🔬 New All-Time Highs for the S&P 500 ...and Japan (?)

Plus: Nvidia's correlation to the market; Reddit's IPO has some stank; and much more.

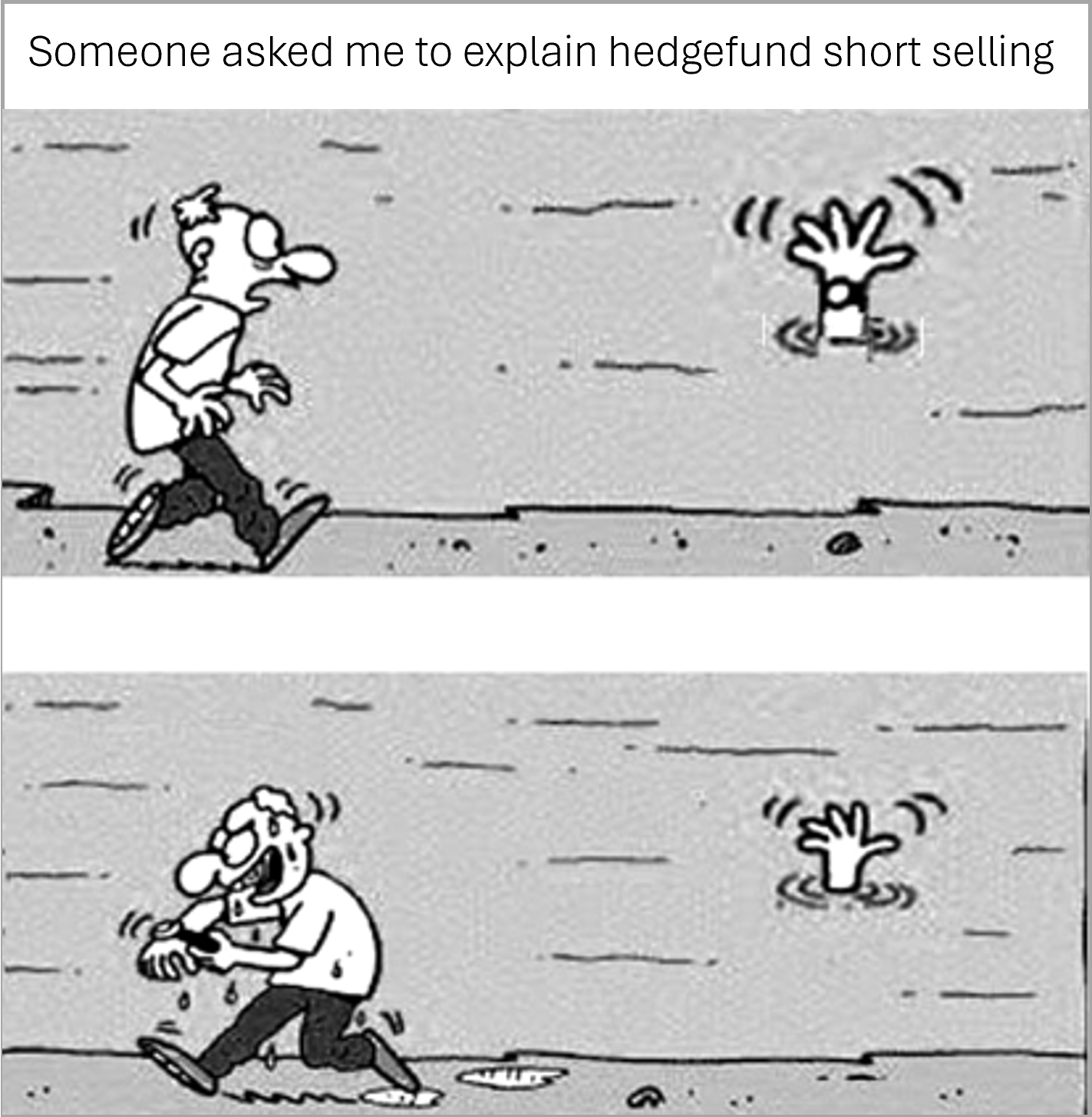

"If you owe the bank $100 that's your problem. If you owe the bank $100 million, that's the bank's problem"

- J. Paul Getty

"There are two times in a man's life when he should not speculate: when he can't afford it and when he can"

