🔬 Market Catches Its Breadth

Mortgage rate are almost affordable again; the Cloud is fine (whatever that is); and much more!

‘Our life is what our thoughts make it.’

- Marcus Aurelius

"Any jerk can have short-term earnings. You squeeze, squeeze, squeeze, and the company sinks five years later."

- Jack Welch

Modestly positive end to another tumultuous week with the S&P 500 +0.5% and Nasdaq +0.5%. That was enough to keep the S&P 500 flat for the week but the Nasdaq still finished -0.2%.

10 of 11 sectors finished higher Friday, with Materials (-0.1%) the only laggard. Mats was down -1.75% for the week, while Tech managed only -0.2% despite the headline grabs.

Oil was the big winner of the week, with WTI Crude finishing +4.5% vs. last Friday.

Notable companies:

Expedia Group (EXPE) [+10.2%] Q2 results mostly better. Lowered 2024 guidance due to macro headwinds and slowdown in US travel demand. Takeaways flagged low expectations given read-throughs from other travel names. Very low bar basically…

Doximity (DOCS) [+38.8%] FQ1 earnings, revenue, and margins beat expectations. Guidance for next quarter and full year is ahead of the Street.

Sweetgreen (SG) [+33.3%] Q2 EPS missed, but revenue and EBITDA were ahead of expectations. Analysts are positive on new categories like protein plates and highlighted minimal downtime amid NY store retrofit with Infinite Kitchen system.

Street Stories

Catching Its Breadth

One of the biggest stories of the year has been that most of the market’s return is attributable to only a handful of stocks. As you can see below, the 8 biggest contributors to the S&P 500 added a total of $5.4 trillion in market cap in the year to July 10th. The other 492 companies? Only $2.1 trillion.

However, this lack of ‘market breadth’ has started to turn around with the Big Tech sell-off since July 10th. Sure, on net the ‘Other’ companies are down - but nowhere near as much as the (former) big winners.

Specifically, those 8 mega-contributors are down a combined $2.3 trillion since things got dicey after July 10th. While the rest are only down a total of $298 billion.

