🔬Lululemon Pt. 2: Flex Appeal or Stretched Thin?

Plus: Job numbers hit multi-year low; Trump's stock hits record low; Chris in Parks & Rec was played by Robe Lowe; and much more!

"Chase the vision, not the money; the money will end up following you."

-Tony Hsieh

"Leadership is the art of getting someone else to do something you want done because he wants to do it."

- Dwight D. Eisenhower

Mixed day for the big US markets, with the S&P 500 -0.3% and Nasdaq +0.3%. A minor relief rally in Tech was responsible for the differing fortunes.

3 of 11 sectors closed higher led by Discretionary (+1.4%) and Comm. Services (+0.5%). Health Care had the worst day, down -1.4%.

August ADP Private Payrolls printed at 99K, well below consensus for 141K (see below).

Notable companies:

Tesla (TSLA) [+4.9%]: Planning to introduce Full Self-Driving (FSD) in Europe and China in Q1, pending regulatory approval.

G-III Apparel Group (GIII) [+22.0%]: Q2 earnings and operating margin beat expectations, despite lighter revenue, with sales strength in DKNY, Karl Lagerfeld, and Donna Karan; announced licensing agreement with Converse and raised full-year EPS guidance.

Hewlett Packard Enterprise (HPE) [-6.0%]: FQ3 EPS and revenue beat expectations driven by strong AI server demand, but gross margins missed; FQ4 guidance was in line, though margin dilution remains a concern.

Street Stories

Lululemon Pt. 2: Flex Appeal or Stretched Thin?

Today is Part Deux in my deux part Lululemon deep-dive. Yesterday I dug into the operations and financials, and today I check-out the athletic apparel market and the valuation.

Picking up from yesterday, Lululemon has consistently grown revenue and profits like clockwork, and save for a few oopsies - like a CEO with foot-in-mouth syndrome - hasn’t put a foot wrong brand-wise.

