🔬Lululemon: Namaste Bearish?

Plus: Nvidia breaks records... even really bad ones; Dollar Tree's struggles are all out problem; and much more!

"Show me the incentive and I will show you the outcome"

- Charlie Munger

“If I had asked people what they wanted, they would have said faster horses.”

- Henry Ford

Mixed day for the big US markets with the S&P 500 -0.2% and Nasdaq -0.3%.

5 of 11 sectors closed higher, with the defensives looking the best (Utilities +0.8%; Staples +0.5%). Energy (-1.4%) was worst with crude down another 1.6% after another day of OPEC+ production headings.

Notable companies:

United States Steel (X) [-17.5%]: Shares fell after reports indicated President Biden plans to block Nippon Steel's proposed acquisition of U.S. Steel.

Frontier Communications (FYBR) [+38.0%]: Shares surged on reports of a potential acquisition by Verizon, with a deal announcement expected soon.

Zscaler (ZS) [-18.7%]: Despite beating on FQ4 earnings and margins, weaker-than-expected guidance for FQ1 and FY25 led to concerns about deceleration in billings growth due to seasonality.

Street Stories

Lululemon: Namaste Bearish?

There once was a time when Lululemon apparel was trendy and cool, but that was a long time ago.

There was also a time when its shares weren’t complete downward-dog-s***. That was a long time ago too…

Today I dive into Lululemon to see if the juice is worth the squeeze. Go time!

Lululemon was founded in 1998 in Vancouver, Canada and quickly established itself as the leader in the nascent yoga apparel market. An IPO followed in 2007 and the company has been a rocket ship ever since.

That’s not to say the company has been without its stumbles or controversies, such as Founder Chip Wilson’s ‘stepping down’ from the CEO role in 2013 after espousing some less than body-positive views on certain of their customers.

Most recently, however, the company has been raked over the coals after reporting a second quarter that was poorly received by Wall Street.

Specifically, the company took a bit of a hatchet to their previous guidance for fiscal 2025:

