🔬 Lost in Transit: FedEx and UPS Struggle to Keep Up

Plus: Inflation is the Pound's new best friend; and much more!

“Good business leaders create a vision, articulate the vision, passionately own the vision and relentlessly drive it to completion.”

- Jack Welch

“It is useless to try to hold a person to anything he says while he’s madly in love, drunk, or running for office.”

- Shirley MacLaine

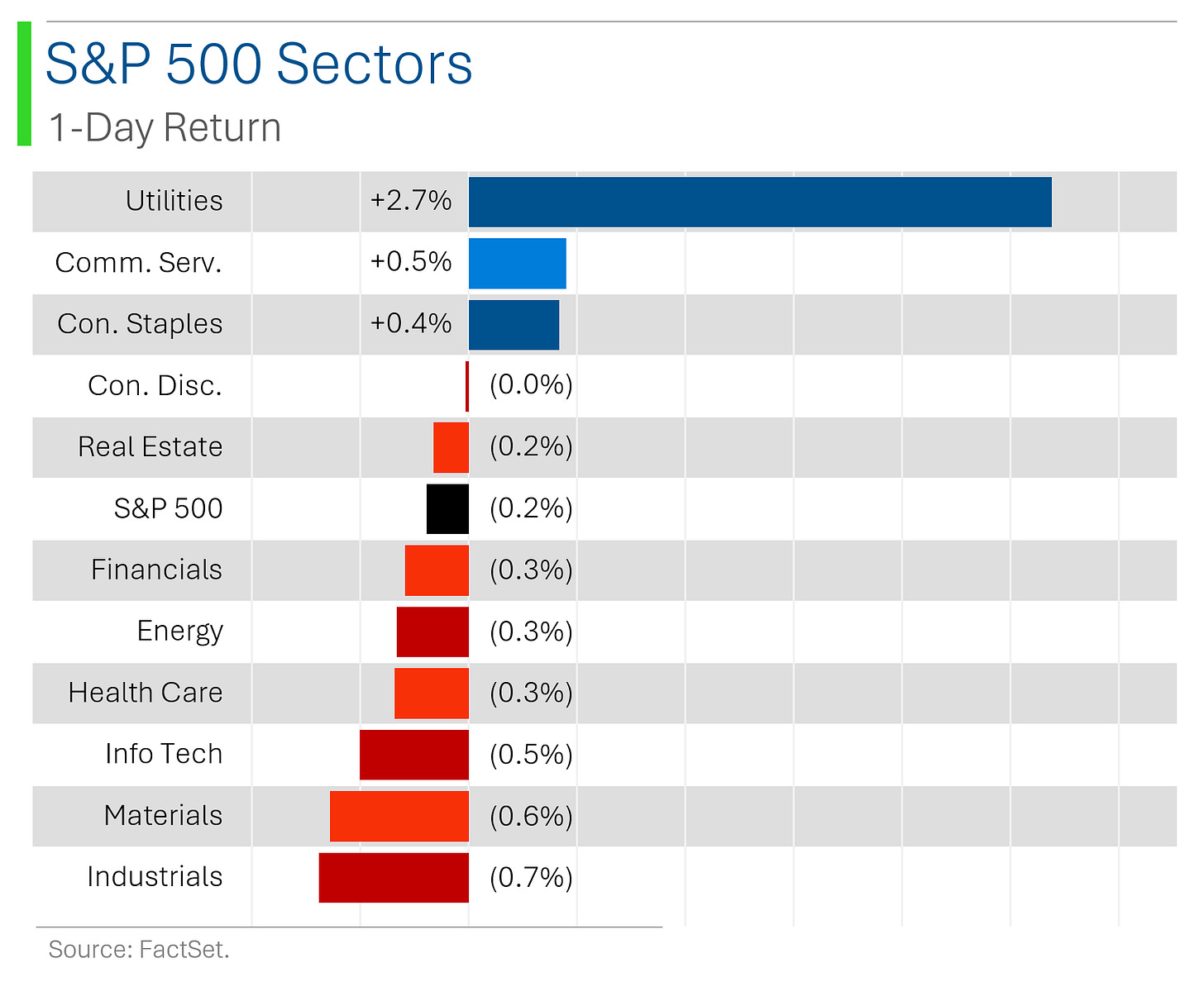

US equities dipped slightly on Friday, after Thursday's record highs: Weakness was seen in parcels/logistics (FDX), semis, homebuilders, and autos, while utilities (CEG), apparel (NKE), and airlines outperformed. Treasury yields were mixed, the dollar edged up 0.1%, and gold hit record highs with a 1.2% gain.