- Mark Twain

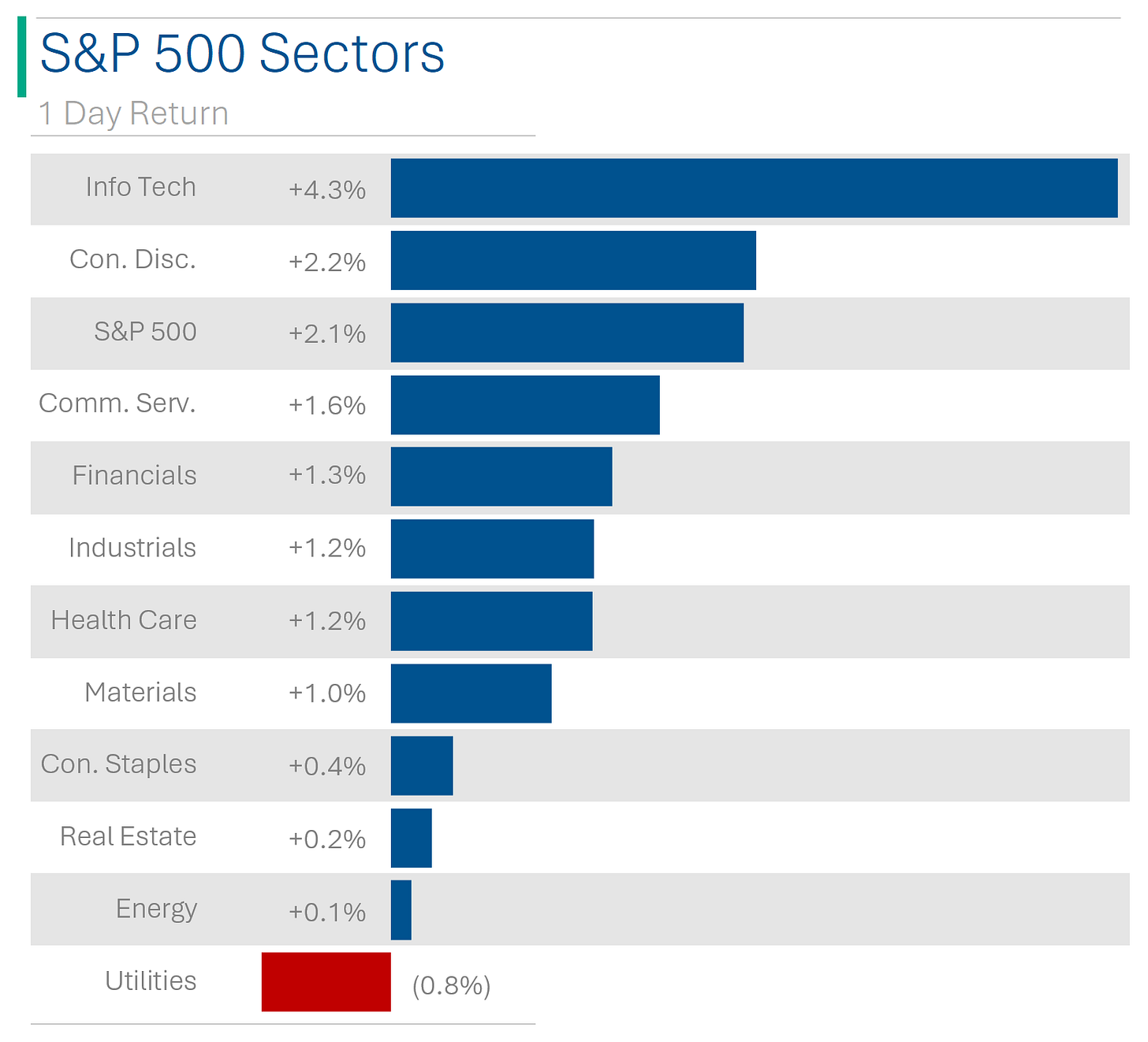

The big US market had a banger yesterday with the S&P 500 +2.1% and Nasdaq +3.0%. Pretty much all of this is attributable to Nvidia’s stand-out quarter after Wednesday’s close which hyped the market.

10 of 11 sectors closed in the green with (you guessed it) Tech (+4.3%) leading the way, in what is one of the best days for Tech in history. Utilities (-0.8%) were the only loser on the day.

