🔬Investors Swipe Left on Dating Apps (Or Why Economic Moats Are Important), and Much More

“Know what you own, and know why you own it”

- Peter Lynch

“Never bend your rules to accommodate your guts”

- Naved Abdali

Table of Contents

Hot Headlines

Joke Of The Day

A.M. Allocations: Investor’s Swipe Left On Dating Apps

Trivia

Market Movers

Market Update

Hot Headlines

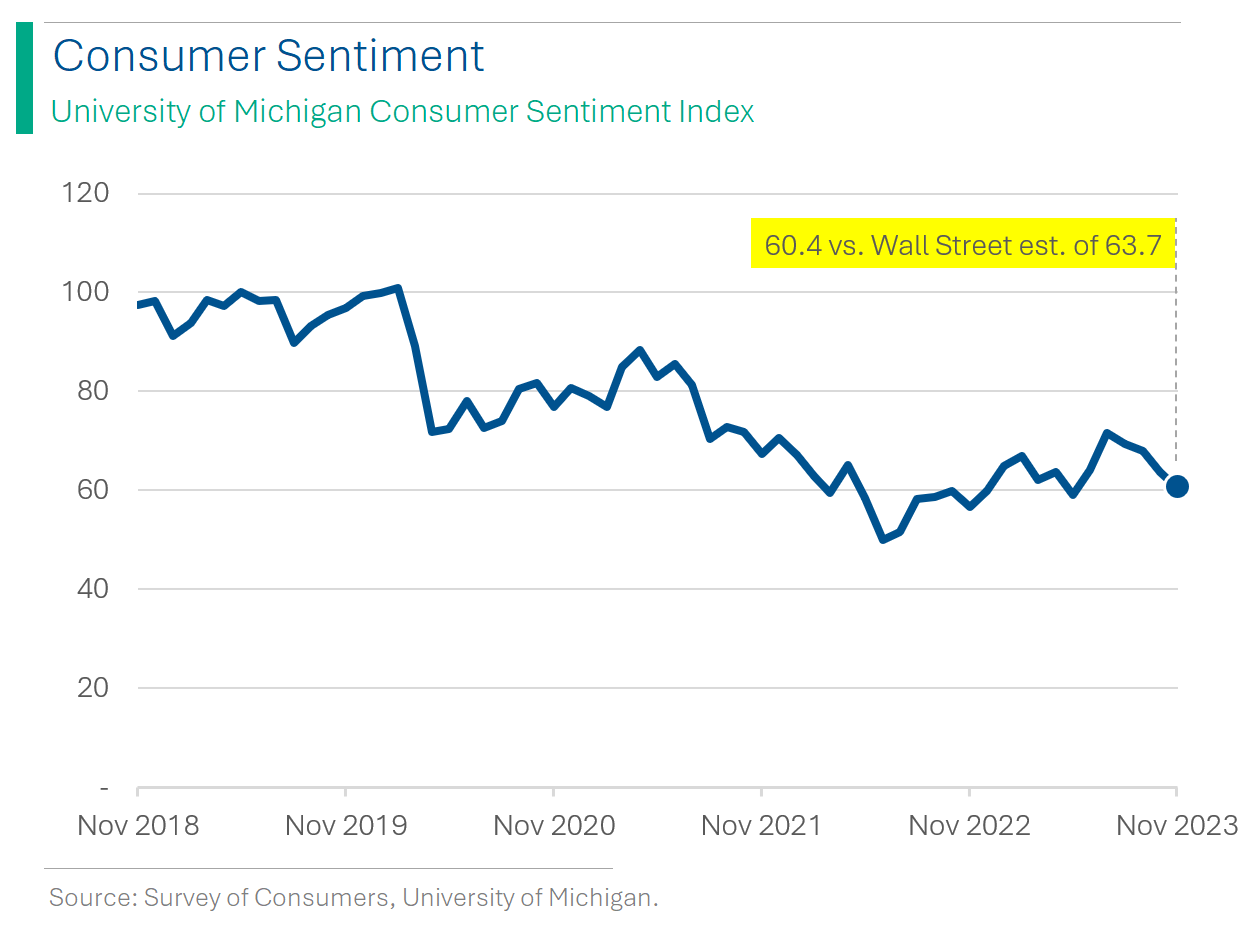

US CONSUMER SENTIMENT - Consumer sentiment in the U.S. dropped for the fourth month in a row to its lowest since May, with the University of Michigan's November index falling to 60.4 vs. Wall Street consensus of 63.7, reflecting growing concerns about high interest rates and the impact of ongoing global conflicts. Long-term inflation expectations have risen to 3.2%, the highest since 2011, accompanied by increasing worries about future gas prices. (Reuters)

