🔬McDonald’s Isn’t Loving It ('It' being price sensitivity)

Plus: Remember the meme-stock rally? Did it die yet?; Bitcoin strength not passed on to crypto companies; and much more!

"In bear markets, stocks return to their rightful owners"

- J.P. Morgan

"When I had money everyone called me brother"

- Polish proverb

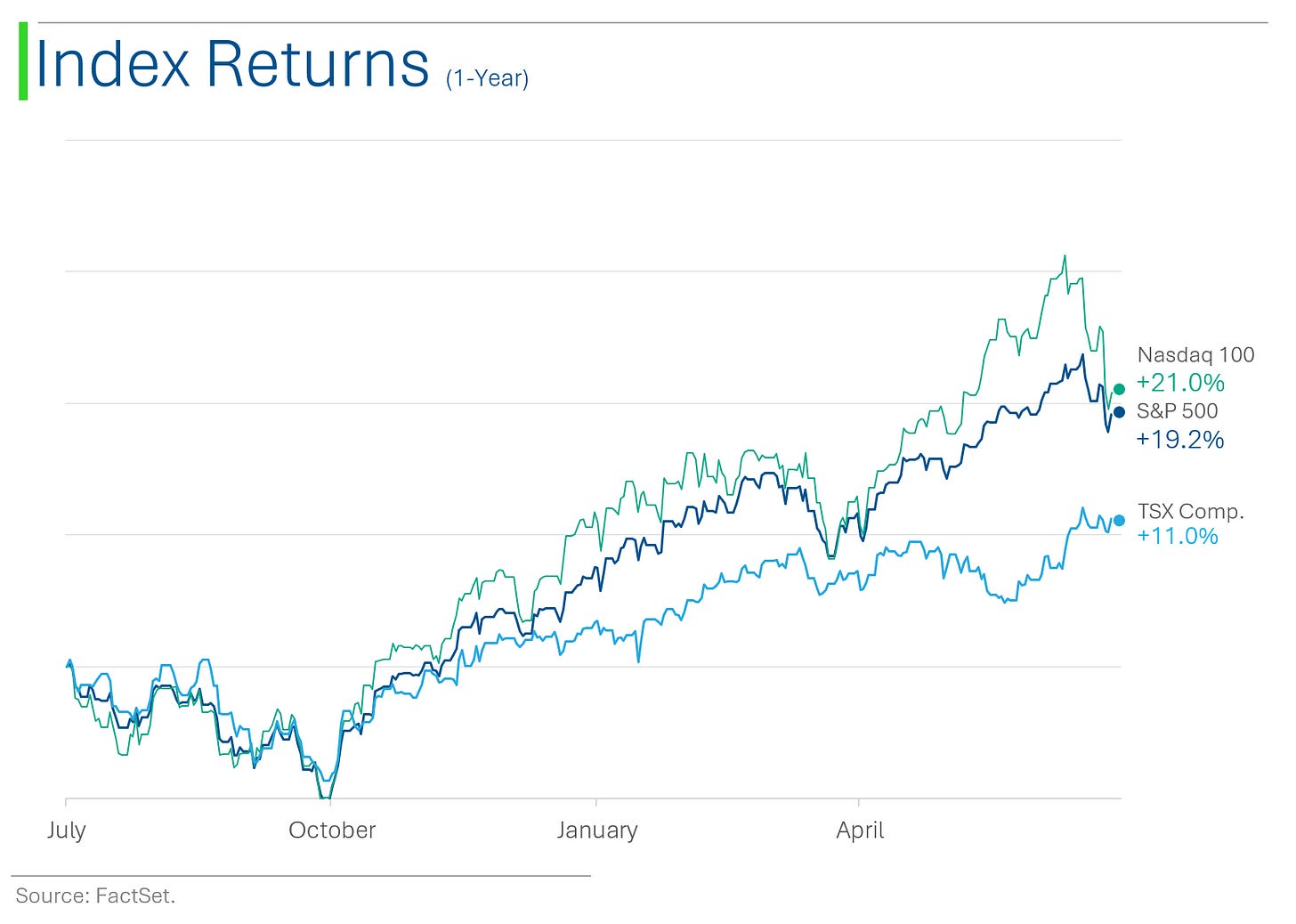

Nothing day for the big US markets with the S&P 500 +0.1% and Nasdaq +0.1%. Small-Cap rally takes a breather with the Russell 2000 down 1.1%.

