🔬Inflation is Dead, Small-Caps are Old, and Much More

"Being too far ahead of your time is indistinguishable from being wrong"

- Howard Marks

“You win some, you lose some, but you keep on fighting . . . and if you need a friend, get a dog”

- Gordon Gekko

Table of Contents

🔥 Hot Headlines

🤭 Joke Of The Day

🔬 A.M. Allocations: Elderly Small-Caps

🙋♂️ Trivia

📈 Market Movers

📊 Market Update

Hot Headlines

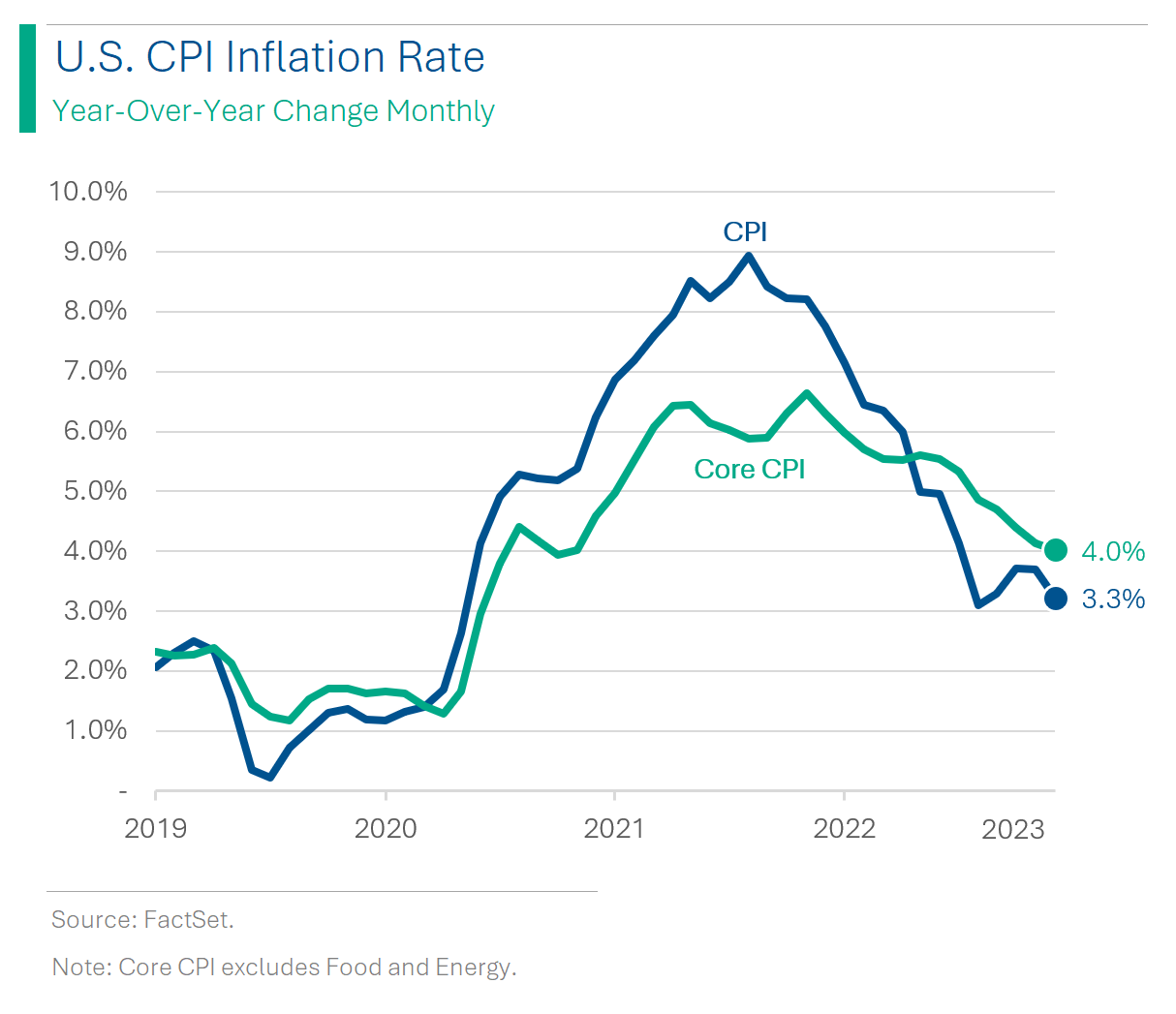

US INFLATION - The biggest news of the day yesterday was the release of the latest Consumer Price Index (CPI) reading. Data for October that showed flat inflation month-over-month, and up 3.2% year-over-year which was below economists’ expectations. This sent markets into a tizzy, with the S&P 500 and Nasdaq closing up 1.9% and 2.4%, respectively. The market is now pricing in a 0% chance of additional interest rate hikes from the Federal Reserve, and the Street’s estimate for year-end 2024 Fed Funds Rate now sits at 4.4% - implying ~100 basis points of interest rates cuts for next year.

