🔬It's a (Debt) Party In The USA!

Plus: AMC's CEO may not know how to fix the business but damn can he issues shares; Household debt is growing fast; and much more!

"The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions."

- Ken Fisher

"Competition is for losers."

- Peter Thiel

The big US markets had a solid day with the S&P 500 +0.5% and Nasdaq +0.8%, as the meme stock rally continues in an otherwise quiet market.

8 of 11 sectors closed higher, led by Tech (+0.9%) and Real Estate (+0.7%), while Consumer Staples (-0.2%) and Energy (-0.1%) were weakest.

Amazon announced that the CEO of it’s cloud business, Amazon Web Services, is stepping down.

Walmart (reporting Thursday) announces hundreds of job cuts to corporate staff and is ordering WFH staff into the office.

Notable Companies:

Alibaba Group (BABA) [-6.0%] Q4 earnings and EBITDA margin missed estimates, with Taoboa/Tmall as notable weak spots, but revenue was solid. Expects conversion to primary Hong Kong listing by August 2024.

Paramount Global (PARA) [-5.2%]: CNBC's David Faber reported Sony may be making an offer for the company, noting that negotiations with Charter may be a factor.

More below in ‘Market Movers’

Street Stories

It’s A (Debt) Party In The USA

The era of cheap debt may be over but companies are still levered up. While I hesitate to make some of sort of ‘Michael Burry, Big Short’-esque call on the situation, I think it is important to note that companies have much higher debt loads than they did a decade ago.

The above chart excludes some sectors where debt is traditionally a bit wonky (Financials, Utilities, Real Estate), but I think the trend is pretty clear: Companies now have much higher debt loads than they have had historically.

Don’t get me wrong, I’m actually a big fan of debt. Debt is non-dilutive and companies should take on a safe amount of leverage to optimize investment returns for shareholders.

All I’m trying to point out is that this may modestly change some of the investment calculus going forward. Two prime examples come to mind:

Interest Rates - The vast majority of debt from public companies comes in the form of fixed rate bonds. Now that we are in a ‘higher for longer’ interest rate environment, more companies will be forced to replace low interest rate debt with higher interest debt.

Being much more levered than in the recent past, this interest rate burden for the average company will have a material impact on profitability. Maybe have a look at the bond maturities of the companies you own to see how exposed they are.

Opportunity Cost - M&A and large capital expenditures (like a new $10 billion semiconductor fab) take money. This typically comes in the form of debt, equity or a combination of the two.

As companies now have more debt on their balances sheets (and likely higher interest expense) they may have reduced firepower with regard to funding large strategic initiatives in a non-dilutive way. If you own companies that heavily rely on acquisitions or large project finance, maybe check that they have the capacity to keep that up going forward.

Anyway, I hate alarmist, ‘click bait’ stuff predicting a coming apocalypse. I’m not saying that debt is the death knell of Western capitalism, only that it might be something to consider with your investments since it’s a material shift that will impact companies progressively over the coming years.

