🔬Inflation Heats Up & the Market Freezes

Plus: Shopify blows-up on soft eCommerce outlook; OPEC thinks oil demand is hotter than it is; Tripadvisor gets put on the M&A table; and much more

"In the business world, the rearview mirror is always clearer than the windshield"

- Warren Buffett

“I made my money the old-fashioned way. I was very nice to a wealthy relative right before he died”

- Malcolm Forbes

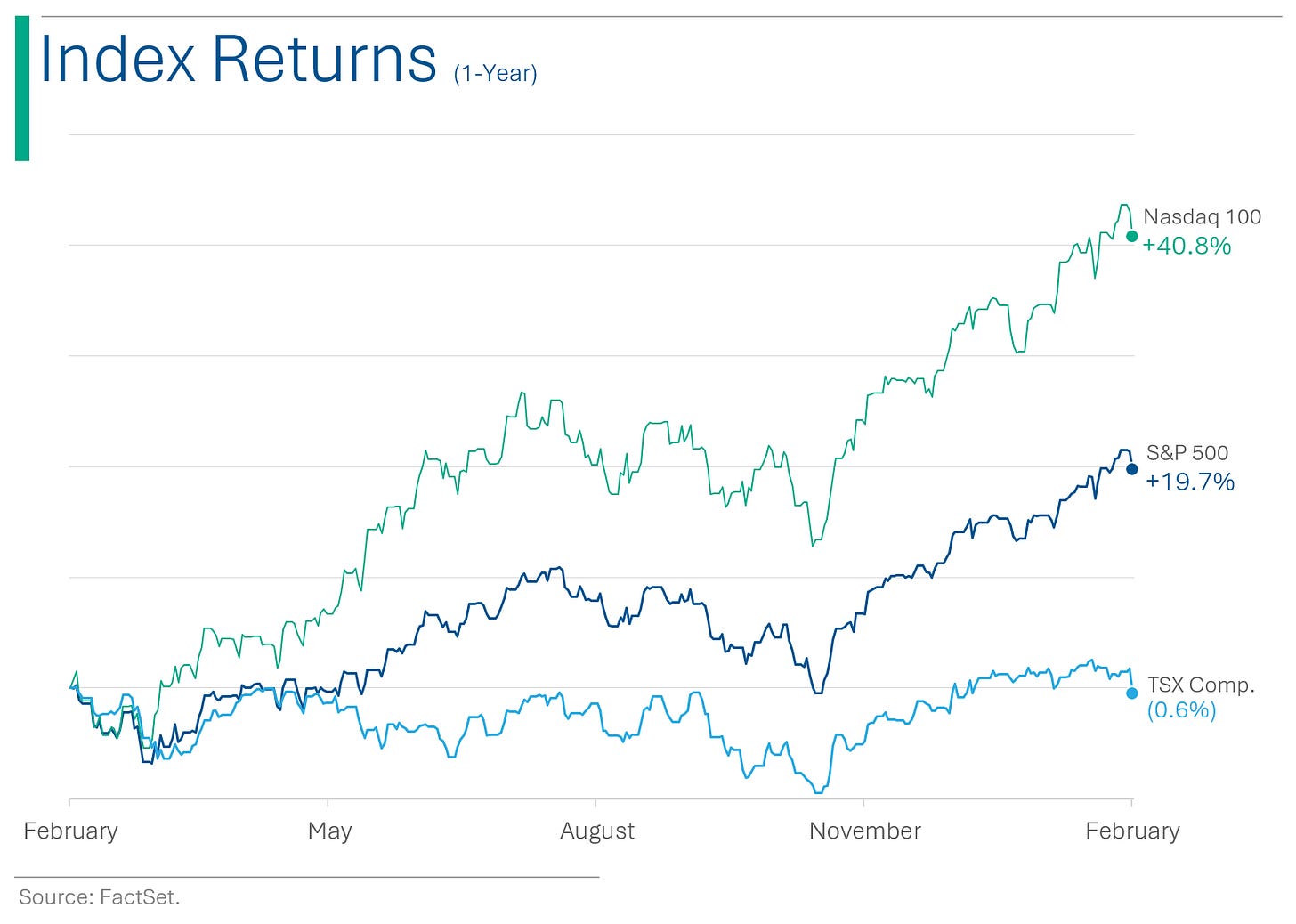

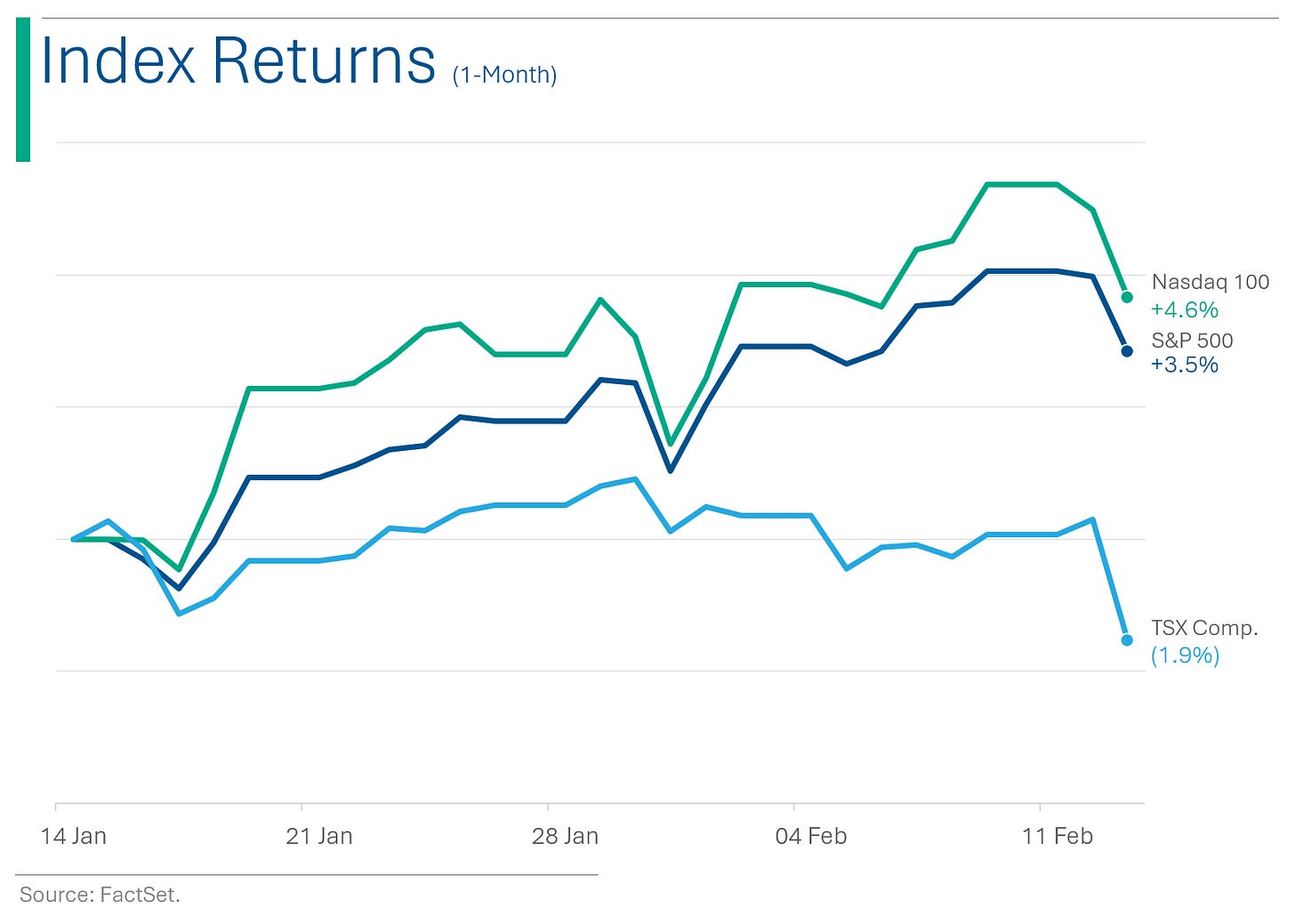

Rough day for the big US markets as the S&P 500 close down 1.37% and the Nasdaq -1.80%, following a CPI inflation print that hints that rate expectations are still too bullish (more below).

