🔬Inflation Drops, Hopes Rise

Plus: Mars' mega merger; and much more!

"The four most dangerous words in investing are: 'This time it's different.'"

- Sir John Templeton

"Success is walking from failure to failure with no loss of enthusiasm."

- Winston Churchill

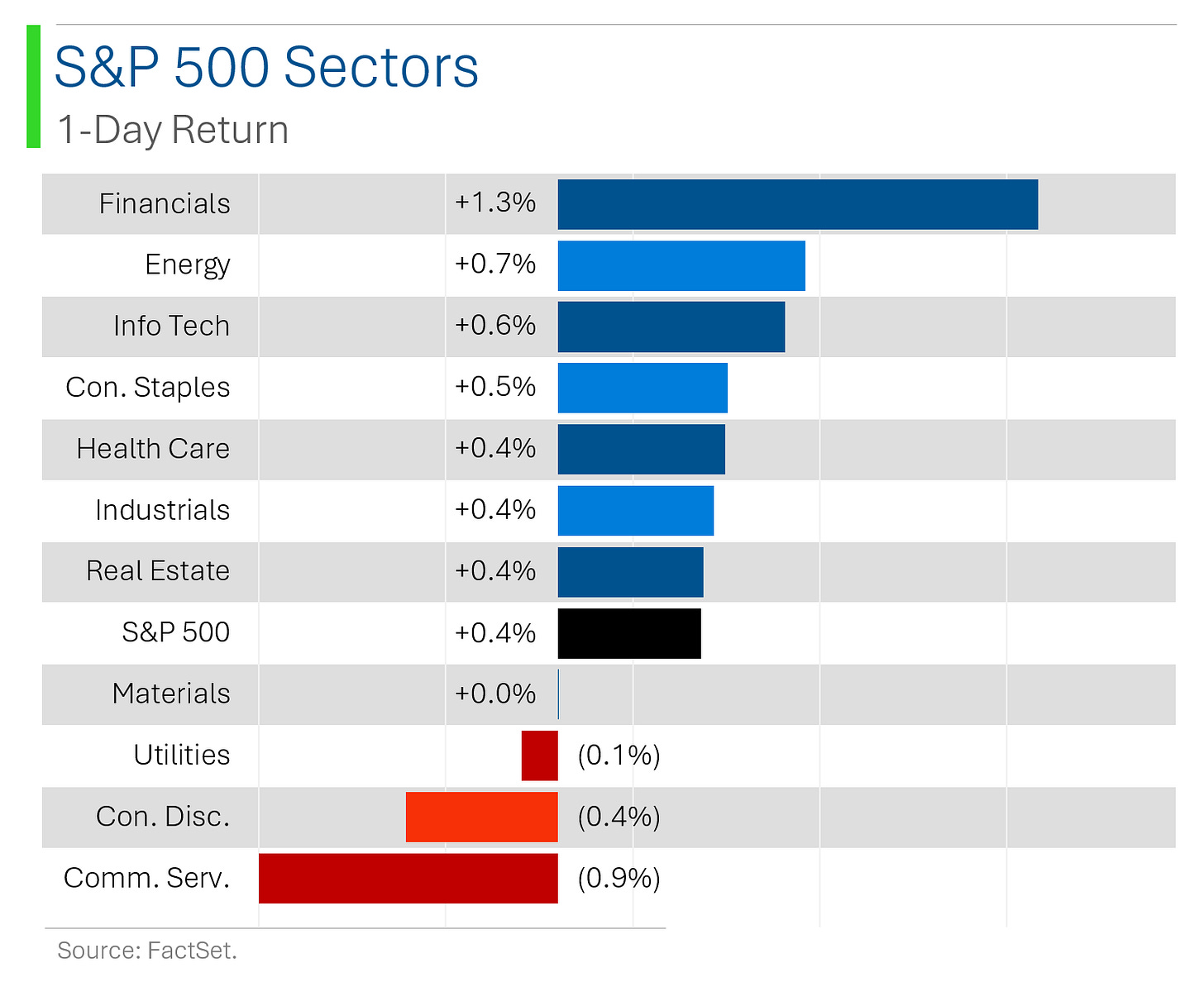

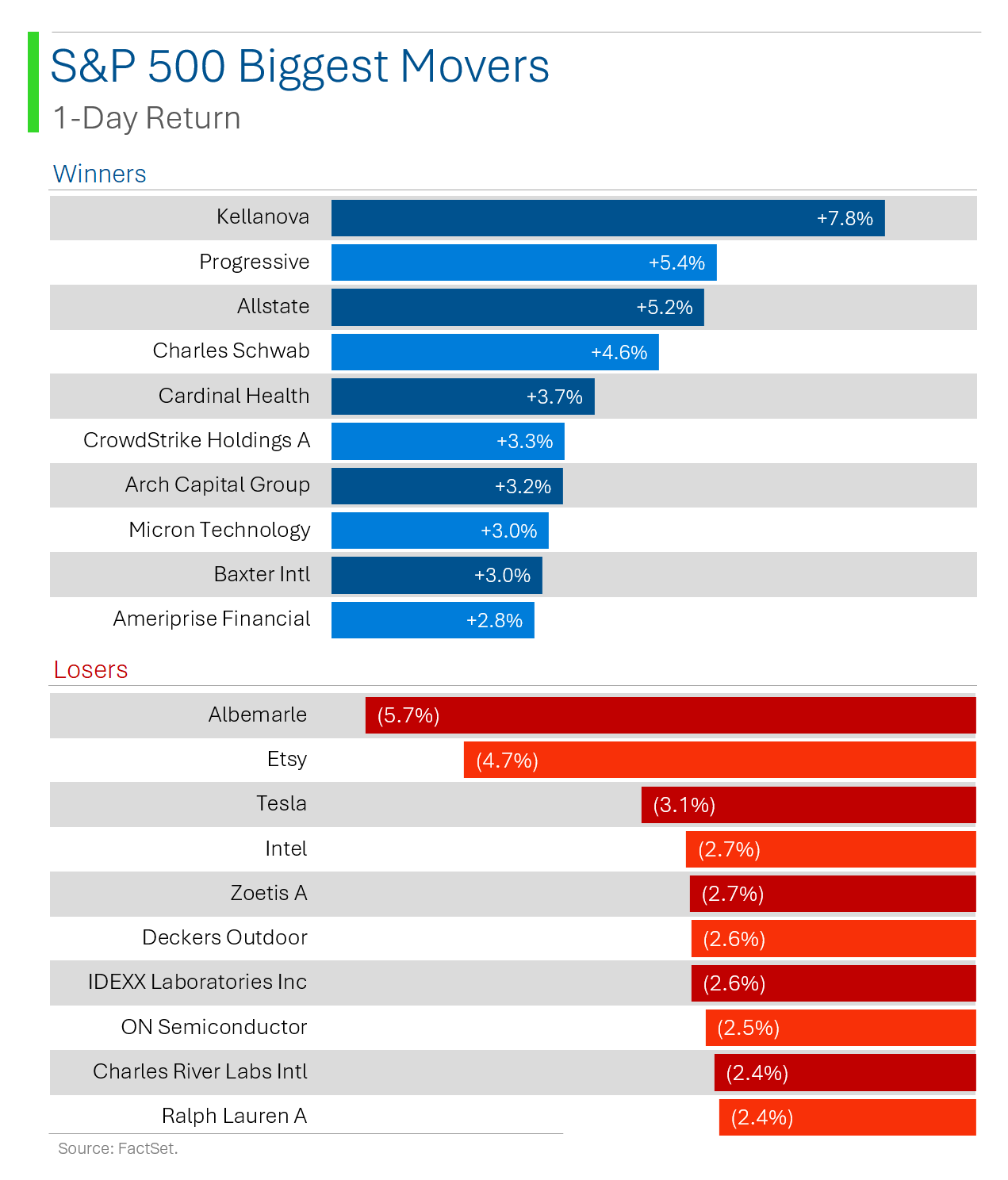

Mixed day for the big US markets with the S&P 500 +0.4% and Nasdaq +0.03%.

