🔬Natural Gas is Down 52% in Three Months (Thanks El Niño, Whoever You Are)

Plus: Japan & the UK are now in recession; another chip stock skyrockets; retail sales data looks pretty sucky; and much more.

"Investing without research is like playing stud poker and never looking at the cards"

- Peter Lynch

"It’s not supposed to be easy. Anyone who finds it easy is stupid"

- Howard Marks

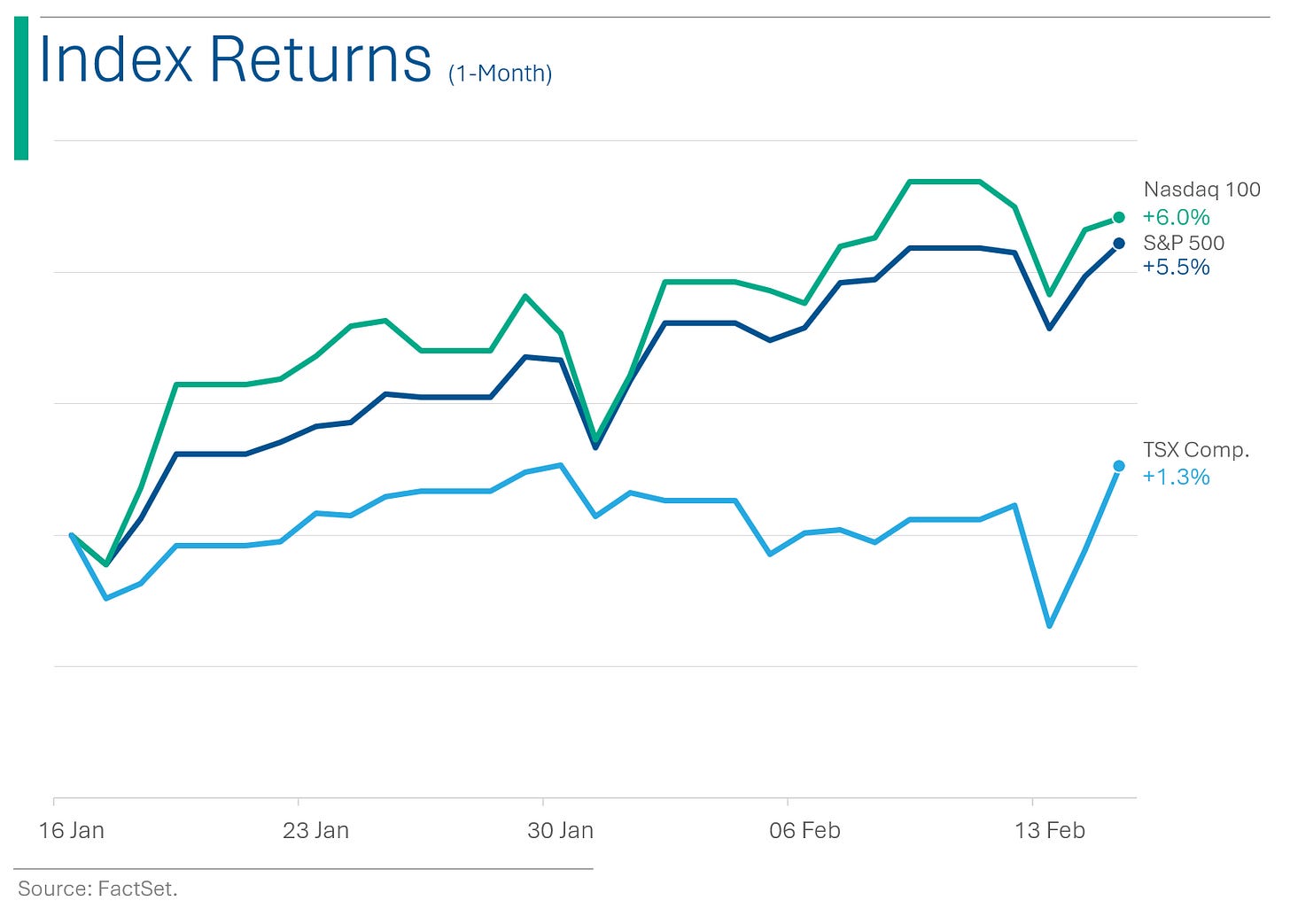

The big US markets had solid day with the S&P 500 +0.58% and Nasdaq +0.30%. Small-cap index Russell 2000 popped +2.45% as the little fellas seem to have a rally going on (+6.95% in the last month).