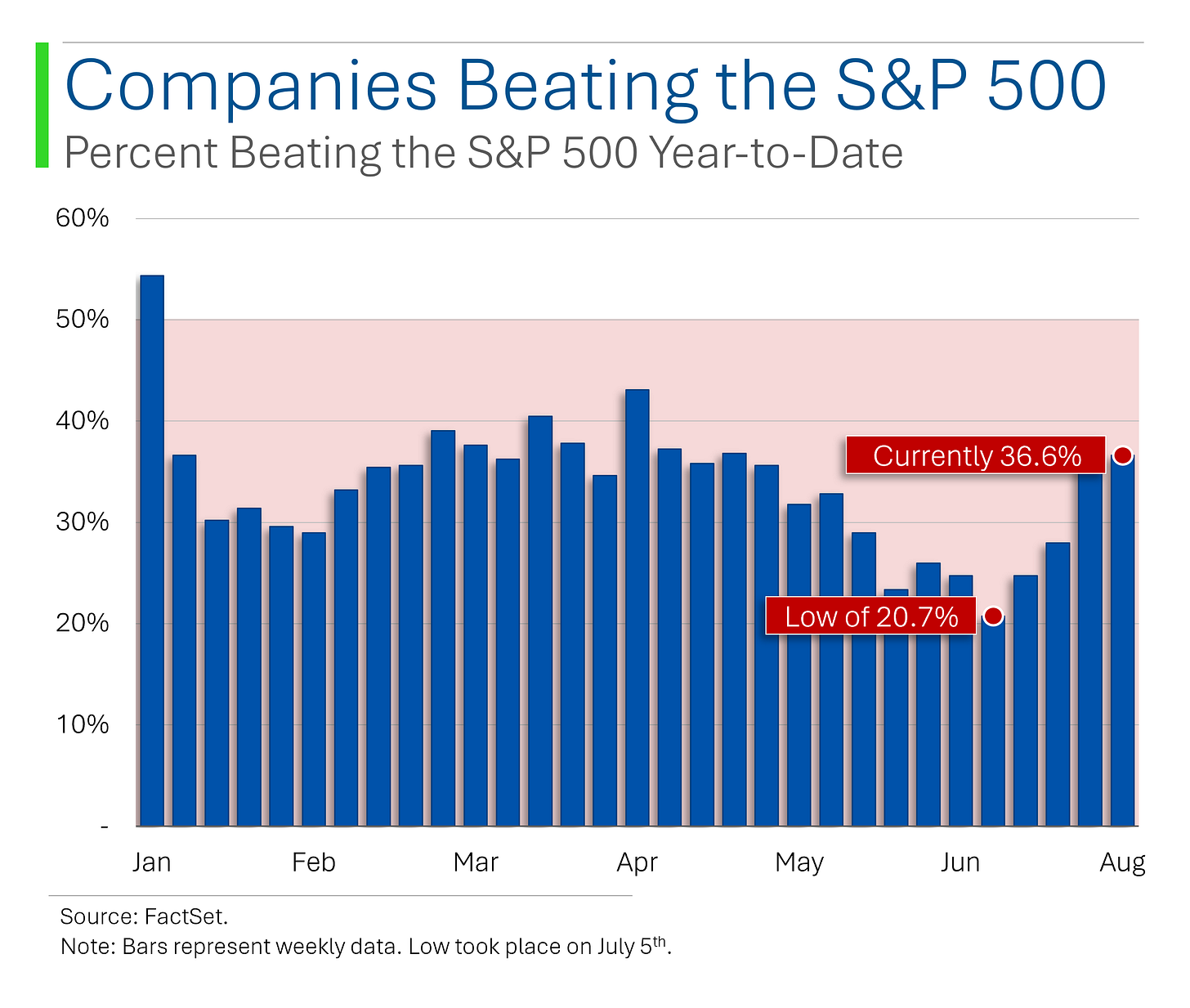

Just how one-sided did things get? Well, on July 5th only 20.7% of companies in the S&P 500 were actually beating the index!

However, this has started to change rapidly and in just a few short weeks that figure is up to 36.6%. And rising daily…

Another way to illustrate this rotation away from the ‘haves’ into the ‘have nots’ is the spread between the S&P 500 (market cap weighted) and the S&P 500 Equal Weight (uhh, equal weighted). See the big winners this year also happened to be most of the biggest companies on the index so their performance had a massive impact.

On July 5th, this spread was 11.7%: the S&P 500 was up 16.7% for the year while the S&P 500 Equal Weight was up only +5.0%. This spread has nearly halved to 5.9% (S&P 500 +12.1%, S&P EQ +6.2%).

Perhaps the best way to show this reversal is to look at how many companies are outperforming the S&P 500 over the last four weeks. That hit a low on June 14th with only 16.1% of companies beating the market.

Right now that is an astounding 73%!

Homeownership: Now 1% Less Impossible

US mortgage rates dropped to 6.47% this week, thanks to weak employment data consolidating views of a September Federal Reserve rate cut, giving homebuyers and refinancers a rare reason to celebrate in the painfully expensive housing market. Rates are now the lowest since May 2023.

Despite this, sky-high home prices keep the dream of ownership just that - a dream - for many, especially in booming cities like New York, San Diego, and Las Vegas. As Wall Street wagers on rate cuts, hopeful a few more buyers can afford a house now, assuming, of course, they find one that isn't priced like a luxury yacht.

Cloud Nine: How Tech Giants Are Riding the AI Wave

Last week in Chip Happens I did a review of second quarter semiconductor reporting. However, arguably the best way to sniff out the health of chip sales and the remaining upside in the space is to see how the mega-scale cloud compute companies are doing.

As you can see below, Q2 made for another strong quarter and Wall Street still has high hopes baked into the future. Fingers crossed.

Joke Of The Day

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort.

Hot Headlines

CNBC / Tesla’s board faces questions from Elizabeth Warren about Musk’s corporate ‘entanglements’. The senator, who sits on both the Banking and Armed Services committees has sent a letter to Tesla's board inquiring about Elon's alleged use of their resources within his other ventures such as SpaceX and OpenAI. If proved true, this is definitely a blatant breach of his fiduciary duties to Tesla’s shareholders. Hate to agree with Warren on anything but this is correct.

CNBC / Trump says he should get a say on Federal Reserve interest rate decisions. Since the Federal Reserve was established in 1913, it has been an unspoken rule that the incumbent presidential administration not involve itself in monetary policy. While few have strayed from this before, such as Obama’s bailout during the GFC, this could mark the beginning of a new practice in American politics, as well as a new executive power for the presidential office.

Yahoo News / Japan warns of heightened risk of megaquake. For the first time in history, Japan has issued a formal warning of a potential ‘megaquake’ that could trigger a tsunami with a casualty rate ten times higher than that of the 2011 disaster.

CNBC / More than half of new cars sold in China are now electric or hybrid. Monthly data from China’s Passenger Car Association data for July showed that for the first time electric/hybrids have outsold traditional internal combustion engines.

