🔬I Joined the S&P 500 and All I Got Was This T-Shirt

Plus: Stagflation prospects give the market the scaries; Big Tech earnings were at least cool; and much more

"The most important quality for an investor is temperament, not intellect."

- Warren Buffett

"I'm in a glass case of emotion."

- Ron Burgundy

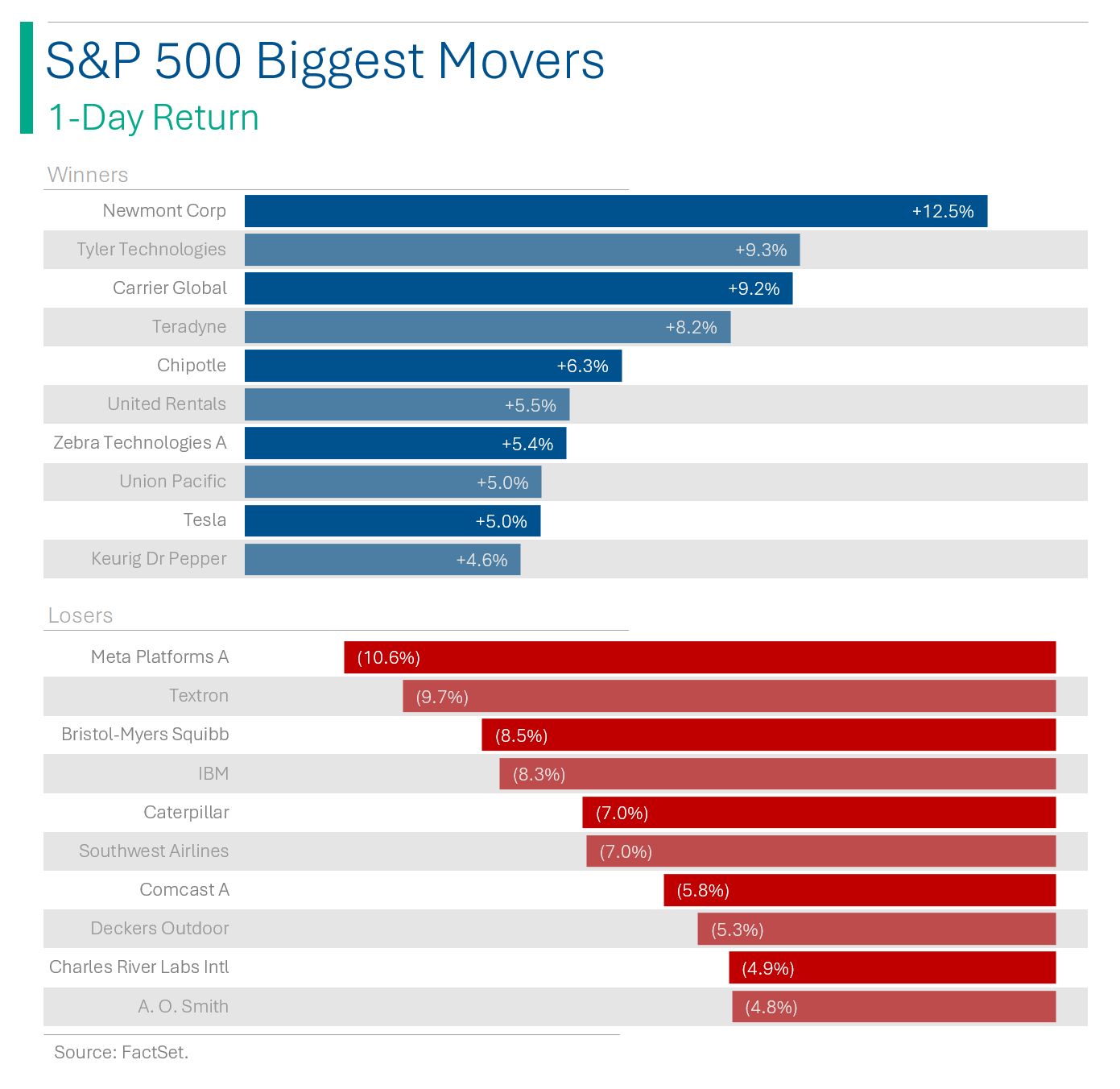

Another bad day for the big US markets (S&P 500 -0.5%, Nasdaq -0.6%) as Q1 GDP came in soft (1.6% vs. estimates for 2.2%) and PCE inflation portion (+3.7%) hinted that costs are speeding up again.

5 of 11 sectors closed down, led by Materials (+0.8%) and Energy (+0.5%). Communication Services (-4.0%) had a terrrrrible day but when you realize Meta was down 11% and it’s ~16% of the sectors it’s much more modest 🤷♂️

Another massive day for Q1 reporting (see ‘Market Movers’ below) with Microsoft and Alphabet posting exceptional quarters (+4.5% and +11.5% in pre-market trading). Hertz Global (-19.3%) and Whirlpool (-10.1%) not so much. 💩

Street Stories

Joining the S&P

Getting added to the S&P 500 has historically been looked at as a strong positive for a company, beyond the fact that the C-Suite gets to add that to their resume. The main positives are:

The massive benchmark tracking ETFs now have to go out and buy your shares.

