🔬How Expensive Is The Stock Market?

“I skate to where the puck is going to be, not where it has been.”

- Wayne Gretzky

"Don’t invest in any idea you can’t illustrate with a crayon."

- Mohnish Pabrai

Hey Readers! Thanks for checking out my first StreetSmarts Weekly!

It’s mostly the same structure as the former daily, but I’ve toggled a few things and will continue to tinker with format as I try to figure out what would be most enjoyable for you the reader.

That said, I’d love any feedback or suggestions! If there’s something that you you’d really like to see, please let me know in the comments or just by replying to this email. All ideas welcome as I try to figure out how to make this the best weekly newsletter I can!

Most importantly, thank you and I hope you continue to enjoy it!

- Ryan

Street Stories

Valuations & Growth

An overly simplified but kinda neat way to look at the state of the market is along the spectrum of growth and valuation: Is the market cheap or expensive compared to where it’s been in the past? And is it growing faster or slower than it has in the past?

As you can see - it’s definitely not in the cheap camp at the moment…

In fact, the only two times this millennium that the market has been more expensive on a P/E multiple basis was the DotCom bubble (before it crashed in 2000) and the pandemic ‘Everything Bubble’ (before it crashed in 2022).

We’re not exactly in good company…

Because markets are rational, the corollary of the above must imply that companies are set for record levels of growth in the coming years. However, according to Wall Street, that’s definitely not the base case.

