Market Corrections in Context (in Charts!)

"Wide diversification is only required when investors do not understand what they are doing."

- Warren Buffett

“I'm tired of hearing about money, money, money, money, money. I just want to play the game, drink Pepsi, wear Reebok.”

- Shaquille O'Neal

Hey Readers!

Sending out a bit later to see if afternoons = higher open rate. Let me know in the comments when you would prefer.

Have a good weekend,

- Ryan

Street Stories

Market Corrections

The S&P 500 closed up 2.1% on Friday. A nice end to a week that still saw the index bleed another 2.3%. However, this did mean the index is no longer in a correction - a decline of 10% from the recent market peak. Score!

The market technically entered a correction on March 13th, after falling a combined 10.1% from its February 19th all-time high of 6,144.

So, after being in correction territory by a mere 0.1% for a grand total of 24 hours, I think it’s safe to safe everything is just peachy again.

Ok, it probably isn’t.

Now I wanted to dig into the history of Corrections to see if there is any useful information to be gleaned by it but I had some issues getting the data to match historical convention for the dates of Corrections and Bear Markets - and it was also super annoying1.

Basically, I tried to manually massage the data but going back to 1978 is 12k trading days and I kinda gave up.

1. For example, if the market is goes -10.1%, -9.8%, -10.2%, -9.7%, and -10.4% - surely that isn’t three separate corrections? Or when a Correction ends with a Bear Market or if the Bear Market ‘technically’ goes back to being a Correction but in the zeitgeist it’s still considered a Bear Market. Blaa.