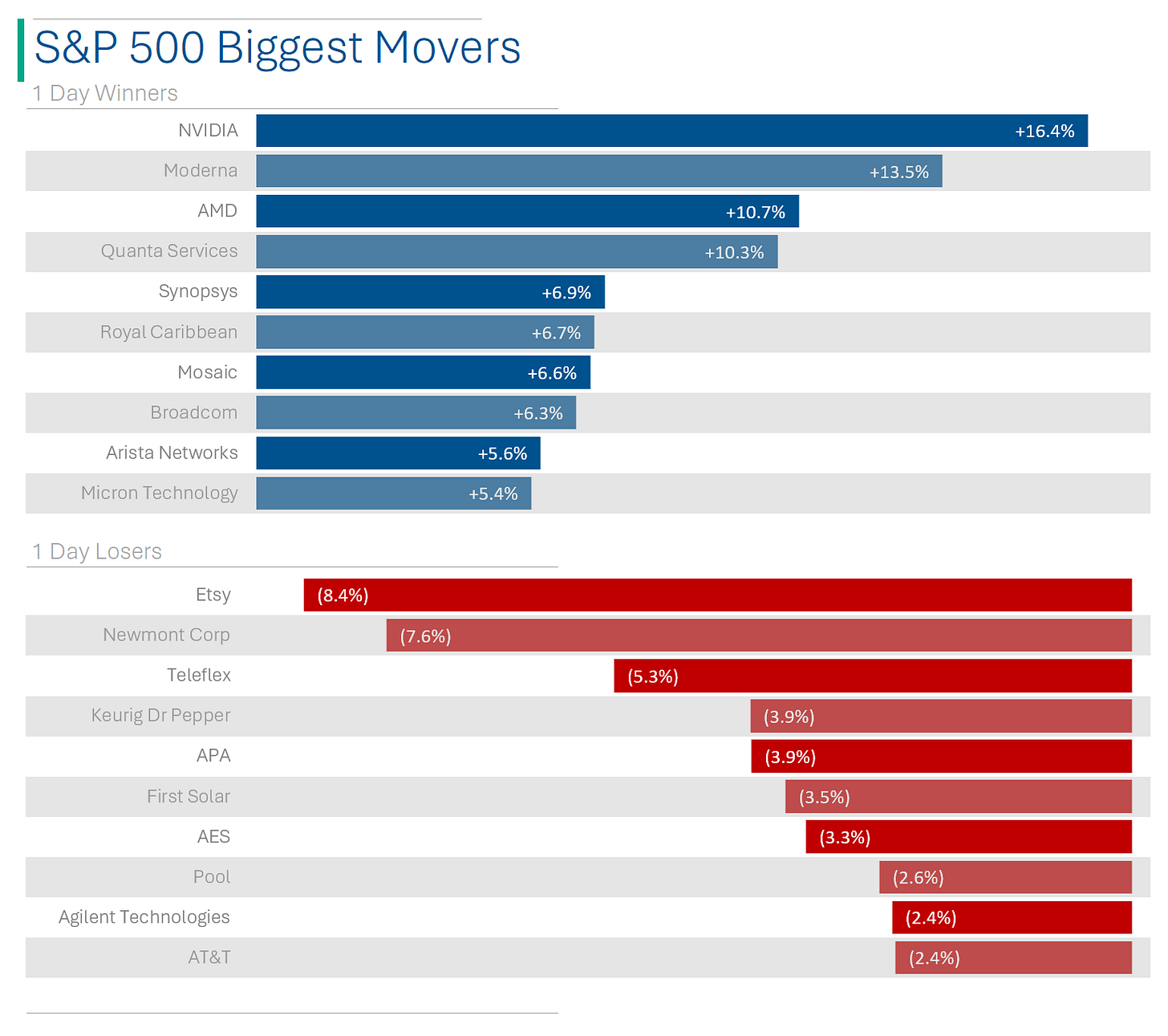

Nvidia ended the day +16.4% following a strong quarter with beats on Revs and EPS, and strong guidance (more details in yesterday’s note). Competitor AMD was up +10.7% based on positive outlook for chip space.

Crude oil was up +0.9% and Bitcoin was up 2.1%.

Street Stories

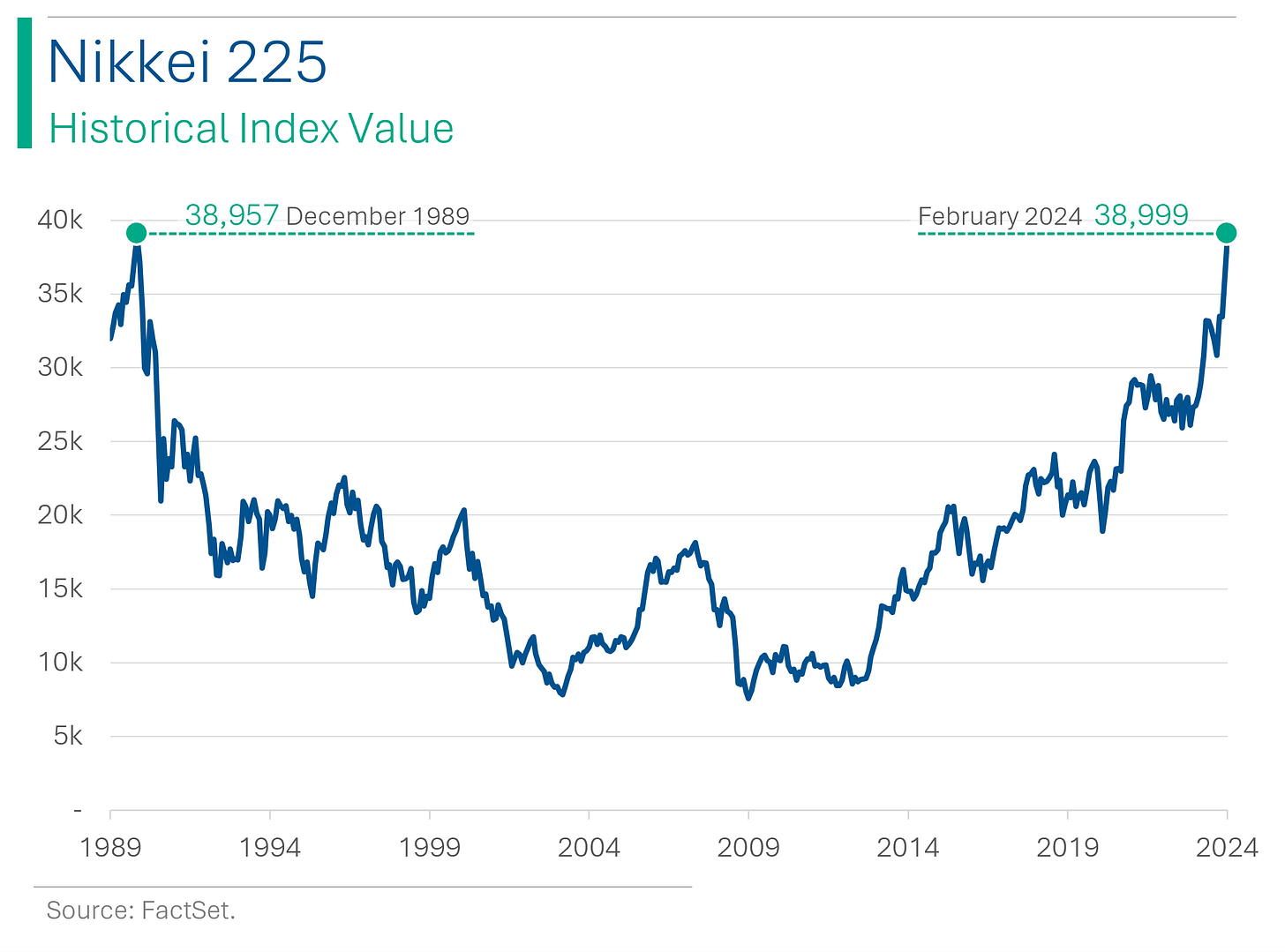

Fresh All-Time High for Japan’s Nikkei

(…after 34 years)

Yep, you read that correctly. The Nikkei’s fall from grace during Japan’s ‘Lost Decades’ has taken some time to overcome. Much longer than even the Great Depression took the US market to bounce back.