Investment managers now have you in their benchmark, so they are more inclined to hold your shares*.

Anyway, that’s what convention says but I wanted to dig in a bit to see if this actually held up in the real world. Spoiler: Kinda?

* ‘Off-benchmark risk’ is heavily factored into investment decisions by the asset management community. For example, if my Microsoft position goes south, I know that at least it’ll pull the benchmark down a bit and also that I won’t have to explain myself too vigorously to investors. Losing your shirt on an off-benchmark company looks extra bad. Moreover, if investors don’t have a view on your shares, they might just hold a benchmark weight to avoid having to think too hard about you.

I looked into the companies added to the S&P 500 since the start of 2020 - there were 71 of them. In their first 3 months on the index the average company returned 6.1%, with 58% of the companies showing a positive return*. Not too shabby.

* If a company was added in the last 3 months (GE Vernova, Solventum, Supermicro and Deckers Brands) the return period data is until April 25.

Compared to the S&P 500 over the same periods the new additions did quite well, with 68% beating the index with a relative outperformance of 11.6%. That’s not chump change.

Looking at the complete period since index inclusion, the data is a bit muddled: some companies have done great, some terrible. However, the general idea that being added to the S&P is good for your share price definitely seems to hold true. For all the companies added since the start of 2020, the average outperformance compared to the S&P 500 was an impressive 29.9%!

Now that we’ve proved that that old stock adage holds true (over the latest medium term, at least), what about the companies that get dropped from the S&P 500? Are they doomed to a life of obscurity or Chapter 11?

To start, the universe of removals since 2020 is a lot smaller than the list of additions, as many of the names left the index due to being acquired or merging (Twitter, Tiffany’s, E-Trade, etc.) Since January 2020, there have been 71 additions but only 47 of the removals are still trading.

Return-wise at the 3 month mark it’s what you’d expect: removals lost 3.8% vs. +6.1% that the new additions made. Nothing here is surprising.

But what is ABSOLUTLEY INSANE is that over the full trading period since being dropped, the average company removed from the index has returned 48.0%! That compares to only 8.1% for the new additions.

Did I just discover the pot of gold at the end of the rainbow… in s*** companies dropped by the benchmark?

Does this make me a Value Investor?!?

Stagflation Scaries

The U.S. economy grew at a yucky 1.6% annualized rate in the first quarter, the slowest since mid-2022, influenced by a rise in imports and minimal inventory accumulation. Despite the modest growth, solid domestic demand was evident with consumer spending showing slight moderation, business investment increasing, and the housing market improving. Still not good though.

What made this worse was that the Core PCE Inflation portion of GDP came in at 3.7% versus an estimate for 3.4%. Tomorrow March PCE gets released and it’s not expected to be fabulous (obviously).

The market freaked out at this as low growth and high inflation (aka Stagflation) isn’t a particularly fun place to be.

Big Tech Earnings

Meta wet the bed following the close Wednesday after reporting a decent Q1 but a soft revenue outlook, which sorta soured the market (closed down 10.6% yesterday). Luckily Microsoft and Google-parent Alphabet leapt in to redeem some investor sentiment after posting strong quarters after close yesterday.

Microsoft

Q3 EPS: $2.94 vs. Wall Street consensus for $2.82

Q3 Revenue: $61.86B vs. est. $60.86B

Reported Cloud revenue (it’s biggest growth engine) was $35.1B, up 23% YoY on the back of strong AI demand

Alphabet

Q1 EPS: $1.89 vs. Wall Street consensus for $1.51

Q1 Revs: $80.54B vs. Street’s $78.77B

The company made two big announcements also:

That the Board approved it’s first ever dividend, with the first one being $0.20 per share that will be paid on June 17th

Also announced plans to repurchase up to $70.0B of its Class A and Class C shares.

Microsoft is trading up +4.5% in pre-market, while Alphabet is up a whopping 11.5%.

Joke Of The Day.

What do you call Santa’s helpers? Subordinate Clauses.

Interviewer to job applicant: “Can you come up with any reason you want this job other than your parents want you out of the house?”

Hot Headlines

NY Times / FCC votes to restore Net Neutrality rules. In a 3-to-2 vote along party lines, the five-member commission appointed by President Biden revived the rules that declare broadband a utility-like service regulated like phones and water.

CNBC / Red Lobster seeks a buyer as it looks to avoid bankruptcy filing. Bloomberg first reported that Red Lobster was mulling a Chapter 11 filing last week. It’d be a dark, dark world without cheddar biscuit and all you can eat shrimp.

Yahoo Finance / ByteDance reportedly prefers TikTok shutdown in US if legal options fail. The algorithms TikTok relies on for its operations are deemed core to ByteDance's overall operations, which would make a sale of the app with algorithms highly unlikely, said the sources in the report.

