🔬How Overbought Is The Market? Active vs. Passive Investing, and Much More

"Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity"

- Carl Icahn

“Life is like a dogsled race. If you ain't the lead dog, the scenery never changes”

- Lewis Grizzard

Fresh all-time highs for the S&P 500 as it had a strong day (+1.2%) to end the week. The Nasdaq fared even better - up +1.70% - on a strong day for Tech.

9 of 11 sectors closed in the green with Info Tech (+2.3%) and Financials (+1.6%) at the forefront. Defensive sectors Consumer Staples (-0.3%) and Utilities (-0.1%) had the worst showing.

New all-time highs for hype names Microsoft and Nvidia, while rate cut expectations continue to ease (I did a neat explainer on this last week)

Tech outperformance likely linked to Taiwan Semiconductor’s (the world’s biggest chip maker) strong Q4 earnings release and bullish industry guidance.

Street Stories

S&P 500 Valuation Drift

When I did my ‘S&P 500 Valuation Update’ two weeks ago the main take-away was ‘Damn, this is f****** expensive’. If you skip over the wonky COVID period, the index averaged a historical 12-month forward Price to Earnings ratio of ~15.2x, so with things currently sitting just shy of 20x, it looks like there is a lot of air underneath the market.

While I stand by those remarks, Bloomberg did an interesting take on how to look at the current situation. Specifically, what happens if you adjust for the fact that the Magnificent 7 stocks (Apple, Meta, Alphabet, Nvidia, Microsoft, Amazon and Tesla) have massively grown in their composition of the index. For example, at the start of 2023, the Mag7 constituted a 22.7% weight in the S&P 500, while it ended the year at around a 30.1% weight.

So, when you look at the P/E multiples of the Mag7, they aren’t exactly out of whack compared to their history: 27.6x currently vs. 27.2x in the 2017 to 2019 period. And if you look at the S&P 500 on an ‘equal weight’ basis (ie: mitigating the distortionary effect of having a higher Mag7 weight), the current average P/E multiple is actually slightly lower than the 2017 to 2019 period (16.4x vs. 16.6x).

Ryan’s Thoughts: Now I won’t go as far as to recant and claim that the S&P 500 is actually ‘cheap’ right now, but I think it adds better context to the situation. Importantly we need to understand what the future growth outlook is in order to continue to support such high valuations; in the Mag7 and elsewhere. Just looking at the S&P 500 over the past 13 years, Earnings Per Share has grown at an average of 7.4%, while current Wall Street estimates are targeting only around 5.3% growth.

Regardless of mix and index composition, to keep supporting valuations at these levels there needs to be the growth to justify it.

