🔬Have Chip Stocks Short Circuited?

Plus: Another Tesla downgrade as Street loses faith, Allbirds doesn't exist to me anymore; TikTok ban bill gets House approval; and much more.

"It's not always easy to do what's not popular, but that's where you make your money"

- John Neff

"I’m only rich because I know when I’m wrong"

- George Soros

Soft day for the big US markets after a big win yesterday. The S&P 500 was down -0.2% and the Nasdaq down -0.5%.

7 of 11 sectors closed higher but heavyweight Tech (-1.1%) finished worst and pulled the index negative. Energy (+1.5%) and Materials (+0.9%) finished best.

Crude oil was up +2.8% and Bitcoin +2.5%.

Williams-Sonoma (+18%) had a good Q4. Allbirds (-19%) and Dollar Tree (DLTR) did not.

Street Stories

Semis Short Circuit

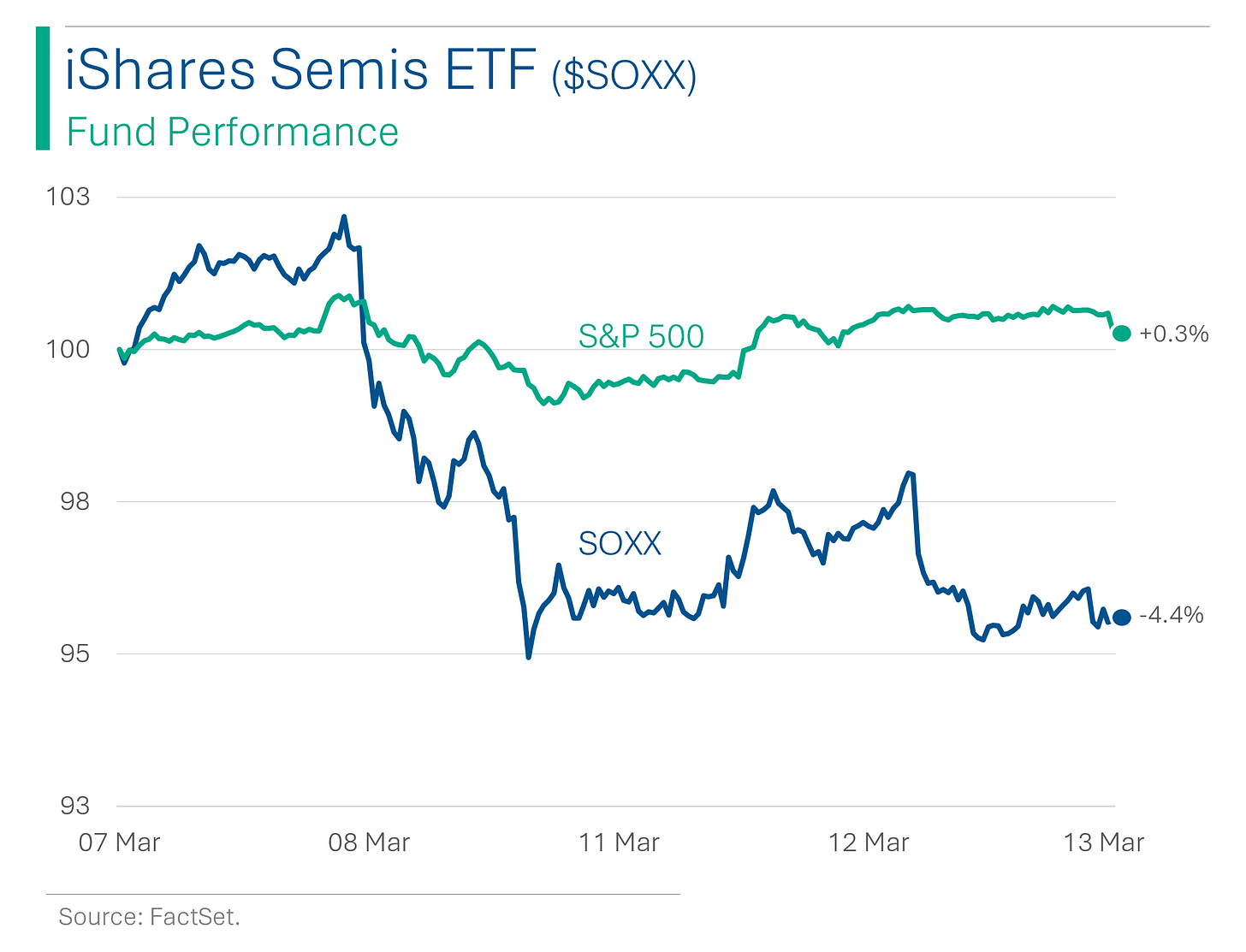