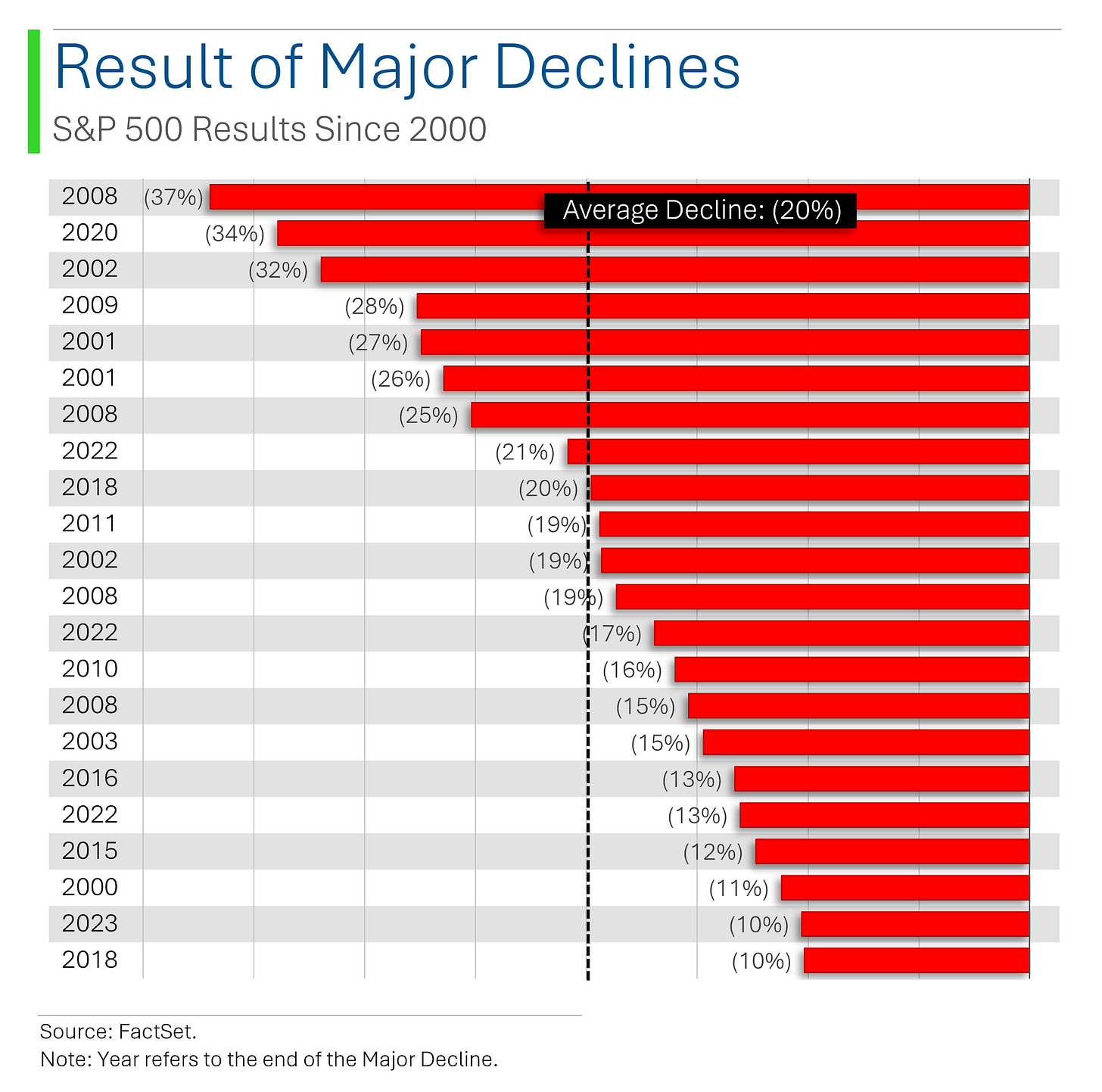

My easier solution was to look at declines of more than 10% to see how they ended. Are they typically short or long? How bad do they typically get? Etc.

Turns out that there have been 38 events that meet this criteria since 1978 which doesn’t really seem that bad.

A few times this millennium (November 2023, July 2018), the market was able to just scrape -10% before picking up steam again.

More often, however, is that once a -10% decline is clocked, things often get worse. Much worse.

The average low-point for a ‘major decline’ ends up at around 20% - the threshold for a Bear Market.

[Note that some years have multiple ‘major declines’. For example, 2008 has four alone. In actuality this is generally considered to be one Bear Market but based on my model’s criteria for a major decline (ends if it’s gained 10% from it’s floor), the super volatile 2008 made for one weird year]

As for how long they last, well that’s often no picnic either.

On average, once the market has dropped 10% from it’s relative high, it’s taken 72 days for the ‘major decline’ to end (either by reaching a new high or by bouncing +10% from the lows) which puts us at the end of May before things start making sense again. Ooof.

Also working against us here is the elevated valuation of the S&P 500.

Sitting at a 20.4x forward P/E multiple, the only two other times the market has been more ‘expensive’ ended particularly terribly (DotCom Bubble and 2022’s ‘Everything Bubble’), with the market seeing declines of 49% and 25% respectively.

Basically, there’s a good possibility this turns into a Bear Market - and those ain’t pretty.

On the sector front, there’s some interesting nuance in what’s worked in 2025 and what hasn’t.

Tech and it’s techy little buddy Communication Services knocked it out of the park in 2024 (+36% and 39% respectively) but they are some of the worst performers so far this year (-9.9% and -3.8%).

Consumer Discretionary was also a big stand out in 2024 (+29%) but is already down 14% this year. And Tesla and Amazon being down 38% and 10% respectively hasn’t helped revive any enthusiasm for the consumer.

Meanwhile, the classic non-cyclicals of Health Care (+4.8%), Utilities (+2.9%) and Consumer Staples (+1.3%) are proving their defensive value.

In the Developed World, the US has fallen short this year with the S&P 500 only besting Japan amongst their global peers.

Hell, even the TSX Composite here in Canada is beating the S&P and I wouldn’t exactly call things here tranquil at the moment…

Even the historically more economically sensitive developing world has hung in there quite well. Of the biggest players, only India’s Nifty 50 has failed to out pace the S&P 500 this year.

