🔬Luxury Companies Pt. II: LVMH - The Devil Wears Prada, the Terminator wears Brunello

Plus: Housing starts sucked (not good); Ticketmaster is getting sued for antitrust (good); banks reporting is solid but no one told their share prices; and much more.

"Only when the tide goes out do you discover who's been swimming naked."

- Warren Buffett

“There is only one thing in the world worse than being talked about, and that is not being talked about.”

- Oscar Wilde

Another down day for the big US markets as this sell-off seems to take hold. The S&P 500 was down 0.2% and the Nasdaq 0.1%.

3 of 11 sectors closed higher, led by a rebounding Tech (+0.2%). Interest sensitive Real Estate (-1.5%) and Utilities (-1.4%) had it the worst.

Trump Media had another bad day to close down 14% following Monday’s 18% drop.

March housing starts missed big, coming in at 1.321 million vs. Street hopes for 1.483 million. This represented a 14.7% drop since February.

Street Stories

Luxury Companies Pt. II: LVMH

The Devil Wears Prada, the Terminator wears Brunello

This is a continuation from yesterday’s note in case you missed it.

No company in the world sells more stuff that you can’t afford than LVMH, and few companies have been so ruthlessly successful either. That’s why it’s founder, Bernard Arnault, is now the richest man in the world.

Arnault got his start after acquiring Financière Agache, a luxury goods company. His big break was acquiring bankrupt conglomerate, Boussac Saint-Frères, for one franc. Mostly a middling textile manufacturer, Boussac Saint-Frères did have two jewels: the Christian Dior brand and the department store Le Bon Marché. Within a few years Arnault had laid off 9,000 workers - earnings him his moniker ‘The Terminator’ - and sold off everything but Dior and Le Bon Marché.

The French Gordon Gekko continued by winning a savage hostile take-over of newly formed LVMH, and subsequently fired its creator, Henri Serge Racamier. Dude has ice in his veins.

What came next was a string of hyper successful acquisitions, that transformed the world of luxury goods from small bespoke, generational businesses, into the efficient, gross-margin machines of the new world of conglomerate luxury.

François-Henri Pinault at Kering (Gucci, Yves Saint Laurent, Balenciaga) would follow suit, as would Capri (Micheal Kors, Versace, Jimmy Choo) and many others, but the archetype and most successful would be Arnault and his LVMH juggernaut.

The business, originally heavily weighted towards wine and spirits, has pivoted to dominate the world of high fashion. And also led the charge of turning brands formerly sold at department stores and luxury retailers, into vertically integrated machines that extract nearly every retail dollar. This allows them hyper control over their branding and product positioning. No more Fendi purses on marked down racks in the back corner.

Perhaps one of the most amazing things about LVMH, albeit not a particularly sexy one, is the capital discipline employed by the company. Usually when you hear of people making mega conglomerates or roll-up stories, there is usually an extreme amount of debt being issued.

That hasn’t been the case with LVMH, which has a AA- credit rating from S&P (Aa3 from Moody’s). In fact, the modest debt level is only above historical levels as a result of the 2021 $16 billion Tiffany’s acquisition, and has been steadily falling ever since.

Moreover, they haven’t even had to use their shares heavily as currency in acquisitions. This $420 billion dollar behemoth was build almost entirely out of shrewd deals, cunning and free cash flow.