The bullish narrative continues with optimism around the Fed's 50 bp rate cut: BofA noted a potential 10% upside in the months following the cut, while dovish comments from Fed officials and resilient economic growth are also supportive. Bearish concerns include hawkish takeaways from Powell, weak industrial earnings, and geopolitical uncertainty.

Focus on soft industrial earnings and notable corporate developments: FedEx lowered guidance on a weak industrial backdrop, while NKE gained on news of CEO transition. Qualcomm reportedly approached Intel for a takeover, and MillerKnoll flagged housing market weakness despite reaffirming FY guidance.

Notable companies:

FedEx (FDX) [-15.2%]: Missed Q1 EPS by almost 25%, cut full-year guidance, and got hit with multiple downgrades due to a shift in demand toward lower-priority services.

CrowdStrike (CRWD) [+8.1%]: Got a price target bump from Goldman Sachs thanks to solid R&D, smart acquisitions, and a strong customer base.

Nike (NKE) [+6.8%]: CEO Jon Donahoe is retiring in October, and former exec Elliott Hill is returning to take over, which has sparked some optimism.

More below in ‘Market Movers’.

Street Stories

Lost in Transit: FedEx and UPS Struggle to Keep Up

FedEx had one of its worst days ever on Friday, with shares tanking 15.2% following what was a comically bad Q1 earnings release1. Highlights included:

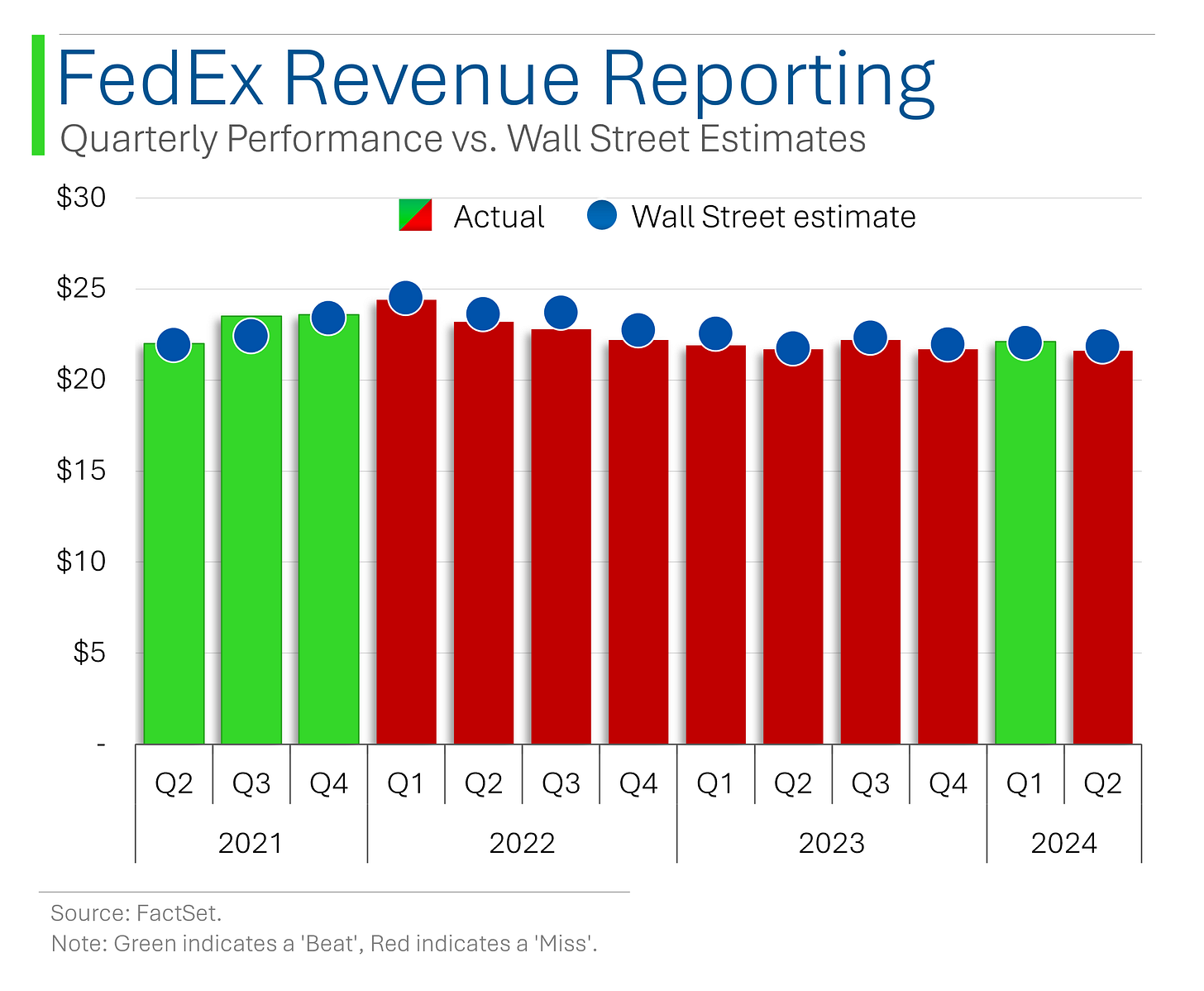

Missing Wall Street estimates for Revenue for the 9th time out of the last 10 quarters.

