🔬Most Boring Earnings Season Ever - in pictures

Plus: RIP to the greatest investor in history; Consumer Confidence takes a nosedive; and much more.

"You can't predict. You can prepare."

- Howard Marks

"Money often costs too much."

- Ralph Waldo Emerson

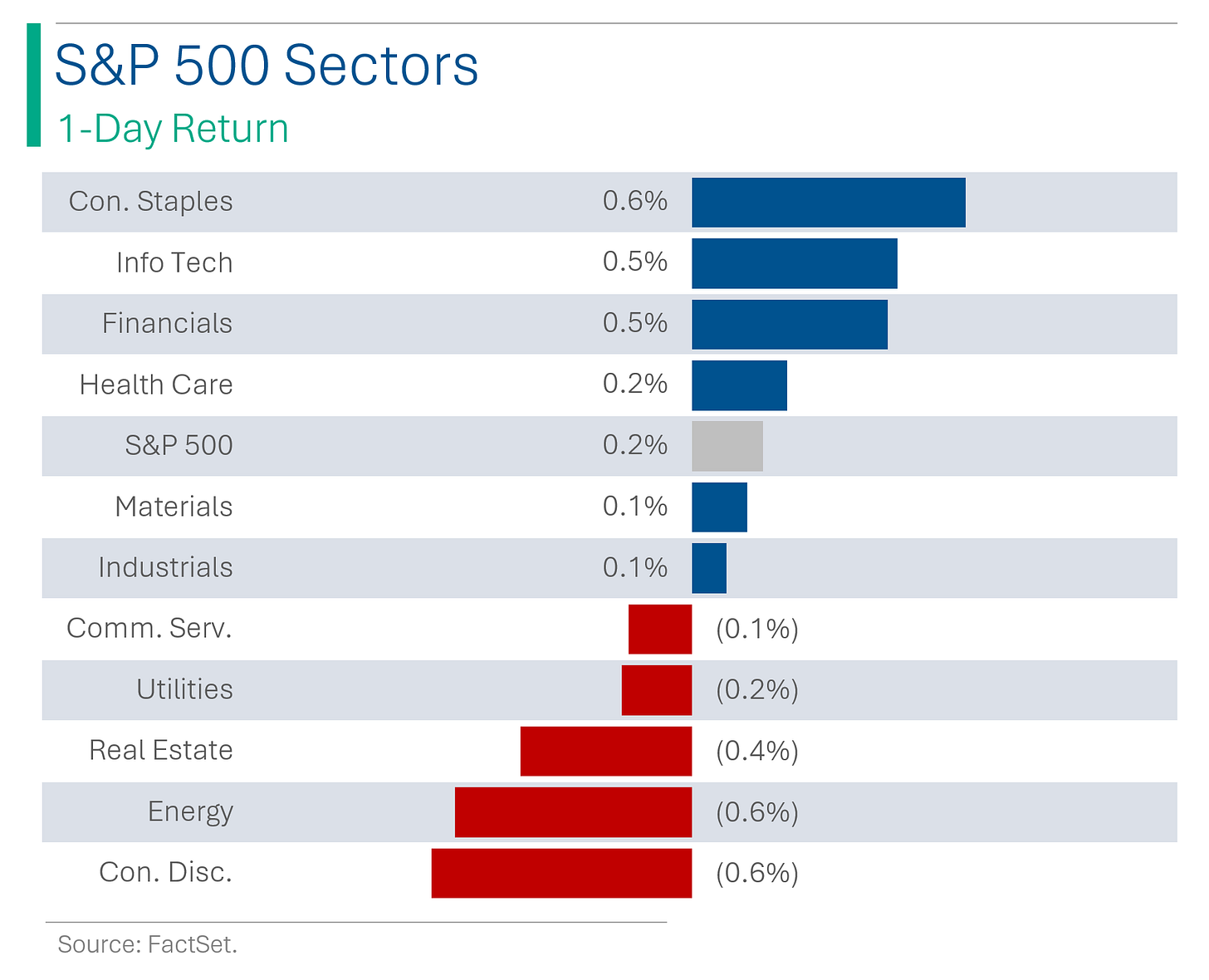

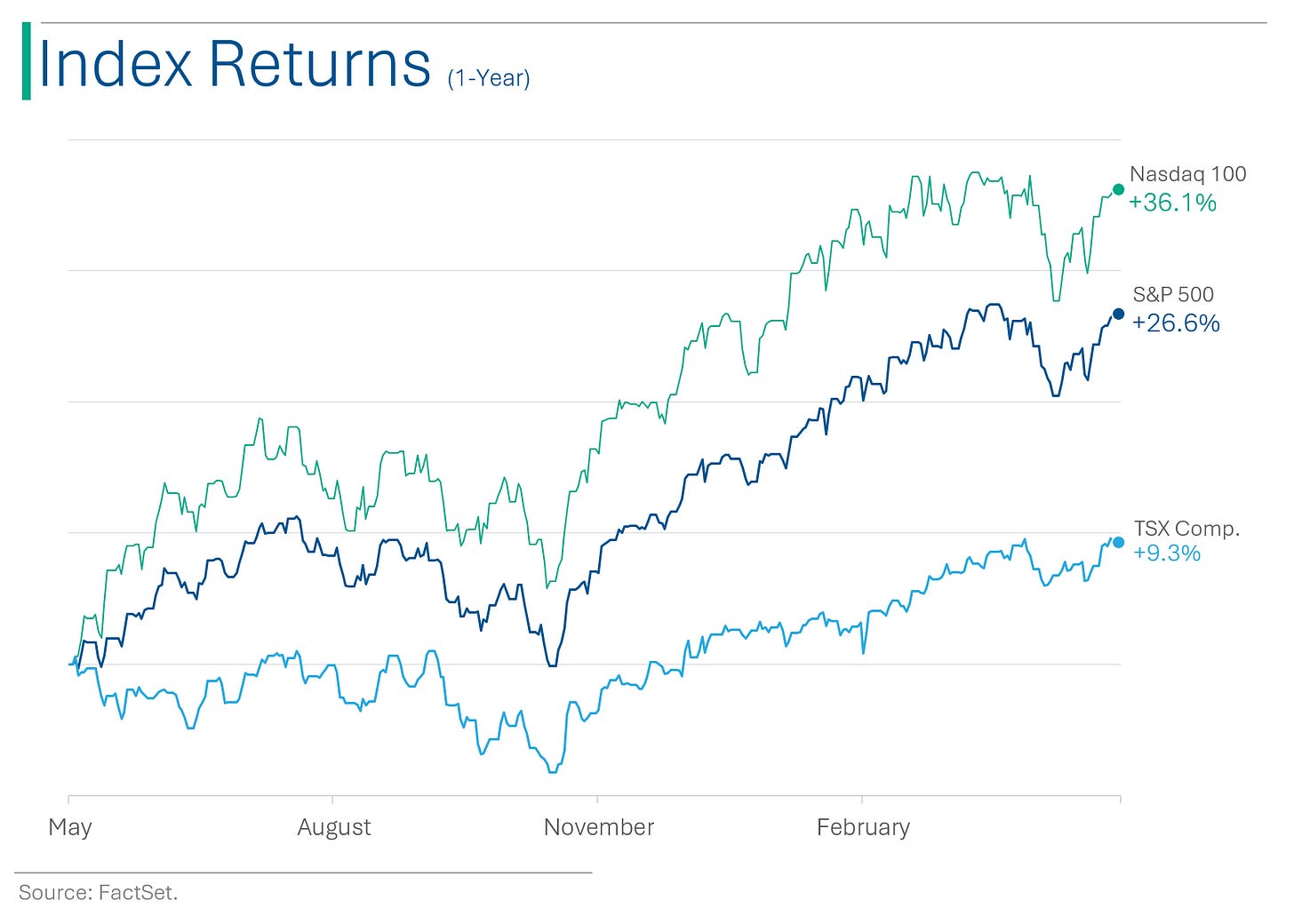

Bla weak end to a bla reporting season with the S&P 500 +0.2% and Nasdaq -0.03%. For the week the S&P finished +1.9% and the Nasdaq +1.1%.

All 11 sectors finished the week higher, led by interest sensitives Utilities (+4.0%) and Financials (+3.1%). Consumer Discretionary (+0.2%) barely made it into the plus column but was still the weakest.

Pretty quiet week on the news front as the market holds out of for more catalysts in the coming weeks, notably April CPI on May 21st (PCE doesn’t come out until May 30th).

