🔬Inflation Fizzles, Yields Dip

Plus: Consumer Confidence vs. Consumer Sentiment; and much more!

“In many ways, the stock market is like the weather, in that if you do not like the current conditions, all you have to do is wait.”

- Low Simpson.

“Never criticize your spouse’s faults; if it weren’t for them, your mate might have found someone better than you.”

- Jay Trachman

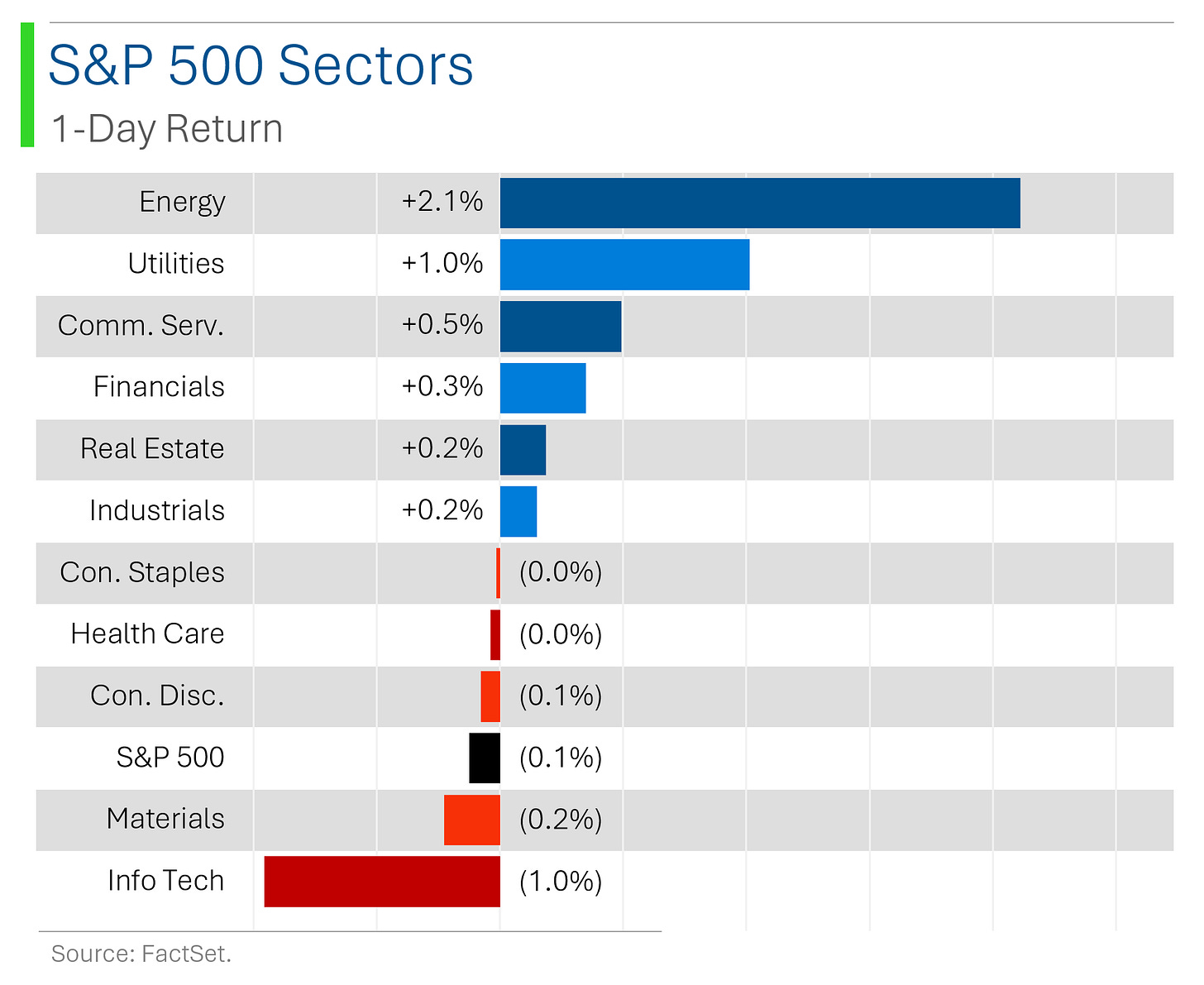

US equities finished mixed after a relatively quiet Friday session - The S&P 500 and Nasdaq managed to log their third consecutive weekly gain, despite declines in semiconductors, healthcare, and retail stocks. Outperformers included energy, autos, media, biotech, and utilities, while Nvidia (NVDA) was a notable tech laggard.