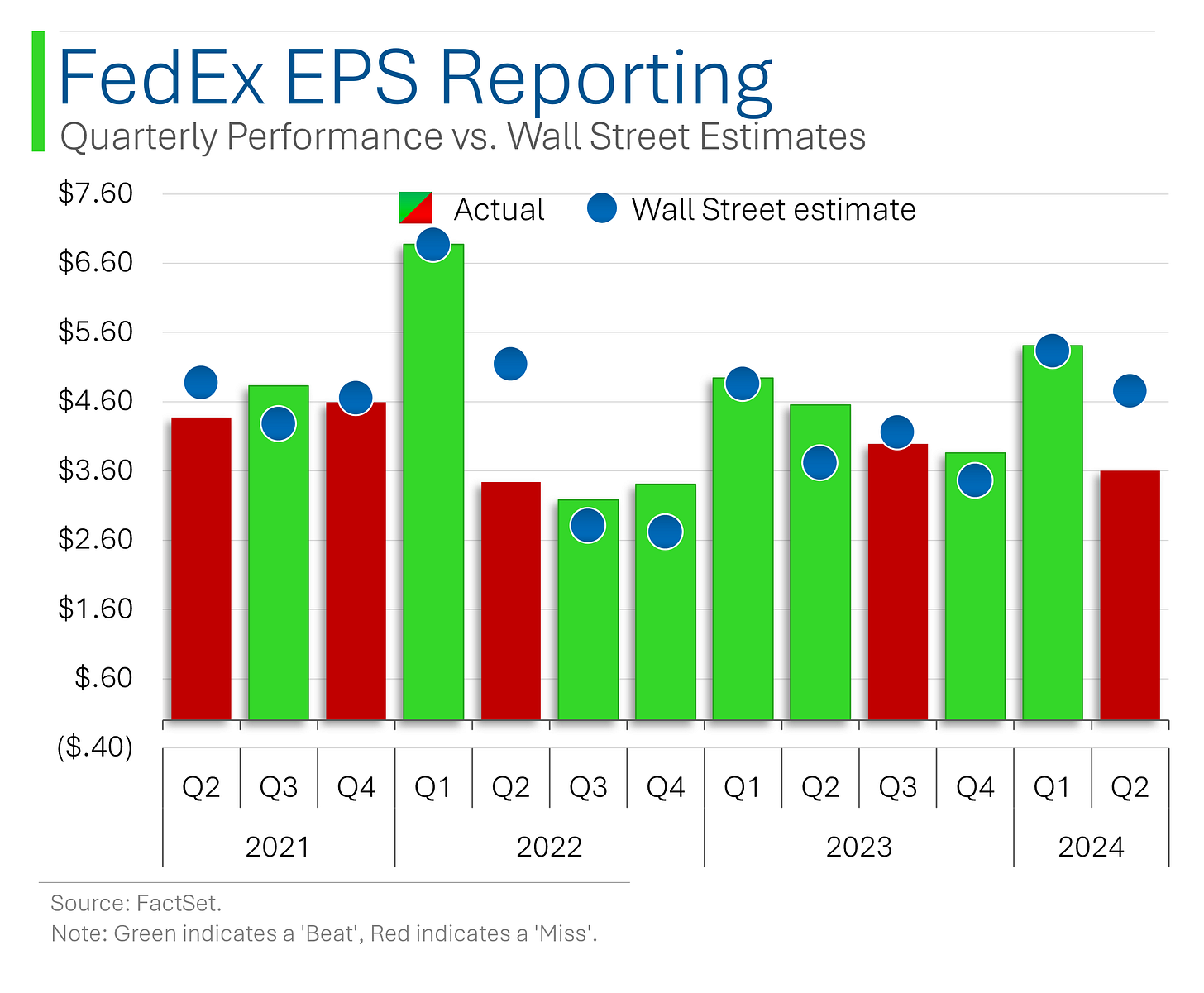

Missing Q1 EPS estimates by a whopping 24% ($3.60 vs. Wall Street consensus of $4.75).

Cut full-year EPS guidance from ‘$20-to-$22’ per share to ‘$20-to-$21’.

Cut full-year Revenue guidance from ‘low to mid single digit growth’ to ‘low single digit growth’.