On the company front:

Sweetgreen (SG) [+34.0%]: Q1 EBITDA positive, exceeding consensus for a loss. Revenue and comps beat expectations with raised FY24 guidance. Infinite Kitchen locations are noted for a significant margin advantage.

Gen Digital (GEN) [+15.3%]: Q4 EPS met expectations with revenue slightly above consensus. FY24 guidance remains consistent. Board approved a $3B share repurchase plan. Revenue showed a 14% Y/Y and 2% Q/Q increase; Ondrej Vlcek to step down as president.

Yelp (YELP) [-7.1%]: Q1 earnings exceeded expectations with revenue aligning closely. Q2 forecasts slightly missed due to RR&O headwinds and broader macroeconomic factors.

Moderna (MRNA) [-4.4%]: The FDA delayed the completion of its review for Moderna's RSV vaccine BLA, originally set for May 12, due to administrative issues. Completion is now expected by the end of May.

More in ‘Market Movers’ below

Street Stories

Most Boring Reporting Season Ever

I won’t lie, going into Q1 reporting I was a little tense. The ‘peak Fed’ interest rate narrative in Q4 propelled the stock market up 15% but now with ‘higher for longer’ and some hints that the economy and labor market are showing a bit of strain, I figured there was real risk that the stock market could pop a tire.

If companies looked strong in their Q1 prints, I figured we might be able to kick the can a bit further down the road. If they were bad, then look out below!

Turns out…not really much of anything happened. Let me explain.

While banks and journalists like to count Beats and Misses, the clearest way to evaluate a company’s reporting is the share price reaction. Looking at each company in the S&P 500 and comparing their share price two days before reporting with their share price two days after gives a good approximation of how investors felt about the print.

As you can see above, 50% of companies traded higher and 50% traded lower. Pretty blaa.

How about the average impact? It was +0.1%. Again, super bla.

As for how Wall Street’s research analysts have updated their views on the market over the course of reporting period…it was pretty bla too.

Since Q1 earnings season started, 59% of companies have seen their current year EPS estimates increased (right around the historical average). Blaaa.

And the average change? -0.01% You can’t make this up.

