🔬LVMH: When Luxury Goes On Sale

"It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong"

- George Soros

"Economists have predicted nine out of the last five recessions"

- Paul Samuelson

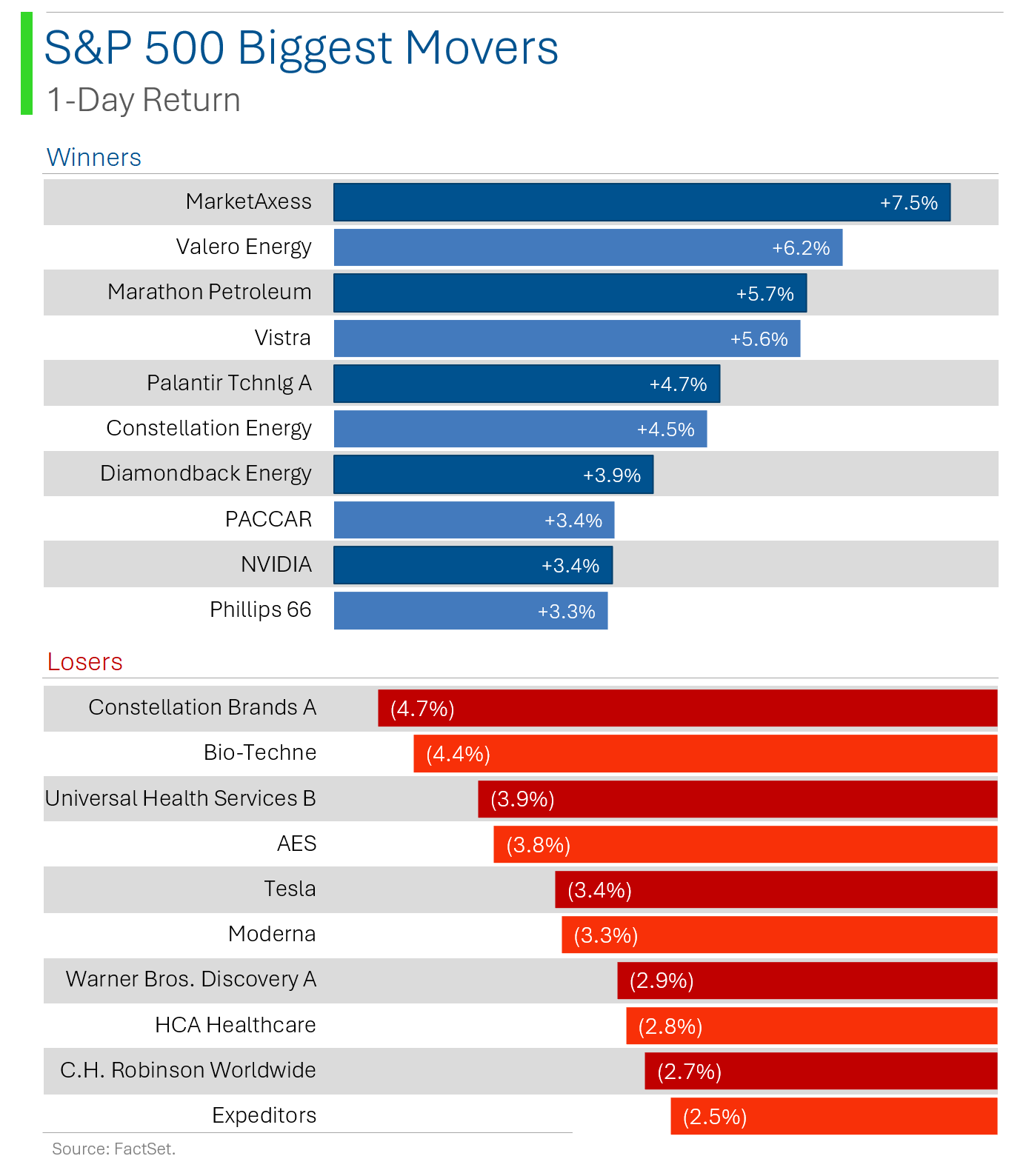

US equities mixed amid sector struggles and market wait for Non-Farm data. Apparel (Levi Strauss), industrial metals, and biotech sectors lagged, while energy and regional banks outperformed. Big tech was mixed, with Nvidia leading the way, and crude oil surged 5.1% on potential Israel actions.