8 of 11 sectors closed higher led by Financials (+1.3%) and Energy (+0.7%), despite crude dipping 1.8%. Communication Services (-0.9%) was weakest, with Alphabet pulling the sector down (see below).

Big news was CPI Inflation came in as pretty much non-event, roughly in-line with estimates and most importantly not ruining the rate cut party. Gold did take a bit of hit on the news (less ‘flight to safety’ trades).

Notable companies:

Alphabet (GOOGL) [-2.3%] Bloomberg reported DoJ considering breaking up the company following landmark antitrust ruling; other potential remedies include forcing data sharing with competitors and measures to limit unfair AI advantages.

Victoria's Secret (VSCO) [+16.4%] Announced Hillary Super as new CEO starting 9-Sep; previously CEO of Savage X Fenty; preliminary Q2 results ahead of consensus.

Sphere Entertainment (SPHR) [+9.3%] FQ4 revenue beat; strong Sphere segment results; lower MSG Networks distribution revenues offset by higher affiliation rates.

Street Stories

Inflation Drops, Hopes Rise

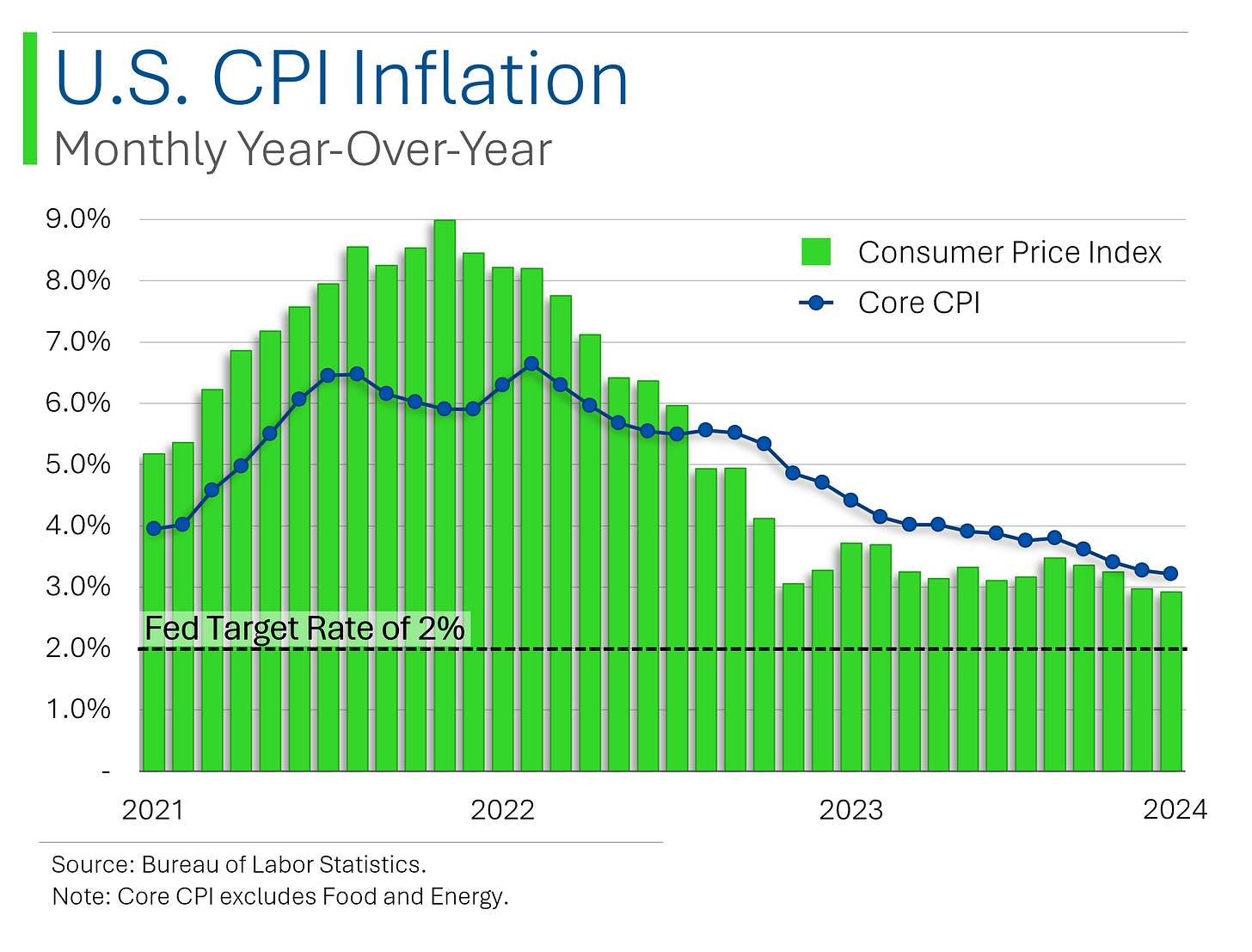

Headline July CPI inflation came in at a +2.9% rate year-over-year, a smidge lower than Wall Street’s consensus estimate for +3.0%. Wanna know the last time an inflation print started with a 2 handle? March 2021.

Yup, it’s been a while.

Core CPI, which excludes the impact of food and energy prices, came in at +3.2% which was in-line with Wall Street’s estimate and June’s print.

Both metrics appear be slowly creeping towards the Fed’s target rate of 2% - but they’re certainly taking their damn sweet time. I mean, June 2023’s print came in at 3.1% after all.