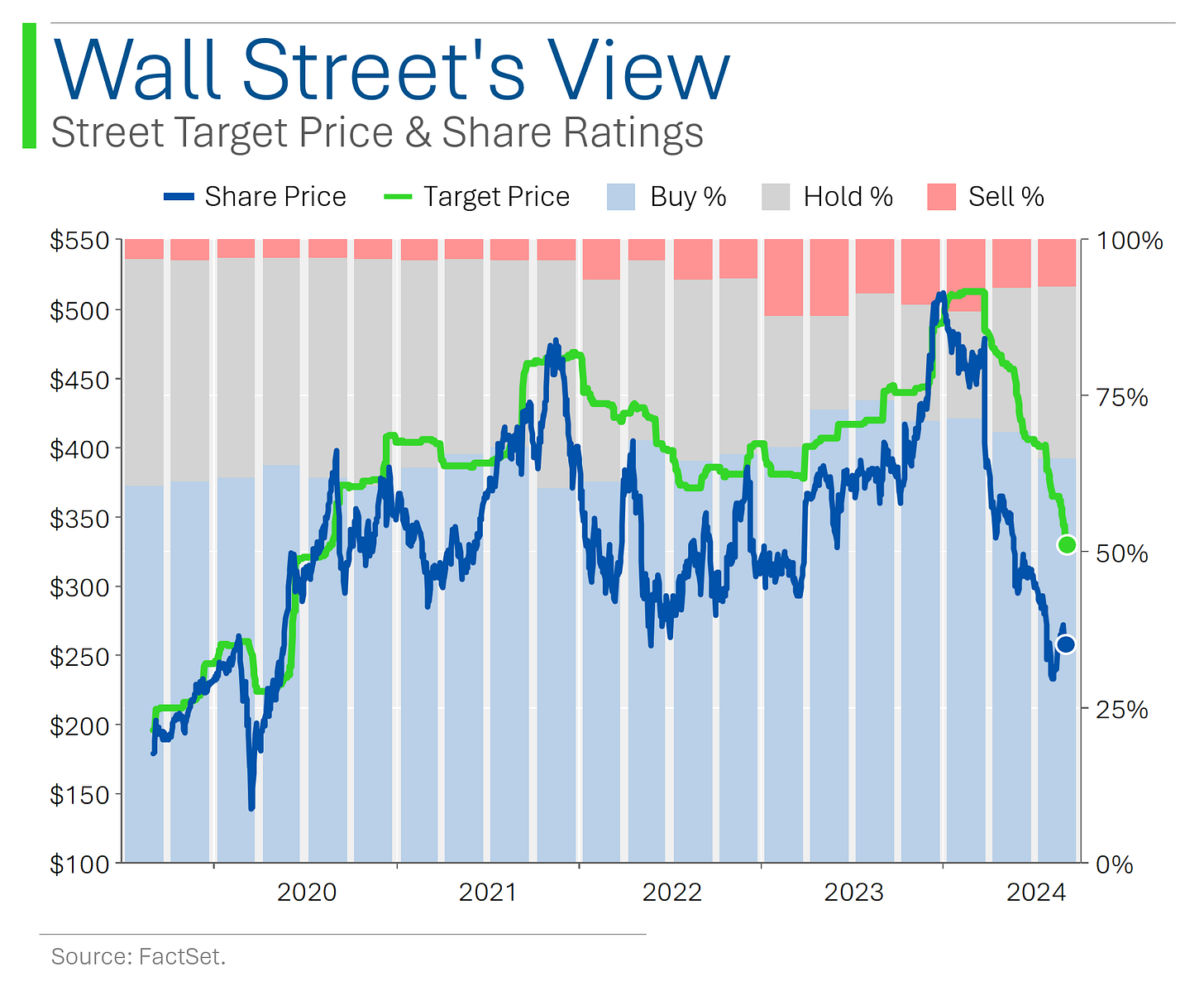

But despite this, the stock is down ~50% since it’s 2023 all-time high and Wall Street’s average target price has been in free-fall.

So what exactly isn’t there to like about Lulu?

Well, to start, growth has been great but the future has some question marks - which seem to be growing every time management speaks.

For example, below you can see that when the company reported their last three quarters, Wall Street ended up lowering their revenue estimates.

Maybe don’t talk so much? Solved.

You see, the company faces challenges, including the failed launch of Breezethrough leggings and increased competition from Vuori and Alo Yoga, which have impacted performance. The departure of their Chief Product Officer in May 2024 was another big hit as it put them on the back foot for product innovation.

And just generally, the athletic apparel market has become quite saturated and seems to be having trouble lapping the pandemic ‘athleisure’ buying spree. In fact, Lululemon is doing the best out of all their big athletics peers…

Investors have really fallen out of love with the space but it still seems like Lulu is taking it on the chin here as they’ve easily been the strongest company.

Part of that sell-off definitely had to do with their valuation: High single-digit revenue growth and low double-digit EPS growth is great but generally wouldn’t justify a multiple as lofty as Lulu’s was.

That said, at 17.4x the company now trades at a forward price to earnings multiple at a material discount to the S&P 500 despite higher levels of expected growth.

And this discount persists even compared to their athletics and outdoor peers, where only Crocs (yuck) trades at a discount.

This is despite some of the highest expected growth in the industry, where Wall Street expects revenue growth over the next three years to average an impressive +8.4%. Pretty nifty - assuming they don’t cut guidance (again).

To wrap this up, Lululemon deserved to have it’s shares come back to earth due to their cooling growth and question marks around competition and product innovation. But - assuming they don’t continue to slash their sales forecasts - there is definitely the potential that the market’s over done it. TBD.

Job Market Hits the Snooze Button

New ADP data reveals the private sector added just 99K jobs in August, the lowest since January 2021 and well below the 145K expected.

