🔬How Bad Is The Job Market?

Plus: The next chapter in the GameStop saga, Nvidia's funny dividend; and much more!

"Inflation is taxation without legislation."

- Milton Friedman

“I was so poor growing up that if I wasn't a boy, I wouldn't have had anything to play with”

- Rodney Dangerfield

The big US markets gave back a bit after Wednesday’s rally, with the S&P 500 -0.02% and Nasdaq -0.1%.

8 of 11 sectors went positive on the day but nothing particularly notable (Consumer Discretionary was +1.0%; Energy +0.6% after getting battered recently). Tech fell -0.5% after a huge day Wednesday, with Nvidia notably falling out of the $3 trillion club.

As expected, the ECB followed Canada’s lead yesterday by cutting its policy interest rate for the first time since 2019.

Notable companies:

Robinhood Markets (HOOD) [+6.5%]: Agreement to acquire Bitstamp, a global cryptocurrency exchange, for $200M in cash.

lululemon athletica (LULU) [+4.8%]: Q1 EPS beat while Q2 guide missed but reaffirmed FY revenue and operating margin guidance, and boosted EPS target.

Salesforce (CRM) [+2.7%]: ValueAct CEO Mason Morfit disclosed purchase of 428K shares.

Street Stories

How Bad Is The Job Market?

For months now I’ve been inundated by news stories about massive layoffs and how that is going to sink the economy - and more importantly - the stock market. So, I thought it behooved me to actually check out what was going on: Who’s working? Who’s not? Are there enough jobs to go around?

Let’s get at ‘er!