When defensive sectors and ‘safety assets’ are the best performers, things obviously aren’t at their best.

Sure, there’s certainly a chance that the 24hrs the S&P spent in correction is the end of it, and we’ll just go back to banging out ATHs like in 2024. But my guess, however, is that we’re going to see a little turbulence first.

Buckle up!

Joke Of The Day

My IQ test results came back. They were negative.

Macro Update

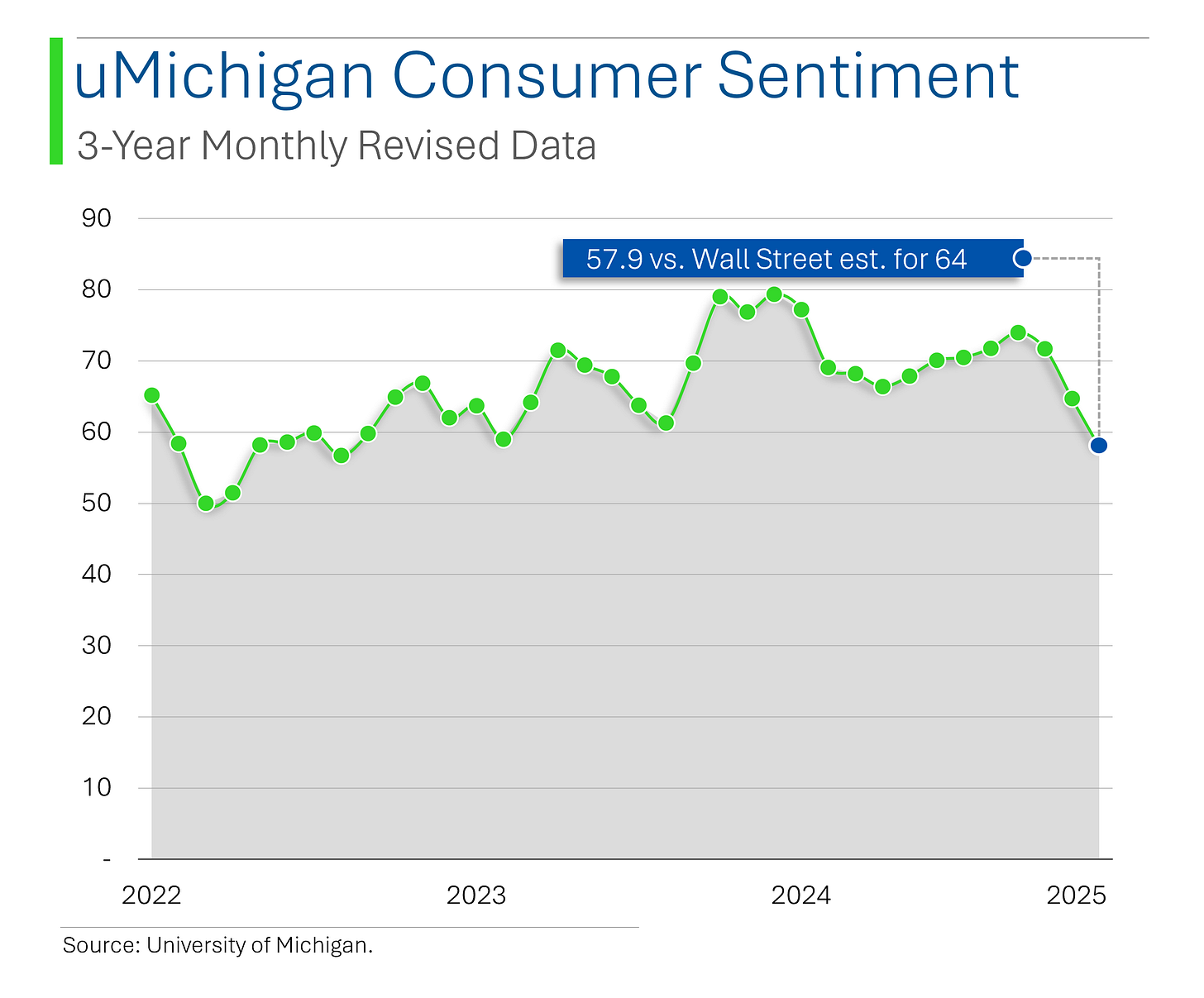

Consumer Sentiment [Friday]

