🔬International Stocks Rally, Employment is Strong, and Much More

"You never know what you will find on the other side of the door until you open it"

- Nassim Nicholas Taleb

"A nickel ain't worth a dime anymore"

- Yogi Berra

The big US markets had a strong end to the week (S&P 500 +0.41%, Nasdaq +0.45%). Equities closed at new highs for the year, with S&P and Nasdaq each locking in sixth consecutive weekly gains.

7 of 11 sectors closed in the green, with Energy (+1.1%) leading the way after the rout in oil prices seemed to take a pause. Consumer Staples had it the worst (-0.7%), since it’s ‘risk on’ and defensives are lame.

WTI crude settled +2.7%, moving back above $70/barrel but still logging its seventh-straight weekly decline.

Paramount Global’s ($PARA) shares jumped +12% after reports of takeover interest from Skydance and RedBird Capital.

US approves first gene-editing treatment, Casgevy, for sickle cell disease. Although shares of co-developers Vertex and CRISPR fell 1% and 8%, respectively.

Time released its ‘10 Best Songs of 2023’… and I only know two of them…because of my wife.

Street Stories

GLOBAL STOCK RALLY - The big rally that’s taken place in stocks hasn’t just been a local affair, as indices from around the world have performed incredibly well since the lows of late October.

The US can claim responsibility for some of this:

The base-case for the world’s largest economy is now pointing towards a ‘soft-landing,’ meaning that trade and export to the world’s largest economy should remain healthy.

Being the first - and generally most committed - to combating inflation with interest rate hikes, other major economies can see a light at the end of the tunnel for tightening their monetary policy. And *fingers crossed* most will face an economic situation far less tepid than originally feared.

Now that bullish sentiment has spread beyond a select few companies (notably the Magnificent 7), and into a general ‘risk on’ for the market, investors are providing strength to areas ignored until recently, including international stocks.

Not everything has been great internationally though. The UK (FTSE 100) has been a laggard for many reasons, including an economy that has looked a bit shaky compared to its global peers (particularly stickier inflation), and an appreciable lack of quality technology companies. Japan (Nikkei 225) was riding high but decelerating GDP and a weak consumer paints a less than optimal picture for financial markets. And the Hang Seng (China) has its own series of economic woes, including a real estate crisis that now looks to be spreading into a broader financial and banking mess.

MEGA HEALTH INSURER MERGER CALLED OFF - Cigna has abandoned its plan to acquire Humana, a deal that would have created a $140 billion healthcare industry giant, due to disagreements over price and financial terms. Instead, Cigna is shifting its focus to smaller acquisitions and plans to buy back an additional $10 billion in stock, increasing its total repurchases to $11.3 billion. This is good as the last thing the U.S needs is any more consolidation in its health insurance industry.

U.S. EMPLOYMENT REMAINS HEALTHY - Friday’s U.S. nonfarm payrolls for November showed a 199k increase vs. Street estimates of 175k. The unemployment rate dropped to 3.7% vs. the Street’s 3.9% bogey (October’s was 3.9%), indicating a resilient job market despite economic slowdown fears. The increase in jobs included significant government hiring and workers returning from strikes, while household surveys showed even stronger job growth. Average hourly earnings rose by 0.4%, signaling modest inflation, and the mixed market response reflects expectations of continued expansion without prompting a Federal Reserve rate hike.

Ryan’s Thoughts: Federal Reserve officials are watching the jobs numbers closely as they continue to try to bring down inflation that had been running at a four-decade high but has shown signs of easing. Recall that the Fed’s job isn’t just to tackle inflation; its ‘Dual Mandate’ is price stability (ok, that’s pretty much just inflation) and also to maximize sustainable employment. While employment falling off a cliff would be a good incentive for the Fed to cut rates sooner (Yaa!) it would also mean the U.S. economy is on a shaky, non-‘soft-landing’ trajectory (Boo!).

