🔬I Talk About How Oil Is Boring (Which Is Great), and Much More

"Time is your friend; impulse is your enemy"

- John Bogle

“Success is going from failure to failure without loss of enthusiasm”

-Winston Churchill

Slow news day with US markets shut down for Martin Luther King Day.

Street Stories

Crude Update

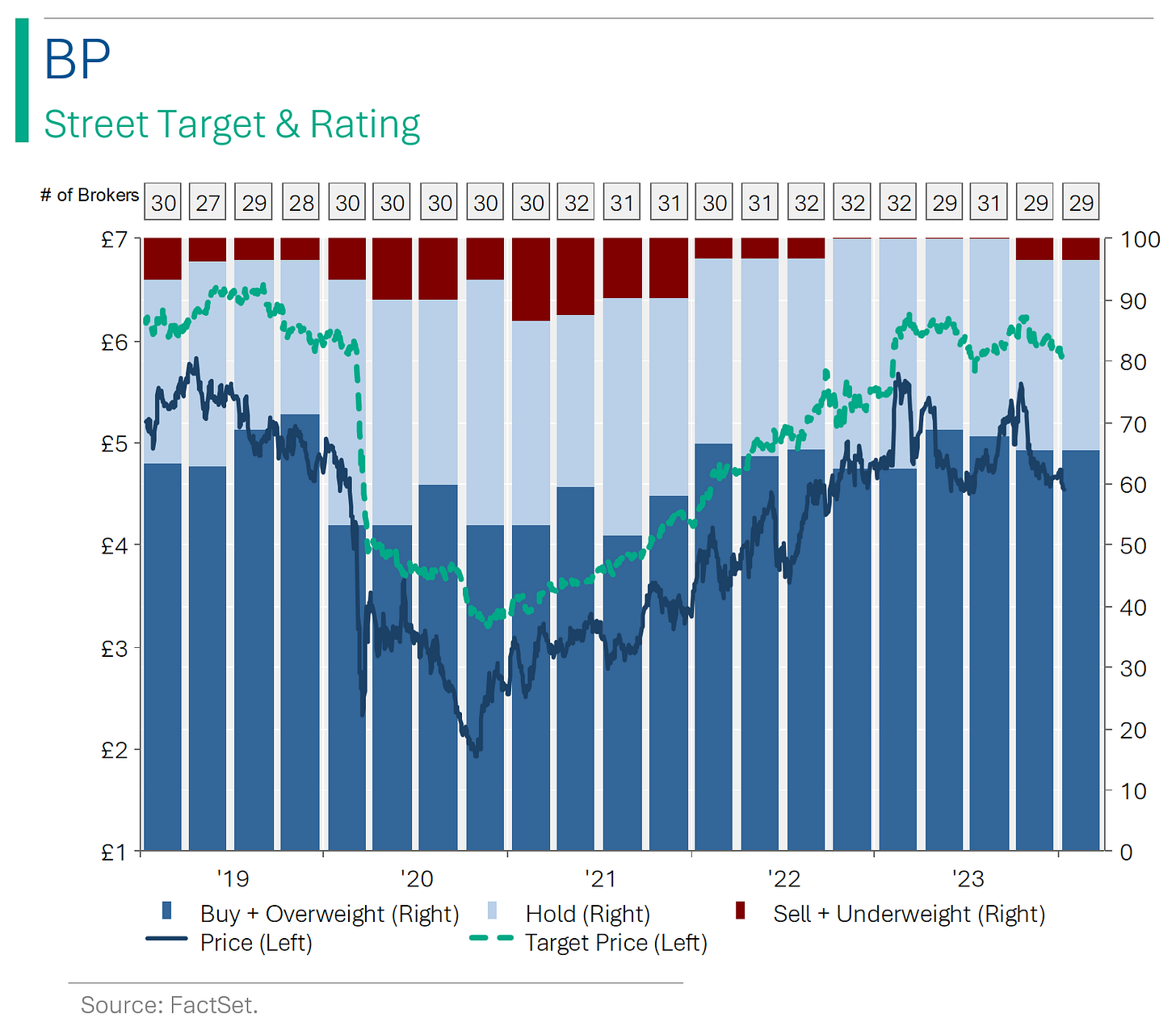

Oil Land is a fickle corner of the investment world. While exploration, production innovation, and distribution all play an important role in the relative interplay between companies, investment returns often have a lot more to do with the macro environment, than anything operational (unless you have an oopsie in the Gulf of Mexico like BP).

