🔬Investing At All-Time Highs, Inflation Keeps Cooling, and Much More

"Buy on the cannons, sell on the trumpets."

- Old Wall Street saying

"Everyone has the brainpower to follow the stock market. If you made it through fifth-grade math, you can do it"

- Peter Lynch

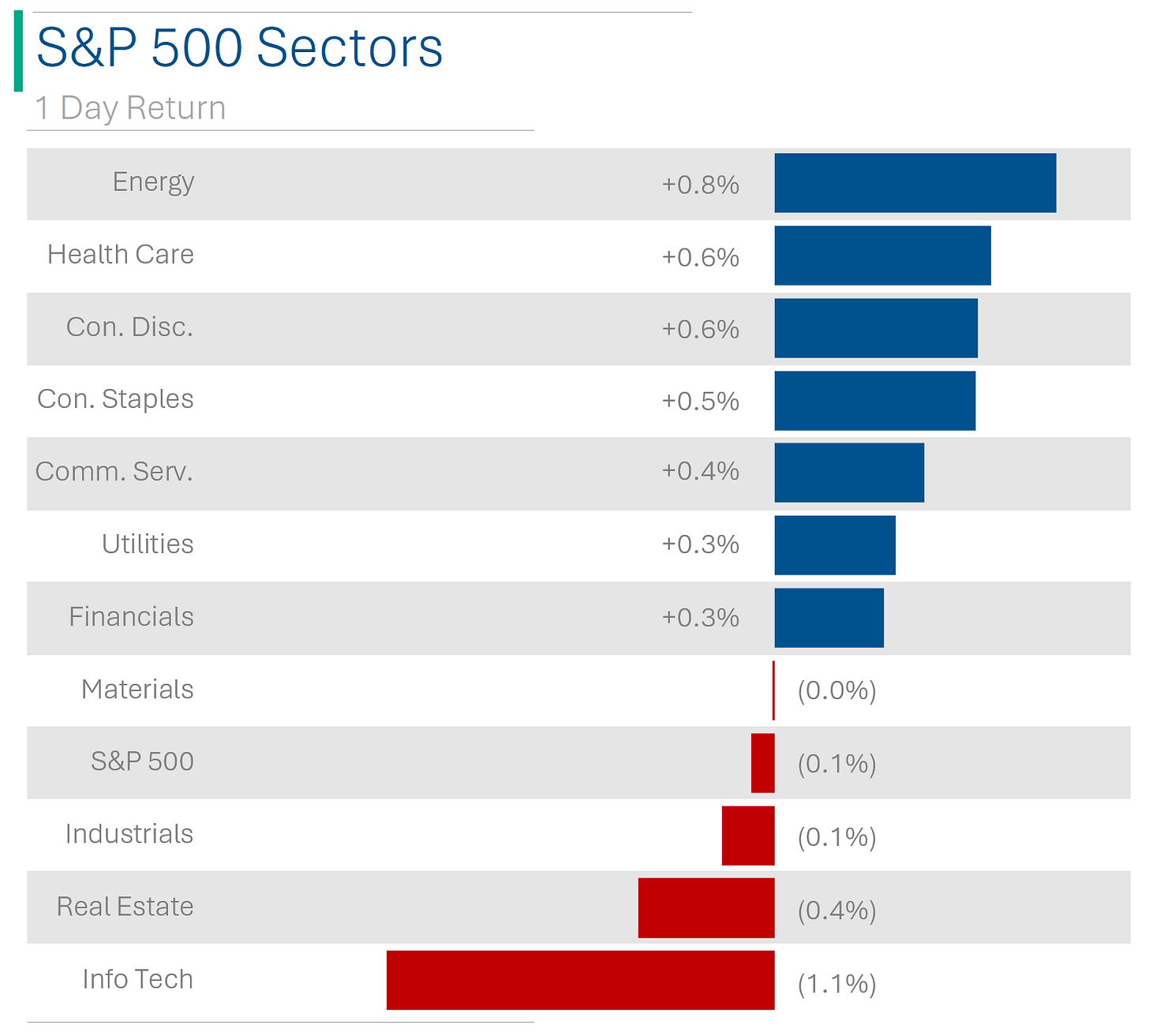

After a relatively strong up-week, the big US markets closed Friday modestly in the red (S&P 500 -0.07%, Nasdaq -0.36%).