Reuters / Microsoft-backed Rubrik's stock jumps 21% in NYSE IPO. The pop gives the cybersecurity firm a valuation of $6.8 billion.

Reuters / US ban on worker non-competes faces uphill legal battle. The FTC’s Tuesday ban reportedly faces considerable challenges. About 30 million people in the US (~20% of all workers) are estimated to be under such employer arrangements.

Trivia

Today’s trivia is on Blockbuster Video (RIP).

What year was Blockbuster Video founded?

A) 1980

B) 1985

C) 1990

D) 1995Where was the first Blockbuster store opened?

A) Toronto, Canada

B) Miami, Florida

C) Los Angeles, California

D) Dallas, TexasAt its peak, how many stores did Blockbuster have worldwide?

A) About 3,000

B) About 6,000

C) About 9,000

D) About 12,000What policy did Blockbuster institute in 2005 to fend off competition?

A) Free popcorn.

B) Rent one, get one free.

C) No charge for not rewarding cassette.

D) No more late fees.

(answers at bottom)

Market Movers

Winners!

Newmont (NEM) [+12.5%]: Q1 earnings per share (EPS) and revenue exceeded forecasts with production boosts at Peñasquito and Yanacocha. Firmly on track for 2024 production, costs, and capital spend. Also announced the sale of the Lundin Gold stream credit facility.

Carrier Global (CARR) [+9.2%]: Q1 EPS surpassed estimates while revenue fell short; organic growth was slightly weak, though operating margin (OM) outperformed expectations. Full-year 2024 EPS and revenue guidance reaffirmed, with an upgraded OM outlook.

Teradyne (TER) [+8.2%]: Q1 revenue exceeded expectations, driven by AI applications in memory/networking despite ongoing mobility sector weakness. Q2 guidance surpassed analyst expectations, though H2 memory visibility remains limited.

Chipotle Mexican Grill (CMG) [+6.5%]: Q1 comparable store sales grew 7%, outpacing the consensus of 5.2%. EPS exceeded forecasts by over 14%, with notable gains from throughput initiatives and a robust start to Q2.

Union Pacific (UNP) [+5%]: Q1 EPS, operating income, and revenue all topped forecasts with a 140 basis point year-over-year improvement in operating ratio, aided by a 60 basis point benefit from lower fuel costs. Management plans to resume share repurchases in Q2.

Losers!

Hertz Global (HTZ) [-19.3%]: Q1 earnings fell short with revenue matching expectations. The company expanded its EV disposition plan to sell 30K EVs in 2024. Increased Fleet and direct operating costs impacted performance this quarter.

Meta Platforms (META) [-10.6%]: Q1 results were strong but aligned with high buyside expectations; however, Q2 guidance was slightly weaker. The company is facing challenges due to increased investment in AI, which is not yet generating proportional revenue, despite boosting engagement.

Whirlpool Corp. (WHR) [-10.1%]: Q1 EPS and revenue outperformed, though free cash flow declined more than expected. Sales dropped year-over-year across all regions. FY24 EPS and revenue guidance are ahead of expectations, but analysts are wary of diminishing margins and softening demand.

Bristol Myers Squibb (BMY) [-8.6%]: Q1 earnings and revenue exceeded expectations, largely due to strong performance from Revlimid and Eliquis, although Opdivo fell short. FY EPS guidance was reduced due to recent transaction impacts, raising concerns about the growth portfolio and potential margin pressure.

IBM (IBM) [-8%]: Q1 revenue and operating profit were below expectations, though EPS beat forecasts with aid from tax benefits. The company noted pressures in consulting and on smaller projects, while acquisition activities, such as HashiCorp and Red Hat, showed positive prospects.

Southwest Airlines (LUV) [-7%]: Q1 revenue and EPS fell short of expectations, with Q2 revenue per available seat mile (RASM) also missing targets. FY guidance was negatively revised due to challenges with Boeing aircraft deliveries and network optimization efforts.

Caterpillar (CAT) [-7%]: Q1 EPS exceeded forecasts, but revenue did not meet expectations with mixed performance across sectors. Energy & Transportation outperformed while Construction and Resource Industries lagged. Q2 sales are expected to decline year-over-year, with FY24 sales anticipated to slightly miss consensus.

Comcast (CMCSA) [-5.8%]: Q1 revenue exceeded expectations but adjusted EBITDA was underwhelming. Free cash flow was a highlight. Performance was mixed, with solid Broadband results but weaker outcomes in Studios and Theme Parks, raising concerns about potential disappointments in 2024 broadband/wireless projections for cable.

Market Update

Trivia Answers

B) Blockbuster was founded in 1985.

D) The first location was in Dallas, Texas.

C) Peak Blockbuster has about 9,000 locations.

D) No more late fees started in 2005. The rent one get one free promotion started in 1999.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Great research on S&P 500 inclusion/exclusion. Original insights I had not seen elsewhere.