🔬Inflation Comes In On Target So Nothing Exploded

Plus: Nasdaq breaks +2 year all-time high; Webull puts hopes in SPAC listing; Canada dodges a recession, buddy; and much more.

"The most important quality for an investor is temperament, not intellect"

- Warren Buffett

"If you want to know what God thinks of money, just look at the people he gave it to"

- Dorothy Parker

Solid day for the big US markets with the S&P 500 +0.5% and Nasdaq +0.9%, which resulted in new all-time highs for both indices.

8 of 11 sectors finished green today, led by Tech and Communication Services (both +1.2%). Defensive sectors Healthcare and Consumer Staples were worst at -0.7% and -0.3% respectively.

Big story of the day was PCE inflation which came dead on to what Wall Street had forecast (+0.3% MoM or +2.8% YoY). (more below)

Congress struck a deal to punt spending expiration deadlines out a week.

AMD shares popped 9.1% on positive news… for Nvidia. Chip stocks man…

Street Stories

Inflation Data Threads The Needle

US Personal Consumption Expenditures (PCE) for January came in yesterday with Core PCE which excludes the volatile food and energies categories - and is the Federal Reserve’s preferred measure of inflation - showing an increase of +0.4% MoM or +2.8% over the last year. This figure came in exactly where Wall Street estimates had predicted so the market reaction was rather ‘meh’.

Headline PCE (which includes food and energy) also matched expectations, showing a +0.3% monthly and +2.4% annual change. While all that was in-line, other data from the Bureau of Economic Analysis showed that personal income rose +1% on the month, well ahead of the forecast +0.3%. Taken all in, this was a good day for the market as my fears are that an unexpected surge in inflation could be the catalyst that derails this strong market rally.

The result of today’s print was that hopes for a June rate cut by the Fed ticked up marginally - but still well below the levels experienced back in January and December.