7 of 11 sectors closed up positive, led by Energy (+0.8%) and Healthcare (+0.6%). Info Tech - which has been on a nice run lately - finished worst, down -1.1%.

PCE inflation came in at +0.2% for the month of December and up 2.6% from a year prior.

Bitcoin closed up 4.9% and ended the week higher.

Earnings season off to a bla start. Currently the average EPS reported has been a miss (-1.4% vs. estimates), compared to Q3 which averaged a +1.6% beat.

Street Stories

Investing Near All-Time Highs

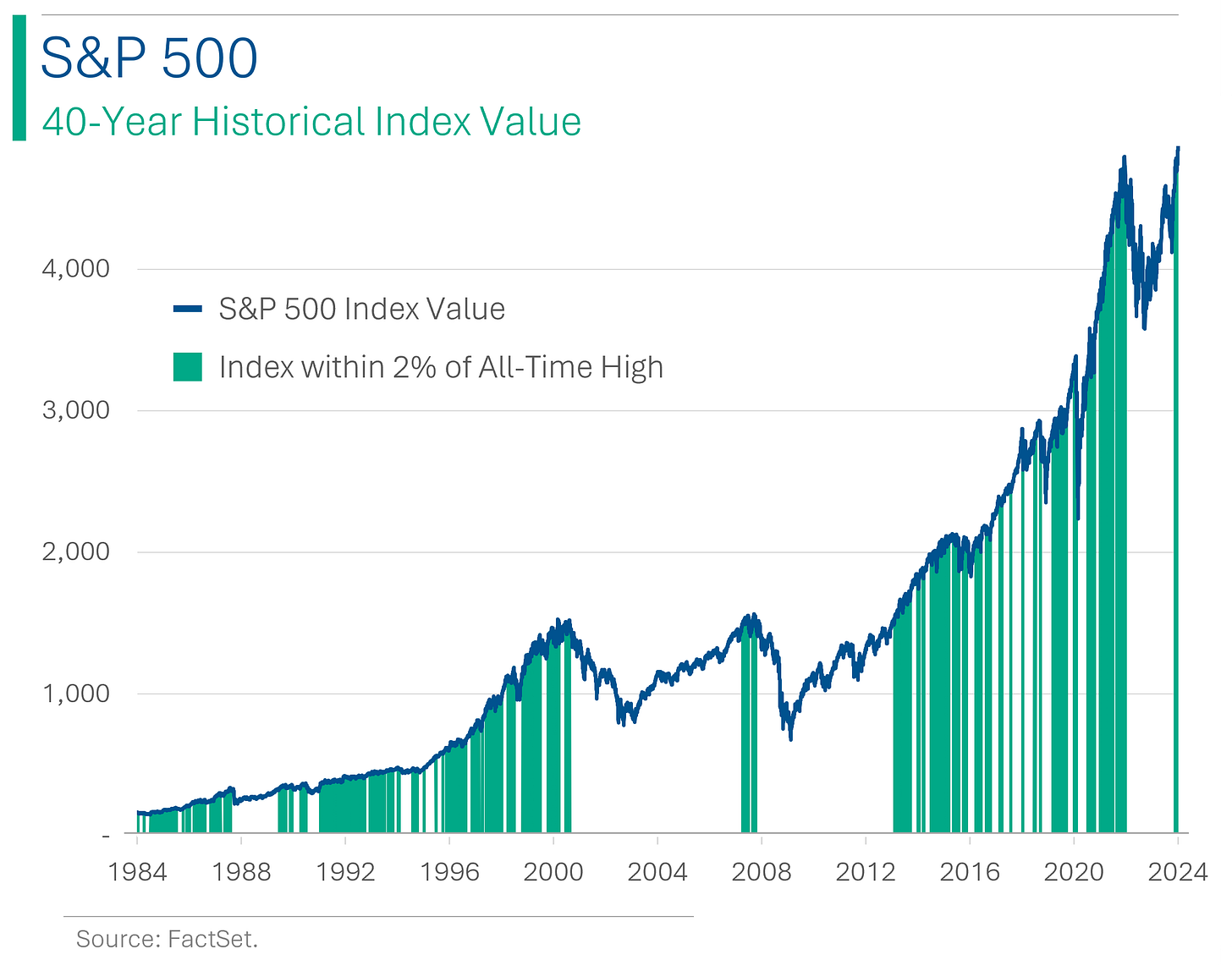

The S&P 500 hit some fresh, new all-time high last week, which got me thinking about how stocks perform when they’re at a new peak. Conventional stock market wisdom cautions investors that investing near the top is risky - better just to buy the dip they say.

As you can see above, over the last 40 years the S&P 500 has been within 2% of its all-time high about 32% of the time. But is that a bad time to invest? Turns out it’s not: Investing near an all-time high has actually been positive for relative returns. For example, investing at any time between January 25th 1984 and January 25th 2023 has averaged a 1-Year return of around +10.1%. During the same period, investing when the Index is within 2% of its all-time high has generated a slightly better returns of +10.3%. And the figures get better for longer investment horizons.

Another way to look at this is the probability that the market will have a positive return at a fixed point in the future. Investing in the market at any point in the last 40 years, has on average had a positive 5-year return 79.8% of the time. But investing during that period when the market is within 2% of an all-time high has had a positive return 86.2% of the time.

The Great American Chip-Off: Funding the Future of Tech

The U.S. government is set to announce significant funding under the Chips Act, involving billions of dollars, to boost domestic production of advanced semiconductors, with companies like Intel, TSMC, and Samsung among the expected beneficiaries. The $53 billion Chips Act, which includes $39 billion in manufacturing grants and aims to cover up to 15% of project costs per fabrication plant, is a key part of President Biden's strategy to strengthen the U.S.'s role in the global tech industry. However, the initiative faces challenges such as environmental review delays and skilled labor shortages, critical factors in its timely and effective implementation. (WSJ has more on the pending announcements)

