🔬Mag7 Reality Check

Plus: What can interest rates cuts do for you! And much more!

"You can get in way more trouble with a good idea than a bad idea, because you forget that the good idea has limits."

- Ben Graham

"There is no such thing as a free lunch."

- Milton Friedman

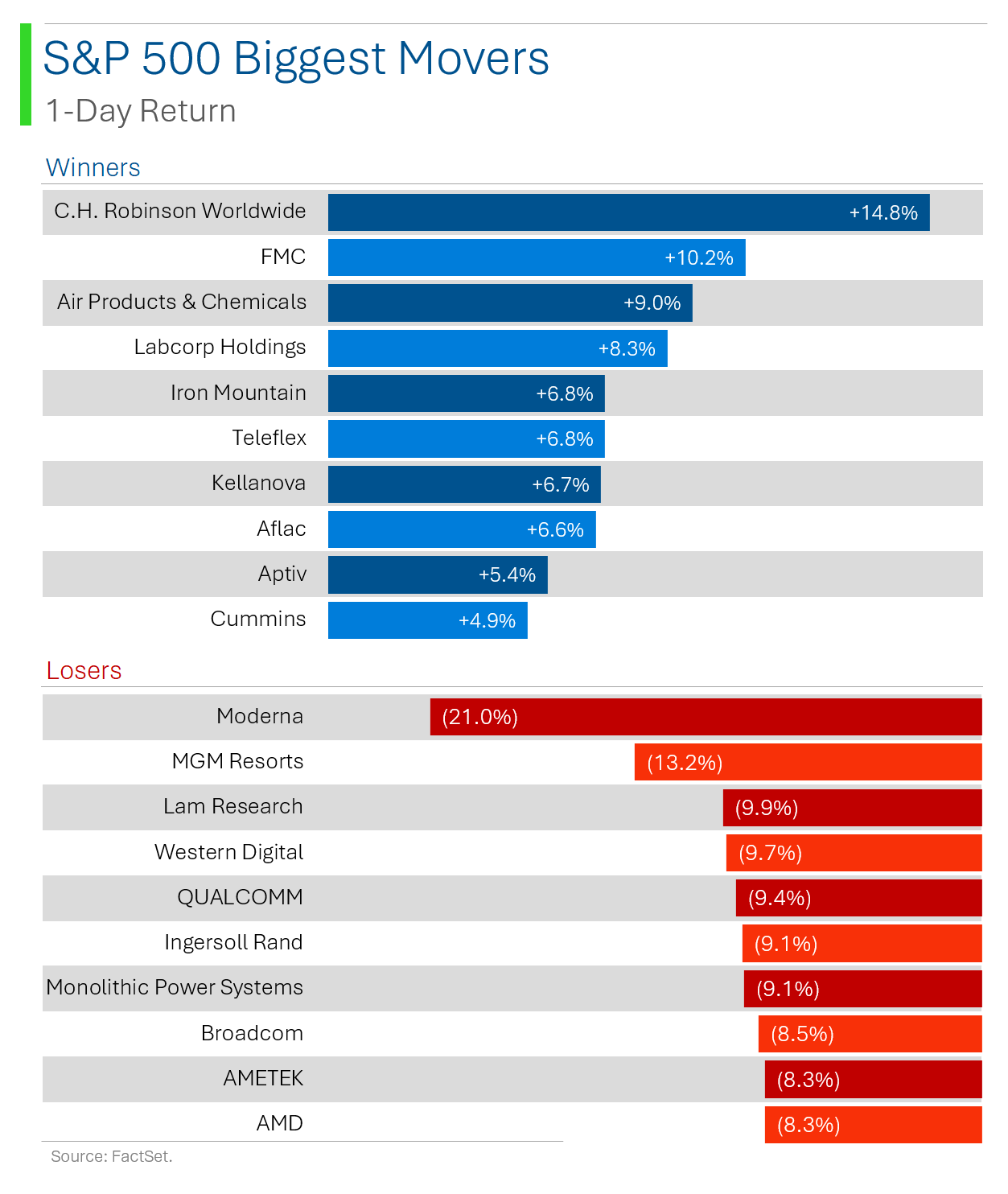

Super bad day for the big US markets with the S&P 500 -1.4% and Nasdaq -2.3%. Small-Cap fans get their feelings hurts as Russell 2000 drops 3.0%.