10 of 11 sectors closed higher, led by Energy (+2.5%) as crude oil closed up 1.8%. Tech (-0.4%) was the only loser.

The UK and Japan both entered technical recessions yesterday (twinsies!)

YETI - yes, the cooler company - sunk 13.8% after Q4 EPS and revenue misses, and gave a weak outlook. While TripAdvisor jumped +9.2% on a strong quarter.

(more in ‘Market Movers’ below)

Street Stories

The Great Gas Dip: How El Niño Turned the Heat Down on Price

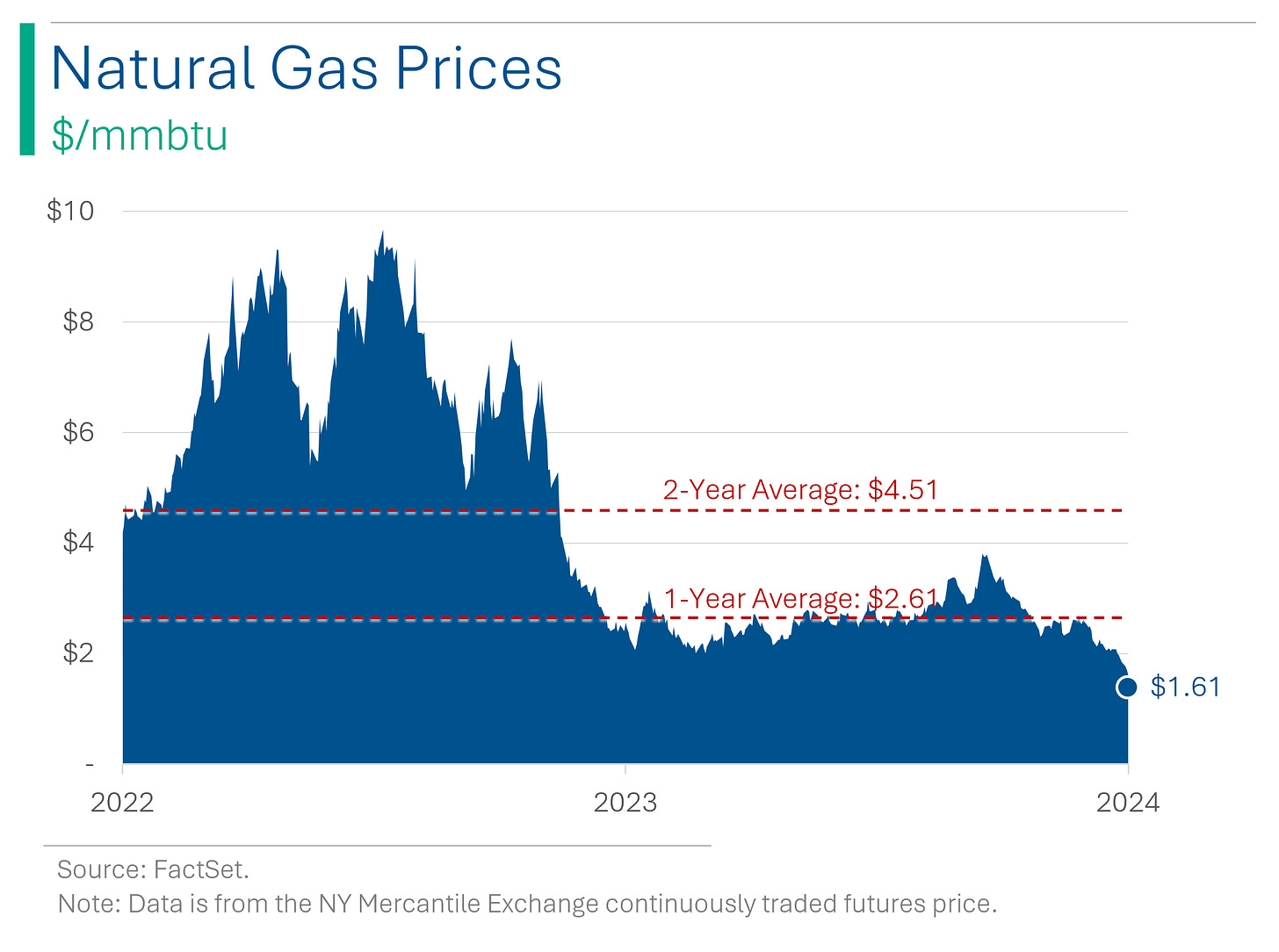

Natural gas prices have dropped 52% in the past three months, and currently sit at $1.61 per million British Thermal Units (mmbtu’s if you’re a commodities nerd), which is well below the one year average of $2.61. Two main factors are at play here: the weather and oil production.

Firstly, the unseasonably warm winter the US is experiencing, largely attributable to the El Niño weather pattern (and probably a sprinkle of climate change), has reduced demand sharply. The winter months of December, January and February typically see natgas usage increase by ~50% so reduced demand here exacerabtes the price/supply situation.

Secondly, US oil production - which has picked back up significantly in the face of the Russian invasion of Ukraine and OPEC+ supply cuts - is now a significant source of natgas. Currently around 15% of US natgas comes as a byproduct of oil drilling (called ‘associated gas’), which is up from 6% back in 2010. So, despite a ~20% reduction in natgas rigs, the overall supply has grown.

As a result, natgas in storage is elevated which continues to weigh on the price. However, the potential expansion of liquefied natural gas (LNG) exports could bolster demand and prices, even as the Biden administration signals a cautious approach to new LNG export terminal approvals.

UK & Japan Enter Recession

Both the United Kingdom and Japan have entered technical recessions after data released Thursday showed further economic contractions within both nations. Fourth quarter Gross Domestic Product (GDP) in the UK came in at -0.3%, below Wall Street estimates for only a contraction of -0.1%. The dip doesn’t bode well for PM Rishi Sunak’s re-election campaign as the Conservative Leader faces what may well be the first time British living standards declined between election periods for the first time since WWII.