Inflation's Winter Retreat

The U.S. Commerce Department reported that the December personal consumption expenditures price index, the Fed’s preferred measure of inflation, rose by +0.2% monthly and +2.6% annually, excluding food and energy, signaling a cooling inflation rate. Consumer spending increased by 0.7%, while the personal savings rate dropped to 3.7%, and the Federal Reserve is anticipated to start reducing interest rates later this year as inflation nears its 2% target. Despite the Fed's aggressive interest rate hikes, the economy expanded with a higher-than-expected 3.3% GDP growth in the fourth quarter, and there is now a 53% chance of a rate cut in March, as per futures traders. (CNBC has more on the inflation print)

Venture Capital Vanishing Act: Where Did All the Money Go?

U.S. startup investments plummeted to their lowest level in four years in 2023, with major venture firms like Tiger Global Management, Andreessen Horowitz, and SoftBank significantly reducing their deal-making. Tiger Global completed only 20 deals, a sharp decrease from 194 in 2021, while Andreessen Horowitz did 145 deals, down from 239, and SoftBank made just seven deals.

This decline in venture funding, exacerbated by rising interest rates and a withdrawal from the era of cheap money, led to widespread cutbacks across various sectors, resulting in staff reductions and closures of many startups. (WSJ has more on the state of Venture Capital)

Download Dilemma: Spotify's Jam Session with Apple's New Fee

Spotify criticized Apple's new plan to charge a ‘Core Technology Fee’ of €0.50 per annual app install after 1 million downloads and a 17% fee for use of external payment processors, labeling it as "extortion" and detrimental to developers, especially those offering free apps. Despite Apple's claim that the changes offer developers more choice, Spotify argues that the new fees make it financially challenging for developers to move away from Apple's ecosystem. The EU Commission plans to review Apple's policy changes, which have sparked widespread criticism among developers, when they take effect in March. (The Verge has more on this story)

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

I reached the office this morning and the boss stormed up to me and said ‘you missed work yesterday, didn’t you?’ I said ‘No, not particularly.’

