Mr. Market Needs a Haircut, 'Crypto Winter' Thaws Out, and Much More.

StreetSmarts Morning Note

***Friendly reminder to hit the ‘Like’ button above, it really helps to get Substack to share my newsletter***

“Play by the rules, but be ferocious”

-Phil Knight, Founder of Nike

“The only place success comes before work is in the dictionary”

-Vince Lombardi, legendary football coach

Table of Contents

A.M. Allocations: Summaries of important news and investing events

Mr. Market Needs a Haircut

Bitcoin's Thawing Out: Wall Street’s Cold Shoulder is Heating Up

Hot Headlines: Links to some of the top financial stories of the day

Market Movers

Notable Gainers:

Textainer Group Holdings (TGH, +44.7%): Set to be ACQUIRED by Stonepeak for ~$7.4B, at a ~46% premium to Friday's close. Deal expected to close in Q1 2024.

EngageSmart (ESMT, +11.9%): Getting ACQUIRED by Vista Equity Partners at a ~14% premium to Friday's close. Deal also closing in Q1 2024.

Walgreens Boots Alliance (WBA, +3.3%): JPMorgan UPGRADE after Tim Wentworth’s appointment to CEO and a new $1B cost-cut target for 2024.

Pinterest (PINS, +2.6%): Stifel UPGRADED the stock based on tech improvements, a collaboration with Amazon, and growing brand interest.

Notable Losers:

Okta, Inc. (OKTA, -8.1%): Revealed a SECURITY BREACH on Friday. Analysts are warning of increased reputational risks.

Chevron (CVX, -3.7%): Plans to ACQUIRE HES for $53B in stock. Announces plans to increase Q1 dividend and increase share buyback.

Intel (INTC, -3.1%): COMPETITOR Nvidia announced plans to develop competing CPUs for Windows OS.

A.M. Allocations

Mr. Market Gets a Haircut

Sometimes the stock market does stuff that you don’t understand, and it does it for a lot longer than you think it will. Take the pandemic for example; as someone covering healthcare stocks at a large mutual fund at the time, I smelt fire early and pushed to move towards safety. And it worked! For a while. After the initial crash, stocks moved to record highs in what I would describe as a mini-tech bubble, as if a few stimulus cheques and some bored Redditors somehow changed the long-term, fundamental outlook for equities. Coming out of the pandemic, the economic outlook was pretty shaky; China was still locked-down, inflation was growing by the second, and there was a shooting war in Europe. Stocks fell. That makes sense. The world was rational again.

