breathing room for an initial shake-up, unbeholden to those pesky KPIs that Wall Street follows like a hawk.

Yesterday, Nike was kind enough to do that for inbound CEO Elliott Hill ahead of his taking over the reins on October 14th - and they didn’t pull any punches.

Curious how that went over? Use the below as a ‘for instance’…

Ok, a lot more happened than just the binning of guidance at Nike’s Q1 earnings yesterday. The company also scrubbed it’s November Investor Day, and also posted its fourth miss on quarterly Revs in the last five.

Just ugly…

EPS actually posted a tidy little beat… but when you factor in how low that bar was set, it’s more like a participation medal.

That’s like ‘trick roller-skater limbo’ low bar level.

The new CEO, Elliott Hill, will obviously have a lot on his plate when he starts later this month. Luckily for Hill, he already knows a little bit about the company, having started there as an intern and only leaving around when outgoing CEO John Donahue took over in 2020.

Donahue was also absent from the earnings call yesterday (not a good look).

The Street is expecting Hill to begin by focusing on repairing fractured relationships with retailers and trying to fix Donahue’s most grievous sin: Making Nike uncool.

All this in the hopes of fixing a revenue line that is less ‘Swoosh’ and more ‘flat, sorta down-ish’.

EPS is expected to fare worst: Yesterday’s Q1 figure was 39.7% down from the same quarter two years ago, and Wall Street’s estimates don’t see that coming back to historical levels any time soon.

And this isn’t a new thing either: The Street’s estimates for Nike have been progressively eroding for years now. For example, back in 2021, the Street was forecasting 2025 revenue to clock in at $65 billion. This has since been chopped down to $48 billion - a 26% decline.

As you can see above, most of these downgrades have taken place following earnings releases (grey bars)… and I think I have a solution for them: Stop reporting.

(yes, I’m available for financial consulting)

One thing that is weird about not just Nike, but the broader athletics footwear and apparel space is that valuations are still generally pretty high. And at a 28x forward P/E, the stock is vastly more expensive than the S&P 500 at 21x. And only duds like Under Armour and VFC are growing revenue slower.

Part of that is attributable to the strength of the brand, which - albeit a bit tarnished atm - is still one of the strongest in the world. Moreover, if they can find a way to put their house in order and fix their softening margins, EPS could actually inflect materially from here. Theoretically, that is.

Heck, all they need is another pandemic fueled athleisure craze and they’re golden!

That said, Wall Street will definitely need a lot of convincing of this potential. As recent as 2022, the company had a Street consensus target price of $185 which is now only at $91 - and I expect that to come down even more today as analyst models get updated.

It’s going to be a long, windy road for Nike to get back to its former glory. Good thing they will all be wearing comfy shoes for it.

Jobs Data… was ok (it’s been a while)

Ah, September's ADP payrolls managed to exceed expectations – a refreshing plot twist in our economic saga – adding 143K jobs against the 125K consensus. Sluggish manufacturing added jobs for the first time since April.

Pay gains for both job-stayers and job-changers cooled off, suggesting that the great wage race of recent years might be entering its cool-down lap. Analysts viewed the report as positive but not strong enough to impact the Fed's easing cycle.

B+ but I’ll take it.

Elon Shrugged

Tesla's stock took a hit after the company reported 463k vehicle deliveries in Q3 2024, missing consensus Street expectations for +483k, with shares ending the day off 3.5%.

Still, much better than Q1…

Despite the miss, Tesla’s Q3 production reached 470k vehicles, up from last year's 435k. However, competition, particularly from Chinese automakers like BYD and Nio, is ramping up.

Despite his libertarian leanings, I have a feeling he’s not too sad about all those new Chinese tariffs…

Joke Of The Day

My boss told me to stop acting like a flamingo, so I had to put my foot down.

Hot Headlines

CNBC / Costco adds platinum bars to its precious metals lineup. Following the sell-out success of gold bars, Costco is now offering 1-ounce platinum bars online for $1,089.99. While gold prices have soared 70% over the last five years, platinum’s performance has been rockier, up 15% in the past year but down 8% since May. With spot Platinum at $1,014 that’s actually not a bad spread.