This marks five consecutive months of payroll growth deceleration. Economists are watching closely as the labor market continues to cool, with job openings also down to 7.67 million…the lowest since January 2021.

Weekly jobless claims dipped to 227k, signaling fewer layoffs, but the slowing hiring pace could signal a larger economic trend. While market expectations now show a 45% chance of a 50 basis point rate cut at the Fed’s September meeting, up from 34% a week ago.

All eyes are on the August jobs report (released Friday), where analysts expect 165k new jobs and a dip in unemployment to 4.2%. Which seems a bit iffy at the moment…

Trump Stock & Poll Numbers Continue Slide

Trump Media & Technology Group (DJT) has taken a nosedive, with shares down 69% since its May peak. The stock is now valued at less than $3.4 billion, compared to more than $9 billion just months ago.

Importantly, the lockup period on insider shares is set to expire on September 19th, which could lead to a flood of shares hitting the market.

Moreover, betting markets now give Trump and Harris almost equal odds in the ring and that definitely isn’t helping Trump’s case…

Joke Of The Day

How can you tell someone is into crypto? They’ll f****** tell you.

Hot Headlines

Bloomberg / Airline Loyalty Programs Under Investigation. The U.S. Department of Transport is looking into Delta, American, United, and others over potential legal violations relating to transparency and fairness in how miles are issued and redeemed.