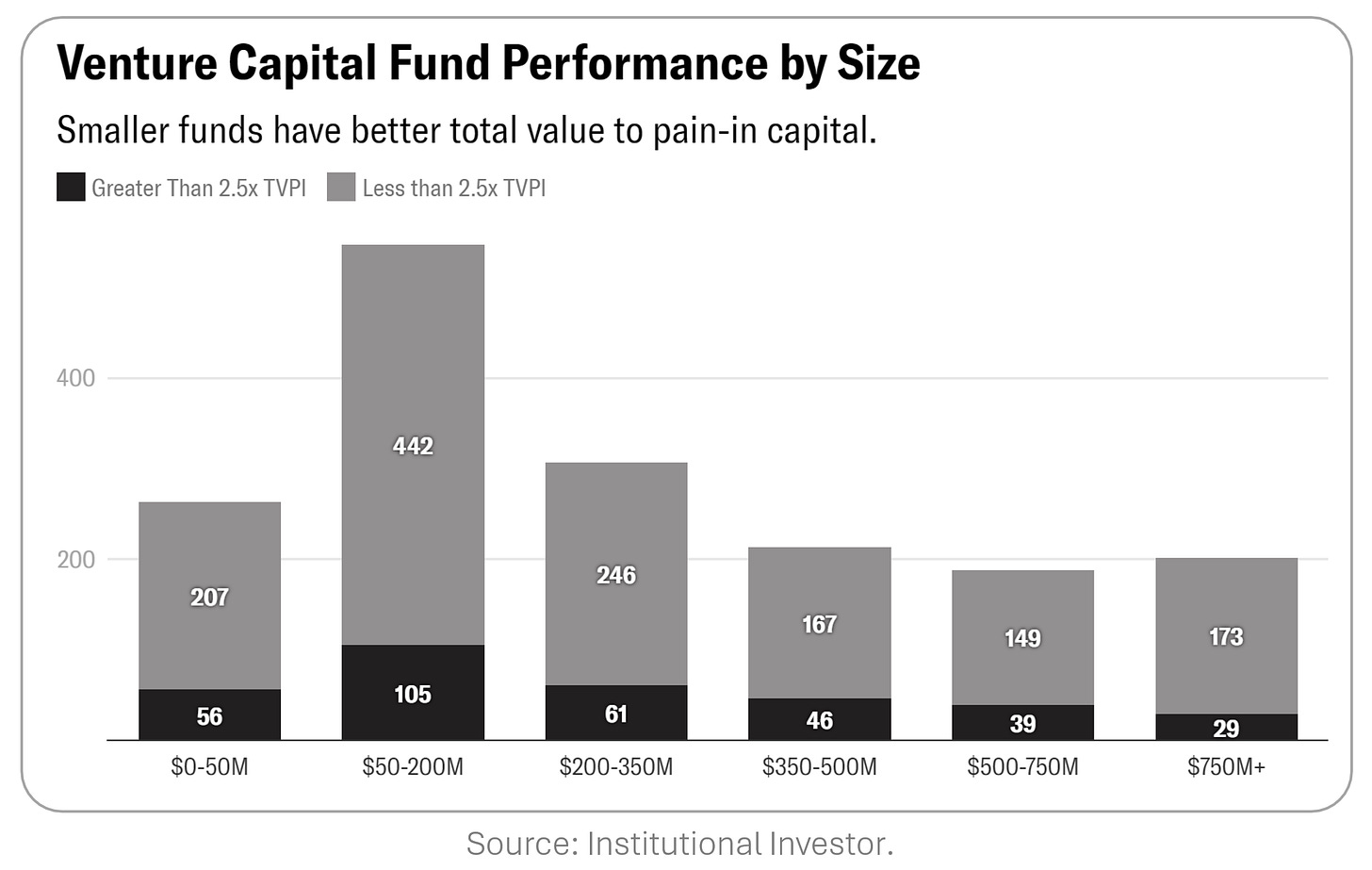

SMALL VCs OUTPERFORM BIG VCs - Institutional Investor did an interesting look into the performance of venture capital firms by the size of their assets under management. It found that for funds >$750 million, only 17% returned a Total Value to Paid-in Capital of more than 2.5x, with an average IRR of ~9.7%. This number is 25% for funds less than $350 million, with an average IRR of 17.4%. Something I think that’s missing from this report is the idea that larger VCs are more involved in later stage funding rounds that have been somewhat de-risked, so while the return is lower, it’s safer deployment. This of course excludes Softbank; who are stupid. (Full story by II)

SELF CHECK-OUTS DECLINE AMIDST GROWING THEFT - Dollar General, realizing that self-checkout isn't the retail utopia it seemed, is scaling back its use, joining the club of stores like Walmart and ShopRite that found the tech more adept at boosting shoplifting than sales. In a twist, even Target is limiting self-checkout to the 10-items-or-less crowd, and Costco is staffing up to catch freeloading non-members, proving that sometimes, the old-fashioned way is just less of a headache.

Kyle at the Investing 101 newsletter did an interesting write-up on the precarious state of the Venture Capital world. Check it out!

Joke Of The Day

A man furiously approaches his neighbor and shouts, “Where is your wife!?”

“Why?” the neighbor asks. “What did Anna do?”

“She tricked my wife into investing in a fake farm for giant snakes,” the man yelled.

“Anna conned her?”

“No. Burmese pythons.”

Hot Headlines

CNBC | Musk’s Scandinavian woes deepen as Tesla loses Swedish court case, Finnish union joins port blockade.

Tech Crunch | Google’s Chat-GPT competitor, Gemini, showed faked outputs in popular product demo.

VICE | Trump’s latest courtroom defeats are a really big deal.

WSJ | The Journal launched a cool 4-part podcast history of Chat-GPT creator, OpenAI.

Reuters | DHL Express U.S. air hub workers strike during holiday rush. Almost like they planned it…