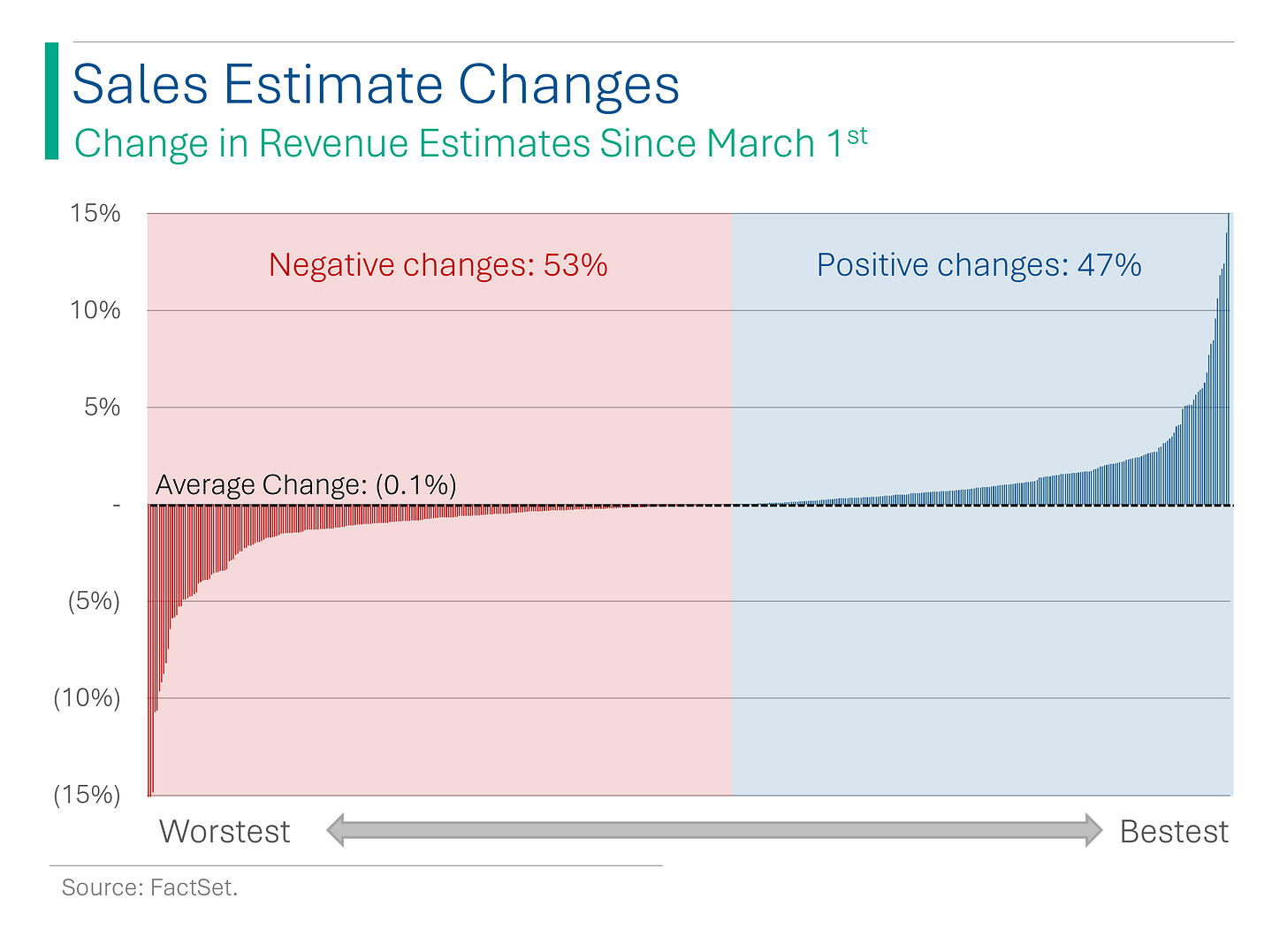

How about revenue? Surely, something interesting is happening there, like a trend or a definitive market indication.

Nope.

53% of companies have had estimates trimmed while the average estimate change was -0.1% (AKA nothing).

The only real conclusions I got here are that companies are doing ok. Not great. Not terrible. Just ok. Investor sentiment? It’s ok too. No euphoria, but no throwing in the towel.

I’d been expecting something significant to happen that would dictate the market’s direction - either up or down. Seems like the market isn’t in a rush to do either.