Preliminary March University of Michigan consumer sentiment fell to 57.9 (vs. 64.0 expected), the lowest since November 2022 and down from February’s 64.7.

March 1-year inflation expectations jumped to 4.9% (vs. 4.3% in February), signaling renewed inflation concerns.

Producer Price Index [Thursday]

February PPI was flat m/m (vs. +0.3% expected), with annualized at 3.2% (vs. 3.3% expected), slowing from January’s 0.6% m/m and 3.7% annualized rise.

Core PPI fell 0.1% (vs. +0.3% expected), with annualized at 3.4% (vs. 3.5% expected), down from 3.8% in January.

While inflation pressures eased, economists warn tariffs could drive future price increases.

Consumer Price Index [Wednesday]

Annualized headline CPI increased 2.8%, below the 2.9% consensus and January’s 3.0%.

Notables:

Shelter costs, which accounted for nearly half of the monthly increase, rose 0.3% but slowed from January’s 0.4% gain.

Airline fares fell 4.0%, while used car prices rose 0.9%, slowing from 2.2%.

Car insurance inflation eased to 0.3% from 2.0%, while food away from home rose 0.4% after last month’s 0.2% gain.

Equities initially rallied on the softer report but pared gains as concerns over economic growth and potential tariffs offset optimism about inflation cooling.