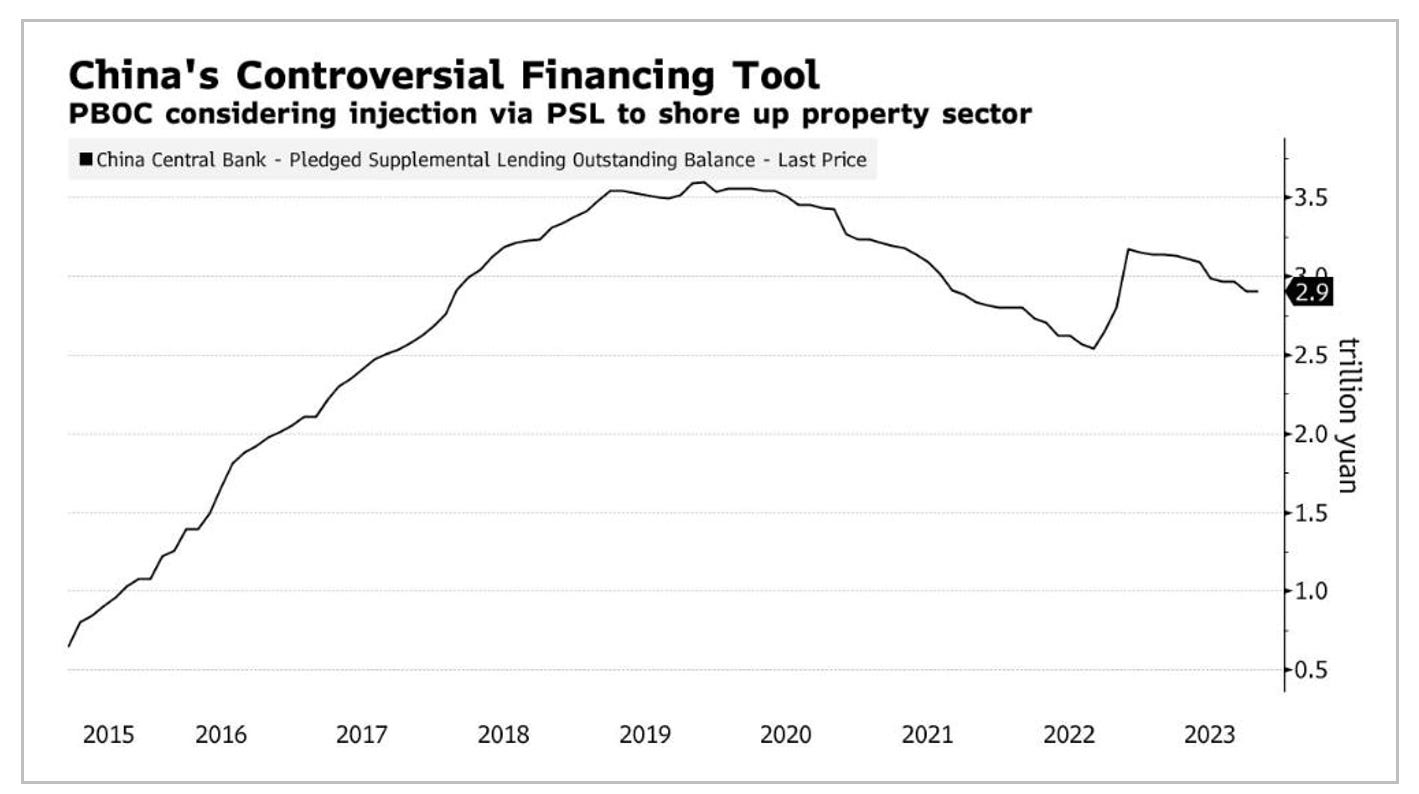

CHINA PROPERTY BAIL-OUT - China is set to provide at least 1 trillion yuan ($137 billion) in low-cost financing to support urban village renovations and affordable housing, aiming to revitalize its struggling property market. This initiative, led by Vice Premier He Lifeng, involves the People's Bank of China channeling funds through policy banks, boosting funds available through the Pledged Supplemental Lending (PSL) program beyond the 2019 record - a controversial measure some refer to as a type of ‘helicopter money’. (Bloomberg)

AIRBNB MAKES AI ACQUISITION - In its first major acquisition since becoming a public company, Airbnb has purchased Gameplanner.AI for just under $200 million. This strategic move signals Airbnb's ambition to integrate advanced AI technologies into their platform, potentially revolutionizing the way travelers choose and experience their stays. This acquisition could pave the way for more personalized and intelligent travel recommendations, adding a touch of tech wizardry to its already diverse range of accommodations. (CNBC)

MICHAEL BURRY BETS AGAINST CHIP STOCKS AND TRAVEL - Michael Burry, made famous in Michael Lewis’ book and the movie ‘The Big Short’, placed new bearish bets, as revealed in the latest 13-F filing for his hedge fund, Scion Asset Management. He did this by purchasing 2,500 put options against Booking Holdings Inc. (formerly known as Priceline.com) and 100,000 puts against the iShares Semiconductor ETF, highlighting his expectation of a downturn in both the semiconductor sector and the travel platform, both of which have showed significant strength this year. (SEC EDGAR)