Coming out of the pandemic, the Majors went on a tear as supply issues and a shooting war in Europe kept the oil price high. While (ex-China) economic activity around the globe picked back up nicely.

But things turned around in 2023 as supply pressures abated and the demand outlook globally began to cool. Another war in the middle-east and an OPEC willing to slash production in the name of price support hasn’t been able to keep the price elevated, and it seems like this $70 - $80 per barrel range seems to be the new normal for the time being. Oil isn’t exactly cheap, but in the grand scheme of things - from a macro economic perspective - it doesn’t seem to be the straw that broke the camel’s back either.

From a supply and demand perspective, the U.S. Energy Information Administration (IEA), forecasts modest +1-2% consumption growth over the next few years, which is slow enough that if all goes to plan, we shouldn’t be expecting anything dramatic to happen with the oil price given the vast amount of idle capacity sitting in the wings. Basically, unless something big happens, like, a full-blown middle-east war, the energy space should (fingers crossed) be boring for the next little while. Which is great.

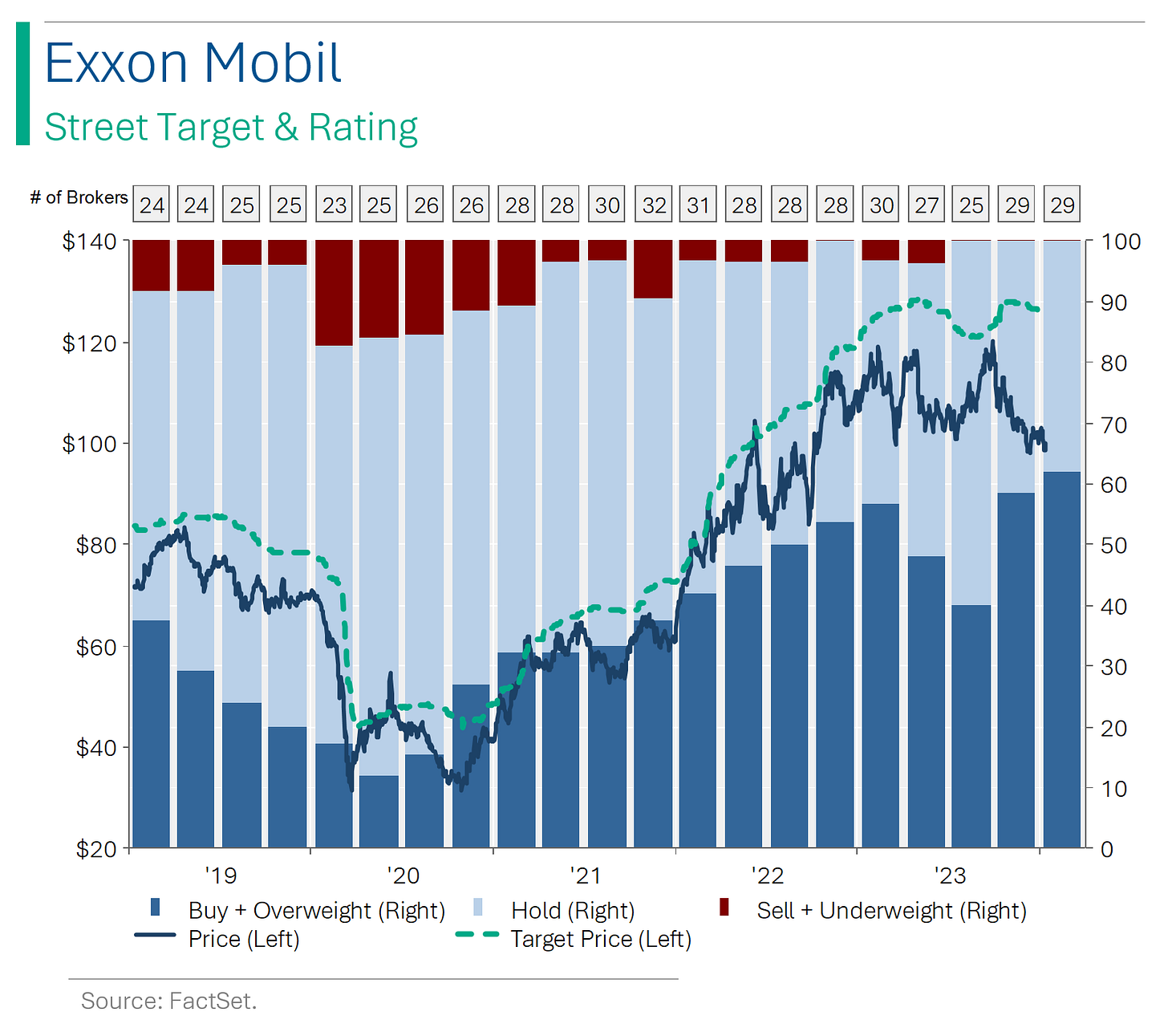

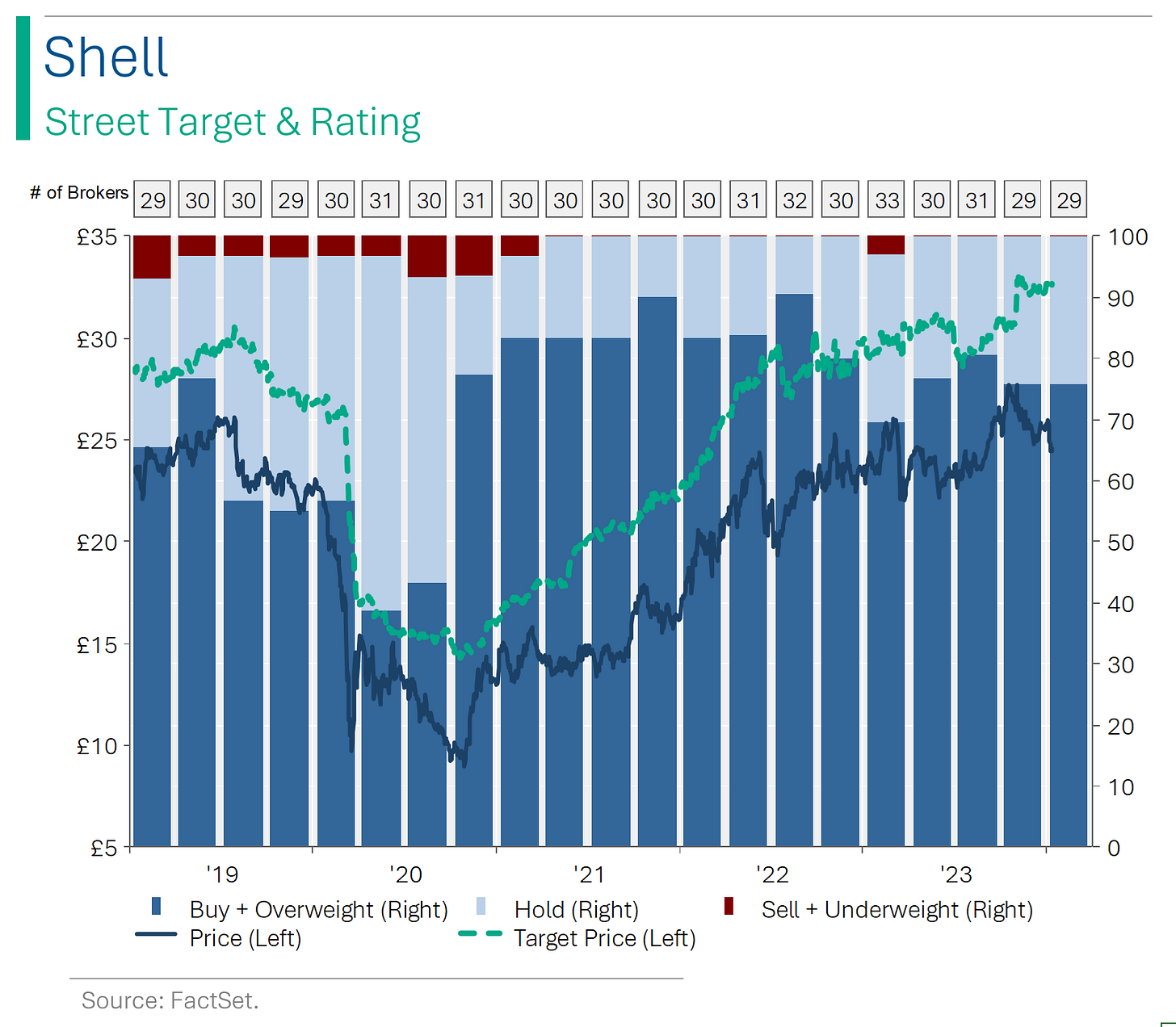

So where does that leave the energy stocks? Well, $70 - $80 oil isn’t exactly the party that we saw in 2022, but is high enough for the majors to remain highly profitable. The current Wall Street forecast sees Exxon and Chevron growing production nicely over the next few years, while the euros (BP and Shell) seem to be flat-lining.