The CEO cried like a baby on the call2

1. Yeah, the company has a goofy May fiscal year-end.

2. Ok, I made that up.

Anyway, this got me thinking: Are the big transport companies lame now?

(Spoiler: kinda)

To start, Revenue growth has been negative for both companies over the last two years. Wall Street seems to see a return to growth in their current fiscal years but you can’t help being skeptical about this.

EPS growth has been even worst with material declines over the last two year - particularly for UPS which gave up all its gains from the pandemic.

Not exactly a glowing endorsement of the transport and logistics space…

And the negative sentiment has been building for a while: Since peaking in early 2022, Wall Street’s revenue estimates for the current fiscal year (FY2025 for FedEx and FY2024 for UPS) have plummeted 20% and 16% for FedEx and UPS, respectively.

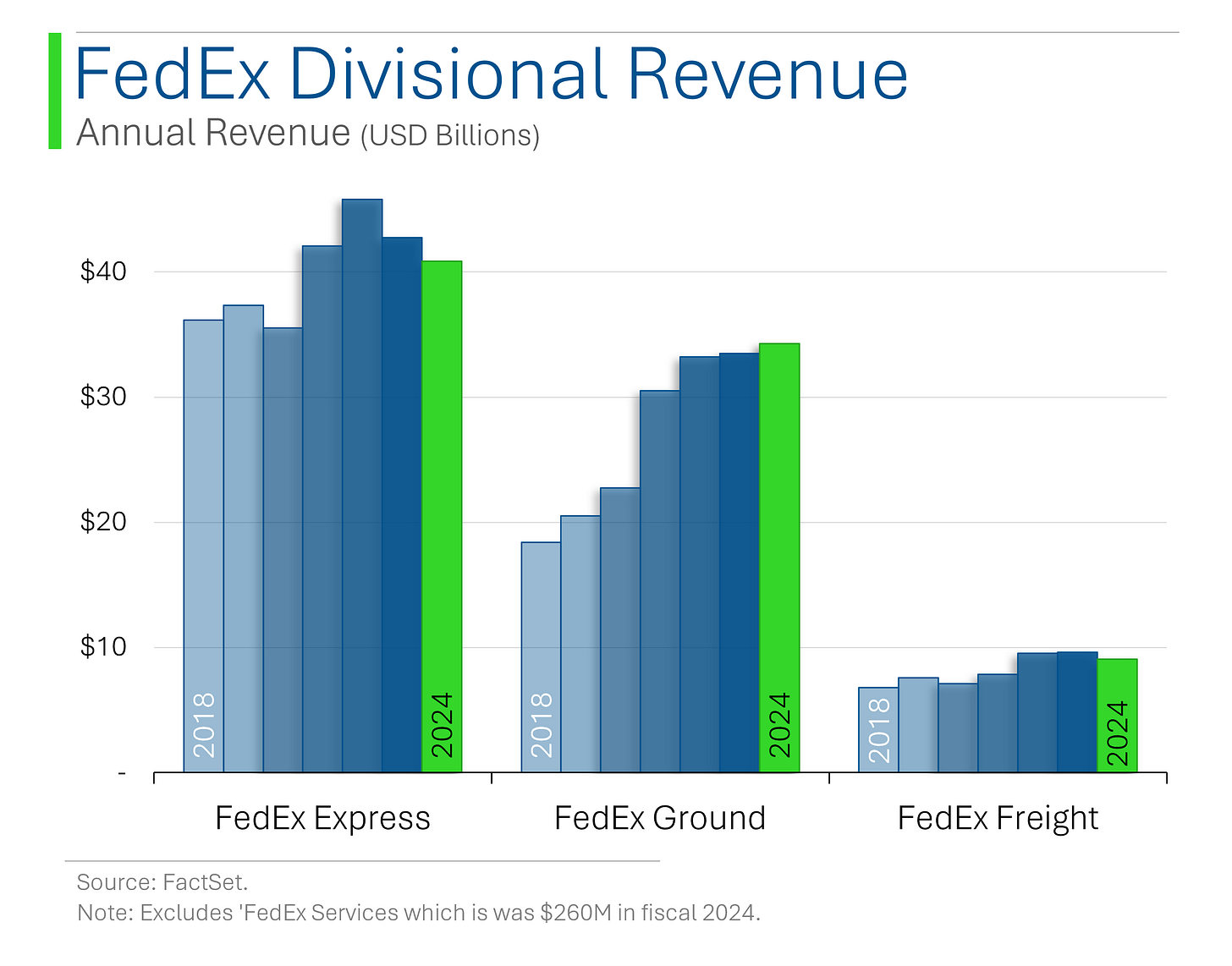

Within FedEx, really only it’s Ground division has held together reasonable well - and has actually had some (albeit minor) revenue growth over the last 2 years.

