🔬Leading Indicators Are Leading Downward

Plus: Companies load up on debt after interest rate cuts; and much more!

When you're in jail, a good friend will be trying to bail you out. A best friend will be in the cell next to you saying, ‘Damn, that was fun.’”

- Groucho Marx

“If you don’t build your dream, someone else will hire you to help them build theirs.”

- Dhirubhai Ambani

Market Update: US equities were mostly higher with quiet trading as the S&P 500 hit a new record high, driven by strong performances in sectors like energy, utilities, EVs, and China tech. Meanwhile, banks, small-caps, retail, and biotech underperformed, with treasuries slightly weaker and the dollar alongside gold inching up.

Talking Points: Market focus today included Intel's potential takeover interest from Qualcomm and investment from Apollo Global, ongoing Fedspeak with mixed signals on rate cuts, and a China rate cut alongside Middle East tensions. Bullish sentiment revolves around Fed easing and earnings growth, while bearish concerns include election uncertainty, geopolitics, and high valuations.

Macro Stuff: September's flash PMI data came in softer than expected for manufacturing (47.0) and services (55.4). Fed officials like Kashkari, Bostic, and Goolsbee discussed the potential for further rate cuts, with more key speeches lined up this week, including remarks from Fed Chair Powell on Wednesday.

Notable companies:

Ciena (CIEN) [+5.0%]: Got upgraded by Citi due to improving conditions like easing excess inventory and a potential investor shift towards networking equipment.

Tesla (TSLA) [+4.9%]: The U.S. Commerce Department proposed a ban on vehicles using certain Chinese and Russian tech starting with the 2027 model year.

Intel (INTC) [+3.3%]: Apollo Global reportedly offered a $5B investment in Intel, while Qualcomm may be eyeing a full takeover and is talking to regulators.