7 of 11 sectors closed higher led by Consumer Discretionary (+1.4%) and Comm. Services (+0.9%). Energy (-0.9%) took it on the chin following another soft day for crude oil (-1.7%).

Dallas Fed Manufacturing Index fell again in July - for the 27th month straight it’s been in contraction territory.

Notable companies:

Tesla (TSLA) [+5.1%]: Named Top Pick at Morgan Stanley, citing benefits from restructuring, ZEV credits, recurring services revenue, and segments beyond EV sphere.

McDonald's (MCD) [+3.7%]: Q2 earnings and revenue light. Comps weaker than consensus due to negative guest counts, partly offset by menu price increases. $5 meal deal saw increasing participation, though limited sales impact.

Stellantis (STLA) [-4.2%]: Downgraded to hold from buy at Deutsche Bank. Cited worse EBIT margin outlook than competitors, growing overhangs from inventory, pricing, and lack of model age compared to peers.

Street Stories

McDonald’s Isn’t Loving It

The Golden Arches reported a terrible Q2 yesterday - but it wasn’t as terrible as the Street had expected so the shares went up 3.7%. Unimportant.

What was important (imho) is the fact that Same Store Sales declined for the first time since the heart of the Covid pandemic.

I’ve talked quite a bit about how consumers are really feeling the pinch lately and there is probably no better indication of this than seeing people so financially stretched that they are being priced out of McDonald’s.