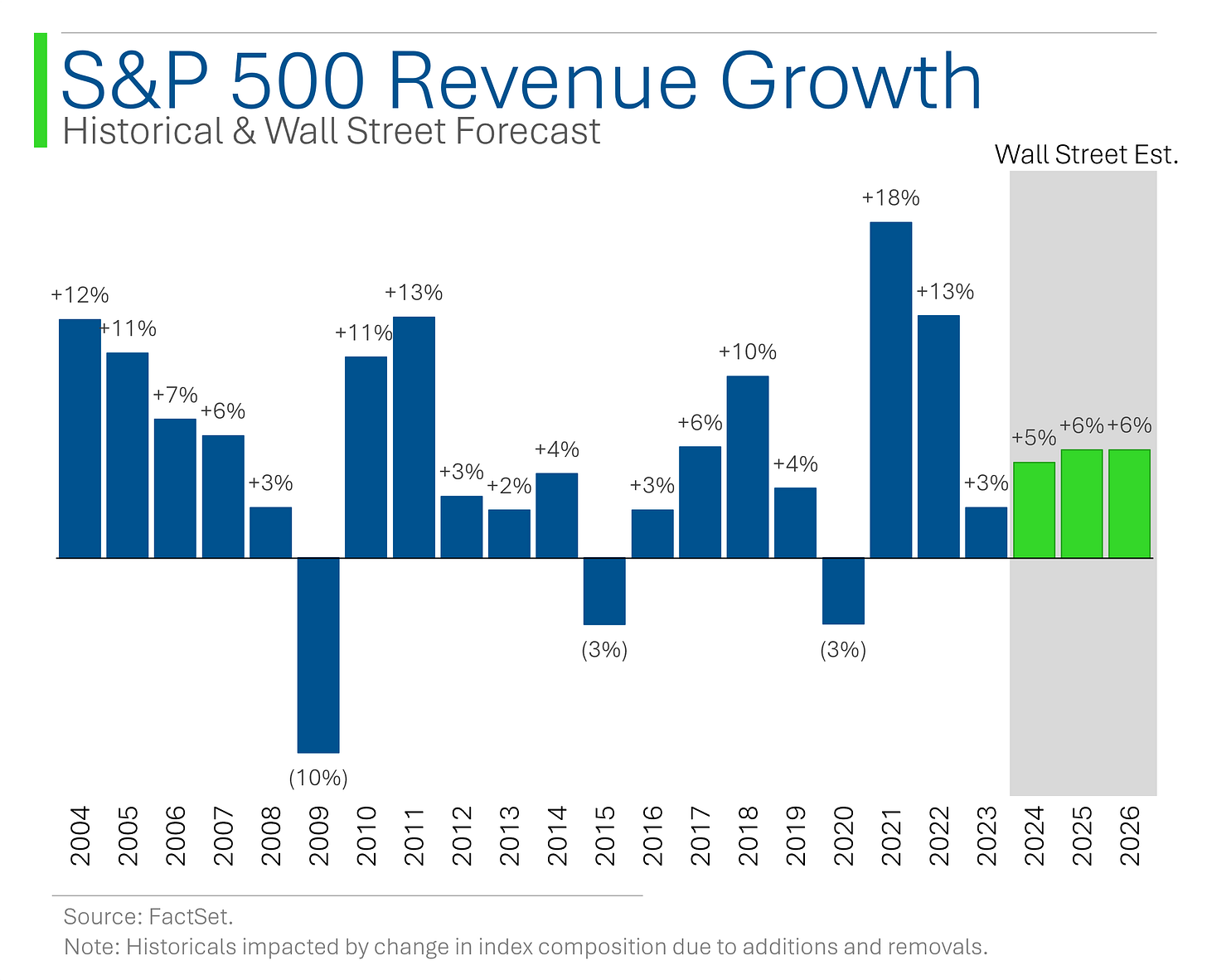

In fact, Wall Street’s aggregate revenue estimates for the S&P 500 work out to around 5% to 6% growth over the next few years. Pretty much smack dab in-line with the 20 year historical average of +5.5%.

Ie: Average growth but record high valuations. Just super….

I thought it would be interesting to dive into this relationship between growth and valuation in detail to see how the h*** we got here, so I charted out the recent path of the S&P 500’s forward P/E multiples relative to its historical earnings per share (EPS) estimates.

As you can see below, during the pandemic, estimates for growth were in the gutter but as the economic recovery took hold those estimates went through the roof (left to right).

However, growth estimates started coming down around May 2021. Valuations remained high but by November 2021 the party was over and multiples began to contract. Cue the 2022 sell-off…

The market may be wonky but in the end, high valuations need to be supported by high growth expectations.

So how does the current situation stack up versus history?

Well, performing the above analysis for the past 20 years reveals that the S&P’s current forward P/E multiple of 21.8x is nearly two standard deviations higher than it’s historical average of 16.4x. Ie: A lot!

All this while EPS growth is still well within one standard deviation of its historical average (+14% vs. +11% average).

So where do we go from here? Well, I’m not a fan of people calling a top to the market (because they are usually wrong), nor would I consider myself a Bear (because they rarely make money).

What I do think is that this will end up being more of a ‘stock picker’s market’ than what we’ve seen in recent years. Riding the index has been extremely lucrative the past 2 years, but my best guess says that to keep making money, you’ll need to put the work into finding those great companies that trade at fair valuations.

They may be harder to find but they are always out there!

(If there is a company you would like me to do do a deep-dive on, please reach out to me directly or in the comments)

Tesla Hits the Gas (or, like, the battery equivalent)

Elon Musk took a brief break from the campaign trail to host Tesla’s Q3 earnings call on Wednesday - which for the first time in a while proved to be a goody.

Revs had a small miss ($25.2 billion vs. Wall Street est. for $25.5 billion) but EPS beat the admittedly low bar set by Wall Street; coming in +22% clear of estimates and posting their first year-on-year increase since Q2 2023.

The biggest driver of the beat was improved cost efficiency leading to a much stronger Gross Margin - even more impressive given the significant price cuts Tesla has been eating this year.

Two other biggies for me were:

Announced ride hailing will launch in 2025 in Texas and California. Recall the stock tanked after its robotaxi event two weeks ago, in part due to a lack of timelines associated with the launch.

That the company is still on track to deliver a sub-$30,000 affordable model in H1 2025. I think most of us thought they’d be kicking that can down the road.

That said, the company also announced that it expects full-year deliveries to show ‘slight growth’ vs. Wall Street estimates for -1.5%.

Slight growth? Is Tesla a growth stock or a cost-cutting, efficiency play?