2025 Revenues: $10.4 to $10.5 billion vs. prior guidance of $10.7 to $10.8 billion (down 3.0% at the mid-point).

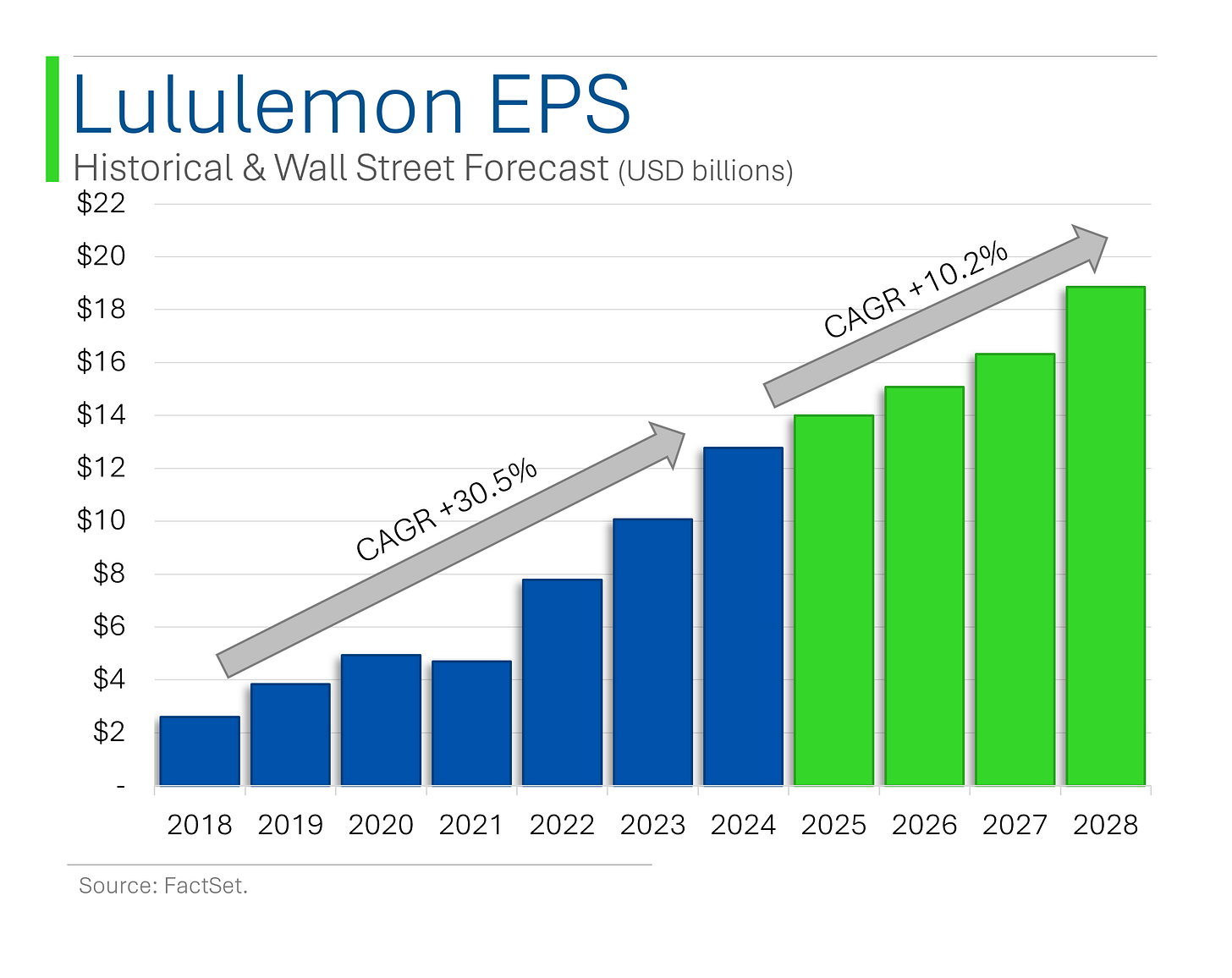

2025 EPS: $13.95 to $14.15 vs. old guidance for $14.27 to $14.47 (down 2.2% at the mid-point).

That said, the company has basically been the Michael Phelps of reporting season so maybe they deserve a wee bit of slack?

And it’s not like they’ve all of a sudden turned into a dumpster fire: revenue growth may be cooling off, but Wall Street is still forecasting high-single-digit growth for the foreseeable future.

And Earnings Per Share is expected to do even better.

Part of that EPS growth is due to a positive mix-shift as E-Commerce displaces company stores as the biggest revenue contributor - bringing its higher margins with it.

The rate of physical store openings has also cooled down as a percentage but still remains quite healthy at +50 new stores per year, while closures have only ever ticked above 10 per year twice (2018 and 2021).

Not exactly seeing a lot of red flags…

So if they keep crushing earnings and growing steadily (and the Founder has been secretly assassinated), why the meltdown?

Well, the outlook for the company does have some issues, such as a failed product launch of Breezethrough leggings, and intensified competition from brands like Vuori and Alo Yoga have also impacted its performance.

Additionally, the departure of their Chief Product Officer (May 2024) further complicated matters during a time when product innovation was crucial for customer engagement.

That, and the stock hasn’t exactly been cheap until recently.

This is probably a good place to call it for today. Check in tomorrow for Part Deux where I dig into the athletics industry, the peers and valuation.

Dollar Tree: Economic Pressures Lead to Slashed 2024 Outlook

Dollar Tree just hit a major hurdle, with shares plunging 12% yesterday after the company posted disappointing Q2 earnings and slashed its full-year profit outlook. EPS dropped 26% to 67 cents per share, about a mile below analyst expectations of $1.04.

Revenue wasn’t much better, coming in at $7.37 billion, missing the forecasted $7.49 billion.

Dollar Tree cut its 2024 profit guidance to $5.20-$5.60 per share, down sharply from its previous expectation of $6.50-$7.00.

Revenue guidance also took a hit, now expected to fall between $30.6-$30.9 billion, a downgrade from the earlier range of $31-$32 billion.

This signals deeper concerns for the U.S. consumer. Inflation continues to squeeze budgets, and even bargain shoppers are feeling the pressure.