ASIAN GROWTH FUELED BY GROWING CONSUMER ECONOMY - Consumer spending has significantly boosted economic growth in Asia's top economies, notably China and India, positioning the region as a key contributor to global growth in 2023. However, the International Monetary Fund (IMF) warns of a potential slowdown in the region's growth, attributed to the global economic downturn and lagging investments, despite a more positive outlook on inflation compared to other regions. (Axios)

(Reuters) Social media companies must face youth addiction lawsuits, US judge rules - Good. F#$% ’em.

(Reuters) China receives US equipment to make advanced chips despite new rules - Shocker. The US didn’t want them to steal the plans for the F-35 either, so I’m sure they could find their way to getting some microchips.

(Bloomberg) How Wall Street Makes Millions Selling Car Loans Customers Can’t Repay

(MIT TECH REVIEW) How Facebook went all in on AI - Didn’t they just go all in on metaverse a few years ago? How’d that go again?🧨💣

(Yahoo) Cathie Wood Predicts Deflation to Take Hold in US Next Year - Good ole Crazy Aunt Cathie. Hasn’t talked about her $1m bitcoin target in a while, eh?

Joke Of The Day

❄️It was so cold today I saw a stockbroker with his hands in his own pockets.

A.M. Allocations

Elderly Small-Caps

A few weeks back I wrote about how Small-Cap stocks tend to get hammered hardest when times get tough (see: The Smaller They Are, The Harder They Fall). The trend wasn’t random - or ‘Size-ist’ - but rather tied to some fundamental reasons why smaller business are more susceptible to weakness in the business cycle, such as liquidity factors, pricing power and credit risk.

