🔬Is the Rally a Bear Trap? I'm Ron Burgundy? And Much More

“It’s kind of like looking for a needle in a haystack, but the trick is to find the haystacks that have needles"

- David Einhorn"I made my money the old-fashioned way. I was very nice to a wealthy relative right before he died"

- Malcolm Forbes

Table of Contents

Hot Headlines

Joke Of The Day

A.M. Allocations: Queue the Bull Trap?

Trivia

Market Movers

Market Update

Hot Headlines

NEW TESLA MODEL - Tesla is reportedly planning to produce a new, more affordable electric vehicle priced at €25k at its Berlin factory, aiming to boost mass market adoption despite no confirmed production start date. The move comes as Tesla seeks to increase its vehicle deliveries to 20 million by 2030, with the German plant's current production capacity at 250,000 vehicles annually and plans to double this output. If it’s another gawdy, futuristic thing like the Cybertruck, I’m officially jumping off the bandwagon. (Reuters)

PARAMOUNT DOWNGRADE - Paramount Global's stock dropped after BofA Securities downgraded it due to the company not proceeding with the sale of assets like Showtime and BET Media Group, despite offers, which creates a negative medium-term outlook in a challenging economic environment. The company's shares fell 8% despite a recent uptick after third-quarter earnings beat estimates and Paramount+ subscribers increased to 63 million. Paramount stock has fallen 25% this year. (Barron’s)

DISNEY’S NEW CFO - Hugh Johnston of PepsiCo fame is set to become Disney's new CFO on December 4th, stepping into the financial fairy tale amidst ongoing corporate shuffling and streaming woes. While Disney plays musical chairs with its executives and considers offloading ABC and finding a strategic partner for ESPN, the Magic Kingdom's stock tiptoes down by 2%, and activist investor Nelson Peltz circles the castle, eyeing a seat on the board as if it's a throne at Disneyland. (CNBC)

RECESSION INDICATOR - The U.S. unemployment rate has risen from 3.4% in April to 3.9% in October, sparking concerns of a recession as historical trends suggest a continued rise once it starts increasing. The Sahm Rule, which predicts recessions based on unemployment rate averages, indicates there's a 40% chance of a recession, though it's not yet crossed the critical threshold. Some analysts argue that the peculiar post-pandemic economic landscape may render traditional indicators like the Sahm Rule less reliable, urging caution in policy responses. (Axios)

EMERGING MARKETS ARE RISK-ON - As Fed rate fears wane, it seems the next area to rally is EM growth stocks, such as e-commerce and electric-vehicle companies. This move marks a departure from the previous preference for value stocks (think banks, consumer staples), as evidenced by a $1.1 trillion increase in emerging-market stocks and growth stocks outperforming value stocks for the first time since March. The trend is reflected across various national benchmarks and US ETFs, with growth-oriented funds delivering significant returns in November. (Bloomberg)

US CONGRESS DIVIDED - The U.S. Congress is experiencing unprecedented polarization, with a record-high ideological gap between the parties according to voteview.com, where scores are assigned to lawmakers' voting records, revealing minimal overlap between the most conservative and most liberal members. (Reuters)

(Reuters) Citigroup considering at least 10% job cuts in major businesses - I’ve been counting over the years and this brings the total to 124%.

(CNBC) The new Bed Bath & Beyond CEO is out, days after activist firm called for his ouster - 20yrs at the company and some goofballs at ‘JAT Capital’ come calling and he doesn’t even put up a fight? Wimp.

(Reuters) Bumble shares drop as founder Whitney Wolfe Herd to relinquish CEO role - Bumble not seen as ‘cool’ so they fire the hip founder and bring in …the CEO of bureaucracy/admin app, Slack? Haha gl.

(CNBC) The holiday spending outlook is sluggish across thousands of retailers: CNBC Supply Chain Survey

(CNN) Striking actors say they have responded to Hollywood and TV studios’ ‘best and final offer’ - still apparently no agreement on certain items, like AI.

(WSJ) Turning Empty Offices Into Apartments Is Getting Even Harder - Efforts to repurpose underutilized U.S. office spaces into apartments are being hindered by financial, regulatory, and practical challenges, despite government efforts to facilitate such conversions to address the housing shortage.