Canucks Dodge Recession

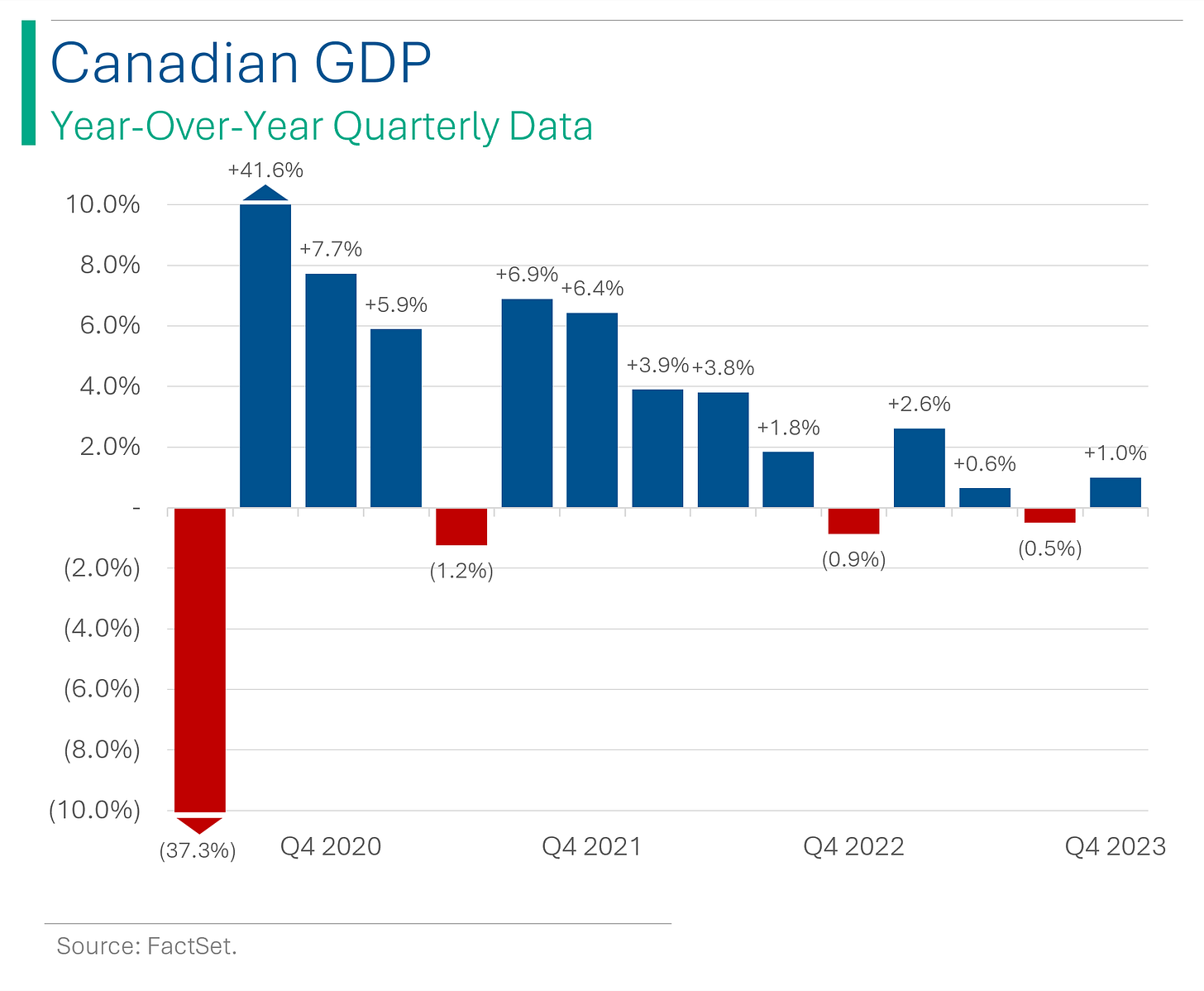

Canadian Q4 GDP came in yesterday and it looks like my fellow hosers will stave off recession for now, buddy. GDP came in at +1.0% YoY, well ahead of the +0.5% that analysts had been forecasting, and was primarily driven by higher exports of crude oil and a reduction in imports.

After a negative 0.5% print in Q3, Canada was one more soft quarter from a technical recession (defined as two consecutive quarters of negative GDP growth), eh. The result means that Canada avoids becoming the third G7 nation to go into recession.