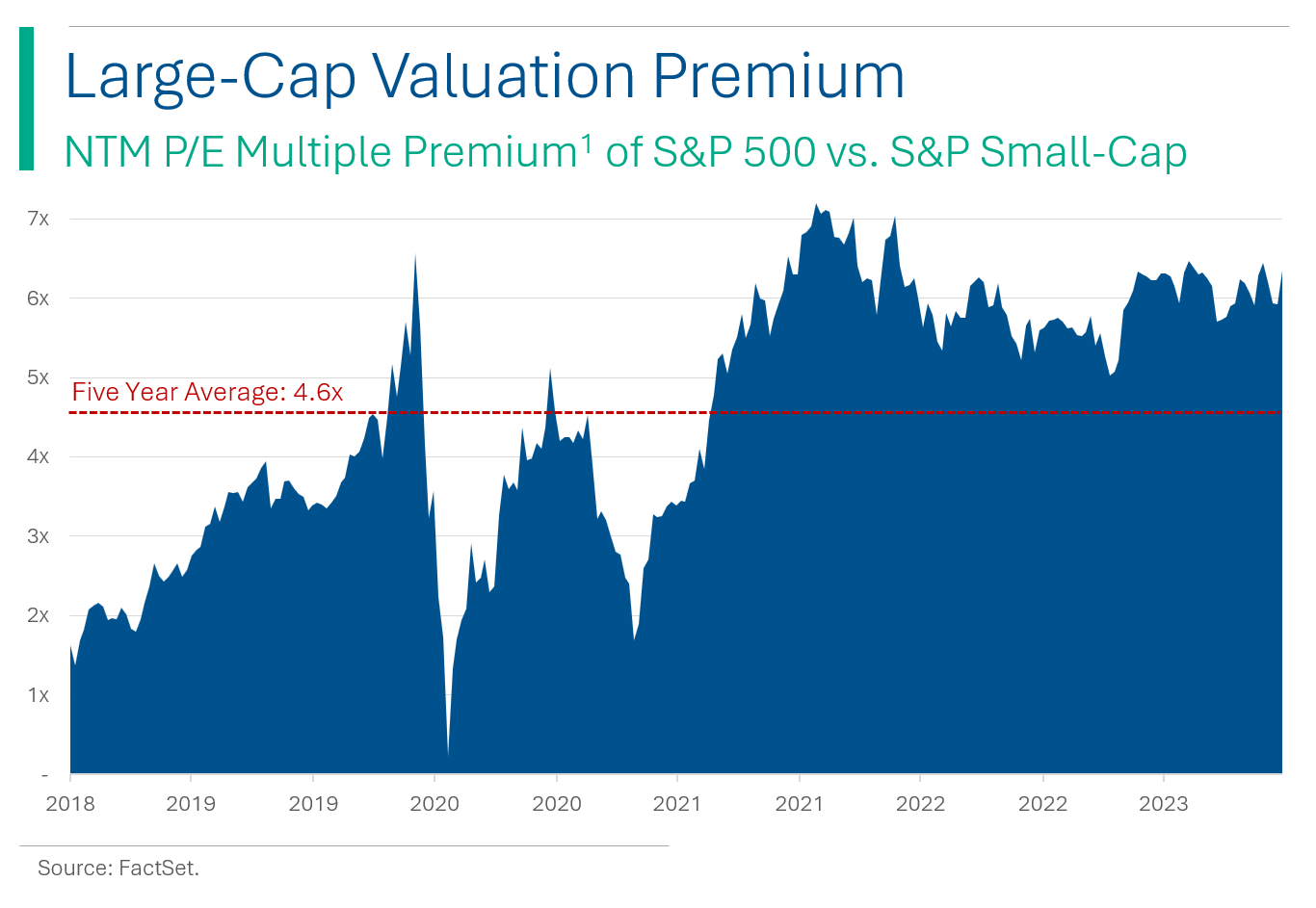

While tinkering a bit yesterday I looked into the valuation history of the small-cap world (ok, just the S&P 600) and I was surprised by the size and persistence of the valuation spread between large-cap (S&P 500) and small-cap (again, S&P 600) companies. Looking at forward P/Es, the spread over the last five years has averaged 4.6x. That’s not nothing. That’s a 31% premium from the small-caps.