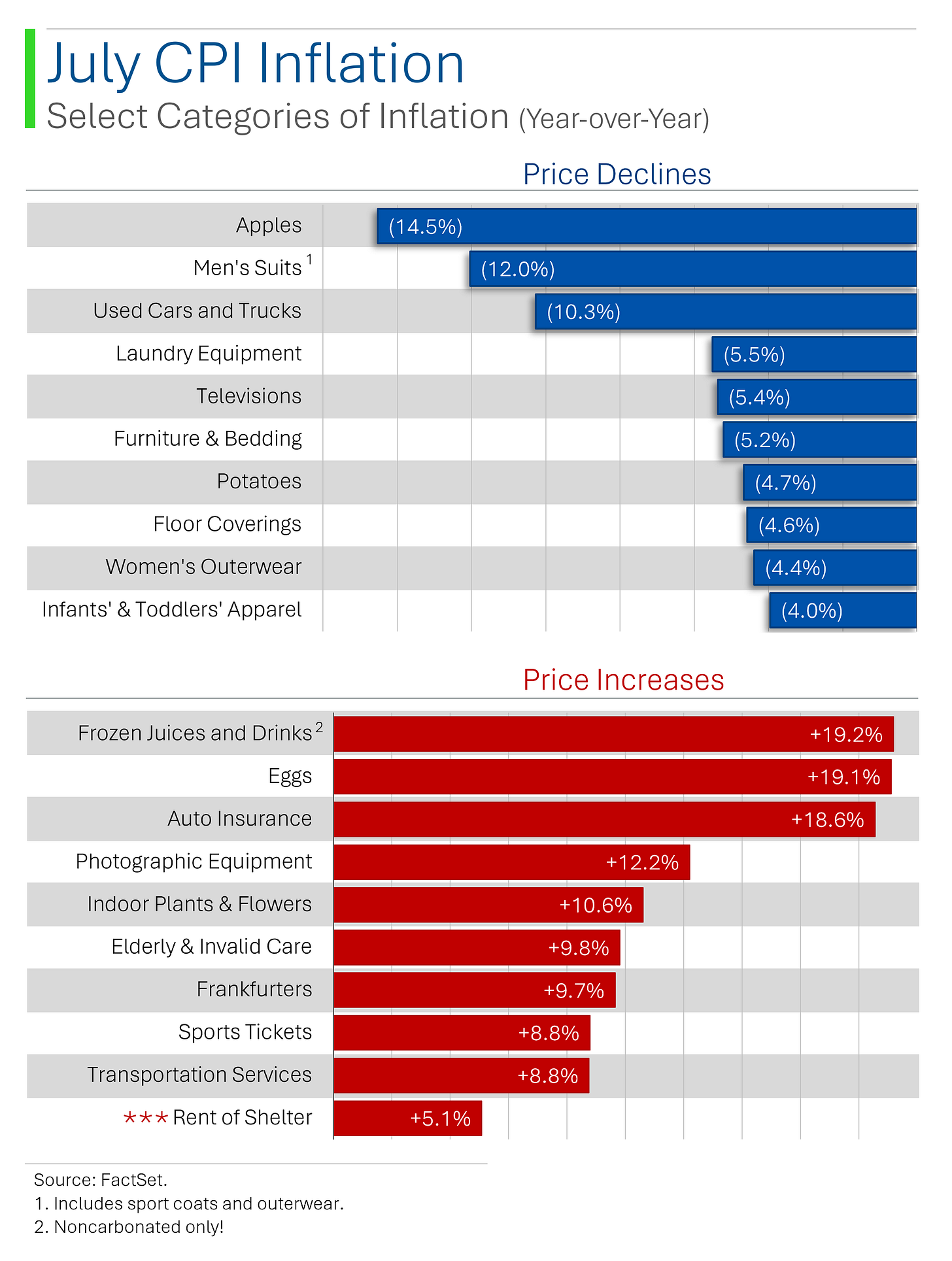

Interestingly, excluding the impact of Shelter cost - notably rent - inflation has actually been at or around the Fed’s target rate for some time now.

Shelter costs aren’t the only things that have gotten suckier over the past year, juices, eggs and frankfurters are also up a ridiculous amount. Like, without using the words ‘oligopoly price collusion’ please explain how auto insurance is up +19% YoY?

