🔬Inflation Is Fine, Google Is An Oligopolist, and Much More

"The older I get, the more I see a straight path where I want to go. If you’re going to hunt elephants, don’t get off the trail for a rabbit"

- T. Boone Pickens

“The only essential oil is WTI”

- @overheardonwallstreet

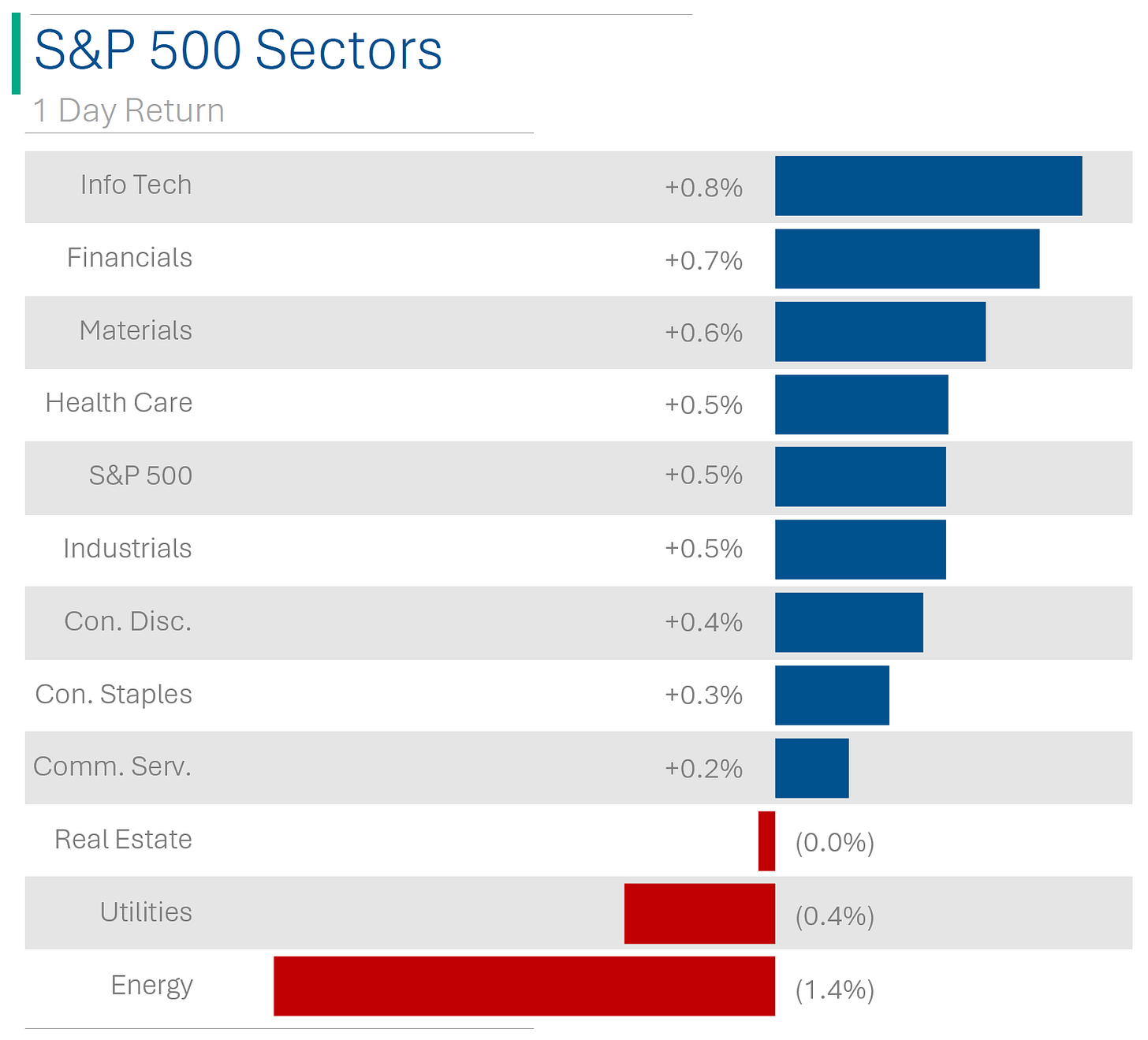

Another good albeit unexceptional day for the big US markets (S&P 500 +0.46%, Nasdaq +0.70%) but marking four straight days of modest gains.