As I said, the idea that Small-Caps get whacked when times are rough makes sense, but surely Small-Caps hold their own otherwise. The traditional view that I held was that the Small-Cap index was chock-full of punchy, growing companies just waiting for their shot at the big time on the Large-Cap index. I guess I was wrong.

Looking at Wall Street estimates, the Small-Cap Index is only expected to grow Earnings Per Share a total of 7% over the next 3 calendar years. What gives? The S&P 500 is forecast to do 3x that, and don’t get me started on the Nasdaq. So what the heck is causing this? Where are all of my zestful growth stocks?

Take-Away: I think I found part of the reason. The view I held - which I think is pretty commonplace - of the Small-Cap being a bunch of rough-and-tumble upstarts, doesn’t really hold any weight. The average age of a company in the Index is 40. 40! Practically a Boomer.

The Index is full of players that never ended up getting called up to the Big Leagues, and have instead been putting around the Minors. Too scared to retire since they don’t have any transferable skills. This leaves me with the question, why would anyone ever invest in this Index?

Sure, maybe if the spread got too wide, you could try to arb it over the short-term. And there are some gems hidden within, for sure (to be invested in individually). But as a long-term, core part of your portfolio, why would you even bother? Weaker growth. Volatile. Loaded with has-beens and never-wases. I think I’ll stick to my S&P 500 and Nasdaq.

Trivia

Since the Fed’s in the news again, where’s some Federal Reserve trivia.

Founding Year: When was the Federal Reserve System established?

a) 1913

b) 1933

c) 1895

d) 1920FOMC: The group within the Fed that makes the big monetary decision is the FOMC. What does that stand for?

a) Federal Office of Monetary Control

b) Financial Operations and Management Committee

c) Federal Operations Management Corporation

d) Federal Open Market CommitteeNumber of Federal Reserve Banks: How many region Fed Banks are there?

a) 12

b) 50

c) 20

d) 7Dual Mandate: The Fed has two main jobs to do, often referred to as its ‘Dual Mandate’. What are they?

a) Inflation and Unemployment

b) Interest Rates and Inflation

c) Economic Growth and Price Stability

d) Price Stability and Full Employment

(answers at bottom)