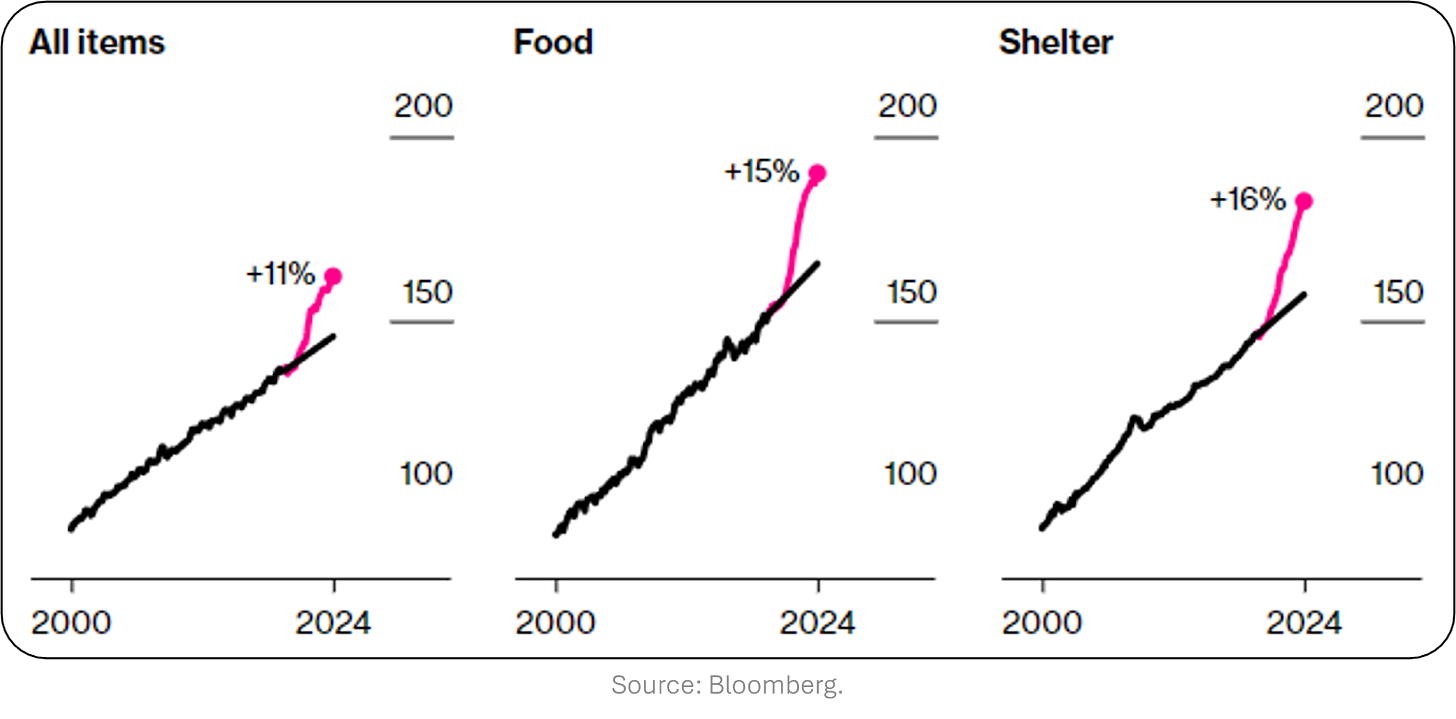

CNBC / Union for Port Workers Voices Full Support for Strike, Raising U.S. Economic Fears. The U.S. International Longshoremen’s Association - the largest union for port employees - is backing ongoing strike actions, sparking fears over disruptions to already fragile supply chains. Talks have stalled, and analysts warn of major shipment delays, which could exacerbate inflation and slow economic growth.

Bloomberg / Trudeau's Re-election Strategy Shaken by Loss of Key Ally. The Canadian Prime Minister’ coalition between his Liberal Party and the New Democratic Party has been torn up amid growing economic and social challenges. Re-election odds look worst than Canadian inflation…

Yahoo Finance / Red Lobster Receives Court Approval for Restructuring Plan. The company’s Chapter 11 bankruptcy plan got the green light, allowing it to close underperforming locations and restructure debt. Still can’t believe all-you-can-eat-shrimp was the nail in the coffin.

Yahoo Finance / Larry Ellison Seeks Control of Paramount in Potential Deal.

The Oracle Founder’s son David is leading the Skydance deal to acquire National Amusements stake in the production company but Larry will end up with 77.5% through a trust and series of corporations.

Reuters / Goldman Sachs says S&P 500 Could See 5% Earnings Hit from Harris’ Proposed Tax Reforms. While a softer proposal than Biden’s original plan, the bank predicts that the proposed 28% capital gains tax could cut S&P 500 earnings by materially.

Trivia

Today's Trivia Is On Precious Metals and Financial History:

During the California Gold Rush, which year marked the peak of gold discovery that sent waves of fortune-seekers to the American West?

A) 1849

B) 1855

C) 1861

D) 1873Which metal, heavily mined in the Comstock Lode in Nevada during the mid-1800s, helped finance the growth of San Francisco and was critical to the U.S. economy?

A) Silver

B) Platinum

C) Gold

D) CopperIn 1933, which U.S. President issued an executive order to ban private ownership of gold, requiring citizens to turn it in to the government?

A) Herbert Hoover

B) Franklin D. Roosevelt

C) Harry S. Truman

D) Woodrow WilsonWhat metal, prized for its catalytic properties, is most commonly used in automotive catalytic converters to reduce harmful emissions?

A) Silver

B) Gold

C) RhodiumD) Platinum

Which event in 1971 effectively ended the Gold Standard, leading to floating exchange rates and significantly impacting global financial markets?

A) Bretton Woods Conference

B) The Plaza Accord

C) Nixon Shock

D) Marshall Plan

(answers at bottom)

Market Movers

Winners!

G-III Apparel Group (GIII) [+22.0%]: Q2 earnings and operating margin beat expectations, despite lighter revenue, with sales strength in DKNY, Karl Lagerfeld, and Donna Karan; announced licensing agreement with Converse and raised full-year EPS guidance.

Shoe Carnival (SCVL) [+8.2%]: Q2 revenue and EPS slightly better, raising the low-end of full-year guidance as customer engagement and sales momentum accelerated during the back-to-school season.

