🔬Meme Stocks Rally, Everything Else is in Limbo, and Much More

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent”

- Charlie Munger

“A lot of people think that if they have a hundred stocks they’re investing more professionally than they are if they have four or five. I regard this as insanity”

- Charlie Munger

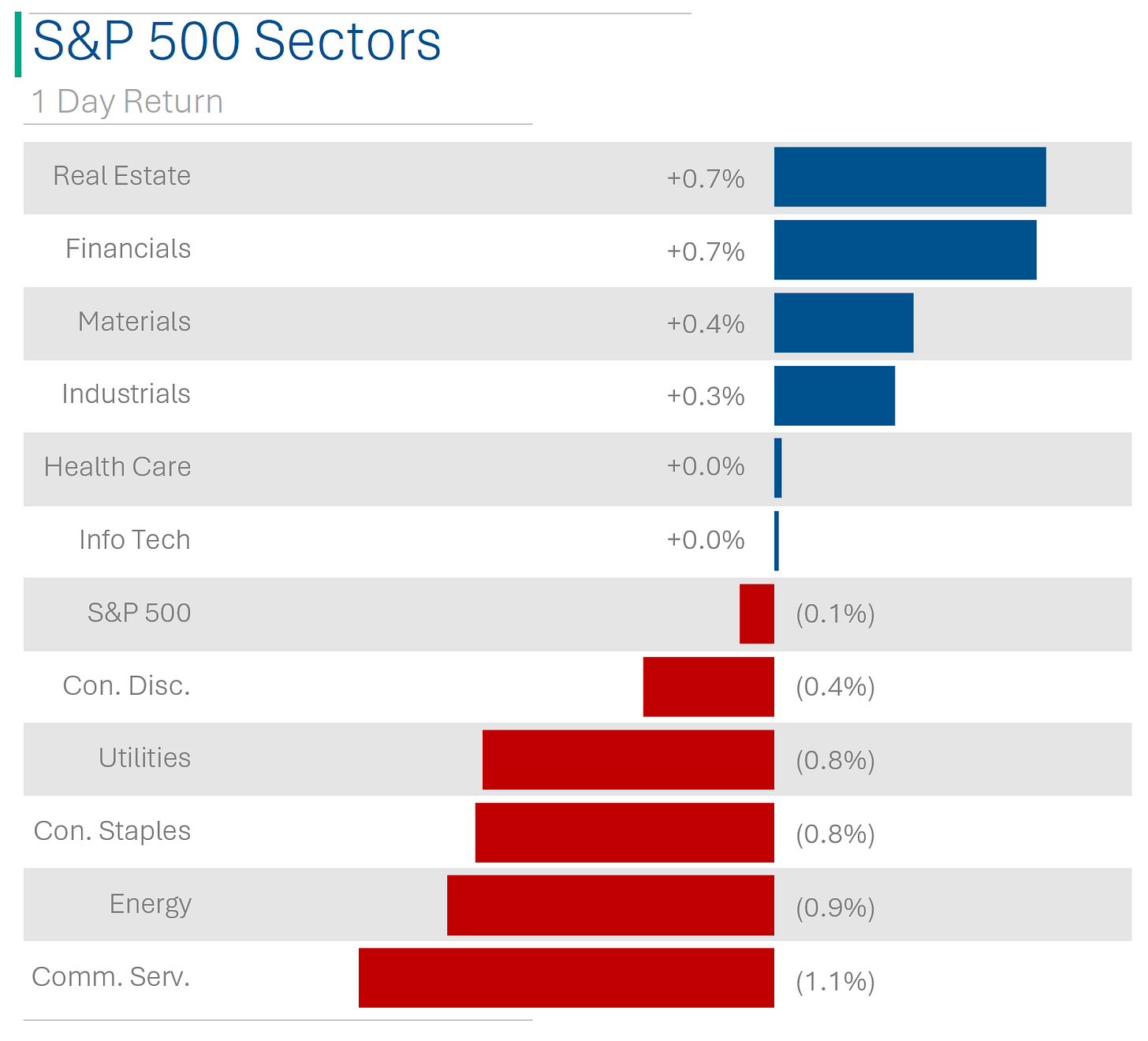

Mixed day as 6 of 11 sectors traded in the green Wednesday but the big markets closed pretty much flat (again) (S&P 500 -0.09%, Nasdaq -0.16%)

Real Estate and Financials were bestest (both +0.7%). Communication Services the worstest (-1.1%)

Meme stocks and lower-quality plays also saw another round of big gains. GameStop is up 36% in the last two days (more below)

Treasuries were higher across the curve, extending this week's rally. 10-Year yield ended below 4.30% and is now down more than 70bp since late October

Gold finished up 0.3% (I’m calling an all-time high in the next week)

WTI crude was up 1.9% on the latest rumors the Saudis might be able to push through an output cut at tomorrow's OPEC+ meeting.

Street Stories

CATALYST VACUUM - The financial markets are navigating a lull in momentum, cautiously awaiting key economic events like US PCE inflation (the Fed’s inflation target), Eurozone CPI, and an OPEC meeting. Optimism is being fueled by easing financial conditions, the potential for a soft economic landing, and stable 2024 earnings forecasts, despite concerns about the longevity of current bullish sentiment and an expected slowdown in stock buybacks. However, the bearish outlook hinges on fears of a persistently aggressive Fed, the delayed impact of monetary tightening, and uncertainties surrounding the sustainability of recent market trends and projected double-digit earnings growth in 2024.

Explainer: Catalysts are events or themes that help drive investing activity, such as the ‘Re-Opening’ after the Pandemic or take-over rumours of a company. If there isn’t a change - or expected change - in the status quo, then most people tend to just sit on their hands and not fiddle with their portfolios. After the big rally in November (month-to-day up ~8.5%), the stock market seems to be waiting for the next swing in sentiment to decide which way to move next. In essence, no one wants to miss out if the rally persists (sell) but no one has the stomach to buy more.