Dollar stores, often seen as a safe haven during economic uncertainty, are finding that their core customers are being stretched too thin to provide much of a boost.

Nvidia’s Chip Dip: DOJ Probe Sparks $279 Billion Meltdown

Nvidia is taking a beating, with the stock tumbling further after the DOJ issued subpoenas in its expanding antitrust investigation. The probe, which now includes legally binding requests for information, focuses on Nvidia’s dominant position in AI chips and concerns about its market practices.

This has triggered THE LARGEST SINGLE DAY STOCK DECLINE IN HISTORY, with Nvidia’s market cap dropping $279 billion as shares took a 9.5% faceplant.

I’m personally glad they were able to finally get the high score after so many valiant efforts…

Joke Of The Day

Two whales walk into a bar.

The first whale says "WHOOOOWAGPOOOOOEEEE"

The second whale says "God damnit Frank, you're already drunk.

Hot Headlines

Reuters / Intel Contract Manufacturing Business Suffers Setback as Broadcom Tests Disappoint. The company has bet heavily to become the world’s number two chip contractor after TSMC but it’s off to a rocky start. Shocker.

Washington Post / Biden Preparing To Block Nippon Steel Purchase Of U.S. Steel. As Nippon Steel tries to buy into American manufacturing, President Biden is putting his foot down. The administration cites national security concerns, however, though some analysts wonder if it's really about union votes in swing states.

CNBC / Harris Unveils Plan For 28% Capital Gains Tax, Softening Biden’s Proposal For 40% Rate. In a shift from Biden's 39.6% proposal, Kamala Harris unveiled a plan for a 28% capital gains tax for high-income households. Expect more business-friendly policies as she faces off with Trump on Sept. 10. Borrowing isn’t stealing…

Bloomberg / Lyft To Dispose Some Bike Assets and Cut Jobs In Overhaul. Lyft is pumping the brakes on its bike and scooter game, ditching some assets and cutting 1% of its workforce to keep costs in check. With up to $46 million in restructuring charges on the horizon, it's all part of a bigger plan to steer back to profitability. So…e-bikes still on the radar, but dockless scooters, not so much.

Yahoo Finance / Apple’s iPhone 16 Launch Is A Big Test For Consumer AI. Apple is betting big on AI with the iPhone 16 launch, positioning its new Apple Intelligence as the must-have feature for consumers. But can summarizing texts and organizing emails really move the needle, or is this just Apple jumping on the AI bandwagon? Monday’s event will be the ultimate test. Investors are watching, and so are we.

CNBC / Sweden’s Volvo Cars Scraps Plan To Sell Only Electric Vehicles By 2030. Volvo has hit the brakes on its 2030 all-electric vehicle goal, now planning for up to 10% of its lineup to include hybrid models. Citing market shifts and cooling demand, the automaker says it’s staying “pragmatic” while still leading the charge on electrification…just with a bit more flexibility.

CNBC / Job Openings Fell More Than Expected In July In Another Sign Of Labor Market Softening. The labor market is cooling fast, job openings in July dropped to their lowest point in over three years, falling to 7.67 million. With layoffs on the rise and hires slightly ticking up, this could give the Fed more reason to consider cutting interest rates in their upcoming meeting. Keep an eye out for Friday’s jobs report for more clues on where the economy is headed next.

Trivia

Today's Trivia Is On The Fashion World:

Which luxury fashion brand, founded in the 19th century, was the first to establish a high-end retail store in Paris, revolutionizing the luxury market?

A) Hermès

B) Louis Vuitton

C) Chanel

D) DiorWhich designer transformed post-war fashion with the launch of the "New Look" in 1947, emphasizing femininity and elegance?

A) Karl Lagerfeld

B) Christian Dior

C) Hubert de Givenchy

D) Pierre BalmainWhich global conglomerate, known for its vast portfolio of luxury brands, including Louis Vuitton and Christian Dior, is currently the largest luxury goods group by revenue?

A) Kering

B) Richemont

C) LVMH

D) PradaWho took over as creative director of Gucci in 2015, bringing a new, eclectic style that revitalized the brand’s image?