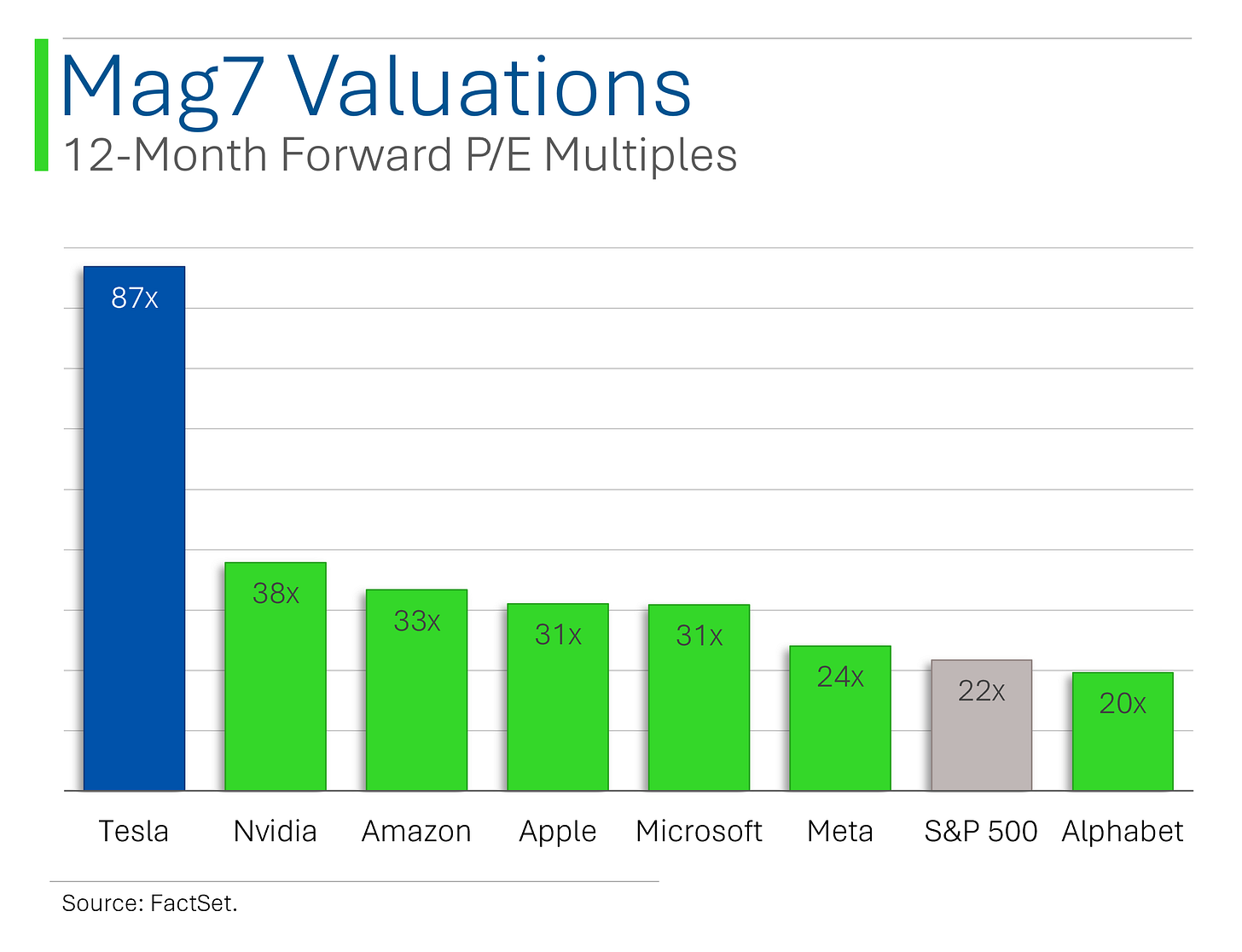

I bring this up because considering the companies it often gets lumped in with, the company hasn’t exactly been a standout.

But still trades at a wee bit of a premium…

How much of that is based on reality is still up for debate. I just know sometimes it’s best not to bet against Cult Stocks.

Joke Of The Week

What’s Irish and stays out all night? Patty O’Furniture.

Hot Headlines This Week

CNN / The U.S. Justice Department has warned Elon Musk’s America PAC that its $1 million giveaway to registered voters in swing states could violate federal law, which prohibits paying people to register to vote. The controversy arose as the sweepstakes, promoted at a Trump campaign event, requires participants to be registered voters in key battleground states, raising legal concerns about its compliance with election law.