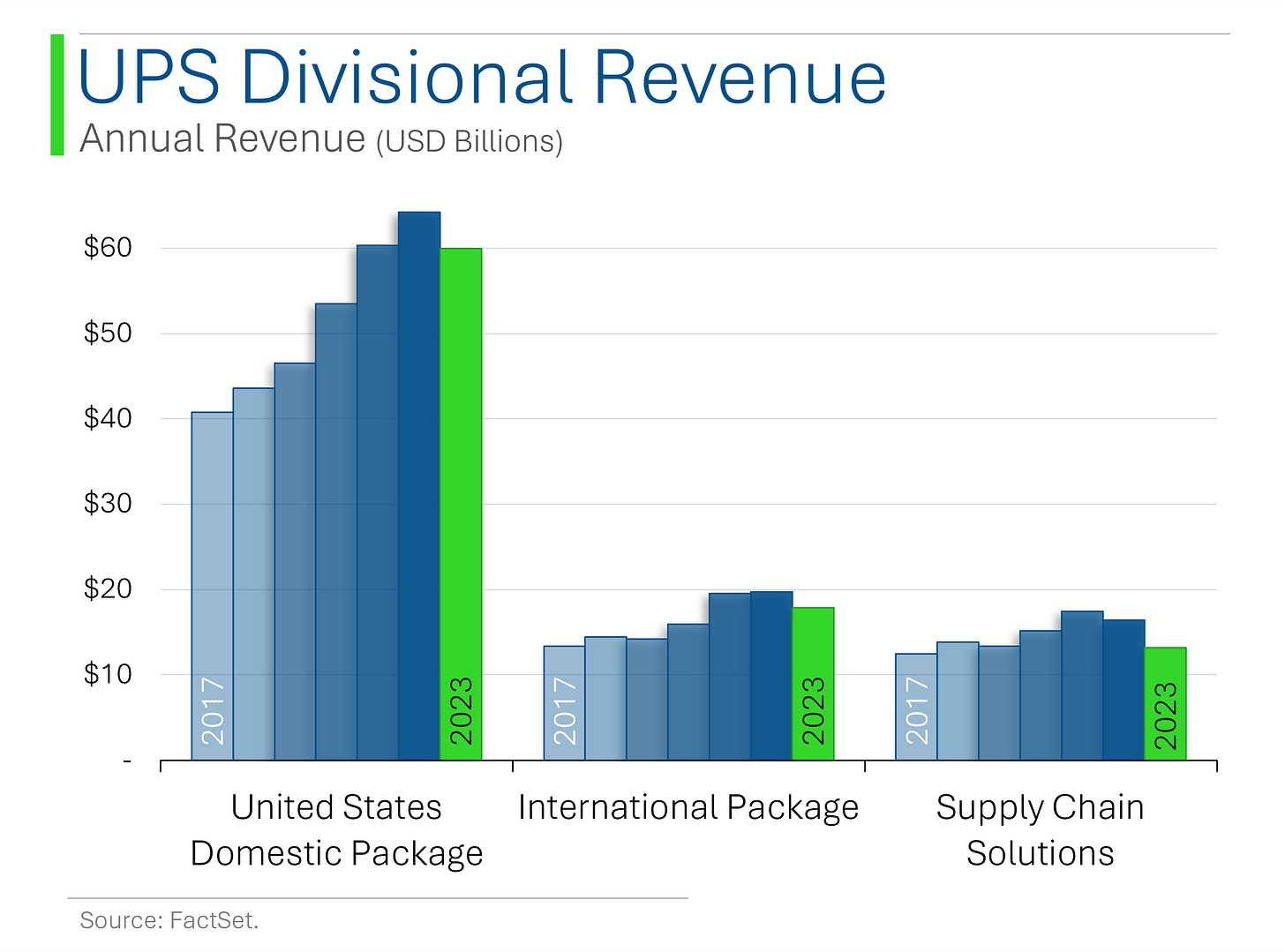

As for UPS, it’s Domestic Package unit is still the main driver of the business and thankfully it’s also its ‘best’ (read as: least bad) performing division.