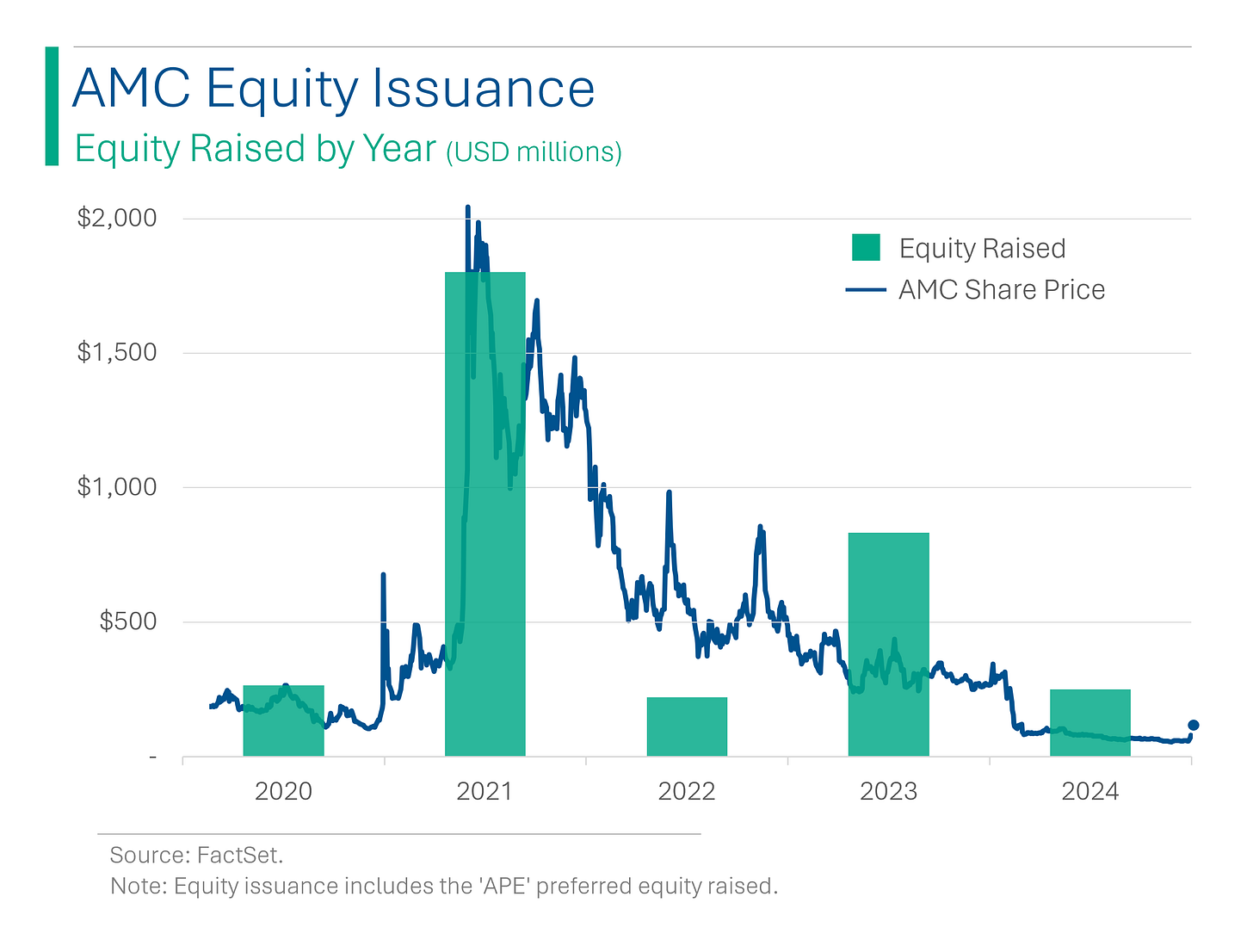

AMC: Never Let A Bubble Go To Waste

AMC Entertainment capitalized on the renewed meme stock craze by raising about $250 million through the sale of 72.5 million shares, with their stock price surging over 78% after the offering amid heightened trading volatility. The frenzy, partly fueled by DeepF******Value/Roaring Kitty, whose return from online hibernation led to a buying frenzy among retail investors, particularly jacking up GameStop's shares.

While AMC hasn’t had the operational rebound meme stock investors hoped for, it is kinda impressive how AMC CEO Adam Aron has been quick to raise much needed capital during times of… let’s call it ‘euphoria’.

Joke Of The Day

I was at the park wondering why this frisbee kept getting bigger… and then it hit me.

Hot Headlines

Bloomberg / Overdue bills are rising with US debt delinquencies a NY Fed survey shows. US household debt rose to $17.7 trillion in Q1, representing a $184 billion increase (+1.1%) since Q4.

The Verge / The US moves to stop buying uranium from Russia and start producing it at home. President Joe Biden signed a new law that bars the US from importing uranium from Russia in the hopes of jumpstarting domestic mining to fuel nuclear reactors. When the US banned coal, oil, and gas imports in response to the war in Ukraine in 2022, it excluded uranium from its sanctions, which showed how much the US depends on foreign imports. ☢️

CNBC / Wholesale prices rose +0.5% in April as producer inflation speeds up. April headline Producer Price Index came in at +0.5% vs. Wall Street estimates for +0.3%. PPI, a measure of what producers receive for the good they produce, is another important indication of inflation and was up +2.2% YoY - the highest it’s been in a year.

CNBC / Fed Chair Powell says inflation has been higher than thought, expects rates to hold steady. In other news, the sky is blue and grass is green.

Bloomberg / Biden accuses China of ‘cheating’ on trade and imposes fresh new tariffs. Changes to impact around $18 billion in current annual imports on semiconductors, batteries, solar cells, and critical minerals, in addition to previously reported increases on steel, aluminum and electric vehicles.

Basically Trump and Biden are fighting for who can appear the toughest on China.

Trivia

Today’s trivia is on cinema giant and meme stock AMC Entertainment.

When was AMC Entertainment founded?

A) 1900

B) 1920

C) 1920

D) 1940What does AMC stand for?

A) American Movie Classics

B) American Multi-Cinema

C) Audiovisual Media Center

D) Association of Movie CinemasAMC is known for introducing which popular cinema feature first?

A) 3D movies

B) IMAX

C) Stadium seating

D) Digital projectionWhat is AMC’s market capitalization?

A) $15 billion

B) $900 million

C) $2 billion

D) $12 billion

(answers at bottom)

Market Movers

Winners!

Plug Power (PLUG) [+19.0%] Received a $1.66B conditional loan guarantee from the DoE for its green hydrogen pipeline, aiding up to six production facilities.

On Holding (ONON) [+18.3%] Q1 earnings and revenue exceeded expectations with strong DTC demand and robust wholesale performance, despite European store closures; FY guidance reiterated, anticipating favorable FX impacts and upcoming product launches.

Alcon AG (ALC) [+10.7%] Q1 sales were light with FX challenges, but operating margin and EPS were strong; raised sales and EPS growth forecasts, noting contact lens success and margin gains.

Newell Brands (NWL) [+5.7%] Upgraded to equal weight from underweight at Barclays; demand seen as stabilizing with improved market visibility ahead.

Vodafone Group (VOD) [+4.8%] Fiscal Q4 and FY25 guidance surpassed expectations, with notable organic service revenue growth in Germany and prospects for a 2H recovery.

Losers!

Alibaba Group (BABA) [-6.0%] Q4 earnings and EBITDA margin missed estimates, with Taoboa/Tmall as notable weak spots, but revenue was solid. Expects conversion to primary Hong Kong listing by August 2024. -5.2%

Paramount Global (PARA) [-5.2%]: CNBC's David Faber reported Sony may be making an offer for the company, noting that negotiations with Charter may be a factor.

Market Update

Trivia Answers

C) AMC was founded in 1920.

B) AMC stands for American Multi-Cinema.

C) AMC introduced stadium seating (seats are elevated relative to the ones in front of them so everyone has a clear view.

C) AMC is worth $2 billion.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.