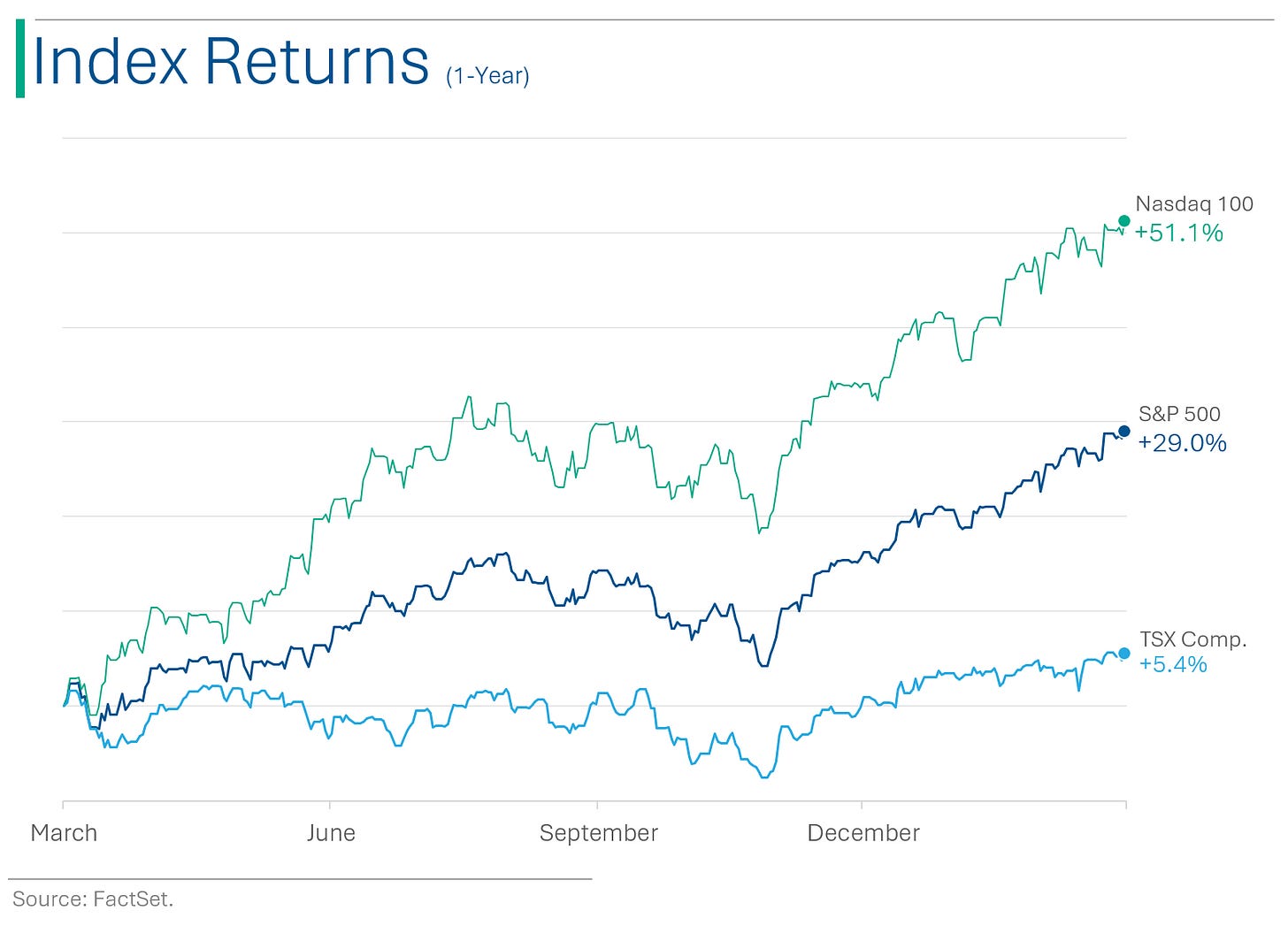

Record Day For The Nasdaq

The Nasdaq broke the record it hit back in November 2021, right before the ‘everything bubble’ burst and things sucked for a while. The S&P 500, which peaked later (January 2022), beat the Nasdaq in breaking through to a new all-time high when it toppled it’s old record back in mid-January. The S&P also hit a new high today, but it’s done that a bunch lately so whatevs.

Webull Says: ‘The SPAC is Back, Baby!’ (they didn’t say that)

Webull, the New York-based online brokerage, is planning to go public via special purpose acquisition company (SPAC). The deal values the platform at $7.3 billion, with the merger expected to close in the second half of the year. Since its U.S. launch in 2018, Webull has seen significant growth, trading $370 billion in equity notional volumes and 430 million options contracts in 2023, catering to a more active and advanced investor base compared to competitors like Robinhood. They also hope their stock does a bit better than Robinhood’s did after they listed.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

There was a safety meeting at work today. They asked me, “what steps would you take in the event of a fire?” “Big Ones” was the wrong answer.

Some cause happiness wherever they go. Others whenever they go.

Hot Headlines

WSJ | Sam Bankman-Fried Calls for Shorter Prison Sentence, Citing Autism. Ya, I heard somewhere that jail is no fun.

Washington Post |Trump Media co-founders sue company, alleging a scheme to dilute shares. The case could complicate a long-delayed bid by the owner of Truth Social to go public and deliver former president Donald Trump a financial lifeline.

AP | A billionaire-backed campaign for a new California city is off to a bumpy start. Again. They won’t quit, though! (They already bought $800 million in land. Shhh.)

National Post | Google sued for US$2.3 billion by media companies over 'abuse of its dominant position'. More than 30 European news media companies filed a €2.1 billion (US$2.3 billion) lawsuit against Google on Wednesday, over the tech giant’s ‘abusive’ digital advertising practices. Another Google lawsuit? Is it that time of the month already?

CNBC | Putin warns of nuclear war if NATO sends troops into Ukraine.

Trivia

This week’s trivia is on early corporations and investing. Today’s is on investing innovation:

What was the first electronic stock market?

A) New York Stock Exchange

B) NASDAQ

C) Tokyo Stock Exchange

D) London Stock Exchange

Which invention in the 19th century revolutionized communication and helped in stock trading?

A) The telephone

B) The telegraph

C) The internet

D) The printing press

What was an early method of stock trading in London before the stock exchange?

A) Coffee houses

B) Online forums

C) Official government offices

D) Pubs

The "Big Board" is a nickname for which stock exchange?

A) NASDAQ

B) New York Stock Exchange

C) London Stock Exchange

D) Tokyo Stock Exchange

(answers at bottom)

Market Movers

Winners!