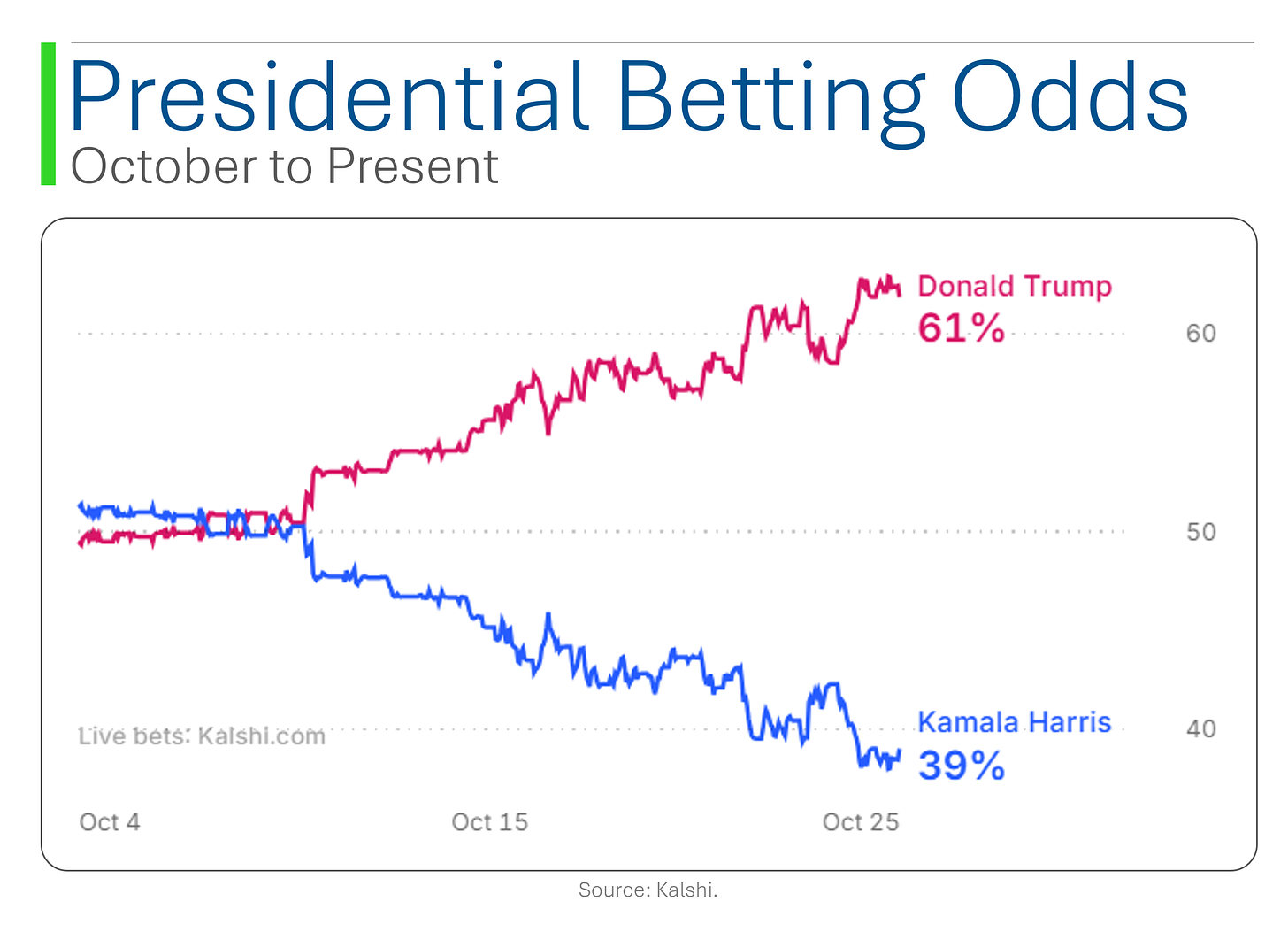

NY Times / Polymarket, a political prediction platform, denied allegations of market manipulation after confirming that a single French trader with extensive financial experience was behind four accounts influencing Trump’s odds with $28 million in bets. Do they know something I don’t?