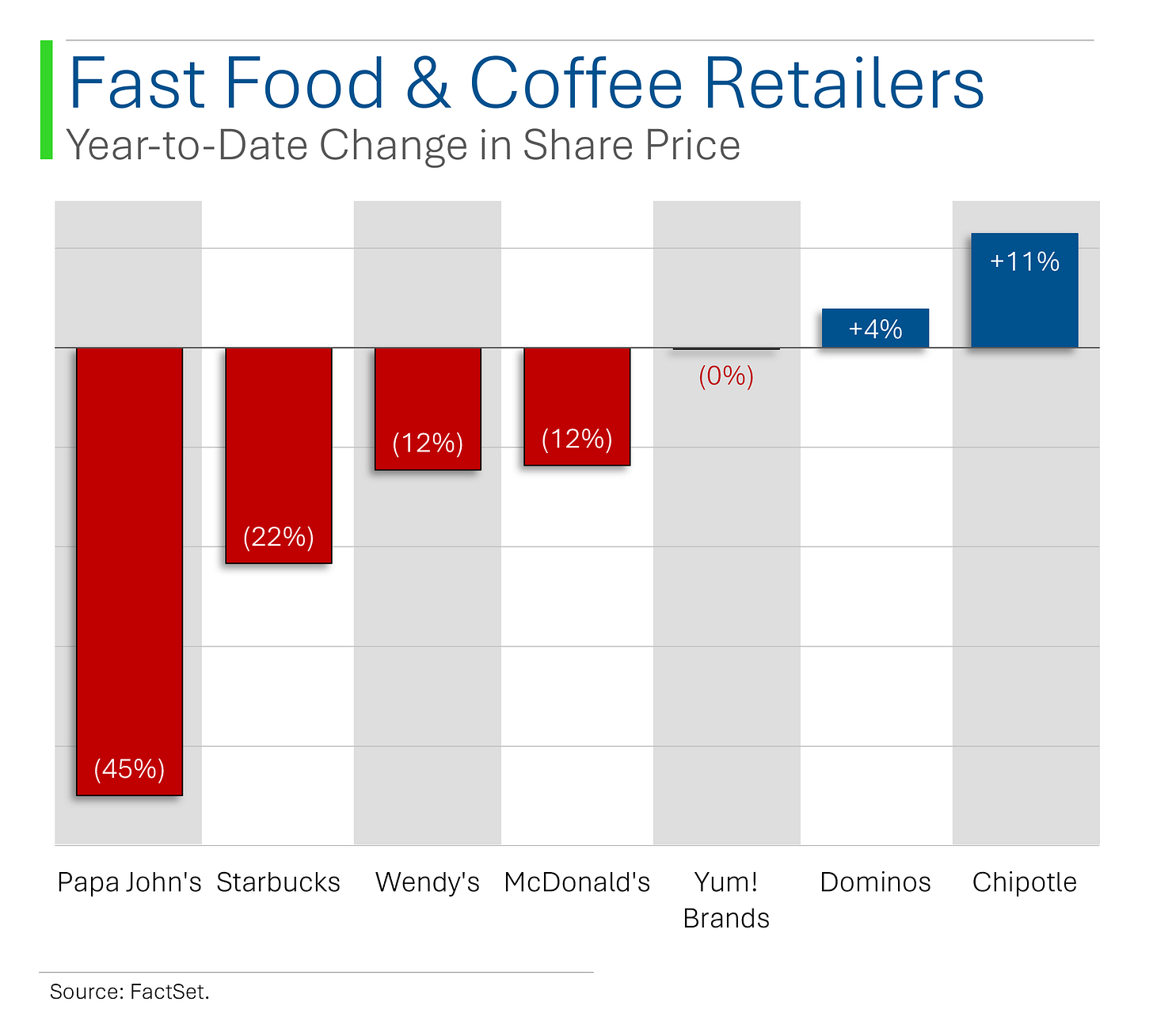

And McDonald’s isn’t the only one being hit. All of their peers have lagged the S&P 500 this year, which is currently up +14.5% despite the recent meltdown.

That said, they obviously don’t feel enough pressure to slow down on new location openings. But management has stated that they are gunna review their pricing strategy, so expect some changes aimed at the struggling consumer.

