🔬Misery Loves Company: Global Stock Indices

Plus: TikTok's ban looks like a slam dunk; the US and China are 'fiscal disaster' buddies; weight loss drugs are voodoo; and much more

“The best time to buy a stock is when the company is in trouble.”

- Leon Cooperman

“You know I always wanted to pretend that I was an architect.”

- George Costanza

Another down day for the big US markets with S&P 500 -0.6% and Nasdaq -1.2%.

4 of 11 sectors closed higher let by defensives Utilities (+2.1%) and Staples (+0.5%). Tech was the worst down 1.7%.

The decline in Tech was primarily the result of a weak Q1 by chip equipment maker ASML which dragged all the chip stocks down (more below).

United Airlines (+17.5%) reported a strong quarter, which also lifted up industry peers on the read through.

Street Stories

Misery Loves Company

‘When America sneezes the rest of the world catches a cold’

Since the S&P peaked on March 28th, the rest of the world appears to have at least caught the sniffles. Beyond sticky US inflation pushing the ‘higher for longer’ interest rate outlook, expanding geopolitical risk has helped lead to a global selling trend.

This has resulted in a flight to quality and the US dollar - given its role as history’s greatest ‘safe haven’ asset - has been the largest beneficiary of this. And USD has gone vertical in the last few weeks.

The biggest loser? Well, that’s probably the Japanese Yen. Already weak before the recent market hubbub, the currency hit its lowest level since 1990 yesterday.

So, after wrapping up yet another down day (it’s 12th in the last 18 sessions), things aren’t too pretty for the market. It’s likely we will need some sort of catalyst to stem the bleeding and there really isn’t too much on the horizon. PCE inflation data comes out on April 26th, and a good print (ie: lower inflation) could go a long way towards lifting sentiment which seems so low right now, it’s subterranean.

TikTok Ban Looks Closer

House Speaker Mike Johnson is rushing a bill that would force TikTok's parent company ByteDance to sell off the app, cleverly tucking it into a package loaded with aid for Ukraine and Israel—because nothing says urgency like bundling social media drama with international aid.

The updated bill now gives ByteDance a leisurely year to divest, a move designed to make the legislation lawsuit-proof and garner bipartisan eyebrow raises in the Senate. Despite concerns that this might stifle free speech and disrupt the livelihoods of countless TikTok influencers (oh, darn), the bill is poised to glide through with minimal fuss, hitched to the much-needed foreign aid bandwagon.

Fiscal Policy in the US & China

The latest version of the IMF’s Fiscal Policy Monitor was pretty interesting as far as things from the IMF go (pretty pictures at least). But the general theme was that the US and China are in particularly bad shape from a government spending perspective. Allow me to oversimplify:

Massive government spending has meant that public debt is up considerably since prior to Covid, and the IMF sees that continuing to balloon.

As a result, interest payments are expected to significantly rise. For the US, this is expected to put them well above their ‘Advanced Economy’ homies.

And by the IMF’s estimates, this government spending is creating a big headwind towards lowering inflation as massive government spending… is inflationary. Quoth the IMF:

“Loose US fiscal policy could make the last mile of disinflation harder to achieve while exacerbating the debt burden. Further, global interest rate spillovers could contribute to tighter financial conditions, increasing risks elsewhere.”