Economic data fuels soft-landing optimism despite inflation concerns. September's ISM Services report hit a 20-month high, but inflation and employment data raised caution. Treasury yields weakened as the market anticipated tomorrow’s Non-Farm Payrolls report, with dovish central bank comments failing to support risk appetite.

Corporate news highlights Nvidia's AI demand and Berkshire's stock sales. Nvidia’s CEO described “insane” demand for its Blackwell chip, while Berkshire Hathaway sold 8.5M shares of Bank of America. Levi Strauss fell after missing Q3 revenue, and Constellation Brands beat earnings but ended lower.

Notable companies:

EVgo (EVGO) [+60.8%] JPMorgan upgraded EVgo to overweight, pointing out that higher usage and charging rates make it a promising pick despite the slow EV market.

Nvidia (NVDA) [+3.3%] NVIDIA's CEO says demand for their Blackwell product is off the charts, and they’re ramping up production.

Levi Strauss (LEVI) [-7.7%] Levi's beat on earnings but cut their sales guidance, citing weak wholesale numbers despite margin expansion and solid DTC business.

Street Stories

LVMH: When Luxury Goes On Sale

For years it looked like nothing could slow the luxury powerhouse Louis Vuitton-Moët-Hennessy down, racking up win after win in a feat that led to it’s founder, Bernard Arnault, briefly being named the richest man in the world.

2024 put an end to this, as broad consumer woes globally mixed with a economically stagnating China - it’s fastest growing market - which resulted in something very, very rare: It underperformed the market.

Oh, and our poor friend Bernie saw his net worth drop by a tidy $50+ billion.

But while things may not be getting better, they might have stopped getting worse. With rate cuts on the menu across the West - and a potential ‘soft landing’ in the works - their clientele amongst the landed and industrialist classes may be ready to open up the coffers again.

The biggest news (and that little pop you see above on the bottom right), however, was the stimulus ‘bazooka’ China laid down last week, which shot the shares up 11%. And gave Bernie a $17 billion Thursday.

(They also just inked a pretty sweet 10 year deal with Formula 1 to sponsor everything from Louis-Vuitton trophy cases to Moët showers on the podium)

And LVMH could really use the boost in demand, with both quarters this year down over 2023 - even with the lift from inflation.

This comes as Wall Street’s outlook for their businesses continues to shrink by the minute. For example, since mid-2023 estimates for this year’s revenue have tumbled by 9.8%.