Bloomberg / The 10-year Treasury’s term premium is rising sharply, signaling investor concerns about future risks like inflation and fiscal policy, with yields climbing as bonds sell off. Market fears are fueled by the tight presidential race, with potential Trump-led spending and tariffs amplifying debt and deficit worries amid already elevated US borrowing.

CNBC / Novo Nordisk has petitioned the FDA to ban compounded versions of semaglutide, citing safety risks, as it battles ongoing drug shortages and lawsuits over unapproved copies of its weight loss and diabetes treatments, Wegovy and Ozempic. That poor company, I hope they’ll be ok…

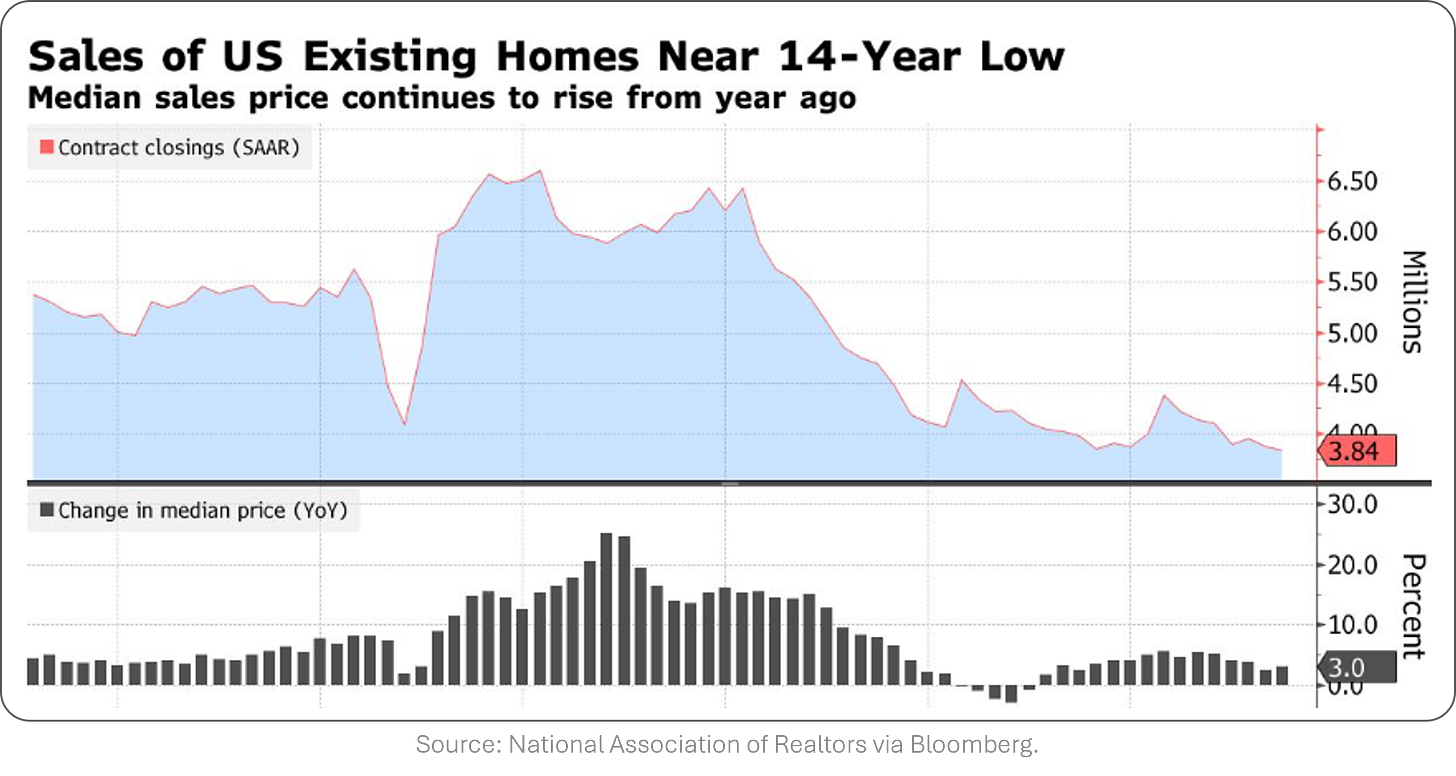

Bloomberg / US Existing Home Sales drops 1% in September to near 14 year low. Prospective buyers sitting on the sidelines for mortgage rates to start going back down is the main culprit.