The Plight of the Meme-Stock

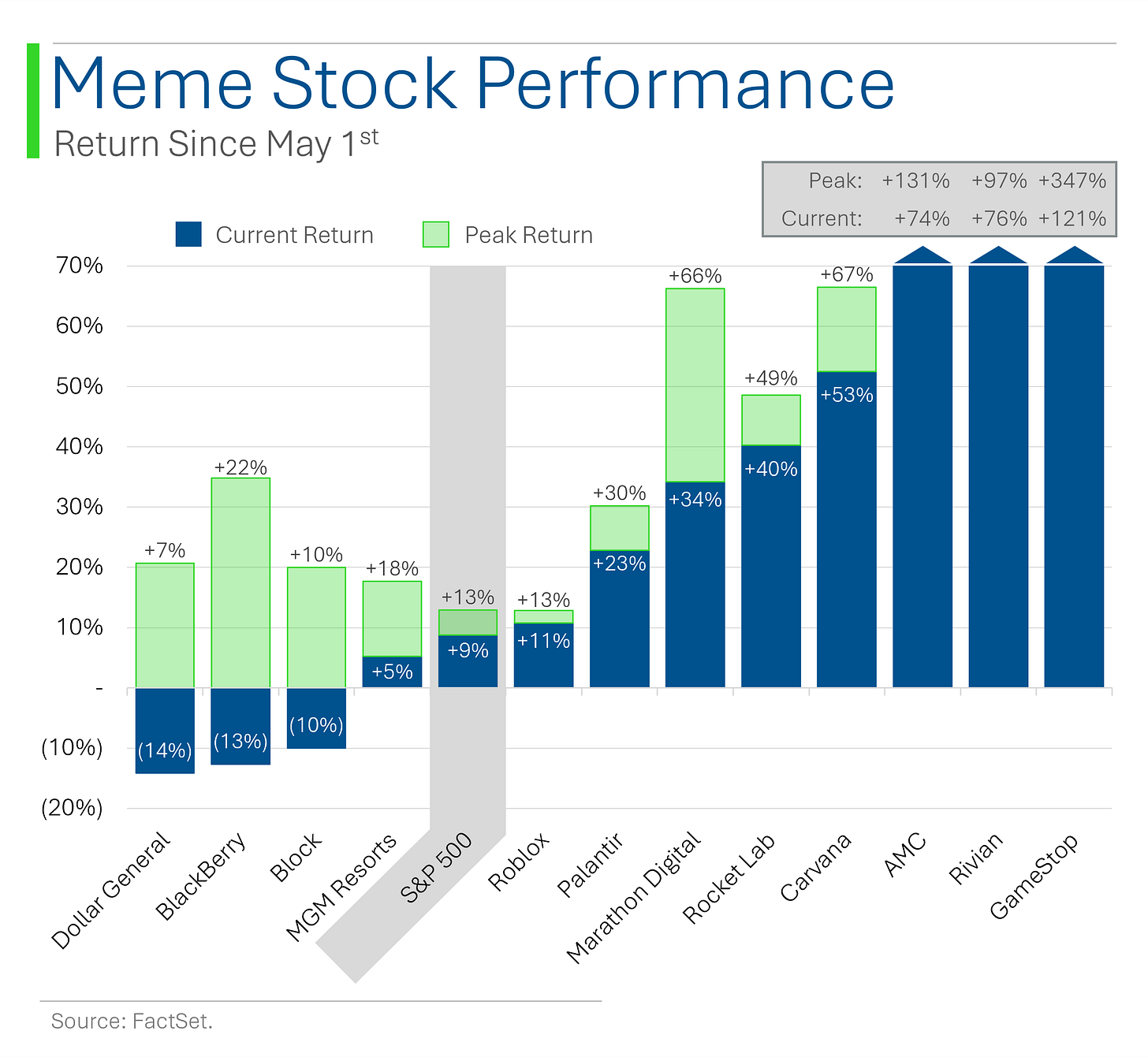

No one’s been talking about the meme rally that kicked off in May so surely it ended poorly, right? Not really…

(See, I tried to trick you with the title there!)

Turns out it only really ended poorly for Dollar General, BlackBerry and Block - and those are mostly the result of weak operating performance, rather than a waning of meme hype.

Even the more sketchy companies like AMC have survived atrocious earnings and massive equity raises but still won’t quit. It’s basically a bad Disney movie at this point.

(If you missed my comedic deep-dive on GameStop the other day you should check it out!)