Trivia

This week’s trivia is on historical financial crises.

The Dutch Tulip Mania, considered one of the first recorded financial bubbles, occurred in which century?

A) 14th Century

B) 15th Century

C) 16th Century

D) 17th CenturyWhich famous Italian family was influential in developing banking in medieval Europe?

A) The Borgia family

B) The Medici family

C) The Visconti family

D) The Sforza familyThe 'South Sea Bubble' was a famous stock market crash that took place in which country?

A) France

B) England

C) Spain

D) Portugal

(answers at bottom)

Market Movers

Winners!

Paramount Global (PARA) [+12.1%]: Skydance and RedBird Capital are rumored to be considering a takeover via National Amusements, which holds about 77% of Paramount's Class A voting shares, according to Deadline.

Riot Platforms (RIOT) [+6.4%]: JP Morgan upgraded the stock to neutral, citing improved insights into the company's hashrate growth, capital expenditure, fleet efficiency, and power strategy.

lululemon athletica (LULU) [+5.4%]: Beat Q3 earnings and margins with consistent revenue and better-than-expected comps. Announced a new $1B buyback and provided Q4 EPS guidance considered conservative by analysts, with positive outlooks for holiday sales and international growth.

Losers!

HashiCorp (HCP) [-16.4%]: Despite better Q3 earnings and a slight increase in FY guidance, concerns arose due to lower-than-expected billings and deferred revenue, decelerating growth, and cloud market challenges.

Restoration Hardware (RH) [-14.0%]: Missed Q3 earnings and revenue, with narrowed FY24 revenue guidance and a reduced operating margin range. The company faces headwinds from a stagnant housing market and a shift towards clearance items impacting gross margins, compounded by minimal new product rollouts affecting market share growth.

Market Update

Trivia Answers

D) Tulip Mania happened in the 17th Century.

B) The Medici family helped develop modern banking in Europe.

B) The ‘South Sea Bubble’ started in England.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.