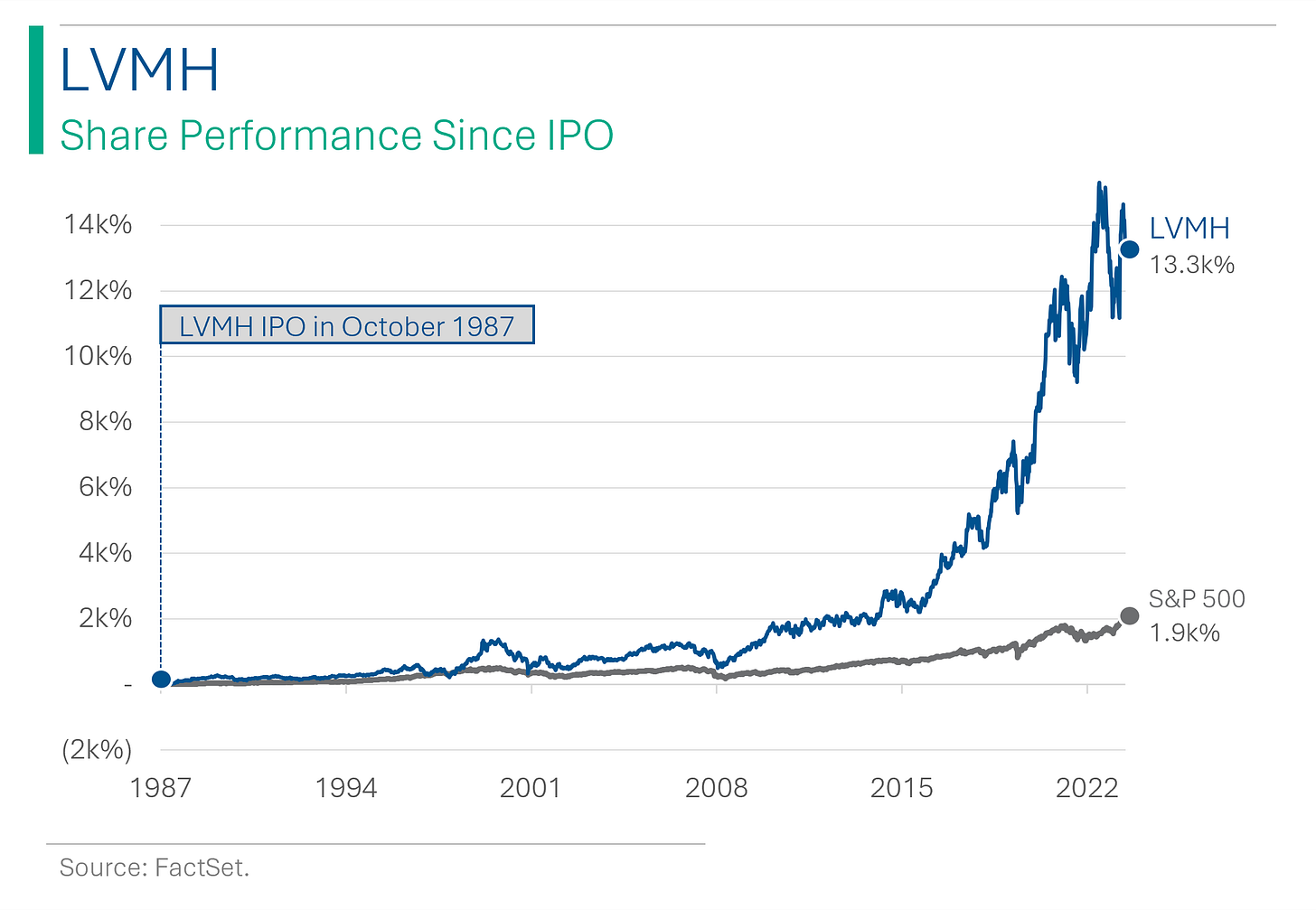

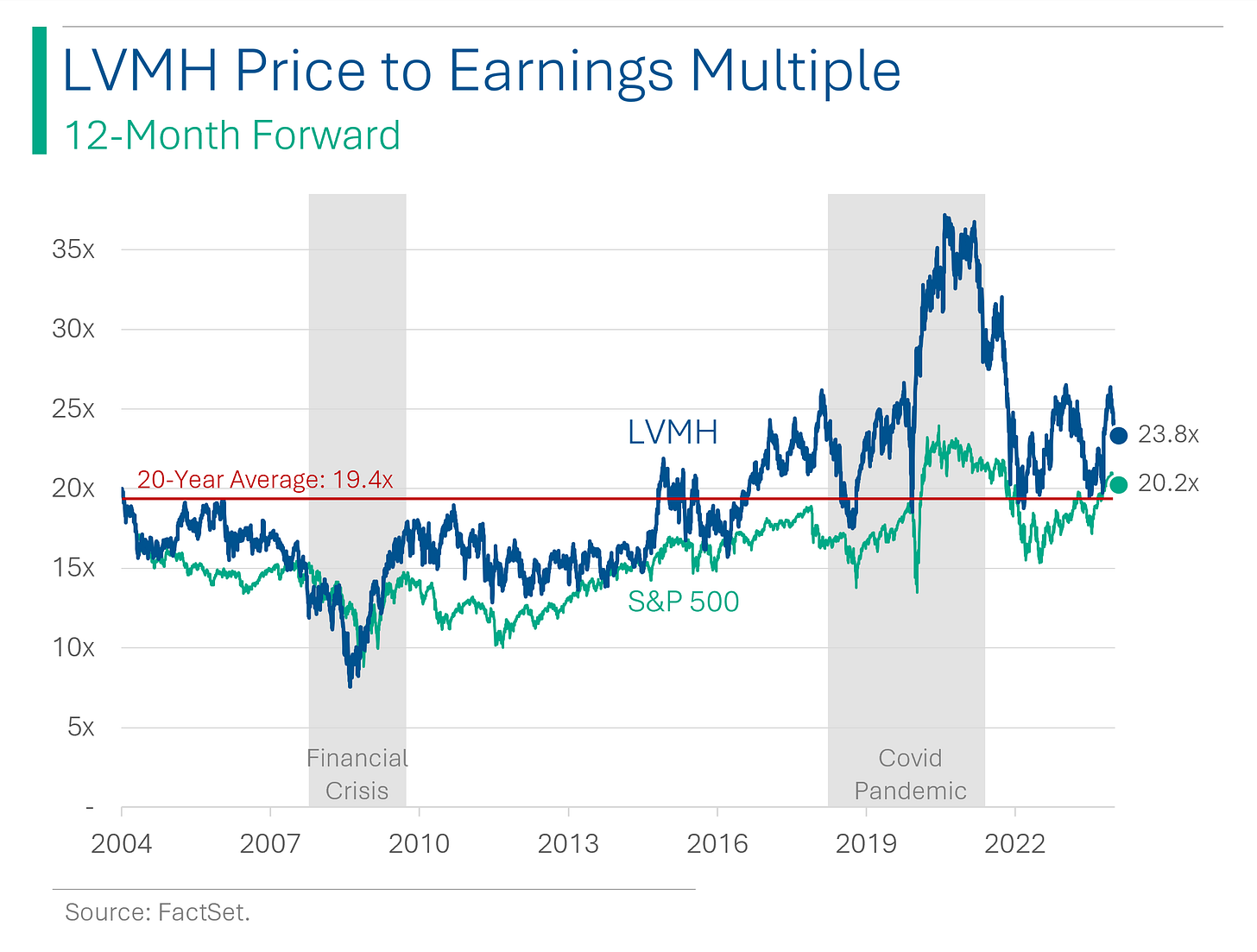

On the valuation front, the company has never really been ‘cheap’ - but outperforming the market by 7x over 36 years certainly warrants a premium.

Now that it’s the King, and rules over the fashion and luxury world, it would be easy to think LVMH’s best years are behind it. But a growing luxury market and excellent - if cut throat - management will likely see this business continue to grow for years. Pivots into new categories, like luxury travel and resorts, will help.

Too bad my fashion sense ends at Nike and Reebok, or I might have learned more about this great company a lot earlier.

Housing Starts Tumble

March housing were a massive disappointment, dropping significantly to 1.321 million, a 14.7% decline from February, and well below the expected 1.483 million. Building permits also decreased by 4.3% month-over-month to 1.458 million, though they showed a modest annual increase of 1.5%.

Is the grim interest rate outlook scaring away some of the builders?

Ticketmaster Antitrust Lawsuit

The U.S. Department of Justice is reportedly preparing to file an antitrust lawsuit against Live Nation Entertainment, the parent company of Ticketmaster, next month amid ongoing investigations into its potentially anticompetitive practices.

This pivot from their cozy 2010 nod to the Live Nation-Ticketmaster merger highlights a growing distaste for the company’s stranglehold on ticket prices and market dominance.