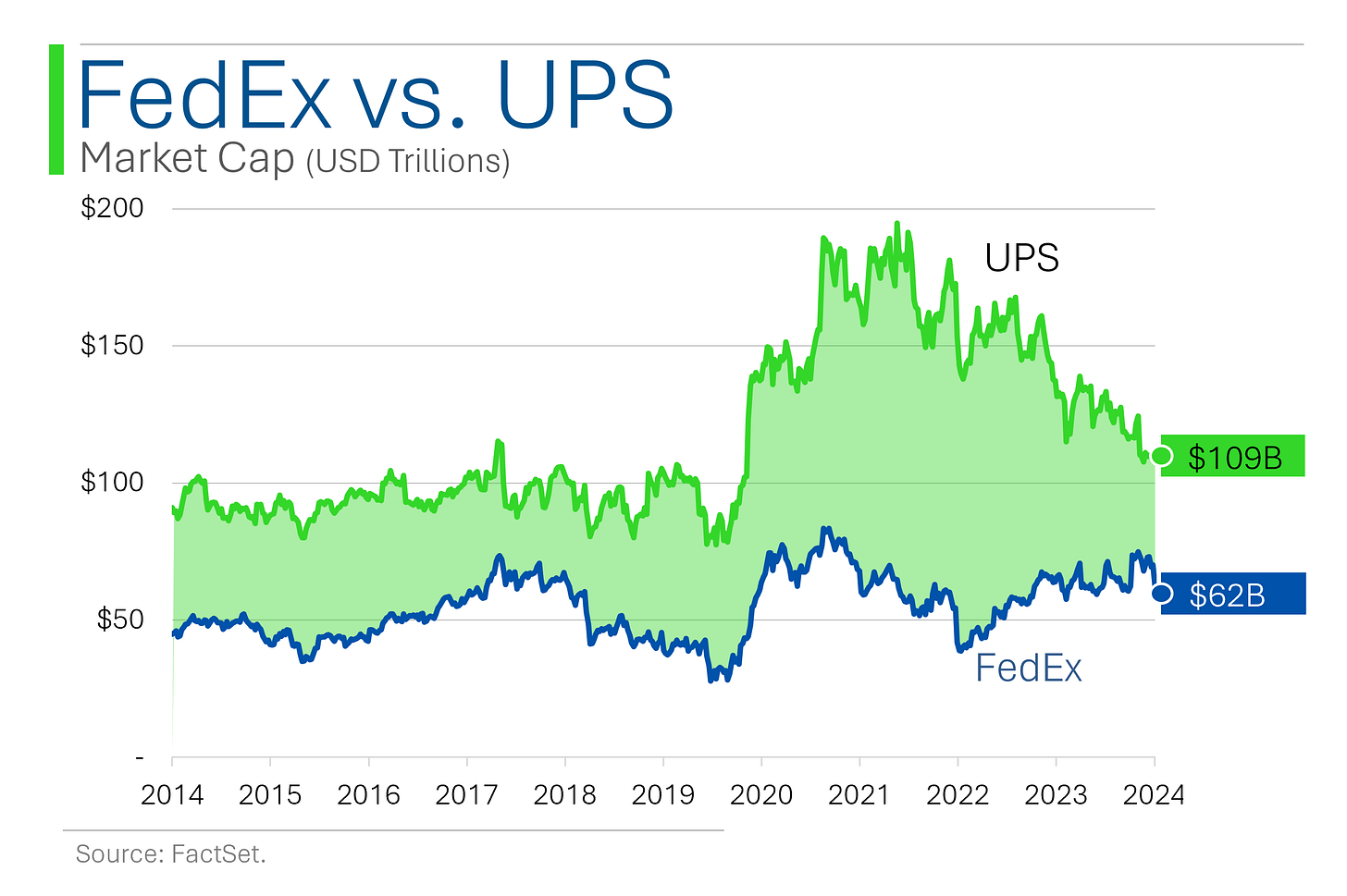

Growth stagnation over the last two years has also wreaked havoc on the shares.

Just how bad? Well, the market caps have only increased by 39% and 21% for FedEx and UPS, respectively, OVER THE LAST TEN YEARS. For context, over the same period the S&P 500 is up 184%.

The only thing that remotely makes these shares appetizing is that the valuations have started to come down. That said, they aren’t exactly in deep-value territory and far from record lows on their forward P/Es.

While the overall performance of FedEx and UPS hasn’t been anything to write home about as of late, they are two of the dominant players in a vitally important market: Getting junk shipped from Temu Global eCommerce.

And while they may have been impacted recently by increased costs, regulation, and competition - as well as a weakening US consumer - the overall trend is for shipping to continue to grow well into the future.

And the US - UPS and FedEx’s bread and butter - should experience some of the strongest of this growth, with some estimates getting into the double digits.

Having said that, I think it’s pretty clear that FedEx probably has its best years behind them…

British Pound’s Rally: Thanks Inflation !(?)

The British pound just soared to $1.33, its highest level since March 2022, after the Bank of England decided to hold interest rates steady during a time when rate cuts are on a majority of agendas in the developed world.

With a 0.8% jump, markets quickly adjusted their expectations, now forecasting 42 basis points of cuts this year instead of 50. Analysts predict the Bank of England will take its time easing, with sterling potentially breaking $1.34 by October and even eyeing $1.40 by next year.

