🔬Is The Market Running Out of Breadth?

Plus: Japan's experiment with negative rates ends; Housing Starts are... ground breaking; global inflation continues to cool; and much more.

"You can't predict. You can prepare”

- Howard Marks

“You don’t hear much about syphilis these days. Very much the MySpace of STDs”

- Tom (Succession)

Solid enough day for the big US markets with the S&P 500 +0.6% and Nasdaq +0.4%.

10 of 11 sectors closed higher. Energy (+1.1%) and Utilities (+0.9%) were best, while techy Communication Services (-0.2%) was worst.

Crude oil was up another +0.7% after a +2.0% day Monday.🛢️

AI-hypetrain poster boy Supermicro Computer tumbled 9% after announcing plans to sell 2 million shares (~4% dilution) to raise capital. That means the stock is only up by 220.9% this year. 🤷

Street Stories

Out of Breadth

I don’t often use the word ‘Moving Average’ - sounds too much like technical analysis and - as a fundamental equity purist - that’s akin to heresy. Half joking.

Anywhoo, one of the uses of Moving Average that I find socially acceptable is to look into the breadth of a index’s performance. Essentially, what proportion of an index is doing well vs. not doing so well.

The chart above gives a few insights: Firstly, that while the S&P’s large-cap, mid-cap and small-cap have all experienced similar breadth over the course of the last 12 months, that relationship has broken down in 2024. The implication (to me at least) being that, as the rally got a bit long in the tooth, quality large-cap has held in much better than mid-cap, which has held in much better than small-cap.

The relationship holds for the ‘techy’ Nasdaq as well, with the Nasdaq 100 - the biggest 100 names on the exchange - holding up better than the composite index that represents the 2,500 or so listed companies. And ok sure, the tracking over the course of the year hasn’t been as tight. Blame Nvidia and the rest of the Mag7.

Turning to the specific sectors, a few other phenomena are worth mentioning. Firstly, Info Tech and Communication Services were the two best performing sectors in the S&P 500 in 2023; up 56% and 54% respectively. Unsurprisingly, they entered 2024 with very high ‘breadth’, with 95% and 86% of companies above their 50-Day MA, respectively.

This has completely turned and now they they represent the lowest and third lowest breadth amongst S&P 500 sectors (respectively). Interestingly, only Energy has a higher proportion of its companies above their 50-Day MA currently than they did at the end of last year. One day’s zero, is another day’s hero, and vicey versey.

Explainer: Why does all this matter? Well, think a building: If it’s held up by a lot of concrete pillars it’s nice and it’s safe. Held up by only a few? Well, that makes it a lot more likely that it will collapse in on itself.

And after one of the great bull markets in history, we are talking about a very tall building.

Global Inflation

Inflation here in Canuckville unexpectedly came in lower than expected in February at 2.8% vs. Wall Street estimate of 3.1%. The data significantly boosts the prospect of a June rate cut for Canada.

Worth noting is that while the US saw inflation come down much quicker than most of the world, with CPI sitting at 3.2% they are actually higher than most of their peers in the developed world.

Groundbreaking Growth: Housing Starts Hammer Past Hurdles

February's housing starts significantly exceeded expectations at 1.521 million, a 10.7% increase from January's revised figure, marking a two-year high for single-family starts. Multifamily home starts also saw a rise of 8.3% following a previous sharp decline. Building permits in February increased to 1.518 million, indicating the fastest growth since August, showcasing an overall improvement in the housing market. Problem solved! lol