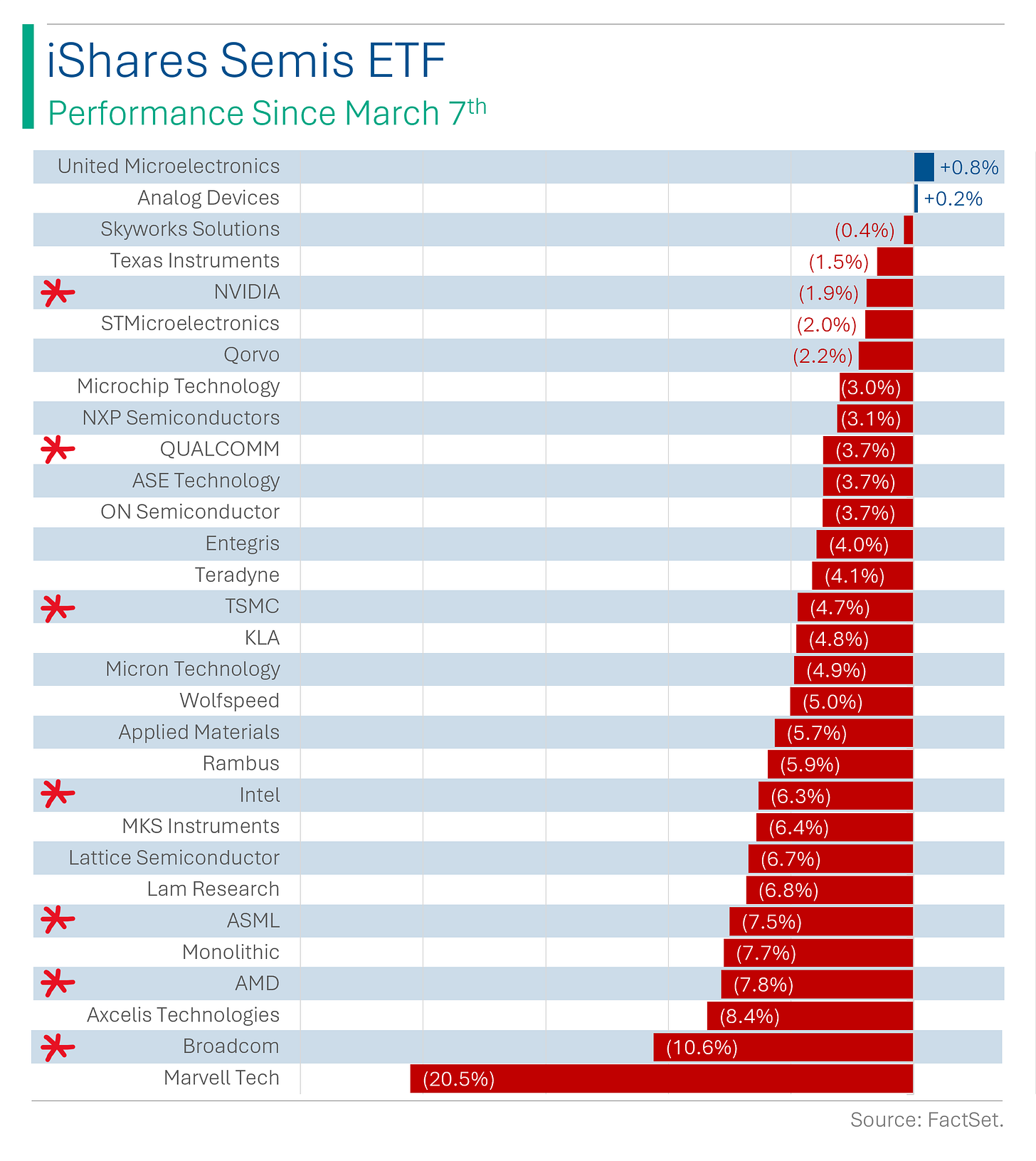

I can’t believe I’m saying this, but chip stocks are down. While it’s only been four trading days, semiconductor companies seem to have reversed after one of the biggest bull runs for a sub-sector ever.

This could just be a pull back, or it could be an indication that investors (finally) feel that chip stocks have reached their full value and that the hype train has left the station.

And while the declines vary in magnitude, it’s probably important to note that: (1) The pullback has been broad-based; and (2) That even fan favorites like NVIDIA, ASML, TSMC and AMD haven’t been spared. Too early to call this a correction, but this has been the first crack we’ve seen in the semiconductor names in a while.

Thanks to NYUGrad for pointing the above out.