Despite sluggish UK growth, the pound is the G10’s top performer in 2024, fueled by persistent inflation keeping borrowing costs elevated.

Joke Of The Day

If a tree falls in the forest and no-one hears it…then my illegal logging business is a success.

Hot Headlines

Reuters / Hezbollah and Israel exchange heavy fire in 'new phase' of fighting. Hezbollah fired 150 rockets at Israel, while Israel targeted 290 sites in Lebanon. Schools are closed, air raid sirens blare, and both sides prepare for a prolonged fight as this conflict drags on. It is reported that over 50,000 people have passed away in the conflict, our hearts go out to the innocent who’s lives and families have been destroyed.

CNBC / Boeing’s defense unit chief Colbert is departing, CEO says. This marks CEO Kelly Ortberg’s first big shake-up at the helm. This particular division is responsible for 40% of Boeing’s revenue and has been plagued by cost overruns, continual production delays. Pretty sure it was the aerospace division making planes that fall out of the sky right?

Yahoo Finance / Musk says SpaceX plans to launch about five uncrewed Starships to Mars in two years. If successful, crewed missions could follow within four years. Furthermore, even if landings fail, Musk promises that more Starships will head to Mars with each transit opportunity. But, I bet that will be a real confidence booster to those first colonizing teams eh?

CNBC / Middle Eastern funds are plowing billions of dollars into hottest AI start-ups. Leading the charge are Saudi Arabia’s PIF and UAE’s MGX, both looking to diversify away from oil are currently eyeing a stake in OpenAI. While Middle Eastern countries aim to position themselves as key players in tech, there are concerns about the "SoftBank effect"... You know, inflated valuations and potential instability in the market. Only time will tell.