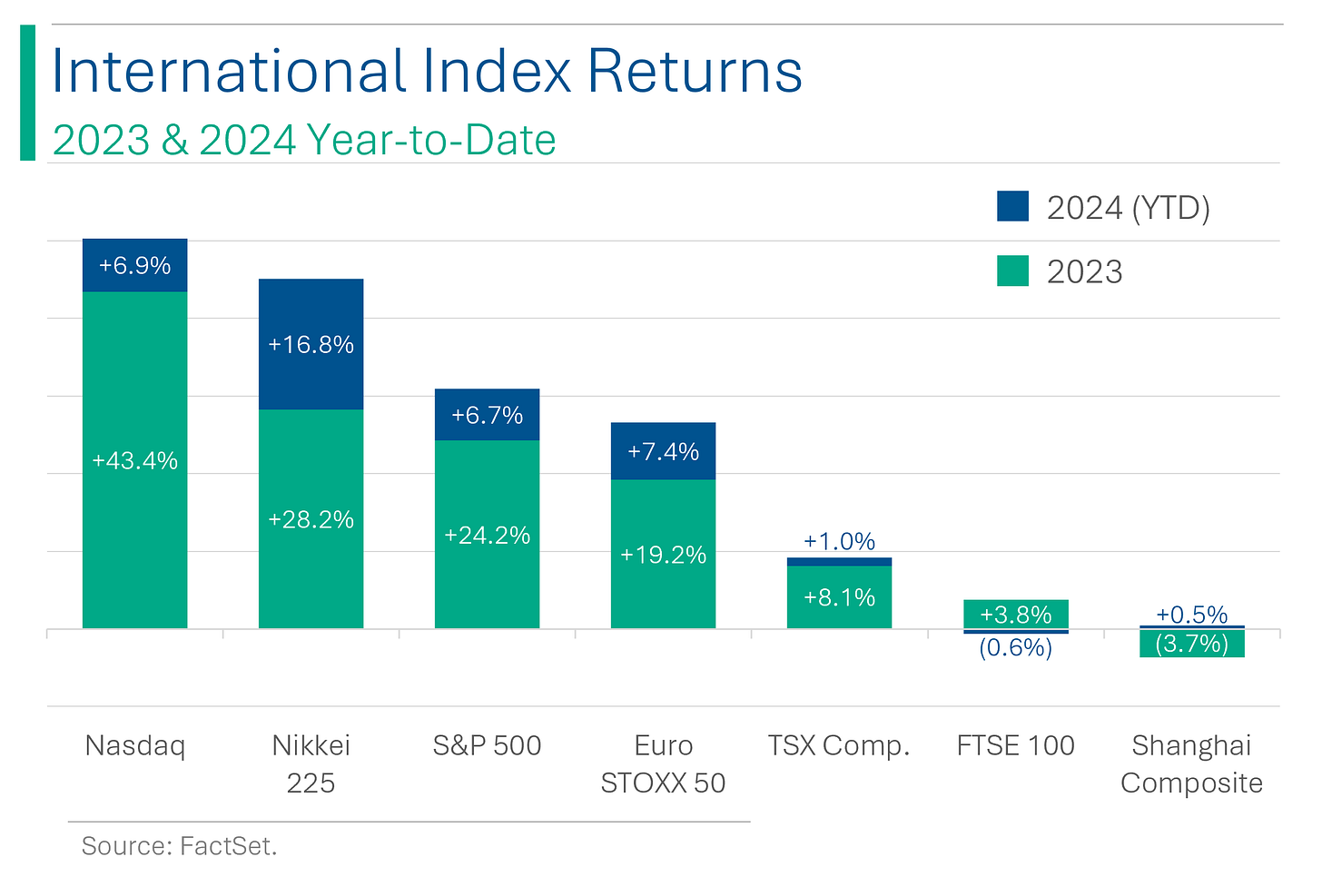

Despite being officially in a recession, Japan’s stock market has done absurdly well. Compared to its global peers, the Nikkei has only really been outpaced by the Nasdaq which - thanks to all the AI hype - has had one of the greatest 14 months in its history. Not too shabby.