And don’t get me started on the category names…

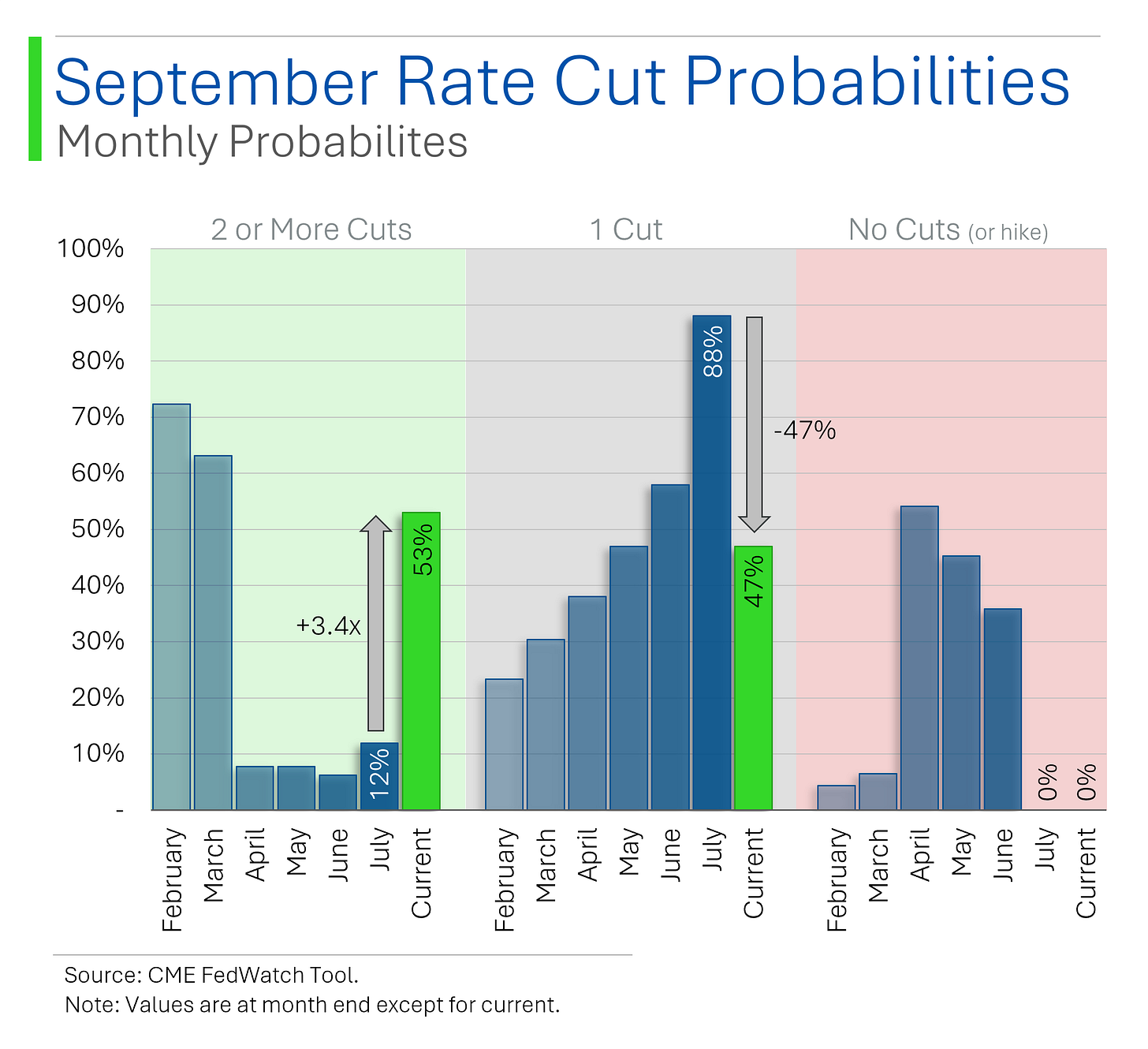

Yesterday’s announcement didn’t cause a furor of excitement, however, as the market’s response was pretty muted. That’s mostly because a September Fed rate cut is 100% priced in at the moment according to the interest rate derivatives markets. In fact, the probability of 2 cuts is bearing a higher probability than 1 cut next month.

Atlanta President Bostic’s comments about ‘waiting for more data’ weren’t well received yesterday but Chicago Fed’s Goolsbee was quite confirmatory, stating that the Fed needs to move quick before the labor market deteriorates further.

This is the correct answer.