Street Stories

Leading Indictors Are Leading Downward

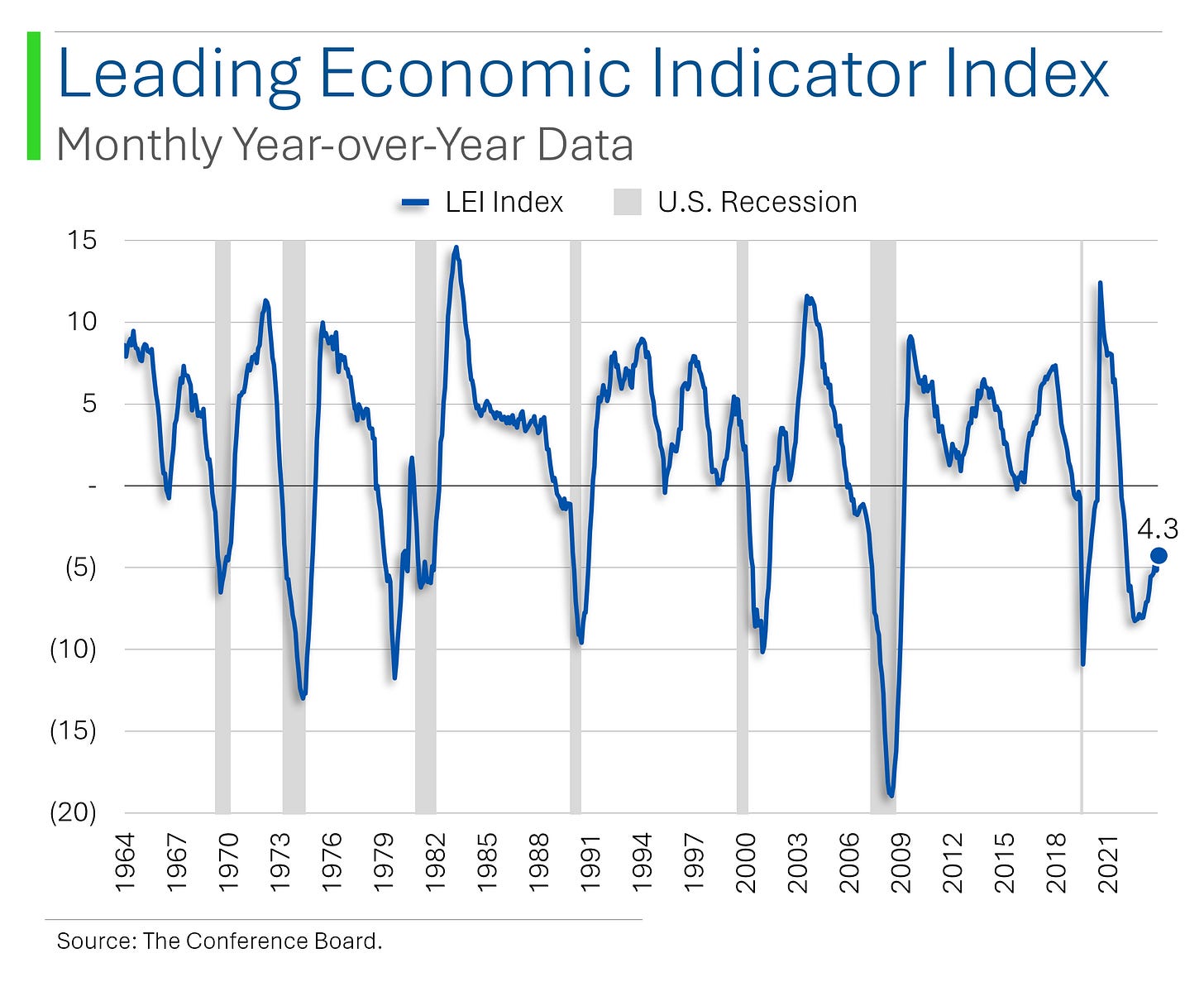

The Conference Board’s 10 factor Leading Economic Indicators (LEI) index is a popular way to track where the economy is headed and has proved to be a reasonably useful took in predicting recessions.

And annoyingly, it’s looking pretty s***** right now.

