🔬Investors Like Meme Stocks (Again), Sam's Back at OpenAI, and Much More

“Price is what you pay. Value is what you get.”

- Warren Buffett

“Successful investing is about managing risk, not avoiding it.”

- Ben Bernanke

Table of Contents

🗣️Market Chatter

🔥Hot Headlines

🤭 Joke Of The Day

📈 Market Movers

🙋♂️ Trivia

📊 Market Update

Market Chatter

US stocks down smalls (S&P 500 -0.20%, Nasdaq -0.59%) in a quiet day of trading. (Is everyone already on holidays but me?)

Healthcare up the most (+0.59%) and Tech the worst (-0.82%) with four of the eleven sectors in the green.

Gold up (+1.1%), WTI Crude flat after +2.5% gain on Monday.

Federal Reserve Minutes mostly as expected (proceed with caution) and ignored by market.

Busy day for retailer earnings (Best Buy, Guess, Abercrombie, Burlington, etc.) but results were very mixed. More on that below.

CEO of world’s biggest crypto exchange, Binance, pleads guilty and agrees to $4.3 billion settlement (largest in history).

Broadcom’s $61bn merger with VMware gets the greenlight from regulators.

Sam Altman returns to OpenAI (because artificial intelligence is no match for humanity’s natural stupidity).

Hot Headlines

NVIDIA EARNINGS - Nvidia’s Q3 report beat analysts’ consensus estimates, but failed to satisfy the loftier expectations of shareholders who have bet heavily on an artificial intelligence boom. The Company shared guidance of expectations of about $20 billion for Q4 revenue - topping the average Wall Street prediction of $17.9 billion - but some projections reached as high as $21 billion. Nvidia shares slid as much as 6.3% in late trading, settling down to a decline of about 0.9%. (Bloomberg has more)

BROADCOM’S VMWARE ACQUISITION - Broadcom Inc. and VMware Inc. expect to close their $61 billion merger on Wednesday, after China approved the deal with some restrictive covenants related to the companies’ dominant positioning across certain software and hardware markets. (More from MarketWatch)