Tesla Downgrades Keep Electrocuting Shares

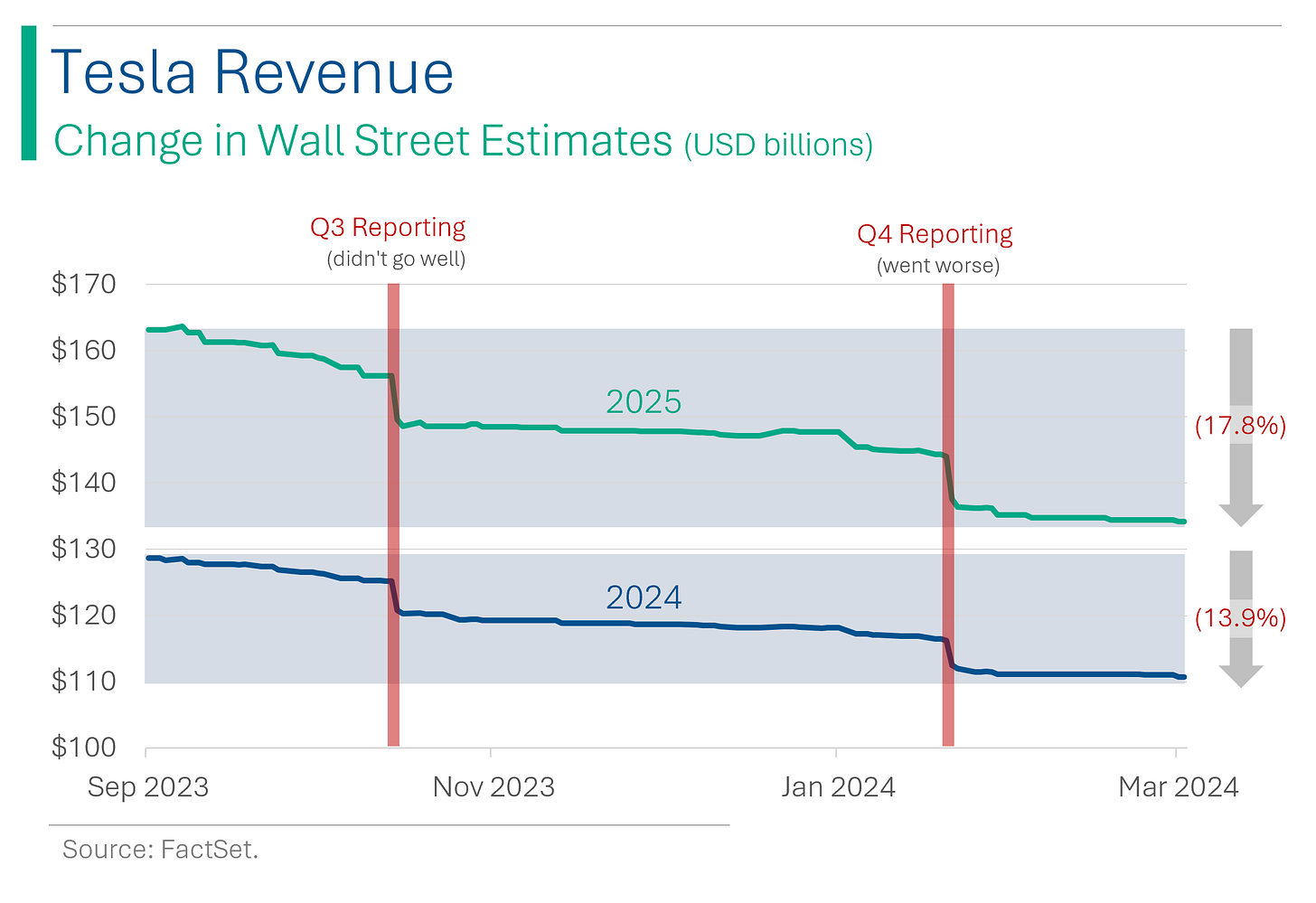

Wells Fargo chopped their Tesla price target from $200 to $125, and cut its rating from ‘Hold’ to ‘Sell’, helping to drop the shares -4.5%. Normally I wouldn’t care (Wells Fargo is Wells Fargo after all) but they are just the latest in a research rout on the EV maker. At the end of February 2023, 65% of Wall Street analysts covering Tesla had a Buy rating on the stock. Today that number is 36% and the trend isn’t Tesla’s friend.

As I wrote about last week in ‘Tough Luck Tesla’, it’s not Elon’s antics that have shaken the narrative, but a massive re-evaluation of Tesla’s medium term growth prospects. For example, six months ago the Street was forecasting unit deliveries to grow by 1.1 million between 2023 and 2025. That growth have been cut 40% to only 655k units.

I mean, if no one else is gunna say it, Tesla is officially out of the Mag7 (Stupendous 6, Supremo Seis?)

ByteDance with Destiny: The U.S. Puts TikTok on the Chopping Block

The House of Representatives has enthusiastically passed a bill 352-65 demanding that ByteDance sell off TikTok or face a ban. The bill, charmingly named the Protecting Americans from Foreign Adversary Controlled Applications Act, is now off to the Senate, where its fate is as uncertain as a TikTok algorithm.

Despite TikTok's plea that banning them would hurt millions, including 7 million small businesses and 170 million American users, the legislation suggests a divestment within six months or a "see you never" goodbye to the app in the U.S. Meanwhile, ex-President Trump mused that getting rid of TikTok might just make Facebook (the "enemy of the people" as he calls it) even stronger, because, apparently, in the world of tech giants, it's all about picking your frenemies.

Bird Is No Longer The Word

The plucky footwear upstart that once held a $4 billion valuation reported yesterday, meeting its forecast revenue guidance. The problem was that guidance was still down 15% year-over-year. Oh, and they announced their second CEO change in less than a year. Anyway, the stock sunk (another) 19.3% bringing the total drop since it’s first day of trading to 97.2%. So, in the same way I bid farewell to Peloton a few months ago, now it’s time to officially never talk about Allbirds ever again. ✌️🕊️

People just open up to Sara Eisen. She’s like finance Oprah. (link)

Joke Of The Day

Today I went to a presentation on how ships are held together. It was riveting.

Hot Headlines

CNBC / Stripe reveals it passed $1 trillion in total payment volume in 2023. Stripe, one of the largest private companies in the world, took 15 years to reach that metric. For context, PayPal took 23 years.