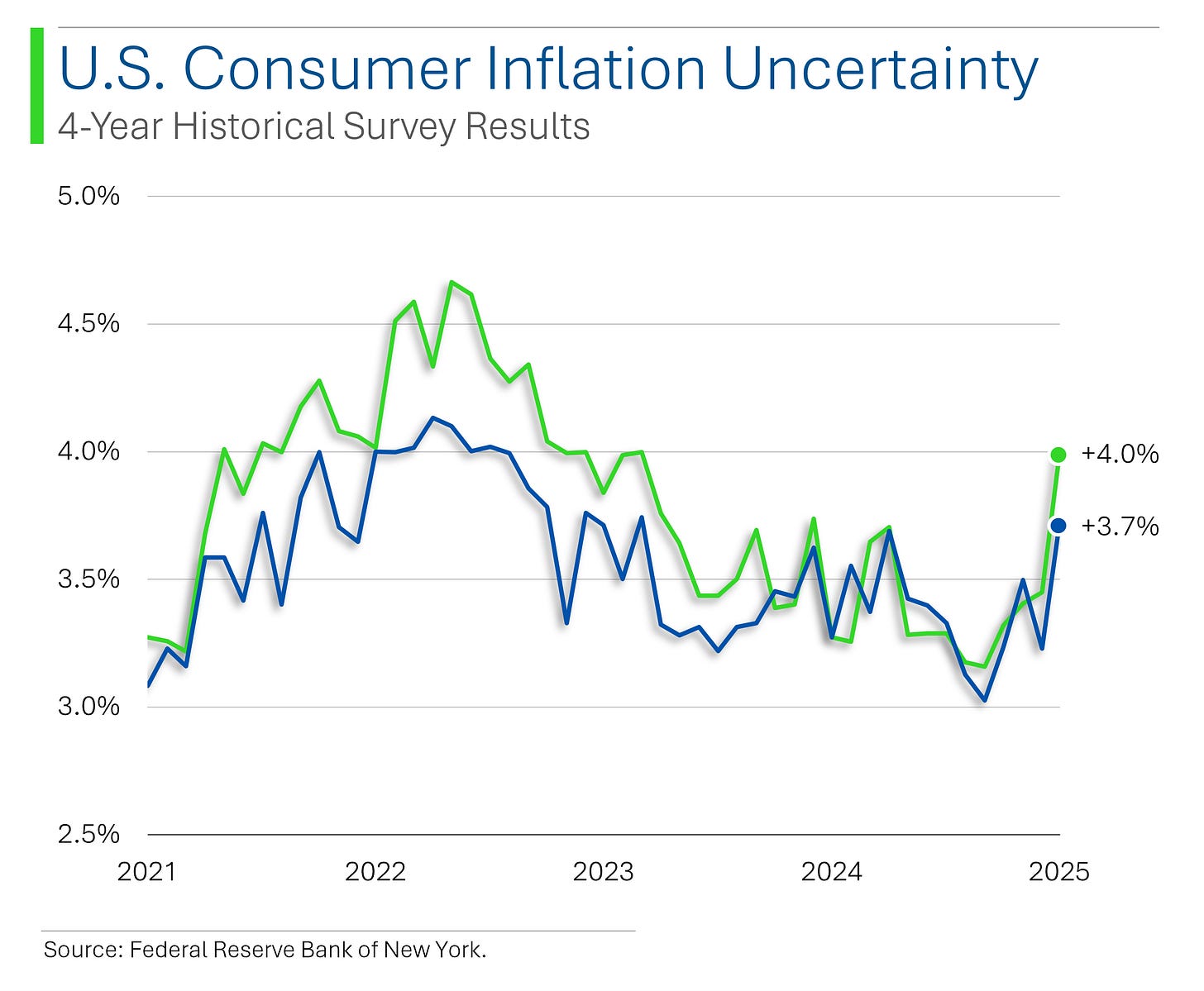

NY Fed Survey of Consumer Expectations [Monday]

The Survey showed inflation expectations were unchanged at 3.0% for both the 3-year and 5-year outlooks, while the 1-year expectation ticked up to 3.1%. However, uncertainty about future inflation had a big increase across all time horizons.

Labor market sentiment was mixed, with earnings growth expectations flat at 3.0%, while the probability of higher unemployment in a year surged 5.4pp to 39.4%, the highest since September 2023. The probability of losing one’s job in the next 12 months dipped slightly to 14.1%.

Trivia

Today’s trivia is on the father of value investing, Benjamin Graham.

Benjamin Graham wrote a famous book on investing, which is this?

A) The Wealth of Nations

B) The Intelligent Investor

C) Security Analysis

D) Common Stocks and Uncommon ProfitsWhich future billionaire was a student of Benjamin Graham at Columbia University?

A) Bill Gates

B) Stan Druckenmiller

C) Warren Buffett

D) George SorosWhich of the following concepts is NOT associated with Benjamin Graham’s investment philosophy?

A) Margin of Safety

B) Efficient Market Hypothesis

C) Mr. Market

D) DiversificationGraham was a pioneer of a particular type of analysis for evaluating stocks. What is it called?

A) Fundamental analysis

B) Technical analysis

C) Sentiment analysis

D) Predictive analysis

(answers at bottom)

This Week In History

March 10, 1876 – First Successful Telephone Call

Alexander Graham Bell made the first successful telephone call, saying, "Mr. Watson, come here, I want to see you."

March 15, 2011 – Syrian Civil War Begins

Protests erupted in Syria against President Bashar al-Assad's regime, leading to a prolonged civil war with significant humanitarian and geopolitical consequences.

March 12, 2009 – Bernie Madoff's Guilty Plea

Financier Bernard Madoff pleaded guilty to operating the largest Ponzi scheme in history, defrauding investors of nearly $65 billion. This event led to widespread reforms in financial regulations.