Bloomberg / Arctic nations unite against Russia and China. Canada and Nordic countries are forming a new Arctic security group, excluding Russia, to address growing defense and cyber threats in the region. As climate change opens up the Arctic, Canada’s Foreign Minister Melanie Joly emphasized the need to counter Russia’s military presence and China’s increasing interest in the area. Arctic dogfighting, pretty cool.

CNBC / Levi Strauss trims guidance as it weighs sale of Dockers business. Dockers sales sank 15% in Q3, dragging Levi’s revenue below estimates. The company is trimming its revenue guidance for 2024 and evaluating a sale of the khaki brand. Meanwhile, Beyond Yoga surged 19%, and Levi’s is betting big on direct-to-consumer growth.

CNBC / Biden’s no-win port strike dilemma: unions vs. inflation. Dockworkers demand a 61.5% wage increase, while a prolonged strike risks reigniting inflation. Biden’s decision to avoid intervention reflects his commitment to unions, but the economic fallout could be severe. The clock is ticking as supply chains strain, and inflation fears resurface. He needed this 33 days from now.

Yahoo Finance / SEC takes XRP case to appeals court, fights for crypto regulation power. After a 2023 court ruling curbed its control over Ripple's XRP sales, the SEC is appealing to restore its regulatory powers. The case could set a precedent for how cryptocurrencies are classified and impact the SEC’s ability to regulate the market.

Trivia

This week’s trivia is on technology innovation.

Who launched the first modern credit card?

A. Visa

B. Diners Club

C. American Express

D. MasterCardWhich company created the first handheld mobile phone?

A. Nokia

B. Samsung

C. Motorola

D. AppleWho developed the first successful color television?

A. Sony

B. RCA

C. Philips

D. Samsung

(answers at bottom)

Market Movers

Winners!

Joby Aviation (JOBY) [+27.9%]: Toyota is investing another $500M to help with electric air taxi certification and production.

Ciena (CIEN) [+7.4%]: They announced a big $1B share buyback program.

Sphere Entertainment (SPHR) [+7.3%]: Got upgraded by Wolfe Research, thanks to higher returns on new spheres and better profitability from live entertainment.

RPM International (RPM) [+6.3%]: Earnings beat expectations, but revenue was light, though they're optimistic lower interest rates will boost residential markets.

Caesars Entertainment (CZR) [+5.3%]: They finished their old share buyback program and launched a new $500M one, with plans to use proceeds from a sale to pay down debt.

CVS Health (CVS) [+1.1%]: Glenview Capital clarified they’re not pushing for a company breakup, but analysts are split on whether a split would help.

Losers!

Humana (HUM) [-11.8%]: Their preliminary Star ratings dropped significantly, with only 25% of members in top-rated plans for 2025, down from 94% in 2024.

Conagra Brands (CAG) [-8.1%]: Earnings and revenue missed, with weak spots in Refrigerated/Frozen and Foodservice, and analysts are cautious despite reaffirmed guidance.

Nike (NKE) [-6.8%]: Sales declined more than expected, though EPS beat, but their guidance is soft, and they're facing multiple headwinds, including a CEO transition and weaker China trends.

Harley-Davidson (HOG) [-4.1%]: Baird downgraded them, pointing to big retail declines and high inventory levels.

Tesla (TSLA) [-3.5%]: Q3 deliveries missed expectations, with the Model S, X, and Cybertruck falling short, though Model 3 and Y deliveries exceeded estimates.

PVH Corp (PVH) [-2.8%]: Bank of America downgraded them, highlighting sales growth challenges in Europe, the U.S., and China.

Market Update

Trivia Answers

B. Diners Club was the first credit card when it launched in 1950.

C. Motorola with the 4.4lb Motorola DynaTAC 8000X in 1973.

B. RCA had the first color TV back in 1953.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.