ONLINE BROKER WEBULL FINED - Massachusetts regulators have fined online brokerage firm Webull $500,000 for inadequate compliance operations, citing the company's failure to effectively manage customer complaints and regulatory inquiries during a period of rapid growth. Despite efforts to bolster its compliance department since 2021, the state criticized Webull's overreliance on external consultants and the inadequacy of its employee training programs. (Barron’s)

HEDGE FUNDS GO BEARISH - Global hedge funds have escalated their bearish positions to a five-year high. There is a a particular focus on short selling in the financial sector, leading to the lowest long/short ratio since May 2020 and significant declines in bank stock indices such as the KBW Bank and S&P 500 Banks indexes. (Reuters)

EXXON MOBIL TO MINE LITHIUM - Yep, you read that right. The world’s biggest non-state controlled driller is entering the mining game. The company, in collaboration with Tetra Technologies, is set to announce its entry into lithium production with plans to begin extracting at least 10,000 metric tons annually in Arkansas by 2026 for electric vehicle batteries, utilizing direct lithium extraction technology. This strategic shift - aimed at leveraging Exxon's expertise in response to shareholder pressure to reduce carbon emissions - will mark their first major venture into lithium, although regulatory challenges regarding lithium royalties in Arkansas may pose short-term hurdles.

CHINA PIVOT TO HIGH-TECH - China is redirecting investment from its property sector to high-tech manufacturing, including semiconductors and electric vehicles (EVs), causing concern about potential overcapacity and increased exports. This shift aligns with China's aim to become an advanced manufacturing powerhouse, as outlined in its 14th five-year plan, despite risks of global market saturation and trade tensions, particularly with Europe. However, signs of overcapacity are emerging, with sectors like lithium-ion batteries and EVs facing potential excess production capacity, compounded by lower domestic consumption levels.

WRESTLING BOSS THROWING IN THE TOWEL - Vince McMahon, seemingly tiring of the wrestling world drama, plans to sell $700 million worth of his WWE parent company, TKO shares, possibly hinting at a tag-out from the family business he's dominated for decades. Meanwhile, Endeavor, the majority owner of TKO and apparently not quite the stock market heavyweight it hoped to be, is mulling over a retreat to private life, courtesy of its biggest fan, P/E shop Silver Lake.

(Barron’s) Fed Probes Morgan Stanley’s Work With Foreign Clients - Morgan Stanley's anti-money laundering policies were so lacking that even repeated visits from the Federal Reserve in 2020, 2021, and 2022 couldn't get them to clean up their act. It’s almost like they were financially incentivized not too.

(Reuters) China's Singles Day festival wraps up with e-commerce giants reporting sales growth - China’s version of Black Friday - but, like, with a sad, lonely twist - was expected to be pretty bad but proved differently.

(Bloomberg) Boeing Closes In on Major Deal With Emirates for 777X Jets - Boeing could use a win right about now.

(WSJ) Best Tech Gifts 2023: Stuff We Actually Bought

(CNN) Moody’s sends a warning to America: Your last AAA credit rating is at risk - I did a bit of a deep-dive on rating agencies downgrading the US a few weeks back. It was pretty sweet.

(Axios) The short shelf life of immersive attractions - Yeh, they’re kinda dumb when you think about it.

(Reuters) Dollar firm ahead of US inflation data; yen hovers near one-year low - Good ole, indefatigable Greenback (so rarely get to use that word in a sentence).

(CNN) Fashion mogul Peter Nygard found guilty of 4 counts of sexual assault

Joke Of The Day

What is the definition of an accountant? Someone who solves a problem you did not know you had in a way you don’t understand.

How is Christmas like your job? You do all the work and the fat guy in the suit gets all the credit!

