🔬 How Much Have the S&P's Top-10 Holdings Changed in 20 Years? A lot.

Plus: Sports memorabilia is ludacris; Warren Buffett thinks nothing is worth investing in; and much more.

"Investing isn’t about beating others at their game. It’s about controlling yourself at your own game"

- Benjamin Graham

"The difference between playing the stock market and the horses is that one of the horses must win"

- Joey Adams

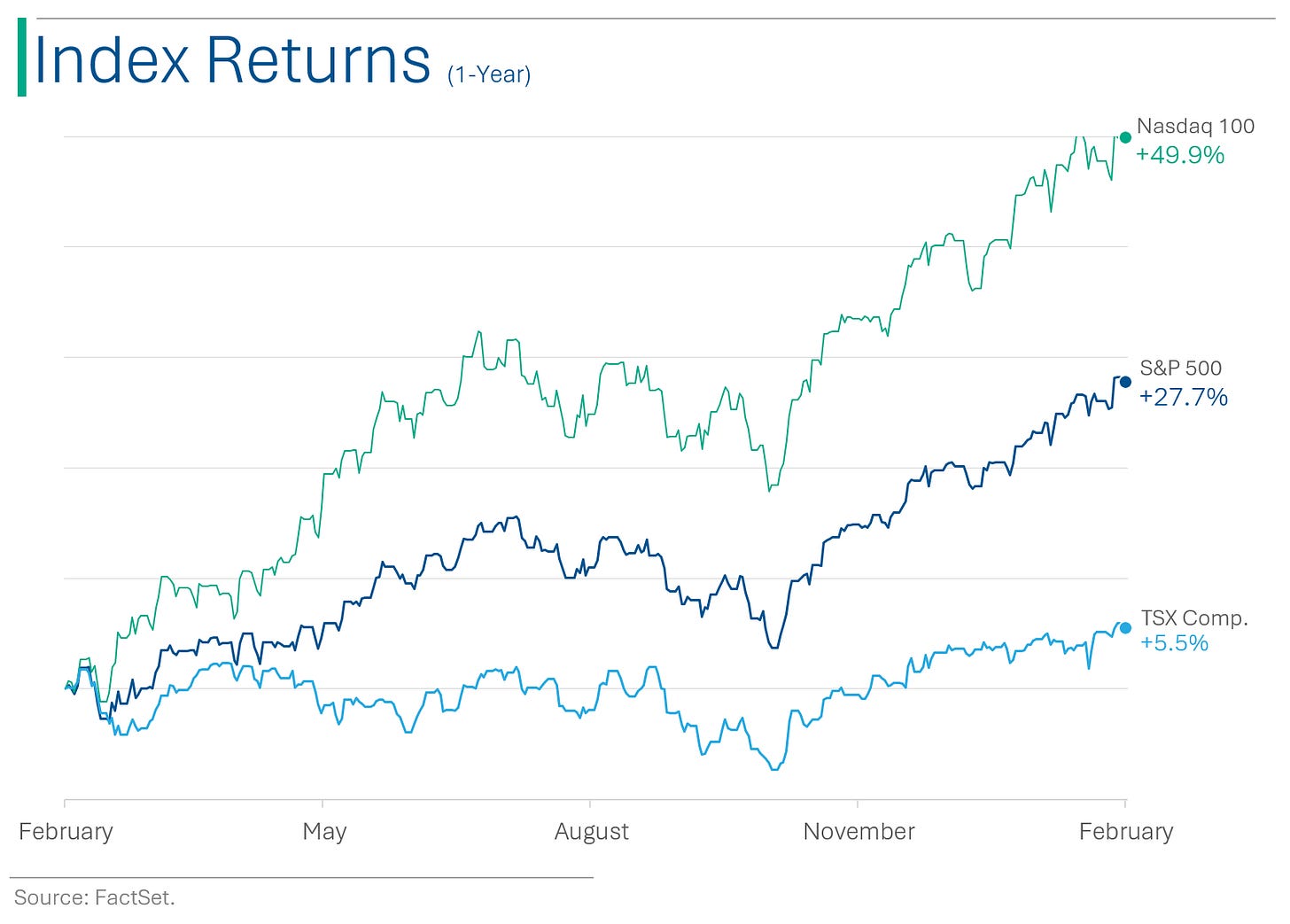

Bla day for the big US markets with the S&P 500 -0.4% and Nasdaq -0.1%.

