🔬Is Sentiment Rolling Over?

Plus: Nah, that's pretty much it...

Short email today as I’ve been walloped with a daycare bug.

The State of Play

The S&P was on quite the streak until March, holding the rare distinction of only having two down weeks in the last 18. How rare? I checked the data back until 1978 and a run like that has never once occurred.

And while that’s great and all, it’s in the past now. And where it leaves us is a bit tricky actually. Since March we’ve started to see weakness in some of the big name stories of 2023 - hell, even Nvidia was down on the week. And while it’s still early, there are hints that a bit of a rotation that might have started.

The best performing 20% of companies in the S&P 500 in 2023 had an average return of 62%. That holds up well against of the average company which was up 14%. The bottom 20%? They averaged a decline of 20%. Eww, I know.

What I noticed, though, was that that bottom 20% has actually outperformed the top 20% by 1.9% so far in March (Bottom: +1.4%; Top: -0.5%). This is important since overall market sentiment is often tied to its big winners - just think about the (former) Mag7 in powering 2023. Is this a junk rally? Are investors broadening out their portfolios? Why do the good stocks (relatively speaking) suck?

Adding a bit more context is which sectors have done well so far in March vs. 2023. The best sectors last year - Tech, Communication Services and Consumer Discretionary - are either flat or down so far this month. While the sectors that are leading in March were some of the worst last year.

Moreover, there are themes that can be tied to the sectors working so far in March (Energy as oil prices have creeped higher; Materials as the soft landing narrative takes hold; rate sensitive Utilities as Fed cut expectations have decreased). However, I wouldn’t suggest that those are long-term themes that can continue to support market sentiment.

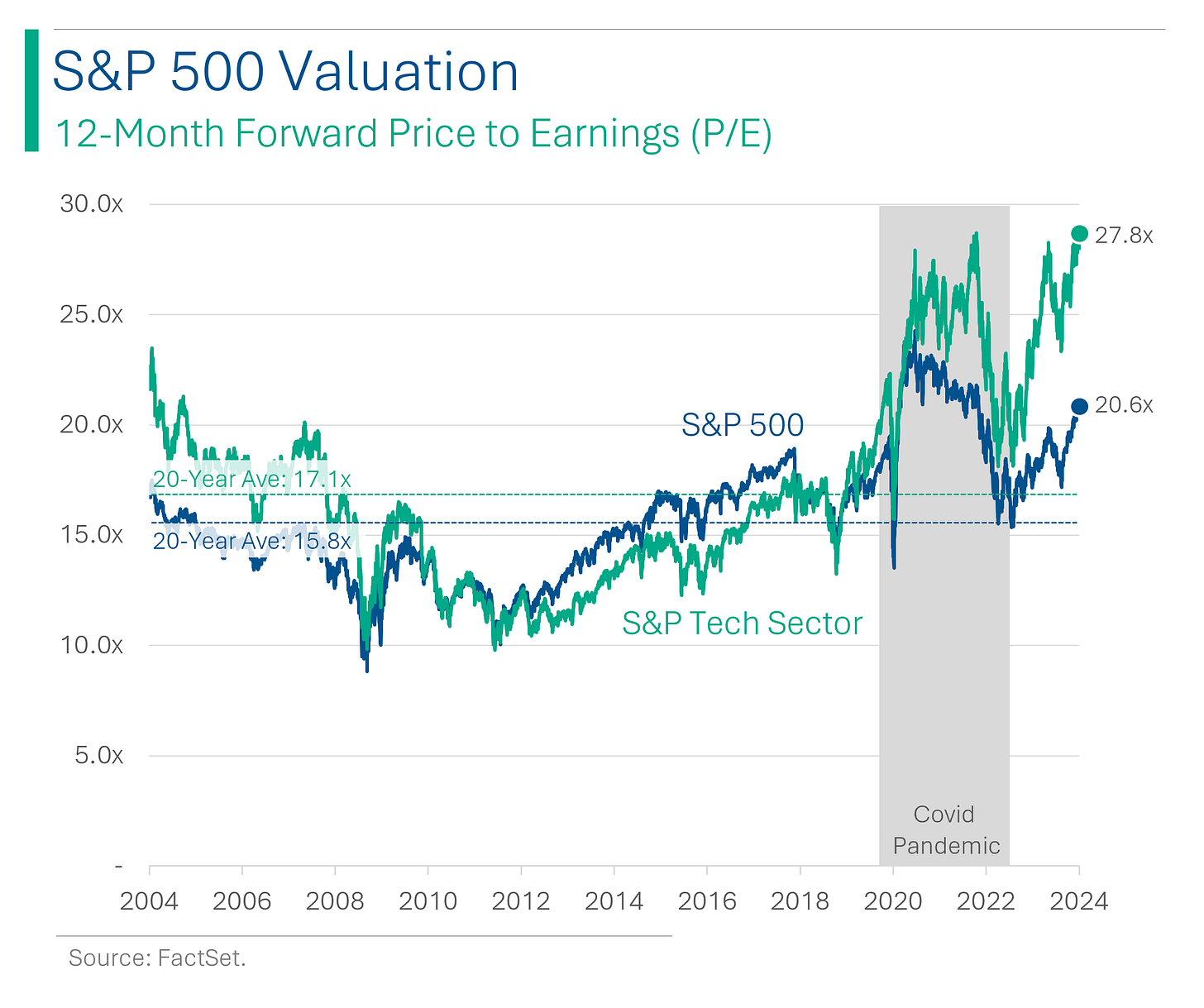

We have experienced one of the greatest bull runs in history and - excluding the Covid blip - have some of the highest valuations since the Dot-Com bubble. What remains to be seen is if there are catalysts that can be found to continue to support such strength in the stock market. Who knows? I’ve had too much NyQuil to even try and guess what they could be.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Nice graphs!