A) Alessandro Michele

B) Tom Ford

C) Karl Lagerfeld

D) Hedi SlimaneWhich iconic fashion figure famously said, "Fashion fades, only style remains the same"?

A) Coco Chanel

B) Giorgio Armani

C) Yves Saint Laurent

D) Christian Dior

(answers at bottom)

Market Movers

Winners!

Frontier Communications (FYBR) [+38.0%]: Shares surged on reports of a potential acquisition by Verizon, with a deal announcement expected soon.

Gitlab (GTLB) [+21.6%]: Strong Q2 results and raised FY guidance drove the stock up, boosted by ARR tailwinds, Ultimate product upselling, and solid execution in a tough macro environment.

Saia Inc (SAIA) [+9.7%]: Tonnage and shipment trends for July and August beat expectations, with notable growth in daily shipments and tonnage.

Nasdaq (NDAQ) [+2.9%]: Upgraded to 'buy' by BofA due to its wide moat and high-growth potential in software and information services.

Sweetgreen (SG) [+2.1%]: TD Cowen upgraded Sweetgreen to 'buy,' citing opportunities in its Infinite Kitchens initiative and market expansion.

Ball Corp (BALL) [+1.5%]: Upgraded to 'overweight' by Morgan Stanley, highlighting medium-term earnings potential and a good buying opportunity after the recent pullback.

Losers!

Dollar Tree (DLTR) [-22.2%]: Q2 results missed expectations due to comp growth and EPS shortfall, with the company lowering FY EPS guidance, citing liability claims and weaker sales at both Dollar Tree and Family Dollar.

Zscaler (ZS) [-18.7%]: Despite beating on FQ4 earnings and margins, weaker-than-expected guidance for FQ1 and FY25 led to concerns about deceleration in billings growth due to seasonality.

United States Steel (X) [-17.5%]: Shares fell after reports indicated President Biden plans to block Nippon Steel's proposed acquisition of U.S. Steel.

Core & Main (CNM) [-15.8%]: Missed Q2 earnings and revenue estimates and lowered FY24 guidance, blaming weather disruptions and delayed growth, now expected in 2025.

REV Group (REVG) [-11.1%]: Q3 beat on EPS and EBITDA but missed on revenue; guidance was adjusted, with raised EBITDA expectations but lowered revenue forecasts for FY24.

Hormel Foods (HRL) [-6.4%]: Sales missed expectations for fiscal Q3, though margins led to an EPS beat, with FY revenue guidance lowered due to softer commodity markets and production issues.

Asana (ASAN) [-5.1%]: Positive Q2 earnings overshadowed by light billings, deal delays, and slower sales cycles, along with a CFO transition and lowered 2H growth guidance.

Dick's Sporting Goods (DKS) [-4.9%]: Strong Q2 performance, but despite raised FY EPS guidance, concerns over the level of the beat led to a slight stock dip.

Super Micro Computer (SMCI) [-4.1%]: Downgraded by Barclays due to uncertainty about AI margins and concerns over internal controls.

Intel (INTC) [-3.3%]: Reuters reported that Intel's contract manufacturing business failed a test with Broadcom, causing shares to decline.

ArcBest (ARCB) [-3.0%]: A soft Q3 mid-update and a downgrade by Wells Fargo, citing macro challenges and weaker tonnage in the LTL industry, impacted shares.

Amphenol (APH) [-1.0%]: Downgraded to neutral by BofA as Nvidia’s design changes could reduce Amphenol’s market share, increasing risk for future growth.

Market Update

Trivia Answers

Louis Vuitton was the first to establish a luxury retail store in Paris.

Christian Dior launched the "New Look" in 1947.

LVMH is the largest luxury goods group by revenue.

Alessandro Michele revitalized Gucci as its creative director in 2015.

Coco Chanel is known for the quote "Fashion fades, only style remains the same."

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Looking forward to the second part on LULU

Apparel is a tough business. I've been tempted to hold my nose and BTD.

Be interesting to contrast this vs another Canadian champ (ATZ) or the comeback of Abercrombie (ANF).