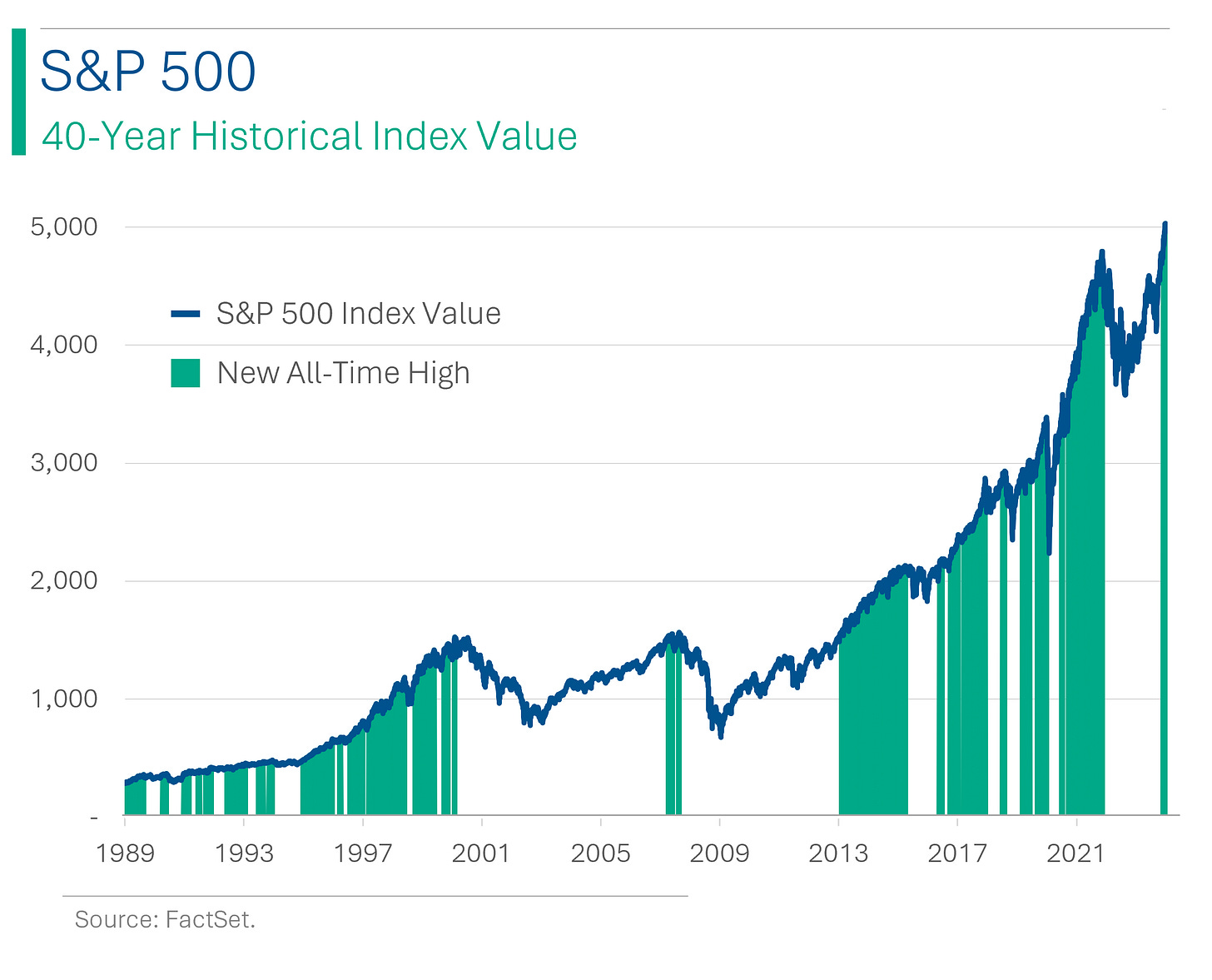

Oh, and for a bit of context on the All-Time High front, since the Nikkei’s last one, the S&P has had more than 700 (including yesterday). Or roughly one every 12.3 trading days. Ha.

Nvidia’s Market

Yeah, I’m sick of talking about Nvidia too so after this I promise I won’t bring them up again for a while. Anyway, after they reported Wednesday and the stock popped up 14%, one of the first things that came to mind was ‘well I guess the market is going to have a good day tomorrow’ (it did). As I’ve stated before, a lot of market sentiment seems to be tied to Nvidia, so when they have a good day, the market tends to as well. One of the key tenets of fundamental analysis is the concept of Beta (β); a security’s correlation to the market*. Lately though, it seems like we should be tracking the market’s correlation to Nvidia.

*To the finance nerds: Yes, Beta is a security’s covariation divided by its variation, which isn’t correlation, but it’s a term my dozens of readers will understand.