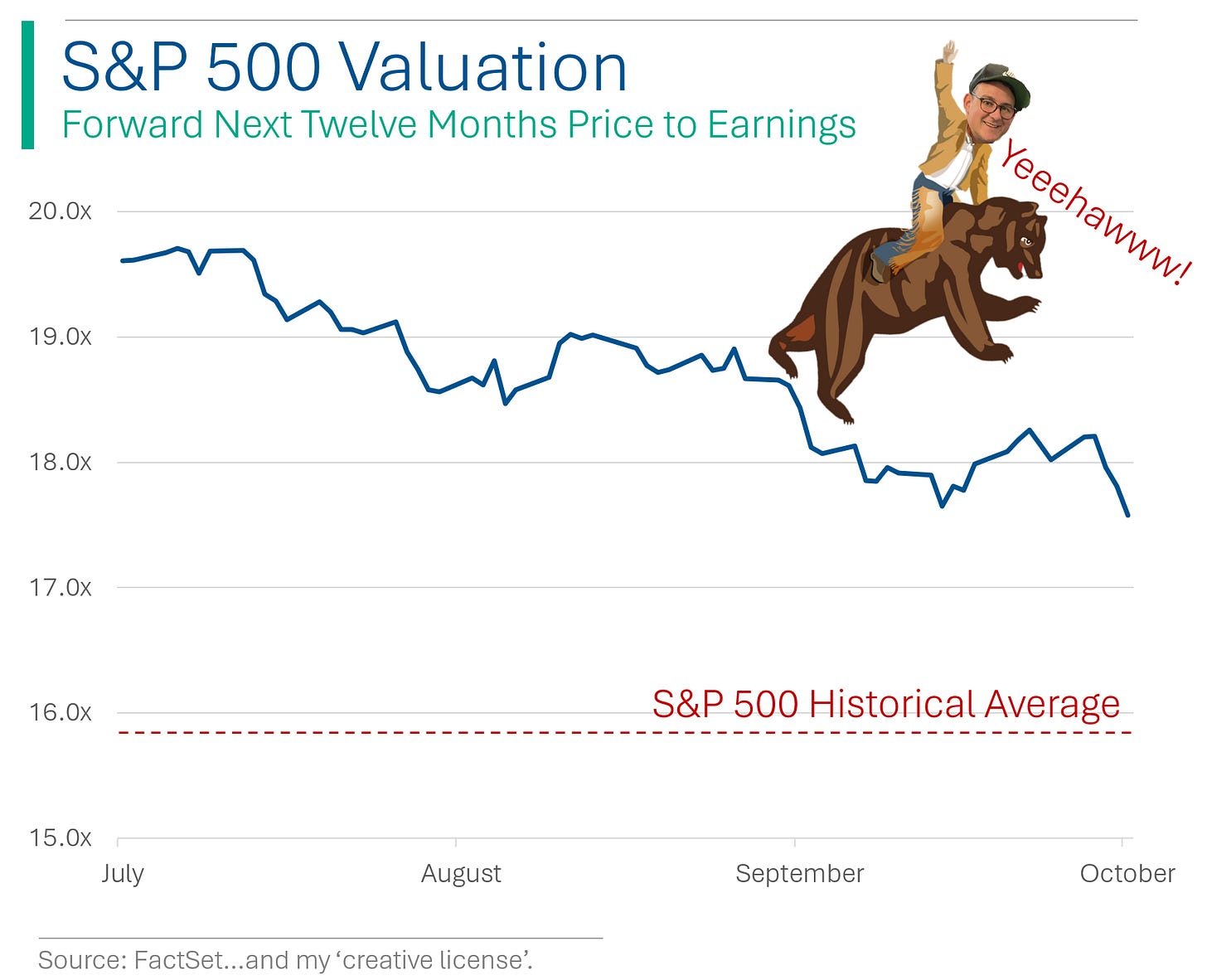

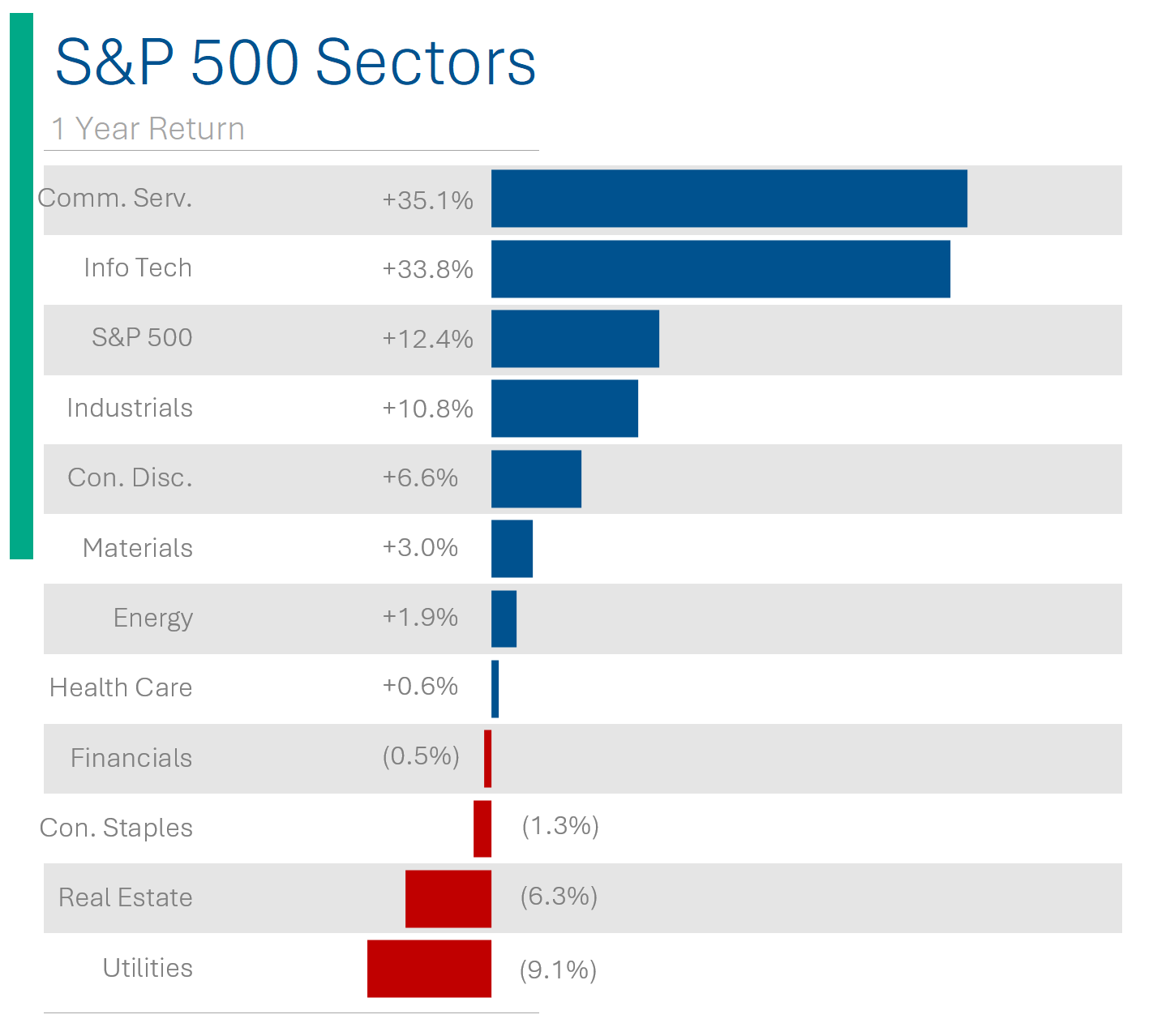

Cue up 2023, and the market went on something of a tear. Up over 15% at one point, with forward P/Es approaching the 20x mark. (We have Chat GPT and the AI wave to thank for this lift via a handful of info tech/communication services stocks that carried US performance.) Meanwhile, the main financial narratives of the year were inflation, hawkish Federal Reserve tightening (aggressively raising interest rates to combat said inflation), and a recession that everyone seems to keep expecting ‘in just a few quarters’. I mean, we just lapped the one year anniversary of Bloomberg’s ‘100% chance of recession in 12 months’. Go us!

In my longwinded way, what I’m getting at is, the picture isn’t too rosy. While all of the above was taking place in 2023, Wall Street estimates for the S&P 500’s earnings (the weighted average of the individual companies’ estimates) have only ticked lower over the last 12 months for the current calendar year and next. Nothing too drastic. Nothing too alarming. Just steadily downward.

Now I’m no Perma-Bear, nor a Doomsday foreteller. In fact, I think part of being a good investor is optimism, and being able to look at the known negatives and not let them outweigh the potential positives. And I’m not predicting a crash, I just want to say:

The S&P 500 has (quickly) come off of highs well above its historical average valuation.

The S&P 500’s valuation is still well above its historical average.

Earnings estimates for companies in the S&P 500 is trending down steadily.

Take-Away: Basically unless Putin decides to stroll out of the Ukraine, and Israel and Hamas (and Iran and Hezbollah) decide to give peace a chance, and inflation/oil/yield curve/Taylor-Swift-movies-about-concerts magically recede, I’m guessing there’s more net downside than upside in the market at the moment. Oh dear, I think that makes me a momentum investor.

Bitcoin's Thawing Out: Wall Street’s Cold Shoulder is Heating Up

Crypto seems to be done its hibernation as analysts at BlackRock, JP Morgan and Morgan Stanley believe that the long "crypto winter" might be over—in part inspired by a shaky U.S. dollar playing Jenga. Bitcoin and major cryptocurrencies like ethereum and XRP have surged in value, with bitcoin crossing $30,000.

Morgan Stanley analysts, including Denny Galindo, noted that bitcoin's recent almost +50% price increase typically signals the end of a downturn. Historical price drops in bitcoin were about 83% from their highs.