Trump’s Crypto Rally Fades

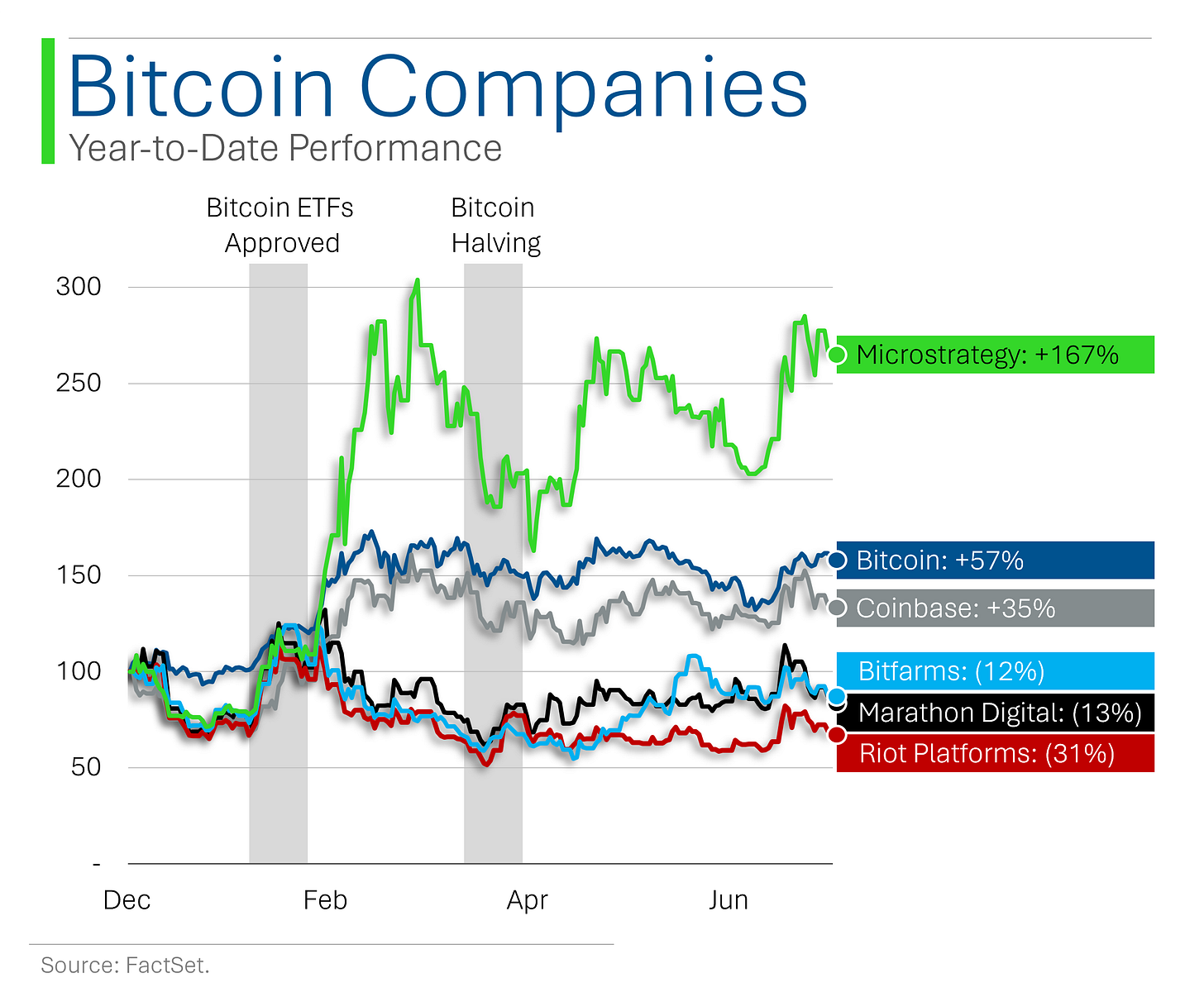

Increased rhetoric from the former President about the merits of Bitcoin helped the King of Crypto break $70k for the first time since May. From speaking at the Bitcoin 2024 conference to calling for a strategic reserve of Bitcoin, Trump has definitely elevated the status of crypto should he be re-elected.

However, the impact on crypto companies hasn’t added any enduring strength. From Microstrategy *cough* ponzi scheme *cough* to Coinbase, the largest crypto exchange (R.I.P. FTX), what small pop we saw has quickly been eroded.

One group that needed the lift is the miners (Bitfarms, Marathon Digital, Riot Platforms) as they continue to incinerate shareholder value again in 2024.

Joke Of The Day

Three econometricians went out hunting and came across a large deer. The first econometrician fired but missed by a meter to the left. The second econometrician fired but missed by a meter to the right. The third econometrician didn’t fire but shouted in triumph, “We got it! We got it!”

Hot Headlines

CNBC / Temu and Shein’s soaring popularity has Wall Street eyeing China’s influence on tech earnings. With Etsy and eBay reporting Wednesday and Amazon Thursday, investors are keen to get update on the state of Chinese competition.

IBD / Morgan Stanley drops Ford for Tesla as Top Pick in Autos. Calls out dominant position amongst Western competitors but sees China sinking in importance as growth driver and, diplomatically, calls Robotaxi expectations ‘too high’. I might have chosen the words ‘nuts’.

Bloomberg / Goldman Sachs says hedge funds are selling Industrials at a record pace. Seeing rotation into areas with commodity exposure (energy, materials) as growing geopolitical risks abound and economic worries over the US and China continue to build.

Axios / Concerns over ‘Superhero Fatigue’ didn’t slow down a record weekend for ‘Deadpool & Wolverine’. The third instalment of Ryan Reynold’s Deadpool franchise raked in $205 million at box offices over the weekend, setting a new record for R-rated films.