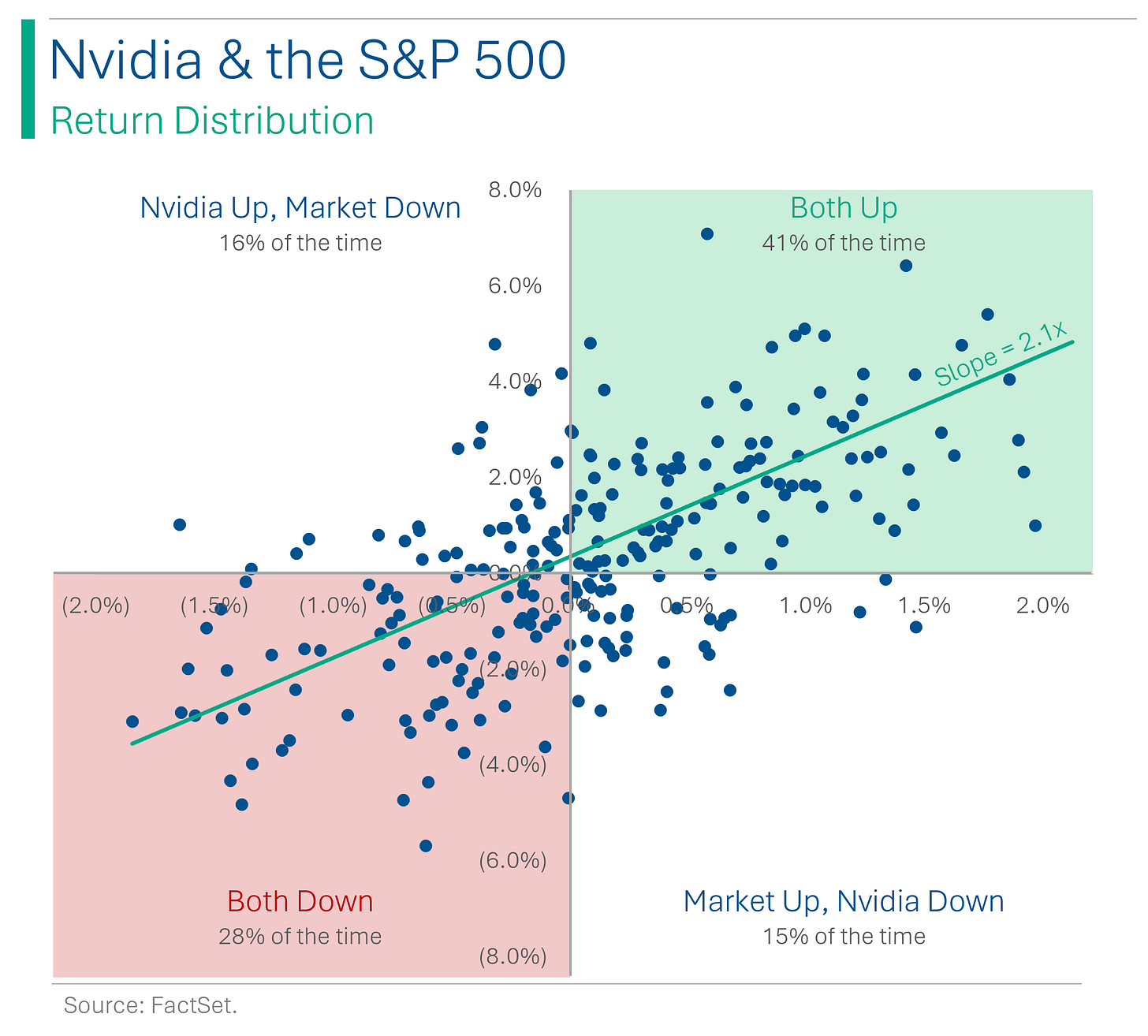

Digging in a bit, I wanted to see how true this connection is by looking at the daily returns over the last year (252 trading days). Turns out, the connection is pretty strong: 41% of the time both the S&P 500 and Nvidia were up, and 28% of the time they were both down. This means that 69% of the time they moved in the same direction. Or, looked at differently, if Nvidia was up, there was a 72% chance that the market was up to. What should also stand out is the slope of 2.1x, meaning that up or down, Nvidia’s moves relative to the market’s were more than 2x the size. And since the stock is up 280% over the last year, you’d be right in guessing that most of these were ‘up-days’ (57%).

Sounds neat but how does that compare to other stocks?* Well, to be fair that 69% of the time Nvidia and the market moved in the same direction isn’t too outlandish, as most of the companies I ran the data for were in the mid-to-low 60s. What differentiated them was ratio of Nvidia Up/Market Down versus Nvidia Down/Market up. For Nvidia this figure was 1.1 (15.9%/14.7%), for Tesla it was 0.8, for Apple it was 0.8, for Home Depot it was 0.9, and for Exxon Mobil it was 0.7. Basically, the times when the market and Nvidia didn’t move together, it more often meant that Nvidia was up, and the market was down. Whereas for the rest, it meant the opposite.

*No way in hell I’m making another one of those charts again so just pretend.

Reddit IPO

Reddit has filed an S1 prospectus (link) for an NYSE IPO expected some time in March. This will also be the first big tech IPO this year and the largest social media one since Pinterest went public back in 2019. Now, I’m an active Redditor (+4k in Karma) but DAMN these numbers aren’t too pretty: The company reported $804 million in annual sales for 2023, a 20% increase from the previous year, but also disclosed a net loss of $90.8 million for the same period. For folks that want to say ‘they’re a tech company, they run losses for a while’ - NO. This is an 18 year old company. Kids have been born and gotten PhDs in that time. Figure it out, bud.

Anyway, Reddit aims to enhance its online advertising business, develop a data-licensing business, and explore new revenue streams through a user economy involving games and digital goods exchanges. A unique twist is that they are also aiming to allocate shares to 75k Redditors based on their “Karma” (a user’s reputation score that reflects their community contributions). And, no, I have not made overtures for an allocation.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

It's time to sell your stocks in the wood chip industry! The market is getting tu-mulch-uous.

What did the accountant do when his shift-key stuck? He capitalized everything.