***Note: For those still learning this junk, a technical recession is defined as two consecutive quarters of contracting GDP.***

The clusterf*** disguised as Japan’s economy followed a huge Q3 contraction of 3.3% with a more modest (looking for positives here…) decline of -0.4%. A follow-up gut punch is the news that Japan has been overtaken by Germany as the world’s third largest economy, after Deutschland clocked GDP of $4.4 trillion versus Japan’s $4.2 trillion in 2023.

One positive, which I touched on in yesterday’s note, is that inflation has been coming down consistently in both nations, though the UK’s progress has stalled out a bit lately. The good news is that recessions are good for reducing inflation! This is a glass-half-full newsletter after all.

Another Day, Another Chip Stock Bangs

Chip equipment maker Applied Materials ($AMAT) reported after the close Thursday for its January quarter, with beats on Revenue and EPS. Shares popped ~12% in after-hours trading. The company forecasts continued growth, citing its leadership in semiconductor technology critical for AI and IoT, and has seen its shares rally about 55% over the past year, outperforming the broader semiconductor sector (a tall order).

Highlights:

Q1 Revenue: Revenue of $6.71 billion vs. Wall Street estimates for $6.48 billion

Q1 Earnings Per Share: $2.13 vs. Street’s $1.90

Q2 Guidance: Semiconductor Systems revenue of ~$4.8 billion vs. Street’s target of $4.7 billion; Applied Global Services revenue of $1.5 billion vs. Street’s $1.48 (so basically the same)

January's Retail Chill: Shoppers in Hibernation

U.S. retail sales experienced their most significant decline in 10 months in January, dropping 0.8%, influenced by cold weather and challenges in adjusting data for seasonal variations. Despite this sharp decrease and revisions indicating slower sales in November and December, the robust job market and high wage growth suggest consumer spending remains resilient, supporting ongoing economic expansion. Economists, including Nationwide's chief economist Kathy Bostjancic, caution against overinterpreting the decline, attributing it partly to revised seasonal factors and adverse weather conditions.

I started reading ‘Far from Equilibrium Economics’, a free newsletter Dr. John Rutledge (if you’re like me, you recognized him from CNBC) puts out every week or so.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

‘You can’t wear pajamas to work’

‘Why not? Everyone else does’

‘That’s because they’re patients!’