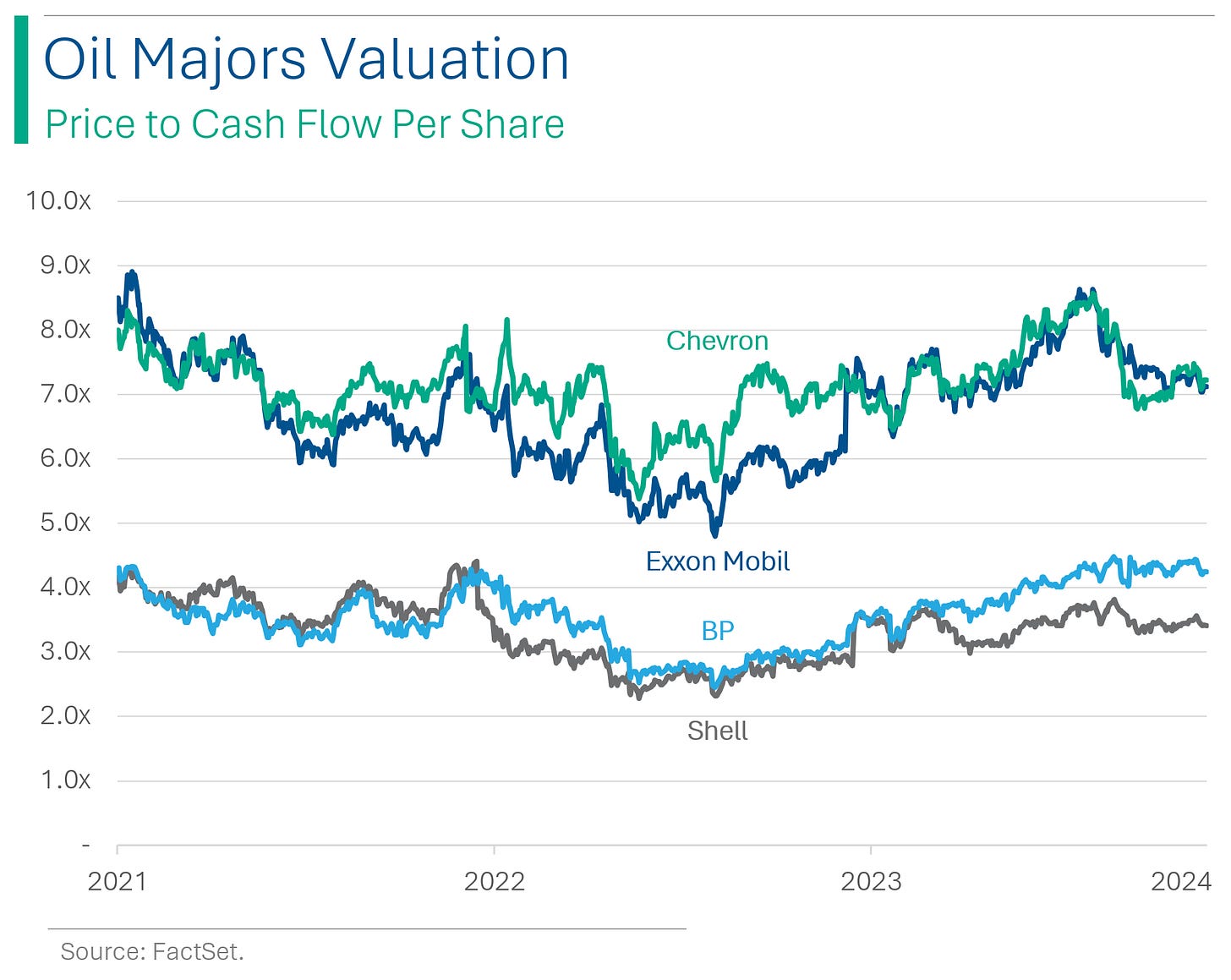

From a valuation perspective, Exxon and Chevron trade at a nice premium to the euros, in part do to their much stronger growth outlooks. Valuations look rich compared to 2022 but bare in mind that at $120 a barrel, they looked artificially cheap back then so it’s not exactly a fair comparison.

Take-Aways: When I decided to dig into oil a bit I was expecting to find something concerning so, while it might not make for great copy, it’s actually reassuring from an economic perspective that things seems pretty stable, despite all the instability in the world. Unless things really spin out of hand in the Ukraine/Russia or Israel/Hamas conflicts and barring a surprise burst of life from Western economies, it seems like oil will remain at levels accommodative to economic growth - or at least not be the trigger for the next slowdown. It’s also nice to see the jerks at OPEC struggle a little bit.

From an equity investing perspective, I’ve never been a big fan of oil companies outside of being a short-term way to play the oil price. However, for those more open minded, the Majors do pay fairly healthy dividends (range from 3.8% yield for Exxon to 4.8% for BP). And for what it’s worth, the Street is still pretty positive on them (see below).

Baidu in a Bot Hot Spot: Military Maneuvers Mangle Markets

Chinese tech giant Baidu's shares in Hong Kong fell 12% following a report that its AI chatbot, Ernie Bot, was tested by scientists affiliated with the Chinese military, raising fears of U.S. sanctions. The company denied any direct links with the military-affiliated laboratory, asserting their AI model is publicly available. Despite this, the association has affected investor confidence, as seen in Baidu's and other Chinese AI companies' fluctuating stock prices. (Barron’s has more on the story)