None of the 11 sectors close in the green, with defensive Health Care (-0.9%) and Consumer Staples (-1.0%) doing the best. Consumer Discretionary (-2.0%) and Real Estate (-1.8%) were the worst.

S&P 500 has closed higher 14 of the last 15 weeks, something Goldman Sachs says hasn’t happened in 52 years, and only five times since 1928. Yeesh.

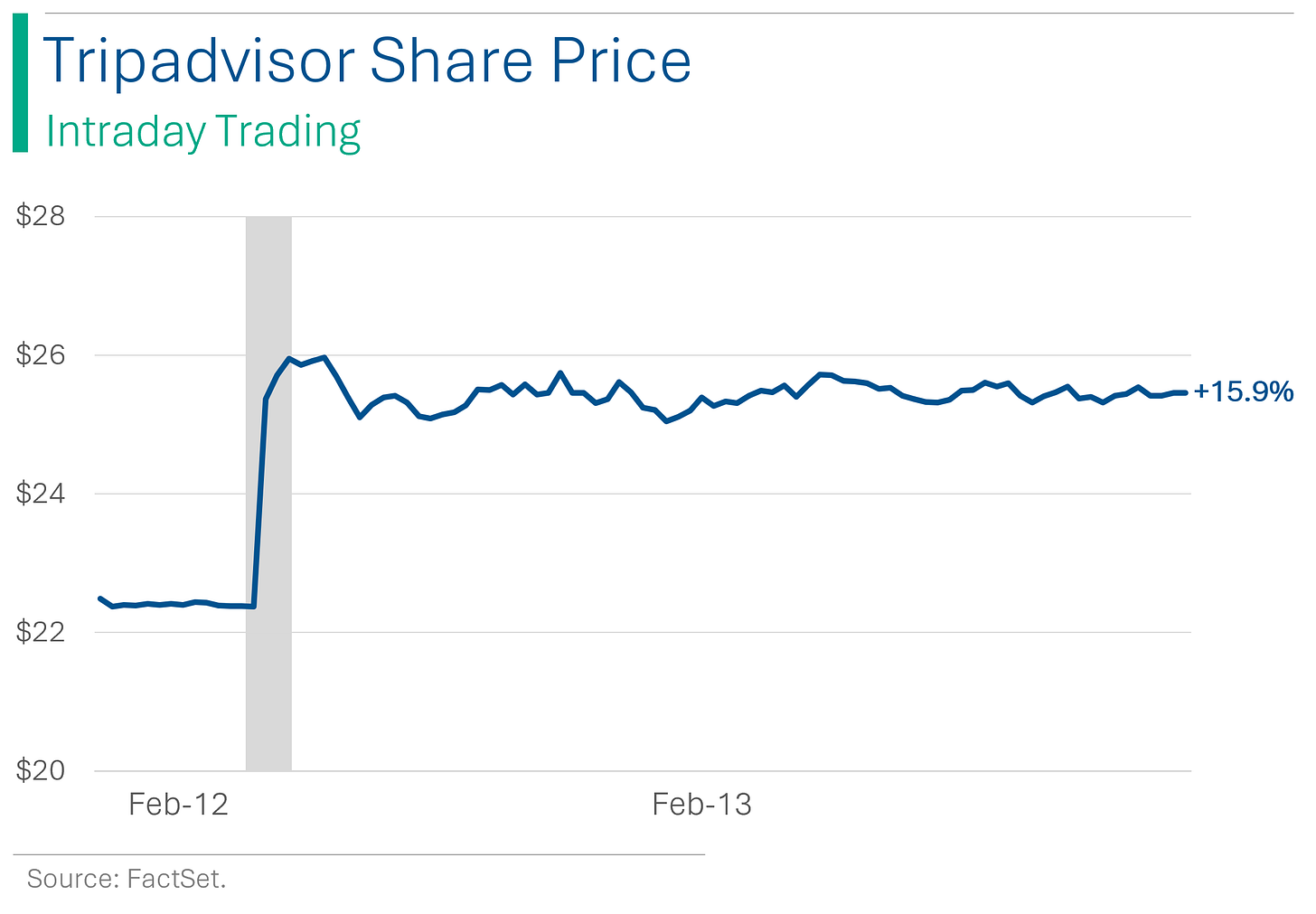

Shopify blew-up (-13.4%) after a weak eCommerce guide on their earnings call, while AirBNB (-4% in after hours trading) posted a bla quarter and outlook. Tripadvisor popped 15.9% on news it was considering selling itself to the highest bidder.