A.M. Allocations

Investors Swipe Left On Dating Apps

Swipe Left on Profits: Big dating apps like Bumble and Match Group are watching their stock prices plummet faster than a bad Tinder date, with Bumble's shares dropping 32% this year and Match Group's not far behind, down 28%. Seems like Zoomers are breaking up with online dating, preferring the old-school charm of meeting in person.

CEO Dating Game: Bumble's CEO Whitney Wolfe Herd is swiping herself out of the executive suite, causing an 8% dip in share prices. This comes shortly after the September exit of its President, Tariq Shaukat. Match Group (Tinder, Match.com, Meetic, OkCupid, Hinge, Plenty of Fish) has also been playing musical chairs with its top execs, including the departure of Tinder's first woman CEO. All this amid a backdrop of slowing revenue growth, despite attempts to woo users with premium subscriptions.

Back to Basics: Meanwhile, college students are ghosting online dating, with a new trend of speed dating making a comeback. But don't worry, the dating app industry isn't destined for 'single' status just yet; their popularity soared during the pandemic, and according to former Tinder and Bumble sociologist Jess Carbino, people's desire for companionship isn't going anywhere.

Take-Aways: I’m no expert on the dating apps (I’ve been with my wife since I was a pimple-faced school boy) but think there is a broader theme that investors need to be cautious of; that things trendy with the twentysomethings can evaporate quite quickly.

Companies like GoPro and Snapchat were all extremely popular at one time but things change - and often quickly. A key term for investors is that of a ‘moat’: characteristics ingrained in your business model that makes it hard for competitors or copy-cats to come along and steal your market share. While things like a company’s ‘brand’ can be an example of a moat, ‘popularity’ isn’t the same thing. Brands are built over years from their connection to things like quality (Volvo), trustworthiness (Wall Street Journal) or coolness (Hermes).

Moreover, often these companies that achieve near overnight success do so because their business doesn’t require significant time, expense or technological sophistication in order to reach such a scale. Looking at the companies above, in nearly every case some smart guys with a laptop can replicate their business model; improve on it; and steal your customers. In essence, the things that can be built quickly, are often built on sand.

Trivia

Founding of Apple: In what year was Apple Inc. founded?

A) 1970

B) 1976

C) 1980

D) 1985

Apple's Revenue Milestone: When did Apple first exceed $100 billion in annual revenue?

A) 1991

B) 1998

C) 2001

D) 2011iPhone Sales: Apple reported its 2023 Earnings on November 2nd with iPhone representing what percent of total company sales?

A) 17%

B) 24%

C) 33%

D) 52%

(answers at bottom)

Market Movers

Winners!

Doximity (DOCS): [+16.2%] Q2 EPS and revenue beat; Q3 earnings and revenue guidance came in much stronger than expected, while FY24 outlook raised.

Hologic (HOLX): [+7.3%] Q4 earnings and revenue beat; highlighted strong growth in molecular diagnostics; FY24 guidance bookends the Street; announced new $500M accelerated repurchase plan.

Warner Brothers Discovery (WBD): [+5.1%] Bit of a bounce back after weak reporting on Wednesday. Downgrades from Goldman and Deutsche Bank.

Sony (SONY): [+5.1%] Maintains FY PlayStation 5 sales guidance of 25M units vs Wall Street estimate of 22.6M units.

Losers!

Plug Power (PLUG): [-40.3%] Q3 earnings and revenue missed; flagged multiple, frequent force majeure events constraining NA liquid hydrogen supply (though argued this dynamic is transitory); analysts voiced concerns about path to margin improvement and limited near-term visibility.

Trade Desk (TTD): [-16.7%] Q3 earnings and revenue better; highlighted strength in CTV with strong momentum in retail media; Q4 guidance below the Street; management flagged cautiousness among some larger advertisers (though they said spend stabilized in early November).

Illumina (ILMN): [-8.0%] Q3 earnings beat with revenue largely in line; GM a touch light but OM better; notable cut to FY guidance, with management citing capital and cash flow constraints for its customers; downgraded at Canaccord Genuity.

Wynn Resorts (WYNN): [-5.7%] Q3 EPS and revenue all beat expectations as strength in gaming, luxury retail and hotel bookings drove steady demand at its Macau properties; Las Vegas also better than expected, though Boston Encore property came in softer than anticipated; higher wages expected from new union contract.

Market Update

Trivia Answers

B) 1976

D) 2011

D) 52%

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.