🔬Home Stretch: The US Housing Sector in 6 Charts

Plus: Consumer Confidence takes a bath; and much more!

"The markets are like a large movie theater with a small door"

- Jeffrey Gundlach

“If at first you don’t succeed, try, try again. Then quit. There’s no point in being a damn fool about it”

- WC Fields

U.S. equities closed higher with record-setting performances from the Dow and S&P. Chemicals, industrial metals, and machinery led the way due to China's stimulus efforts, while credit card companies like Visa and regional banks underperformed due to regulatory concerns.

China's policy support was a key market focus, but more aggressive stimulus may be needed. Additional measures were announced, though weaker consumer confidence, labor market conditions, and mixed housing data added to concerns about the economic outlook.

Corporate news was relatively quiet, but some notable developments caught attention. Visa may face a monopolization lawsuit from the Department of Justice, Smartsheet confirmed its acquisition by Blackstone and Vista Equity, and Snap teamed up with Google to improve its AI chatbot.

Notable companies:

Liberty Broadband (LBRDK) [+25.9%]: Liberty Broadband responded to Charter's merger proposal with a counter that involves a tax-free stock swap and a 2027 closing date.

Visa (V) [-5.5%]: The U.S. Justice Department is reportedly planning a lawsuit accusing Visa of monopolizing the debit-card business.

Light & Wonder (LNW) [-19.5%]: Light & Wonder is facing a court injunction from Aristocrat Leisure over its Dragon Train game but plans to keep fighting the claims while sticking to its FY25 guidance.

More below in ‘Market Movers’.

Street Stories

Home Stretch: The US Housing Sector in 6 Charts

The Case-Shiller 20-City Index came in yesterday at +0.3% m/m for July which was a smidge higher than Wall Street expectations but slightly below the June figure.

And while +0.3% m/m doesn’t sound terrible, the y/y figure comes in at +5.92% and is a massive +57% over the last 5-years which is a real d*** punch to folks out there trying to sleep indoors.

Anyway, I’m going to try and breakdown the (depressing) Housing situation in 6 charts. Pitter patter, let’s get at ‘er.

1. Housing Prices

As you’ve seen above, prices have been out of control over the last few years. Prices shot up at the start of the Covid pandemic, mostly due to the Fed slashing interest rates to effectively zero.

As the Fed started raising interest rates in March 2022, prices dipped but around the time the Fed stopped raising interest rates (July 2023) things picked back up and are only now showing signs of cooling off. Bout time…

2. Mortgage Rates

The real bridge between Interest Rates and Housing Prices is mortgage rates, which have followed a similar trajectory to the Fed Fund rates.

According to Freddie Mac data, rates peaked last October and have been in something of a free-fall since May due to expectations for interest rates cuts.

Bout f***** time…

3. New Home Sales

New Home Sales popped a bit during Covid but have remained relatively healthy. As you can see, current new home sales are barely half of what the peak looked like before the housing crisis kicked off in 2007. Given the housing shortage, this isn’t particularly great though.

4. Existing Home Sales

But while developers are able quickly offload new product, the market for existing homes (ie: resales to new owners) is in a very poor state:

High mortgage rates discourage sellers (have to break that 3% mortgage for a shiny new 7% one);

Fewer sellers and weak new inventory has helped push prices into the stratosphere which deters buyers;

Economic uncertainty has kept a lot of potential buyers/sellers on the sidelines.

The result is that last month was just ~10k in sales above October 2023’s 3.85m figure; the lowest month since the fall-out from the Housing Crisis.

5. Construction Cooling

Housing supply on deck has also taken a nosedive, following a steady decline for the last 12 months. Not super helpful in offsetting one of the tightest markets ever.

6. Housing Starts and Permits

The softness in supply is further backed up by Housing Starts and New Housing Permits which continues to tick lower.

The lack of enthusiasm on the part of the Builders is partly due to economic uncertainty; high borrowing costs for development; and worries about ‘over building’ like in 2007.

That said, it’s still all their fault!

To wrap this up, there are some small positives - like mortgage rates coming down - but Housing Prices are unaffordable, sellers are scarce and builders aren’t building.

Basically…

Consumer Unconfidence

Consumer Confidence took a significant hit in September, with the index dropping from 105.6 in August to 98.7, well below economists’ expectations of 104, as concerns over the economy's direction weighed heavily on Americans' minds.

Fewer respondents are expecting higher incomes or an increase in available jobs, while more are anticipating worsening business conditions. The report highlights growing pressure on households as the labor market weakens and inflation remains a concern, leading to a more cautious outlook on the economy’s future.

Also - that 7.9 point drop is the largest one month decline since August 2021 - which was a pretty terrible time.

Joke Of The Day

We need to start investing more in solar energy. But it's not just going to happen overnight.

Hot Headlines

CNBC / FTX fraudster Caroline Ellison sentenced to 2 years in prison, ordered to forfeit $11 billion. Well, they did recover all the money right?

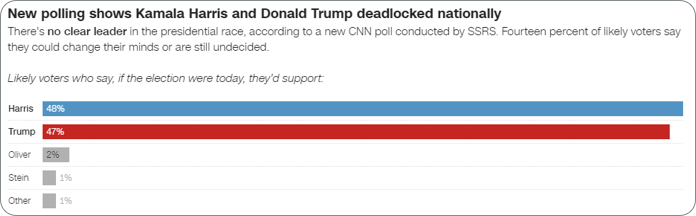

Reuters / Harris at 48%, Trump at 47% in the latest CNN/SSRS poll. The poll was conducted between September 19-22, surveyed 2,074 registered voters and has a margin of error of 3 percentage points.