The Hill / Harris gets Insane Clown Posse’s endorsement. The only endorsement that matters.

The Hoya / Hirshhorn Museum Displays “Basquiat X Banksy” Exhibition for the First Time

The Tax Foundation / Analysis of Harris’s billionaire minimum tax on unrealized capital gains

NY Mag / Why Meta is filling your Facebook and Instagram feeds with bots. Money?

CNN / 51% of workers in Iceland are now working reduced hours, including four-day weeks, and the economy is ripping. But when do they go on Insta?

9to5 Mac / Apple slashes iPhone 16 orders by 10 million units.

Trivia

This week’s trivia is on the great corporate collapses.

What large US automaker DIDN’T declare bankruptcy as part of the 2008 financial crisis?

A) General Motors

B) Chrysler

C) Ford

The Dutch Tulip Mania bubble took place in what century?

A) 1500s

B) 1600s

C) 1700s

D) 1800s

The collapse of which airline, formerly controlled by Howard Hughes, in 2001 was one of the largest airline bankruptcies in U.S. history at the time?

A) Pan American World Airways

B) TWA (Trans World Airlines)

C) Eastern Air Lines

D) Continental Airlines

(answers at bottom)

Market Movers

Friday:

Intel (INTC) [+1.5%]: Announced a $28B investment to build two new advanced chip factories in Ohio to boost semiconductor production.

HCA Healthcare (HCA) [-8.9%]: Q3 earnings and revenue missed expectations, with hurricane impacts expected to weigh on future results.

Colgate-Palmolive (CL) [-4.1%]: Posted solid Q3 results but analysts worry about limited pricing power and North American sales shrinkage despite raising FY24 guidance.

Thursday:

ADT Inc (ADT) [+17.6%]: Strong Q3 performance with increased sales, solid retention, and higher FY EPS guidance.

Tesla (TSLA) [+21.9%]: Blew past Q3 expectations, highlighting strong margins and teasing 2025 growth with affordable models launching next year.

United Parcel Service (UPS) [+5.3%]: Beat Q3 EPS expectations with strong domestic performance, raising its margin outlook but lowering revenue guidance.

TKO Group Holdings (TKO) [-8.7%]: Announced a $3.25B all-equity acquisition of sports assets from Endeavor Group.

IBM (IBM) [-6.2%]: Q3 revenue disappointed, but software growth and AI bookings helped offset weaknesses in consulting and infrastructure.

Wednesday:

AT&T (T) [+4.6%]: Q3 wireless revenue beat expectations, with steady fiber growth despite weather challenges.

McDonald's (MCD) [-5.1%]: Hit by a CDC Food Safety Alert over E. coli cases linked to Quarter Pounders, clouding strong sales momentum.

Qualcomm (QCOM) [-3.8%]: ARM reportedly issued a 60-day notice to cancel Qualcomm's architectural license agreements.

Coca-Cola (KO) [-2.1%]: Q3 results were solid but lower-than-expected volume growth dampened enthusiasm for its FY outlook.

Enphase Energy (ENPH) [-14.9%]: Q3 earnings missed, with weak demand in Europe dragging down guidance and prompting a downgrade from Guggenheim.

Tuesday:

GE Aerospace (GE) [-9.1%]: Q3 earnings beat estimates, but weak commercial engine sales dragged down overall performance.

Monday:

Spirit Airlines (SAVE) [+53.1%]: Extended its debt refinancing deadline and expects to end the year with over $1B in liquidity.

Hertz Global (HTZ) [-8.6%]: Downgraded by JP Morgan due to weaker travel trends and potential legal risks from past bankruptcy issues.

Canada Goose (GOOS) [-7.0%]: Downgraded to sell by Goldman Sachs amid rising competition, brand fatigue, and a slowing luxury market.

Market Update

Trivia Answers

C) Ford never declared bankruptcy while GM and Chrysler did.

B) Dutch Tulip Mania took place in the 1600s.

B) TWA went bankrupt in 2001 (for the third time I might add), and it’s pieces acquired by American Airlines.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.