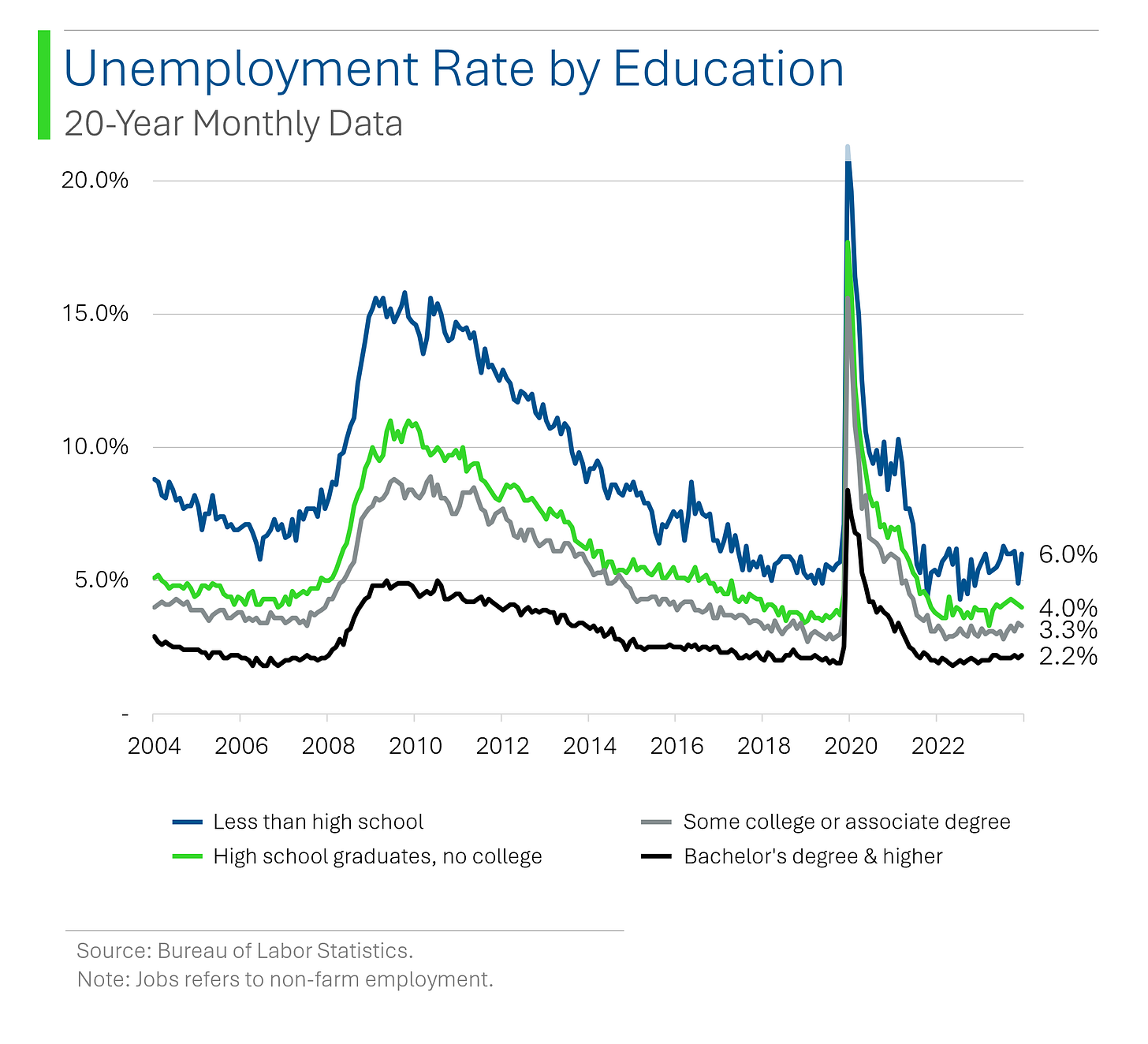

From the chart above, it should immediately be clear that ‘no, things aren’t that bad at all’. Unemployment is within spitting distance of multi-decade lows, and the number of jobs openings is higher than any period this millenium save for the immediate aftermath of the pandemic.

That said, as you can see, both trends are converging. So while things might not be bad now, it’s easy to imagine a scenario where things continue to erode.

The split between education levels is one area that has generally improved over the years, which might be a bit surprising but may also have its roots in supply falling faster than demand. As well as a confluence of issues beyond the scope of this newsletter.

The important bit missing here is of course income, as service workers, factory workers, etc., have seen their relative wealth continually erode over the years due to factors such as increases in automation. So not chill.

Across the main age buckets the gap has remained roughly the same, with older individuals experiencing moderately better employment rates than younger individuals. But both are in a healthy state - for now at least.

Looking at the working age population as a whole, there hasn’t been too much of a shift in recent years, although it is clear a material proportion of the population decided to use the pandemic as a time to exit the labor force (predominantly early retirements).

Over the last twenty years the shift towards individuals not in the labor force has grown considerably. For example, since 2004 the number of individuals employed has grown by 16.3%, whereas the number of people no longer in the workforce has grown by 31.9% - nearly double. Most of this is the result of recent demographic shifts, primarily the aging baby boomer population.

TL;DR - Anyway, getting back to the original reason I did this; I think it’s clear that despite what you may have been hearing in the media, employment is on comparatively good footing relative to the past. However, the recent trend hasn’t been positive (unemployment ⬆️, job openings ⬇️) and down the road this could have negative impacts on the economy. Or, more importantly, the stock market.

Only time will tell.

Nvidia’s Massive Dividend Raise

The company announced it is raising its dividend by a GINORMOUS 150%!…

…Oh, nm, not as exciting as I thought.

Explainer: A lot of companies pay token dividends, not as a way to meaningfully compensate their investor base, but because a large proportion of investment funds are mandated to only invest in companies that pay a dividend.

By paying a modest dividend they get access to a huge potential investor base but, in Nvidia’s case - even compared to other token dividends - it was becoming laughably small.

GameStop Saga Gets Juicer

Keith Gill (aka Roaring Kitty aka DeepF***ingValue) has a YouTube account that has been dormant for three years. Until yesterday…

That’s when it announced that he will be doing a livestream today at 12PM. The result? Another 47% jump in the share price. This is getting tasty.