5 of 11 sectors closed higher, mostly the defensive ones - Utilities (+1.9%), Staples (+1.1%), Health Care (+1.1%). Tech went skydiving without a parachute (-3.4%).

The UK cut rates for the first time in four years yesterday, with the 25bp cut taking their benchmark rate to 5.0%.

The July ISM Manufacturing Index missed expectations, coming in at its lowest level since last November.

Notable companies:

Shake Shack (SHAK) [+16.9%]: Q2 EPS in line, revenue beat. Q3 guidance in line; FY24 revenue guidance raised at low end of range. Company on track to meet FY2024 targets, including 14%-15% revenue growth; system-wide sales up 13.5% Y/Y.

Qualcomm (QCOM) [-9.4%]: FQ3 EPS and revenue beat; FQ4 guidance ahead of consensus. Mixed sentiment with top-line/QCT, Automotive, and EPS beats. Huawei loss seen as a headwind for C2H24.

Apple (AAPL) [+0.6% in pre-market]: Q3 EPS and Revs in-line. iPhone was ok but iPad (+24% YoY) helped make the quarter.

Amazon (AMZN) [-6.9% in pre-market]: EPS Beat, Revenue in-line but Q3 guidance was well below Wall Street estimates. AWS beat estimates but online store sales were light.

StreetSmarts will not be publishing on Monday, August 5th due to a Civic Holiday in Canuck Land. See you next Tuesday😏

Street Stories

Mag7 Reality Check

The July sell-off has taken its toll on the Mag7. Right now the vaunted basket of megacaps is down 10.4% from their July 10th peak - erasing $1.7 trillion in market value while they were at it. Admittedly, some have fared better; Apple is down only 5.8% while Nvidia and Tesla are really taking it on the chin, down 16.7% and 15.1% respectively.

One thing that I feel hasn’t helped the Mag7 in holding their value through this rotation is the general lack of new optimism built into the stories. For example, over the course of the year Amazon’s shares are up +22% (from a peak of +29%) but Wall Street analysts have actually decreased their revenue estimates for their fiscal 2025 by 1%.

Ya, sure, obviously 2025 doesn’t wholly represent the long-term earnings potential of the business, but, simplistically/ceteris paribus/‘efficient market hypothesis’/whatever, stocks should go up on improved future expectations and down on diminished ones.

Save for Nvidia and kinda Meta, we haven’t really seen that from the Bigs this year.

Throughout all the ups and downs this year, we have seen something pretty interesting at the top of the pile: The title of ‘world’s largest publicly traded company’ has traded hands 6 times this year. Which is extremely high compared to history.

Apple has resumed its top spot after negative sentiment around iPhone sales has started to abate. Its regained throne is something it has held pretty much uninterrupted over the last 5 years (there was a week or so in 2021 when briefly Microsoft usurped them).

Anyway, whoever wears the crown, if the Mag7 wants to keep its title, it’s clear that investors are going to start requiring a lot more from them. Growth being the biggest.

Fed Up

Signs of cooling inflation and a weakening economy have been stoking rate cut hopes for a few months now. Expectations for a July cut were pretty much nil but all eyes were on September (no Fed meeting in August) when J-Pow took the stage Wednesday following the Federal Open Market Committee’s (FOMC) - and thankfully he didn’t break anything.

According to the interest rate futures market, September is a 100% go!

With the Fed’s target rate sitting in the 5.25% to 5.50% band for over a year now (last hike was July 27th, 2023), I think everyone is looking forward to this.

Sure, inflation has a wee bit to come down, but a weakening economy appears to be of great concern at the moment.

One of the best places this optimism can be seen is in the steadily sinking yield curve, as ‘higher for longer’ rhetoric appears to have disappeared.

In the last three months, the shift has been quite dramatic. Most impacted have been the 3- and 5-year treasury notes, which have seen yields drop by 0.8%.

And while the drop has been pretty significant, it’s by no means back to levels we’ve experienced for most of the decade. For example, the 10-year treasury note is still well above the historical average of the 2-3% range.

One place where there hasn’t been much improvement as yet is in mortgage yields. Sure, they’ve come down from their October 2023 peak of ~7.8%, but it is still a pretty terrible time to lock-in for 30-years!