March 16, 2020 – Global Stock Market Crash

Global stock markets experienced significant declines due to fears over the COVID-19 pandemic, leading to economic turmoil and prompting unprecedented fiscal and monetary interventions.

Market Update

Market Movers

Friday:

RBRK (Rubrik) [+27.8%]: Strong Q4 beat across earnings, revenue, and margins, with Subscription ARR and guidance exceeding expectations.

PTON (Peloton Interactive) [+16.1%]: Upgraded to buy at Canaccord Genuity, citing valuation and optimism on revenue initiatives.

DOCU (DocuSign) [+14.8%]: Q4 revenue, EPS, and billings topped estimates, though Q1 guidance was light; analysts positive on growth acceleration.

XPOF (Xponential Fitness) [-38.5%]: Q4 earnings missed, FY25 guidance disappointed, and 2023 financials will be restated, citing rapid scaling issues.

Thursday:

INTC (Intel) [+14.6%]: Named Lip-Bu Tan as CEO, with analysts mostly positive despite lingering concerns over industry headwinds.

AVDX (AvidXchange Holdings) [+13.8%]: Reportedly exploring a sale after attracting takeover interest.

ADBE (Adobe) [-13.9%]: Q1 earnings beat but guidance was weak; concerns over discontinued ARR metrics offset positive AI growth commentary.

S (SentinelOne) [-5.5%]: Q4 earnings mixed with ARR and billings missing expectations; analysts disappointed as expected tailwinds failed to materialize.

Wednesday:

RBRK (Rubrik) [+6.1%]: Upgraded to buy at Rosenblatt, citing valuation and strong subscription growth outlook.

INTC (Intel) [+4.6%]: Reports suggest TSM is exploring JV partnerships to run Intel factories.

SEAT (Vivid Seats) [-23.1%]: Q4 revenue and EBITDA beat, but FY25 guidance and order volume missed expectations amid competitive pressures.

RUN (SunRun) [-5.2%]: Downgraded at Jefferies due to weak residential solar market and policy uncertainty.

PEP (PepsiCo) [-2.7%]: Downgraded at Jefferies, citing limited upside until Frito-Lay turnaround gains traction.

Tuesday:

PAY (Paymentus Holdings) [+24.6%]: Q4 results topped expectations, and management highlighted a strong backlog and higher digital payments adoption.

RDDT (Reddit) [+14.4%]: Loop Capital called shares "extremely attractive" after a sharp 50% decline, citing ad growth potential.

LUV (Southwest Airlines) [+8.3%]: Lowered Q1 RASM guidance but announced an accelerated $2.5B buyback and upcoming bag fees.

JBLU (JetBlue Airways) [+4.2%]: Adjusted capacity outlook slightly lower but maintained revenue guidance; demand remains healthy during peak periods.

TER (Teradyne) [-17.1%]: Announced acquisition of Quantifi Photonics; terms undisclosed, deal expected to close in Q2 2025.

DAL (Delta Air Lines) [-7.3%]: Cut Q1 revenue and EPS guidance, citing macro uncertainty impacting consumer and corporate travel confidence.

Monday:

RDFN (Redfin) [+67.9%]: To be acquired by RKT (Rocket Cos) [+15.4%] in an all-stock deal worth ~$1.75B, at a ~115% premium.

NVO (Novo Nordisk) [-9.4%]: CagriSema trial data was positive but fell short of competing weight-loss drugs.

DXCM (Dexcom) [-9.2%]: Received an FDA warning letter over facility inspections, but management downplayed the impact.

NOW (ServiceNow) [-7.9%]: Acquiring Moveworks for ~$2.9B.

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

B) Graham wrote The Intelligent Investor.

C) Warren Buffett was a student and mentee of Graham’s.

B) The Efficient Market Hypothesis isn’t something Graham is known for. That was Eugene Fama in 1970.

A) Graham literally wrote the book on Fundamental analysis.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.