Economic data remained a key focus, with inflation and sentiment showing mixed signals - Core PCE inflation rose just 0.1% in August, slightly below expectations, while personal income and spending also decelerated. The University of Michigan's final consumer sentiment reading came in stronger than expected, although sentiment remains historically low.

Corporate news was light, but several notable developments occurred - Intel (INTC) reportedly turned down a potential acquisition approach from ARM, while Costco (COST) impressed with a solid Q4 earnings beat. Bristol-Myers Squibb (BMY) received a boost from the FDA approval of a new schizophrenia drug, and Acadia Healthcare (ACHC) updated investors on legal probes into its billing practices.

Notable companies:

IonQ (IONQ) [+20.5%]: Signed a big $54.5M contract with the US Air Force to advance quantum systems, and they’re feeling confident about future bookings.

Eli Lilly (LLY) [-3.5%]: Wells Fargo flagged concerns that its US script tracker indicates Q3 diabetes/obesity sales may miss consensus estimates.

Costco Wholesale (COST) [-1.8%]: Beat Q4 EPS with solid revenue, but membership fees fell short of expectations; analysts liked the margin growth and share gains, though some are worried about the stock’s valuation.

More below in ‘Market Movers’.

Street Stories

Inflation Fizzles, Yields Dip

Friday brought us the August print of Personal Consumption Expenditures which revealed a +0.1% increase for the month. Inflation’s kinda a non-event now that rate cuts have started, eh?

Not to be outdone, Core PCE - which nobly excludes such plebeian concerns as food and energy - matched this herculean feat with its own 0.1% rise. One imagines the champagne corks popping in the Federal Reserve's boardroom at this news.

On an annual basis PCE is just a smidge above the Fed’s 2% target but Core PCE looks to be a bit more stubborn and yet to crack the 2.5% level despite flirting with it since April.

The release also helped the treasury yield curve shed a few more basis points, particularly with the short end falling off a cliff.

In fact, the 1-Year Treasury Bill’s yield has dropped almost a whole percent in the past two months.

Just don’t tell anyone that this is mainly the result of a weakening consumer and slowing economy!

The Great Economic Cognitive Dissonance of 2024

Friday also saw Consumer Sentiment tick up again in September in it’s final reading. The 70.1 print was upped from a preliminary read of 69.0 and Wall Street consensus for ~69.3.

The eagerly anticipated survey strengthened in all five of its categories, including a rise in year-ahead business expectations, as the inflation-focused survey reached its highest levels since April.

It’s a bit weird since Consumer Confidence - released on September 24th - saw it’s largest one month drop since August 2021. Shouldn’t they be similar - or at least not exact opposites?

Similarities & Differences Between Consumer Sentiment & Consumer Confidence:

(Similarity) Economic Sentiment Indicators: Both the University of Michigan Consumer Sentiment Index and The Conference Board's Consumer Confidence Index measure how consumers feel about the economy, providing insights into future spending behavior.

(Difference) Survey Scope: The University of Michigan survey focuses more on personal financial situations and long-term economic expectations, while The Conference Board emphasizes short-term business conditions and labor market outlooks.

(Similarity) Monthly Data Release: Both indices are released monthly, providing a regular pulse check on consumer attitudes and confidence levels in the economy.

(Difference) Sample Size & Respondents: The Conference Board surveys 3,000 households, whereas the University of Michigan surveys around 500, leading to differences in sample size and possibly in regional consumer responses.

(Difference) Focus on Durables vs. Overall Spending: The Conference Board’s index tends to highlight consumers’ willingness to spend on big-ticket items, while the University of Michigan is broader, reflecting overall sentiment and inflation expectations.

Joke Of The Day

How many kids with ADHD does it take to change a light bulb?

Let's go play on our bikes

Hot Headlines

CNBC / The U.S. wants to triple nuclear power by 2050. America’s coal communities could provide a pathway. Apparently, Building reactors at retired coal plants could cut costs by up to 30% by leveraging existing infrastructure. This strategy could add up to 174 gigawatts of nuclear capacity and maybe help pacify those that don’t understand that nuclear power is actually green…

CNBC / OpenAI sees roughly $5 billion loss this year on $3.7 billion in revenue. Backed by Microsoft, the company expects to raise at $150 billion in valuation, with revenue forecasted to jump to $11.6 billion next year. I mean, they did call themselves a ‘non-profit’…

CNBC / SpaceX launches rescue mission for 2 NASA astronauts who are stuck in space until next year. After Boeing's Starliner was deemed unsafe due to technical failures, a SpaceX capsule was launched Saturday evening with a downsized crew but isn’t planning to return until February…yes, 2025. Ooof.