Yahoo Finance / FTC set to greenlight Chevron's $53 billion buy of oil rival Hess, sources say. The final challenge is coming from Exxon Mobil as Exxon and CNOOC are Hess's partners in a lucrative Guyana oil venture and feel that they should be able to contest the deal over a right of first refusal for Hess's assets. Arbitration on this issue is set for 2025.

Bloomberg / Visa sued by US in antitrust case over debit card markets. The DOJ has sued Visa, accusing the company of monopolizing the U.S. debit card market by penalizing merchants and paying off rivals. Based on their staying power it seems like it was working for them…I personally love my Amex Cobalt.

Reuters / FAA chief says Boeing safety reforms could take 3 to 5 years. In his his two-hour hearing to a House subcommittee, Mike Whitaker said at he has spoken to Boeing’s CEO about reforms but that it’s ‘not a six-month program’. Yeesh, even the ‘99 Cleveland Browns put up two wins.

Trivia

Today's trivia is all about Las Vegas - may the odds be ever in your favor!

Which Las Vegas casino was famously the site of Howard Hughes' month-long stay in 1966, leading him to purchase the property to avoid being evicted?

A) Desert Inn

B) Stardust

C) Sands

D) FlamingoWhat was the original name of the Las Vegas Strip before it became the iconic destination we know today?

A) Fremont Street

B) Arrowhead Highway

C) Las Vegas Boulevard

D) Route 91Which Las Vegas hotel and casino was destroyed in the largest controlled demolition in history?

A) Riviera

B) The Sands

C) The Dunes

D) StardustWhich Las Vegas casino was originally built as a mob-controlled enterprise, featuring Bugsy Siegel as one of its key financiers?

A) Flamingo

B) El Cortez

C) Sahara

D) TropicanaWhich Las Vegas attraction, with more than 22 million gallons of water, is one of the largest aquariums in the world?

A) Shark Reef Aquarium

B) Bellagio Conservatory

C) Siegfried & Roy's Secret Garden

D) Mandalay Bay Aquarium

(answers at bottom)

Market Movers

Winners!

Liberty Broadband (LBRDK) [+25.9%]: Liberty Broadband responded to Charter's merger proposal with a counter that involves a tax-free stock swap and a 2027 closing date.

Freeport-McMoRan (FCX) [+8.0%]: Reports suggest that Indonesia is still negotiating to buy an additional 10% stake in Freeport's Indonesian subsidiary.

Smartsheet (SMAR) [+6.5%]: Smartsheet is being acquired by BX and Vista Equity in a $56.50 per share cash deal, expected to close by January 2025.

Thor Industries (THO) [+6.1%]: Thor's earnings beat expectations thanks to stronger margins, though their guidance for 2025 is a bit underwhelming due to ongoing macro issues.

Snap (SNAP) [+3.6%]: Snap is teaming up with Google to boost its My AI chatbot with help from Google's Vertex AI and Gemini models.

Salesforce (CRM) [+2.4%]: Piper Sandler upgraded Salesforce, citing AI opportunities and the potential for their free cash flow to double by 2029.

Losers!

Light & Wonder (LNW) [-19.5%]: Light & Wonder is facing a court injunction from Aristocrat Leisure over its Dragon Train game but plans to keep fighting the claims while sticking to its FY25 guidance.

Visa (V) [-5.5%]: The U.S. Justice Department is reportedly planning a lawsuit accusing Visa of monopolizing the debit-card business.

McKesson (MCK) [-4.9%]: McKesson got downgraded after Baird lost confidence in its ability to beat earnings following recent misses.

Triumph Group (TGI) [-4.4%]: BofA downgraded Triumph, citing too much reliance on uncertain production schedules from Boeing and Airbus.

Regeneron (REGN) [-4.2%]: Regeneron got downgraded after Leerink Partners flagged reduced clarity on its Eylea franchise post-Amgen lawsuit denial.

Invitation Homes (INVH) [-2.6%]: Invitation Homes is settling with the FTC for $48M over unlawful practices, with the money going toward customer refunds.

Costco Wholesale (COST) [-1.7%]: Costco was downgraded by Truist, pointing to valuation concerns, new ID scanning policies, and some packaging changes that might slow down sales.

Market Update

Trivia Answers

A) Desert Inn – Howard Hughes famously overstayed his reservation at the Desert Inn in 1966, leading him to buy the property to avoid being evicted.

B) Arrowhead Highway – Before becoming the Las Vegas Strip, this stretch of road was known as Arrowhead Highway, a key route connecting California to Nevada.

C) The Dunes – The Dunes was demolished in 1993 in the largest controlled demolition in history, making way for the Bellagio.

A) Flamingo – Opened in 1946, the Flamingo was largely financed by Bugsy Siegel and became one of the first mob-controlled casinos on the Strip.

A) Shark Reef Aquarium – Located at Mandalay Bay, Shark Reef holds over 22 million gallons of water, making it one of the largest aquariums in the world.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.