Hot Headlines

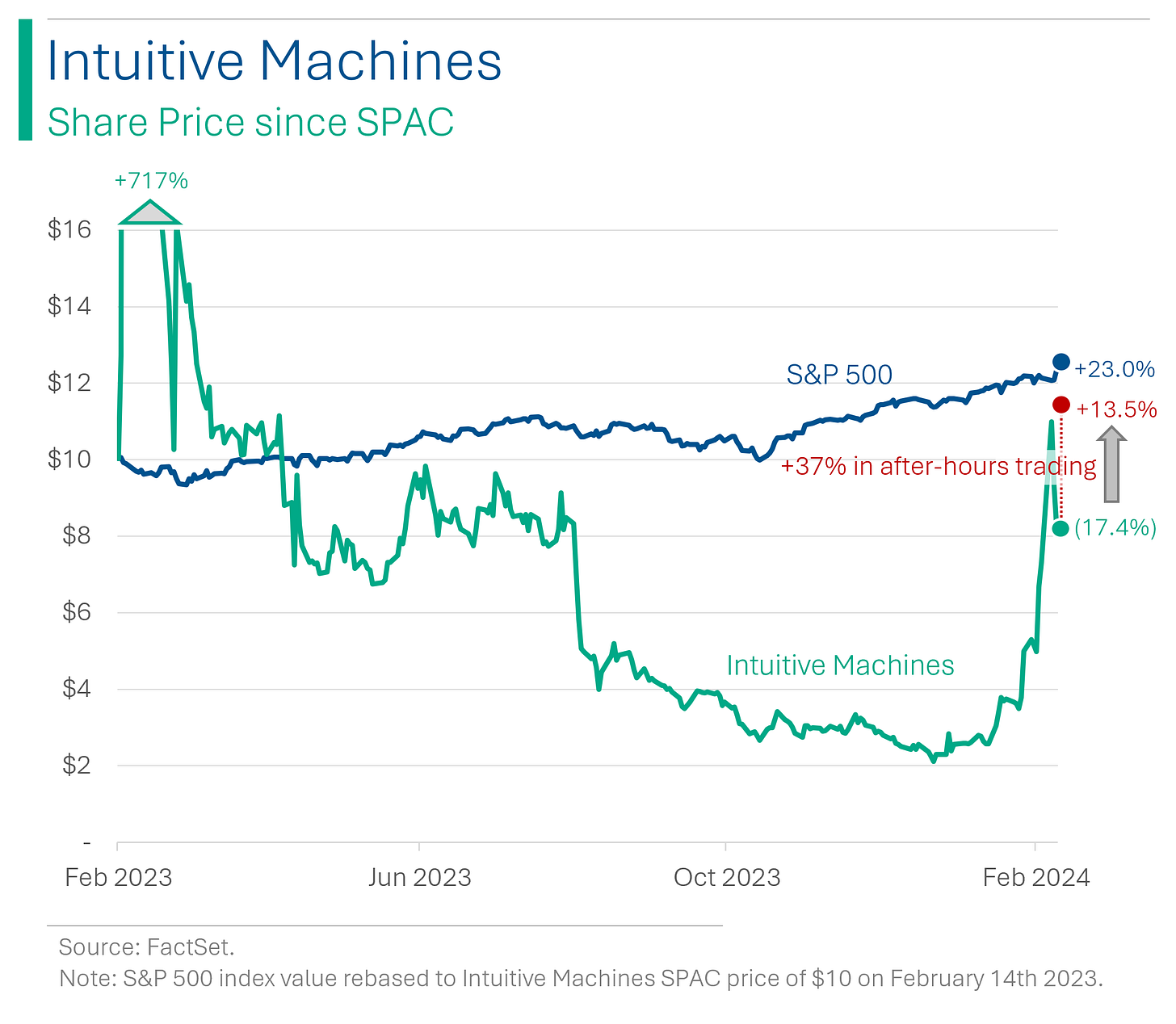

CNN | Odysseus becomes first US spacecraft to land on moon in over 50 years and the first non-governmental one ever. It’s maker Intuitive Machines, who have seen their shares on a wild ride since it’s SPAC listing last year, got a +37% pop in after-hours trading since the news got announced.

FOX Business | Pharmacies nationwide face delays as health-care tech, Change Healthcare, reports cyberattack.

Reuters | US crude stockpiles rise, products draw on low refining rates. Crude inventories rose by 3.5 million barrels to 442.9 million barrels in the week ending Feb. 16 according to EIA data.

Axios | Dunkin' gambles on caffeine-spiked drink after Panera deaths. The Dunkin’ fruit-flavored energy drinks contain slightly less caffeine than Panera Bread's Charged Lemonades, which led to lawsuits over customer deaths. Reportedly the Panera ones contained 390mg of caffeine which is around 4-5 coffees.