Dot Plot Dilemma: Fed's Future Cuts Caught Between Growth and Grit

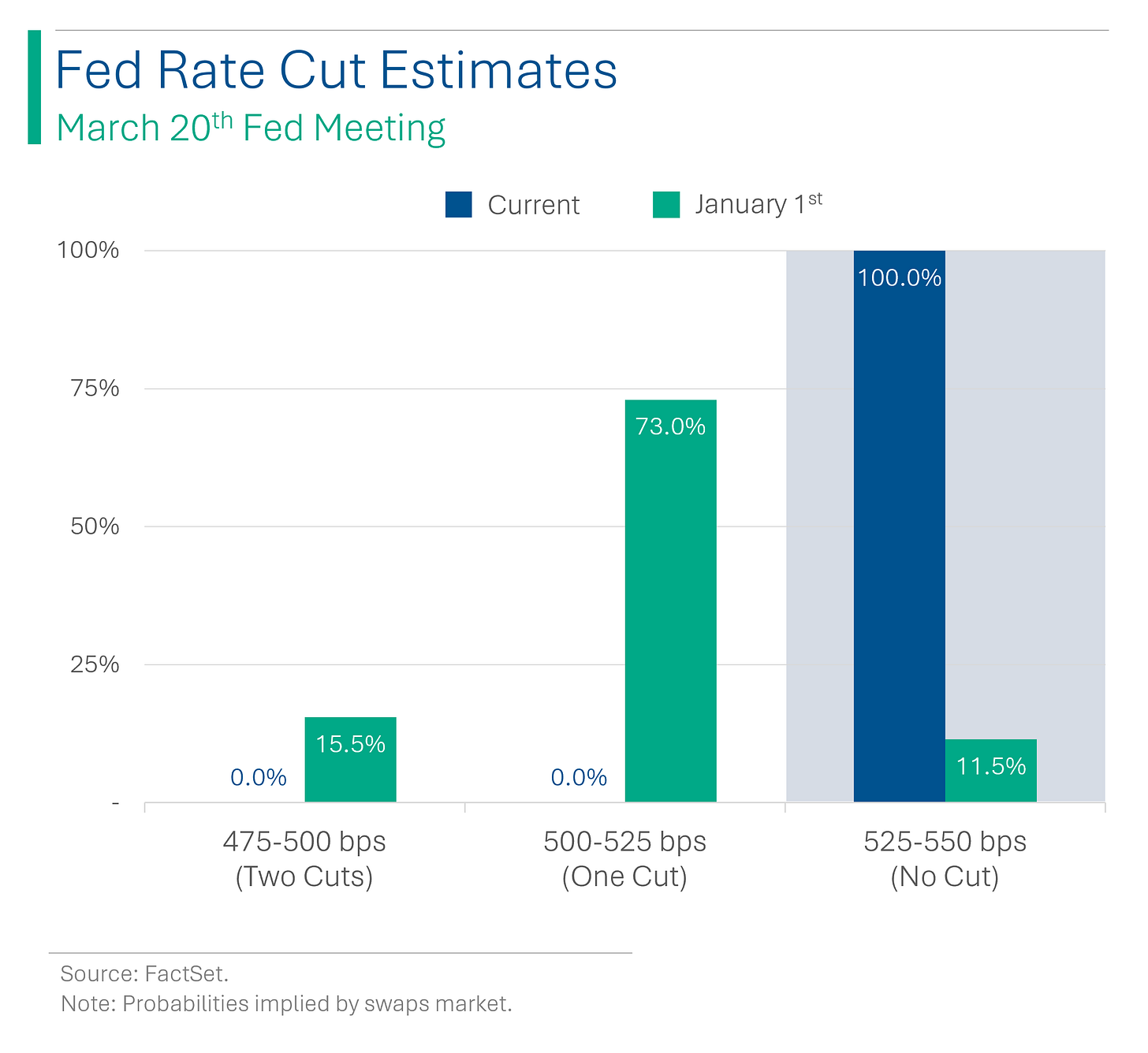

The latest Fed meeting concludes today, and expectations for any rate action have been ground down to zero with the first move only priced in for June. Oh, what a long way we’ve come since January when expectation for two cuts had a higher probability than none.

There's speculation the Fed could adjust their forecast to two cuts for 2024 from three (which the market currently has started to price in), influenced by economic growth, inflation concerns, and mixed signals from the labor and retail sectors.