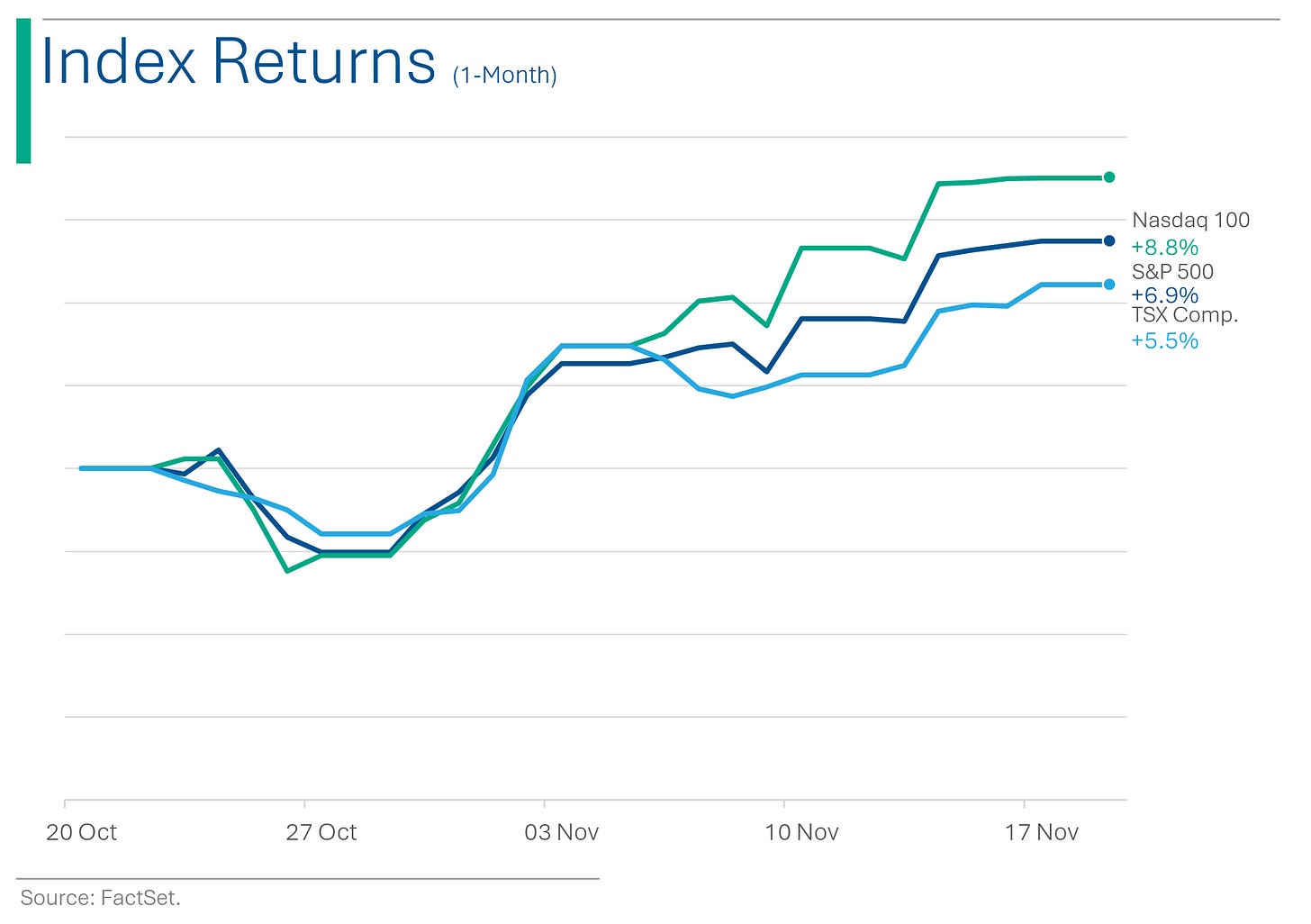

MEME STOCK RALLY - The Roundhill Meme ETF (MEME) and the Global X Robotics and AI ETF (BOTZ) have both outpaced the recent 10% surge in the S&P 500 since its recent low on Oct. 27, with MEME up 15.2% and BOTZ up 17.4%. The resurgence of meme and momentum stocks shows that investors’ animal spirits are starting to run hot again. Also, meme stocks tend to benefit from lower rates since they have an even greater need to raise capital at reasonable prices, so some of the rally can be explained by the recent narrative that the US Fed may be done hiking interest rates. (Yahoo talks meme stocks here)

ALTMAN TO RETURN TO OPENAI - In one of the crazier corporate dramas I’ve seen, Sam Altman has been reinstated as CEO of OpenAI, the company at the forefront of the AI boom, following his firing on Friday. OpenAI has revamped its board, appointing Bret Taylor as chair and adding Larry Summers, amidst a reshuffle that seems to align with the interests of major financial backer Microsoft. The board restructuring raises questions about the roles of existing directors and investors in OpenAI's capped-profit entity, including Microsoft's significant 49% stake. (More from Reuters and Axios)

BINANCE CEO GUILTY PLEA - Changpeng "CZ" Zhao, CEO of Binance, the world's largest crypto exchange, has agreed to plead guilty and step down in a $4.3 billion settlement with U.S. authorities over criminal and civil charges, including money laundering violations. The settlement includes Binance paying the largest penalty in U.S. Treasury history and implementing major compliance reforms under a 5-year monitorship. Richard Teng, formerly Global Head of Regional Markets at Binance, will take over as CEO, marking a significant shift in the company's leadership and strategy. Remember yesterday when I wrote about how all crypto exchanges are frauds? (Axios has more)

RETAIL EARNINGS ALL OVER THE PLACE - Usually related industries tend to have some commonality or trend (in industry parlance, ‘read-throughs’) but yesterday’s retailer reporting was all over the place. Even in closely related segments like casual wear, Abercrombie (+2.4%) and American Eagle (-15.8%) had vastly different results and, more importantly, guidance outlooks. Some retailers posted strong remarks towards 2024 revenue (Burlington, Dicks’) while others cast a darker outlook for the future or lowered already-published guidance (Best Buy, American Eagle).