WSJ / EV start-up Fisker prepares for possible bankruptcy filing. Company hired financial adviser FTI Consulting and the law firm Davis Polk to work on a potential filing. RIP to the company that made Rivian look like Berkshire Hathaway.

Yahoo / Wells Fargo pushes back Fed rate-cut expectation to June from May. On Wednesday the company joined major banks including Morgan Stanley, Goldman Sachs and UBS Wealth Management in forecasting the first rate cut from the U.S. Federal Reserve in June. A higher than expected inflation print on Tuesday was likely the final straw.

Axios / The so-called "last mile" of the Fed's inflation fight was always going to be hard but at least a few economists think 3% inflation could well become the new normal.

CNBC / Elon Musk cancels X partnership with former CNN anchor Don Lemon after interview. Being a ‘free speech absolutist’ ends when you ask me embarrassing questions. 🤐

Trivia

This week’s trivia is on J.P. Morgan (the bank, not the fellow).

What year was J.P. Morgan & Co. founded?

A) 1871B) 1895

C) 1902

D) 1929

Which major event did J.P. Morgan play a key role in averting in the early 20th century?

A) The Great Depression

B) The Panic of 1907

C) World War I

D) The 1929 Stock Market Crash

How much did J.P. Morgan pay to acquire Bear Stearns during the 2008 financial crisis?

A) $24.7 billion

B) $1.4 billion

C) $1

D) $17.2 billion

J.P. Morgan has been a part of major historical events. Which of these did it finance?

A) The construction of the Panama Canal

B) The new White Star Line, which included the RMS Titanic

C) The Louisiana Purchase

D) The Apollo Moon Landing

(answers at bottom)

Market Movers

Winners!

Williams-Sonoma (WSM) [+17.8%]: Q4 EPS and revenue exceeded expectations with better-than-anticipated gross margin (GM) and operating margin (OM). Comp decline was less severe than feared, with growth driven by Potter Barn, Pottery Barn Kids, and an unexpected rise in Williams-Sonoma. The company increased its dividend by 26% and expanded its repurchase capacity to $1B, projecting FY25 revenue growth above consensus.

Losers!

Allbirds (BIRD) [-19.3%]: Q4 results surpassed low expectations, yet weak guidance and another CEO change were announced. Focus on persistent soft sales and headwinds from store closures, with a silver lining in inventory progress.

Dollar Tree (DLTR) [-14.2%]: Q4 missed on earnings, revenue, and operating margin (OM); however, overall comps were solid except for Family Dollar. Management highlighted positive traffic and margin trends, with a cautionary Q1 EPS forecast below expectations. Plans to close ~600 Family Dollar stores in H1 amid ongoing challenges.

Tesla (TSLA) [-4.5%]: Downgraded at Wells Fargo due to potential volume risks from ineffective price cuts and anticipated delivery disappointments. Concerns over further price reductions potentially leading to negative EPS revisions, with skepticism about Model 2's impact in the mass market.

Intel (INTC) [-4.4%]: Pentagon reportedly scrapped a $2.5B chip grant, possibly shifting financial responsibility to the Commerce Department and potentially reducing CHIPS Act funding for Intel, per Bloomberg.

McDonald's (MCD) [-3.9%]: Anticipates lower Q1 international revenue, impacted by the Middle East conflict and a slow start in China, as shared at a UBS conference.

Market Update

Trivia Answers

B) 1895. J.P. Morgan & Co. was founded in 1895 by J. Pierpont Morgan, becoming one of the most powerful banking firms of its time.

B) The Panic of 1907. J.P. Morgan was instrumental in averting a banking collapse during the Panic of 1907 by rallying other bankers to provide liquidity to the struggling financial institutions.

B) $1.4 billion. In a fire-sale deal that marked one of the defining moments of the 2008 financial crisis, J.P. Morgan agreed to acquire Bear Stearns for roughly $236 million - a 93% decrease from its Friday close. A subsequent arrangement saw the price increase to $1.4 billion.

B) The new White Star Line.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Very nice product. I'm impressed!