Street Stories

Shopify Goes on Sale Again

The stock market’s love/hate with the DIY eCommerce giant did another about-face today after the company posted a strong quarter with Revenue up 24% but guidance failed to impress, and the stock plummeted 13.4%.

Highlights:

Q4 Revenue: $2.14bn vs Wall Street estimate of $2.08bn [2.9% BEAT]

Q4 Earnings Per Share: $0.34 vs Street’s $0.30 [13.3% BEAT]

Q4 Gross merchandise volume: $75.13bn vs Street’s $72.08bn [4.2% BEAT]

The company, which offers tools and services for business to operate their own online stores, was actually in the middle of the nice recovery since its shares blew-up back in 2022. It seemed like in a matter of hours it went from Wall Street darling, to poster child of the 2021 ‘Everything Bubble’ and back again.

Growth has definitely slowed - that usually happens when you hit a $100 billion valuation - but is still forecast to clip along at a nice ~+20% pace for Revenue and close to +40% for EPS.

The issue for me, however, has always been the valuation, which now is much better than it used to be but still remains well above Tech Peers. This, despite a history of shaky earnings and curious expense management. Great company, but definitely some ‘buyer beware’ here.

Note: I used Price to Sales here because the historical P/E is was just too hilarious. Currently the forward P/E is 72x but when they had their earnings blip in 2022 it went into the 10s of thousands (and that just doesn’t make for a good comp chart).