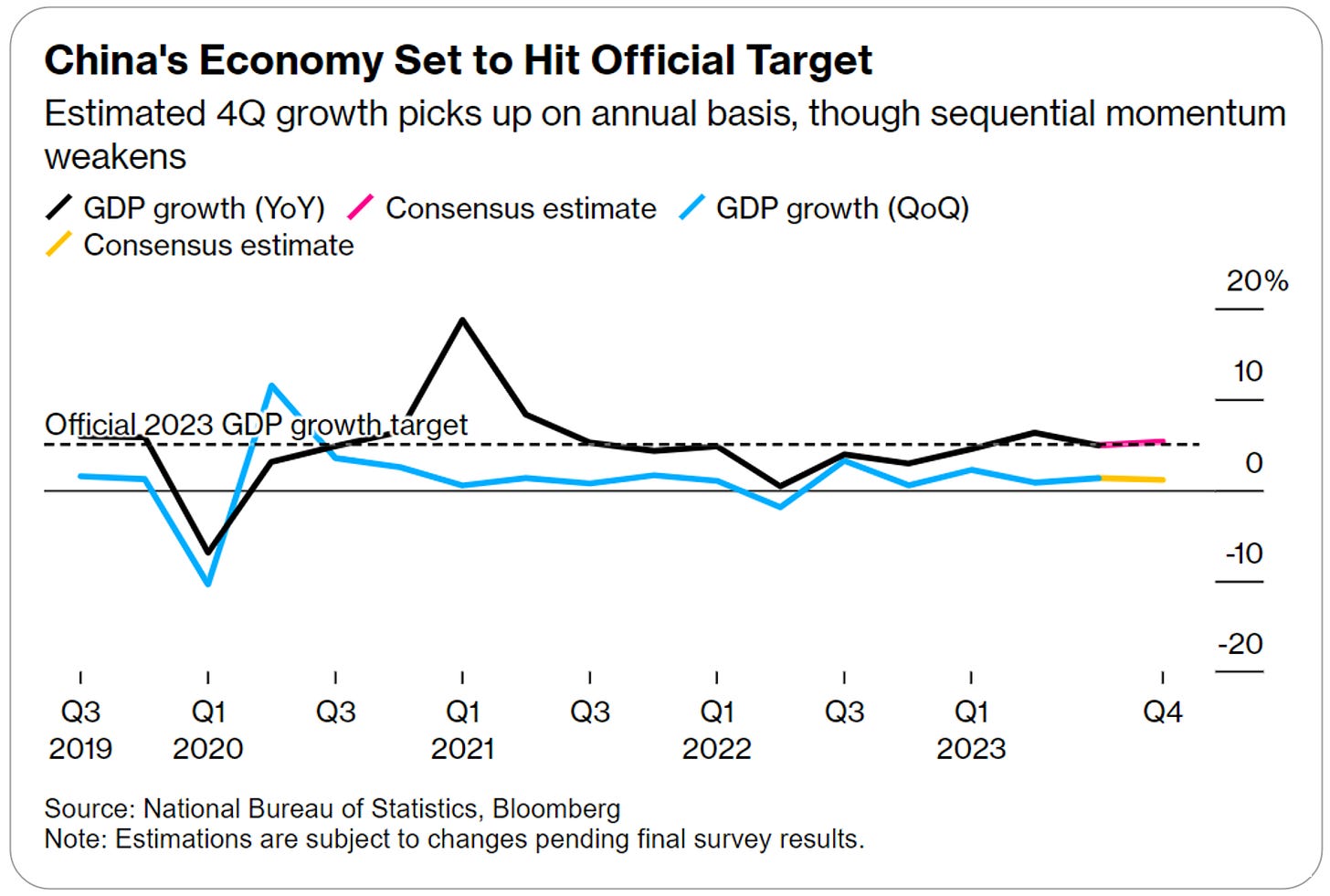

Beijing's Balancing Act: Wobbling Out of a Covid Slump

China is poised to release its final major economic data for 2023, with expected improvements in GDP, industrial production, and retail sales due to a low comparison base from pandemic restrictions. The country's GDP likely grew by 5.2% last year, aligning with government targets, but forecasts for 2024 suggest a slowdown to 4.5% growth without additional stimulus. Real estate challenges remain a significant threat to economic stability, with calls for decisive policy actions to stabilize the sector. (Bloomberg has the full story)