Anyway, hope you like tables…

World’s Greatest Investor Dies

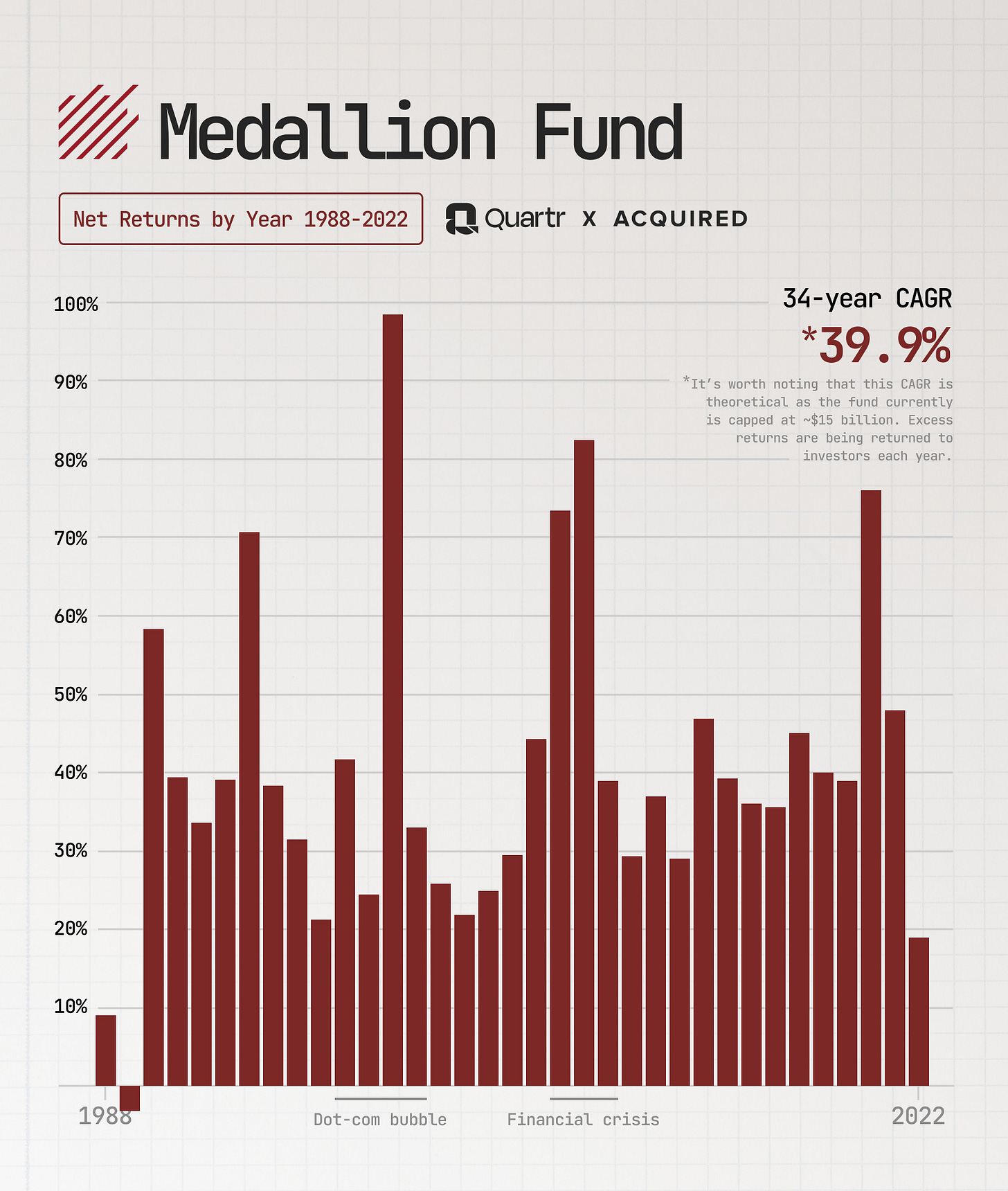

Jim Simons, the founder of Renaissance Technology, passed away on Friday. Having given away more than $6 billion to charity, he goes down as one of the most philanthropic humans of all-time, and should be fairly judged as the single greatest investor ever.

Just how good was he? Well, RenTech’s famed Medallion fund - which has been closed to all but Simons and fellow RenTech employees past and present for years - has averaged a compound annual growth rate of 39.9% between it’s launch in 1988 and 2022.

While those numbers sound great, the scale can easily be lost without a direct comparison. For example, if you invested in Warren Buffett’s Berkshire Hathaway at the start of 1988, you would have received a 14.5% return. In the S&P 500 you would have averaged 8.5%.

But due to the beauty of math, if you invested a $100 with with Uncle Warren that 14.5% would have netted you $11.5 thousand by 2023. At RenTech’s 39.9% that would leave you with $12.4 million - 1,071x what Warren did.

Truly lightning in a bottle.

RIP To The King.

Consumer Sentiment Falls Off A Cliff

Preliminary UMich Consumer Sentiment printed at 67.4 on Friday, a mile below the 77.9 figure economists were targeting. Ewww.

Joke Of The Day

“This is your captain speaking, AND THIS IS YOUR CAPTAIN SHOUTING.”

Hot Headlines

PC Magazine / Softbank's ARM plans to launch an AI chip next year. UK-based ARM is already in negotiations with TSMC to manufacture the chip, as part of Soft Bank CEO Masayoshi Son’s $64 billion plan to rebuild the chip designer into an AI superpower.

Yahoo Finance / Google’s Waymo says its robotaxis are now making 50,000 paid trips every week. The company operates Waymo One in Phoenix, San Francisco and Los Angeles, and reports that it has officially crossed the 1 million rides threshold.

WSJ / Stubbornly high rents prevent Fed from finishing inflation fight. Housing inflation - most recently coming in at +5.8% in March (YoY) - is dragging out the battle with inflation. It represents around one-third of the CPI calculation, and one-sixth that of PCE, the Fed’s preferred measure of inflation.

Reuters / Chinese fast-fashion giant, Shein, steps up London IPO preparations amid U.S. hurdles to listing. The company, valued at $66 billion in a fundraising last year, has had struggles with US regulators over that whole ‘we use slave labor’ thing.

Daily Mail / Three Boeing crashes in two days. A Senegal flight catches fire after skidding off the runway; a burst front tire grinds a landing to abrupt halt; and a front landing gear failure in Turkey.

Thankfully no one was severely injured. No suggestion that Boeing equipment is to blame but given it’s recent safety record, this is definitely something they didn’t need at the moment.