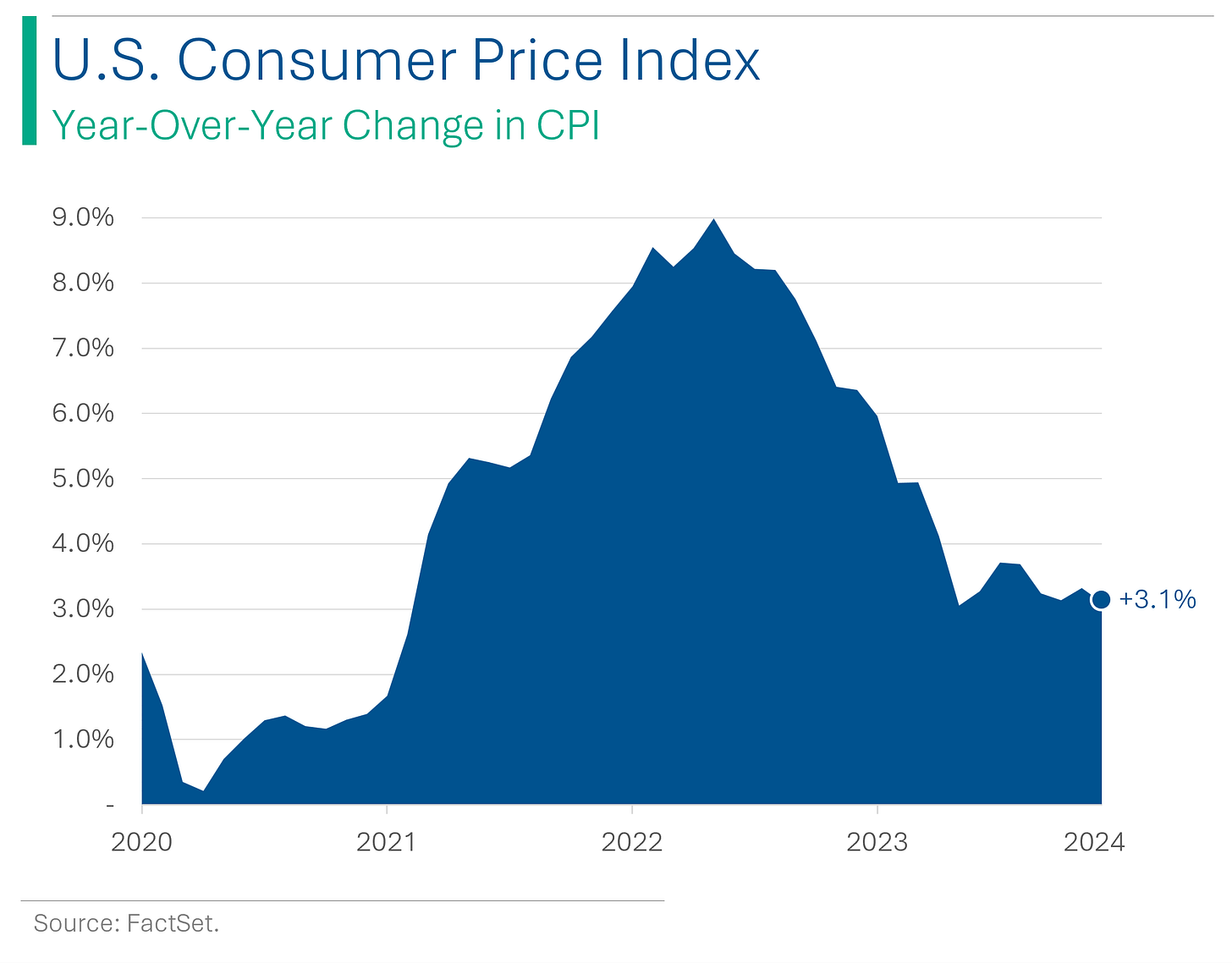

Hot Inflation Freezes the Market

Wall Street's main indices experienced significant declines on Tuesday following a consumer inflation report for January that exceeded expectations, challenging the anticipation of near-term interest rate cuts and resulting in a sharp increase in U.S. Treasury yields. January CPI came in at +0.3% since last month and +3.1% year-over-year, ahead of the +0.2% and +2.9% that Wall Street had forecast.

The higher-than-forecast inflation data, particularly in shelter costs, led to a reduced likelihood of the Federal Reserve cutting rates in May, with market expectations shifting based on the latest figures. The odds of one or more cuts following the Fed’s May meeting dropped from 58% to 36% in just a few short hours following the CPI print. The news compounds the recent Fed efforts to slow-play rate cuts which the Street had apparently been optimistic for.

For Sale: One Travel Giant, Slightly Used

Tripadvisor's shares surged 16% following an announcement that its board is considering strategic options, including a possible sale, with boutique investment bankers Centerview Partners advising the company. Tripadvisor’s controlling stake is held by Liberty Tripadvisor Holdings, part of giant bigwig John Malone's portfolio, which has (allegedly) received at least one bid for its interest in Tripadvisor. Amidst financial challenges, particularly Liberty Tripadvisor's significant debt, there's speculation that Tripadvisor's assets might be leveraged to manage this burden. The travel giant reports its Q4 today, so the plot will likely thicken.

Pump it Up: OPEC's Vision for a Well-Oiled Global Economy

OPEC maintained its optimistic forecast for global oil demand growth in 2024 and 2025, projecting increases of 2.25 million barrels per day (bpd) and 1.85 million bpd, respectively. They also upgraded there economic growth expectations for both years, citing potential for further improvement. Despite output cuts by the OPEC+ alliance to support market prices, OPEC's demand growth outlook for 2024 surpasses estimates from other entities like the International Energy Agency (which I trust more than these knuckleheads) which only sees output growing by 0.6 million barrels per day.

The organization also highlighted disagreements with the IEA over long-term demand projections and the necessity for new supply investments, with OPEC anticipating sustained demand growth up to 2045, contrary to IEA's predictions of a peak by 2030. Almost like these guys have a vested interest in oil?

Lyft’s IR Oopsie

Lyft reported a solid quarter after the close yesterday but not enough to warrant a ~+60% pop in the shares. That’s when management realized they had a bit of a typo in their market release: See they meant to forecasts a 50 basis points (50%) in Gross Bookings - which is great, but a far cry from the 500 basis points (500%) one that made it into the presser.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

"The difference between the buy side and the sell side is that on the sell side, you shout 'F*** you' after you slam down the phone."