Joke Of The Day

What’s another name for long term investment? A failed short term investment!

A.M. Allocations

Queue the Bull Trap?

For those just learning about the stock market, there exists this concept called a ‘Bull Trap’, which many investors have seared into their memory as…well, a 'teachable moment’. What is it exactly, though? During periods of an extended market trend, often a short-term reversal will occur, with many investors joining in hoping to profit from this reversal picking up steam, only to see that short-term correction erased, and the long-term trend continue.

If the trend has been positive and the reversal negative, that’s a Bear Trap (as in, Bearish investors get suckered in). If the trend has been negative and the reversal positive, that’s a Bull Trap (as in, Bullish investors get suckered in). I’d even go as far as to say that you aren’t a real investor unless you’ve been a sucker for both types of traps.

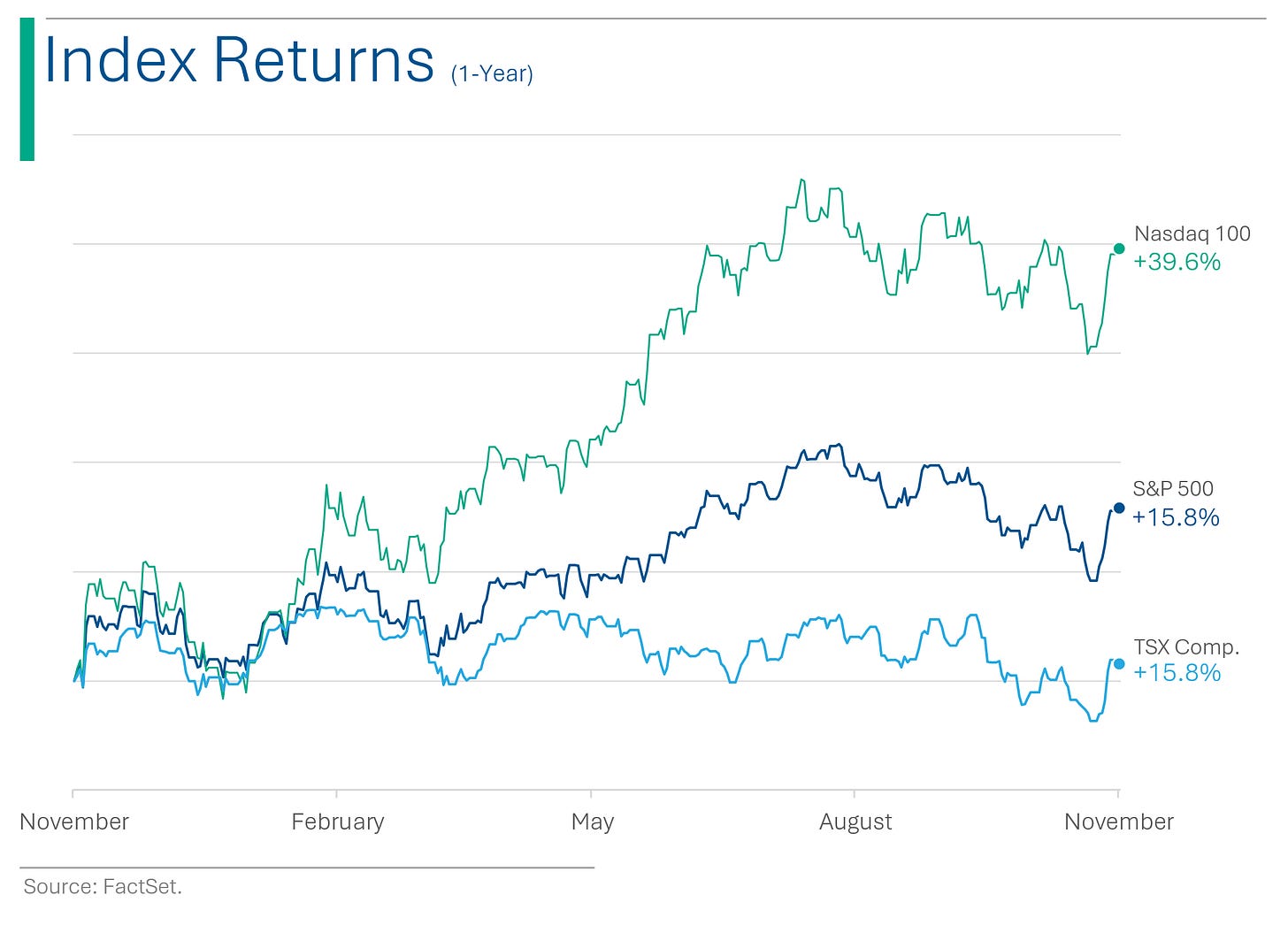

Take-Aways: Last week the S&P 500 closed up +5.9% - its largest increase in a year - and investors seem to be building a lot of hype following what the Street has dubbed ‘Peak Fed’ - ie: they don’t expect further interest rate increase out of the Federal Reserve. Before this, however, the market had steadily shed over 10% in the previous 12 weeks.

Now, I’m not going to say that this is a Bull Trap, and that the market will continue to tank. Far from it. But as always with the stock market, I think discretion is the better part of valour. A few days worth of hype and some modestly positive talking points (rate hikes and earnings season) shouldn’t be enough to overwhelm your market outlook.

Trivia

Today’s trivia is on stock market circuit breakers.

Circuit breakers are automatic stops to an equities trading in the event that it breeches certain thresholds in order to stop any panic selling taking place. They were first instituted after what event?

A. The DotCom Bubble (2001)

B. Black Monday (1987)

C. The Flash Crash (2010)

D. 9/11 (2001)There are currently 3 levels of circuit breaker built into the US markets. They trigger at 7% (Level 1), 13% (Level 2) and what %?