Pure Storage (PSTG) [+25.0%]: Q4 earnings, revenue, margins beat. Q1 revenue guide exceeds Street, FY25 slightly light. Added $250M buyback, positive on Subscription growth and operating margin (OM) expansion.

C3.ai, Inc. (AI) [+24.5%]: Fiscal Q3 results surpass expectations, Q4 guidance mixed. Focus on AI leverage, record bookings, subscription revenue, Federal sector strength, margin concerns due to Q4 investments.

Okta, Inc. (OKTA) [+22.9%]: Q4 revenue, cRPO, EBIT, EPS beat; raises Q1 and FY25 revenue outlook. Minimal impact from October security incident, conservative guidance, positive on Spera opportunities and sales productivity.

Duolingo (DUOL) [+22.2%]: Q4 beats on earnings, revenue, user growth; guides Q1, FY24 well over consensus. In-app purchases and user growth to continue, driven by product improvements and large market.

Celsius Holdings (CELH) [+20.4%]: Q4 revenue, EBITDA, EPS ahead of estimates. Expanded product availability, customer awareness credited; stock significantly up YTD and last year.

GoodRx Holdings (GDRX) [+20.4%]: Q4 revenue, adjusted EBITDA surpass expectations; forecasts Q1, FY24 EBITDA above Street. Increased transactions from more active customers, new $450M buyback announced.

Hormel Foods (HRL) [+14.4%]: FQ1 earnings, revenue, margins outperform. Retail volume growth from value-added meats, foodservice sales up, reaffirmed FY guidance.

Natera (NTRA) [+13.0%]: Q4 EPS, revenue beat; FY24 revenue outlook above consensus. Positive on Women's Health, Signatera ASPs, organic gross margins improved to 51%.

AMD (AMD) [+9.1]: Not really anything other than some bullish news and positive analyst note for Nvidia which seems to be lifting all ships.

Nutanix (NTNX) [+6.9%]: FQ2 EPS, revenue exceed forecasts; beats driven by subscription growth. Net-new customers up, strong free cash flow, optimistic on VMware & Cisco opportunities.

Monster Beverage (MNST) [+5.8%]: Q4 EPS aligns, revenue slightly misses; GM beats, OM falls short. Distribution costs improved, volume growth strong into January, pricing strength and lower freight, input costs seen as margin tailwinds.

Losers!

Chemours (CC) [-31.5%]: Delayed Q4, FY23 earnings for internal controls review. CEO, CFO on leave after ethics complaints on working capital management. Unaudited FY23 revenue in line, net income below Street.

DoubleVerify (DV) [-21.3%]: Q4 revenue in line, solid volume growth. Q1, FY revenue guidance below expectations, cautious on slow advertiser start and new customer ramp-up.

WW International (WW) [-18.2%]: Q4 misses on revenue, EPS; FY24 outlook below. Oprah Winfrey not seeking board reelection but will collaborate. Noted potential in business model transformation.

Snowflake (SNOW) [-18.2%]: Q4 ahead, Q1, FY25 product revenue growth guidance disappoints, CEO retiring immediately. Concerns on external storage use, valuation pressure.

FIGS, Inc. (FIGS) [-13%]: Q4 revenue light, EBITDA benefits from expenses. Guidance below expectations amid macro pressures, decelerating metrics. Downgraded at Telsey Advisory Group.

Iovance Biotherapeutics (IOVA) [-8.7%]: Q4 misses on earnings, revenue. Mixed views on Amtagvi melanoma uptake, sustainable patient growth mentioned.

First Advantage (FA) [-7.0%]: Q4 EPS aligns, revenue misses; FY24 below consensus. To acquire STER for $2.2B, suspends share buyback.

Bath & Body Works (BBWI) [-5.4%]: Q4 beats on EPS, revenue; Q1, FY24 guidance short. 2024 sales to decline 3% to flat, contrary to slight growth expectation. Net sales down 1.7% in 2023, strong gross margins.

Market Update

Trivia Answers

B) NASDAQ was the first electronic stock exchange.

B) The telegraph revolutionized financial communication.

A) Coffee houses were the primary location to trade stocks before the first exchange.

B) New York Stock Exchange is often referred to as the ‘Big Board’.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.