Mars Makes Mega Merger Move

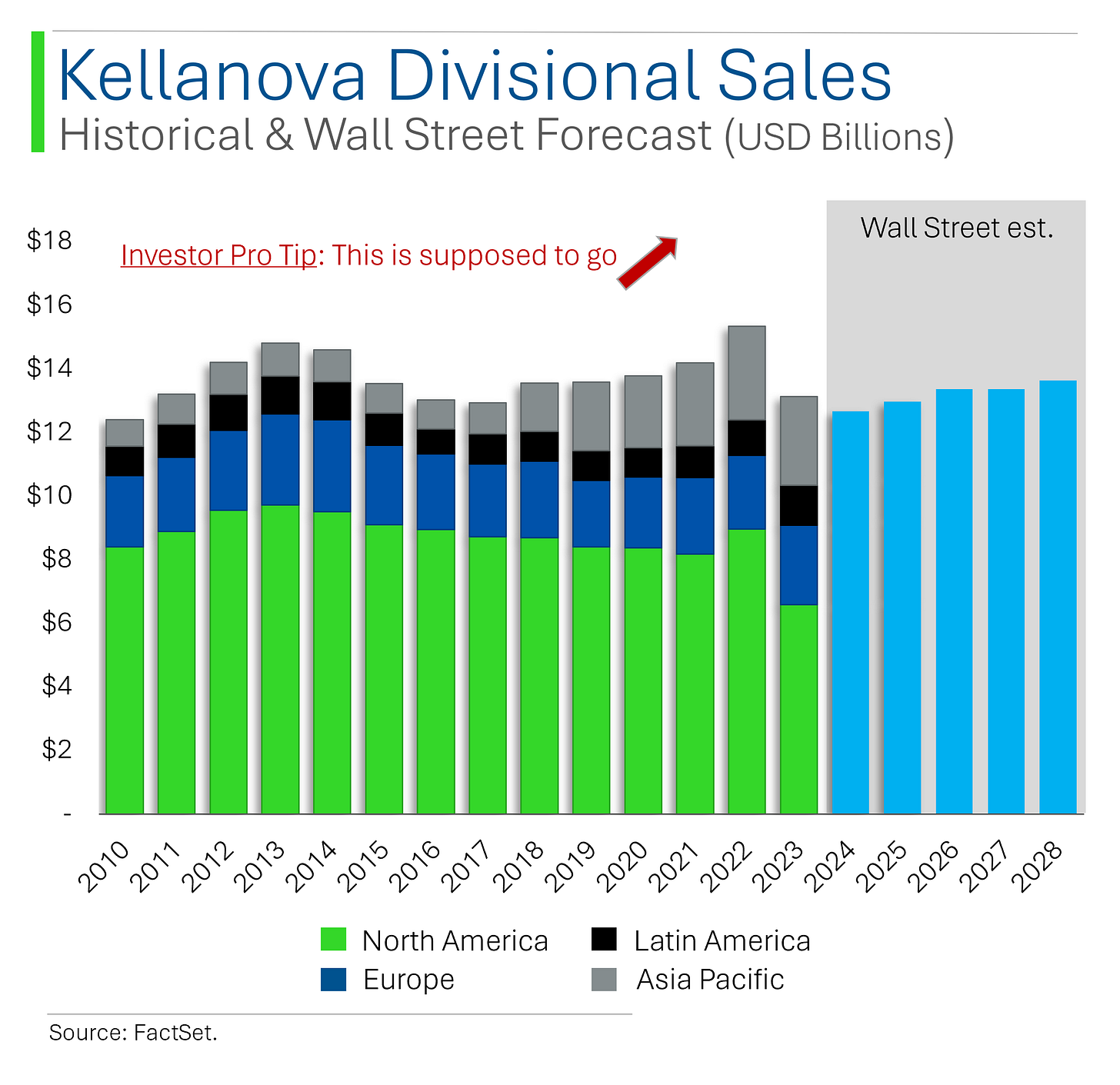

Global snack foods conglomerate Mars Inc. has recently announced its plans to acquire Kellanova in a $36 billion deal. Formerly known as Kelloggs, they’re responsible for brands like Pringles and Cheez-it, which fit well within Mars’ current product mix.

The transaction is priced at a 33% premium to Kellanova’s pre-deal price, which seems steep since the company has a wee bit of a growth problem. However, with cocoa prices soaring, this allows Mars to add a new dimension to their offering and be better positioned for growth in Kellanova’s international markets.

Gunna dig out my broken power washer. Mars might want to buy that too.

Joke Of The Day

I told my wife I invested in a vineyard, but she wasn’t impressed… until I explained it was full-bodied and had a robust yield.

Hot Headlines

Yahoo Finance / Disney argues wrongful death suit should be tossed because plaintiff signed up for a Disney+ trial. Death related to an allergic reaction while eating at a restaurant in Disney Springs. Does signing up for Disney's popular streaming service mean you have agreed to never sue the entertainment giant over anything forever? Apparently, Yes.

CNBC / Google’s live demo of Gemini ramps up pressure on Apple as AI reaches smartphone users. Google’s live demo on Tuesday had some bugs, but the company showed it’s a real rival when it comes to bringing artificial intelligence to smartphones. Just those couple minor bugs to tweak a bit…

Funny video of one of the demonstrations oopsies.

AP / What is mpox, the new global health emergency? The WHO declared mpox a global health emergency, warning the virus might ultimately spill across international borders. Currently 96% of all cases have occurred in Congo.

Yahoo Finance / Google Fitbit, Peloton announce fitness content partnership. As part of the deal, Fitbit premium members based in the U.S., UK, Canada and Australia would have access to Peloton's classes across categories, including pilates, running, boxing and cycling. Peloton grasping at straws rn.

Yahoo Finance / Walmart expected to post another quarter of growth as it draws shoppers in with cheap groceries. Cash stretched consumers race to the lower end of retail shopping to make ends meet.