FORD EV BATTERY PLANT - Ford Motor is reducing its investment in a $3.5 billion battery plant in Michigan to approximately $2 billion, cutting its production capacity by 43% and decreasing the expected employment from 2,500 to 1,700 jobs. This decision is due to a slower-than-expected consumer shift to electric vehicles, rising labor costs, and a broader move to trim costs, amidst global automakers' retreat from EVs due to various challenges. Sure, EV sales have sucked lately but this might be short-sighted. But then again, Ford hasn’t really been known to play the long-game in the last few decades. (CNBC has more on this)

(Tech Crunch) Tech CEO and Luminar Founder Austin Russell’s bid to buy Forbes fails after failing to get the ‘right group of investors’. In May, the 28-year-old announced plans to buy an 82% stake in a deal that values the company at nearly $800 million. I’m sure the below doesn’t have anything to do with it? *wink*

(CNBC) Qatar says Israel, Hamas agreed to 4-day cease-fire in Gaza and 50 hostages from Israel to be released.☮️

(Bloomberg) The New China Rich List. mbfn. 💰💰

(Reuters) Argentina's black market peso slides with eyes on Milei, while local equities soar. 😅

(Reuters) China government advisers call for steady growth target in 2024 and more stimulus. Targeting 4.5% to 5.5% GDP growth.📈

(Bloomberg) Novo Sees Ozempic Shortages Continuing Next Year in Europe. 💉

Joke Of The Day

Did you hear about the accountant who hated negative numbers? He would stop at nothing to avoid them.

Market Movers

Winners!

Symbotic (SYM) [+40.2%] Q4 revenue beat but EPS missed. More importantly Q1 revenue guidance exceeded estimates, with analysts noting positive margins in recurring/software.

Burlington Stores (BURL) [+20.7%] Q3 results met Wall St. consensus. The company raised the lower end of its FY EPS guidance.

Dycom Industries (DY) [+17.4%] Q3 EPS and Revs beat. The results were notably strong against an uncertain telecom capex environment.

Agilent Technologies (A) [+8.7%] Q4 EPS and Rev beat. Strong guidance driven by China growth.

Losers!

American Eagle Outfitters (AEO) [-15.8%] Q3 EPS and revenue exceeded expectations, but gross margins fell short. Upped guidance. Stock had been on big rally so decent quarter wasn’t enough to keep folks happy.

Jacobs Solutions (J) [-8.7%] Beat on Q4 Revs but EPS missed estimates. 2024 EPS guidance was lower than expected.

Kohl's (KSS) [-8.6%] Beat on Q3 EPS but Revs missed. Comparable sales decline was greater than consensus. Management noted strong growth in Sephora but analysts expressed caution about ongoing investments.

Trivia

Some good ole NYSE trivia today!

When was the New York Stock Exchange (NYSE) founded?

A) 1754

B) 1792

C) 1817

D) 1865What was the largest single-day percentage drop in the Dow Jones Industrial Average?

A) 12.8% in 1929

B) 22.6% in 1987

C) 20.4% in 2008

D) 18.3% in 2001What is the NYSE's longest Bull Market?

A) 1990 - 2000

B) 2009 - 2019

C) 1982 - 1987

D) 1949 - 1956

(answers at bottom)

Market Update

Trivia Answers

B) The NYSE was founded in 1792 with the Buttonwood Agreement signed by 24 stockbrokers to set rules for how stocks could be traded and established set commissions.

B) The largest single day drop was 22.6% in 1987 (‘Black Monday’).

B) The longest Bull Market was 2009 - 2019.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.