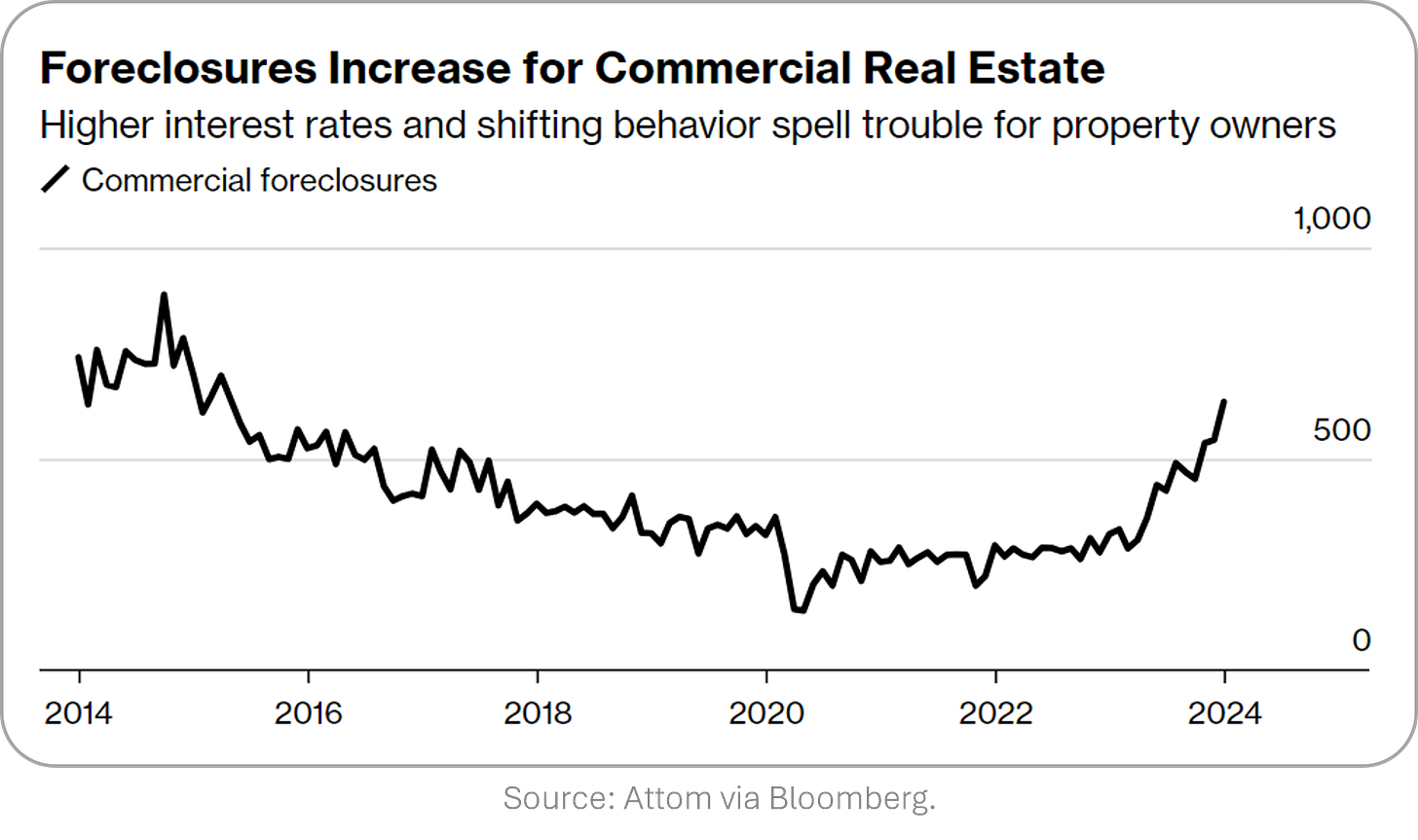

Bloomberg | US commercial property foreclosures spike in January. High interest rates are to blame, and also that lenders were quite lenient during pandemic but that patience has worn thin.

Trivia

This week’s trivia is on great financial dynasties. Maybe a bit of a stretch but today’s is on Nvidia Founder and CEO Jensen Huang (it’s topical).

What is Jensen Huang’s net worth?

A) $8.8 billion

B) $281 billion

C) $29 billion

D)$62 billionAt 30 years old Jensen founded Nvidia with his buddies. What year was this?

A) 1993

B) 1998

C) 1988

D) 1984Prior to founding Nvidia, Jensen worked at which rival?

A) AMD

B) Intel

C) Global Foundries

D) Applied MaterialsSteve Jobs had his black turtlenecks, but Jensen’s look for public engagements includes what?

A) Sunglasses

B) A monocle

C) Cardigans

D) Leather biker jacket

(answers at bottom)

Market Movers

Winners!

NVIDIA (NVDA) [+16.4%] Q4 revenue and EPS significantly above estimates, with Q1 guidance surpassing expectations. Strength noted in AI inference and demand from hyperscalers; Gen AI adoption and product pipeline are strong.

Lantheus Holdings (LNTH) [+14.7%] Q4 EPS and revenue outperform, with notable margin strength. DEFINITY and Pylarify saw double-digit growth. Q1 and FY24 guidance above consensus.

Moderna (MRNA) [+13.5%] Q4 EPS beat on improved costs; revenue and margins better with steady Covid vaccine sales. Expects higher prices to offset lower volumes; reaffirms 2024 sales guidance and anticipates RSV vaccine launch.

Wayfair (W) [+10.8%] Q4 EPS above forecasts, with revenue and EBITDA meeting targets. International revenue offsets US dip; US EBITDA shines. Analysts optimistic on positive EBITDA amid cost reductions.

Bausch Health Cos. (BHC) [+7.3%] Q4 results beat projections, led by Bausch + Lomb. International and diversified products excel; Xifaxan shows robust demand. FY guidance tops estimates.

Synopsys (SNPS) [+6.9%] FQ1 earnings and margins outshine, with revenue as expected. Upbeat next-Q and FY EPS guidance. Positive analyst sentiment on AI focus, despite China concerns.

Royal Caribbean Group (RCL) [+6.7%] Lifts 2024 EPS outlook; demand and pricing look promising. WAVE season bookings exceed last year's, signaling strong consumer interest.

Losers!

Rivian (RIVN) [-25.6%] Mixed Q4 with slightly better revenue but worse EBITDA loss. 2024 production guidance disappoints at 57K vehicles amid economic and geopolitical challenges.

SunRun (RUN) [-18.0%] Q4 revenue falls short, new customer growth aligns. Q1 solar installations miss expectations, citing seasonality. Notes accelerating momentum; announces $475M convertible debt deal.

Goosehead Insurance (GSHD) [-17.9%] Missed Q4 earnings and revenue with lower royalty fees and commissions. FY24 revenue guide underwhelms; announces CEO transition. Analysts see potential for 2025 rebound despite slow growth.

Lucid Group (LCID) [-16.8%] Q4 EPS meets expectations, revenue does not. FY24 production forecast at 9K, below 14K expected. Challenges in luxury EV market noted, with no new products until late 2024.

Etsy (ETSY) [-8.4%] Q4 EPS misses, revenue exceeds. Q1 GMS expected to drop slightly, reflecting a slow start. Despite challenges, new buyer growth remains strong with long-term potential noted.

Market Update

Trivia Answers

D) Jensen is worth around $62 billion.

A) Nvidia was founded in 1993.

A) Jensen worked at GPU competitor AMD.

D) Jensen can always been seen in a leather biker jacket.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.