Casey's General Stores (CASY) [+7.4%]: FQ1 earnings exceeded expectations, though revenue came in light, with fuel sales a bright spot and analysts praising improved margins in Grocery/General Merchandise.

JetBlue Airways (JBLU) [+7.2%]: Revised Q3 revenue guidance higher due to improved operational performance, lower fuel prices, better bookings, and progress on revenue initiatives.

Roku (ROKU) [+5.0%]: Upgraded by Wells Fargo citing stronger engagement and monetization in the Roku Channel, setting the stage for stronger platform revenue growth through Q4.

Tesla (TSLA) [+4.9%]: Planning to introduce Full Self-Driving (FSD) in Europe and China in Q1, pending regulatory approval.

Smartsheet (SMAR) [+4.3%]: Reuters reported the company is in talks to be acquired by a group including Blackstone and Vista Equity Partners, with no terms disclosed yet.

Planet Fitness (PLNT) [+3.5%]: Upgraded by BNP Paribas Exane due to upside from pricing increases, new marketing efforts, improved member experience, and a reacceleration of store openings into 2025.

Fortive (FTV) [+1.5%]: Announced the spin-off of its Precision Tech segment, which is expected to drive multiple expansion and capital returns, while reducing M&A risk.

Losers!

Verint Systems (VRNT) [-11.2%]: Q2 earnings and revenue missed expectations, though strong AI momentum was noted; headwinds from SaaS deal timing impacted results, but FY guidance was reaffirmed and a new $200M buyback was announced.

Toro Co. (TTC) [-10.1%]: FQ3 earnings and revenue missed, with strong residential results offset by weak professional segment performance; lower shipments of lawn-care products led to cuts in full-year EPS and revenue guidance.

McKesson (MCK) [-9.9%]: Announced the sale of Rexall and Well.ca businesses to Birch Hill Equity Partners, with undisclosed terms.

XPO, Inc. (XPO) [-9.6%]: Reported a 4.6% y/y decline in August tons per day, with a soft industrial market impacting results; management expects margin expansion due to cost control measures.

Frontier Communications (FYBR) [-9.5%]: Verizon confirmed acquisition for $20B in cash, with consideration slightly above prior close; transaction expected to finalize in approximately 18 months.

Zimmer Biomet Holdings (ZBH) [-8.7%]: Disclosed a "temporary challenge" in transitioning its legacy ERP system, which is expected to negatively impact FY sales by about 1%.

C3.ai, Inc. (AI) [-8.2%]: FQ1 EPS and margins beat with revenue in line, though subscription revenue missed; analysts highlighted the company's dependency on Baker Hughes, which represents about 33% of FY25 revenue.

Copart (CPRT) [-6.7%]: FQ4 earnings and margins missed expectations, with a decline in global ASPs, though US prices remained more resilient; analysts were concerned about the lack of clarity regarding decelerating volumes.

Hewlett Packard Enterprise (HPE) [-6.0%]: FQ3 EPS and revenue beat expectations driven by strong AI server demand, but gross margins missed; FQ4 guidance was in line, though margin dilution remains a concern.

Old Dominion Freight Line (ODFL) [-4.9%]: Reported a year-over-year decline in revenue per day due to lower LTL shipments and weight per shipment, reflecting softness in the US economy and lower fuel surcharge revenue.

UTZ Brands (UTZ) [-1.8%]: Guided full-year organic net sales lower, primarily due to expectations of a more competitive promotional environment in the second half of 2024.

Market Update

Trivia Answers

A) The peak of the California Gold Rush was 1849, leading to the nickname "49ers" (and a football team!).

A) Silver from the Comstock Lode was critical in financing the growth of San Francisco and the U.S. economy.

B) Franklin D. Roosevelt issued the executive order to ban private gold ownership in 1933.

D) Platinum is the metal used in catalytic converters due to its catalytic properties.

C) The Nixon Shock of 1971 ended the convertibility of the U.S. dollar to gold, leading to the collapse of the Gold Standard.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.