3 of 11 sectors were up, with Energy (+0.3%), Consumer Discretionary (+0.2) and Tech (+0.0% (rounded down)) the only winner.

US new home sales rose +1.5% year-over-year after three straight months of declines. Albeit still below economists’ estimates.

Dominos up (+5.9%) after a Q4 print that saw strong guidance, a +25% dividend hike and a $1 billion buyback program, that outweighed a miss on revenues.

Space tech company Intuitive Machines (-34.6%) sunk after it revealed that its craft actually landed sideways on the moon. CEO affirms that some of its mission will still be attainable.

Thanks for all the birthday wishes! I had a excellent day with my wife and kiddos. And maybe a few (10) beers with my best buddy.

Street Stories

In yesterday’s post I wrote about the progression of the S&P 500 into the top-heavy index it is today (the top-10 companies represented 17% of the index in 2014 but now represent 34% today), and as a bit of a follow-up I wanted to look at the specific companies that occupy the top of the index today, and how that’s changed over time. Again, it’s changed a lot.

Only one company in today’s top-10 was in the top 20 bucket (Microsoft at #2). Diabetes (and now weight-loss) kingpin Eli Lilly was closest: Now #8, back then it was 12th. Walmart (#13) was 6th back then, and good ole Exxon Mobile (#16) was #4 back then after a solid stint as #1 throughout the early 2000s.

Moreover, six of the top-15 companies weren’t even publicly traded at that point, including Alphabet, Meta, Tesla and Visa.

Looking at it the other way, the bigwigs of 2004 have aged like a fine milk, with the average company in the top-10 back then now clocking in at an average of 51 on today’s list. Time comes for us all - especially for banks/insurers (Citigroup, AIG) or industrial conglomerates (IBM, GE) it seems. RIP.

Buffett’s Cash Pile Grows

Warren Buffett's Berkshire Hathaway reported a record cash pile of $167.6 billion in Q4 due to challenges in finding attractive investment deals, despite its operating earnings rising to $8.48 billion from $6.63 billion the previous year. Buffett highlighted the scarcity of meaningful acquisition targets that could significantly impact Berkshire's performance, stating that there are few companies in the U.S. and virtually none internationally that meet their criteria for capital deployment. Despite this, Berkshire has pursued some investments, such as buying Alleghany Corp. and increasing stakes in Occidental Petroleum and Japanese trading houses, while also spending $9.2 billion on share repurchases throughout the year.

Sports Memorabilia Records

I stumbled across a cool story about a family in rural Saskatchewan, Canada that had an unopened box of O-Pee-Chee hockey cards from 1979-1980 NHL season. Cool find, but the kicker is that just happens to be Wayne Gretzky’s rookie season. Rookie cards of ‘The Great One’ have sold as high as $3.75 million, and the rough estimates are that this box contains between 25-27 of said cards. So it seems like a bargain that said box only sold for $3.7 million at auction on Sunday.

Anyway, this got me curious about what the most expensive sports memorabilia has gone for in the past. Here’s my list:

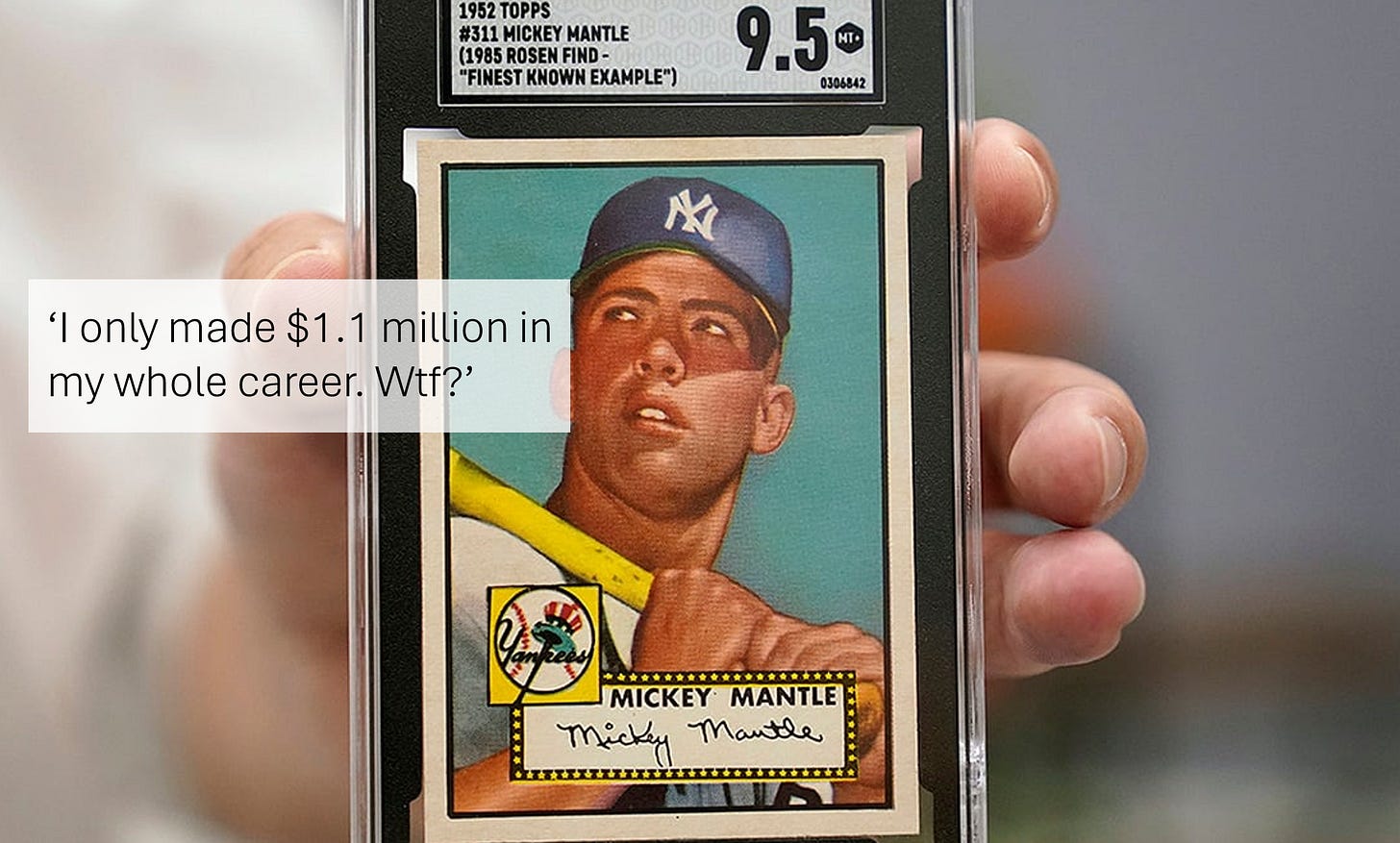

1952 Topps Mickey Mantle #311 Trading Card ($12.6 million)

Not the most famous baseball player of all-time so this is a bit of a shocker.

Michael Jordan's 1998 NBA Game 1 Jersey ($10.09 million)

Worn by Michael during their loss to the Utah Jazz in the finals, peak Jordan would turn it around to bring home the team’s sixth and final title in the so-called ‘Last Dance’Diego Maradona 1986 World Cup Jersey ($9.28 million)