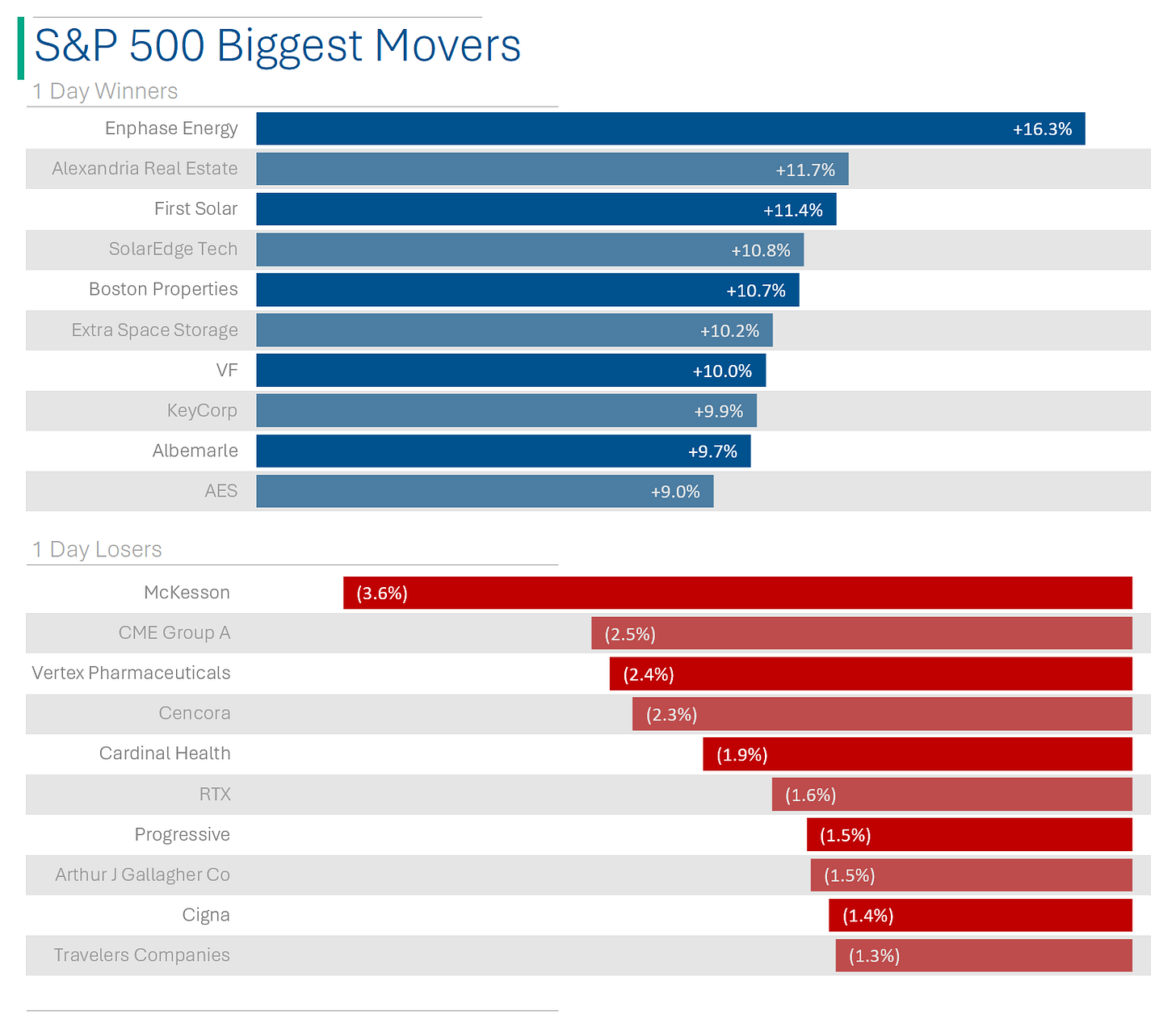

Market Movers

Winners!

Snap (SNAP) [+7.5%]: Announced a partnership with Amazon, enabling direct purchases of Amazon products from Snapchat ads, similar to Amazon's recent deal with Meta, aiming to expand its reach against competitors like TikTok and Shein.

Energizer Holdings (ENR) [+7.4%]: Reported FQ4 earnings and revenue beat with better-than-expected organic growth. Battery volumes increased due to early holiday orders, but next-quarter guidance is below Street expectations due to this timing shift; FY24 EPS guidance falls short.

Joby Aviation (JOBY) [+5.9%]: Conducted a successful exhibition flight in New York City, with plans to launch commercial passenger service in 2025. That’d be awesome but I doubt it.

Home Depot (HD) [+5.4%]: Beat on Q3 sales and EPS despite negative comparables vs. previous quarters and lower GMs. The company saw continued interest in smaller projects, but pressure in big-ticket items and narrowed its FY guidance.

Losers!

Sea Limited (SE) [-22.1%]: Beat on Q3 Revenue but earnings missed by a country mile. The company saw stronger sales in E-commerce and Digital Entertainment, but notable profitability issues in the E-commerce segment.

Fisker (FSR) [-18.7%]: Reduced its FY delivery forecast by 30% to 13-17k due to logistics and inventory balancing, implying Q4 deliveries around 9k. Analysts are concerned about EV demand challenges, financing dilution, operational risks in production ramp-up, and long-term margin prospects. Shocking these guys are still allowed to be a company.

Aramark (ARMK) [-8.2%]: Decent Q4 revenue but earnings in line with Wall Street. The FY24 adjusted EPS guidance is below market expectations, with analysts cautious about slower net new business growth and margin recovery.

Market Update

Trivia Answers

a) The Fed was founded in 1913.

d) FOMC stands for Federal Open Market Committee.

a) 12 regional banks make-up the Federal Reserve system.

a) Inflation and Unemployment make up the ‘Dual Mandate’

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend who might enjoy it.