8 of 11 sectors closed in the green with Info Tech (+0.8%) bouncing back after a weak Monday. Energy again led the way down (-1.4%) as the oil price continued its trip south after a brief headfake yesterday (WTI crude -3.6% to $68.75).

November headline inflation (CPI) rose +0.1% m/m vs. consensus for another unchanged month after October's flat reading.

Oracle tanked 12.2% after a Q2 miss on revenue and soft guidance for Cloud/OCI growth.

EV maker Lucid fell 8.3% as CFO Sherry House announced she was leaving

this Hindeburg of an automakerto pursue other opportunities.

Street Stories

INFLATION - November's headline Consumer Price Index (CPI) in the U.S. rose by 0.1% month-over-month vs. no change expected by Wall Street, with an annual increase of 3.1%, marking the lowest yearly rise since March 2021. Core CPI, excluding food and energy, increased by 0.3% month-over-month, driven largely by shelter costs which, as you can see below, has remained quite persistent. The market reaction was subdued, suggesting that the data supports ongoing disinflation and could influence the Federal Reserve's policy decisions at the upcoming FOMC meeting. [Bloomberg has more on this]

‘EPIC’ WIN OVER APP STORE - Epic Games Inc. won an antitrust trial against Google, with the jury deeming Google's app store practices illegal and monopolistic, a decision set to disrupt the app store economy and likely to lead to a lengthy legal battle culminating in the U.S. Supreme Court. While Epic did not seek monetary damages, the outcome challenges the traditional app store model, especially in terms of commission fees and market definition, with significant implications for major tech companies and app developers.

Explainer: Epic Games - the maker of the popular video game Fortnite - found that the 30% fee charged by Apple and Google for any purchases through their app stores was egregious (because it is), so in 2020 it sought to bypass this by allowing purchases directly through their own site. This resulted in Fortnite being kicked-out of any iOS and Android platform, which Epic followed up by filing lawsuits against both Apple and Google. The case is important since, as there is effectively only two mobile operating systems (Apple’s iOS and Google’s Android), developers are stuck paying a huge oligopoly tax. Sure, its their platform but a 30% fee seems more like rent collecting than a listing fee in a free market.

BANKRUPTCY LEAVES CUSTOMERS WITHOUT RETAINERS - SmileDirectClub's sudden downfall has left customers with clear aligners in a not-so-clear situation, especially those who recently snagged a "once-in-a-lifetime" discount only to find themselves part of an involuntary game of dental hide-and-seek. As the company shuts down amidst bankruptcy, its customers, now unwitting collectors of rare, unusable aligners, are left biting their nails instead of straightening their teeth.