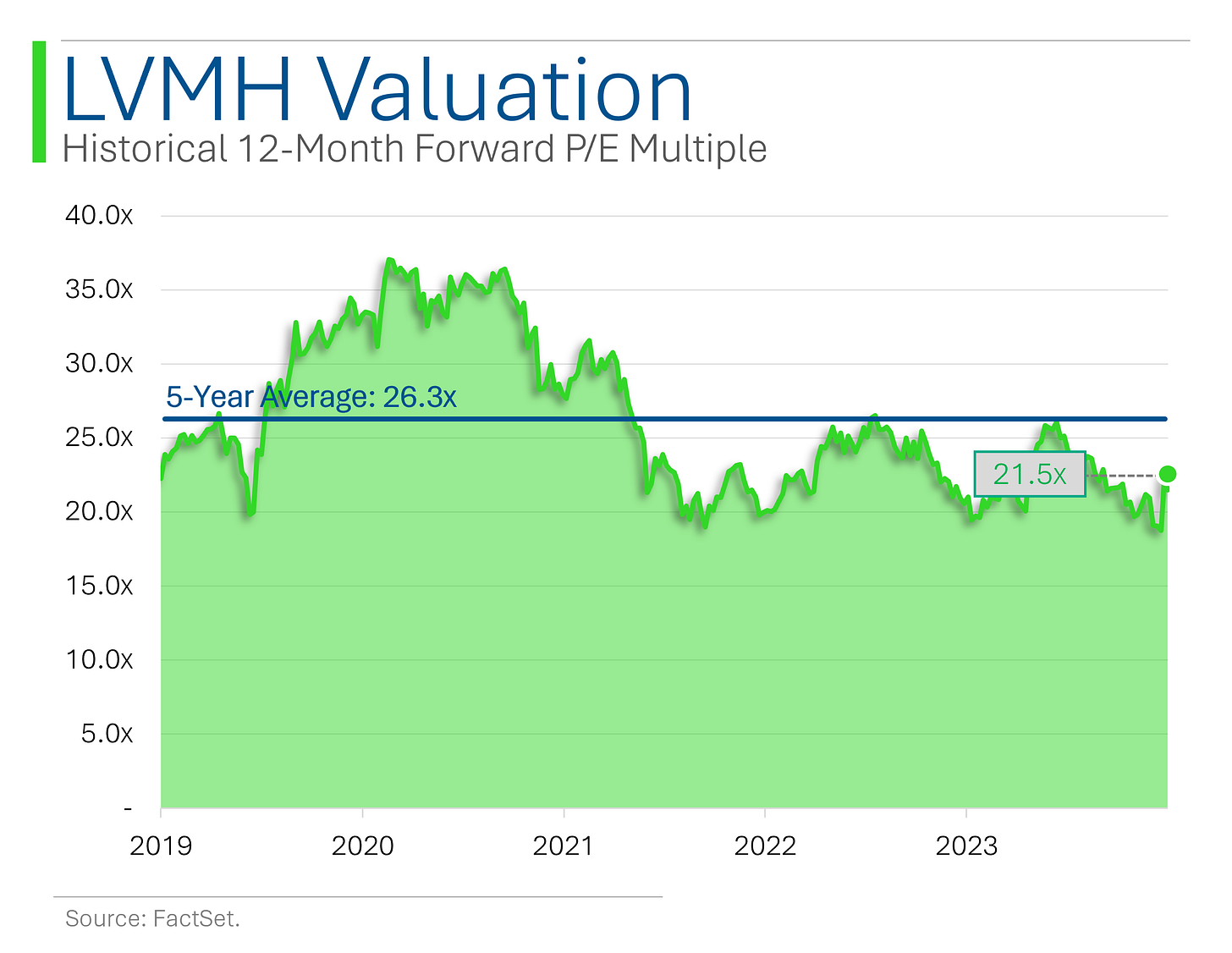

All this has meant that LVMH is only recently off of some of the lowest P/E multiples in the company’s existence. That said, at a multiple still higher than the broader S&P 500, no one would dare say it’s cheap.

But, I guess, if you have to ask what it trades at, you can’t afford it.

Winners Win

I’ve griped about the lack of ‘breadth’ in the stock market a lot this year, with the biggest dozen or so companies contributing the vast majority to the S&P 500 (which has ~500 stocks).

While the July sell-off gave us much broader market participation, it’s hasn’t exactly been the end of the world for the biggest of the big: Of the top 15 largest companies in the US, every single one (save for Tesla) is up on the year, with the average being up 38% on year. Ok, only 30% if you exclude Nvidia.

Moreover, they’re all still pretty close to the highs of the year, with Alphabet - down 13% from it’s YTD high - hitting the quicksand hardest.

On the valuation front, it’s been a mixed bag with most companies seeing their P/E multiples goosed higher. The few that have actually become ‘cheaper’ (notably Eli Lilly and Amazon) mostly did so in the ‘good way’. Ie: While their shares have risen nicely (numerator), estimates for future earnings have increased by even more (dinomiminater).

Joke Of The Day

It's time to sell your stocks in the wood chip industry! The market is getting tu-mulch-uous.

What did the accountant do when his shift-key stuck? He capitalized everything.

Hot Headlines

CNBC / Port strike ends as workers agree to tentative deal on wages and contract extension. After a week-long strike that disrupted 14 ports, the International Longshoremen’s Association and U.S. Maritime Alliance agreed on a wage increase, ending the first dockworker strike since 1977. With operations resuming, the supply of goods like fruits and automobiles is expected to recover, but port automation remains a sticking point for future negotiations.