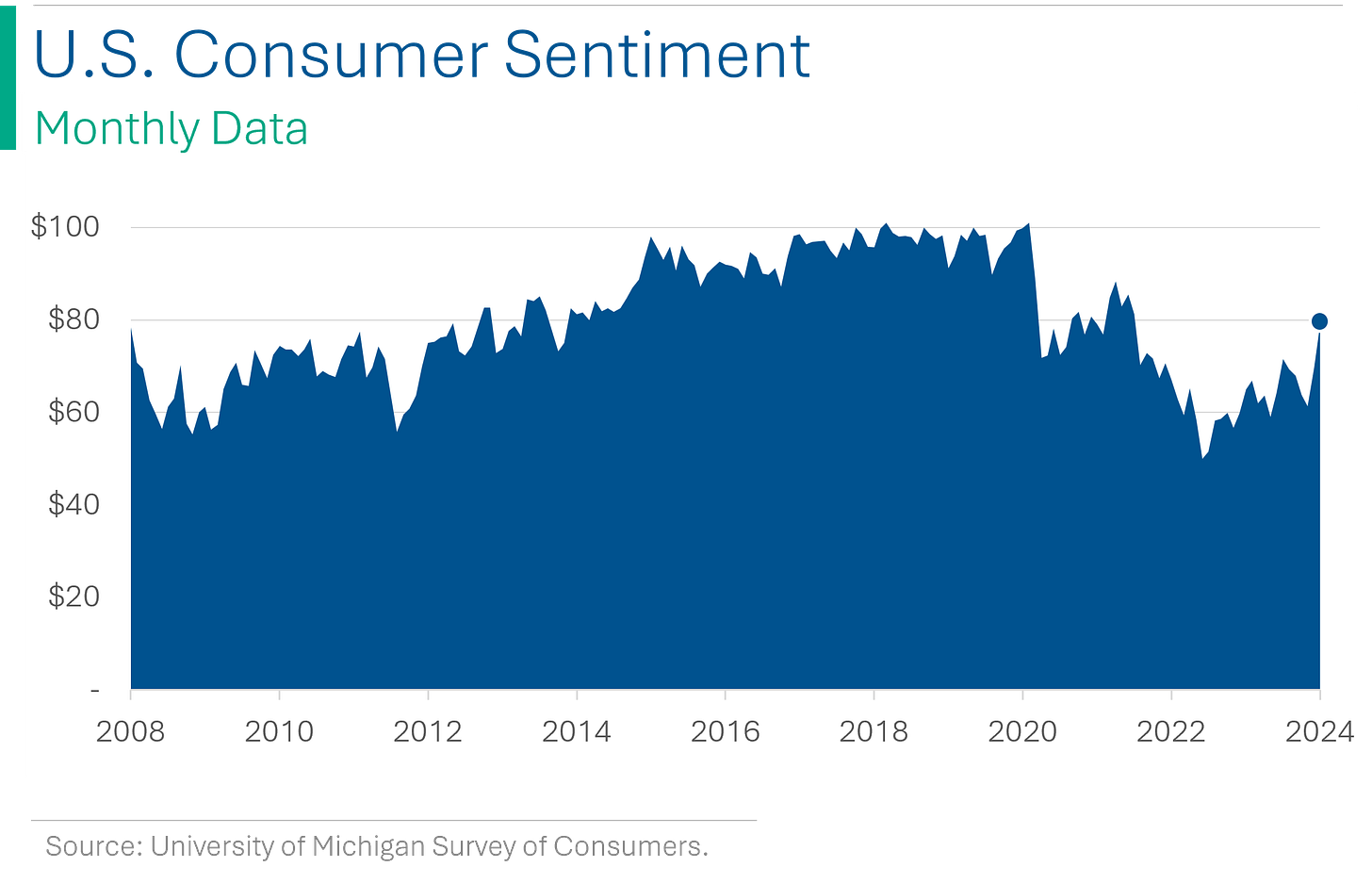

High Hopes for the Economy: Consumer Sentiment Soars to New Peaks

U.S. consumer confidence surged to a two-year high in January, marked by the University of Michigan's index rising significantly, fueled by optimism about personal income, the economy, and a more positive inflation outlook. The report indicates a broad improvement across various demographics and a decline in short-term inflation expectations, suggesting sustained consumer demand and potential easing of Federal Reserve policies. Despite the recent downturn in home sales, economic optimism is bolstered by stronger stock market expectations and an anticipated housing market rebound, as mortgage rates decrease and more inventory is expected.

Active vs. Passive

As someone who spent their career up until recently picking stocks, you’d think I’d have a disdain for all things ‘passive’, and view the notion of ETF investing as sacrilege. But you’d be wrong. I love ETFs and can see the value in holding them; whether you’re a grizzled old market junky like myself wanting some long Nasdaq exposure, or an absolute novice, trying not to lose the $4k your grandmother left you.

And the success speaks for itself, as ETFs and other passive equity vehicles have officially passed actively managed equities (ie: mutual fund and their ilk) in total market value (CNBC has some thoughts on this, and Morningstar has the data).

As a bit of a coincidence after reading about this, I stumbled upon another, adjacent Morningstar article outlining, and I quote, ‘How passive investing harms markets’. Really?

Explainer: The linked article above adds some data to some already well known phenomena that affect stocks as a result of high ETF ownership. While there are many areas impacted, most can be chalked up to two primary concerns: 1. Liquidity and 2. Outside price influence.

In the case of the first, if people are more inclined to hold ETFs vs. individual stocks, then there will be fewer buyers and fewer sellers in the market. The impact is that bid-ask spreads get wider (you pay more to buy or sell shares) and that price movements can be exacerbated by said buyers and sellers, causing inefficiency in the share price.

Secondly, as flows into and out of ETFs result in a proportional share of buying and selling into constituent companies, additional volatility is thrust upon companies that otherwise wouldn’t have experienced any price action. For example, if you sell your S&P 500 ETF then Whirlpool - the 465th largest company in the US - experiences some small selling pressure, despite the fact that nothing has essentially changed at Whirlpool to warrant it. Again, share price inefficiency.