A. 30%

B. 25%

C. 20%

D. 15%Breeching a Level 3 circuit breaker ends trading for the day but Level 1 and 2 breeches only stop trading for how long?

A. 1 hour (unless it’s after 2:00PM then there is no halt)

B. 5 minutes

C. 15 minutes (unless its after 3:25PM then there is no halt)

D. 45 minutes

(answers at bottom)

Market Movers

Winners

Bluegreen Vacations Holding (BVH): [+106.8%] Accepted a $75 per share acquisition offer from Hilton Grand Vacations, valuing the deal at $15B, a double premium to its last close, with an expected 1Q24 closure.

Freshpet (FRPT): [+16.9%] Beat on Q3 and upped guidance.

Celldex Therapeutics (CLDX): [+13%] Phase 2 trial of barzolvolimab showed primary goal success and sustained efficacy.

Knife River (KNF): [+7.8%] Beat on Q3.

Constellation Energy (CEG): [+6.5%] Beat on Q3.

HollySys Automation Technologies (HOLI): [+5.9%] Take-over offer.

Clorox (CLX): [+2.8%] UBS upgrade to neutral, predicting FY24 guidance to be cautious after cyber attack with potential robust FY25 growth and significant earnings rebound.

Losers

Dish Network (DISH) [-37.4%]: Q3 earnings fell short, with a drop in Pay-TV and Wireless subscribers. CEO Erik Carlson to resign on November 12, with Hamid Akhavan slated as successor.

Tecnoglass (TGLS): [-12.1%] Q3

Treehouse Foods (THS): [-10.3%] Q3

Hilton Grand Vacations (HGV): [-8.1%] Q3 ok but weak guidance and Maui fire impact.

Paramount Global (PARA): [-7.8%] Downgrade by Bank of America due to no forthcoming asset sales and challenges including economic conditions, industry changes, and negative free cash flow.

Albemarle (ALB): [-6.7%] UBS downgraded to neutral, noting risks to lithium growth, potential earnings decline in 2024, and slowing EV demand.

Bumble (BMBL): [-4.4%] CEO Whitney Wolfe Heard to step down, with Lidiane Jones taking over, previously appointed as Slack Technologies CEO in January.

Market Update

Trivia Answers

B. Black Monday (1987).

C. 20%

C. 15 minutes (unless its after 3:25PM then there is no halt)

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.