***For those just learning the ‘Sell Side’ refers to the divisions in the banks that ‘sell’ services to institutional clients, and includes folks like Traders and Investment Bankers. The ‘Buy Side’ are the big money managers, like Private Equity, Hedge Funds, Mutual Funds, etc. The Buy Side generally has the power in the relationship, and the Sell Side just pretends to like them/puts up with their sh**. I’ve been on both and Buy Side > Sell Side.

Hot Headlines

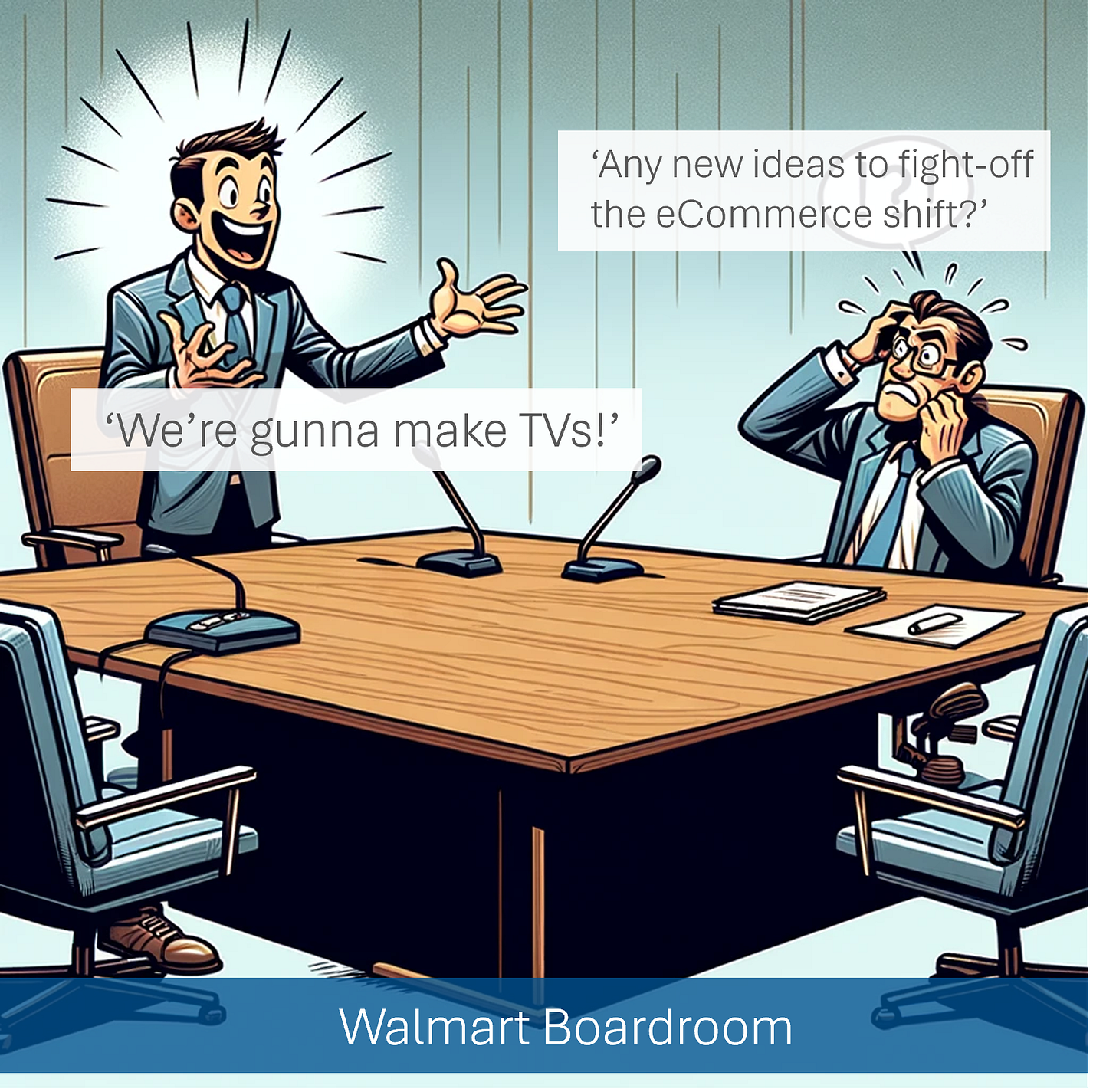

Reuters | Walmart in talks to buy smart-TV maker Vizio for more than $2 billion. Vizio shares popped 24.6% on the news that the reported offer price is +30% higher than their ~$1.5 billion market cap at Monday’s close.