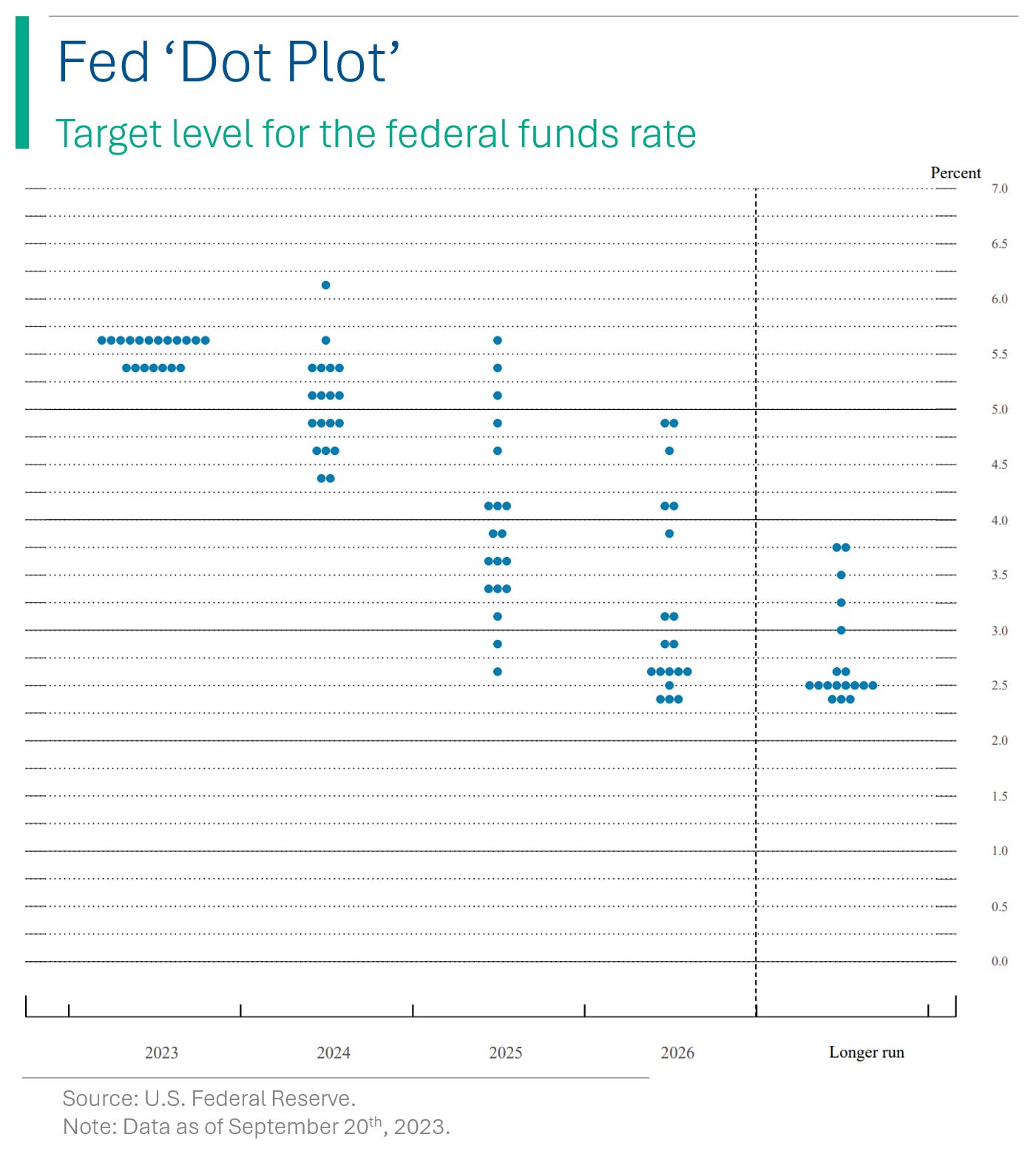

BOND MARKET TARGETING AGGRESSIVE RATE CUTS - Investors in the bond market are closely watching Federal Reserve Chair Jerome Powell's upcoming speech today and the central bank's dot-plot (more on this below) for indications of future U.S. interest rate cuts, having bet on a reduction exceeding 100 basis points in 2024. Despite some recent de-risking, the market is heavily invested in a Fed pivot to easing rates, with the risk that a ‘hawkish’ Fed could potentially lead to a rapid unwinding of these bets. The recent auction of 30-year bonds showed strong demand, easing concerns about market absorption of U.S. government debt, while investors remain attracted to the high yield levels amidst expectations of a quick rate cut by the Fed. [Bloomberg has more on what’s implied by bond swap market]

What is the ‘Dot Plot’? At every other Fed meeting, the Board members update a list of their expectations for key economic factors, such as inflation, interest rates and economic growth. The ‘Dot Plot’ is one of these outputs and is highly valued by investors as it gives a ‘base case’ for where the Fed members believe interest rates are headed in the future, and changes to the plot are important indicators of policy shifts.