Trivia

Today’s trivia is on Robinhood.

When was Robinhood founded?

A) 2010

B) 2013

C) 2015

D) 2012Which of the following features did Robinhood introduce first?

A) Fractional shares

B) Options trading

C) No-commission stock trading

D) Leveraged tradingWhat was a major regulatory challenge for Robinhood in early 2021?

A) Embezzlement allegations

B) GameStop selling restrictions

C) Insider trading investigation

D) Money laundering accusationsWhat is the current market cap of Robinhood?

A) $3.5 billion

B) $14.2 billion

C) $9.1 billion

D) $34.0 billion

(answers at bottom)

Market Movers

Winners!

Sweetgreen (SG) [+34%]: Q1 EBITDA positive, exceeding consensus for a loss. Revenue and comps beat expectations with raised FY24 guidance. Infinite Kitchen locations are noted for a significant margin advantage.

Mettler-Toledo International (MTD) [+17%]: Reported a strong Q1 earnings and revenue beat. Despite ongoing market demand reductions, recovery from delayed shipments exceeded forecasts. Slight increase to FY EPS guidance amidst soft market conditions, especially in China.

Gen Digital (GEN) [+15.3%]: Q4 EPS met expectations with revenue slightly above consensus. FY24 guidance remains consistent. Board approved a $3B share repurchase plan. Revenue showed a 14% Y/Y and 2% Q/Q increase; Ondrej Vlcek to step down as president.

DigitalOcean Holdings (DOCN) [+10.2%]: Surpassed Q1 earnings and revenue expectations. Revenue guidance for Q2 is ahead, with FY24 revenue projections also increased. Notable year-over-year revenue growth and stronger than expected adjusted gross margins.

Natera (NTRA) [+10.2%]: Outperformed in Q1 earnings and revenue, aided by a true-up benefit. Achieved cashflow breakeven despite disruptions from the Change cyberattack. Raised FY revenue guidance, with strong performance noted in Women's Health volumes.

Victoria's Secret (VSCO) [+5.3%]: Preliminary Q1 EPS between $0.07 and $0.12, surpassing prior expectations. Q1 revenue and operating income forecasts increased, with FY24 guidance reaffirmed. Improvements seen in both store and digital sales for Victoria's Secret and PINK brands.

Losers!

JFrog (FROG) [-18.7%]: Despite better Q1 earnings and revenue, billings and deferred revenue were below consensus. Management noted a cautious client approach to cloud spending and forecasted a delay in spending to later quarters, with a slight uptick in FY guidance.

Iovance Biotherapeutics (IOVA) [-18.5%]: Q1 earnings met expectations with significant enrollment for Amtagvi therapy. Management was optimistic about attrition rates and reimbursement trends, though concerns about patient conversion and procedural clarity remain.

Collegium Pharmaceutical (COLL) [-16.8%]: Q1 earnings and revenue fell short; while Belbuca showed momentum, disappointment came from Xtampza and Nucynta. FY guidance was reaffirmed. CEO Ciaffoni's departure raised concerns about impacting potential M&A activities, prompting multiple downgrades.

Progyny (PGNY) [-15.3%]: Q1 EPS outperformed, but revenue fell below forecasts. Both Q2 and FY24 guidance were revised downward, impacted by a weak March and adverse rulings in maternal healthcare. However, margins were highlighted as a positive aspect.

Akamai Technologies (AKAM) [-11%]: Q1 EPS exceeded forecasts, though revenue was slightly under. Both Q2 and FY24 guidance were reduced. The company announced a $2.0B share repurchase plan, citing reduced business from a major customer and competitive pricing pressures in the industry.

Yelp (YELP) [-7.1%]: Q1 earnings exceeded expectations with revenue aligning closely. Q2 forecasts slightly missed due to RR&O headwinds and broader macroeconomic factors. The challenging environment in several business categories was partially offset by strengths in home services.

Moderna (MRNA) [-4.4%]: The FDA delayed the completion of its review for Moderna's RSV vaccine BLA, originally set for May 12, due to administrative issues. Completion is now expected by the end of May.

Market Update

Trivia Answers

B) The company was founded in 2013.

C) Robinhood was the first to introduce no-commission stock trading.

B) GameStop trading restrictions caused a bit headache for Robinhood and the brand lost a lot of credibility.

B) Robinhood’s market cap $14.2 billion.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.