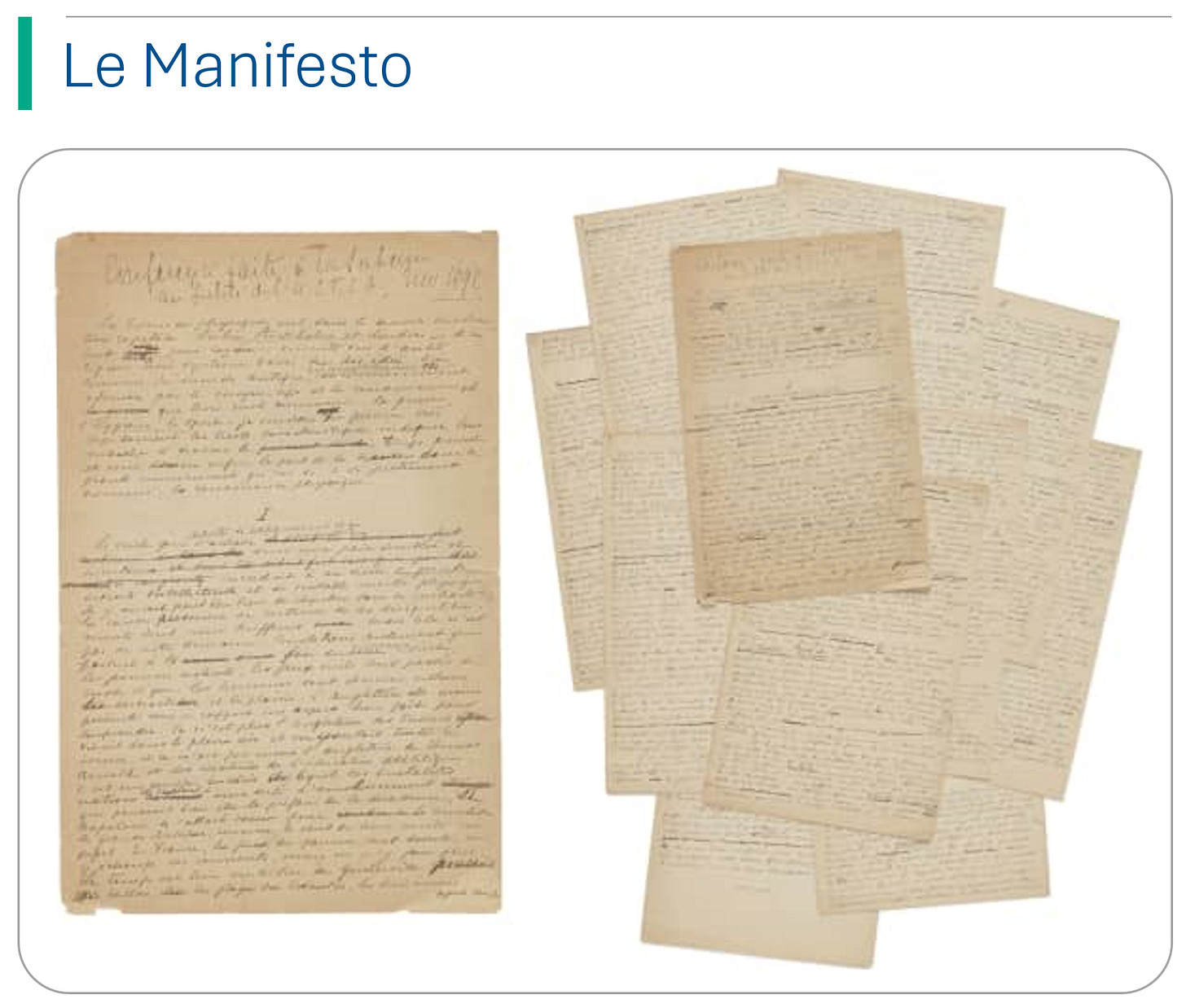

Worn during the famous ‘Hand of God’: the illegal goal that cost England a chance at the finals, while Argentia went on to win the World Cup.Pierre du Coubertin's 1909-1910 Olympic Games Manifesto ($8.8 million)

Turns out it was actually just supposed to be one big drinking game.

Lionel Messi set of six 2022 World Cup match-worn shirts ($7.8 million)

Another win for Argentina (this time they didn’t cheat) and a career moment for one of the sport’s greats.

Honus Wagner T206 Trading Card ($7.25 million)

Other than his baseball cards, has anyone actually heard of this guy? Apparently the rarity of his cards has to do with him being a health nut and demanding that they stop using his likeness, as these first cards came in packs of cigarettes. Respect.

Muhammad Ali's 1974 WBC Heavyweight Championship Belt ($6.180 million)

Rumble in the Jungle, baby!Kobe Bryant 2007-2008 Lakers jersey ($5.8 million)

Babe Ruth's 1928-1930 Jersey ($5.64 million)

‘The Sultan of Swat’, ‘The great bambino’

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

Blessed are the young, for they shall inherit the national debt.

– Herbert Hoover

Why are Irish bankers so successful? Because their capital’s always Dublin.