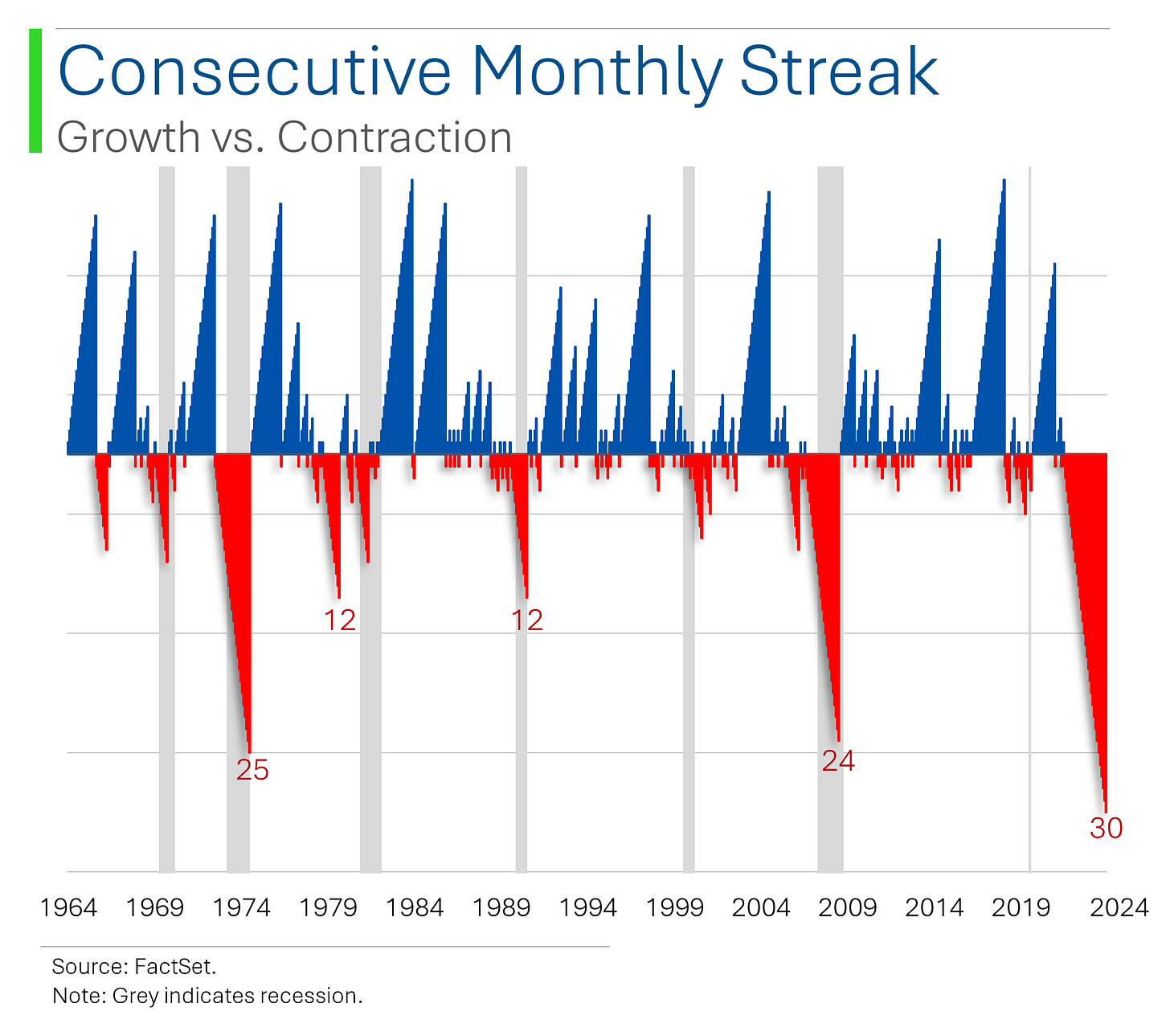

Specifically, the index has declined for 30 straight months. The longest stretch since color TVs were rolled out.

Gross.