Hot Headlines

WSJ | Investors are betting on defense startups but the Pentagon isn’t. VCs have poured +$100 billion into defense-tech start-ups since 2021 but so far there hasn’t been much buying on the part of the government (their only real end-market).

Reuters | Spain's Grifols sues Gotham City damaging short report that it claims is inaccurate. The damning report, which alleges accounting improprieties, tanked Grifols share price by ~30% and wiped out €2.8 billion in market cap.

PYMNTS | Shein investors sell discounted shares as IPO enthusiasm wanes. Private share deals value the company as low as $45 billion, well below the $90 billion valuation they hoped to hold at IPO and $66 billion they were valued at in their last funding round in May 2023. I mean, they are having trouble IPOing in the States because of that whole ‘buying from companies that employ slave labor’ thing, so I don’t feel too bad.

Variety | Amazon Prime Video’s move to steamroll into ads could generate more than $3 billion this year. Ads will start playing on Amazon Prime later this year unless the subscriber elects to pay an extra $2.99/month. Booooo.

CNN | The NSA buys Americans’ internet data, newly released documents show. At least their paying for it, I guess.

Trivia

This week’s trivia is on companies and war.

Which company was heavily involved in the Opium Wars of the 19th century, acting as a de facto arm of its European government?

A. Dutch East India Company

B. British East India Company

C. Hudson's Bay Company

D. Royal Spanish Merchant CompanyMitsubishi, a Japanese conglomerate, is known for manufacturing which type of military equipment during World War II?

A. Tanks

B. Aircraft

C. Battleships

D. FirearmsThe company BASF, part of the IG Farben conglomerate, was involved in producing which notorious product during World War II?

A. Tanks

B. Explosives

C. Zyklon B gas

D. Rifles

(answers at bottom)

Market Movers

Winners!

AppFolio (APPF) [+28.3%]: Q4 revenue and EPS exceeded expectations. FY24 revenue guidance slightly below midpoint due to 50bp credit card fee cut starting April, but EPS and margins are projected to be better.

Booz Allen Hamilton Holding (BAH) [+13.6%]: FQ3 EPS and revenue surpassed forecasts. FY24 EPS and revenue growth estimates raised, alongside an 8.5% increase in quarterly dividend.

American Express (AXP) [+7.1%]: Q4 EPS and revenue fell short of expectations, with revenue affected by Discount and Processed units, though Net Interest Income was slightly ahead. FY24 EPS and revenue growth forecasts exceed market expectations, and a 17% dividend increase was announced. Analysts noted better-than-expected net charge-offs and larger buybacks.

Losers!

Spirit Airlines (SAVE) [-13.4%]: Spirit received notice from JetBlue (JBLU) that the merger agreement might end on or after January 28. JetBlue is evaluating options, while Spirit contends there's no basis for termination.

Intel (INTC) [-11.9%]: Q4 earnings, revenue, and margins were strong, particularly in Client Computing. However, Q1 guidance is notably weak, with expectations for a double-digit sequential decline in Data Center and material inventory corrections in Mobileye and PSG. The announcement led to multiple downgrades.

KLA (KLAC) [-6.6%]: FQ2 EPS and revenue exceeded expectations, but the guidance was disappointing, indicating a muted recovery. The company anticipates spending in the wafer fab equipment market to be in the mid-to-high $80 billions in 2024, roughly flat or slightly up from 2023, with limited visibility on demand resumption.

Market Update

Trivia Answers

B. British East India Company effectively started the Opium Wars by flooding China with the drug in order to use it as a currency to trade for tea.

B. Mitsubishi produced Aircraft, which included the famous Zero fighter.

C. BASF produced Zyklon B gas, used in the Nazi gas chambers. Today they are the world’s largest chemical manufacturer.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.