Headline: Archeologist’s career lies in ruins.

Hot Headlines

WIRED | OpenAI (the Chat-GPT folks) launched Sora, a new product that takes text prompts and turns them into photorealistic videos. Product will be in testing with a select view of ‘creatives’ and security-types before public release.

Vanity Fair | Inside Johnny Depp’s epic bromance with Saudi Crown Prince MBS. Just gross. Like ‘Amber Heard bedsheets’ gross.

The Verge | GM targeting Tesla with expansion of its hands-free (semi-autonomous) Super Cruise system. News wasn’t well timed as it coincided with the resignation of Cruise’s autonomous driving hardware unit, Carl Jenkins, in the latest exodus since the company suspended testing fully-autonomous cars after a pedestrian death last October.

CNBC | Coinbase shares surge in premarket trade after posting first quarterly profit in two years.

Assoc. Press | Ford CEO says company will rethink where it builds vehicles after last year's auto workers strike.

Trivia

This week’s trivia is on the great financial collapses.

Arthur Andersen, once one of the "Big Five" accounting firms, saw its collapse primarily due to its association with:

A) Enron

B) Lehman Brothers

C) WorldCom

D) Bernie Madoff

Which company was infamously involved in a scandal involving the falsification of emissions tests?

A) Ford

B) Volkswagen

C) Toyota

D) Tesla

One of the key people blamed for the Great Financial Crisis, Stan O’Neal got a $161.5 million ‘golden parachute’ when he left his role as CEO of what firm?

A) Goldman Sachs

B) Citigroup

C) Morgan Stanley

D) Merrill Lynch

(answers at bottom)

Market Movers

Winners!

Shake Shack (SHAK) [+26%]: Q4 outperformed with strong comp growth and better-than-expected sales, EBITDA, and EPS. February sees improved trends; plans for 2024 profitability shared.

Super Micro Computer (SMCI) [+14%]: Bank of America initiated with a buy, citing AI-driven demand for server and storage solutions.

Crocs (yes, that Crocs) (CROX) [+12.2%]: Surpassed Q4 expectations; early January FY24 guidance reiterated and new EPS guidance introduced. Growth in Crocs brand across all regions and channels noted.

TripAdvisor (TRIP) [+9.2%]: Beat Q4 EPS and revenue expectations with Viator achieving EBITDA profit. Reduced expenses credited for financial success.

CBRE Group (CBRE) [+8.5%]: Q4 EPS and revenue exceeded forecasts; FY24 core EPS guidance optimistic. Leasing revenue growth attributed to international markets.

Wells Fargo (WFC) [+7.3%]: 2016 sales practices consent order by OCC terminated. Move seen as a step towards lifting the asset cap.

Coinbase (COIN) [+3.3%]: Upgraded to neutral at JP Morgan, citing positive bitcoin ETF flows and higher bitcoin prices enhancing earnings potential.

Losers!

Twilio (TWLO) [-15.2%]: Beat Q4 expectations but projected a ~4% sequential revenue drop in Q1, with no full-year outlook yet. Plans to review Segment operations by early March and noted margin improvements.

Penn Entertainment (PENN) [-13.8%]: Missed Q4 earnings and revenue, facing headwinds in the Interactive segment and costs from BET ESPN launch.

YETI Holdings (YETI) [-13.8%]: Q4 EPS and revenue fell short; FY24 EPS and revenue growth guidance below consensus. Expects margin and EPS growth despite cautious outlook and cooler sales dip.

Paramount Global (PARA) [-4.5%]: 13F filings reveal Berkshire Hathaway reduced its stake by ~32%, to 63.3M shares.

Cisco Systems (CSCO) [-2.4%]: Fiscal Q2 revenue and EPS exceeded forecasts, but guidance for the April quarter and 2024 lowered due to macro uncertainty and Service Provider market weakness.

Alphabet (GOOG) [-2.2%]: Facing potential competition from OpenAI's reported web search offering; Third Point sold 900K shares.

Market Update

Trivia Answers

A) Their work for Enron resulted in the collapse of Arthur Andersen.

B) Volkswagen was responsible for the emissions scandal.

D) Stan O’Neal blew up Merrill Lynch. Douche.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Thank you for reading my work!