Magical Weight Loss Drugs

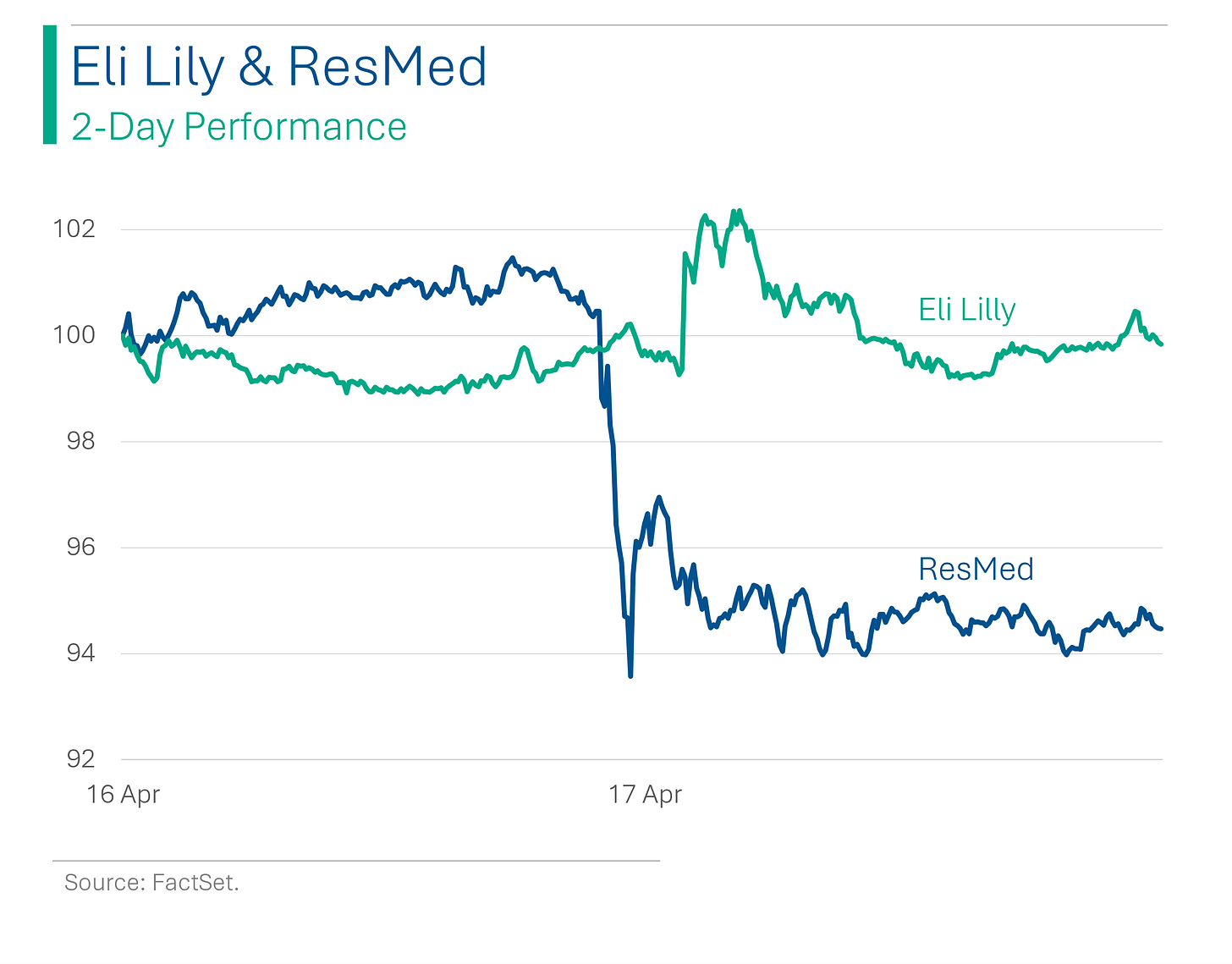

Last year was rife with weird spill-over impacts from Ozempic and it’s weight loss peers. Some examples include sell-offs at Hershey over expected reduced chocolate demand; medical device makers like Stryker dropping on lower expected hip and knee replacements; and even dialysis company DaVita got hit after Ozempic data showed it helped with kidney function. Wild.

Anyway, there’s a new one to add to the pile after Zepbound - Eli Lilly’s weight loss/diabetes challenger - showed positive results in people suffering from sleep apnea. The biggest pure-play CPAP company, ResMed, crumbled 6.0% on the news.

The New York Times did a nice write-up on this in case interested (link).

Joke Of The Day

Did you hear about that Italian chef? He pasta-way.

Hot Headlines

Yahoo Finance / Investors increasingly expect 'no landing' for US economy. Bank of America’s latest Global Fund Manager Survey now shows that 36% of investors polled don’t see the US entering a recession in the next 12 months, which is way up from only 7% in January.

Quartz / Tesla asks shareholders to reinstate Elon Musk's $56 billion pay package. The company - under no influence from Musk, I’m sure - will allow shareholders to vote on the proposal at Tesla’s annual meeting on June 13. This comes after the deal was originally struck down by a Delaware judge in January. They even made a cheesy website for it, praising Musk.

CNBC / Chip stocks get smoked after equipment maker ASML reports bookings fell 61% over the quarter.

CNBC / Amazon starts selling smart grocery carts to other retailers. The ‘Dash Carts’ have been used in Amazon stores, such as Fresh and Whole Foods since 2020. How is this faster? Just open up more registers, God!

The Verge / NBA bans player for life over online sports betting. Raptors forward Jontay Porter’s NBA career is extinct after some particularly dumb online betting. What a dummy. Not just that he cheated, but that he did it so poorly.

Trivia

Today’s trivia is on Meta, formerly Facebook.

In what year did Facebook hold its initial public offering (IPO)?

A) 2008

B) 2012

C) 2010

D) 2015What was Facebook’s original name?

A) FaceLook

B) FaceTime

C) Thefacebook

D) MyFaceWhich major company did Facebook acquire in 2012, boosting its mobile strategy?

A) Snapchat

B) Instagram

C) Twitter

D) WhatsAppAs of Q4 2023, how many monthly active users (MUAs) does Meta have across its platforms?

A) 3 billion

B) 1.1 billion

C) 820 million

D) 2.3 billion

(answers at bottom)

Market Movers

Winners!

United Airlines (UAL) [+17.5%] Q1 EPS and revenue beat, FY24 EPS guidance reaffirmed despite aircraft delivery delays expecting 61 narrowbody and 5 widebody aircraft in 2024. FY24 Capex guidance cut to $6.5B from $9B, operating margins exceeded forecasts.

Mobileye Global (MBLY) [+2.8%] Secured orders for at least 46M EyeQ6 Lite assisted-driving chips over the next few years.

Losers!

J.B. Hunt Transport Services (JBHT) [-8.1%] Q1 earnings and revenue missed expectations, OR above consensus. Reported lower gross revenue per load in intermodal and truckload segments but some strength in Final Mile Services, in a tough pricing/competitive scenario.

Travelers Cos. (TRV) [-7.4%] Q1 EPS missed but revenue beat, attributed to higher cat losses which overshadowed better underlying combined ratio and higher net investment income. Concerns include decelerating commercial lines pricing and lower favorable prior year development, though strong personal lines results were a highlight.

Prologis (PLD) [-7.2%] Q1 core FFO met expectations but FY core FFO guidance was cut. Management noted cost-focused customers impacting decision-making and leasing pace, with competitive leasing necessary in some large, high-rent markets.

ASML Holding (ASML) [-7.1%] Q1 earnings and revenue exceeded expectations, but faced weaker bookings in VA and EUV. Q2 revenue guidance below expectations, with FY24 sales projected similar to FY23, marking it as a transition year.

Autodesk (ADSK) [-5.8%] Updated on delayed 10-K filing, expecting a notice from Nasdaq for non-compliance with the timely filing requirement.

Market Update

Trivia Answers

B) Facebook’s IPO was in 2012.

C) The original name was Thefacebook.

B) Facebook acquired Instagram in 2012.

A) The company had 3 billion MAUs at the end of last quarter.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

This blog is fresh AF! love it