While these things have been known about forever - and continue to become more impactful - what I think gets lost is that idea that this is a good thing. While some daytrader, punting shares willy nilly, might end up with a bloody nose, for those of us that want to hold great companies, and hold them for the long term, then amplified price movement can give us better entry and exit prices (if we’re paying attention). Greater market inefficiency is the best friend of the long term investor.

Elon and AI (Part II)

Elon Musk's latest venture, the AI company xAI, has casually scooped up a cool $500 million in investments on its leisurely stroll towards a $1 billion goal, while flirting with a valuation of between $15 and $20 billion. This ambitious project, Musk's alternative to his own co-brainchild OpenAI (which he bailed on over issues with CEO Sam Altman’s commercial strategy), leverages X’s (formerly Twitter) chatter for its chatbot Grok - because where else to find the zenith of intellectual discourse but on social media?

The fun part is that Musk has said that X shareholders will hold 25% of the newly founded AI company. But not for free. Investors in Elon’s $44 billion deal for Twitter (now valuing itself at $19 billion internally, or $12 billion if you’re investor Fidelity), which include Larry Ellison, Sequoia Capital, Andreessen Horowitz, and Saudi Prince Alwaleed bin Talal, have been invited to invest at least 25% of their financial contribution to the Twitter deal into the new AI company. So their initial investment in Twitter is worth a fraction of what they paid for it but if they invest more they can own a piece of technology that was already developed at said company? Sounds like a bargain.

Joke Of The Day

My boss told me to stop acting like a flamingo, so I had to put my foot down.

My boss is very easygoing. He told me not to think of him as the boss, rather, think of him as a friend who is never wrong.

Hot Headlines

Reuters | Ron DeSantis ends 2024 campaign, endorses Trump over Haley. The news come two days before the New Hampshire primary, and a week after he got smoked in Iowa. Nikki Haley left as Trump’s only threat to the Republican nomination.

WSJ | New trading start-ups have DIY quant traders running their own micro-hedgefunds. Sounds awesome but I think a lot of school teachers and accountants are gunna lose their shirt thinking they’re the next Ed Thorp.

Axios | ESPN eyes messy solution to streaming puzzle. Company is trying to buy equity stakes in professional sports leagues to fight off cord cutting eventualities.

WSJ | A guide to the Middle East’s growing Conflicts, in Six maps. Sounds like Disneyland for people that don’t value human life.

Reuters | Macy's rejects Arkhouse's $5.8 billion bid, citing financing concerns. "The Board has determined not to enter into a non-disclosure agreement or provide any due diligence information to Arkhouse and Brigade," Macy's said in a statement, citing "a lack of compelling value" in the proposal. Zing. This could get messy.

Trivia

This week’s trivia is on technology innovation.

Who launched the first modern credit card?

A. Visa

B. Diners Club

C. American Express

D. MasterCardWhich company created the first handheld mobile phone?

A. Nokia

B. Samsung

C. Motorola

D. AppleWho developed the first successful color television?

A. Sony

B. RCA

C. Philips

D. Samsung

(answers at bottom)

Market Movers

Winners!

Kaman (KAMN) [+100.9%]: Agreed to be acquired by Arcline for approximately $1.8B.

Super Micro Computer (SMCI) [+35.9%]: Raised Dec quarter revenue guidance by ~30%, indicating over 100% year-over-year growth, and increased EPS guidance by ~18%, citing strong demand in AI and IT solutions.

Spirit Airlines (SAVE) [+17.1%]: Forecasts Q4 revenue at the upper end of earlier estimates due to robust year-end bookings; exploring refinancing options for 2025 debt.

Wayfair (W) [+10.2%]: Plans to reduce ~13% of its global workforce and ~19% of corporate staff, aiming for over $280M in annual cost savings.

Texas Instruments (TXN) [+4%]: Upgraded to buy at UBS, with expectations of early order increases due to lower distribution reliance.

Losers!

IRobot (IRBT) [-26.9%]: Facing challenges from Europe's antitrust regulator regarding its planned $1.4B sale to Amazon.

Hertz Global (HTZ) [-4.1%]: Downgraded to hold from buy at Jefferies, citing concerns over near-term profitability, EV repair issues, higher operating expenses, and rising interest rates.

Market Update

Trivia Answers

B. Diners Club was the first credit card when it launched in 1950.

C. Motorola with the 4.4lb Motorola DynaTAC 8000X in 1973.

B. RCA had the first color TV back in 1953.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.