I have a feeling it’s going to be a pretty busy autumn…

(thought I’d stick with the Jurassic Park theme…)

Joke Of The Day

I have a joke about trickle-down economics, but most people won’t get it.

Hot Headlines

Tech Crunch / Google is bringing AI-powered search history and Lens to Chrome desktop. Actually seems kinda useful.

NY Times / Former CNN host Don Lemon sues Elon Musk over canceled X deal. The $1.5 million exclusive content deal fell apart shortly after Musk appeared as his first guest and things turned *acrimonious* when Lemon asked him about drug use and politics. Lemon reportedly had no signed contract. This is the first lawsuit against Elon in over 2.5 days.

Reuters / As rate cuts near, investors assess whether Fed can stick the 'soft landing'. Pace and consistency of cuts seen as crucial to keeping economic hopes alive, while asset strength this year has depended on ‘soft landing’ rhetoric.

Venture Beat / Intel plans to lay off 15% of workforce - at least 15,000 people. Move comes as part of massive $10 billion restructuring and includes suspending the dividend. Yer boy here called the divy cut back in ‘Intel’s Lost Chip Crown’.

Gizmodo / JD Vance’s drunken college photo met with shrugs as the Facebook generation runs for office. Drunk Ryan has slept in worse places.

Trivia

Today’s trivia is on interesting stock market facts.

The term "Bear Market" refers to a market condition where prices fall 20% or more from recent highs. What is believed to be the origin of the term "bear" in this context?

A) It comes from the way a bear attacks its prey, swiping down.

B) It’s a mix up from ‘bare market’, referring to a lack of buyers of stock.

C) It's named after a famous statue of a bear in the Wall Street area.

D) It was named after "Bearson", the trader who first sold stocks short.Which company was the first to reach a $1 trillion market cap?

A) Amazon

B) Apple

C) Microsoft

D) Apple

Who is known as the "Father of Value Investing"?

A) Warren Buffett

B) Benjamin Graham

C) Philip Fisher

D) Peter Lynch

(answers at bottom)

Market Movers

Winners!

Shake Shack (SHAK) [+16.9%]: Q2 EPS in line, revenue beat. Q3 guidance in line; FY24 revenue guidance raised at low end of range. Company on track to meet FY2024 targets, including 14%-15% revenue growth; system-wide sales up 13.5% Y/Y.

FMC Corp (FMC) [+10.3%]: Q2 organic growth and EBITDA better. Q3 EBITDA guide below but expected; offset by stronger Q4. Positive takeaways on volume inflection; debate likely on Q4 guidance achievability.

Carvana (CVNA) [+10.1%]: Q2 earnings and revenue beat with positive net income, much higher Y/Y. FY24 earnings guidance beat; unit sales up 33% Q/Q. Analysts positive on margins and cost controls, with concerns around macro and debt.

R1 RCM (RCM) [+9.7%]: To be acquired by TowerBrook and CD&R for $8.9B in cash; $14.30/sh consideration represents ~11% premium to yesterday's close. Acquisition expected to be completed by year's end.

Life Time Group (LTH) [+6%]: Q2 EBITDA, net income, and revenue beat; average center revenue per membership and comps ahead. Raised FY24 EBITDA, revenue guidance. Analysts highlight member growth trends and increased average dues, driving more in-center spend.

Aptiv plc (APTV) [+5.4%]: Q2 revenue missed but EPS better on strong margin performance. Lowered FY guidance metrics; takeaways positive on margins and new $5B buyback authorization with $3B ASR.

Cummins (CMI) [+4.9%]: Q2 sales beat by 6% while EBITDA 5% ahead. Noted significant improvement in Power Systems business; raised FY guidance. Takeaways highlight better margin guidance in Power Systems and Engines.

Eli Lilly (LLY) [+3.5%]: Announced positive topline results from SUMMIT phase 3 clinical trial evaluating tirzepatide injection in adults with heart failure and obesity.

Losers!

Mobileye Global (MBLY) [-22.5%]: Q2 earnings, revenue, and margins better; however, pressure from excess inventories at Tier 1 customers. Cut FY revenue and operating income guidance; destocking nearly complete, but China softness expected to lead to H2 challenges.