PC Mag / Intel ‘postpones’ Innovation Event amidst mass layoffs, CPU controversy and bleeding market. Ya, maybe take a breather and actually come out with some innovation…

Trivia

Today’s trivia is on global financial markets.

Which country introduced the world’s first fiat currency?

A) United Kingdom

B) China

C) United States

D) FranceWhich international organization is known for providing loans to countries facing balance of payments problems?

A) World Bank

B) International Monetary Fund (IMF)

C) World Trade Organization (WTO)

D) Asian Development Bank (ADB)What was the unemployment rate in the United States at the peak of the Great Depression in 1933?

A) ~10%

B) ~15%

C) ~25%

D) ~30%

(answers at bottom)

Market Movers

Winners!

Doximity (DOCS) [+38.8%] FQ1 earnings, revenue, and margins beat expectations. Noted strong contributions from largest customers and a strong start to the pharma upsell season. New products and Client Portal showed strength. Guidance for next quarter and full year is ahead of the Street.

Sweetgreen (SG) [+33.3%] Q2 EPS missed, but revenue and EBITDA were ahead of expectations. Comparable sales were better than expected. Raised FY24 EBITDA and revenue guidance. Analysts are positive on new categories like protein plates and highlighted minimal downtime amid NY store retrofit with Infinite Kitchen system.

Rocket Lab USA (RKLB) [+12.6%] Q2 earnings and revenue in line, with Space Systems and Launch segments as expected. Launch demand remains strong, though customer schedule variability affects revenue cadence. Backlog up 5% Q/Q, with significant growth expected in Q4 2024.

Trade Desk (TTD) [+12.5%] Q2 EPS and revenue beat, driven by strong revenue growth. Q3 guidance is ahead of consensus. Benefits from a stable ad environment and initiatives in connected TV (CTV), with tailwinds from Olympics/political events. International revenue growth outpaced domestic for the sixth straight quarter.