CNBC / U.S. airlines cut growth plans in a bid to stem profit-eating fare discounts. Domestic airlines in severe oversupply, and low-cost carriers feeling the pressure to cull unprofitable routes. Think I’ve made my thoughts clear on this recently… (‘Should You Invest In Airlines (or just set your money on fire)?’)

Trivia

Today’s trivia is on the Dot-Com Bubble.

What was the peak of the NASDAQ Composite Index before the dot-com bubble burst? (For context, it’s ~16,000 right now)

A) 3,000 points

B) 5,050 points

C) 7,000 points

D) 10,050 points

Which company's IPO is often cited as a symbol of the dot-com bubble's excess?

A) Amazon.com

B) Pets.com

C) eBay

D) Google

What was the typical percentage of ownership retail investors had in tech stocks at the peak of the bubble?

A) 20%

B) 75%

C) 50%

D) 90%

How much did the NASDAQ Composite Index fall from its peak in March 2000 to its low in October 2002?

A) 50%

B) 78%

C) 65%

D) 85%

(answers at bottom)

Market Movers

Winners!

ON Semiconductor (ON) [+11.9%]: Q2 EPS and revenue slightly ahead of consensus. Q3 guidance in line but shows some weakness due to automotive correction. Reiterated 10-12% CAGR through FY27. Business unit revenue down y/y but margins beat. FCF up ~$250M y/y.

Revvity (RVTY) [+8.6%]: Q2 earnings and OM beat, revenue largely in line. Organic growth decline narrower than feared. Strength in Diagnostics offset Life Sciences weakness. Raised FY EPS guidance midpoint.

Tesla (TSLA) [+5.1%]: Named Top Pick at Morgan Stanley, citing benefits from restructuring, ZEV credits, recurring services revenue, and segments beyond EV sphere.

McDonald's (MCD) [+3.7%]: Q2 earnings and revenue light. Comps weaker than consensus due to negative guest counts, partly offset by menu price increases. $5 meal deal saw increasing participation, though limited sales impact. Results better than feared.

Inspire Medical Systems (INSP) [+2.9%]: Guided Q2 revenue of $195.9M vs FactSet $186.3M. US revenue expected up 30% y/y. Raised FY24 revenue guidance.

Guardant Health (GH) [+2.0%]: Shield Blood Test approved by FDA as a primary screening option.

Crown Holdings (CCK) [+1.5%]: Board authorized $2.0B share repurchases through end of 2027.

Losers!

Integra LifeSciences Holdings (IART) [-18.0%]: Q2 revenue better with organic growth in Codman and Tissue Technologies segments, but notable FY guidance cut. Flagged quality and labeling compliance shipping holds and significant H2 investments in quality/compliance improvement.

Enstar Group (ESGR) [-5.9%]: To be taken private by Sixth Street for ~$5.1B equity value, but $338/sh cash consideration is ~3% below Friday's close. Agreement includes a go-shop period expiring 2-Sep.

Stellantis (STLA) [-4.2%]: Downgraded to hold from buy at Deutsche Bank. Cited worse EBIT margin outlook than competitors, growing overhangs from inventory, pricing, and lack of model age compared to peers.

Charles Schwab (SCHW) [-2.1%]: Downgraded to neutral from overweight at Piper Sandler. Cited near-term uncertainty due to company's shift to less-capital-intensive model.

Bristol Myers Squibb (BMY) [-2.0%]: Downgraded to underweight from equal weight at Barclays. Cited extended shares after 25% rally over past 11 sessions, failure to address longer-term trough guidance, low-quality EPS beat, and lack of visibility beyond 2026.

Market Update

Trivia Answers

B) The Nasdaq peaked at 5,048 points before the bubble burst. It took more than 14 years to get back to a new all-time high.

B) Pets.com. Such a hilarious story.

B) 75%. Everyone became a day trader back then.

B) The Nasdaq crumbled 78% from its 2000 peak.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.