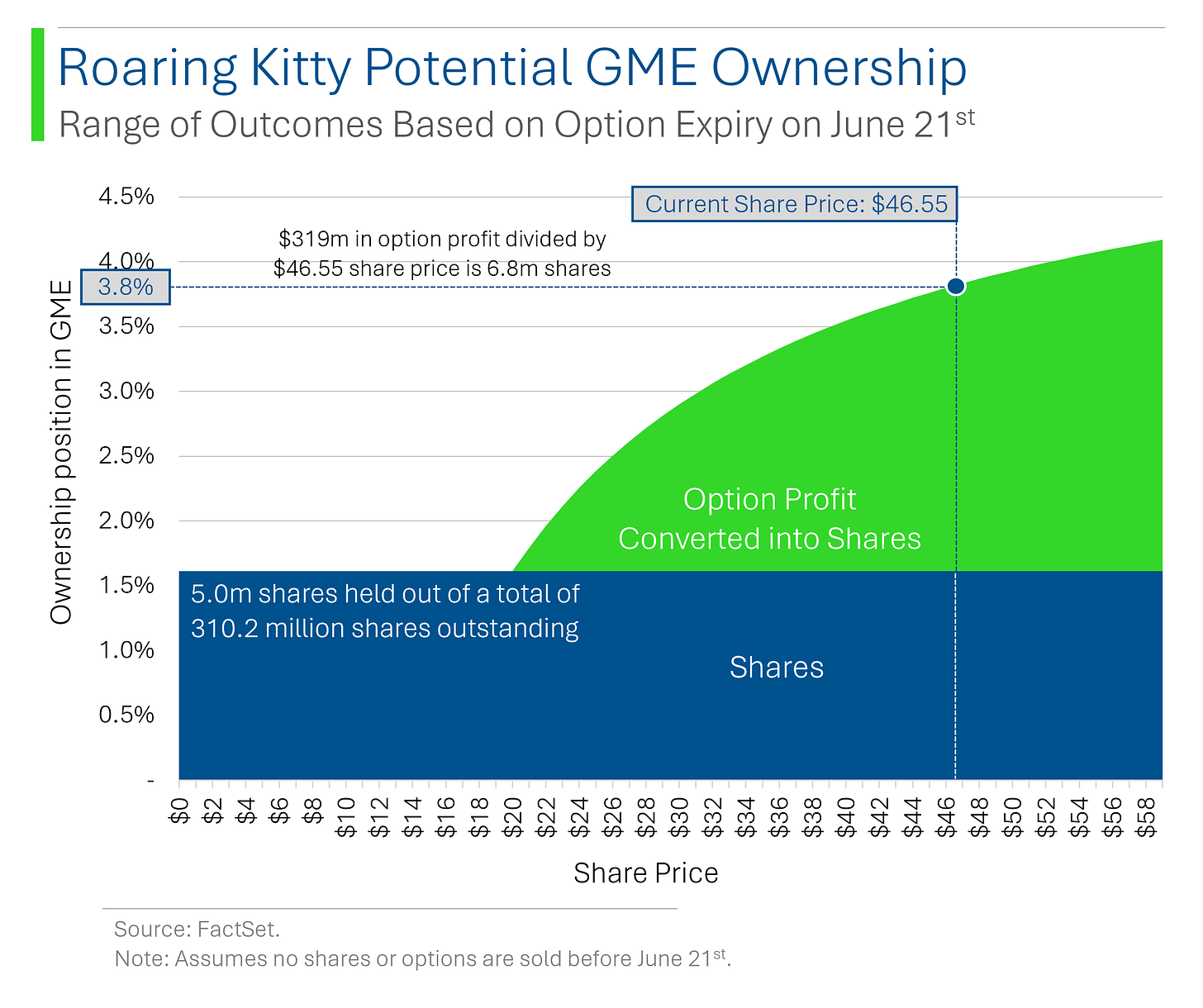

For those who missed the last few StreetSmarts, a few days back Keith revealed via Reddit that he holds a 5m share position in GameStop as well as 120k call options on the stock with a strike price of $20 a share.

If those options were to exercise today, that would mean that the guy that started out with a $50k position in GME out of his E*Trade account would be worth $551 million.