The controversy intensified following a major ticketing failure during Taylor Swift's 2022 'Eras Tour' presale, exacerbating public and regulatory scrutiny of Ticketmaster's control over the live event ticketing market. And pissing off a million Swifties

Bank Reporting

With five of the big US banks reported, the numbers in finance land look to be strong as everyone so far has recorded beats across Revs and EPS.

Although the weakness in the market has quickly eroded most of the gains made in their shares from reporting. Please don’t feel too bad for Goldman Sachs.

Joke Of The Day

Did you hear they arrested the devil? Yeah, they got him on possession.

What did one DNA say to the other DNA? “Do these genes make me look fat?”

Hot Headlines

Reuters / Half of the 75 poorest countries in the world are getting poorer. These countries are experiencing a widening income gap with the wealthiest economies for the first time this century in a historic reversal of development, the World Bank said in a report.

CNBC / ECB's Lagarde says interest rate cuts may be coming, but waiting to build ‘a bit more confidence’. Notes that disinflationary pressures are working but is cautious about the impact to the oil market from middle east conflicts.

Investing.com / JP Morgan sees more downside risk at Tesla despite the massive declines so far this year. Firm claims that it’s weak demand and not supply issues that have suppressed sales.

Bloomberg / LVMH reports slowest quarterly growth since the pandemic. Biggest division Fashion and Leather Goods saw sales rise 2% vs. 18% growth last year. They couldn’t have waited until after I wrote my glowing appraisal of them?

CNBC / Trump Media says Truth Social to launch TV streaming but shares close down more than 14%. This follows an 18% decline Monday after the company announced it would be selling more shares.

Trivia

Today’s trivia is on LVMH Moët Hennessy Louis Vuitton.

LVMH broke the $50 billion in revenue milestone in what year?

A) 1999

B) 2005

C) 2018

D) 2021Which of the following fashion houses is NOT owned by LVMH?

A) Fendi

B) Dior

C) Gucci

D) GivenchyWhich of the following champagne labels is NOT owned by LVMH?

A) Veuve Clicquot

B) Krug

C) Dom Pérignon

D) TaittingerIn what year did LVMH acquire Tiffany & Co., its largest acquisition ever

A) 2008

B) 1995

C) 2021

D) 2015

(answers at bottom)

Market Movers

Winners!

Intra-Cellular Therapies (ITCI) [+23.3%] Announced positive results from Study 501 using lumateperone 42 mg as an adjunct therapy for major depressive disorder with antidepressants.

Super Micro Computer (SMCI) [+10.6%] Loop Capital Markets increased target price to $1,500 from $600, citing its leadership in the gen AI server industry.

Envestnet (ENV) [+9.3%] Exploring strategic options including a sale after takeover interest; retained an advisor to potentially sell Yodlee, acquired for $590M in 2015.

UnitedHealth Group (UNH) [+5.2%] Q1 earnings and revenue exceeded expectations despite cyberattack disruptions; lower taxes helped, Optum showed strong results; maintained FY EPS guidance.

Morgan Stanley (MS) [+2.5%] Q1 EPS and revenue surpassed forecasts; investment banking segment excelled with significant underwriting gains; wealth and investment management revenues also above expectations; expenses rose on higher than anticipated compensation costs.

Losers!

Live Nation Entertainment (LYV) [-7.6%] Justice Department reportedly preparing to file antitrust lawsuit against the Ticketmaster parent next month.

Barrick Gold (GOLD) [-5.1%] Reported lower preliminary Q1 production for gold and copper due to maintenance at gold mines and lower grade at copper mines.

Bank of America (BAC) [-3.5%] Q1 EPS better with NII and fees beating consensus; strong IB and trading; guided Q2 NII slightly better than Street, anticipates growth in H2; concerns about higher expenses and weaker credit metrics noted.

Market Update

Trivia Answers

C) LVMH broker $50 billion in 2018 ($55.2 billion).

C) Gucci isn’t part of LVMH, it’s part of rival Kering.

D) Taittinger is owned by Barry Sternlicht’s Starwood Capital Group.

C) LVMH bough Tiffany & Co. in 2021 for just under $16 billion.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

There is no way you’re producing this much content every day on your own!