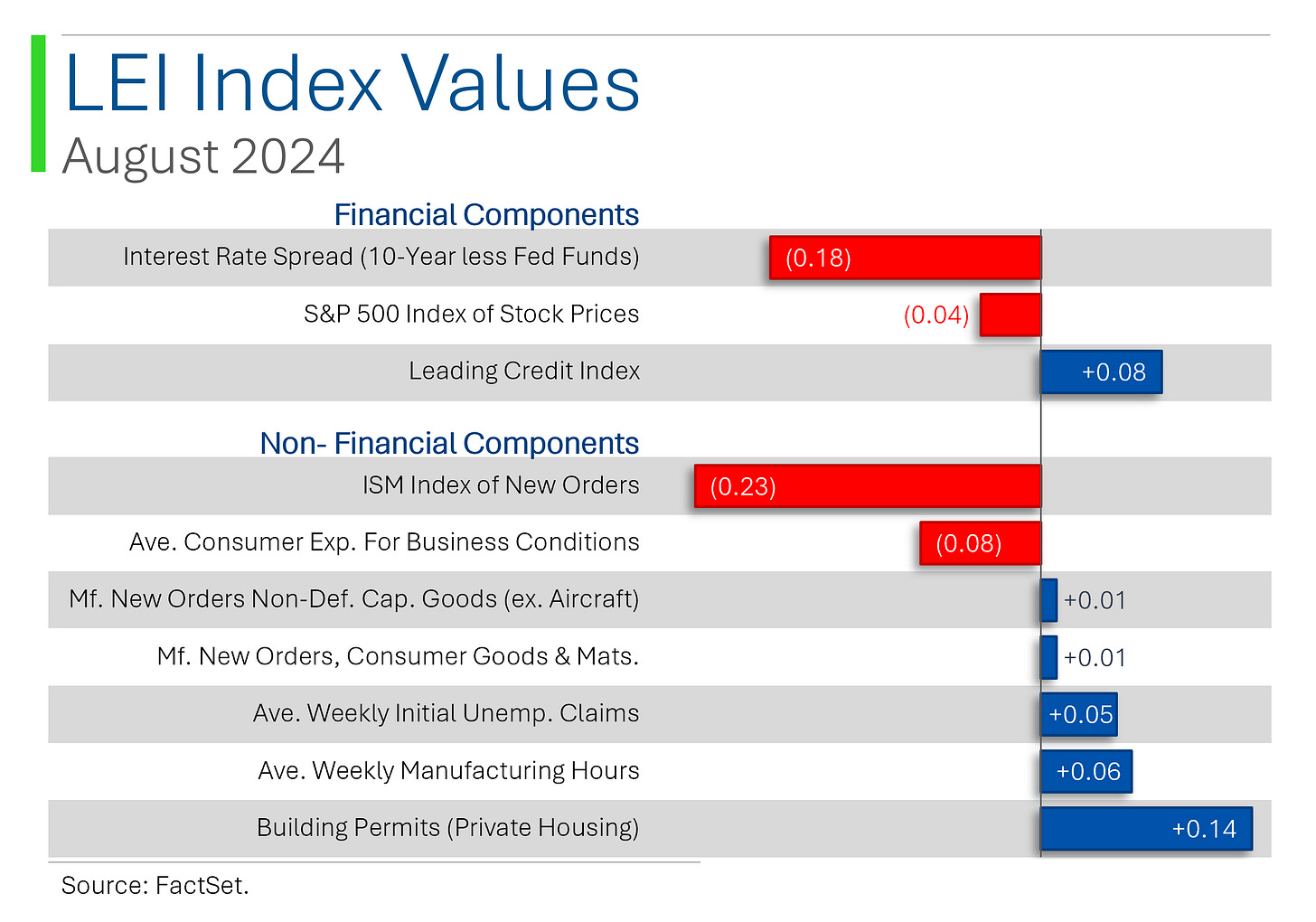

As I said above, the index includes 10 factors - 3 financial and 7 non-financial. This includes the interest rate spread between the 10-Year U.S. T-Bill and the (recently lowered) Federal Funds Rate, which is one way to account for the ‘inverted yield curve’ we’ve been facing since 2023.

Other important economic areas include new order data from businesses1, the labor market2, and housing3.

1. ISM Index of New Orders; Manufacturing New Orders for Non-Defense Capital Goods; Manufacturing New Orders for Consumer Goods & Materials.

2. Weekly Initial Unemployment Insurance Claims.

3. Private Housing New Building Permits.

Above you can see that out of the 10 factors, only 4 were negative in August and as a result the index was only down 0.2% sequentially in August.

Over the last six months, however, it’s been much more heavily skewed to the downside, with 6 of 10 factors pulling the index down.

But while August was negative (-0.2%) it’s still looking much better than before, so that’s a win, right? RIGHT?!?

Not really…

Now with a lot of stuff there’s still a ‘Covid hangover’, and my initial reaction to weak LEI data was that maybe the index hit some weird toppy peak during the 2021 ‘Everything Bubble’ and it’s going to take a while to catch back up.

However, as you can see above that’s not the case: We are well below pre-pandemic levels and - after clocking in at 100.2 in August - at a level first seen as far back as 2005.

I’m not saying we won’t get that ‘soft landing’ after all, but I’m not sure that’s the base-case right now.

Debt Party in the U.S.A.

After the Fed slashed interest rates, U.S. companies wasted no time stampeding into debt markets, raising $12.2 billion in high-grade bonds like it was back in the free-money era pre-2023 (aka the good ole days).