Hot Headlines

Reuters | Financial giant TIAA is trying out a new avenue to reach Millennials and Gen Z: a rap album. Yup, Wyclef Jean, Pusha T, Lola Brooke, Capella Grey and Flau’jae have made an album to promote financial literacy amongst the youngins. Paid for by the $1.2 trillion asset manager.

Smithsonian | Flaco, the famous owl that escaped the Central Park Zoo, dies after hitting a building. Goodnight sweet prince.

CNBC | Tesla rival BYD launches electric supercar that could take on Ferrari — for $233,000. Cuz ppl that buy $200k cars buy s*** from China…

Reuters | Micron starts mass production of memory chips for use in Nvidia's AI semiconductors. Not a bad week they’re having.

WSJ | FTC sues to block $25 Billion Kroger-Albertsons merger. The supermarket chains have said the deal will help them compete against Walmart, Amazon.

CNBC | Bitcoin resumes its rally, ripping through $54,000 for the first time since December 2021. Other cryptos are ripping on this rally, including Ether +2% to trade at $3,173.87; Solana +5%, and Cardano’s ADA token +4%. #HODL

Trivia

This week’s trivia is on the first corporations. Yesterday’s and today’s is on the Dutch East India Company (the VOC).

The VOC is often credited with establishing the world’s first:

A) Fast food chain

B) Stock exchange

C) Central bank

D) Multinational trading company

Which product was a major driver of the VOC's profits?

A) Tea

B) Spices

C) Silk

D) Coffee

What was a unique feature of the VOC's business model?

A) Use of cryptocurrency

B) Sovereign powers, including the ability to wage war

C) Operated their own currency

D) Granted monopoly over asian trade

(answers at bottom)

Market Movers

Winners!

Altice USA (ATUS) [+36.1%]: Bloomberg reported a potential takeover by Charter Communications, stirring significant stock movement.

Agiliti (AGTI) [+29.1%]: Announced a $2.5B privatization deal by THL Partners; $10/share cash consideration, a ~31% premium, with closure expected in H1'24.

R1 RCM (RCM) [+25.1%]: Shareholders CoyCo 1 and 2 pushed for exploring strategic options, citing a proposal at $13.75/share (~24% premium) and seeking a standstill waiver.

Freshpet (FRPT) [+19.7%]: Surpassed Q4 EPS, EBITDA, and revenue expectations; FY24 forecasts also exceed predictions, driven by volume growth, pricing power, and lower input costs.

Pilgrim's Pride (PPC) [+8%]: Q4 earnings and revenue outperformance; US portfolio gains noted, alongside cost improvements and stabilization in Mexico.

Domino's Pizza (DPZ) [+5.9%]: Q4 EPS exceeded forecasts, despite slightly missing on revenue; company-owned stores saw notable comp sales growth, announced a $1B repurchase program and dividend hike, with positive analyst outlooks on supply chain efficiencies and customer loyalty gains.

Losers!

Intuitive Machines (LUNR) [-34.6%]: After a ~275% YTD surge, shares dropped following an update that its Odysseus lunar vehicle didn't land as planned, but the CEO confirmed it remains operational with some mission goals still achievable.

Alcoa Corp. (AA) [-4.5%]: Proposed a $2.2B stock deal for Australia's Alumina (AWC.AU) JV partner, at a ~13.1% premium; Citi sees minimal synergies but strategic sense in consolidating assets, though price is a concern.

Alphabet (GOOGL) [-4.4%]: Faced a downturn amid Melius Research's cautious outlook on AI image generator issues, potential brand harm, and competition; noted DeepMind's CEO on a brief halt for improvements, and Musk's venture into an email alternative.

Fresh Del Monte Produce (FDP) [-3.1%]: Missed Q4 expectations with weaker banana sales impacting results, though partially offset by better performance in fresh/value-added products; non-cash impairment charges noted, yet raised dividend.

Charter Communications (CHTR) [-2.3%]: Shares fell on reports from Bloomberg about potential interest in acquiring Altice, indicating strategic moves in the telecom sector.

Market Update

Trivia Answers

B) The VOC is often credited for establishing the world’s first modern Stock Exchange.

B) Spices made up the majority of the VOC’s profits. Slavery was also a big contributor as well (they don’t like to bring that up as much tho).

B) Sovereign powers, including the ability to wage war. Other trading companies that followed were also granted monopolies but the VOC effectively operated as an arm of the Dutch government.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.