Moderna (MRNA) [-21%]: Q2 earnings largely in line; revenue above consensus amid Covid vaccine decline. Big cut to FY net product sales guidance due to low EU sales, potential revenue deferrals to 2025, and increased US competition for respiratory vaccines.

Confluent (CFLT) [-17.6%]: Q2 EPS, total revenue beat; OM, FCF surprised positive, though deferred revenue light. FY24 EPS guidance in line with prior midpoint; subscription revenue guide maintained. Analysts noted deceleration in Confluent Cloud growth rate.

Goodyear Tire & Rubber (GT) [-15.9%]: Q2 earnings better but revenue missed; Americas pressured by lower replacement volumes and unfavorable price/mix from commercial truck weakness. EMEA hit by lower volumes and FX; FY guidance sees volume lower due to weaker industry environment.

Arm Holdings (ARM) [-15.7%]: Fiscal Q1 beat, company guided Sep Q above; disappointment over lack of FY guidance raise given valuation. Scrutiny on royalties amid continued softness in industrial IoT and networking.

MGM Resorts (MGM) [-13.2%]: Q2 earnings in line, revenue beat; management flagged Q4 softness in Las Vegas due to F1 event and room rates. Analysts positive on FCF growth and international digital opportunities.

Hims & Hers Health (HIMS) [-12.9%]: Lilly CEO expects tirzepatide shortage to end "very soon"; Hims has sold compounded versions of the weight loss drugs.

Lam Research (LRCX) [-9.9%]: FQ4 earnings, revenue, and margins better; strong services growth, though systems light. Next-Q guidance largely in line; analysts positive on China demand and AI tailwinds but cautious on weak NAND recovery.

Western Digital (WDC) [-9.7%]: FQ4 earnings and margins better; revenue in line. Next-Q guidance midpoints below Street; analysts positive on HDD strength but flagged weaker NAND/Flash pricing and bit growth.

Qualcomm (QCOM) [-9.4%]: FQ3 EPS and revenue beat; FQ4 guidance ahead of consensus. Mixed sentiment with top-line/QCT, Automotive, and EPS beats; noted extra week in quarter aiding guidance beat. Huawei loss seen as a headwind for C2H24.

Wesco International (WCC) [-9.3%]: Q2 EPS and revenue missed; backlog declined by 10% Y/Y. Flagged slowdown in utility customer purchases; expects mixed economic environment and customer delays to continue through H2 of 2024. Reduced FY24 outlook.

Ingersoll Rand (IR) [-9.1%]: Q2 EPS better on in-line revenues, better margins, and lower tax rate; raised FY EPS guidance. Reduced 2024 organic growth guide by 200 bp due to market conditions in China; highlighted macro pressures.

Teladoc Health (TDOC) [-8.9%]: Q2 EBITDA beat but revenue missed; EPS included $790M goodwill impairment charge. Integrated Care members slightly ahead, but BetterHelp users missed; withdrew FY outlook on BetterHelp amid issues; analysts flagged weakening growth trends.

Etsy (ETSY) [-7.7%]: Q2 EBITDA beat, revenue ahead on Marketplace upside; active buyers and sellers light. Q3 GMS expected to decline LSD y/y; downgraded to perform at Oppenheimer due to reduced visibility and lack of FY GMS guidance.

Applied Materials (AMAT) [-7.5%]: Commerce Department decided company's $4B facility in Sunnyvale, California, doesn't qualify for CHIPS Act grant.

Wayfair (W) [-6.9%]: Q2 revenue and EBITDA slightly below; active customers light, though average order value better. Highlighted macro headwinds impacting shopping behavior; added customers cautious in home spending.

Roblox (RBLX) [-6.4%]: Q2 bookings, EBITDA beat; DAUs, average bookings per DAU beat. Raised FY24 bookings guidance, but lowered EBITDA range. Management highlighted expense reduction including AI moderation; focus on Q3 bookings outlook deceleration.

Market Update

Trivia Answers

A) Bear Market is believed to come from the way a bear attacks its prey, swiping down. Whereas, a bull thrusts upward with its horns to attack; thus, a ‘Bull Market’.

D) Apple was first to reach a trillion dollar market cap.

B) Sorry Buffett fans, but Benjamin Graham is the OG value investor.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.