We also have on tap the bitcoin "halving" event next April: which cuts supply of new coins. Plus, rumors of a U.S. approval for a bitcoin spot ETF are circulating, because nothing says confidence like bureaucratic paperwork!

Joke Of The Day

How many bankers does it take to change a lightbulb? Two. One to remove the bulb and drop it, the other to sell it before it crashes.

I used to be a banker... But I lost interest.

Hot Headlines

(Axios) Bond vigilantes factor into the changing interest rate environment - Even as geopolitical tensions simmer, the bond market's real drama comes from an unexpected quarter: the U.S. government's fiscal decisions. The bond vigilantes, those discerning debt investors of yore, appear to be riding back into town, reminding everyone that while international crises may come and go, a nation's debt is forever.

(Bloomberg) UAW Strikes Stellantis’ Michigan Truck Plant; 6,800 Walk Out - In the unfolding drama of the Detroit Three labor negotiations, Stellantis' latest chapter sees intensified union strikes. The automaker's bid to resolve with a 23% wage increase has fallen short of the UAW's benchmarks, especially when juxtaposed against Ford and GM's proposals.

(CNBC) Apple, caught by surprise in generative AI boom, to spend $1 billion per year to catch up - Sees near-term potential in improving Siri, Apple Music and Messages. Too bad iRobot is already taken by those Roomba folks.

(Axios) Goldman Sachs leads small biz campaign against new bank rules - All from the goodness of their hearts. Nah, its more of an attack on new Basell III Endgame (pretty sick title for a bank reform) regulations coming in 2025 which would increase regulatory requirements and lending restrictions - and sure, also make it tougher for small business to get loans.

(WSJ) There’s Never Been a Worse Time to Buy Instead of Rent

***Fought the urge to put myself riding a bear here too.***

Trivia

What percent of the total value of stocks in the world do US companies represent?

16%

28%

33%

43%

Information Technology is the largest sector in the S&P 500 and represents 28% of its market value. What is the second largest at 13%?

Health Care

Industrials

Consumer Discretionary

Consumer Staples

What sector has the lowest weight on the S&P 500 at only 2%?

Energy

Utilities

Financials

Industrials

(answers at bottom)

Market Update

Trivia Answers

43%. As of Q2 2023, the value of stocks listed on US exchanges was worth $46 trillion out of a total global value of $109 trillion, according to Visual Capitalist.

Health Care.

Utilities.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.