If he chose to convert that profit into shares, he would now be the fourth largest GameStop holder after its CEO and index funds Vanguard and BlackRock, with a 3.8% position in the (now) $14.4 billion video game retailer.

I should have made better choices with my life.

Joke Of The Day

How did we know communism was doomed from the beginning? All the red flags.

When I was at Credit Suisse, I had an intern mentee rocking Patek. TF?

Hot Headlines

CNBC / U.S. regulators to open antitrust probes into Nvidia, Microsoft and OpenAI. The FTC will take the lead on looking into Microsoft and OpenAI, while the DOJ will focus on Nvidia, and the investigations will focus on the companies’ conduct, rather than mergers and acquisitions, according to the source.

Axios / Over 100 ex-federal agents and prosecutors ask White House to help imprisoned crypto exec stuck in Nigerian prison. Tigran Gambaryan, head of financial crime compliance at Binance, traveled to Nigeria after the country accused Binance of contributing to a crash of the local currency. After arriving, he was arrested and charged with such crimes as tax evasion and money laundering.

Reuters / Five reasons financial disasters are hard to avoid. A detailed look at the risks associated with the growth of non-bank financial players and the potential issues for to financial system. Unless you work at one. Then you’re ballin’.

Yahoo Finance / Lyft forecasts 15% growth in bookings over the next three years. New three year outlook published at inaugural investor day.

Bloomberg / Banks tap complex mortgage product to fight deposit flight risk. CMOs, which you may remember from the Financial Crisis (or at least the movie The Big Short) have increased considerably in recent years.

Market Movers

Winners!

GameStop (GME) [+47.2%]: Roaring Kitty scheduled first YouTube Live Stream in three years for today.

Smartsheet (SMAR) [+17.2%]: Q1 earnings, revenue, and OM beat; continued strength among enterprise customers; raised FY guidance, ARR growth outlook; analysts positive on new pricing/packaging model for higher licensed user count.

Toro Co. (TTC) [+14.4%]: FQ2 earnings and OM beat; revenue in line; strong residential results (mass channel, product introductions, favorable weather); reaffirmed FY guidance; professional strength supported by golf business backlog.

Robinhood Markets (HOOD) [+6.5%]: Agreement to acquire Bitstamp, a global cryptocurrency exchange, for $200M in cash.

lululemon athletica (LULU) [+4.8%]: Q1 EPS beat; Q2 guide below but reaffirmed FY revenue and operating margin guidance, boosted EPS; positive takeaways on expected 2H innovation, international strength, US issues, trough multiples.

J. M. Smucker (SJM) [+4.6%]: Q4 EPS beat driven by gross margin expansion, though revenue missed; FY25 EPS guidance weak but better than feared; organic sales up 3% in Q4; pet sales comp 11%; EBITDA increased 13% due to Hostess acquisition.

Salesforce (CRM) [+2.7%]: ValueAct CEO Mason Morfit disclosed purchase of 428K shares.

Losers!

G-III Apparel Group (GIII) [-13.5%]: FQ1 EPS beat, revenue missed; FQ2 EPS and revenue guidance below expectations; FY25 earnings guidance raised; announced strategic partnership and 12% stake in All We Wear Group; entered third restated credit agreement.

Sprinklr (CXM) [-13.4%]: FQ1 EPS and revenue beat; Q2 EPS and revenue guidance missed; FY EPS guidance raised but revenue guidance lowered, especially subscription revenue; COO Trac Pham appointed as co-CEO; management noted pressure on renewals, longer sales cycles, muted demand.

Five Below (FIVE) [-10.6%]: Q1 earnings, revenue, and OM missed; comps below consensus; higher prices offset by lower units per transaction; lower freight costs but higher shrink; cut FY guidance; management cited difficult macro backdrop with consumers more deliberate with discretionary spending.

Fluence Energy (FLNC) [-7.6%]: Downgraded to neutral from buy at Guggenheim; cited valuation after appreciating 60% since early March.

Market Update

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.