Yahoo Finance / House-rich consumers are using their homes to help them get out of debt. Americans are increasingly using home equity lines of credit (HELOCs) to consolidate debt as they face rising living costs: While HELOCs offer lower interest rates than credit cards, they come with risks, as homes are used as collateral…Nothing goes wrong when you bet the house right?

Yahoo Finance / Latest talks between Boeing and its striking machinists break off without progress, union says. The union, representing nearly 33k workers, is pushing for higher pay and the restoration of a pension plan. Boeing’s offer of a 30% raise over four years remains unsatisfactory to many. History says you shouldn’t fight a two-front war…

NYT / 5 days with Elon Musk on X: deepfakes, falsehoods and lots of memes. The New York Times spent the week tracking Elon’s X feed and did some hard fact checking on what he shared. I think he’d disagree tho.

Trivia

Today's trivia is all about Lamborghini as Netflix added the movie starring Frank Grillo over the weekend and I thought it was pretty good!

Lamborghini was born out of rivalry - what year did Ferruccio Lamborghini, a tractor manufacturer, decide to start his own luxury car company to compete with Ferrari?

A) 1948

B) 1953

C) 1963

D) 1967Lamborghini has produced some of the most iconic supercars ever, but which model, introduced in 1974, set the standard with its legendary scissor doors?

A) Miura

B) Countach

C) Diablo

D) AventadorLamborghini’s ownership has changed hands a few times. In 1998, which global automotive giant added Lamborghini to its portfolio of luxury brands?

A) BMW

B) Fiat Chrysler

C) Volkswagen Group

D) Ferrari

(answers at bottom)

Market Movers

Winners!

IonQ (IONQ) [+20.5%]: Signed a big $54.5M contract with the US Air Force to advance quantum systems, and they’re feeling confident about future bookings.

Establishment Labs Holdings (ESTA) [+14.3%]: Got FDA approval for its Motiva breast implants, the first such approval since 2013, making a splash in the medical world.

TransMedics Group (TMDX) [+10.1%]: Set to join the S&P SmallCap 600 on October 1st, boosting investor excitement.

EchoStar (SATS) [+8.9%]: DirecTV and Dish are reportedly close to merging, according to Bloomberg, which has EchoStar on the rise.

Wynn Resorts (WYNN) [+7.2%]: Got a boost from Morgan Stanley with an upgrade thanks to growth opportunities in the UAE and potential in Macau.

Scholastic (SCHL) [+6.2%]: Surprised everyone with a better-than-expected fiscal Q1 and reaffirmed its FY25 guidance, bouncing back from a rough year.

Bristol Myers Squibb (BMY) [+1.6%]: The FDA gave the green light to its new oral schizophrenia drug, Cobenfy, which offers a novel treatment approach.

Losers!

Acadia Healthcare (ACHC) [-16.4%]: Revealed it’s dealing with a grand jury subpoena and an info request tied to investigations into admissions and billing, while pushing back against recent critical media coverage.

Cassava Sciences (SAVA) [-10.6%]: Settled with the SEC over statements about a 2020 clinical trial, agreeing to a $40M penalty but not admitting guilt, and doesn’t expect criminal charges.

Summit Therapeutics (SMMT) [-8.4%]: Citi downgraded it to neutral, pointing to concerns about valuation.

Udemy (UDMY) [-5.9%]: Morgan Stanley downgraded it to underweight, citing concerns over demand trends and overly optimistic profitability targets.

HP, Inc. (HPQ) [-4.0%]: BofA downgraded it to neutral, highlighting that EPS growth might rely too much on buybacks and unsustainable margin boosts from temporary factors.

Vail Resorts (MTN) [-3.9%]: Missed on FQ4 EBITDA and saw fewer skier visits, with management flagging delayed season pass sales decisions, while offering lower-than-expected FY25 guidance but approving a buyback boost.

Eli Lilly (LLY) [-3.5%]: Wells Fargo flagged concerns that its US script tracker indicates Q3 diabetes/obesity sales may miss consensus estimates.

Costco Wholesale (COST) [-1.8%]: Beat Q4 EPS with solid revenue, but membership fees fell short of expectations; analysts liked the margin growth and share gains, though some are worried about the stock’s valuation.

Market Update

Trivia Answers

C) 1963 – Ferruccio Lamborghini founded the company in 1963 after a famous spat with Enzo Ferrari.

B) Countach – The 1974 Countach changed the game with its cutting-edge design and scissor doors.

C) Volkswagen Group – Lamborghini joined the Volkswagen Group family via its Audi division in 1998.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.