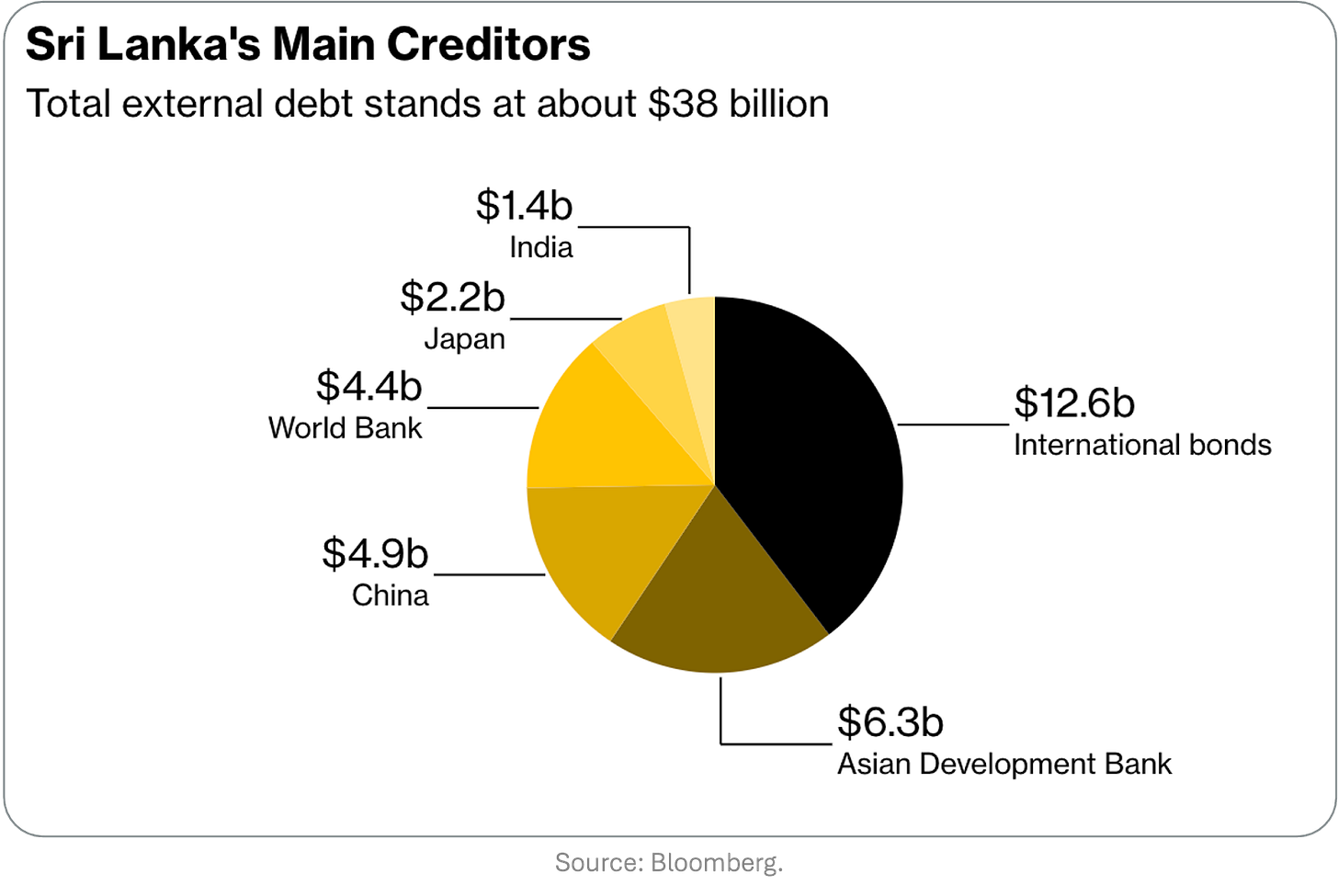

Bloomberg / Sri Lanka leftist wins election after vowing to rejig IMF Deal. Anura Kumara Dissanayake won Sri Lanka's presidential election, defeating the incumbent with 5.74 million votes in the country's first runoff on a platform focused on clean governance and fighting corruption. While he plans to seek modifications to the IMF deal, his promises of tax relief and reversing austerity measures may (definitely will) clash with creditor demands. I bet these were not empty politician promises.

Trivia

Today's trivia is on the British Royal Family, a centuries-old institution that has shaped the history of the United Kingdom!

Who was the first monarch of the House of Windsor? (hint: WWI)

A) King George V

B) King Edward VII

C) King George VI

D) Queen VictoriaWhich British monarch had the most legitimate children during their reign?

A) Queen Elizabeth II

B) Queen Victoria

C) King George III

D) King Henry VIIIWho was the first British royal to make an official visit to the United States? (hint: it was in the 1900s)

A) King Edward VII

B) Queen Elizabeth II

C) King George VI

D) Prince WilliamIn which year did Queen Elizabeth II officially ascend to the throne and begin her reign?

A) 1945

B) 1952

C) 1960

D) 1977

(answers at bottom)

Market Movers

Winners!

Constellation Energy (CEG) [+22.3%]: Signed a 20-year power purchase deal with Microsoft.

Vistra (VST) [+16.6%]: Announced they're buying out the rest of Vistra Vision for $3.1 billion.

CrowdStrike (CRWD) [+8.1%]: Got a price target bump from Goldman Sachs thanks to solid R&D, smart acquisitions, and a strong customer base.

Nike (NKE) [+6.8%]: CEO Jon Donahoe is retiring in October, and former exec Elliott Hill is returning to take over, which has sparked some optimism.

Losers!

FedEx (FDX) [-15.2%]: Missed Q1 EPS by almost 25%, cut full-year guidance, and got hit with multiple downgrades due to a shift in demand toward lower-priority services.

MillerKnoll (MLKN) [-14.5%]: Missed earnings and revenue, pointed to sluggish housing demand, and offered weak guidance for next quarter despite reaffirming its FY25 EPS outlook.

Apellis Pharmaceuticals (APLS) [-11.5%]: Got a negative EU opinion on their Pegcetacoplan treatment for Geographic Atrophy after a re-examination.

Dana Inc (DAN) [-5.7%]: Downgraded to underweight by Wells Fargo, with concerns about weaker North American heavy truck demand and lower Ford Super Duty volumes.

Lennar (LEN) [-5.3%]: Despite strong Q3 earnings, analysts are cautious due to weaker-than-expected guidance for Q4 homebuilding margins.

Chewy, Inc. (CHWY) [-4.3%]: Announced a $500M share offering from its largest shareholder, while Chewy will buy back $300M worth at $30 per share.

ASML Holding (ASML) [-4%]: Downgraded by Morgan Stanley due to concerns over China demand, Intel capacity trends, and a weaker DRAM cycle next year.

Valero Energy (VLO) [-3.1%]: Downgraded by Piper Sandler, citing increased product capacity and softer-than-expected demand for refined products.

PepsiCo (PEP) [-2%]: Morgan Stanley downgraded the stock, noting that their previous upgrade was wrong as snacks growth hasn't materialized despite higher spending and price changes.

Market Update

Trivia Answers

A) King George V – King George V became the first monarch of the House of Windsor in 1917, changing the name from the House of Saxe-Coburg and Gotha during World War I.

C) King George III – King George III had 15 legitimate children, the most of any British monarch.

A) King Edward VII – King Edward VII was the first British royal to visit the United States in 1860 when he was still the Prince of Wales.

B) 1952 – Queen Elizabeth II ascended the throne in 1952, following the death of her father, King George VI.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.