Reuters / US President Biden does not believe there will be 'all-out-war' in Middle East. Biden remains optimistic that an all-out conflict can be avoided in the Middle East, even as Israel contemplates its next steps following Iran's missile strike. Looks pretty all-out to me.

CNBC / Ford reveals new 2025 Expedition SUV, including off-road and ‘Ultimate’ models. Ford’s latest Expedition redesign focuses on enhancing luxury and off-road capabilities. Looks the f***** the same.

Bloomberg / US Jobs Report is expected to show stable growth in September. That said, underemployment and slowing catch-up hiring in healthcare and government could still signal broader challenges ahead.

Yahoo Finance / McDonald’s is finally selling the Chicken Big Mac in the US. The Chicken Big Mac will be available at McDonald’s U.S. locations for a limited time starting October 10. The sandwich, which replaces beef with tempura chicken patties, saw massive success in the UK. As fast-food sales slow, McDonald’s hopes this new offering will attract more budget-conscious diners. In other news, plz sign my petition.

Bloomberg / Zuckerberg passes Bezos to become world’s second-richest person. The rich get richer.

Trivia

This week’s trivia is on early corporations and investing. Today’s trivia is on early stock trading.

What is considered the world's first stock exchange by modern standards?

A) The London Stock Exchange

B) The Amsterdam Stock Exchange

C) The New York Stock Exchange

D) The Tokyo Stock Exchange

The Buttonwood Agreement, signed in 1792, led to the creation of which stock exchange?

A) The London Stock Exchange

B) The Tokyo Stock Exchange

C) The New York Stock Exchange

D) The Amsterdam Stock Exchange

What was one of the primary reasons for the establishment of early stock exchanges?

A) Entertainment

B) Funding voyages and trade expeditions

C) Gambling

D) Social gatherings

(answers at bottom)

Market Movers

Winners!

EVgo (EVGO) [+60.8%] JPMorgan upgraded EVgo to overweight, pointing out that higher usage and charging rates make it a promising pick despite the slow EV market.

Rezolve Ai (RZLV) [+5.3%] Rezolve Ai just partnered with Microsoft to power its Brain Suite using Azure, which should give it a nice boost.

Wolverine World Wide (WWW) [+4.9%] Wolverine's Saucony brand got a nice upgrade thanks to new retail accounts and big growth in China.

Constellation Energy (CEG) [+4.5%] Google’s CEO hinted that they’re exploring nuclear power options for their data centers, which is big news for Constellation.

Nvidia (NVDA) [+3.3%] NVIDIA's CEO says demand for their Blackwell product is off the charts, and they’re ramping up production.

Southwest Airlines (LUV) [+3.2%] Southwest got a bump after director Rakesh Gangwal revealed some big insider stock purchases and voiced opposition to further leadership changes.

Losers!

Ingevity (NGVT) [-11.8%] Ingevity's CEO is stepping down, and they've named an interim leader while they search for a permanent replacement.

Hims & Hers Health (HIMS) [-9.6%] Hims took a hit after the FDA removed Lilly’s weight loss drug from the shortage list, which could put more pressure on compounded GLP-1 meds.

Levi Strauss (LEVI) [-7.7%] Levi's beat on earnings but cut their sales guidance, citing weak wholesale numbers despite margin expansion and solid DTC business.

Wolfspeed (WOLF) [-5.9%] Wolfspeed got downgraded due to softer global EV sales and rising supply from China for silicon carbide.

Stellantis (STLA) [-4.0%] Stellantis was downgraded after warnings about US inventory issues and falling market share in the US and Europe.

Humana (HUM) [-1.9%] Humana was downgraded on concerns that losing its top Star rating position could cut into Medicare revenue and hurt 2026 earnings.

Market Update

Trivia Answers

B) The Amsterdam Stock Exchange is considered the first modern stock exchange.

C) The Buttonwood Agreement created what became the New York Stock Exchange. It’s called that because prior to the agreement, traders and merchants would meet under a buttonwood tree near Wall Street to transact.

B) Funding voyages and trade expeditions was the initial reason for creating stock exchanges.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Great stuff..

Thx. Fun one to write