Trivia

Today’s trivia is on Gold!

What year was the California Gold Rush, which sparked a massive migration to the western United States?

A) 1848

B) 1852

C) 1849

D) 1850In 1933, which U.S. President signed the Executive Order 6102, which prohibited the hoarding of gold by private citizens?

A) Herbert Hoover

B) Franklin D. Roosevelt

C) Harry S. Truman

D) Dwight D. EisenhowerWhat is the purity level of 24-karat gold?

A) 90%

B) 92.5%

C) 99.9%

D) 100%

(answers at bottom)

Market Movers

Winners!

Victoria's Secret (VSCO) [+16.4%] Announced Hillary Super as new CEO starting 9-Sep; previously CEO of Savage X Fenty; preliminary Q2 results ahead of consensus; noted ongoing improvement in North American sales both in-store and online.

Sphere Entertainment (SPHR) [+9.3%] FQ4 revenue beat; strong Sphere segment results; lower MSG Networks distribution revenues offset by higher affiliation rates; announced MSGN refinancing plans with exiting lenders.

Flutter Entertainment (FLUT) [+8.1%] Q2 revenue and EBITDA ahead; US and ex-US segments outperformed; positive execution vs. DraftKings; September Investor Day seen as a potential catalyst.

Kellanova (K) [+7.8%] Agreed to be acquired by Mars for $83.50/share in cash (~$29.5B equity value); 12% premium to Tuesday’s close, 33% since Reuters reported Mars’ interest; deal expected to close 1H-25.

Performance Food Group (PFGC) [+7.7%] FQ4 earnings beat, though revenue was light; strong case volume growth in Foodservice business; raised FY25 guidance, excluding Cheney Bros. acquisition benefit (~$2.1B in cash).

UBS Group (UBS) [+5.6%] Q2 profitability exceeded expectations; capital, cost-cutting, and inflows among bright spots; noted positive investor sentiment and continued momentum in client activity.

Allstate (ALL) [+5.2%] StanHope Financial Group agreed to buy ALL's voluntary benefits business for ~$2B in cash; adjusted net income ROE expected to drop ~100bp but sale generates ~$1.6B in deployable capital; analysts say sale eases capital concerns.

Cardinal Health (CAH) [+3.7%] FQ4 earnings and revenue beat; solid performance in Pharmaceutical/Specialty Solutions, particularly generics; strong cash flows and success from GMPD Improvement Plan; raised FY25 Pharma profit growth guidance.

Losers!

Ibotta (IBTA) [-26.7%] Q2 results ahead; standout performance in 3P redemption segment; Street positive on Walmart rollout and new Instacart partnership; concerns over softer brand advertising, weaker Q3 guidance, and challenging macro/competitive environment.

Brinker International (EAT) [-10.7%] Fiscal Q4 comps strong but EBITDA and EPS missed due to weaker RLMs; FY25 sales guidance ahead, but EPS below midpoint; outperformed industry in sales and traffic; increased menu prices, higher traffic, and "Big Smasher" burger launch provided tailwinds for Chili's; stock up over 60% ytd before report.

Sonos (SONO) [-4.4%] The Verge reported ~100 layoffs today; company also plans to close some customer-support offices later this year; moves follow backlash from a poorly received mobile app redesign, delaying some hardware launches.

Alphabet (GOOGL) [-2.3%] Bloomberg reported DoJ considering breaking up the company following landmark antitrust ruling; other potential remedies include forcing data sharing with competitors and measures to limit unfair AI advantages.

Intuit (INTU) [-1.4%] Downgraded to equal-weight from overweight by Morgan Stanley; concerns over aggressive pricing strategy possibly contributing to share losses at TurboTax and introducing risks at QuickBooks.

Market Update

Trivia Answers

A) 1848 was the year of the California Gold Rush.

B) Franklin D. Roosevelt signed Executive Order 6102.

C) 99.9% is the purity level of 24-karat gold.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

That's a big premium to pay for Kellanova. Don't really understand it - just doesn't make too much sense, apart from diversification.