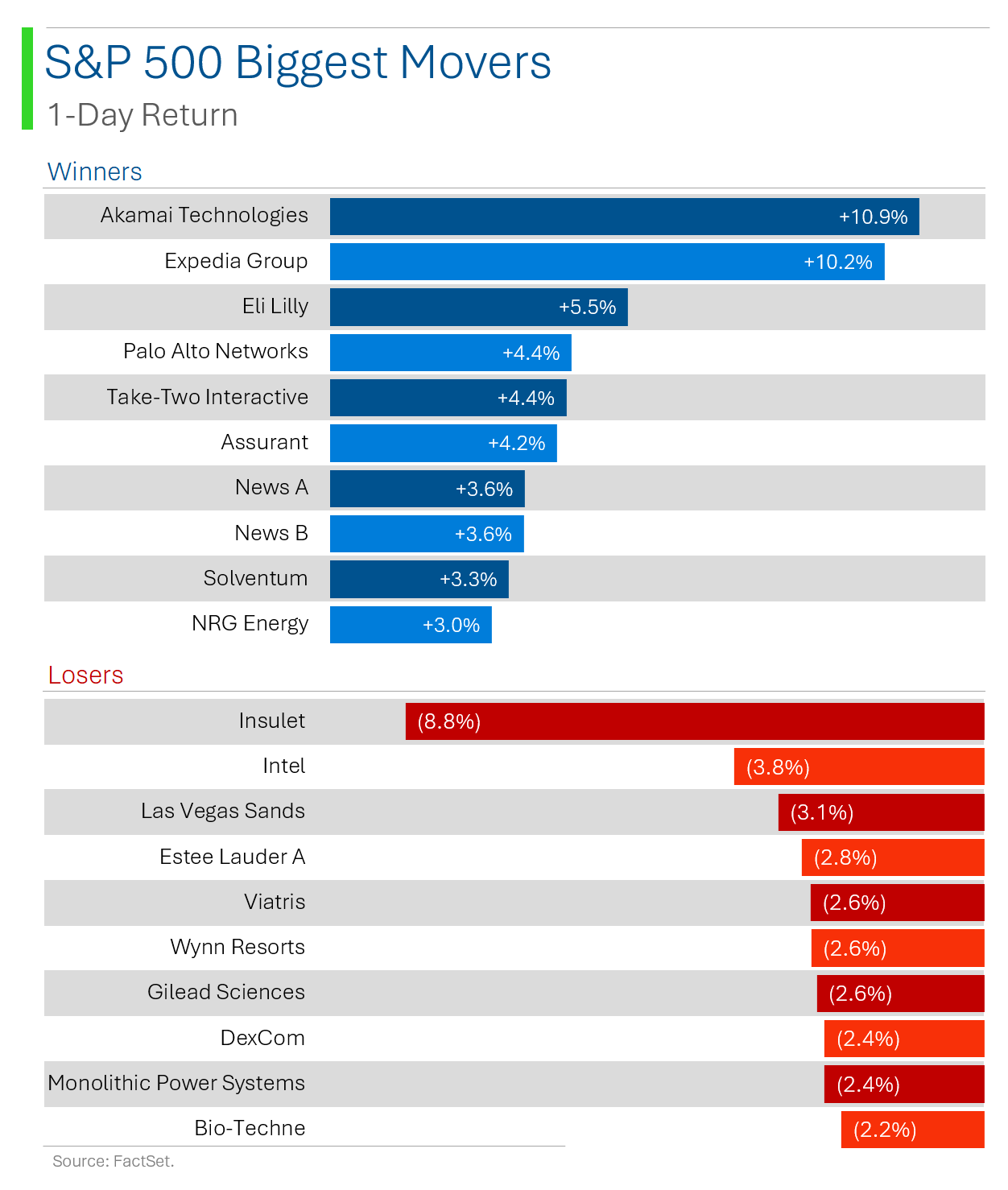

Akamai Technologies (AKAM) [+10.9%] Q2 revenue largely in line, with EPS 3% better. Noted strength in Security and Compute. Enterprise Compute ARR doubled y/y, driving Compute guidance higher. Delivery traffic growth remains an issue, but some firms flagged stabilization.

Pitney Bowes (PBI) [+10.6%] Q2 earnings and revenue stronger y/y, with benefits from cash-optimization initiatives. Sold a controlling interest in its Global Ecommerce business to Hilco Commercial Industrial, eliminating ~$136M in annual losses.

Expedia Group (EXPE) [+10.2%] Q2 results mostly better. Lowered 2024 guidance due to macro headwinds and slowdown in US travel demand. Takeaways flagged low expectations given read-throughs from other travel names. Positive on Vrbo improvement.

Take-Two Interactive (TTWO) [+4.4%] FQ1 EPS beat but net bookings were light. Reaffirmed FY25 EPS and net bookings guidance. Analysts highlighted mobile momentum and expectation for record FY25 bookings on GTA VI launch.

Dropbox (DBX) [+3.3%] Q2 revenue, EPS, and ARR beat expectations. GM, OM, paid users, and ARPU were all ahead. Raised FY24 OM range and low end of revenue guidance. Analysts highlighted resilience in paid user growth despite macro headwinds, though noted ongoing SMB choppiness.

Losers!

Five9 (FIVN) [-26.5%] Q2 revenue and EBITDA were better, but FY24 guidance was cut more than expected, removing the typical seasonal 2H ramp. Noted a bookings slowdown due to heightened budget constraints. Downgraded at Baird.

EchoStar (SATS) [-16.6%] Q2 adjusted OIBDA and EPS declined Y/Y, with revenue mostly in line. Net Pay-TV subscribers decreased by ~104,000 vs. 294,000 Y/Y. Retail Wireless net subscribers decreased by ~16,000 vs. 188,000 Y/Y, and Broadband net subscribers decreased by ~23,000 vs. 55,000 Y/Y.

e.l.f. Beauty (ELF) [-14.3%] FQ1 earnings and revenue were better, with higher unit volume, digital strength, and loyalty-program traction. Raised FY25 guidance midpoints. Analysts are generally positive, particularly on international prospects, but the magnitude of the guidance raise underwhelmed.

Insulet (PODD) [-8.8%] Q2 revenue and earnings beat expectations, with FY24 revenue growth guidance raised. New patient starts grew Q/Q, with expected sequential acceleration. However, the acceleration isn't as strong as expected due to allowing existing G6-only Omnipod inventory to burn off naturally and a slowdown in competitive switching.

Sealed Air (SEE) [-6.9%] Downgraded to hold from buy at Jefferies, citing secular headwinds in the Protective segment and a weakening consumer environment.

Capri Holdings (CPRI) [-4.9%] Fiscal Q1 EPS missed expectations due to weaker sales and higher expenses. All three brands saw revenue declines and margin contractions. Performance continued to be impacted by softening global demand for fashion luxury goods.

Market Update

Trivia Answers

B) The Song Dynasty in China was the first to issue paper money, jiaozi, about the 10th century CE.

B) The International Monetary Fund (IMF) helps developing countries with payment issues.

C) Peak unemployment in the Great Depression was around ~25%.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

The bears have to hate that as soon as the top 7 takes a hit the rest of the 493 stocks step up their game. That's the sign of a healthy market.