Bloomberg | Paramount Global to cut 800 jobs in drive to boost profitability. Imagine pulling an all-nighter so that CBS (owned by Paramount) could cover the Super Bowl just to get s*** canned on Tuesday.

Times of Israel | Progress is reportedly being made on hostage deal and ceasefire in Israel/Hamas conflict. ✌️🕊️

Yahoo | Gasoline futures are trading at highest level in three months due to refinery outages. Recent shutdowns at large refineries, including BP’s facility in Whiting, Indiana and a Phillips 66 unit in Ponca City, Oklahoma, have exacerbated seasonal maintenance.

Reuters | Senate passes $95 billion aid package for Ukraine/Taiwan/Israel but bill still faces uncertainty in the House. Ukraine has been pushing for the package since its offensive efforts stalled last year and Russia has been making steady inroads.

Trivia

This week’s trivia is on the big financial collapses.

WorldCom's $107 billion collapse was primarily due to:

A) Diversification into unrelated businesses

B) Accounting fraud

C) Failure to adapt to new technology

D) Excessive CEO compensation

Which company's bankruptcy is often remembered for its role in the dot-com bubble burst?

A) Apple

B) Pets.com

C) Amazon

D) eBay

The South Sea Bubble, a famous early 18th-century corporate collapse, was based in which country?

A) Spain

B) Great Britain

C) The Netherlands

D) France

(answers at bottom)

Market Movers

Winners!

Vizio Holding (VZIO) [+24.7%]: Media reports suggest discussions for acquisition by Walmart for over $2B.

JetBlue Airways (JBLU) [+21.6%]: Icahn takes 9.9% stake, sees undervalued shares, and discusses board seat.

ZoomInfo Technologies (ZI) [+14.4%]: Beats Q4 EPS, revenue, and FCF with strong enterprise trends. 1Q24 and FY24 guidance meets consensus. Momentum in Copilot expected 2H24, though retention issues noted.

TripAdvisor (TRIP) [+13.8%]: Forms special committee to review potential transaction proposals.