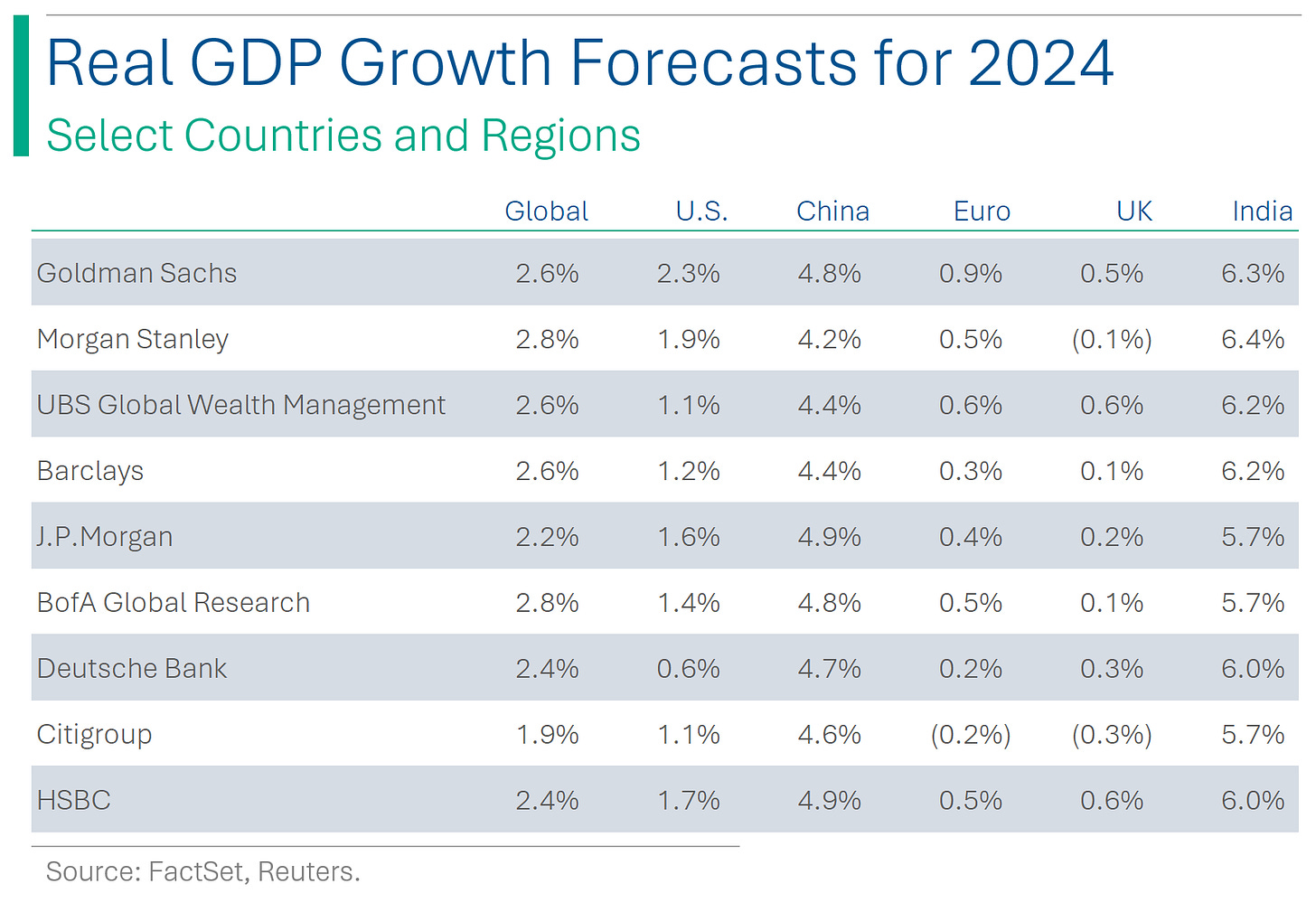

Global Growth Outlook

Reuters was nice enough to aggregate a pile of bank forecasts for GDP growth in 2024. US numbers are a far cry from most recent Q3 figure of +4.9% year-over-year (Q2 was +2.1%) but still consensus is that it will skip the recession everyone was forecasting this time last year. The outlook for Europe and UK looks a bit dicey (range -0.2% to +0.9% and -0.3% to +0.6%, respectively), while India continues to crush it as the new growth machine of Asia. (Link to the article)

Joke Of The Day

Hot Headlines

WSJ | China’s solar dominance faces new rival in ultrathin film. Chinese firms control over 80% of the global supply chain for silicon solar panels, and China’s share of polysilicon, the core material for the panels, is even higher.

Reuters | Trump wins Iowa caucus, DeSantis and Haley battle for second place in the first primary of the 2024 Republican nomination race. Results are still being tallied but the real battle was for second with DeSantis and Haley at 21% and 19% of the vote, respectively. After coming in fourth, Vivek Ramaswamy has ended his Presidential campaign.

Reuters | Apple offers iPhone 15 at a rare discount in China as competition intensifies. Cuts as high as $70 for some iPhones, as the iPhone 15 has proved to be the worst performing launch in recent memory in the country.

WSJ | Houthis turn their sights on U.S. ships an vow to keep attacking Red Sea targets.

Barron’s | Microsoft unveils a copilot pro service for AI power users across Windows applications.

Trivia

This week’s trivia is on first in corporate history.

Which company made the first commercial mobile phone call?

A) Motorola

B) Nokia

C) AT&T

D) EricssonWhich company was the first to reach a market value of $1 trillion?

A) Microsoft

B) Apple

C) Amazon

D) GoogleThe first company to use an assembly line was?

A) General Motors

B) Ford Motor Company

C) Chrysler

D) Toyota

(answers at bottom)

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Trivia Answers

A) Motorola made the first successful commercial mobile phone call.

B) Apple was the first company to be worth a trillion dollars.

B) Ford Motor Company created the first proper assembly line.