Japan Ends Negative Interest Rate Era (finally)

The Bank of Japan made it’s first rate hike… in 17 years. Yep, the era of negative rates - that lasted eight years - has officially come to an end, as the country raised its policy rate from (0.1%)-to-0% to 0%-to-0.1%. Does it get more exciting than this?

The move comes after Japan entered a technical recession earlier in the year, however ‘core-core inflation’ still remains above the BOJ’s target 2% rate and the move is expected to help stabilize price levels, particularly in the face of strong wage growth.

Joke Of The Day

Interviewer: What are your thoughts about nepotism in a workplace environment?

Candidate: Well, that’s a really good question, Dad

Hot Headlines

The Verge / The EV revolution hinges on upcoming emissions rules by the Environmental Protection Agency (EPA). Environmental groups are hopeful the EPA gets more aggressive with than its original proposal that would have resulted in battery-electric vehicles accounting for 37% by 2027 and 67% by 2032 - a dramatic increase over the current EV sales numbers of around 8%.

Axios / Star Wars creator George Lucas backs Disney CEO Bob Iger in proxy fight with Nelson Peltz. Unlike some of the other ‘backing’ Iger has received, such as from Jamie Dimon last week, this actually matters as Lucas is believed to be Disney’s largest shareholder after selling the Star Wars franchise to Disney for $4 billion in 2012, including $1.8 billion in stock.

Reuters / SpaceX to sell satellite laser links that speed in-space communication to rivals. The thousands of Starlink satellites in use inter-satellite laser links to pass data between one another in space, allowing the network to offer broader internet coverage around the world with fewer ground stations. All I heard was space lasers…

Bloomberg / Reddit’s IPO could face significant volatility from the 8% shares (without lock-up) allocated to users. Unlike most investors, the Reddit users that subscribed to the deal don’t face any selling restrictions, with many expected to punt the shares immediately.

Yahoo Finance / PepsiCo wins 10-year deal to replace Coca-Cola at Subway’s US locations. Subway is the US' largest fast-food chain with around ~20k restaurants.

Trivia

This week’s trivia is on Walmart.

When was Walmart founded?

A) 1945

B) 1950

C) 1962

D) 1970

Where was the first Walmart store opened?

A) Dallas, Texas

B) Rogers, Arkansas

C) Wellington, Kentucky

D) Woodstock, West Virginia

What was the original name of Walmart?

A) Walton's 5&10

B) Walton's Market

C) Walton's Discount City

D) Sam's Wholesale Club

How many Walmart stores are there worldwide as of 2023?

A) About 5,000

B) About 8,000

C) About 10,000

D) About 11,000

(answers at bottom)

Market Movers

Winners!

Fusion Pharmaceuticals (FUSN) [+99.1%] To be bought by AstraZeneca for ~$2B cash; $21/share is ~107% premium over Monday's close, expected to close in Q2'24.

Crinetics Pharmaceuticals (CRNX) [+19.1%] PATHFNDR-2 Phase 3 study of paltusotine for acromegaly met primary endpoint.

International Paper (IP) [+11.0%] Announces Andrew Silvernail as new CEO, effective 1-May, succeeding CEO Sutton; Silvernail was executive advisor at KKR.

Nordstrom (JWN) [+9.4%] Exploring privatization with Morgan Stanley and Centerview, reports Reuters.

Core & Main (CNM) [+7.5%] Q4 adjusted EBITDA up, revenue on target; sales rise from fire-protection, pipes/valves; benefits from lower steel-pipe prices; FY25 guidance beats expectations.

Losers!

NuScale Power (SMR) [-34.9%] Downgraded to underweight from equal weight by Wells Fargo due to market competitiveness and lack of secured customers for VOYGR product.

Super Micro Computer (SMCI) [-9.0%] Filed to sell 2M shares to boost capital for operations, inventory purchases, working capital, manufacturing expansion, and R&D investments.

Market Update

Trivia Answers

C) Walmart was founded in 1962.

B) The first Walmart opened in Rogers, Arkansas.

C) Walton's Discount City was the original name of Walmart.

D) There are currently about 11,000 Walmart stores.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.