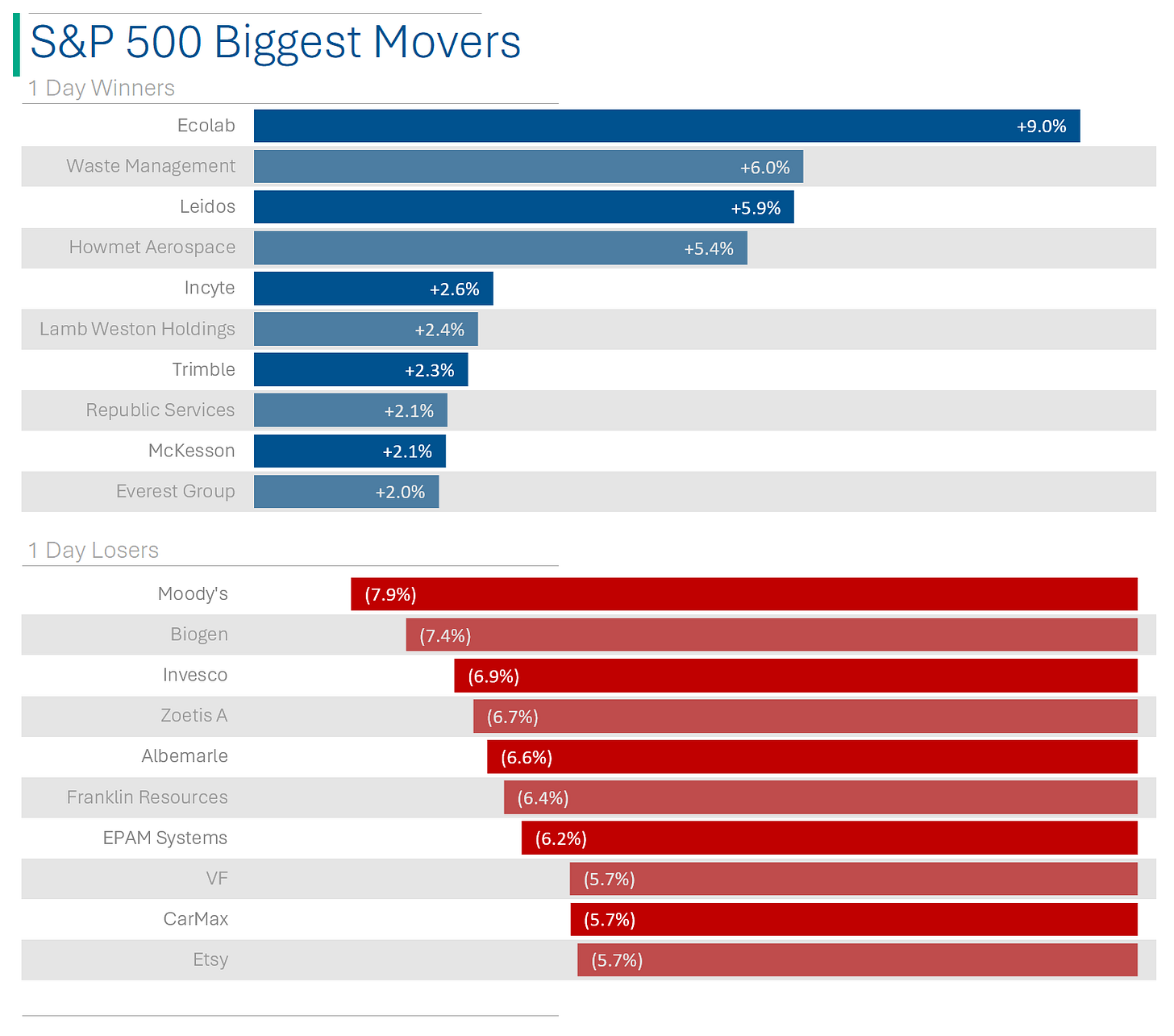

Ecolab (ECL) [+9%]: Q4 EPS and revenue match expectations with organic sales up 6%. Q1 and FY24 EPS guidance exceeds consensus, predicting margin expansion amid easing inflation.

Bruker (BRKR) [+8.8%]: Q4 EPS matches, revenue surpasses expectations with 15.5% organic growth. FY24 growth outlook beats consensus, driven by new secular trends.

WK Kellogg (KLG) [+8.1%]: Q4 earnings, revenue, and margins exceed forecasts. Management raises FY24 EBITDA guidance, citing revenue-growth initiatives and cost discipline.

Waste Management (WM) [+6%]: Q4 EPS and revenue top estimates with record margins. FY24 adj. EBITDA guidance slightly above consensus, driven by price growth and strong post-collection volumes.

Losers!

Avis Budget Group (CAR) [-22.9%]: Q4 EBITDA and revenue fall short, with higher-than-expected per-unit fleet costs and weaker utilization in Americas and International segments.

Shopify (SHOP) [-13.4%]: Beats Q4 EPS, operating income, and revenue forecasts. Q1 gross margin expected to rise, with higher FCF anticipated; however, analysts express caution on operating income and FCF outlook.

Brighthouse Financial (BHF) [-12.8%]: Misses Q4 earnings and revenue, with analysts highlighting higher expenses and underwhelming Annuities performance.

Biogen (BIIB) [-7.4%]: Q4 earnings fall short, affected by Aduhelm close-out costs. Analysts point to erosion of MS franchise and disappointing Spinraza and rare-disease performance, with FY24 guidance slightly below consensus.

Zoetis (ZTS) [-6.7%]: Reports Q4 revenue beat but EPS miss, with weaker margins. FY24 EPS and revenue guidance disappoints, despite operational growth guidance matching consensus.

Marriott International (MAR) [-5.6%]: Q4 EPS outperforms due to strong incentive fees, though revenue misses. 1Q24 and FY24 EPS guidance below consensus, despite solid RevPar guidance and evidence of strong travel trends.

Market Update

Trivia Answers

B) Worldcom blew up over accounting fraud, particularly that it tried to hide expenses from investors.

B) B) Pets.com was the poster child of .Com stupidity.

B) Great Britain is to blame for the ridiculous SS Bubble.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.