GAMESTONK IS BACK (KINDA) - GameStop's shares soared 36% in the last 2 days to a two-month high, with retail traders riding the wave of nostalgia for 2021's meme stock frenzy. The stock's surge is a beacon of hope for risk-hungry investors, as short sellers likely rummage for their stress balls. Coupled with the rallies in crypto, zero-profit tech stocks and hints of a new IPO frenzy, the speculative end of the market is looking pretty ‘Risk On’ at the moment. But buyers should beware; despite the heroic hype, GME hasn’t exactly been good for anyone who bought after the January 2021 fiasco (peak of pre-market price was $125 on January 28th). (Reuters has more details)

SHEIN IPO GETTING HEAVY SCRUTINY - Shein's secretive leap towards a U.S. IPO lands it in hot water, not just for braving a frosty market, but for carrying a suitcase heavy with allegations of using forced (AKA slave) labor and evading U.S. tariffs. The fast fashion behemoth faces a choir of critics, from U.S. officials to state attorneys general, all harmonizing in concern over its supply chain ethics in Xinjiang and compliance with American laws. Despite Shein's attempts at damage control, including a PR-savvy influencer factory tour and a Singaporean HQ shift, skeptics are circling, wondering if the company's public commitments to human rights are just a fashionable facade for deeper, darker business practices. (Yahoo has more on the story)

VIX AT LOWEST SINCE PANDEMIC - Wall Street's "fear gauge," the Cboe Volatility Index (VIX), has dropped to its lowest level since January 2020, indicating a period of calm not seen since before the COVID-19 crisis. High VIX readings typically signal positive stock market returns, as seen when the VIX surpassed 20 in October amid surging bond yields, leading to a subsequent equity rally.

Explainer: As I said above in ‘Catalyst Vacuum’, it seems like investors are sitting on their hands, and that extends into the VIX. The VIX is calculated based on the implied volatility of options, which is the only real moving part that isn’t defined by a mathematical formula and instead comes from market expectations. The options market is telling us that expectations are for very little to happen in the coming months. One nice things for investors when the VIX is so low, is that it means you can buy protection for your portfolio, such as hedging some of your downside risk with put options, much cheaper than before.

Joke Of The Day

I used to be a doctor but then I lost patients.

Hot Headlines

CNBC | Fed’s Barkin says rate hikes are still on the table if inflation doesn’t continue to ease.

Tech Crunch | The 2024 IPO cohort is coming into focus as Shein, Reddit prep to go public.

CNBC | Major League Pickleball asks players to take 40% pay cut on the back of rapid growth. Put this one in the category of ‘things I didn’t know were things’

Guardian | Child respiratory sickness overloads China’s paediatric clinics. This sounds like its getting pretty bad but not much talk of it moving westward?

Yahoo | At Dealbook Summit, Elon Musk tells Bob Iger, Disney and other advertisers that left X to ‘Go F--k Yourself’.

Bloomberg | The robots will insider trade. Some quality Matt Levine.

Decrypt | Within 15 minutes of Charlie Munger’s death MUNGER coin was launched on crypto exchange Uniswap. A vocal critic of crpyto, MUNGER coin is up >200% since trading started and briefly traded up ~31,500%!

Trivia

This week’s trivia is on the Roman Empire.

What good was so heavily valued by the Romans that Diocletian's Edict on Maximum Prices of 301 AD fixed the price of one kilo of it at 4,000 gold coins?

a) Silk

b) Wine

c) Amber

d) DiamondThe collapse of the Roman currency is often attributed to?

a) Decrease in military conquests

b) Over-reliance on slave labor

c) Debasement of coins

d) Increased trade with the EastAround what year did the Roman Empire reach its maximum territorial extent, influencing its economic power?

a) 117 AD

b) 306 AD

c) 44 BC

d) 476 AD

(answers at bottom)

Market Movers

Winners!

Rover Group (ROVR) [+28.9%]: Agreed to be acquired by Blackstone for $11 a share, deal valued at ~$2.3B, a 29%+ premium, expected to close in Q1 2024.

Foot Locker (FL) [+16.1%]: Beat Q3 EPS and Revs, but lowered guidance.

NetApp (NTAP) [+14.6%]: Beat Q3 revenue and EPS, raised Q4 and FY24 guidance. Highlights include hardware product momentum, margin growth, strategic review impacts.

Workday (WDAY) [+11.0%]: Strong Q3, raised FY24 subscription revenue and operating margin outlook. Played up the ‘AI opportunities’. K, bud.

General Motors (GM) [+9.3%]: Reinstated FY23 earnings guidance, including a $1.1B EBIT-adjusted impact from UAW strike, $10B accelerated buyback planned, dividend expected to increase ~33% in 2024.

Losers!

Petco (WOOF) [-28.9%]: Q3 EBITDA and EPS sucked, and FY guidance cut. Gordon Gekko would call this a ‘dog with fleas’.

Patterson Cos. (PDCO) [-17.2%]: FQ2 EPS and revenue below expectations, FY EPS guidance reduced, softer demand in end markets.

The Cigna Group (CI) [-8.1%]: Reports suggest potential cash-and-stock merger talks with Humana (HUM), possible agreement by year-end. Because America needs less competition in the health insurance oligopoly. Joke.

Market Update

Trivia Answers

a) Silk was so valuable to the Roman elite that Diocletian fixed the price at $4,000 gold coins to guarantee price stability and supply.

c) Debasement of coins is considered the leading cause of the devaluing of Roman coinage.

a) The Empire reached its territorial zenith in 117 AD under Trajan.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.