With borrowing costs down and credit spreads tighter, companies are scrambling to lock in deals before earnings blackouts and election chaos rain on their parade. Wayfair, Cerdia, and Windstream are among the opportunists grabbing cheap debt while they still can, like kids at a candy store before closing time.

Joke Of The Day

Women only call me ugly until they find out how much money I make.

Then they call me ugly and poor.

Hot Headlines

Bloomberg / US Ports are threatened with strikes in election-season jolt. 45k dockworkers at ever major port on the East and Gulf coasts are threatening to strike on October 1st after talks have gone nowhere since June. Right when inflation starts coming down. Why can’t we have nice things?

Yahoo Finance / Cards Against Humanity sues Elon Musk’s SpaceX for trespassing on Texas border land. The card game maker filed a $15 million suit, accusing Elon’s company of construction operations, dumping gravel and operating heavy equipment without permission. Just wait till Elon finds out NASA thinks they own space…

CNBC / Nike CEO John Donahoe is out, replaced by company veteran Elliott Hill. Hill, an ex-Nike-er(?), will take over on the 13th of October and he has his work cut out for him. Despite a revenue jump from $39.1B to $51.4B under Donahoe, Nike still faces a 10% projected sales drop this quarter. When you’re out, you’re out. When you’re in, you’re just waiting till you’re out.

Bloomberg / Monday Fed-speak leaves door open to another large interest-rate cut. Chicago Fed President Goolsbee warned that rates are still far above neutral, while Atlanta’s Bostic and Minneapolis’ Kashkari support slower quarter-point cuts. Governor Waller appears openminded, depending on upcoming data.

Axios / America's new apartment wave is peaking. A record half-million-plus new apartments will be built this year in the U.S. (yay!) but apparently the pipeline following this has dried up. This will likely exacerbate the current housing shortage, as well as record housing prices. Super.

Trivia

Today’s trivia is on technological firsts.

Which company invented the first jet airplane?

A) Rolls-Royce

B) Heinkel

C) General Electric

D) Pratt & Whitney

Which company created the first commercially successful computer mouse?

A) IBM

B) Apple

C) Microsoft

D) Logitech

Who is credited with inventing the assembly line?

A) Andrew Carnegie

B) Henry Ford

C) Alfred Sloan

D) John D. Rockefeller

(answers at bottom)

Market Movers

Winners!

Biohaven (BHVN) [+13.7%]: Announced positive results from a key study for troriluzole in treating Spinocerebellar Ataxia and plans to submit an NDA soon.

AeroVironment (AVAV) [+11.9%]: The U.S. Army lifted a stop work order on a major $990M contract, giving them a big boost.

Ciena (CIEN) [+5.0%]: Got upgraded by Citi due to improving conditions like easing excess inventory and a potential investor shift towards networking equipment.

Tesla (TSLA) [+4.9%]: The U.S. Commerce Department proposed a ban on vehicles using certain Chinese and Russian tech starting with the 2027 model year.

Intel (INTC) [+3.3%]: Apollo Global reportedly offered a $5B investment in Intel, while Qualcomm may be eyeing a full takeover and is talking to regulators.

Wix.com (WIX) [+2.0%]: Upgraded by Piper Sandler, with analysts liking their transformation over the past two years and improved margins compared to peers.

Losers!

Ulta Beauty (ULTA) [-2.0%]: Downgraded by TD Cowen due to rising competition from Sephora and Amazon, plus expected category normalization next year.

General Motors (GM) [-1.7%]: Bernstein downgraded GM, pointing out delayed EV progress, struggles in international markets, and potential need for more capital.

Market Update

Trivia Answers

B) Heinkel invented the first jet aircraft…too bad it was for the Nazis.

B) Apple invented the mouse after it ‘borrowed’ the idea after Steve Jobs’ trip to Xerox PARC.

B) Henry Ford is generally considered the inventor of the modern assembly line.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.