RENAULT SELLING OFF NISSAN STAKE - Renault is bidding adieu to a chunk of its Nissan stake, selling back 5% to Nissan in what seems like a garage sale, only with billions involved. The French carmaker's ambitious decluttering plan aims to reduce its hoard of Nissan shares from around 43% to a more modest 15%, in a move reminiscent of a New Year's resolution to downsize. The sale fetched a cool 765 million euros. Can’t help it but whenever I think of these two I think of CEO Carlos Ghosan’s escape from Japanese custody in a speaker box. These two dogs deserve each other.

Joke Of The Day

The economy’s so bad, Exxon-Mobil laid off 15 Congressmen.

Hot Headlines

Reuters | The looming $5 trillion options expiration this Friday is linked to lowered volatility and flat stock market. Apparently this is the largest single day expiry in 20 years and the VIX is at a four year low at 12.07.

The Sun | Top Russian diplomat found dead by his wife in ANOTHER mystery death after he worked as ‘Putin’s Man in Iran’. Add another one to the list of ‘suspicious’ (ie: Putin did it) deaths of senior Russian diplomats and businessmen (Wikipedia’s long list).

WFB | 'This is Definitely Plagiarism': Harvard University President Claudine Gay copied entire paragraphs from others’ academic work and claimed them as her own. Website seems a bit Alt-Right but the plagiarism examples are pretty ridiculous.

ars technica | Tesla again threatens to sue Cybertruck buyers who try to resell the cars. Fix the panel gaps before you get all uppity.

Thought this was a nice macro/sentiment overview from Market Mosaic:

Trivia

This week’s trivia is on financial crises and bubbles.

What was a key factor in the 1997 Asian Financial Crisis?

A) Dot-com bubble

B) Housing bubble

C) Currency devaluation

D) Oil price shockDuring what period did the United States experience 'Stagflation'?

A) 1950s

B) 1960s

C) 1970s

D) 1980sWhich term describes the economic situation of Germany in the 1920s?

A) Deflation

B) Stagflation

C) Hyperinflation

D) Reflation

(answers at bottom)

Market Movers

Winners!

Icosavax (ICVX) [+48.9%]: Agreed to an acquisition by AstraZeneca for $15 per share in cash, totaling ~$800M, a 43% premium. Additional CVR of up to $5 per share could increase value to $1.1B.

BRP Group (BRP) [+8.4%]: Upgraded at Raymond James to strong buy from outperform. See market undervaluing potential for 2024-25 and improving loss trends.

Perion Network (PERI) [+7.9%]: Announced the acquisition of Hivestack for up to $125M.

HubSpot (HUBS) [+4.5%]: Upgraded at Piper Sandler to overweight from neutral, based on website traffic recovery and positive 2024 CIO survey data.

Losers!

Oracle (ORCL) [-12.2%]: Fiscal Q2 revenue fell short, missing Cloud/OCI growth expectations for the second quarter. Skepticism about meeting +29% CC organic Cloud revenue growth target in F24 persists.

Lucid Group (LCID) [-8.3%]: CFO Sherry House resigned effective immediately to pursue other opportunities.

Johnson Controls International (JCI) [-7.2%]: Missed Q4 Revenue; EPS in-line after adjustment for a cyber incident. Q1 and FY24 EPS guidance below expectations; analysts cautious about the back-loaded FY24 guide and muted FCF conversion.

Macy's (M) [-6.8%]: Downgraded to sell from neutral at Citi following take-private offer news. Skepticism about the deal's completion and challenges in leveraging real estate value.

Moderna (MRNA) [-5%]: Announced operational changes; CEO Stephane Bancel to oversee sales and marketing in 2024. President Stephen Hoge will handle pipeline commercial strategy, and Chief Commercial Officer Arpa Garay is expected to leave in the coming months.

Market Update

Trivia Answers

C) Currency devaluation was a leading cause of the Asian Financial Crisis.

C) Stagflation was a hallmark of the 1970s economy.

C) Germany experienced hyperinflation in the 1920s. Thankfully it didn’t lead to anything bad. 😕

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Just discovered your page. Loved the mid-week summary!